Subodh Mishra is Managing Director at Institutional Shareholder Services, Inc. This post is based on an ISS paper by Maura Souders, Associate at ISS ESG, the responsible investment arm of Institutional Shareholder Services. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Max M. Schanzenbach and Robert H. Sitkoff (discussed on the Forum here); and Companies Should Maximize Shareholder Welfare Not Market Value by Oliver Hart and Luigi Zingales (discussed on the Forum here).

Key Takeaways

- A considerable proportion of respondents to the survey (62.5%) report that the Social domain of the Environmental, Social and Governance (ESG) spectrum is attracting more of their attention since the beginning of the COVID-19 pandemic.

- Governance remains the most important ESG factor in the investment analysis and stewardship activities of 86% of respondents.

- Respondents whose ESG engagements have grown since the outbreak of the pandemic report that the primary drivers of growth include client and stakeholder demand, racial inequality and diversity, and regulatory changes.

- A significant share of respondents (44.1%) expect future ESG ratings to place a greater weight on workplace safety, treatment of employees, diversity and inclusion, as well as supply chain labor dynamics.

- All these changes necessitate an increased workload, and 37.5% of respondents have either already added or intend to add new staff to manage ESG-related issues, following the onset of the pandemic.

Survey Purpose and Overview of Respondents

The asset management and broader financial community has weathered a variety of impacts stemming from the COVID-19 pandemic, and the resulting initial market downturn and market sell-off in response to this unprecedented global health crisis. The pandemic has also highlighted the need for a renewed and refreshed lens on Environment, Social and Governance (ESG) investing and the ability to pivot engagement protocols to address topics around employee health and safety, compensation and support packages for furloughed workforces, executive compensation and a deeper evaluation of the supply chain.

Has the pandemic marked a turning point in attitudes, policies and practices toward ESG investing, however? ISS ESG, the responsible investment arm of Institutional Shareholder Services, surveyed asset managers to gauge the extent to which COVID-19 has impacted their consideration of ESG in both investment decision-making and stewardship or engagement activities.

The ISS ESG Investing Pre- and Post-Pandemic survey, directed at asset managers only, consisted of 25 questions and ran from July 24 to September 11, 2020. The bulk (61.5%) of responses came from managers investing globally rather than focusing on regional markets. The overwhelming majority (86%) of respondents were from developed Northern Hemisphere countries (U.S., Canada and the EU), and just over 80% managed in excess of $1 billion. More details on the survey methodology can be found in the Appendix.

The survey was designed to gain a better understanding of how the pandemic, specifically, has shaped asset managers’ investment decision-making and stewardship activities, including:

- Engagement with portfolio companies by frequency;

- Investors’ willingness to pay a sustainability premium for companies with higher ESG ratings (lower volatility) now compared with before the outbreak of COVID-19; and

- Whether each of environmental, social, or governance factors are emphasized as more important today, or conversely, less important.

ESG Considerations in Investing: Changing Attitudes

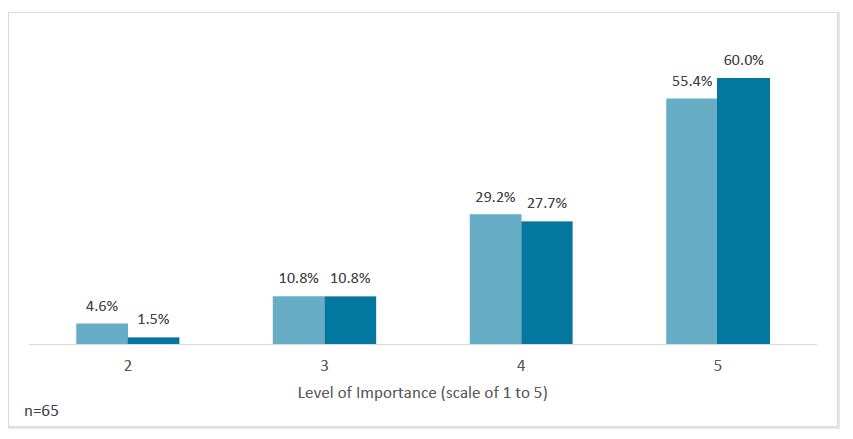

How has COVID-19 changed attitudes in ESG investing? Survey respondents were asked to rank (on a scale of 1 to 5) the level of importance of ESG considerations in their overall investment approach.

Survey findings indicated that only a modest portion of respondents reported a major shift in policy and stewardship since the outbreak of COVID-19.

The results show that 12.3% of respondents reported an increased level of importance of ESG considerations in their investment decisions or stewardship activities as compared to before the pandemic. Since the outbreak of COVID-19, 98.5% of respondents reported that the importance of ESG considerations in their investment decisions or stewardship activities either remained the same or increased since the outbreak of COVID-19. The overall average level of importance assigned to ESG considerations (scale of 1 to 5) increased modestly from 4.35 to 4.46.

Figure 1: Distribution of Respondents’ Reported Level of Importance of ESG Considerations in Investment Decisions & Stewardship Activities Prior to and Since the Start of COVID-19

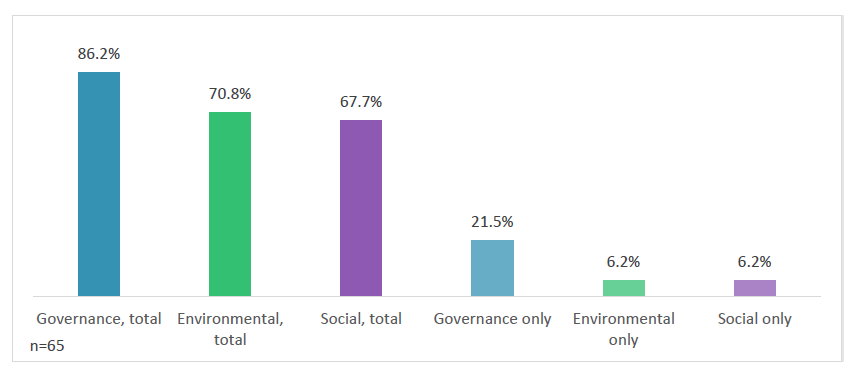

Of all 65 respondents, more than 86% cited Governance as one of the most important factors of ESG in their investment analysis and stewardship activities. Environmental and Social were chosen as one of the most important factors by 70.8% and 67.7% of total respondents, respectively.

Governance was also the top-considered factor among those respondents who only chose one of the three options. As illustrated in Fig. 2 below, 21.5% of total respondents selected Governance as the single most importance aspect of ESG to consider in their investment analysis and stewardship activities. The Environmental and Social factors were the sole most important factor of ESG for 6.2% of respondents.

Figure 2: Most Important Factor of ESG Investment Analysis/Stewardship Activities Prior to COVID-19, by Share of Respondents

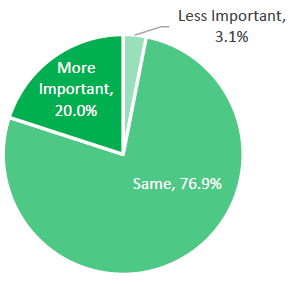

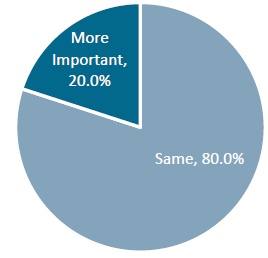

Next, respondents were asked to describe any change in their attitude regarding the importance of Environmental, Social, and Governance aspects of ESG, individually. Responses for Environmental and Governance aspects of ESG are similar. The majority of respondents (76.9% and 80%, respectively) report that their attitudes on the importance of Environmental and Governance factors have remained the same since the outbreak of COVID-19. Around 3% of respondents report viewing Environmental factors as less important compared with pre-COVID-19. The remaining respondents, 20% for each Governance and Environmental, report that they consider the aspect to be more important.

Figure 3: Change in Attitude Since COVID-19, Environmental

n=65

Figure 4: Change in Attitude Since COVID-19, Governance

n=65

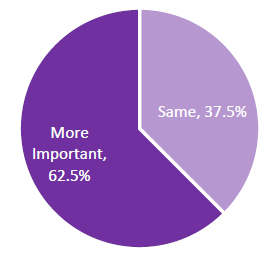

Unsurprisingly, Social thematics see the greatest share of increased importance and focus for investors. As shown in Fig. 5 below, 62.5% of respondents report that they consider Social factors to be more important than before the pandemic. The remaining 37.5% report that their attitudes about Social aspects have not changed since the pandemic.

Figure 5: Change in Attitude Since COVID-19 – Social

n=64

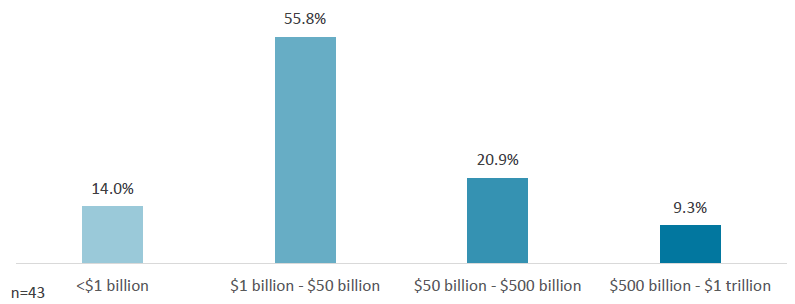

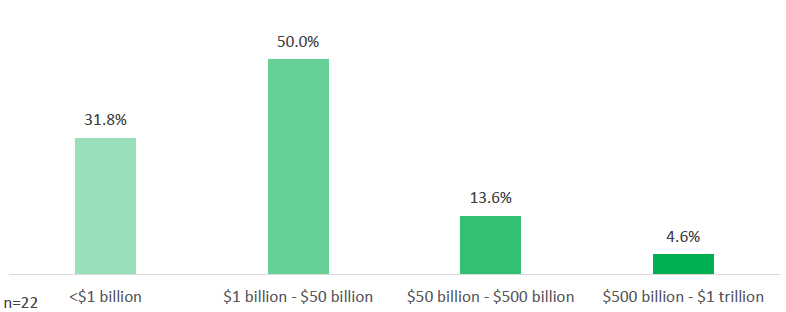

An analysis of responses broken down by size of AUM suggests that those respondents with larger AUMs were more likely to adjust their view of the importance of any of the three aspects of ESG since the outbreak of the COVID-19 pandemic. Those respondents that have not had such a reaction have slightly smaller AUMs, on average, as shown in Fig. 6 and Fig. 7 below.

Figure 6: Share of Respondents That View At Least One Factor of ESG As More Important Since COVID-19, by AUM

Figure 7: Share of Respondents That Did Not Change Their View of Any of the Three Factors of ESG, by AUM

For investors, Governance clearly remains the most important aspect of ESG in investment analysis and stewardship activities. Survey participants, however, indicate that Social elements and themes have increased in their level of importance.

This trend might be a result of the higher level of scrutiny on employee health and safety measures amid the pandemic, or in relation to the sharper focus on race at portfolio companies and society more broadly in the U.S. and elsewhere over recent months. While responses overall suggest the importance of ESG considerations in investing has increased just minimally, certain individual factors are gaining currency in light of the pandemic, especially among those respondents with greater assets under management.

ESG Considerations in Investing: Changing Behaviors

While evolving and subjective attitudes toward ESG investing are worth noting, any tangible change in responsible investment practice should be identifiable in adjustments to direct policy and actions on the ground. A series of the survey questions focused on asset managers’ changing behaviors when it comes to ESG investing, including:

- The likelihood of ESG-specific budget increases;

- The addition of new staff to address ESG issues;

- Engagement with companies on ESG issues;

- The likelihood that the respondents’ organizations would pay a premium for companies with a higher ESG rating; and

- Support of ESG shareholder proposals.

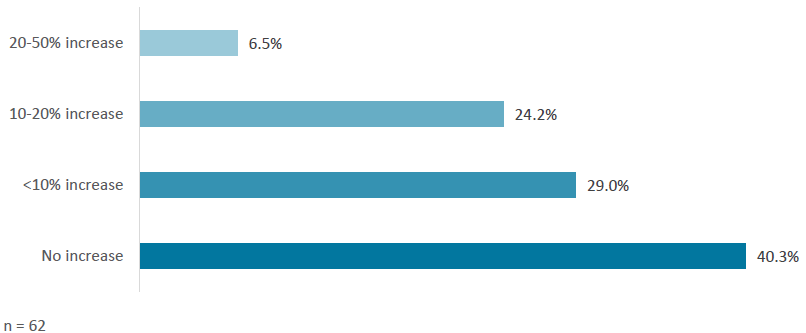

Interestingly, 59.7% of respondents report that a budget increase of some amount is likely. Drilling down further, and as illustrated in Fig. 8 below, 29% of respondents estimate an increase in budget of <10%; 24.2% estimate a 10%-20% increase in budget; and 6.5% estimate a 20%-50% increase in budget allocated to ESG products, solutions, and services.

Figure 8: Distribution of Increase in Budget Allocated to Furthering ESG

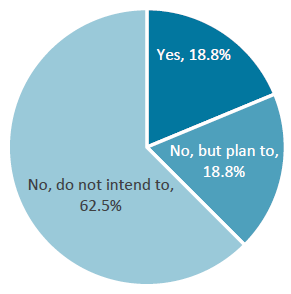

Respondents were also asked if they have added additional staff to address ESG issues since the outbreak of COVID-19. According to the results, 37.5% of respondents have either already added or intend to add new staff. The remaining respondents reported that they do not intend to add staff to address such issues.

Figure 9: Have you added new staff to address ESG issues since the outbreak of COVID-19?

n=64

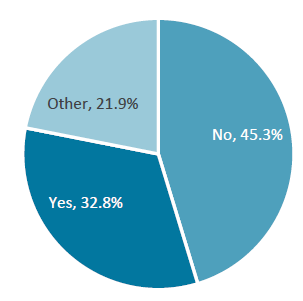

When asked whether they would be more likely to support ESG-related shareholder proposals since the pandemic, 32.8% of respondents said yes, and 21.9% of respondents designated “Other.” When asked to elaborate, those who responded “Other” added that their support of ESG shareholder proposals “has nothing to do with the pandemic,” that they “assess these on a case-by-case basis,” or that they “already support ESG shareholder proposals prior to the pandemic.” The remaining respondents noted that they are not more likely to support ESG shareholder proposals following the pandemic.

Figure 10: Following the pandemic, are you more likely to support ESG shareholder proposals?

n=64

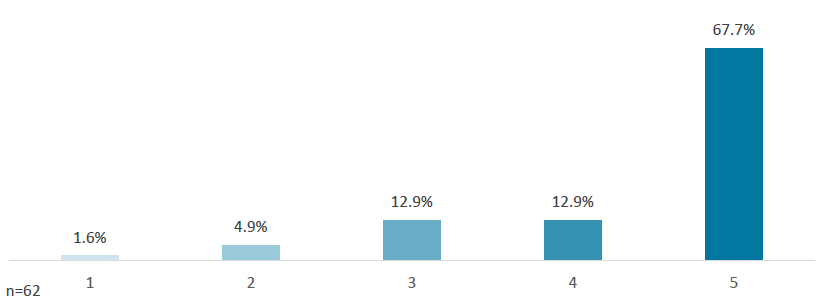

In response to a survey question regarding the likelihood (scale of 1 to 5) that respondents will engage with companies on ESG issues following the pandemic, more than two-thirds ranked this a 5, corresponding with the highest likelihood. The same share of respondents (12.9%) selected 4 and 3, to represent their likelihood to engage. The remaining respondents chose 2 and 1, 4.9% and 1.6%, respectively. Respondents whose ESG engagements have grown report that the primary drivers of growth include client and stakeholder demand, racial inequality and diversity, and regulatory changes.

Figure 11: Following the pandemic, how likely are you to engage with companies on ESG issues? (scale of 1 to 5)

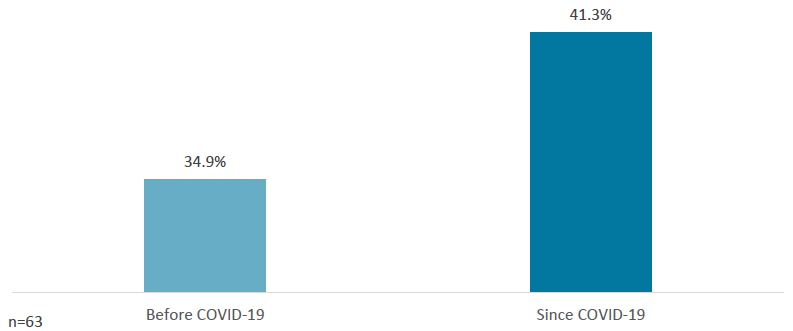

The share of investor respondents who would pay a premium for securities issued by companies with a higher ESG rating increased from 34.9% before COVID-19 to 41.3% since the outbreak of COVID-19.

Figure 12: Share of Respondents Who Would Pay a Premium for Securities Issued by Companies with a Higher ESG Rating

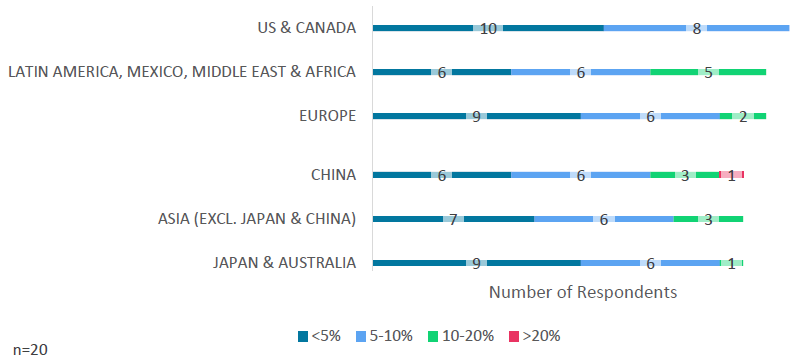

ISS ESG asked those respondents who indicated that they would pay a premium for securities issued by companies with a higher ESG rating to detail how much of a premium they would pay and in which markets.

Of 20 total respondents to this question, the results indicate that 18 (90%) would pay a premium in the U.S. and Canada, although the premium would only be about 10% or less. Seventeen respondents (85%) would pay a premium in Latin America, Mexico, Middle East & Africa, as well as Europe.

The distribution of the amount of premium paid spans from <5% (30% and 45% of respondents for Latin America, Mexico, Middle East and Africa, and Europe, respectively), to 5-10% (30% of respondents for both markets), and 10-20% (25% and 10% of respondents for Latin America, Mexico, Middle East & Africa and Europe, respectively).

Sixteen respondents (80%) reported that they would pay a premium in China, Asia (excluding Japan and China), as well as Japan and Australia. Notably, one respondent indicated that they would pay a premium of more than 20% for securities issued by companies based in China with a higher ESG rating.

What is most striking in this set of results is that respondents appear willing to pay a higher premium for ESG outperformance in developing markets, and particularly in China. This willingness may be related to investors’ desire to offset the increased risks inherent in these markets or based on the belief that good ESG performance will pay higher dividends.

Figure 13: Premium Paid for Securities Issued by Companies with a Higher ESG Rating, by Market and Amount

Top Motivations and Challenges for ESG Investing

So, what are the top motivations for investors in ESG today?

The survey asked respondents to identify their main drivers for undertaking ESG investing. Respondents identified the following as their top five motivations for considering ESG factors in the investment analysis process and stewardship activities:

- To help generate higher risk-adjusted returns (53.1% of respondents);

- Client/beneficiary demand or mandate (53.1%);

- To align investment strategies with organizational values (48.4%);

- To minimize headline risk (45.3%);

- Because it is mandated by your investment policy (34.4%); and

- To develop new ESG product offerings/solutions (34.4%).

Other top motivations as submitted through the “Other” category option include:

- To have a positive impact;

- Belief in sustainable investment;

- To capture ESG risk in valuation; and

- To reflect the respondent’s social justice activism.

Figure 14: Top Motivations for Considering ESG Factors in the Investment Analysis Process and Stewardship Activities, by Share of Respondent

Survey respondents were asked to rank order a list of potential barriers to ESG investing. The top barriers and challenges are determined by calculating the average ranking of each option, and then listing those in order of highest to lowest rank. Table 1 below illustrates the barriers and challenges in order of average rank, with lower rankings indicating the greatest challenges and barriers.

Table 1: Top Barriers/Challenges for Considering ESG Factors in the Investment Analysis Process and Stewardship Activities, by Average Rank

| Barrier/Challenge to ESG Investing | Average Score | Overall Rank |

|---|---|---|

| Lack of standardized disclosed data from issuers | 3.0 | 1 |

| Lack of appropriate quantitative ESG information | 3.6 | 2 |

| Questionable data quality/lack of assurance | 4.3 | 3 |

| Lack of appropriate qualitative ESG information | 4.9 | 4 |

| Lack of sufficient material information | 5.5 | 5 |

| Cost of research, data gathering and analysis too high | 6.7 | 6 |

| ESG disclosures are boilerplate, general and/or not company-

specific |

6.8 | 7 |

| Too much immaterial information being disclosed by companies makes it difficult to access material information | 7.8 | 8 |

| Timeliness | 8.2 | 9 |

| Infrequent disclosure | 8.4 | 10 |

| Lack of predictive nature of ESG research | 8.7 | 11 |

| Inconsistent track record of alpha generation of ESG strategies | 10.0 | 12 |

| Lack of client/beneficiary demand | 11.4 | 13 |

n=60

The greatest challenges for ESG investing, according to survey respondents, include:

- The lack of standardized disclosed data from issuers;

- Lack of appropriate quantitative and qualitative ESG information;

- Questionable data quality/lack of assurance; and

- Lack of sufficient material information

Valuable conclusions can also be drawn by examining the bottom of the list of challenges. Respondents most often ranked the ‘lack of client/beneficiary demand’ and ‘inconsistent track record of alpha generation of ESG strategies’ at the bottom of the barrier options. This trend suggests that asset managers are confident about the presence of client demand for ESG investing, and the ability of ESG strategies to generate competitive returns.

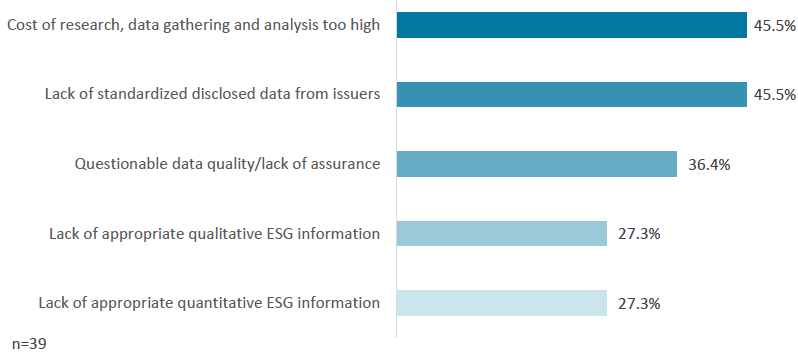

The survey also asked respondents to choose the top three reasons why their focus on ESG may not have grown since the pandemic, and from the 22 response to this question, five primary reasons emerged.

45.5% of the respondents that answered this question indicated that advancement in the focus on ESG is hindered by the high cost of research, data gathering and analysis. The same share of respondents cites the absence of progress on the lack of standardized disclosed data from issuers. Questionable data quality and lack of assurance were reported as the reason behind the lack of growth in focus on ESG for 36.4% of respondents. Finally, and as illustrated in Fig. 15 below, 27.3% of respondents pointed to each of the lack of appropriate qualitative and quantitative ESG information to explain the lack of progress in ESG considerations in investing.

Figure 15: Top Five Reasons Why Respondents’ Focus on ESG Has Not Grown Since the Pandemic

Outlook for Post-Pandemic ESG Investing

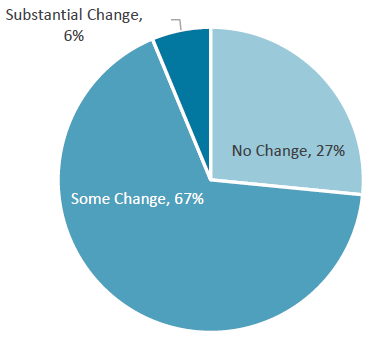

Survey respondents were asked to what extent, if at all, they expect ESG rating agencies’ methodologies to change in the months following the pandemic. Results indicate that 72% of respondents expect at least some change in this area.

Figure 16: To what extent, if at all, do you expect ESG rating agencies’ methodologies to change in the months following the pandemic?

n=64

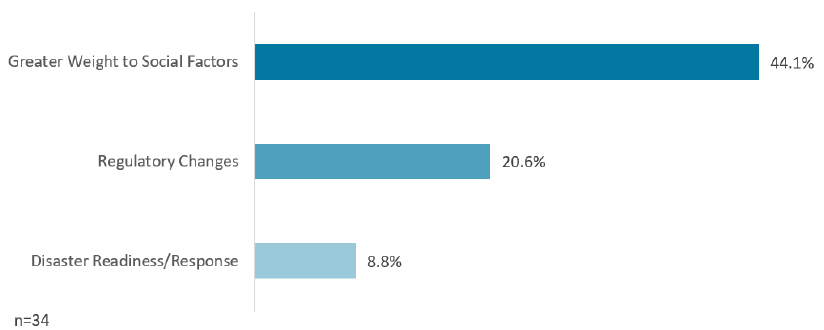

When respondents were asked to elaborate on the anticipated changes in ESG research, a number of categories emerged—with many related to the Social factors of ESG.

Numerous respondents (44.1%) expect future ESG ratings to place a greater weight on workplace safety; appropriate treatment of employees; diversity and inclusion; as well as supply chain labor dynamics. Another point of focus from the survey results reveals an expectation of regulatory changes for the ESG research industry, as reported by 20.6% of respondents. Such developments might yield changes including standardization and increased transparency of methodology; greater granularity spurred by the SASB developments; and changes from the EU Action Plan. Finally, a minority of respondents (8.8%) mentioned that they expect that ESG rating agencies’ methodologies will include an analysis of how companies handle disaster readiness and response.

Figure 17: Top Three Changes Expected for ESG Ratings

It is clear from this survey that the COVID-19 pandemic has had a major influence on responsible investors’ thinking in terms of ESG research and integration. A heightened focus on social issues is paired with an increased willingness to invest in in-house ESG capacity.

At ISS ESG, we acknowledge the increasing interest in transparency and consistency around providers’ research methodologies, and the expectation that research services will evolve to meet changed investor expectations in a post-pandemic world. We will continue to invest in these areas, and look forward to lots more direct engagement with our client in the coming months.

The complete publication, including footnotes, is available here.

Print

Print

One Comment

Hello, thank you for publishing your recent ESG survey report which is very useful. Could I invite one of the report author to present your survey findings and conclusion to the public at one of my coming webinar? The webinar will be organized with a UN organization in Nov. and Dec. 2020. please kindly contact me at the above email anytime. Many thanks. Michel