Sandra Boss is Global Head of Investment Stewardship at BlackRock, Inc. This post is based on a BlackRock report authored by Ms. Boss, Michelle Edkins, Amra Balic, Gassia Fox, Jon Posen, and Jim Badenhausen. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here) and Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Robert H. Sitkoff and Max M. Schanzenbach (discussed on the Forum here).

This past January, BlackRock wrote to clients about how we are making sustainability central to the way we invest, manage risk, and execute our stewardship responsibilities. This commitment is based on our conviction that climate risk is investment risk and that sustainability-integrated portfolios, and climate-integrated portfolios in particular, can produce better long-term, risk-adjusted returns.

Our efforts around sustainability, as with all our investment stewardship activities, seek to promote governance practices that help create long-term shareholder value for our clients, the vast majority of whom are investing for long-term goals such as retirement. This reflects our approach to sustainability across BlackRock’s investment processes, in which we use Environmental, Social, and Governance factors in order to provide clients with better risk-adjusted returns, in keeping with both our fiduciary duty and the range of regulatory requirements around the world. As a result, we have a responsibility to our clients to make sure companies are adequately managing and disclosing sustainability-related risks, and to hold them accountable if they are not.

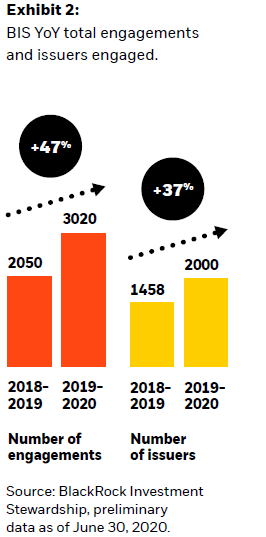

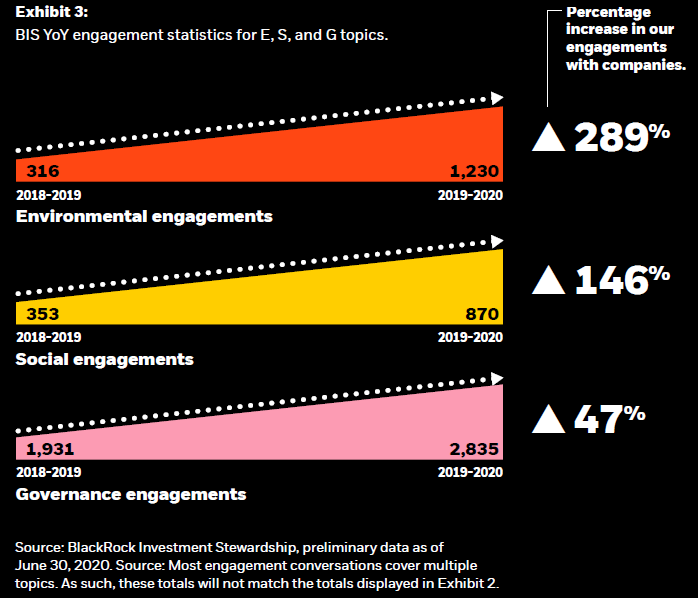

While we have been speaking with companies for years on sustainability issues, our investment stewardship team has intensified its focus and dialogue this year with companies facing material sustainability-related risks. Our approach on climate issues, in particular, is to focus our efforts on sectors and companies where climate change poses the greatest material risk to our clients’ investments. ‘Climate risk’ may include a company’s ability to compete in a world that has transitioned to a low-carbon economy (transition risk), for example, or the way climate change could impact its physical assets or the areas where it operates (physical climate risk).

As with other matters of corporate governance, we use the two key instruments of the stewardship toolkit: engagement and voting.

Engagement is how we build our understanding of a company’s approach to governance and sustainable business practices, and how we communicate our views and ensure companies understand our expectations.

Voting is how we hold companies accountable when they fall short of our expectations. Our voting actions typically take the form of either votes against company directors (or boards) or support for shareholder proposals (SHP).

Our approach on climate issues, in particular, is to focus our efforts on sectors and companies where climate change poses the greatest material risk to our clients’ investments.

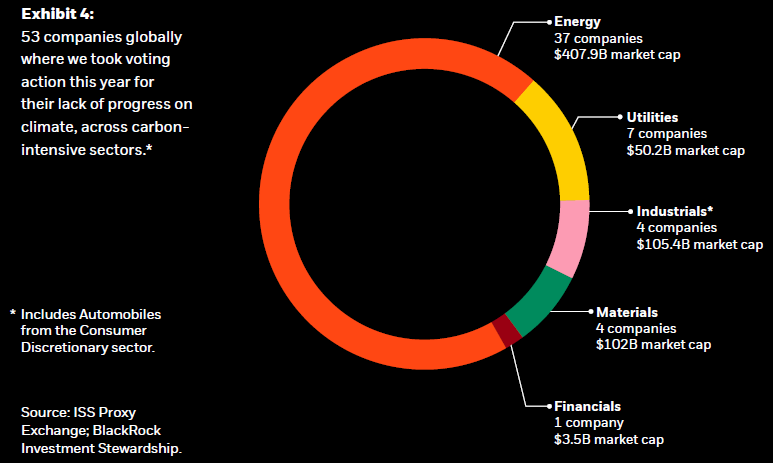

In order to maximize our impact on behalf of clients, our climate-related engagements are focused on companies in carbon-intensive sectors that, taken together, represent a significant proportion of market capitalization and C02 emissions in their respective regions.

These companies face material financial risks in the transition to a low-carbon economy that we need to understand as long-term investors.

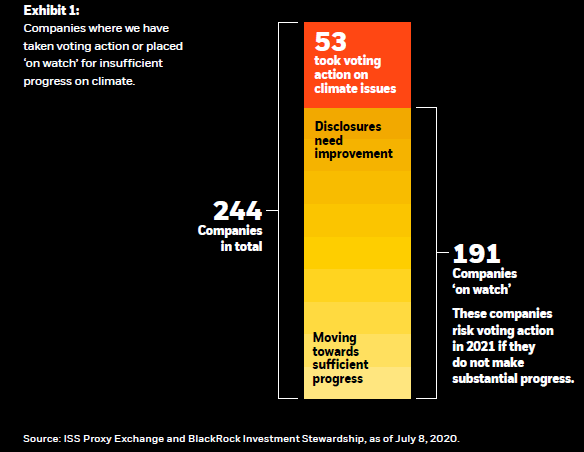

In 2020, we identified 244 companies that are making insufficient progress integrating climate risk into their business models or disclosures. Of these companies, we took voting action against 53, or 22%. We have put the remaining 191 companies ‘on watch.’ Those that do not make significant progress risk voting action against management in 2021.

We have engaged hundreds of other companies on climate and sustainability-related issues over the years. Many companies have made important progress in recent years, and we will continue to engage with them to monitor this progress. We have also identified a number of companies outside the carbon-intensive sectors that present high sustainability-related risk for heightened engagement over the next year.

While this report focuses on climate-related issues, our investment stewardship approach to sustainability is much broader. It encompasses other environmental issues, such as sustainable practices in agribusiness.Our stewardship also includes topics that have been central to many companies’ license to operate, particularly over the past few months, such as human capital management and diversity and inclusion.The COVID-19 crisis, and more recently the protests surrounding racial injustice in the United States and elsewhere, have underscored the importance of these issues and a company’s commitment to serving all of its stakeholders.

In January, we asked companies to publish disclosure aligned with the Sustainability Accounting Standards Board (SASB) standards, which includes disclosing the racial and ethnic profile of their U.S. workforce. In the second half of 2020, as we assess the impact of companies’ response to COVID-19 and associated issues of racial equality, we will be refreshing our expectations for human capital management and how companies pursue sustainable business practices that support their license to operate more broadly. We also will continue to emphasize the importance of diversity in the board room and will consider race, ethnicity, and gender as we review a company’s directors.

The COVID-19 crisis, and more recently the protests surrounding racial injustice in the United States and elsewhere, have underscored the importance of these issues and a company’s commitment to serving all of its stakeholders.

Through this report, we hope to provide a deeper look at our engagement process and methods; how we are working to promote transparency in investment stewardship, both in our own activities and through the adoption of disclosure standards [1]; our involvement with Climate Action 100+; and our view on the importance of social factors to the long-term health of companies and society as a whole.

Going forward, we will continue to review our process for engaging and voting on climate risk and other sustainability-related issues. We have made important progress heightening our focus on sustainability, but we are also committed to constantly enhancing our approach in order to protect our clients’ long-term investments.

Our approach on climate engagement

We began this process with a series of letters in 2017 and 2018.

We have been engaging for several years with companies—particularly those in carbon-intensive industries—regarding the need to enhance disclosure of climate risks and how they will impact business models over time.

We began this process with a series of letters in 2017 and 2018, prioritizing companies with the most carbon-intensive business models where BlackRock’s clients collectively were significant shareholders.

Our objective was to bring the final recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) to the attention of company leadership and ask them to consider reporting in line with the TCFD framework. This past January, we elevated our request, explicitly asking companies to report in line with TCFD standards.

In our direct dialogue with company leadership, we seek to understand how a company’s strategy, operations and long-term performance would be affected by the transition to a low-carbon economy and other climate risks. Broadly, we aim to ensure that companies are effectively managing the risks and opportunities presented by climate change and that their strategies and operations are aligned with the transition to a low-carbon economy—and specifically, the Paris Agreement’s scenario of limiting warming to two degrees Celsius or less, which is laid out in the ‘Metrics and Targets’ pillar of the TCFD framework. Such engagement can help inform the approach taken by corporate leadership as they advance their sustainability practices and disclosure.

Our approach employs a natural escalation process. If we are not satisfied with a company’s disclosures, we typically put it ‘on watch’ and give the company 12 to 18 months to meet our expectations. (The complexity of many sustainability issues may necessitate detailed reviews of operations by the company if it is to make substantive disclosures that inform investors.) If a company has still failed to make progress after this timeframe, voting action against management typically follows.

In our engagements, we often see examples of companies whose disclosures, targets, and business practices on climate issues align with our expectations. We have identified over 60 who fit this category. For these companies, we will continue to engage to ensure that their long-term capital investments and business decisions continue to align with the commitments they have made.

Voting actions

There are two main categories of our voting actions: holding directors accountable and supporting shareholder proposals.

When we vote against a company, we do so with a singular purpose: maximizing long-term value for shareholders. There are two main categories of our voting actions: holding directors accountable and supporting shareholder proposals. Both can be valuable tools in the stewardship toolkit. Shareholder proposals, while often non-binding and less common outside of the U.S., can garner significant attention and send a strong public signal of disapproval. Our approach typically employs votes against directors more frequently since they are a globally applicable signal of concern; additionally, significant votes against directors register strongly with both the individual director and the full board, and, importantly, failure to win a substantial majority frequently results in a director stepping down before the next annual meeting.

We usually express our concern about lack of effective governance of an issue by voting against the re-election of those directors with oversight responsibility for the issue of concern or those in senior leadership roles on the board.

In certain European markets, concerns about a board’s performance may be reflected by a vote against the approval (or ‘discharge’) of a board’s actions over a year. Electing directors is a fundamental shareholder right in the vast majority of the markets in which BlackRock invests on behalf of our clients, with elections held annually at most companies. As such, it is an effective, globally applicable tool to hold companies accountable for poor governance practices in general, and for lack of progress on sustainability issues more specifically.

Voting on shareholder proposals offers another way to express targeted disapproval of a company’s policies or practices. BIS may support shareholder proposals that address issues material to a company’s business model, which need to be remedied urgently and that, once remedied, would help build long-term value. We may support proposals seeking enhanced disclosure if the information requested would be useful to us as an investor and if management has not already substantively provided it. To gain our support, the requests made in a shareholder proposal should be reasonable and achievable in the time frame specified. In some cases, shareholder proposals address issues that may not be material to the company’s business operations or risk or suggest changes that are not reasonably achievable within the specified timeframe. In such instances, we generally decline to support the proposals but may vote against directors where we agree that the proposal highlights a failure (such as insufficient climate risk disclosure).

During the 2020 proxy season, we took voting action against 53 companies for their failure to make sufficient progress regarding climate risk disclosure or management. Voting action means that we voted against the re-election of one or more members of a company’s board, voted against the discharge of directors or the entire board in certain European markets, or voted for one or more climate-related shareholder proposals.

A wide variety of investors, including BlackRock, have expressed their concerns about the investment risks of insufficient climate risk management. In 2020, we took voting action against those companies where we found corporate leadership unresponsive to investors’ concerns about climate risk or assessed their disclosures to be insufficient given the importance to investors of detailed information on climate risk and the transition to a low-carbon economy. In the appendix, in Exhibit 5, is a list of companies that we held accountable through voting for a lack of progress on climate risk disclosures.

Placing companies ‘on watch’

Of the 244 companies we identified as not making sufficient progress in 2020, we have placed 191 companies ‘on watch’ regarding climate disclosure. While these companies’ disclosures are insufficient based on our assessment today, and as such raise concerns about long-term value creation, we did not take voting action this year. We expect each of these companies to make substantial progress prior to the 2021 annual meeting or risk our voting action against boards and management in 2021.

In some cases, these companies had legitimate concerns that delayed their progress on climate issues in 2020, such as responding to the economic crisis and existential threat to business models sparked by the COVID-19 pandemic. In other cases, disclosure standards are evolving for certain sectors, for example, there are several concurrent projects between financial services companies and key institutions, such as the United Nations, that will enhance future reporting. These projects aim to develop reporting methodologies on scenario analysis, stress tests, and science-based Scope 3 emissions definitions and measurement for companies. As a result, we expect companies outside carbon-intensive sectors to be better positioned to provide more complete TCFD-aligned reporting in the near future.

In our assessment, many of these companies are making progress to provide sufficient disclosures by year-end 2020. However, other companies have yet to fully acknowledge the risks and opportunities posed by the transition to a low-carbon economy.

Initiating engagement

We have identified 110 other companies across carbon-intensive sectors to initiate engagement with in the second half of 2020. These 110 companies represent over $2.7 trillion in market cap of carbon-intensive industries, nearly 1.7 billion tons of CO2 emissions (Scope 1 and 2) and over $132 billion of our clients’ exposure.

These are companies where we have had limited or no climate-related conversations to date but have potentially engaged on a number of other governance-related topics. These companies generally fall into two categories. The first category is companies based in emerging market countries that are heavily reliant on carbon-intensive sources of energy such as coal, and as a result, at an earlier stage of addressing climate change. The second category is companies in sectors that are in the next wave in tackling climate change, such as financial services, whose emissions generally are what is considered Scope 3. While we have already had conversations with a number of banks, we plan to increase these engagements over the next year as the sector improves its understanding of Scope 3 disclosures.

Promoting transparency on climate and broader sustainability risks

We believe that all investors need a clearer picture of how companies are managing sustainability-related risks and opportunities.

BIS has long been committed to initiatives that inform and influence governance and reporting practices at the market level, which helps benefit not only our clients but all investors. In relation to climate risk, we have advocated for companies to report in line with the TCFD and SASB frameworks.

We have engaged companies on grounds similar to the strategy of Climate Action 100+, which we joined in January of this year. BIS also enhanced its own disclosures of its stewardship activities to help clients, companies and other stakeholders to better understand our engagement, voting, and advocacy.

Engaging on TCFD and SASB to drive adoption

We believe that all investors need a clearer picture of how companies are managing sustainability-related risks and opportunities.

We advocate for companies to use the TCFD framework and SASB standards as the basis for their sustainability reporting. Both are practitioner-led and continue to evolve in response to feedback from stakeholders on the materiality of certain sustainability issues, on what information is most relevant to investment decision-making and on the need for globally applicable, industry-specific reporting standards. BlackRock contributes to improving market practices, as an original member of the TCFD Board and a member of the Investor Advisory Group of the SASB. We also expect that emerging regulatory standards, particularly the European Union’s Non-Financial Reporting Directive, will provide the granular, comparable metrics and targets that investors are seeking.

TCFD and climate engagement in developing market countries

Developing countries and their companies are at very different stages in terms of climate risk management and disclosures relevant to investors. For much of the developing world, sustainability-related disclosure norms are nascent and there is considerable opportunity in the coming years for reporting and target-setting to improve, supported by policy developments and investor engagement.

In our view, the TCFD framework is a valuable tool for enhancing how companies in developing markets can manage and disclose information pertaining to material risks and opportunities from climate change. In the first half of this year, we wrote letters to the CEOs of companies representing 90% of the Asia ex-Japan market to bring our expectations for TCFD-aligned disclosures to their personal attention.

Climate Action 100+

BlackRock joined Climate Action 100+ (CA 100+) in January of this year, a natural progression in our work to advance corporate reporting aligned with TCFD. CA 100+ is a group of investors that engages with companies to improve climate disclosure and align business strategy with the goals of the Paris Agreement.

Prior to joining, BlackRock was a member of the group’s five partner organizations [2]. BIS’s climate engagement universe includes nearly all of the companies in the CA 100+ list (except those whose ownership structure means we doubt our engagement would influence corporate behaviors). Beyond the CA 100+, BIS’s climate engagement universe also includes over 200 additional companies that we believe warrant prioritization. CA 100+ members benefit from the group’s collective insights, but each investor determines how to vote their holdings independently of other members [3].

As a member of CA 100+’s Asia Advisory Group, and the Asia-region sponsoring organizations, we seek to provide the group with strategic insight into the characteristics of local Asian markets to help inform engagements. Together with Cathay Financial, we have taken on the role of lead investor in engagement with China Steel, a Taiwanese company. In this engagement, we are encouraging China Steel to enhance its climate disclosures and to pursue more ambitious targets and investment plans to transition its business in line with a lower than 2-degree Celsius scenario.

Sustainability issues beyond climate

We have long made human capital management one of our engagement priorities.

Since the beginning of the COVID-19 pandemic, we have engaged with more than 380 companies across all 11 GICS sectors and 29 countries globally to understand how they are balancing short-term pressures created by the COVID-19 crisis with efforts to oversee long-term material financial and operational performance.

In particular, we have focused on how the crisis has impacted companies’ commitment to sustainable social practices—that is, the compensation, employee development and advancement, working conditions for employees and suppliers, local community outreach, and other measures companies put in place to build a diverse, engaged workforce and a strong corporate culture within supportive local communities.

It is our investment conviction, grounded in research [4], that companies with sustainable business practices can deliver better long-term, risk-adjusted returns. Companies with clear purpose that build strong relationships with their employees, suppliers, and other stakeholders are more likely to meet their strategic objectives, while poor relationships can reduce productivity, harm product and service quality, and even jeopardize a company’s social license to operate.

For this reason, we have long made human capital management one of our engagement priorities. Our broad approach to human capital management touches upon eight of the UN’s Sustainable Development Goals—including decent work and economic growth, gender equality, reduced inequalities, and good health and well-being. Well-supported employees, who align with the company’s purpose, are more likely to be engaged and play a central role in creating sustainable long-term value. As such, our approach focuses on the board’s effectiveness in overseeing how a company meets the expectations of its workforce.

In our recent engagements, we have found many companies that are finding ways to strengthen their commitment to employees and other stakeholders during the pandemic, from establishing employee relief funds to providing meals to local hospitals.

Because COVID-19 poses an existential threat for many companies, it is also straining the social contract between companies and their employees and other stakeholders. As companies reduce staffing levels and restart post-lockdown, for many workers, the promise of decent work in safe conditions feels increasingly remote. In some countries, the resultant economic dislocation has heightened economic, gender and racial inequality. As long-term investors, we believe that companies forced into difficult choices affecting employees, suppliers and local communities—especially those companies receiving government financial support—need to make prudent, balanced decisions about executive and board compensation and allocation of capital.

Where we are unconvinced that companies are preserving their social license to operate—whether in the context of the pandemic or more broadly—we may take voting action.

For example:

- We voted against management at Tyson Foods, a S. packaged food company, by supporting a shareholder proposal on supply chain due diligence because we were not satisfied with the company’s disclosures and practices around sustainable working conditions.

- We voted against the re-election of a director at McKesson, a U.S. pharmaceutical company, for the company’s failure to take adequate remedial action for their role in the U.S. opioid crisis.

- We supported a shareholder proposal at financial services company Santander Consumer USA where we were concerned that the risks of racial discrimination in lending practices were not being managed in a transparent and effective manner.

- We supported a shareholder proposal at S. technology company Fortinet that demanded greater disclosure around the company’s diversity and inclusion efforts.

- And we voted against management at Ocado, a UK online grocery retailer, over concerns that the board did not exercise appropriate oversight of executive compensation given the current economic environment, potentially harming its relationship with consumers.

We believe issues that could threaten a company’s license to operate will become even more acute in the wake of the COVID-19 crisis.

We have also engaged extensively over the year on purpose and culture, which both reflect whether a company exhibits a stakeholder-focused orientation. In our recent engagements, many companies have described to us the importance as they responded to COVID-19 of the prior work they have done to align their mission, vision, and values with their day-to-day operations.

The consistent message we have heard is that a strong, purpose-driven culture provides companies with a unifying concept for employees and external stakeholders on which they depend.

* * *

The complete report is available here.

Endnotes

1We asked in January 2020 that companies publish reports aligned with the recommendations of the Task-Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB) standards.(go back)

2Asia Investor Group on Climate Change (AIGCC); Ceres; Investor Group on Climate Change (IGCC); Institutional Investors Group on Climate Change (IIGCC) and Principles for Responsible Investment (PRI).(go back)

3As the CA 100+ website notes: “All investor signatories to the Climate Action 100+ initiative are responsible for their own voting decisions—this includes pre-declaration and vote Climate Action 100+ investor networks do not seek to provide voting recommendations or to facilitate block voting.”(go back)

4BlackRock Investment Institute: Sustainable Investing: a ‘why not’ moment; Sustainability: the bond that endures.(go back)

Print

Print