Kyle Isakower is Senior Vice President of Regulatory and Energy Policy at the American Council for Capital Formation. This post is based on his ACCF report.

Introduction

A new analysis of companies’ supplemental filings to their proxy materials with the U.S. Securities and Exchange Commission (SEC) during the majority of the 2020 proxy season shows at least 42 instances where proxy advisors have formulated recommendations based on errors* or analysis disputed by the companies themselves.

For example, in one supplemental filing, a proxy advisor generated a recommendation using a disputed figure for a company’s net income, a basic but critical number. Another highlighted how a proxy advisor based its recommendation on a peer group that did not include the company’s actual competitors. Other filings showed instances where proxy advisors issued recommendations that appear to be contradictory with their stated policies.

These results are consistent with the prior analysis of supplemental filings we conducted into the 2016, 2017, and part of the 2018 proxy seasons, and which uncovered a total of 139 apparent errors.

The findings are significant as they show that disputes between companies and proxy firms have continued despite significant scrutiny from Congress, the SEC, and an array of impacted stakeholders. They suggest that these efforts have not fully had the intended effect and that further intervention is needed in order to ensure that investors have as accurate information as possible before voting their securities.

*In this post, any use of the term “errors” refer to cases where companies’ supplemental filings plainly stated that a proxy firm’s analysis contained either an outright factual mistake or fundamental errors or omissions in analysis when developing vote recommendations. Companies who submitted such filings are subject to antifraud provisions within SEC regulations and are legally liable for any misstatement of fact. A full accounting of the supplemental filings analyzed for the report is contained in the appendix of the complete publication.

Summary of Findings

A search of the SEC’s EDGAR database through July 9, 2020 found 42 examples of public companies filing supplemental proxy materials this proxy season in order to correct the record regarding a proxy advisory firm vote recommendation. Because supplemental filings are subject to antifraud provisions of SEC regulations this study views them as accurate.

The companies that have made these filings cut across virtually every sector of our economy and most are small or mid-cap entities that do not have the significant legal and compliance resources of their larger counterparts.

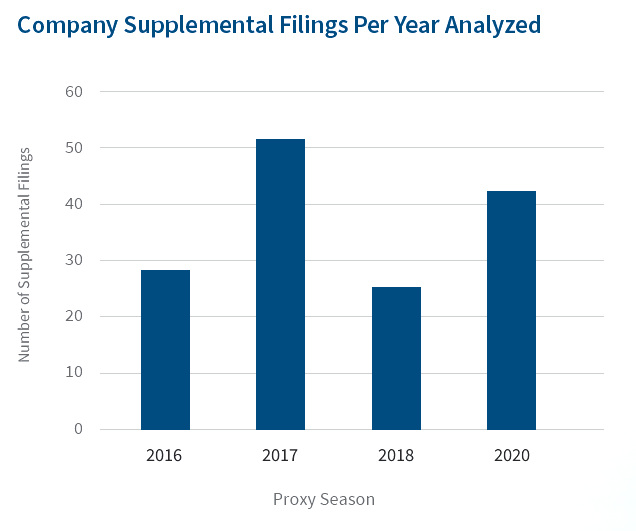

These filings are consistent with our previous research into this topic, which showed 29 supplemental filings in 2016, 52 in 2017, and 26 during the period examined in 2018. They demonstrate that companies are still encountering proxy advisor recommendations that they argue are based on factual and analytical errors, as well as serious disputes, all of which should be considered by investors before casting their votes in corporate elections.

It is important to note that the number of supplemental filings highlighted in this and previous ACCF reports may well represent the “tip of the iceberg” and still undercount the overall instances of errors or other methodological flaws contained in proxy advisory firm recommendations.

Specifically, the data includes only those companies that have taken the extraordinary step of filing a supplemental proxy. Doing so not only entails voluntarily increasing the company’s anti-fraud risk, but also requires diverting significant company resources to submit the filing in the limited window available. Anecdotal evidence suggests that many companies who face issues with proxy advisers are either unable or choose not to submit

supplemental filings.

We would suggest that the current system of submitting supplemental filings does not represent the most efficient solution to correcting errors or disputed analysis in proxy advisors’ recommendations. The process is both laborious and time consuming and perhaps most importantly imposes added demands on investors to identify necessary information before voting. As such, an update to the proxy voting process would certainly appear to be warranted.

Case Studies

Factual Errors: Plains All American disputed the decisions by two proxy advisers to issue votes against the company’s say on pay proposal, noting that one report was “wrong and (is) based on a flawed and error-filled analysis.” The company claimed that amongst other errors, the pay for performance analysis in the proxy report was based on an erroneous net income figure that was off by $1.7 billion. This was the second year the proxy advisor based their analysis off a disputed figure, even though the company previously pointed out the issue to the advisor.

Analytical Errors: Five9 was puzzled when it found that a proxy adviser had issued a ‘withhold’ recommendation against one of its directors, due to her membership on four audit committees. The reason for the confusion was the proxy firms’ own guidance, which states a director should not serve on more than three public audit committees, “unless the audit committee member is a retired CPA, CFO, controller or has similar experience, in which case the limit shall be four committees.” The director who was subject to the ‘withhold’ recommendation is a retired finance professional and holds no operating positions with any company—clearly within the proxy firm’s guidance on the subject.

Serious Disputes: Hecla Mining challenged a proxy adviser over its peer group selection for a say-on-pay recommendation. One of the oldest US incorporated mining companies, it stated that although the North American industry is dominated by Canadian businesses, a proxy adviser chose to use a peer group which only featured US incorporated companies, including those in the chemicals and agricultural products sectors.

Analysis of the SEC’s Proposed Rulemaking

It is important to recognize that proxy advisory firms perform a critical function in the U.S. capital markets. They provide institutional investors with research and vote recommendations regarding board of director elections, executive compensation, mergers and acquisitions, and other corporate governance matters at public companies. A well-functioning proxy advisory system can enhance the long-term value of businesses and ultimately benefit Main Street investors.

However, over the last decade, the practices of proxy advisory firms have come under increased scrutiny from market participants, Congress, academics, and the SEC. The quality of vote recommendations, a concern that proxy firms may issue “one size fits all” vote recommendations, and apparent conflicts of interest within the industry have led policymakers to propose reforms that would increase transparency and ensure proxy advisors provide high-quality voting advice that promotes the long-term best interests of investors.

Questions regarding the independence of proxy advisor firms have also been raised over the years. For example, proxy advisor “specialty reports”—provided to certain proxy firm clients based upon “socially responsible” or faith-based investment guidelines—are alleged to give preference to certain shareholder resolutions and have the potential to influence reports provided to other clients.

Companies typically have little insight into the content of such specialty reports and how it may affect the advice being provided to their shareholders.

These concerns have led the SEC to clarify the responsibilities of asset managers who hire proxy advisory firms. Asset managers owe a fiduciary duty to retail investors that put their savings into mutual funds, exchange-traded funds, or other managed investment vehicles. Asset managers must prioritize the economic interests of these shareholders when casting votes and take steps to affirm that any advice they rely on from proxy advisory firms is based upon factual and accurate information.

As the Commission explained through guidance issued in August 2019, a regular assessment by asset managers regarding, “the extent to which potential factual errors, potential incompleteness, or potential methodological weaknesses in [a] proxy advisory firm’s analysis…materially affected the proxy advisory firm’s research or recommendations” could assist them in fulfilling their fiduciary duty to shareholders. In other words, when asset managers rely on vote recommendations that contain errors or analytical weaknesses, it could ultimately harm retail investors.

In November 2019, the SEC proposed rules that would implement long-overdue reforms to the proxy advisor industry. The proposal is the culmination of a decades-long effort by the Commission to examine the practices of proxy advisory firms and those who rely on their recommendations, and has been informed by several SEC roundtables and solicitations for public comment, as well as Congressional hearings dating back to 2013. The proposal is properly calibrated to improve the overall quality of proxy advice received by institutional investors without imposing undue costs on market participants.

An important component of the SEC’s proposed rule is a mechanism granting companies the ability to provide feedback on draft vote recommendations. This would provide companies the opportunity to correct any apparent errors or raise serious points of disagreement prior to a final report being issued. While nothing in the proposal grants companies any type of “veto” over a recommendation, a draft review process would ensure that recommendations are based on facts and that investors have both company and proxy adviser viewpoints available when making voting decisions. At a stroke, this will address not only factual disputes, but also the differences of opinion which proxy firms contend make up the majority of supplemental filings and other company complaints. Importantly, we see no reason as to why this would hinder proxy advisers’ independence.

In a speech on the proxy advisor rule, SEC Commissioner Elad Roisman indicated that the proposal would likely be tweaked so that companies and institutional investors would both receive the proxy advisor reports at the same time and review them contemporaneously. If companies find errors or have serious disagreements with the recommendations, they could submit their response to proxy advisors and the advisors would then distribute the response to their institutional investor clients to consider before voting their shares. To ensure companies have time to submit their response before investors vote, Roisman indicated that the final rule would also likely include a “speed bump” or time period where proxy advisors would disable any mechanisms they have to “robo-vote” their clients’ shares on their behalf.

If the final rule is updated to include this contemporaneous review period, it will represent a significant compromise by the business community. It removes companies’ ability to review reports prior to publication and will not allow investors to assess both sides of the argument simultaneously. However, it will address concerns raised that the rule as proposed will slow down the voting process and give companies an opportunity to raise the concerns currently reflected in the often-overlooked supplemental filings highlighted in this report.

Currently, the largest proxy advisory firm permits only companies included in the S&P 500 the opportunity to review and comment on draft recommendations. Other proxy advisory firms have established subscription services for companies that wish to review draft reports. Both practices implicitly acknowledge the value of company feedback in the process. However, despite the importance of ensuring accurate information is included in final reports, there is no regulatory standard for providing companies with a way to correct errors and submit comments before a final vote recommendation is issued.

As noted by the SEC in the proposal, this lack of a standard has led to concerns that, “there are not meaningful opportunities to engage with the proxy voting advice business and rectify potential factual errors or methodological weaknesses in the analysis underlying the proxy voting potential to improve the accuracy, transparency, and completeness of the information available to make those voting decisions.” Ensuring that the clients of proxy advisor firms receive the most accurate and up to date information on critical proxy matters fits squarely within the SEC’s mission and will promote the long-term best interests of investors.

Conclusion

The supplemental filings submitted by companies thus far in the 2020 proxy season provides a public glimpse of potential proxy firm errors and serious disputes they face each year.

These disputed data and analyses are critical pieces of information that must be evaluated by the institutional investors who vote on behalf of their clients in order to uphold their fiduciary duty. Left unevaluated, errors can cost companies instead of increasing their value as intended. The factual disputes identified in this new report are consistent with previous years’ findings, and demonstrate

that recent efforts, including the SEC’s August guidance, will not on their own be sufficient to resolve the problem. Further action is needed.

The SEC’s proposed rule to regulate proxy advisors will address this critical issue by enhancing the information available to institutional investors without compromising the independence of proxy advisors. Once finalized, the rule will improve the workings of corporate governance by facilitating greater transparency and accountability amongst public companies and their investors.

The complete publication, including appendix, is available here.

Print

Print