Joseph F. Keefe is President and Julie Gorte is Senior Vice President for Sustainable Investing at Impax Asset Management LLC. This post is based on their rulemaking petition to the United States Securities and Exchange Commission.

Ms. Vanessa Countryman, Secretary

Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

June 10, 2020

Dear Secretary Countryman,

On behalf Impax Asset Management LLC, Investment Adviser to Pax World Funds, we submit this rulemaking proposal to require that companies identify the specific locations of their significant assets, so that investors, analysts and financial markets can do a better job assessing the physical risks companies face related to climate change.

Scientific research is increasingly showing that severe precipitation, floods, fires, droughts, sea level rise, extreme heat, and the spread of tropical diseases and pests to temperate zones are often not random and or impossible to anticipate, but are linked to a warming climate. These changes pose risks not only to companies, but their investors, financial markets and the global economy.

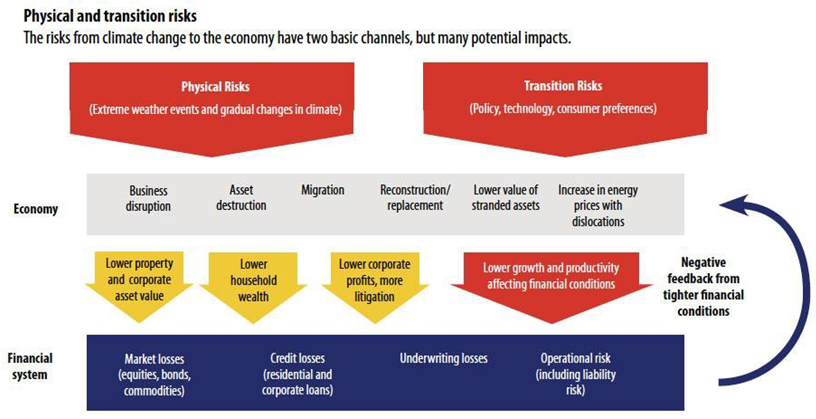

Climate change poses several types of risk. Transition risks—regulatory risk, the risk of litigation, reputational risks, and possible losses of competitiveness as the world moves closer to a low-carbon economy—often fall most heavily on the largest emitters. Physical risks, however, can happen to any enterprise, and depend not on emissions but on where the company operates, and where the major facilities are in its value chain. This is why investors need more precise physical location data from companies than most now provide.

The value at risk due to climate change has been estimated in several reviews and papers, as shown in Table 1 below.

Table 1 – Studies on the Potential Macroeconomic Impact of Climate Change

| Report and Date | Estimated Impact |

|---|---|

| Stern Review, The Economics of Climate Change, 2007 |

|

|

Risky Business, The Economic Risks of Climate Change in the United States, 2014 |

|

| Nature Climate Change, Global non-linear effect of temperature on economic production, 2015 |

|

| The Economist Intelligence Unit, The cost of inaction: Recognizing the value at risk from climate change, 2015. |

|

|

OECD, The Economic Consequences of Climate Change, 2015 |

|

|

Nature Climate Change, ‘Climate value at risk’ of global financial assets, 2016 |

|

| Federal Reserve Bank of Richmond, Temperature and Growth: A Panel Analysis of the United States, 2018 |

|

The above studies underscore that trillions of dollars’ worth of assets are at risk globally, and while most estimates span decades, there is no doubt that these impacts are being felt already. Indeed, the physical impacts of climate change are increasingly obvious, and increasingly expensive. CDP recently reported that 215 of the world’s largest companies report that they see almost $1 trillion in value at risk from climate change within the next five years. This figure includes both transition risks and physical risks, with over 70% of the companies reporting that the physical impact of climate change posed risks to direct company operations, and an additional 20% reporting that physical impacts posed supply chain risks. Losses to other assets and asset owners, and over longer time periods, are far higher.

Standard & Poors recently estimated that 60% of S&P 500 Index companies’ own physical assets that face high risk of at least one kind of climate-related physical losses. This represents a total market capitalization of $18 trillion dollars in the United States alone. “While the extent of effectiveness of the global response to climate change remain uncertain, one thing is very clear: companies and investors must prepare for a range of possible outcomes with diverging transition and physical risks,” concluded S&P.

Central banks are also beginning to understand climate risks (both physical risks and transition risks) as systemic (see Figure 2 below) and are implementing requirements and tools such as stress testing, green quantitative easing and asset purchase programs to address these risks.

Figure 1. Physical and Transition Risks Resulting from Climate Change

Source: Pierpaolo Grippa, Jochen Schmittmann, and Felix Suntheim, “Climate Change and Financial Risk,” Finance & Development Vol. 56, No. 4, International Monetary Fund, December 2019.

The Taskforce on Climate-related Financial Disclosure (TCFD), an initiative established by the G20 Financial Stability Board, recommends that companies and investors perform scenario analysis to understand better the risks posed to their own assets and portfolios of various pathways toward a low-carbon future. As of February 2020, over 1,000 organizations supported TCFD, and the library of TCFD reports is growing.

Analysis such as that recommended by the TCFD is hobbled when it comes to physical risk by inadequate disclosure of the location of companies’ key assets. A company with a major manufacturing facility in a flat coastal location is far more vulnerable to both coastal cyclones and sea level rise than the same facility sited hundreds of feet above sea level. But in their reporting companies often only identify the location of their headquarters, whereas the geographic location of major facilities within states or countries is more pertinent to a market assessment of physical risk.

As physical risks become more severe, it is increasingly important for investors to understand their vulnerabilities to them. We understand that it is not possible to precisely predict the location of the next hurricane or drought, but we can identify areas that are more and less vulnerable to various types of physical risks. Understanding the changing probabilities of these future events is something that is potentially valuable to investors, and potentially valuable to companies as they make siting decisions. PG&E’s bankruptcy, and the vulnerabilities of other utilities’ transmission lines, reminds us that companies with significant assets in vulnerable geographies can have significant implications for investors.

In 2010, the SEC issued interpretive guidance detailing the importance of and parameters for disclosure of climate-related risks and opportunities. This guidance was very useful, and it noted that the material risks posed by climate change are already required to be disclosed under Regulation S-K. But what Regulation S-K does not require is information on the specific location of companies’ major facilities, which are at particular risk from the physical impacts of climate change.

We request that the SEC require companies to list specific locations—at least street addresses, and preferably longitude and latitude—of all facilities whose loss or impairment would materially affect financial results. This information, which companies already hold and would not require significant new data gathering and compilation costs, would be very helpful to investors in assessing and pricing physical climate risks appropriately. Without this information, investors will be vulnerable to an increasingly frequent and severe set of shocks that might be mitigated or avoided with increased disclosure.

Thank you for your attention.

Sincerely,

Joseph F. Keefe

President

Impax Asset Management LLC

Julie Gorte

Senior Vice President for Sustainable Investing

Impax Asset Management LLC

Print

Print