Steve W. Klemash is Americas Leader; Jamie C. Smith is Investor Outreach and Corporate Governance Specialist, and Rani Doyle is Executive Director, all at the EY Center for Board Matters. This post is based on their EY memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here) and Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here).

The 2020 proxy season saw companies and investors navigating a rapidly evolving business environment, including new virtual modes of communication and working.

The COVID-19 pandemic, including its widespread, multidimensional impacts and acceleration of changes and risks, is casting a spotlight on corporate resiliency. It is also challenging recent company commitments to stakeholder capitalism, driving attention to environmental, social and governance (ESG) matters, and reshaping areas of corporate and investor focus.

To help boards navigate this new normal and meet evolving stakeholder expectations, this report examines four ESG developments from the 2020 season and considers how investor and corporate perspectives and priorities are changing in the wake of the pandemic, the growing push to eradicate systemic racism, and other macro developments. [1]

1. Workforce issues take center stage

The focus on human capital and talent in corporate governance has intensified in recent years as more stakeholders—led by large institutional investors [2]—seek to understand how companies are integrating human capital considerations into overarching strategy to create long-term value. Investor focus on human capital was magnified as the pandemic made workforce health, safety, well-being and compensation central to many companies’ ability to survive and thrive in the face of uncertainty. Further, as racial justice becomes a national focus, workforce diversity and related diversity and inclusion policies and practices are coming under closer scrutiny.

Investors’ prioritization of workforce issues manifested in a number of ways this season, from publicly-declared stewardship goals to high-profile letter campaigns, including a letter signed by more 300 institutional investors calling on companies to take specific steps to protect their workforce in responding to COVID-19, and a more recent campaign calling on companies that issued supportive statements on racial equality to publicly disclose the composition of their workforce by race, ethnicity and gender. [3] Investors also took action through record-level support of shareholder proposals on workforce issues, achieving majority support on topics including human capital risks and opportunities, workforce diversity, and contractual provisions requiring employees to arbitrate employment-related claims, including sexual harassment claims.

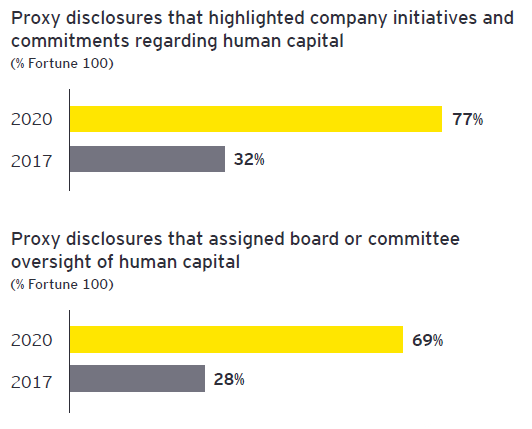

This year’s proxy disclosures demonstrate that many companies are paying attention: the percentage of Fortune 100 companies that voluntarily highlighted human capital initiatives and commitments more than doubled over the past three years, rising from 32% in 2017 to 77% in 2020. Similarly, the percentage of companies that explicitly assigned board or committee oversight of human capital jumped from 28% in 2017 to 69% in 2020, with those responsibilities generally assigned to compensation committees.

Workforce disclosures focused on diversity

What follows is a closer look at human capital initiatives and commitments voluntarily disclosed in Fortune 100 proxies this year, including what kinds of key performance indicators and goals were communicated. The level of company-specific detail varies widely.

Top five human capital topics addressed (% Fortune 100 companies)

![]()

Diversity—Twenty-seven percent provided some measure of workforce diversity data, most often disclosing the percentage of women and/or minorities across the workforce or across certain leadership or management categories. Ten percent disclosed a forward-looking target, most often around increasing the number of women and minorities holding senior-level roles.

![]()

Health, wellness and safety—Fifteen percent provided a related performance measure, most commonly recordable injury or incident rates. Other metrics disclosed included the number of employees participating in health and wellness programs, the company’s recent record on work-related fatalities, and the aggregate amount invested in employee benefit programs.

![]()

Compensation—Thirteen percent disclosed specific pay ratios for female to male employees and/or minority to nonminority employees, in all but one case adjusted for job function. [4] Five percent reported a specific minimum wage, and a few disclosed the aggregate amount spent on workforce compensation.

![]()

Culture initiatives— Nine percent provided an indicator of current cultural performance, generally key results of employee surveys (e.g., reflecting whether employees are proud to work at the company or would be willing to give extra effort to meet the company’s goals).

![]()

Development, skills and capabilities—Twenty-one percent provided a measure of performance, usually the number of employees that participated in training and development programs. Other performance measures included the aggregate amount of money invested in training programs, the average number of hours of training and development per employee, and the percentage of managerial positions filled by internal promotions

Key board takeaway

Understand that many investors view human capital as vital to assessing the potential value and performance of a company over the long term and will hold directors accountable for effective oversight. In light of recent events, investor focus on human capital is increasing. How a company treats its employees in the wake of the COVID-19 crisis could affect its brand value for years to come. As the national conversation on race advances, scrutiny of how companies uphold their commitments to diversity and inclusion will intensify. Companies should enhance communications regarding human capital, including providing data to demonstrate progress and accountability around the company’s stated commitments and describing the allocation of board-level oversight responsibilities.

2. Companies enhance environmental governance and communications

As the manifestation of physical climate risks continues to accelerate, a growing number of investors are prioritizing engagement on climate change and other environmental topics. In late fall 2019, more than half of the 64 institutional investors we engaged told us they view environmental issues, particularly climate change, as a key threat to their portfolio companies over the next three to five years, making it the second highest risk cited. Close to 60% of investors told us they planned to engage companies on climate change in 2020, making it the top engagement priority shared with us prior to COVID-19.

Underscoring investor focus in this area, in January two institutional investor giants strengthened their public statements on the link between material environmental issues and long-term financial value and announced plans to hold companies accountable for making progress on sustainability reporting and the business practices underlying them. [6]

While COVID-19 has pulled workforce and community health issues to the fore, addressing systemic climate risk and pressing companies for increased transparency and progress around environmental risks and opportunities remains an investor priority. Votes on environmental shareholder proposals this season reflect this conviction. Among the shareholder proposal topics securing majority support in 2020 are the alignment of company strategy and operations with the Paris well below 2 degrees Celsius; public health risks of expanding petrochemical operations in areas increasingly prone to climate change‑induced storms, flooding and sea level rise; alignment of corporate lobbying with the Paris Agreement; and sustainability reporting describing company ESG performance.

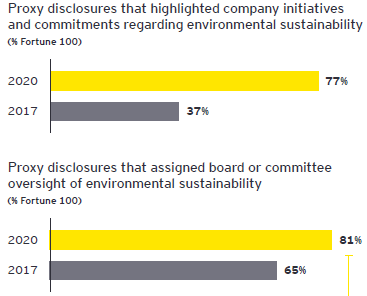

As investors double down on sustainability, companies are enhancing their environmental governance and communications. The percentage of Fortune 100 companies voluntarily highlighting environmental sustainability initiatives and commitments more than doubled over the past three years, jumping from 37% in 2017 to 77% in 2020. Similarly, there has been a significant increase in proxy disclosures assigning board or committee oversight of sustainability, rising from 65% of companies in 2017 to 81% in 2020, with those responsibilities usually assigned to the nominating and governance committee.

Top five environmental topics addressed (% Fortune 100 companies)

![]()

Climate change/emissions—Thirty-six percent disclosed a measure of related performance, most often a percentage reduction in emissions against a baseline. Other performance indicators included the amount of money invested in climate solutions, a measure of carbon emissions avoided due to the company’s practices or products, and carbon neutrality across certain operations. Thirty-five percent provided a future target, generally a percentage reduction in emissions by a certain date. A handful disclosed goals to become, or remain, carbon neutral.

![]()

Renewable energy—Twenty-one percent disclosed future goals, generally a commitment to source a certain percentage of energy from renewables by a target date. Thirteen percent provided a measure of current performance, usually the percentage of energy currently sourced from renewables.

![]()

Waste—Twelve percent disclosed related performance indicators, usually an estimated measure of the amount of waste eliminated or diverted from landfills. Twelve percent disclosed a future performance target, often a percentage of waste to be diverted from landfills or a percentage of waste reduction against a specified year.

![]()

Energy efficiency—Ten percent provided a measurement of performance, usually percentage improvement in energy efficiency over a specified time period, a measurement of energy saved, or an estimate of how much money has been saved related to energy efficiency projects. A few companies provided forward-looking targets, generally a percentage reduction against a baseline.

![]()

Water—Fourteen percent disclosed related performance indicators, in most cases the percentage of water use reduction over a baseline. Some companies disclosed an estimate of the gallons of water saved by the company’s efforts or the percentage of water returned to its source. Six percent disclosed forward-looking targets, generally a percentage reduction of water use against a baseline.

Key board takeaway

3. Board diversity and related disclosures advance

The pressure on boards to diversify across a number of dimensions, but particularly gender and race, continues to grow. Board diversity was the second-highest 2020 engagement priority investors shared with us this fall, with those investors citing diversity as foundational to enhancing board perspectives, deliberations and decision-making.

Many investors also think board diversity sets an increasingly crucial tone at the top for broader workforce diversity, a factor that is likely to draw more attention from stakeholders amid the increased national focus on racial justice. Additionally, a growing number of state legislatures, including in Washington, California, Illinois and Maryland, have enacted requirements related to board diversity, and at least two shareholder proposals on board diversity have secured majority support so far this year. [7] Under this increasing stakeholder pressure, board diversity and related disclosures generally continue to advance, but whether boards are making progress on racial diversity is unclear.

All-male boards nearly extinct—number of women on boards rising

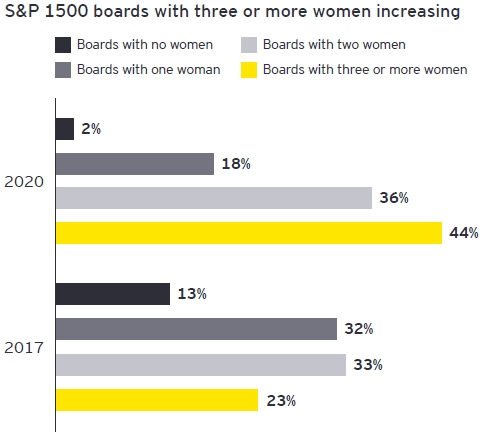

Close to half of the boards of S&P 1500 companies now have three or more women, almost doubling the percentage that did so three years ago. At the same time, all-male boards have nearly disappeared. A more dramatic shift is underway across the S&P 500, where all boards now have at least one woman and two-thirds have at least three women.

In addition, the percentage of women-held directorships across the S&P 1500 has continued to increase by at least 2 percentage points annually since 2018, reaching 26% this year. Prior to 2018, that rate had increased just 1 percentage point each year.

Along with successful engagements between investors and companies on this issue, a key driver of change has been increasing investor votes against the nominating committee chairs and members of all-male boards. Director opposition votes typically average around 4%–5% at S&P 1500 boards. In contrast, this year the average opposition to nominating chairs at all-male S&P 1500 boards was 28% of votes cast (up from 24% last year), and it was 24% for nominating committee members overall (up from 18% last year).

Racial/ethnic board diversity disclosures continue to climb, but unclear if such diversity is advancing

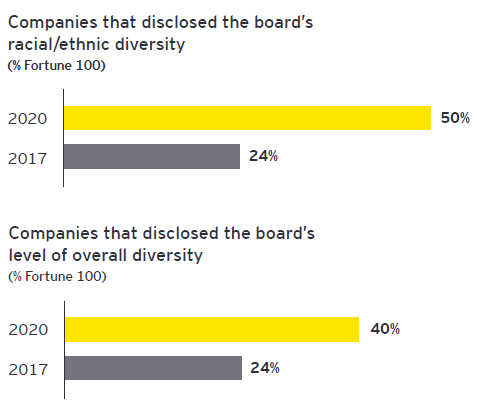

More companies are voluntarily disclosing the board’s racial/ethnic diversity, with half of Fortune 100 companies doing so this year, up from 24% in 2017. More boards are also disclosing their aggregated diversity, combining diversity across gender, race, ethnicity and sometimes other identity categories to provide an overall percentage of “diverse” directors. This year, 40% of the Fortune 100 disclosed the level of overall diversity on the board, up from 24% in 2017.

Enhanced racial/ethnic diversity disclosures largely hinge on director willingness to self-identify, [8] and some directors may choose not to do so for personal reasons. Without these disclosures, it is unclear if racial diversity is advancing. Among Fortune 100 companies that voluntarily disclosed the board’s racial/ethnic diversity this year, that level of diversity averaged 25%, which is the same level of racial/ethnic diversity for Fortune 100 companies making those disclosures in 2017.

As boards and executive leadership work to set the tone at the top for how companies prioritize and value diversity, they should understand that a lack of racial and ethnic diversity in the boardroom and C-suite often speaks for itself, and likely sends a stronger signal to investors, employees and other stakeholders than the company’s messaging in this area.

Key board takeaway

Challenge whether the board is setting the right tone at the top regarding the importance of diversity and effectively advancing diversity across the company through its responsibilities related to talent, succession planning and compensation. Enhance disclosures to highlight current board and workforce diversity; discuss the company’s commitments to increase diversity, including the practices and policies that will drive change; and discuss the specific steps the company and the board are taking to advance racial justice and live the organization’s values.

4. Virtual annual meetings surge

From a governance perspective, a key development of the 2020 proxy season was the surge in virtual-only shareholder meetings. While the number of companies having such meetings has increased in recent years, COVID-19 catapulted this minority practice into the mainstream. More than 2,200 virtual meetings were held in the US market this year, up from 286 for all of calendar 2019. A vast majority of these companies were holding virtual meetings for the first time. [9]

This change created an opportunity for companies to dispel some investor concerns that virtual meetings shield companies from direct accountability and criticism. It also created an opportunity to pave the way for what may become a more permanent shift to a practice that enables higher levels of shareholder participation, lowers the carbon footprint of an annual meeting and achieves cost savings and efficiency for companies and shareholders alike.

While acknowledging the learning curve of adopting a new practice during a crisis, and the intense demands on service providers needing to move companies to virtual platforms almost overnight, investors have raised concerns about some of their experiences in the 2020 meeting season. Reported problems include challenges logging into meetings, inability to ask or get answers to questions and a lack of transparency on questions asked by shareholders. [10]

Some governance practitioners have assessed this year’s virtual meeting results and are suggesting enhanced approaches that optimize technology to enhance shareholder attendance and engagement and aspire to replicate an in-person meeting. These practices include:

- Providing prominent and clear instructions on how to attend, vote and ask questions

- Having a video component to enable shareholders to see company representatives speaking in real time

- Allowing shareholder proponents to call into the meeting to present their proposal or send a prerecorded message to be played at the meeting

- Having a help line or online chat feature to assist shareholders as needed at each step of login and meeting participation

- Posting a written Q&A for all appropriate questions asked in advance of and during the meeting on the company website after the meeting [11]

Key board takeaway

Companies should seek feedback from shareholders on what worked well and what didn’t at the company’s virtual meeting (and virtual meetings generally), leverage lessons learned from peers and refresh annual meeting processes. Understand that investors will hold accountable those companies that hold virtual meetings without enabling strong investor participation similar to what might be experienced at an in-person meeting.

How recent events are reshaping areas of investor and corporate focus

Proxy season 2020 unfolded as the COVID-19 pandemic locked down people and economies globally and wrapped up amid civil unrest related to the recent and ongoing injustice against the Black community. These events, on the heels of other macro developments—such as shifts away from globalization, sustainable investing going mainstream and climate change becoming a dominant business and political issue—are reshaping the global business environment. [12]

A number of key business trends are accelerating, including digitization and the transition to virtual working environments, the diversification of supply chains, and stakeholder capitalism as the pandemic underscores the interdependence of long-term financial value and social and environmental factors.

The growing global focus on racial and economic justice and equality is already further sharpening the spotlight on companies’ societal role and how, and for whom, capitalism creates value.

In this environment, long-term stakeholder value—inclusive of ESG factors—is more clearly emerging as a critical lens through which to assess a company’s resilience and competitive differentiation. Through this lens, a number of topics are emerging as key areas of focus for investor and company engagement over the coming year:

- Risk management and resilience—Investors want to understand how risk management, business continuity and crisis preparedness practices and oversight have fared throughout the crisis. They also want to know what lessons learned are being applied to strengthen resilience, including as business purpose and strategic opportunities are reimagined and virtual working escalates key risks (e.g., risks related to culture, compliance and cybersecurity).

- Supply chain—The pandemic has exposed long, complex and opaque supply chain structures that cannot withstand broad disruptions from trade and other political and environmental risks. Investors want to understand how supply chain risks are being assessed, redesigned and made more resilient.

- Human capital—New ways of working and changing social mindsets are leading to new stakeholder expectations regarding human capital management, including around employee health and wellness policies, workplace flexibility, reward frameworks, and workforce strategy and investment. Companies will need to upskill and reskill their people for a workforce of the future, position themselves as a reputable employer of choice and communicate to the market how talent strategy supports long-term value creation. [13] Diversity practices, and particularly the results of those practices (i.e., data around minority hires, promotions, pay and positions across senior leadership), will be under greater scrutiny, as will board composition and diversity.

- Executive compensation—Investors generally want to see that senior executives are not insulated from the pain felt by key stakeholder groups, including employees enduring pay cuts, furloughs and layoffs; investors who have suffered steep losses; and communities and governments struggling to manage drastically reduced budgets.

- Capital allocation— Investors have grown increasingly critical of share buybacks in the recent bull market. Some legislators have had similar views, as evidenced by provisions under the CARES Act that place stock buyback restrictions on companies that receive certain loans or investments under the Act. [14] Investors want clarity on how capital allocation decisions support long-term sustainable growth.

- Environmental risks—Climate change remains the most pressing economic and environmental challenge globally. COVID-19 may intensify pressure on companies to better address climate change, as stakeholders recognize the current disruption as an opportunity for companies to reprioritize environmental goals aligned with the business’ long-term prospects—and as potentially foreshadowing future disruption society could face without an expedient energy transition.

- Stakeholder commitments and long-term value— Investors are closely scrutinizing how companies are being accountable to their commitments around human capital, community and the overall importance of stakeholders to the business. Investors understand that how companies treat their employees, customers, suppliers and communities during this crisis, and the social impacts of their decisions, will affect their brand value for decades.

Where do we go from here?

As companies simultaneously contend with and look to emerge from global economic and societal upheaval in the wake of COVID-19, new and evolving challenges are already presenting themselves: upcoming US national elections, shifting consumer preferences, a deepening climate crisis and rapidly shifting geopolitical and environmental risks. Companies must enhance their strategic, operational and financial resiliency. Boards and management must lead the way with a focus on simultaneously addressing short-term demands and long-term value creation.

With today’s challenges comes opportunity. Current economic conditions and extreme liquidity pressures may force many companies to adopt a more strategic, cost-efficient focus on exactly where sustainability intersects with and drives business value over the long term. Out of necessity, sustainability efforts and reporting may be synthesized and sharpened to strip away the immaterial, move beyond greenwashing and prepare for the new future of needing to be more digitally driven, socially purposeful and resilient in a carbon-constrained economy.

In turn, this may act as a catalyst for more streamlined, decision-useful nonfinancial reporting that is aligned with the business, focused on clear metrics, goals and progress, and more effectively communicates the company’s long-term value proposition.

As companies accelerate into uncertainty, effective governance executed by a highly skilled and diverse board, sustained corporate focus on long-term stakeholder value, and authentic, transparent communications that address investor needs and priorities will help companies adapt and thrive.

Questions for the board to consider

- As the company navigates a new normal in the wake of COVID-19, how is it communicating to shareholders around key decisions impacting the workforce, capital allocation, board and executive pay, strategy, risk management and future resilience? Do those communications clearly align to the company’s long-term, multi-stakeholder value proposition?

- Has the company leveraged external reporting frameworks to identify, measure and disclose material ESG information? How confident is management in the quality of its data in these areas? Is the company providing progress updates on its ESG goals similar to its quarterly reporting of financial results?

- How does the company’s workforce diversity data align with its aspirations regarding diversity and inclusion? How is the company addressing any misalignment?

- Does management’s sustainability strategy focus on the environmental risks and opportunities most relevant to long-term value? Are there transparent governance structures to oversee sustainability and reporting that communicates how the company measures related success?

- What is the board doing to proactively challenge its composition in terms of gender, race and ethnic diversity as well as diversity of skills aligned to the company’s oversight needs? How is it communicating these efforts to shareholders and demonstrating the value it places on diversity?

- What feedback has the company received from shareholders on its 2020 virtual annual meeting format, or on shareholders’ broader experience of virtual annual meetings this season? How is the company maximizing opportunities to make virtual shareholder meetings (or the virtual component of hybrid meetings) an inclusive, transparent platform for engagement?

Endnotes

1Vote results and shareholder proposal data for 2020 are as available for meetings through June. Proxy disclosure data is based on the 78 companies on the 2020 Fortune 100 list that filed proxy statements as of June 15. All other data is full year and based on the Russell 3000 index unless otherwise specified.(go back)

2For recent investor perspectives on human capital, see What investors expect from the 2020 proxy season, EY Center for Board Matters, February 2020.(go back)

3See Investor Statement on Coronavirus Response, Interfaith Center on Corporate Responsibility, and Comptroller Stringer and Three New York City Retirement Systems Call on 67 S&P 100 Companies Who Issued Supportive Statements on Racial Equality to Publicly Disclose the Composition of their Workforce by Race, Ethnicity and Gender, Office of New York City Comptroller Scott Stringer, July 1, 2020.(go back)

4One company disclosed pay gaps for women and minorities based on median pay, unadjusted for job function or other factors. This measurement, which addresses the lack of representation of women and minorities in higher-paying roles, is one that some investors have highlighted for us as being of increasing interest. See EY Center for Board Matters 2020 proxy season preview: what investors expect from the 2020 proxy season, February 2020.(go back)

5See Measuring Stakeholder Capitalism: World’s Largest Companies Support Developing Core Set of Universal ESG Disclosures, World Economic Forum, 22 January 2020, and What boards need to know about ESG, EY Center for Board Matters, 25 March 2020.(go back)

6See Larry Fink, Chairman and CEO, BlackRock, letter to CEOs, A Fundamental Reshaping of Finance, January 2020, and BlackRock Investment Stewardship Engagement Priorities for 2020, March 2020. See also Cyrus Taraporevala, President and CEO, State Street Global Advisors, CEO’s Letter on our 2020 Proxy Voting Agenda, January 2020.(go back)

7See Washington’s Substitute Senate Bill 6037, California’s Senate Bill No. 826, Illinois’ HB3394, and Maryland’s SB911.(go back)

10See Council of Institutional Investors May 3, 2020, letter to Anne Sheehan, Chair, Investor Advisory Committee, Securities and Exchange Commissions, providing comments on shareholder engagement/virtual shareholder meetings in the Covid-19 pandemic context. See also July 6, 2020, letter from the Interfaith Center on Corporate Responsibility, Shareholder Rights Group, US SIF, Council of Institutional Investors and Ceres to Jay Clayton, SEC Chairman, and William Hinman, Director, Division of Corporation Finance, SEC.(go back)

11See Key Takeaways and Best Practices from Virtual Shareholders Meetings in 2020, Doug Chia, President of Soundboard Governance LLC, and Statement on Shareholder Participation and Virtual Annual Meetings, Interfaith Center on Corporate Responsibility and Shareholder Rights Group, July 2020.(go back)

12For information on how current geopolitical forces are shaping the global business outlook, see How boards can support a geostrategic response to new political risks, EY Center for Board Matters, June 2020.(go back)

13See also How boards can help shape a new normal for the workforce, EY Center for Board Matters, May 2020.(go back)

Print

Print