Aniel Mahabier is CEO and Founder, Iris Gushi is Research Operations Lead, and Thao Nguyen is a Research Analyst at CGLytics. This post is based on their CGLytics memorandum.

Introduction

The COVID-19 pandemic has had a major impact on the US economy. Businesses that have seen financial impact have laid off or furloughed employees, cut salaries, and in some cases, received state aid in order to preserve cash and stay afloat. In addition to these measures, some businesses have taken an additional step and adjusted the compensation practices for their Executives and Board Members (mainly in form of reduced base salaries and cash fees). So far in 2020 we have seen 634 companies listed on the Russell 3000 (114 of which are listed on the S&P 500 index) issue some type of pay adjustments to Executives, and to their Board of Directors. As a result, the total amount of base salary reductions for CEOs of these companies are expected to approximately equate to USD 180 million in 2020. For this study, CGLytics looked at the 554 companies that had issued pay adjustments to Executives and their Board as of May 31, 2020. The study examines how companies have reduced CEO, NEO and Director pay, and questions if enough is being done in light of the pandemic.

Perpetual Pay for Performance Misalignments

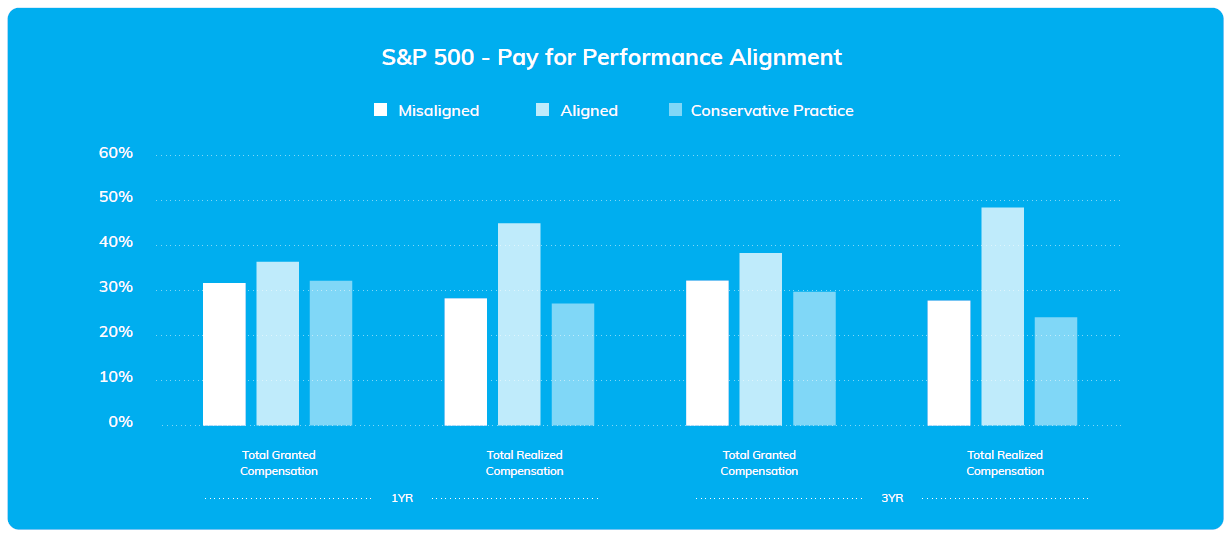

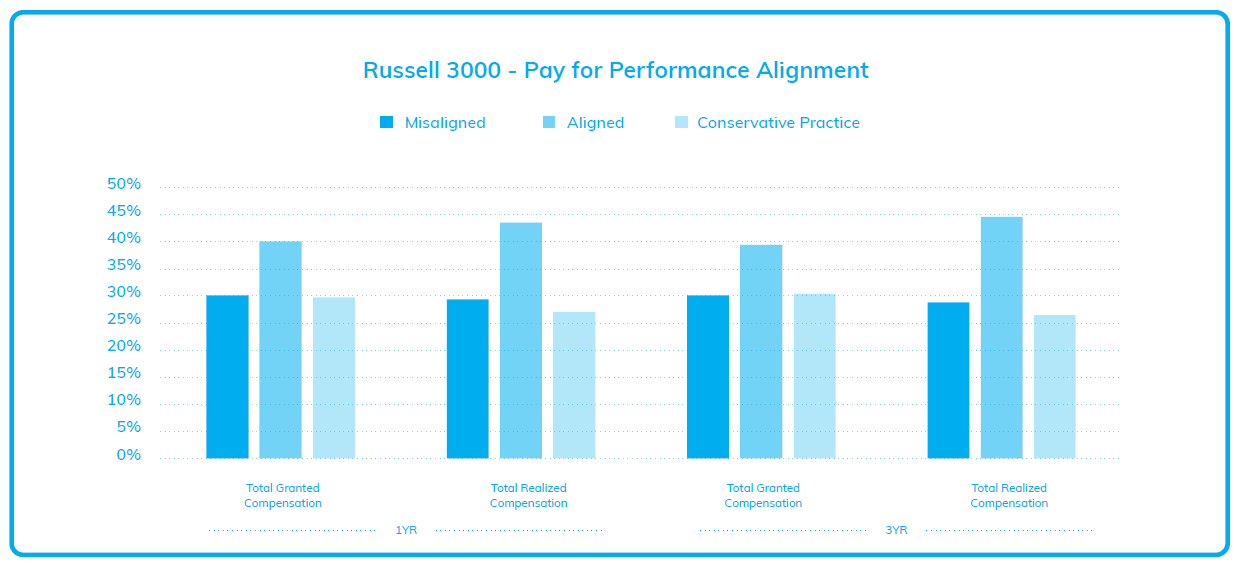

Executive compensation has always been a topic of controversy. It is often unclear whether multi-million dollar payouts accurately reflect the performance of the company and its Executives. Analysis by CGLytics found that roughly one-third of the S&P 500 and the Russell 3000 are overpaying their C-suite compared to their company’s performance based on Total Shareholder Return (TSR). Furthermore, we have seen that, compared to last year, the average CEO granted pay is up 9% for the S&P 500 companies and down 6% for Russell 3000. The median CEO granted pay has increased 11.5% in the Russell 3000 index. For both indexes, the Named-Executive Officers’ (NEO) granted compensation increased compared to the previous year.

Adjustments to Executive and the Board of Director Compensation

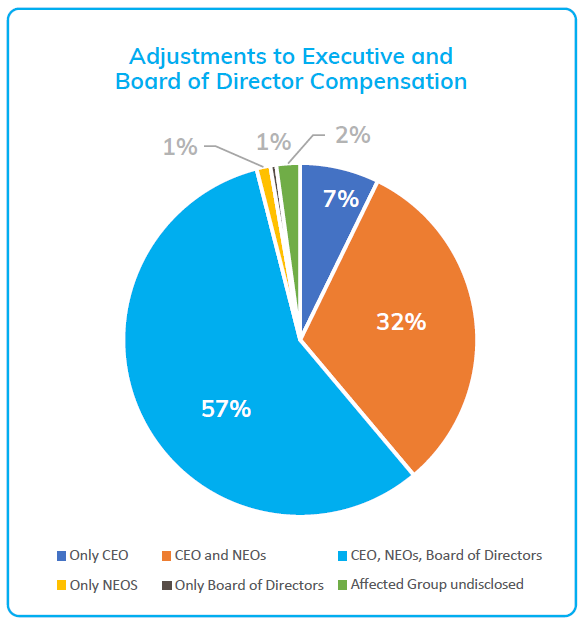

Company revenues and share prices have been hit hard by COVID-19. Companies can no longer afford to maintain multi-million dollar remuneration packages for their leaders. Of the 554 companies in the Russell 3000 that exercised changes to compensation as of May 31 this year, 7% adjusted compensation for only the CEO and roughly one-third adjusted compensation for CEO and NEOs. 57% of companies went further than just reducing their Executives’ pay, extending the pay cuts to include the Board. Only a small number of companies had pay changes for either the NEOs or their Board of Directors.

Most of the adjustments to Executives’ and Board of Directors’ compensation were made in the form of reductions to base salary and board fee, rather than long-term incentive compensation and annual cash bonuses. This is possibly due to the total effects of COVID-19 on the payouts of the latter two remaining unclear. Moreover, reducing base salary and board fee is a means to lower expenses and preserve cash.

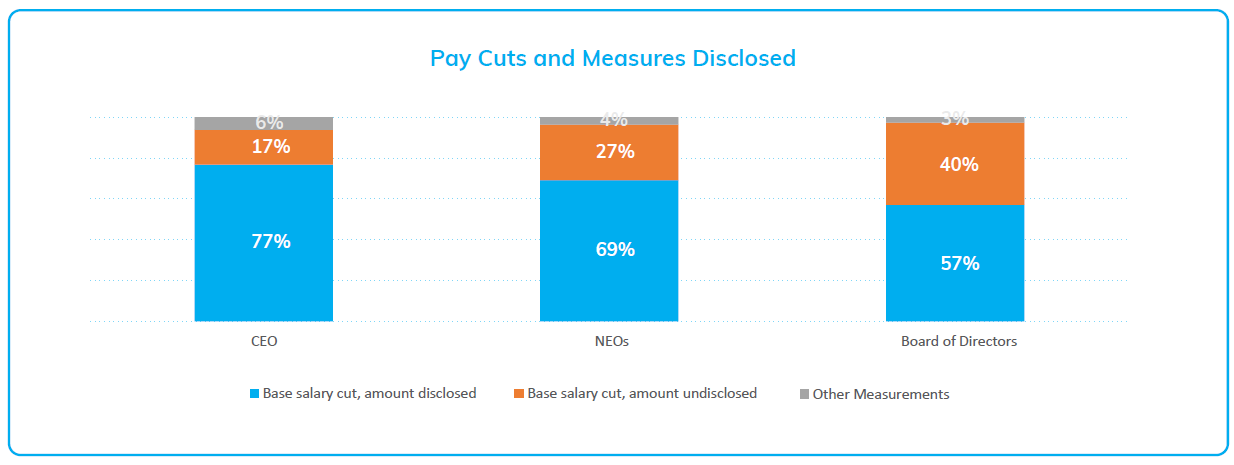

Of the companies that imposed changes in compensation affecting the CEO, three-quarters specified the amount of the pay reduction, while 17% did not disclose exactly how much of a cut their CEO’s are taking.

Of the companies that also adjusted compensation beyond the CEO, 27% did not disclose the specifics of the pay reduction for NEOs and 40% did not disclose the specifics of the pay reduction for the Board of Directors. Some companies (33) opted for other pay adjustment measures, such as a deferral of base salary, or a payment of salary in Restricted Stock Units (RSUs).

More than half of these companies chose to pay their CEO’s and NEOs in RSUs, ranging from 50% to 100% of their base salary.

Notably, Wynn Resorts and MGM Resorts International, which were materially impacted by COVID-19, converted 100% of their CEO base salary into RSUs. Deferrals of salary, on the other hand, are lower, mainly ranging from 25% to 50% of base salary. A small group of companies (9) have also implemented a deferral of cash fee or payment of fee in RSUs for the Board for a period or for the full remainder of the year.

Adjustments to Executive and the Board of Director Compensation

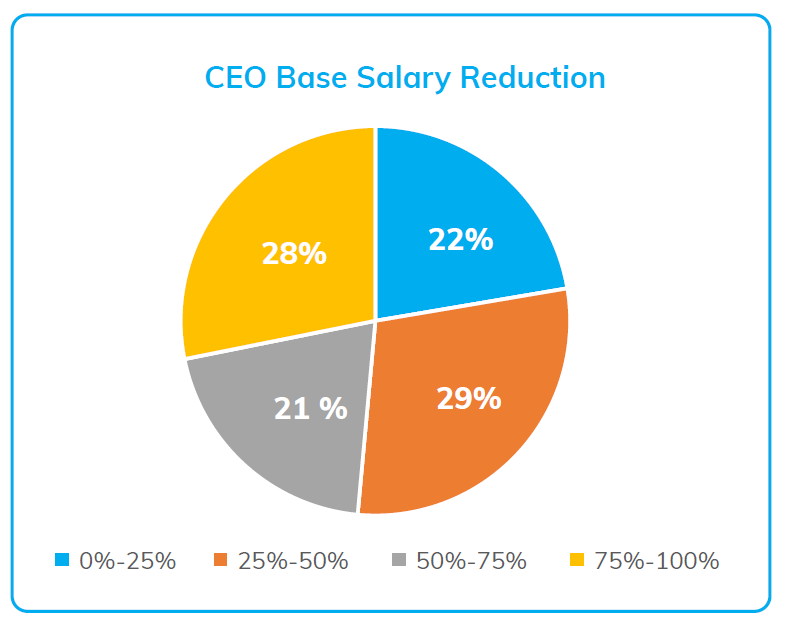

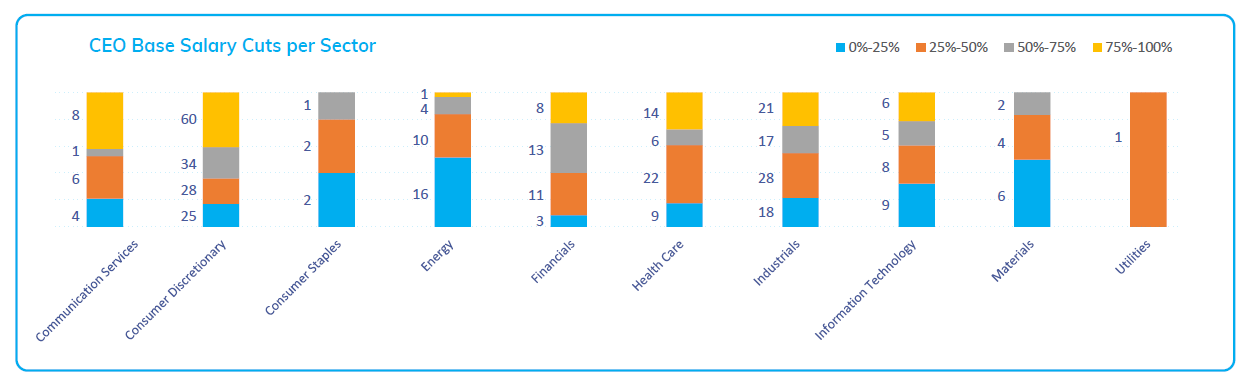

Looking at the companies that specified base salary reduction, it is revealed that nearly half of the companies reduced their CEO’s base salary by more than 50%, and more than a quarter cut their CEO’s base salary by 100%. The median strength of base salary cuts for CEO’s is 40%.

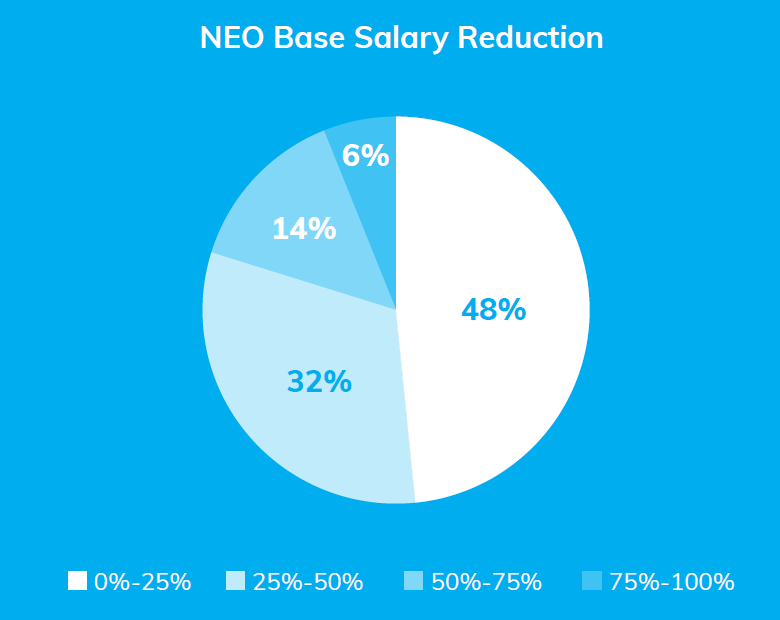

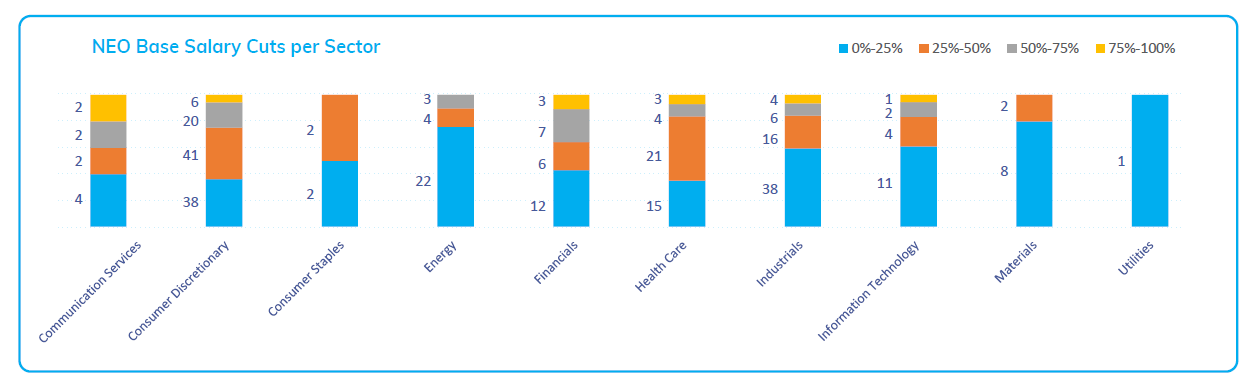

In contrast, only 20% of companies reduced NEO base salary by more than half; reductions are primarily less than 25%. The median strength of pay cuts for NEOs is 25%.

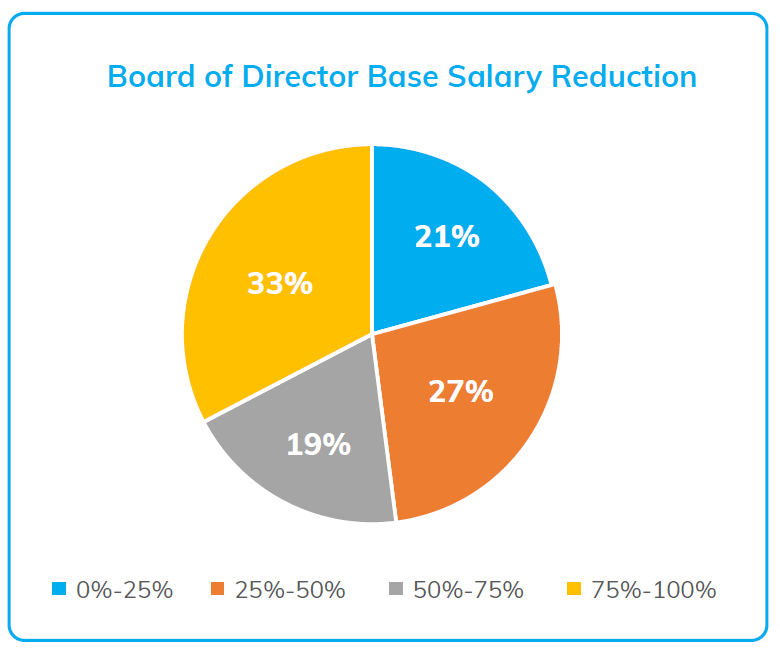

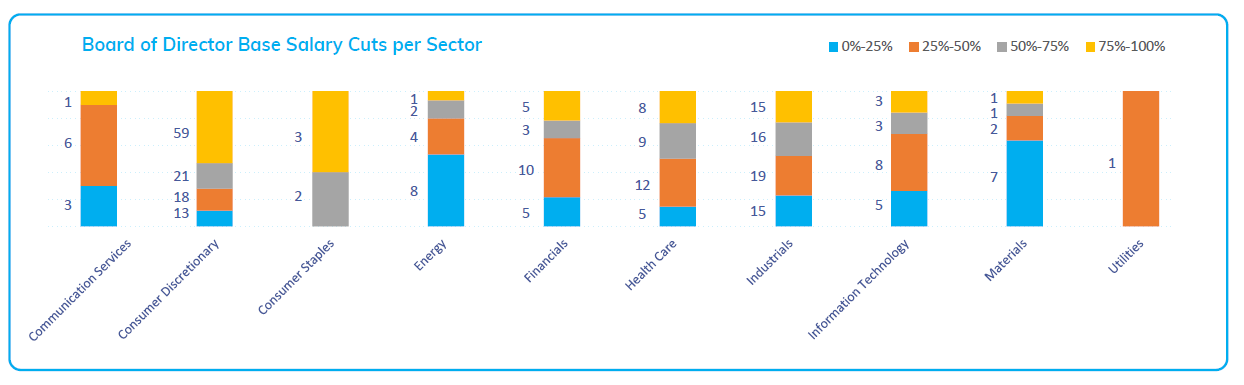

Board of Directors’ cash fee reductions follow the same trend as CEO base salary reductions. 52% of the companies slashed board fees by more than half and 32% of companies cut 100% of cash fees for Directors. The median cash fee reduction for the Board is 35%. Additionally, half of the companies which imposed 100% reduction in CEO base salary also did the same to Board of Directors’ fee.

Pay Adjustments by Industry

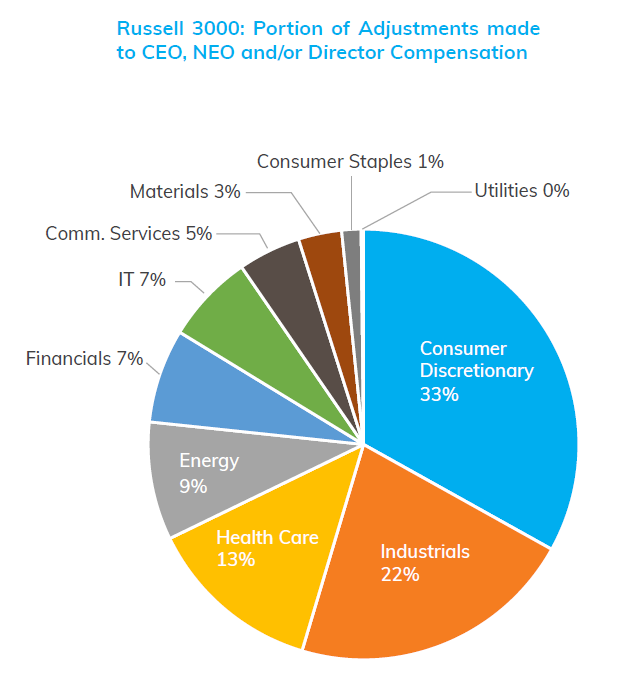

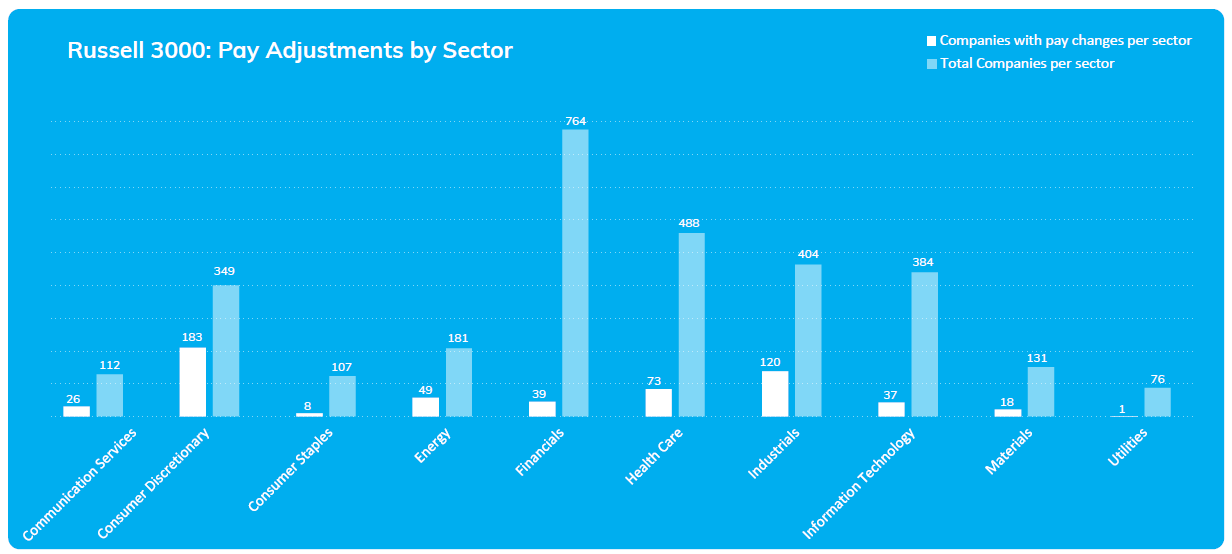

The Consumer Discretionary sector, which includes hospitality, restaurants & leisure, and retail companies, represents the largest portion of the companies that issued compensation adjustments, followed by the Industrials sector, which includes airlines. A sharp drop in travel demand, a surge in cancellations, and slowed traffic to retail stores caused by the pandemic have severely affected these two industries.

As shown below, 52% of the companies within the Consumer Discretionary sector in the Russell 3000 have declared some form of pay adjustments to Executives and/or to the Board, while 29% of the companies within the Industrials sector have done so.

Interestingly, even though the Financial sector has the largest representation in the Russell 3000 (764 companies), only 5% of the companies have performed changes to Executive and/or Board compensation.

Furthermore, the least affected sectors, such as Consumer Staples (food, household and personal product companies) and Utilities, occupy the smallest portions of companies with pay adjustments. Of companies listed on the Russell 3000 index, only 7% of the 107 Consumer Staples companies and 1% of the 76 Utilities companies have implemented pay changes to Executives and/or their Boards.

The Health Care sector, although not a hard-hit industry, has seen 73 out of 488 (15%) companies announcing pay actions, representing the third largest portion of the total number of companies with pay announcements.

Pay Reductions in Hardest Hit Industries

Considering only the companies that specified compensation cuts, more CEO’s in the Consumer Discretionary sector fall into the highest base salary reduction category. 60 companies in this sector have seen their CEO’s pay cut between 75-100%. The same pattern also holds true for Board of Directors’ fee reductions, with one-third of Consumer Discretionary companies cutting 75%-100% of board fees. Meanwhile, most of NEO cuts for this sector tend to be of lower magnitude, mainly less than 50%. For Consumer Discretionary companies, the median pay cut is 50% for CEO’s, 20% for NEOs and 25% for Board Members.

Compared to the Consumer Discretionary sector, we see fewer companies within the Industrials sector with base salary cuts larger than 50% for all CEO’s, NEOs and Board of Directors. The bulk of the reductions in this sector are between 25%-50% for CEO’s and Board Members, and between 0%-25% for NEOs. Median pay reductions for the Industrials sector are 25%, 15% and 20% for CEO’s, NEOs and Board of Directors, respectively.

Is Reducing Base Salary Enough?

While salary reductions for Executives are greatly appreciated in this difficult time and are meant to show solidarity with employees, the fact is that base salary is only a fraction of the often enormous compensation packages granted to CEO’s and other Executives. Compensation packages predominately consist of cash bonuses and equity awards. Even though 80% of the Russell 3000 companies have disclosed 2019 compensation for Executives, we have not witnessed any companies making adjustments to these figures in light of the crisis, even for companies in hard-hit industries.

Edward Bastian, CEO of Delta Airlines, has agreed to cut 100% of his base salary for 6 months, [1] which equals USD 714,000, but still holds on to his 2019 cash and stock awards of USD 16 million, which were granted earlier in 2020. [2] Another interesting case is MGM Resorts International, where CEO Jim Murren was supposed to stay through 2021 to receive USD 32 million in compensation, including USD 12 million in severance. According to the terms of his termination agreement, he would not receive the compensation package if he left before 2021. [3] However, days after he resigned voluntarily in March, MGM announced that his resignation would be treated as a “termination without good cause”, which would qualify him to receive the full USD 32 million package. [4] In the meantime, 63,000 employees of MGM have been furloughed and will possibly be fired. [5]

Furthermore, activist investors have begun to feel unhappy about some executive pay actions amid the pandemic. CtW Investment Group, an investor of Uber, urged shareholders to reject Uber’s compensation package at the Annual General Meeting since it includes a USD 100 million equity grant to the CEO. [6]

While the ride-hailing company has suffered from a USD 2.9 billion first quarter net loss in 2020 [7] and planned to lay off 6,700 employees [8] (about 30% of its workforce), its CEO Dara Khosrowshahi only took a 100% base salary cut from May until the end of 2020, [9] which totals USD 666,000, and took home a USD 42.4 million pay package for 2019.

The same investor also urged shareholders of McDonald’s to vote against the USD 44 million+ exit package, including USD 700,000 in cash severance, for former CEO Stephen Easterbrook, who was fired last year over violation of company policies due to his relationship with an employee. [10]

The investor’s efforts failed in both instances and the CEO’s took home millions of dollars while their companies are struggling.

Since the COVID-19 outbreak, a number of public companies have gone bankrupt. Nevertheless, large sums of compensation were paid out to their Executives. Retailer J. C. Penney paid almost USD 10 million in bonuses to top executives [11] and oil company Whiting Petroleum issued USD 14.6 million in bonuses for its C-suite, [12] just days before both companies filed for bankruptcy.

Another school of thought is that the practice of issuers deferring executive salary cuts into RSUs will give rise to huge payouts in the future when the market eventually recovers and share value increases. This means that Executives who deferred their base salary have made a sacrifice that ultimately will benefit them, defeating the purpose of pay cuts.

Although the economic impacts of the pandemic on businesses are still on-going, the number of pay cuts announced has slowed since the end of May. As the effects continue to unfold over the next months, we expect companies to continue to re-evaluate their executive compensation policies. COVID-19 has changed daily lives, business operations, and the economy. Even though we will only know the full extent of impact in the second half of 2020, COVID-19 will certainly change executive pay and corporate governance practices in the future.

Endnotes

1https://www.sec.gov/Archives/edgar/data/27904/000168316820000862/delta_8k-ex9901.htm(go back)

2https://www.sec.gov/Archives/edgar/data/27904/000130817920000240/0001308179-20-000240-index.htm(go back)

3https://www.sec.gov/ix?doc=/Archives/edgar/data/789570/000119312520038441/d870226d8k.htm(go back)

4https://www.sec.gov/ix?doc=/Archives/edgar/data/789570/000156459020012233/mgm-8k_20200321.htm(go back)

5https://www.wsj.com/articles/mgm-resorts-warns-63-000-workers-of-possible-layoffs-11588795280(go back)

6https://www.sec.gov/Archives/edgar/data/1377739/000137773920000005/uber2020shletter.htm(go back)

7https://www.sec.gov/ix?doc=/Archives/edgar/data/1543151/000154315120000022/fy2020q1financialstate.htm(go back)

8https://www.sec.gov/ix?doc=/Archives/edgar/data/1543151/000155278120000362/e20337_uber-8k.htm(go back)

9https://www.sec.gov/ix?doc=/Archives/edgar/data/1543151/000155278120000325/e20313_uber-8k.htm(go back)

10https://www.ft.com/content/1f8aecd7-7f6f-4b20-8c99-6984c8304129(go back)

11https://www.reuters.com/article/us-jc-penney-bankruptcy/j-c-penney-files-for-bankruptcy-protection-idUSKBN22R3DP(go back)

12https://www.bloomberg.com/news/articles/2020-04-01/whiting-executives-got-14-6-million-bonuses-before-bankruptcy(go back)

Print

Print