Steve W. Klemash is Americas Leader at the EY Center for Board Matters, Jennifer Lee is Audit and Risk Specialist at the EY Center for Board Matters, and Bridget M. Neill is Americas Vice Chair, Public Policy at EY. This post is based on their EY memorandum.

For the ninth consecutive year, the EY Center for Board Matters has reviewed voluntary proxy statement disclosures by Fortune 100 companies relating to audit committees, including their oversight of the audit.

These disclosures are an important tool for investors and other stakeholders to gain insight into the activities of audit committees, whose role in promoting high-quality and reliable financial reporting is widely acknowledged. The Securities and Exchange Commission (SEC), for example, has affirmed that independent audit committees have proved to be one of the most effective financial reporting enhancements included in the Sarbanes-Oxley Act. [1] The transparency provided by these disclosures can help strengthen investor confidence in financial reporting and US capital markets.

This post provides data on the types of audit committee-related disclosures that the largest public companies are providing on a voluntary basis, above what is required by US securities laws and regulations. It also includes some samples of the disclosures we examined to illustrate the information being provided to investors.

Understanding the context

This year’s data demonstrates a continuity of voluntary disclosures across areas of continued interest for investors and other stakeholders. Beyond emerging disclosures around critical audit matters, the type and extent of audit committee- related disclosures remain largely unchanged since last year. The COVID-19 pandemic does not appear to have had a significant impact on the disclosures, although that may be due in part to the timing of many proxy filing deadlines, which fell before the full extent of the pandemic was felt.

What we see in 2020

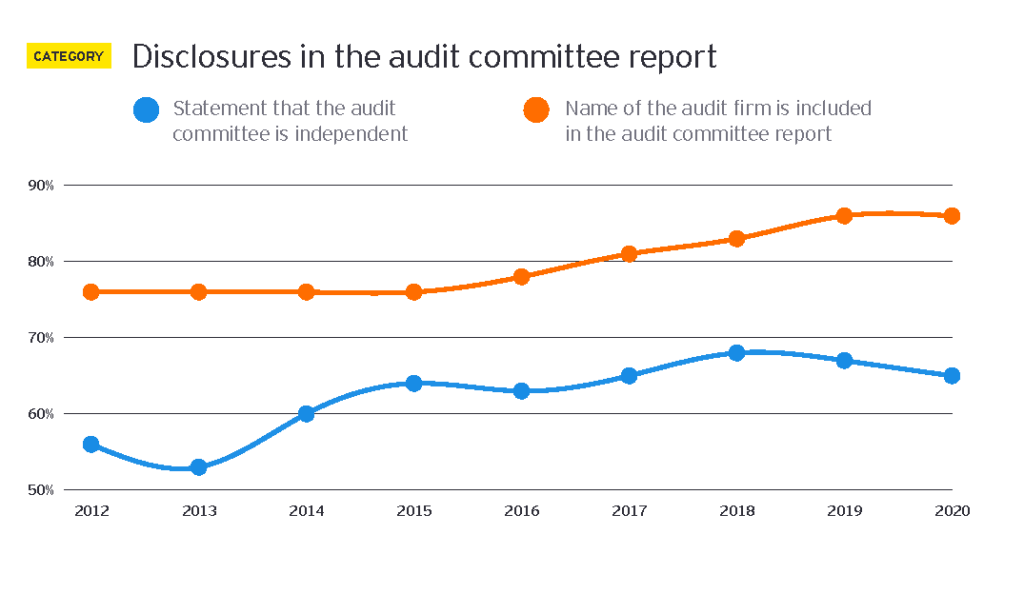

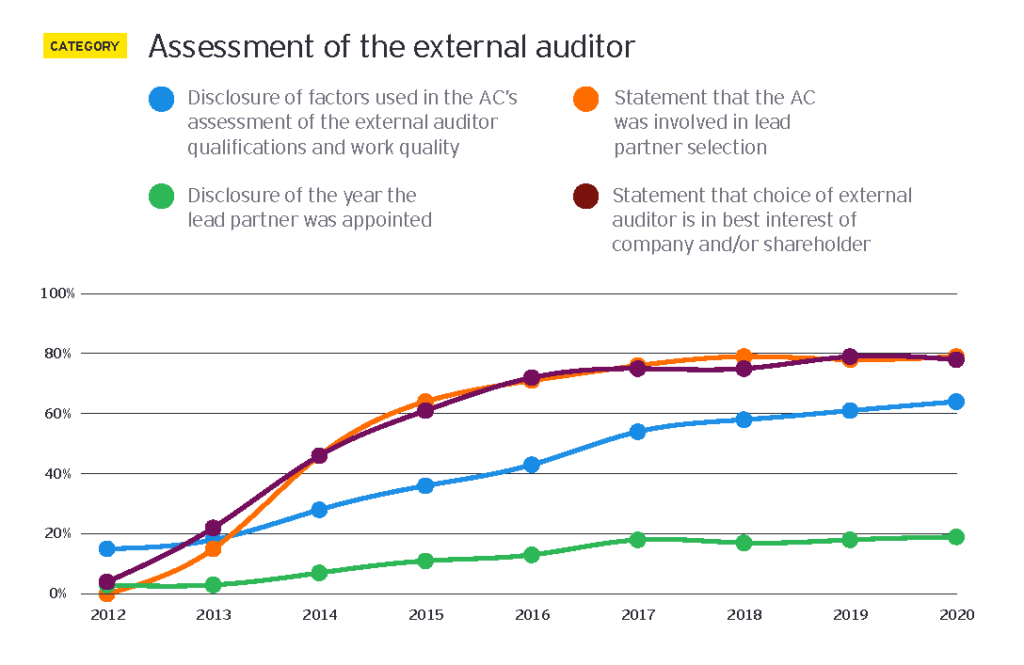

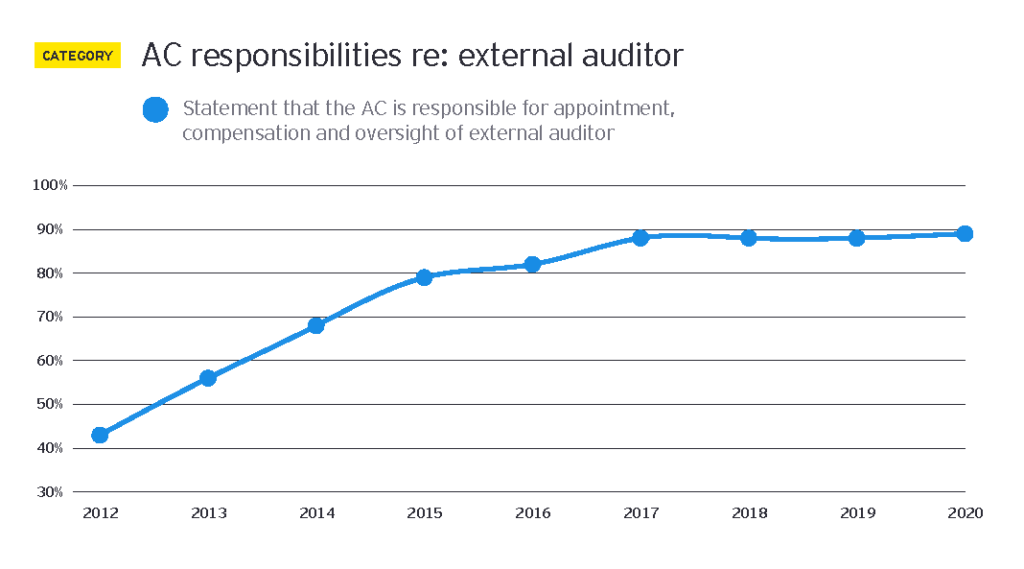

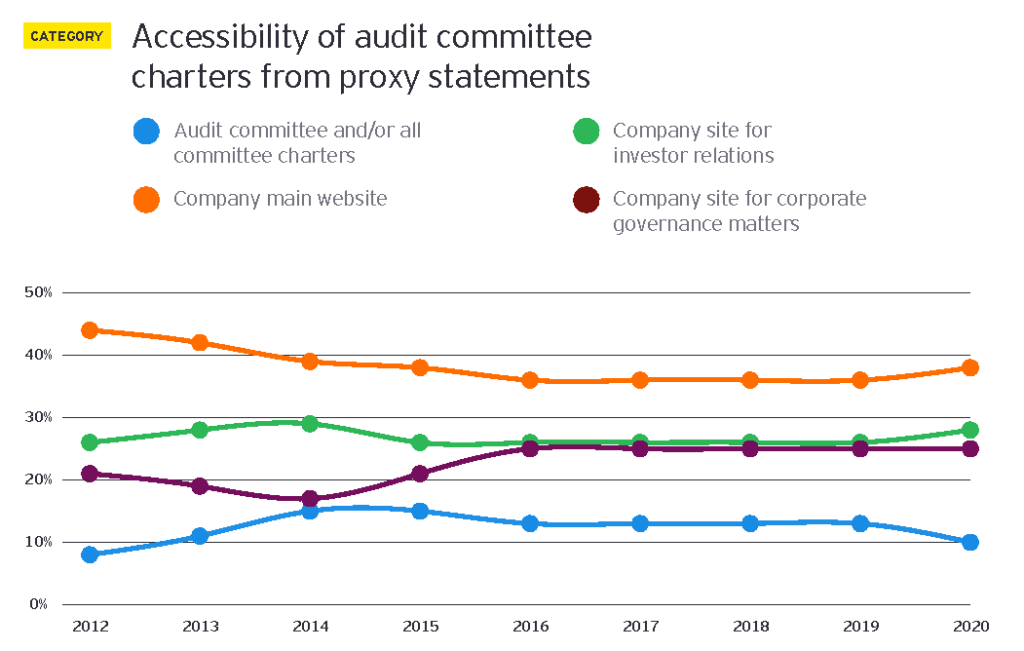

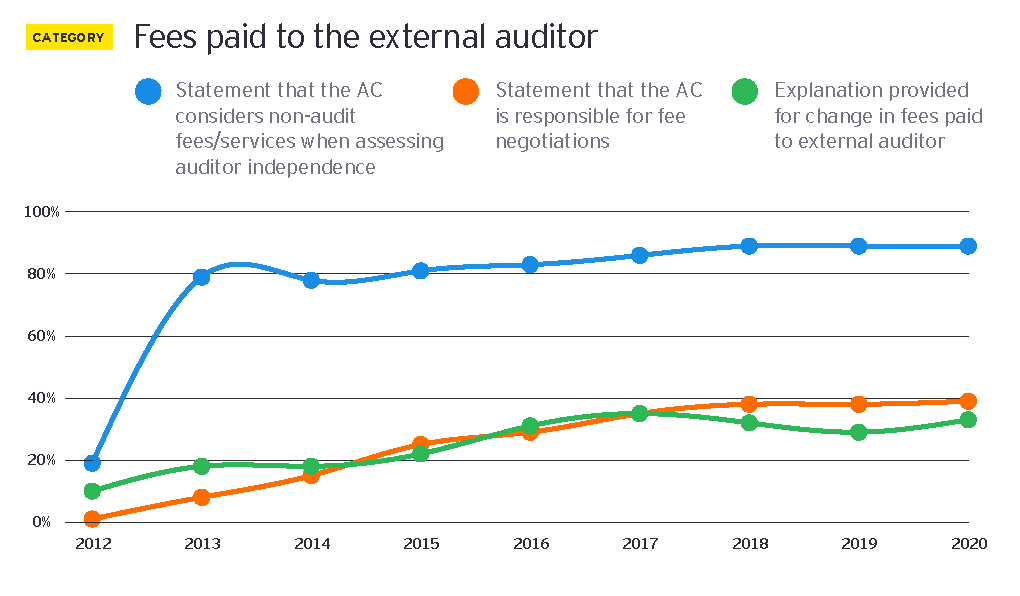

While the year-over-year change in the percentage of companies providing these voluntary disclosures has changed only slightly, there has been a dramatic increase in disclosures in most categories since we began examining these disclosures in 2012. For example:

- This year nearly 80% of companies disclosed that the audit committee is involved in selecting the lead audit None of these companies made that disclosure in 2012.

- Nearly 90% of companies disclosed that the audit committee considers non-audit fees and services when assessing auditor independence, vs. just 19% in 2012

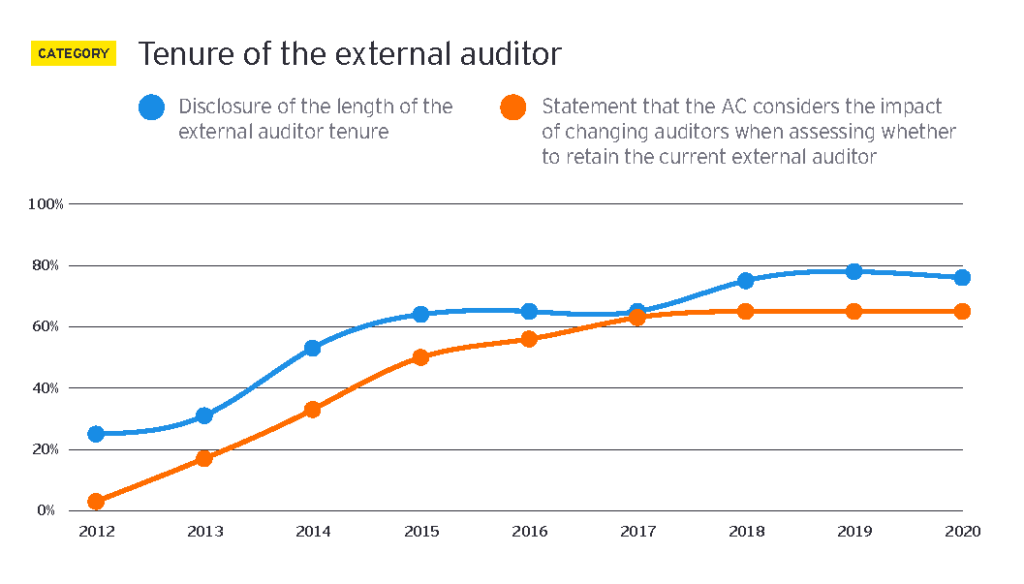

Nearly two-thirds of companies stated that they consider the impact of changing auditors when assessing whether to retain the current external auditor, and 76% disclose the tenure of the current auditor. That’s up from just 3% and 25%, respectively, in 2012. [2]

- Sixty-four percent of companies disclose factors used in the audit committee’s assessment of the external auditor qualifications and work quality, which is four times the 15% that did so in 2012.

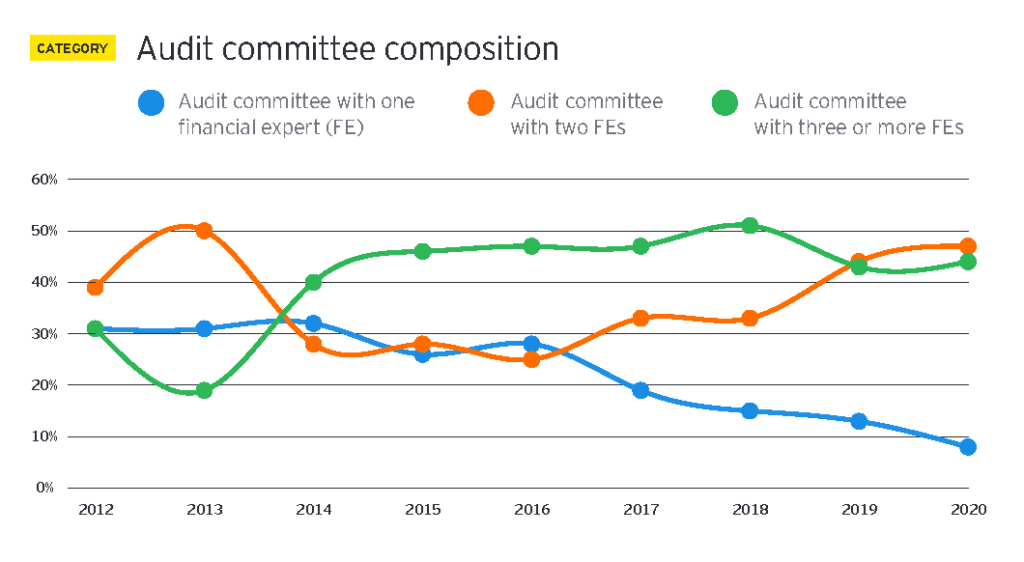

- This year, we saw an increase in audit committees with two or more financial experts (up to 91%, compared with 70% in 2012). This could be indicative of the increasing complexity of risks that audit committees are dealing with, requiring more financial expertise.

- Fifteen companies (21%) provided voluntary disclosures relating to the critical audit matters (CAMs) added to the auditor’s report in the current year for the largest filers. [3] As this is the first year that CAMs disclosures have been required, there is no previous data with which to compare. These disclosures generally noted that the audit committee reviewed and discussed with the external auditor CAMs that arose during the current period audit.

- Consistent with the trends of voluntary audit committee disclosures, we continue to see companies expand their description of audit committee oversight about the roles and responsibilities of the audit committee. This year, we reviewed the key committee responsibility-related disclosures to assess if there were additional disclosures around additional risks/issues falling under the audit committee’s purview beyond financial reporting, compliance and legal matters.

- We found that nearly two-thirds, 64%, included additional disclosures around risks beyond financial reporting that were being overseen by the audit committee.

- Some of these top risks being overseen by audit committees include cybersecurity, data privacy, ERM and ESG/health and safety-related matters.

- Leading companies are also adding additional specificity by highlighting any changes to oversight activities and key focus areas for the audit committee for the year.

Trends in audit committee disclosures

Percentages based on total disclosures for audit committees each year. Data based on the 72 companies on the 2020 Fortune 100 list that filed proxy statements each year during 2012–20 and held annual meetings through July 2020.

Disclosure observations and sample language from 2020 Fortune 100 proxy statements

Explanation provided for change in fees paid to external auditor

Most companies provide an explanation for the types of services included within each fee category. Reviewed companies explained the circumstances for the change, for example:

The increase in audit fees is predominantly attributable to additional work related to Brexit for certain European and UK entities

Disclosure of factors used in the audit committee’s assessment of the external auditor qualifications and work quality

Reviewed companies provided examples of criteria used in auditor assessments.

The Audit Committee annually reviews Firm’s performance and independence in deciding whether to retain Firm or engage a different independent registered public accounting firm. In the course of these reviews, the Audit Committee considers, among other things:

- The quality and efficiency of Firm’s historical and recent audit plans and performance on the [company] audit

- Firm’s capability and expertise in handling the breadth and complexity of Company’s worldwide operations

- Firm’s expertise in and knowledge of X industry and its network of partners and managers in Company’s key areas of global operation

- The desired balance of Firm’s experience and fresh perspective occasioned by mandatory audit partner rotation and Firm’s periodic rotation of other audit management

- External data on audit quality and performance, including recent Public Company Accounting Oversight Board (“PCAOB”) reports on Firm and its peer firms

- The appropriateness of Firm’s fees for audit and non-audit services

- The quality and candor of Firm’s communications with the Audit Committee and management

- Firm’s independence and objectivity in its performance of audit services

- Firm’s tenure as our independent registered public accounting firm, including the benefits of having a long-tenured auditor, in conjunction with controls and processes that help safeguard Firm’s independence

Statement that the audit committee considers the impact of changing auditors when assessing whether to retain the current external auditor

Reviewed companies indicated that the audit committee considered alternatives to retaining the external auditor.

The Audit Committee considers a number of factors in deciding whether to re-engage Firm X as the independent registered public accounting firm, including the length of time the firm has served in this role and an assessment of the firm’s professional qualifications and resources. In this regard, the Audit Committee considered that Company A requires global, standardized, and well-coordinated services, not only for audit purposes, but for other nonaudit services items, including statutory audits and various regulatory certification items, such as valuation support, IT consulting, and payroll services … A change in our independent auditor would require us to replace one or more of the multinational service providers that perform non-audit services for Company A and could significantly disrupt our business due to loss of cumulative knowledge in the service providers’ areas of expertise.

Disclosure of audit committee’s discussion of critical audit matters with its external auditor.

In conformance with Public Company Accounting Oversight Board rules, the Committee reviewed and discussed with Firm four critical audit matters arising from the current period audit of Company’s financial statements … The Committee concurred with Firm’s assessment and identification of the CAMs contained in its Audit Report included within Company’s 2019 Annual Report on Form 10-K.

Questions for audit committees to consider

- Does the company’s proxy statement effectively communicate how the audit committee is overseeing and engaging with the external auditor? Does it address areas of investor interest, such as the independence and performance of the auditor and the audit committee’s key areas of focus?

- How has the role of the audit committee evolved in recent years (e.g., oversight of enterprise risk management, cybersecurity risk) and to what extent are these changes being communicated to stakeholders?

- In light of the changing environment, what additional voluntary disclosures might be useful to shareholders related to the audit committee’s time spent on certain activities, such as cybersecurity, data privacy, business continuity, corporate culture and financial statement reporting developments?

- Has the audit committee considered how changes in the auditor reporting requirements may impact audit committee disclosures?

- How do director qualifications and board composition-related disclosures highlight the diversity considerations, expertise, experiences and backgrounds of audit committee members?

Endnotes

1https://www.sec.gov/news/public-statement/statement-role-audit-committees-financial-reporting(go back)

2This disclosure is now required in the auditor’s report, pursuant to the Public

Company Accounting Oversight Board’s AS 3101: The Auditor’s Report on an Audit

of Financial Statements When the Auditor Expresses an Unqualified Opinion.(go back)

3CAMs must be disclosed by the auditors of public companies pursuant to AS 3101: The Auditor’s Report on an Audit of Financial Statements When the Auditor Expresses an Unqualified Opinion. CAMs include matters communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements; and (2) involved especially challenging, subjective or complex auditor judgment. Auditors of companies that are large accelerated filers are required to disclose CAMs in the auditor’s report for periods ending on or after 30 June 2019, while auditors of other public companies are required to disclose CAMs for periods ending on or after 15 December 2020.(go back)

Print

Print