We appreciate the opportunity to comment on the Securities and Exchange Commission’s (the “Commission”) proposed Reporting Threshold for Institutional Investment Managers. Herein we provide comments and analysis relating primarily to the Request for Comments in Sections II.D III.B of the proposed rule (“Proposal”).

Part I of this letter provides comment on the central premise of the Proposal. The Commission estimates that the Proposal would exempt 89% of institutional investors from filing Form 13F (“affected filers”) and provide an average annual cost savings of approximately $21,000 per affected filer. These cost savings are economically small in that they amount to 0.004% (0.008%) of assets under management for the average (median) affected filer, and 0.02% of assets for the smallest filer. This small cost savings needs to be weighed against the potentially large costs to investors and others created by eliminating a public disclosure that they heavily use.

Part II of this letter comments on various aspects of Section II of the Proposal, “Discussion and Economic Analysis.” We believe the analysis in Section II is incomplete for two reasons. First, the Proposal does not contain any formal economic analysis, and does not attempt to quantify either the extent of use of Form 13F or the benefits that it provides to investors and other stakeholders. To help fill this void, we analyze the usage patterns of the EDGAR system, and specifically the frequency of Form 13F downloads from EDGAR.

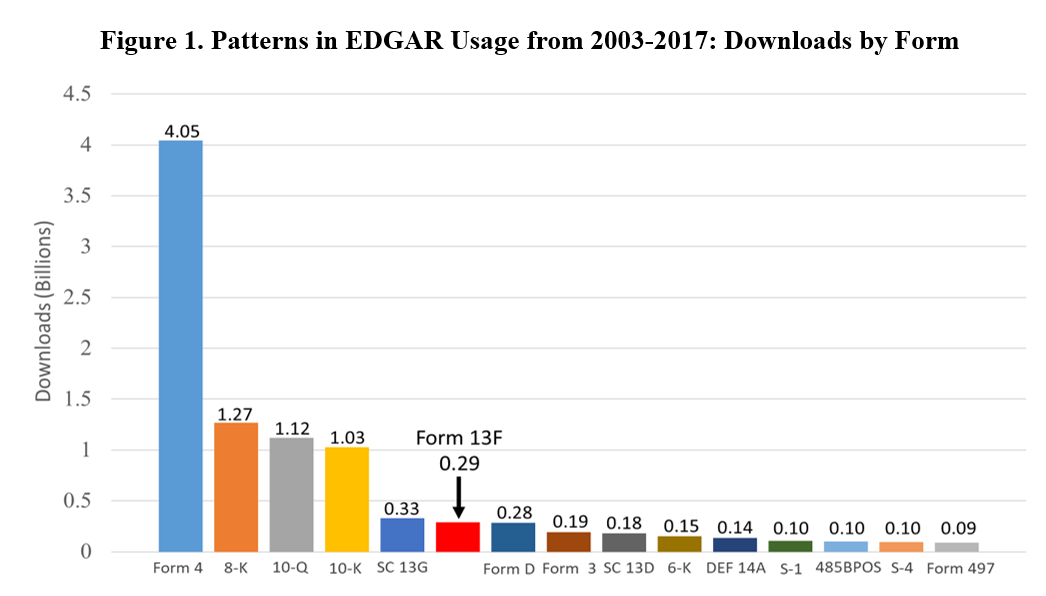

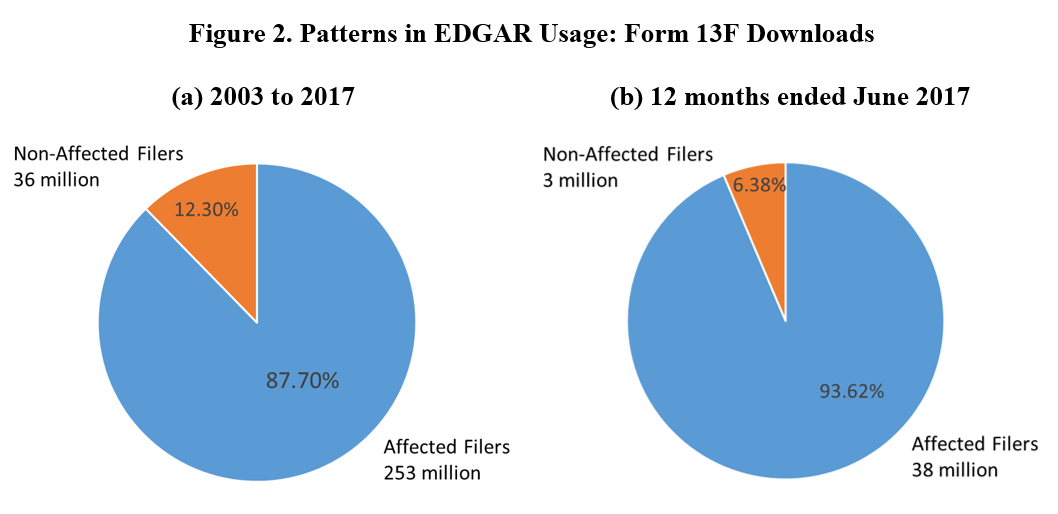

Our analysis reveals that Form 13F is the 6th most highly downloaded form. The most frequently downloaded forms are (in descending order): Form 4, Form 8-K, Form 10-Q, Form 10-K, Schedule 13G, and Form 13F, followed by all other types of forms (e.g., Form S-1 and Form DEF14A). Our analysis reveals that between January 2003 and June 2017, there were 289 million downloads of Form 13F from the EDGAR system. Of these, 87.7%, i.e., 253 million downloads, pertain to affected filers. To put these numbers in perspective, the total downloads of all IPO prospectuses, i.e., Form S-1, during the same period was only 104 million. Thus, the demand for affected filers’ Forms 13F was more than twice the demand for all IPO prospectuses from January 2003 to June 2017.

Our analysis suggests the investing public and other stakeholders are strongly interested in the information in Form 13F filings, particularly those of affected filers, and that exempting such institutions from filing Form 13F would deprive the market of this information.

Part I. Comments on the Proposal’s Central Premise

A central premise underlying the Commission’s proposal is that elimination of the Form 13F filing requirement for institutional investors managing investments totaling less than $350 billion in fair market value, (hereafter “affected filers”) will reduce compliance costs and encourage capital investments that otherwise would not be made, without materially affecting the ability of investors to make informed investment decisions.

I.A Economic Significance of the Cost Savings

Regarding the reduced compliance costs, the analysis in the Proposal suggests an average annual cost savings of approximately $21,000 per year for affected filers (Proposal, Table 2). The Proposal concludes that such costs represent a reporting burden.

To analyze the economic significance of these costs, similar to the Proposal, we analyze all Form 13F filings for the year ended 2018 and calculate the value of investments under management for each filer. We estimate that 89.4% of filers will be affected, which is similar to the estimate of 89.2% in the Proposal. Under present SEC rules, only filers with more than $100 million under management are required to file Form 13F. Our analysis reveals that affected filers have a mean (median) of $527 ($250) million of assets under management. Thus, for the mean (median) affected filer, the cost savings is approximately 0.004% (0.008%) of assets under management, and for the smallest affected filers, the cost savings is only 0.02% of assets under management. Hence, for virtually all affected filers, the cost savings is economically small and is unlikely to affect their investment decisions or the decision whether to grow their business beyond the $100 million assets under management threshold and become subject to the current Form 13F reporting requirements.

I.B Economic Significance of the Cost Savings—Indirect Costs

In addition to compliance costs, the Proposal suggests there are indirect costs of filing Form 13F, i.e., revealing proprietary information about investment strategy that exposes institutions to “the potential for front-running and copy catting” (p. 19, hereafter “proprietary costs”). The Proposal does not quantify these proprietary costs. Our analysis suggests that these costs also are economically small.

Under current SEC rules, filers can request confidential treatment of information in Form 13F, i.e., redaction of information. If the proprietary costs associated with Form 13F were economically large, we would expect institutions to request confidential treatment. Indeed, the Proposal cites academic studies that suggest that redaction of information in Form 13F allows filers to avoid these costs. The Proposal does not contain an analysis of redactions of information in Form 13F. Our analysis of Forms 13F filed during 2018 and 2019 suggests that only 3.7% of affected filers redacted information. The fact that 96.3% did not redact information suggests that for the vast majority of affected filers, Form 13F does not contain propriety information.

On p. 14, the Proposal states that these costs may be larger for affected filers:

Form 13F data of smaller managers may be more likely to be used by other market participants to engage in behavior that is damaging to the manager and the beneficial owners of the managed portfolio, such as front running (which primarily harms the beneficial owners) or copycatting (which potentially harms the portfolio manager), which may increase the costs of investing for smaller managers and hinder their investment performance.

However, the Proposal provides no evidence in support of this statement. In addition, as we noted previously, managers can avoid these costs by requesting confidential treatment of information in Form 13F. Our analysis of Forms 13F filed during 2018 and 2019 indicates that affected and non-affected filers redact information at similar rates, i.e., 3.7% and 3.2%. The similarity in redaction rates is inconsistent with proprietary costs being disproportionately larger for affected filers.

Part II. Comments on the Proposal’s Analysis

Evidence-based policymaking necessitates that policymakers consider a cost-benefit tradeoff. Consequently, we encourage the Commission to weigh the benefit of the estimated annual cost savings of $21,000 per affected filer against the cost to investors and stakeholders of not having access to the information. Unfortunately, the Proposal does not quantify either the extent of use of Form 13F or the benefits that it provides to investors and other stakeholders.

Academic research suggests one way to measure the extent to which the investing public uses the information in Form 13F is to measure the frequency with which such Forms are downloaded from the EDGAR system. We begin our analysis in January 2003 and end it in June 2017 because this is the period during which EDGAR download information is publicly available. We begin our analysis by measuring the total downloads of all SEC forms on EDGAR. We then rank forms based on the frequency of downloads. Figure 1 presents the number of downloads of the top 15 most frequently downloaded forms. Form 4 is the most frequently downloaded, with just over 4 billion downloads. Form 13F is the sixth most frequently downloaded, with approximately 289 million downloads.

Next, we identify the Central Index Key of Form 13F filers with less than $3.5 billion in assets under management, i.e., affected filers, and with more than $3.5 billion in assets under management, i.e., non-affected filers. We estimate that 89.4% of filers will be affected, which is similar to the estimate of 89.2% in the Proposal. We then calculate the number of downloads of Forms 13F separately for affected and non-affected filers. Figure 2 presents Form 13F downloads separately for these two groups of filers for two periods: (a) from January 2003 to June 2017 and (b) for the twelve months ending in June 2017. This figure provides evidence of the demand for information in Form 13F and the extent to which it is attributable to affected and non-affected filers.

Figure 2 shows that of the 289 million Form 13F downloads, 87.7%, i.e., 253 million, pertain to the filings of affected filers. To put this in perspective, the downloads of affected filers’ Form 13F (253 million) is more than double the downloads of all IPO prospectuses between 2003 and 2017, i.e., Form S-1 (104 million). Figure 3 shows that affected filers constitute a greater percentage of all Form 13F downloads in the most recent publicly available 12-month period, 93.6%. Thus, although affected filers are much smaller than non-affected filers, in the most recent period, the demand for their filings is more than ten times that of non-affected filers.

Thus, the Proposal’s statement (p. 24):

“We believe that the investing public specifically would be less concerned about the availability of portfolio holdings of these smaller managers”

is contradicted by an analysis of EDGAR usage patterns. An analysis of EDGAR downloads suggests the investing public is considerably more interested in the information in Form 13F of affected filers than that in Form 13F of non-affected filers, 253 versus 58 million downloads, and in the information in Form S-1, 104 million downloads. Collectively, our analysis suggests the investing public and other stakeholders are strongly interested in the information in Form 13F filings, particularly those of affected filers, and that exempting such institutions from filing Form 13F would deprive the market of this information.

Endnotes

10.004% = 21,000 / 527,000,000; 0.008% = 21,000 / 250,000,000; 0.02% = 21,000 / 100,000,000.(go back)

2See George O. Aragon, Michael Herzel, and Zhen Shi, Why Do Hedge Funds Avoid Disclosure? Evidence from Confidential 13F Filings, 48 Journal of Financial and Quantitative Analysis, 1499 (Oct. 2013); see also Agarwal Vikas, Wei Jiang, Yuehua Tang, and Baozhong Yang, Uncovering Hedge Fund Skill from the Portfolio Holdings They Hide, 68 Journal of Finance 739 (2013).(go back)

3In examining download statistics from EDGAR it is important to keep in mind they represent a lower bound on use, i.e., the statistics do not include downloads or views by third-party aggregators such as Bloomberg or Yahoo! Finance. In addition, some downloads undoubtedly are conducted by webscrapers that collect data hosted on third-party websites and for other purposes. Our statistics include such downloads because such downloads represent use of the information in the Form.(go back)

4https://www.sec.gov/dera/data/edgar-log-file-data-set.html(go back)

SEC’s Proposed Reporting Threshold for Institutional Investment Managers

More from: Daniel Taylor, Mary Barth, Travis Dyer, Wayne Landsman

Daniel Taylor is associate professor of accounting at the Wharton School of the University of Pennsylvania. This post is based on a comment letter to the U.S. Securities and Exchange Commission by Mr. Taylor; Mary Barth, the Joan E. Horngren Professor of Accounting, Emerita, at Stanford Graduate School of Business; Travis Dyer, assistant professor of accounting at Cornell University SC Johnson College of Business; and Wayne Landsman, KPMG Distinguished Professor of Accounting at the University of North Carolina Kenan-Flagler Business School. Related research from the Program on Corporate Governance includes The Law and Economics of Blockholder Disclosure by Lucian Bebchuk and Robert J. Jackson Jr. (discussed on the Forum here).

We appreciate the opportunity to comment on the Securities and Exchange Commission’s (the “Commission”) proposed Reporting Threshold for Institutional Investment Managers. Herein we provide comments and analysis relating primarily to the Request for Comments in Sections II.D III.B of the proposed rule (“Proposal”).

Part I of this letter provides comment on the central premise of the Proposal. The Commission estimates that the Proposal would exempt 89% of institutional investors from filing Form 13F (“affected filers”) and provide an average annual cost savings of approximately $21,000 per affected filer. These cost savings are economically small in that they amount to 0.004% (0.008%) of assets under management for the average (median) affected filer, and 0.02% of assets for the smallest filer. This small cost savings needs to be weighed against the potentially large costs to investors and others created by eliminating a public disclosure that they heavily use.

Part II of this letter comments on various aspects of Section II of the Proposal, “Discussion and Economic Analysis.” We believe the analysis in Section II is incomplete for two reasons. First, the Proposal does not contain any formal economic analysis, and does not attempt to quantify either the extent of use of Form 13F or the benefits that it provides to investors and other stakeholders. To help fill this void, we analyze the usage patterns of the EDGAR system, and specifically the frequency of Form 13F downloads from EDGAR.

Our analysis reveals that Form 13F is the 6th most highly downloaded form. The most frequently downloaded forms are (in descending order): Form 4, Form 8-K, Form 10-Q, Form 10-K, Schedule 13G, and Form 13F, followed by all other types of forms (e.g., Form S-1 and Form DEF14A). Our analysis reveals that between January 2003 and June 2017, there were 289 million downloads of Form 13F from the EDGAR system. Of these, 87.7%, i.e., 253 million downloads, pertain to affected filers. To put these numbers in perspective, the total downloads of all IPO prospectuses, i.e., Form S-1, during the same period was only 104 million. Thus, the demand for affected filers’ Forms 13F was more than twice the demand for all IPO prospectuses from January 2003 to June 2017.

Our analysis suggests the investing public and other stakeholders are strongly interested in the information in Form 13F filings, particularly those of affected filers, and that exempting such institutions from filing Form 13F would deprive the market of this information.

Part I. Comments on the Proposal’s Central Premise

A central premise underlying the Commission’s proposal is that elimination of the Form 13F filing requirement for institutional investors managing investments totaling less than $350 billion in fair market value, (hereafter “affected filers”) will reduce compliance costs and encourage capital investments that otherwise would not be made, without materially affecting the ability of investors to make informed investment decisions.

I.A Economic Significance of the Cost Savings

Regarding the reduced compliance costs, the analysis in the Proposal suggests an average annual cost savings of approximately $21,000 per year for affected filers (Proposal, Table 2). The Proposal concludes that such costs represent a reporting burden.

To analyze the economic significance of these costs, similar to the Proposal, we analyze all Form 13F filings for the year ended 2018 and calculate the value of investments under management for each filer. We estimate that 89.4% of filers will be affected, which is similar to the estimate of 89.2% in the Proposal. Under present SEC rules, only filers with more than $100 million under management are required to file Form 13F. Our analysis reveals that affected filers have a mean (median) of $527 ($250) million of assets under management. Thus, for the mean (median) affected filer, the cost savings is approximately 0.004% (0.008%) of assets under management, and for the smallest affected filers, the cost savings is only 0.02% of assets under management. [1] Hence, for virtually all affected filers, the cost savings is economically small and is unlikely to affect their investment decisions or the decision whether to grow their business beyond the $100 million assets under management threshold and become subject to the current Form 13F reporting requirements.

I.B Economic Significance of the Cost Savings—Indirect Costs

In addition to compliance costs, the Proposal suggests there are indirect costs of filing Form 13F, i.e., revealing proprietary information about investment strategy that exposes institutions to “the potential for front-running and copy catting” (p. 19, hereafter “proprietary costs”). The Proposal does not quantify these proprietary costs. Our analysis suggests that these costs also are economically small.

Under current SEC rules, filers can request confidential treatment of information in Form 13F, i.e., redaction of information. If the proprietary costs associated with Form 13F were economically large, we would expect institutions to request confidential treatment. Indeed, the Proposal cites academic studies that suggest that redaction of information in Form 13F allows filers to avoid these costs. [2] The Proposal does not contain an analysis of redactions of information in Form 13F. Our analysis of Forms 13F filed during 2018 and 2019 suggests that only 3.7% of affected filers redacted information. The fact that 96.3% did not redact information suggests that for the vast majority of affected filers, Form 13F does not contain propriety information.

On p. 14, the Proposal states that these costs may be larger for affected filers:

However, the Proposal provides no evidence in support of this statement. In addition, as we noted previously, managers can avoid these costs by requesting confidential treatment of information in Form 13F. Our analysis of Forms 13F filed during 2018 and 2019 indicates that affected and non-affected filers redact information at similar rates, i.e., 3.7% and 3.2%. The similarity in redaction rates is inconsistent with proprietary costs being disproportionately larger for affected filers.

Part II. Comments on the Proposal’s Analysis

Evidence-based policymaking necessitates that policymakers consider a cost-benefit tradeoff. Consequently, we encourage the Commission to weigh the benefit of the estimated annual cost savings of $21,000 per affected filer against the cost to investors and stakeholders of not having access to the information. Unfortunately, the Proposal does not quantify either the extent of use of Form 13F or the benefits that it provides to investors and other stakeholders.

Academic research suggests one way to measure the extent to which the investing public uses the information in Form 13F is to measure the frequency with which such Forms are downloaded from the EDGAR system. [3] We begin our analysis in January 2003 and end it in June 2017 because this is the period during which EDGAR download information is publicly available. [4] We begin our analysis by measuring the total downloads of all SEC forms on EDGAR. We then rank forms based on the frequency of downloads. Figure 1 presents the number of downloads of the top 15 most frequently downloaded forms. Form 4 is the most frequently downloaded, with just over 4 billion downloads. Form 13F is the sixth most frequently downloaded, with approximately 289 million downloads.

Next, we identify the Central Index Key of Form 13F filers with less than $3.5 billion in assets under management, i.e., affected filers, and with more than $3.5 billion in assets under management, i.e., non-affected filers. We estimate that 89.4% of filers will be affected, which is similar to the estimate of 89.2% in the Proposal. We then calculate the number of downloads of Forms 13F separately for affected and non-affected filers. Figure 2 presents Form 13F downloads separately for these two groups of filers for two periods: (a) from January 2003 to June 2017 and (b) for the twelve months ending in June 2017. This figure provides evidence of the demand for information in Form 13F and the extent to which it is attributable to affected and non-affected filers.

Figure 2 shows that of the 289 million Form 13F downloads, 87.7%, i.e., 253 million, pertain to the filings of affected filers. To put this in perspective, the downloads of affected filers’ Form 13F (253 million) is more than double the downloads of all IPO prospectuses between 2003 and 2017, i.e., Form S-1 (104 million). Figure 3 shows that affected filers constitute a greater percentage of all Form 13F downloads in the most recent publicly available 12-month period, 93.6%. Thus, although affected filers are much smaller than non-affected filers, in the most recent period, the demand for their filings is more than ten times that of non-affected filers.

Thus, the Proposal’s statement (p. 24):

is contradicted by an analysis of EDGAR usage patterns. An analysis of EDGAR downloads suggests the investing public is considerably more interested in the information in Form 13F of affected filers than that in Form 13F of non-affected filers, 253 versus 58 million downloads, and in the information in Form S-1, 104 million downloads. Collectively, our analysis suggests the investing public and other stakeholders are strongly interested in the information in Form 13F filings, particularly those of affected filers, and that exempting such institutions from filing Form 13F would deprive the market of this information.

Endnotes

10.004% = 21,000 / 527,000,000; 0.008% = 21,000 / 250,000,000; 0.02% = 21,000 / 100,000,000.(go back)

2See George O. Aragon, Michael Herzel, and Zhen Shi, Why Do Hedge Funds Avoid Disclosure? Evidence from Confidential 13F Filings, 48 Journal of Financial and Quantitative Analysis, 1499 (Oct. 2013); see also Agarwal Vikas, Wei Jiang, Yuehua Tang, and Baozhong Yang, Uncovering Hedge Fund Skill from the Portfolio Holdings They Hide, 68 Journal of Finance 739 (2013).(go back)

3In examining download statistics from EDGAR it is important to keep in mind they represent a lower bound on use, i.e., the statistics do not include downloads or views by third-party aggregators such as Bloomberg or Yahoo! Finance. In addition, some downloads undoubtedly are conducted by webscrapers that collect data hosted on third-party websites and for other purposes. Our statistics include such downloads because such downloads represent use of the information in the Form.(go back)

4https://www.sec.gov/dera/data/edgar-log-file-data-set.html(go back)