Steve W. Klemash is Americas Leader; Rani Doyle is Executive Director; and Jamie C. Smith is Investor Outreach and Corporate Governance Specialist, all at the EY Center for Board Matters. This post is based on their EY memorandum.

Boards can enhance a culture of continuous improvement by routinely having board members share and receive candid feedback from each other, as well as from senior executives and external parties with whom they regularly interact. This feedback can bring about important adjustments to board dynamics, agendas, processes, meeting materials and resources, and board and committee composition.

Additionally, investors and other stakeholders remain keenly interested in how boards are enhancing their performance and composition through regular assessments. Disclosures about a board’s evaluation process and results can enhance investor understanding and trust in the board’s oversight.

Annually since 2018, the EY Center for Board Matters (CBM) has reviewed proxy statements filed by Fortune 100 companies to identify trends in board evaluation practices. We find that companies continue to evolve their evaluation practices and related disclosures. A vast majority (95%) of 2020 Fortune 100 proxy filers provide at least some disclosure about their evaluation process, up slightly from 2019 and 2018. While the scope and details of the disclosures continue to vary, we offer the following six observations and emerging trends.

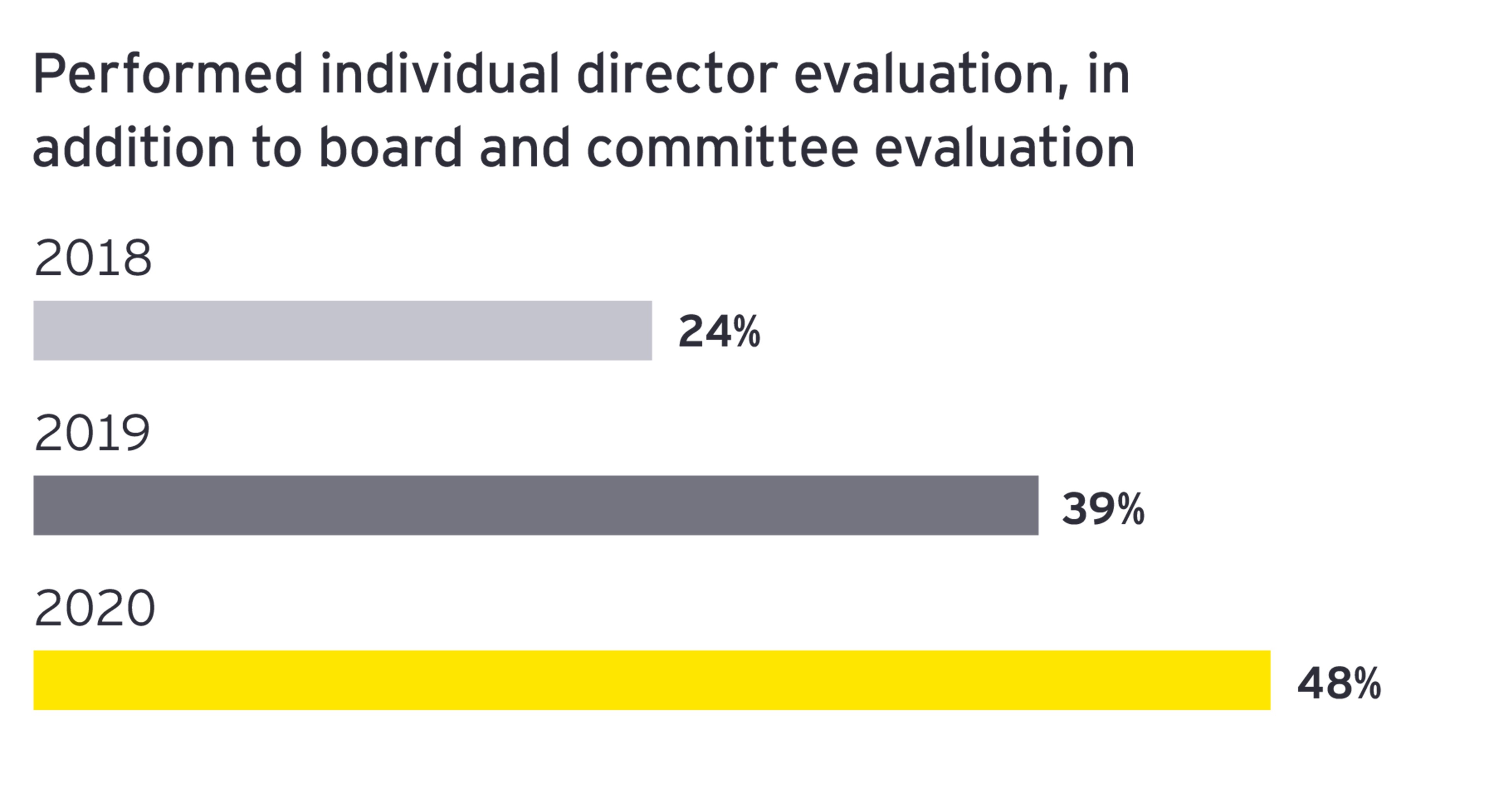

1. Evaluation of individual directors is increasing

Since 2018, the most significant change we have observed is that more boards are expanding their evaluation process to include individual director evaluations. Almost half of 2020 Fortune 100 proxy filers disclosed that they performed individual director evaluations along with board and committee evaluations, up from 24% in 2018.

While board and committee evaluations have long been required of all public companies listed on the New York Stock Exchange and are a best practice for all public companies, this growing momentum around individual level assessments is new. By more directly addressing questions of director performance, individual director evaluations may raise the bar for clear introspection, respectful candor and healthy dissent.

Among the companies that disclosed performing individual director evaluations, it was not always clear whether that assessment involved peer evaluation, director self-evaluation or both. Twenty-nine percent made clear that the individual director evaluation component includes director peer evaluations, up from 10% in 2018, and 11% made clear that it involves self-evaluation, up from 5% in 2018.

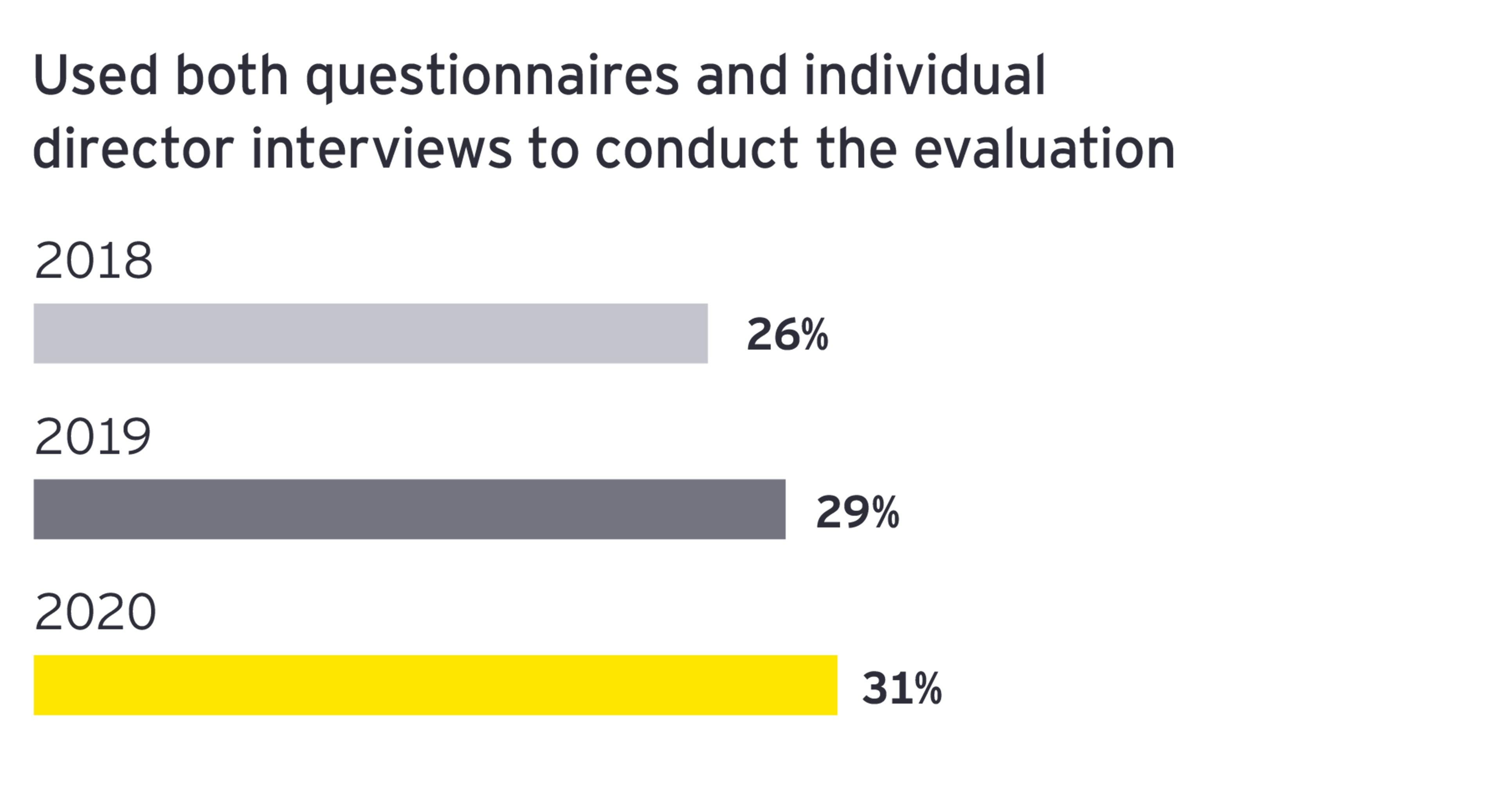

2. Using both questionnaires and interviews continues to increase

Questionnaires can elicit thoughtful qualitative responses or quantitative ratings that can be completed without attribution and analyzed to identify matters for discussion and action on improving effectiveness. Questionnaire responses and analysis can also be used to meaningfully focus individual one-on-one interviews with some or all directors to elicit additional information that can enhance overall performance.

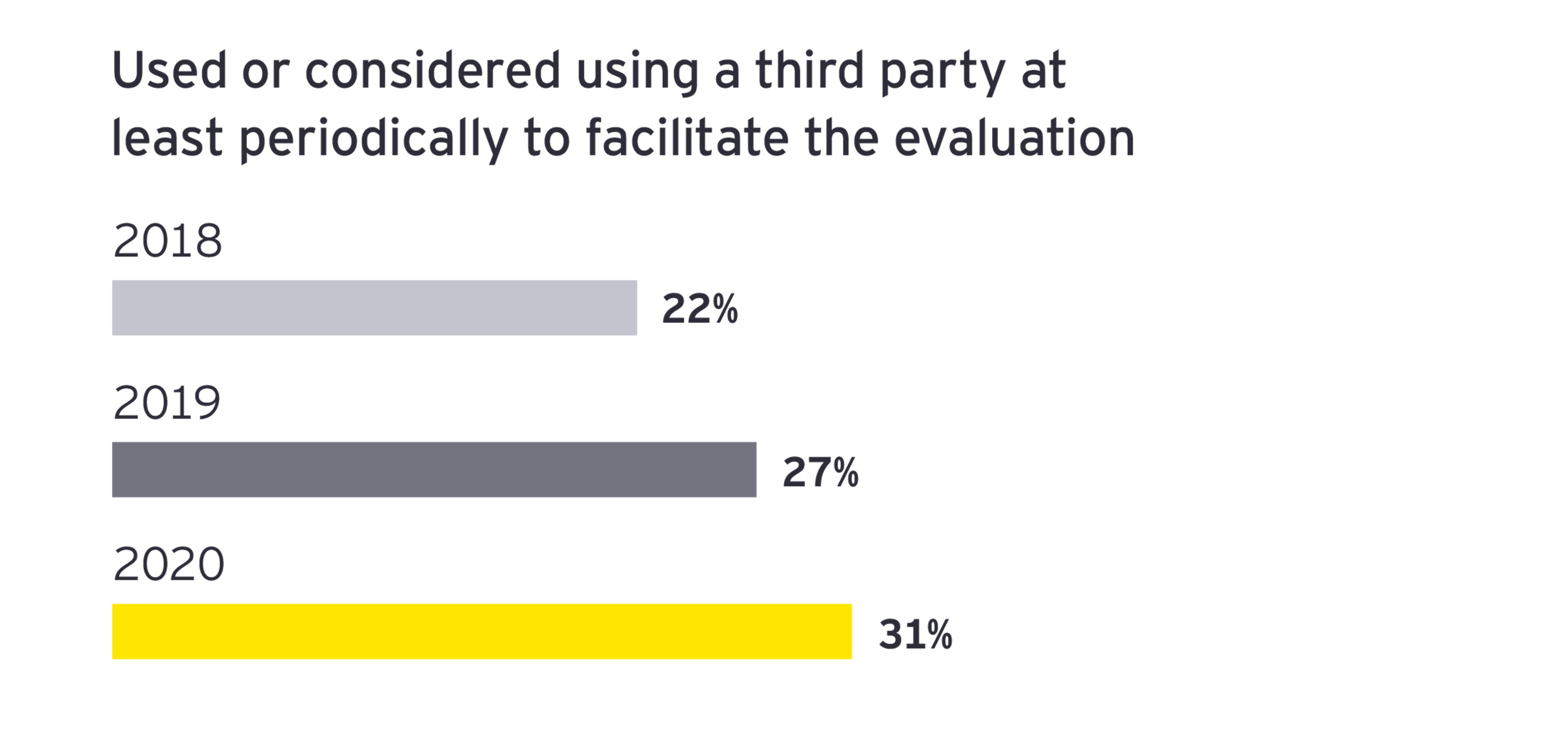

3. Use of third-party facilitators is continuing to expand

Our findings indicate that boards are moderately increasing their use of third-party facilitators, such as governance advisory firms or external counsel, in the way board evaluations are designed and implemented and in the formulation of action items to address findings from the process. Third parties can assist with some or all parts of an evaluation, from reviewing or drafting evaluation questionnaires to designing and fully executing tailored evaluation programs. Third parties bring market insight and practices that can enhance and strengthen assessment processes through an objective eye and deeper insights, as even the strongest board can have one or more blind spots or biases. Additionally, directors are often more direct, open and candid with a third party when providing overall insight or development areas of a peer director.

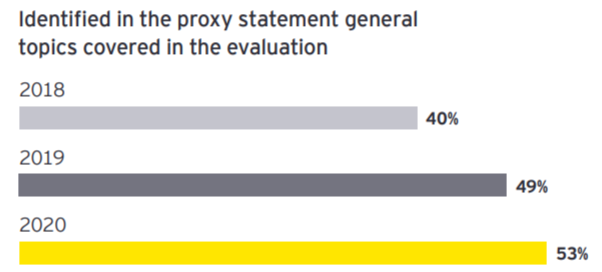

4. The disclosure of topics covered in board assessments is on the rise

Fifty-three percent of 2020 Fortune 100 proxy filers disclosed the general topics covered in their board evaluation program, up from 49% in 2019 and 40% in 2018. We found that ongoing evaluation matters frequently include agenda and meeting effectiveness, composition, structure, board culture and dynamics, information needs, the board’s relationship with management, succession planning and effectiveness of strategy and risk oversight. Boards should consider disclosing how assessment topics are changing to address emerging areas of stakeholder focus such as: purpose, culture, talent/D&I, disruption/innovation, crisis preparedness, geopolitics, cybersecurity and privacy, and ESG initiatives.

5. More companies are making disclosures about changes made in response to evaluations

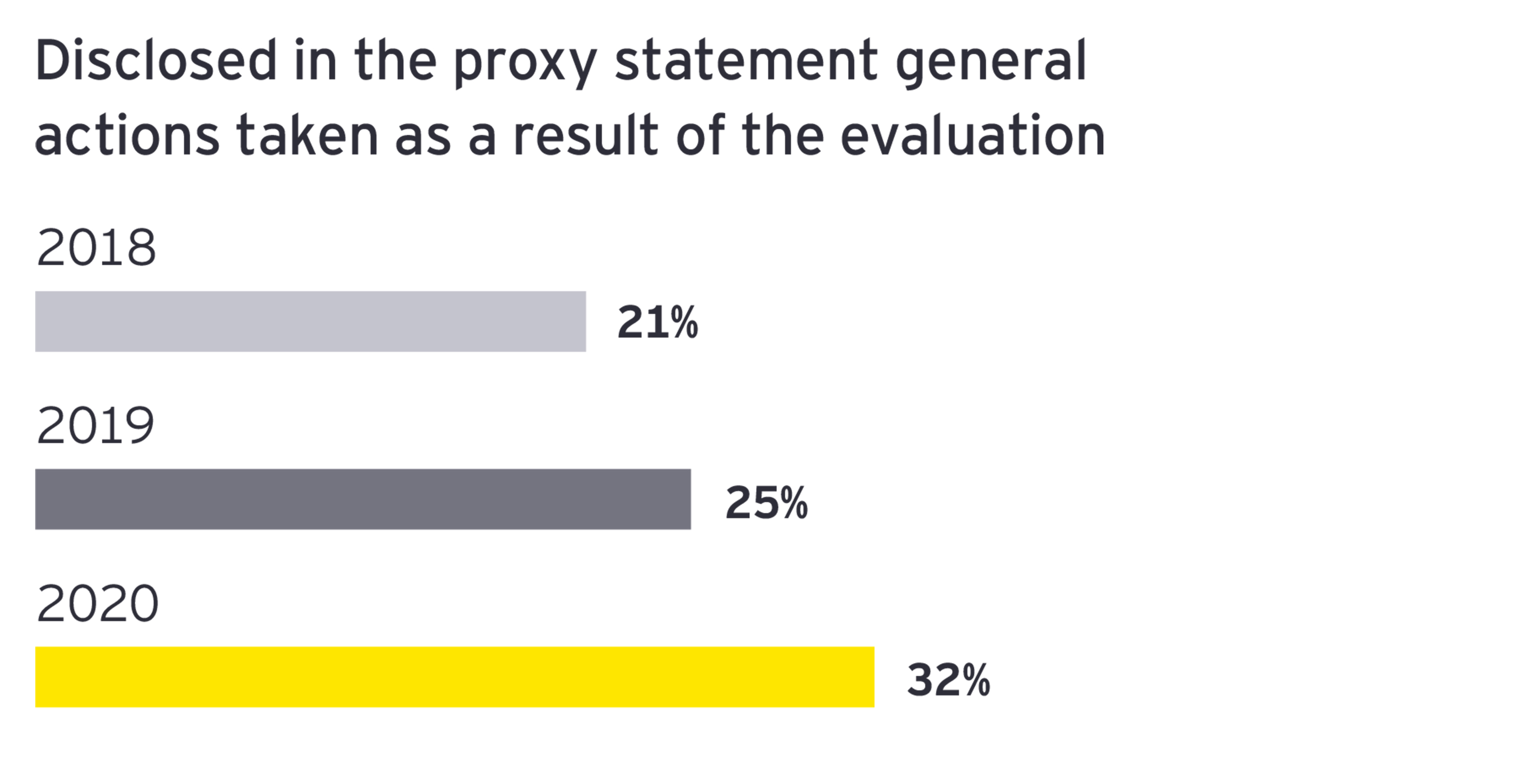

We observed a sizable increase in the number of companies that disclosed, typically at a high level, actions taken as a result of their board evaluation.

Changes cited include:

- Changes to committee structures and responsibilities

- Expanding the responsibilities of the independent board leader

- Changes to focus board and committee agendas on strategic priorities and allow more robust discussion, additional presentations on key topics, enhancements to pre-read and meeting presentation materials and board refreshment

- Strengthening director education and orientation programs

This increase is responsive to increasing investor interest in the results of a board’s evaluation process. Articulating key outcomes and specific areas of focus for improvement—including changes to the board evaluation program itself—allows boards to demonstrate the rigor of their evaluation programs and their commitment to effectiveness in ways that can foster investor confidence.

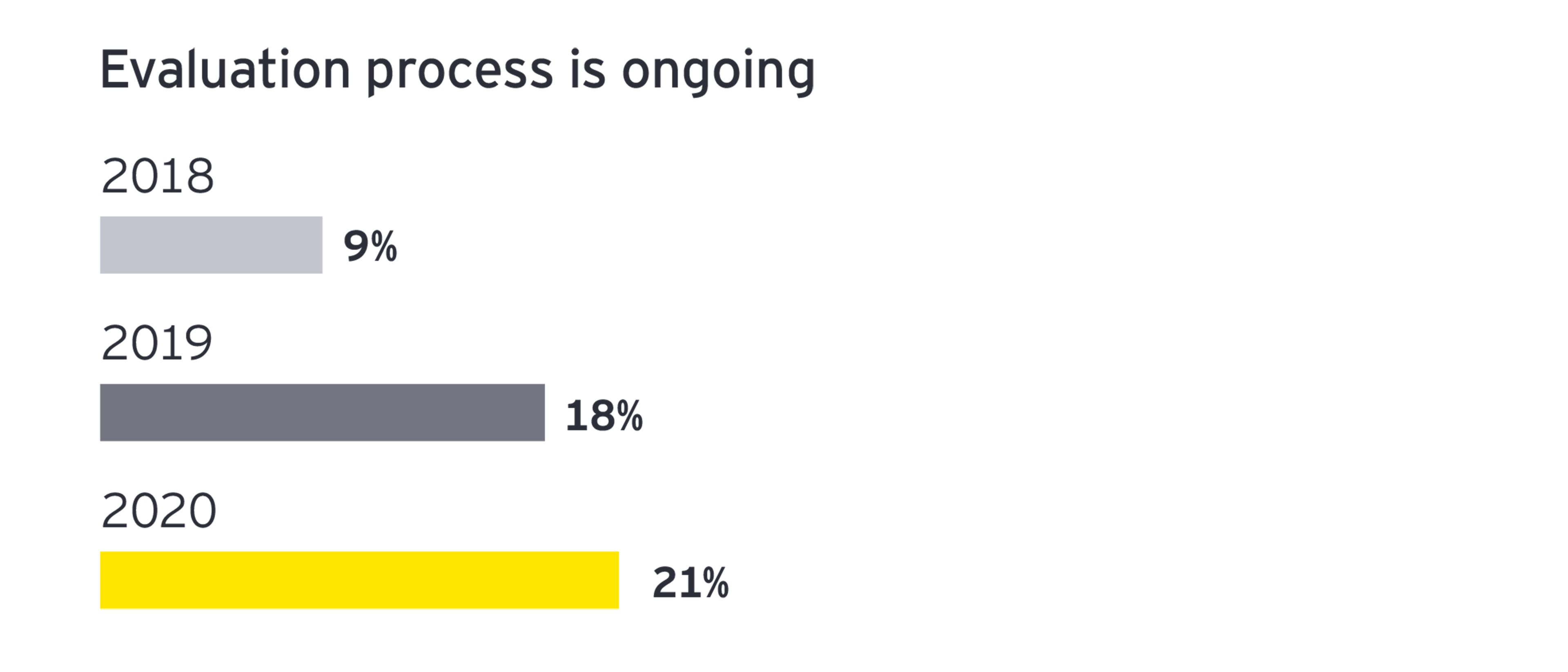

6. More companies are emphasizing a process of ongoing assessment—beyond the formal annual exercise

In 2020, 21% of proxy filers in the Fortune 100 disclosed that they address certain evaluation matters and proactively seek feedback on an ongoing basis, beyond the formal annual evaluation—more than double the 9% that did so in 2018. Being timely and agile with ongoing evaluations allows boards, committees and directors to proactively look for gaps in information needs and any other emerging issues in engagement and oversight and find ways to promptly address them. Spotting and addressing issues in real time avoids deepening problems and enables continuous improvement.

Anecdotally, the CBM often hears from directors that board and director performance is assessed in a real-time manner as part of an executive session or at the conclusion of a board or committee meeting. In such cases, boards might consider how disclosure of these practices and outcomes might better reflect their efforts.

Moving forward

Many stakeholders continue to note board effectiveness and composition as a top priority and foundation for long-term value creation and sustainability. With the deep and broad business challenges arising in 2020 and likely continuing into 2021, the focus will be on boards to enhance their agility, expand their competencies and diversity and timely address stakeholder interests and concerns.

Given that board meetings have gone virtual and meeting frequency has significantly increased to deal with the COVID-19 pandemic, boards may need to dig deeper and ask more pointed questions around the effectiveness—and security—of virtual meetings and the board’s evolving information needs as the business landscape rapidly evolves. Boards can show that they are attentive and responding to today’s crises and preparing to address tomorrow’s demands by making meaningful disclosures about how they are enhancing and evolving their effectiveness

Questions for the board to consider

- How can the board evaluation process be refreshed and strengthened to enhance overall board performance and address evolving stakeholder expectations?

- Are the topics and the depth of evaluation sufficient to uncover areas of strength and for improvement in board dynamics, structure and composition, information practices, meeting schedules and agendas, decision making and overall effectiveness?

- Is the evaluation process being led by the right individual or committee in ways that drive full participation, elicit meaningful information, candor and make it relevant to improving board effectiveness?

- Does the board use a third party to provide objectivity and facilitate or improve the evaluation process and results?

- Does the board and its committees promote ongoing evaluation, either informally in real time at all board meetings, or more formally on a quarterly basis in executive session?

- Does the board evaluation process result in the timely identification of action items to improve performance that are calendared and promptly addressed as planned?

- Does the evaluation address whether all directors are candid with each other, provide and receive constructive criticism and engage in healthy and rigorous debate? Does it uncover what steps can be taken to achieve stronger board dynamics?

Print

Print