Gregory V. Milano is founder and CEO of Fortuna Advisors. This post is based on a recent paper authored by Mr. Milano; Brian Tomlinson, Director of Research of the CEO Investor Forum at Chief Executives for Corporate Purpose (CECP); Riley Whately, Fortuna Advisors; and Alexa Yiğit, Sustainable Finance Lead at the CECP CEO Investor Forum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Toward Fair and Sustainable Capitalism by Leo E. Strine, Jr (discussed on the Forum here).

Executive Summary

The role of the corporation in society is under review. The paradigm that corporations are run solely in the interests of shareholders, which has defined a generation of management practice, is being contested. The emerging paradigm references “stakeholders” as the broader group that managers should consider in decision-making. Such a transition is full of complexities for chief executives, investors and policy makers.

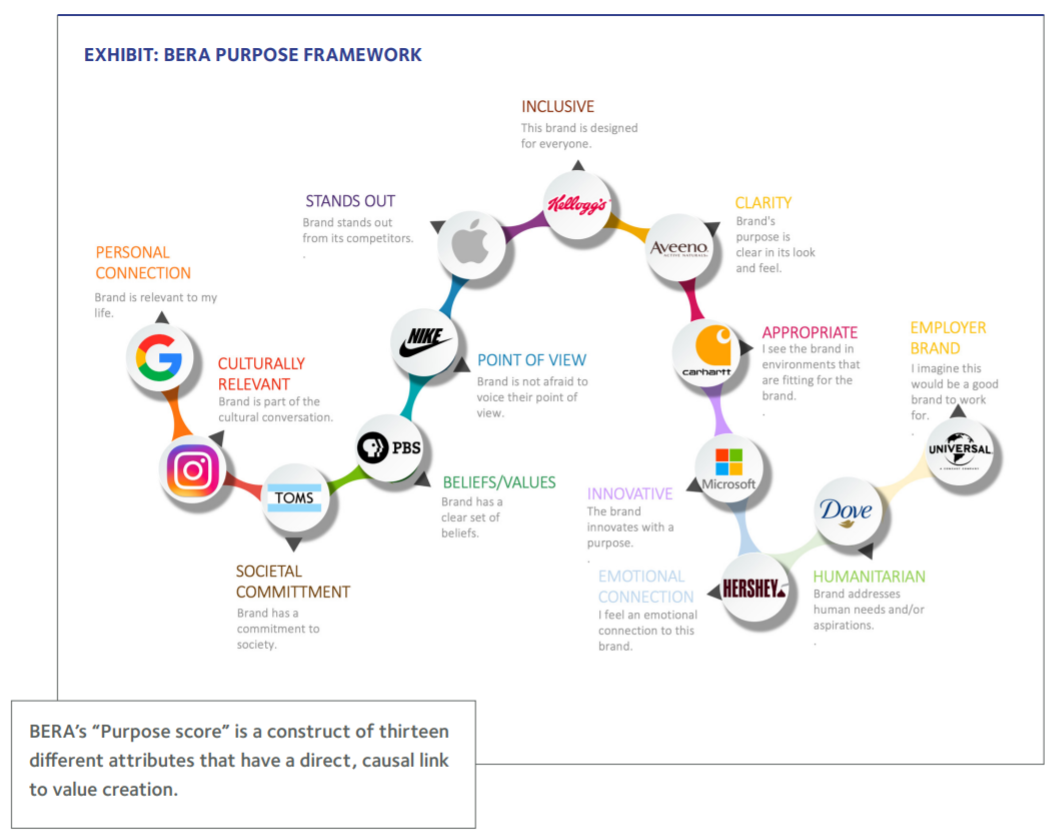

In this paper, we seek to highlight a few implications of corporate purpose—in its stakeholder aspect. We look at whether a clear corporate purpose can impact the valuation of listed equities and how that relationship to value may arise. As part of that, we explore a corporate purpose measurement framework developed by BERA Brand Management. Drawing on a CEO survey, we look at examples of corporations that have deployed their stated corporate purpose to guide them through crisis induced decision-making. [1]

To study the impact of purpose on performance, the authors conducted new analysis on how corporate purpose relates to company financial performance, market valuation and shareholder value creation. The analysis highlights how effective investment in corporate purpose can deliver value to both stakeholders and shareholders.

In Our Study:

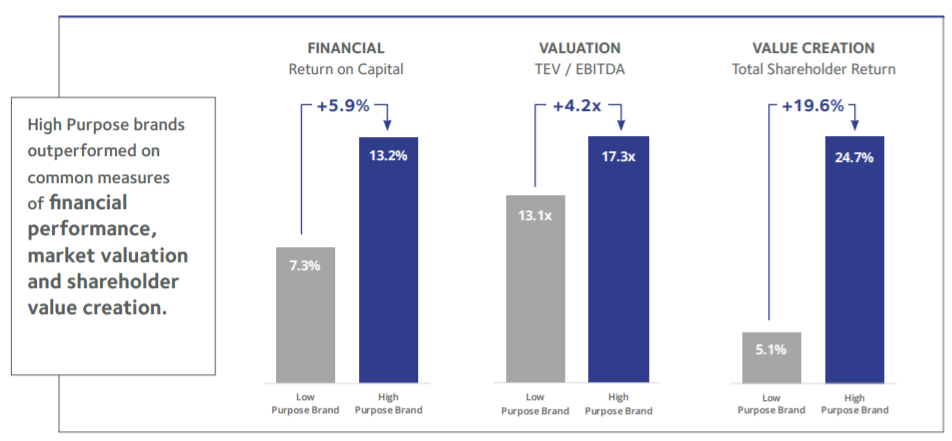

- Companies that scored high on corporate purpose metrics outperformed their low-scoring counterparts on common measures of financial performance, market valuation and shareholder value creation.

- The COVID crisis provided another important insight: the valuation and value creation advantage for companies scoring high on corporate purpose widened, sometimes materially, as the crisis developed and progressed.

- We find that the average EBITDA valuation multiple earned by High Purpose brands is over 4 turns higher than that of Low Purpose brands. If sustained over time, this means High Purpose brands would double their market value over 4x faster than Low Purpose brands.

Corporate Purpose In Context

The purpose of the corporation has been debated many times before. However, a striking feature of the current debate on purpose is the role leading CEOs are playing in it, suggesting a growing recognition that purpose is central to how corporations create value. The Business Roundtable’s (BRT) Statement on the Purpose of a Corporation is the most high-profile example of this. In that statement, leading CEOs identified a laundry list of stakeholders, including shareholders, who these CEOs expect to hold in view. This type of initiative yields a number of questions. What are its implications for management decision making? Is this statement a codification of existing practice or does it establish a direction in which the signatories expect practice to develop? How will we know CEOs are living by it across the business and its governance arrangements?

Skepticism

Many express a skeptical view of the emerging stakeholder paradigm and the extent of corporate commitment to it. Institutional investors have expressed concern that a stakeholder approach may be an excuse for pursuing a policy agenda that seeks to erode shareholder rights, leading to management entrenchment and other externalities. Others have suggested that identifying a stakeholder approach—and a more prosocial stance by corporations—may be an attempt to forestall regulation at a time when corporate practice is under scrutiny; “No need to regulate us, we’re already doing what you want us to”.

A further note of skepticism is informed by groups, including institutional investors, that are asking whether high-profile policy statements by corporations can be reconciled with their lobbying and political contributions; the statements being very public, the contributions much less so. American corporations play a major role in funding the political process and many question whether a stakeholder approach is consistent with the policy positions taken by groups funded with corporate money.

And even for those who believe the stakeholder focus is credible, it is unclear how executives should make tradeoffs across stakeholder groups. For example, if a strategy benefits consumers, but has negative implications for employees, how is such a strategy decision to be made? Trade-offs are also not static and their characteristics adjust depending on the time frame used to assess them. For example, upfront costs to retain and train workers may over time yield benefits in terms of productivity and customer satisfaction; meaning that any tradeoff cannot be fully assessed over a short-term time horizon.

These notes of skepticism will continue to inform analysis of corporate behavior, priorities, spending and policy positions. They represent real questions that corporate managers need to answer about corporate purpose.

In our paper, we seek to identify emerging practices and patterns in the stakeholder approach to corporate purpose and to demonstrate that this can benefit shareholders as well as other stakeholders.

Purpose Statements and Emerging Implementation

Companies often issue high-level statements of purpose. Typically these statements are aspirational, simply descriptive, or a declaration, given the activity of the business, of common sense. Take the examples of Walmart and Citigroup:

“…[We] save people money and help them live better.”

“…[We] responsibly provide financial services that enable growth and economic progress.”

Institutional investors expect corporations to have an authentic statement of purpose—but the statement is just the start. More interesting is to get a sense of how a clearly stated corporate purpose is operationalized within the business and how it features in management decision-making. Investor expectations reflect an assessment that purpose-driven companies are likely to be more coherently managed, more resilient, better incentivized and prove themselves more able to innovate and respond to disruption.

In our work empowering corporate leaders to effectively communicate their long-term value to investors, we recommend that companies provide examples of how “purpose” is operationalized. A number of non-exhaustive approaches can achieve this in the context of an investor presentation:

Purpose as Teachable Moments

For example, some companies have identified the key elements of their corporate purpose and its origin story. Through salient examples, derived from the core business, these companies communicate how the stated purpose affected management’s decision-making. Such decisions could take a number of forms; an example would be to cut back share repurchases in order to preserve financial flexibility to maintain current employment levels and benefits through temporary dislocations, or to fund workforce transition to new offerings that align to broader market changes. Having taken such decisions, companies can then feature those teachable moments in management training and development programs—an approach discussed by both Alex Gorsky of J&J and former CEO Paul Polman of Unilever at recent CEO Investor Forums.

Structuring for Stakeholders

If companies are taking a stakeholder approach, management teams need to provide visibility on the identification and prioritization of key stakeholders and the feedback mechanisms for stakeholder outcomes. One technique is to disclose a stakeholder-focused materiality assessment with explanatory commentary on how it was developed, how it is overseen, and how regularly it is refreshed. In addition to external visibility, it is important to articulate how such insights inform decisions internally. Nestle provided an example of this at a recent CEO Investor Forum.

Board-Issued Statement

An early and emerging approach to purpose is board-issued purpose statements. Many institutional investors have indicated that the board should own and oversee purpose, as part of framing the strategic direction and stance of the company. A board-issued purpose statement is a structured means for the board to identify the key stakeholders that it holds in view, how it expects to oversee them, and the time-horizon over which the company sets strategy and manages the business. This approach also has the virtue of setting the goals around purpose at the highest governance level of the firm, providing air cover for management to pursue a long-term, purpose-driven strategy (as noted in “Enacting Purpose within the Modern Corporation: A framework for boards of directors”).

Consumer and Social Expectations: Driving Purpose

“Consumers’ voices can change the financial trajectory of companies. They are more than buyers—they are active stakeholders who are investing their time and attention and want to feel a sense of shared purpose. The winners in this era will not be passive bystanders.” [2]

Consumers are making more mindful purchase decisions and are seeking out purpose-driven companies that appear to reflect their personal values, beliefs, and impact objectives. In response, companies are establishing deeper connections with consumers by aligning their purposeful practices across their lines of business and brands with environmental or social impact. [3]

The interaction of consumer engagement with corporate purpose is a key dimension of purpose that our study seeks to examine. And, in particular, we seek to evaluate how the COVID crisis affected consumer preferences for purpose-driven brands.

Emerging Evidence on Purpose and Value

A growing body of research is developing, which our study builds on, indicating that purpose driven-companies are associated with a variety of performance benefits. Studies have found a significant association between a company’s purpose and its financial performance, by exhibiting higher rates of productivity, growth, and employee retention. Evidence also suggests that firms demonstrating high purpose and clarity of purpose across management teams exhibit systematically higher financial performance and shareholder value creation over the long term. [4] Further studies have found that companies that over-performed on revenue growth linked all of their strategies and practices to various dimensions of purpose. And our prior research has found that companies recognized on both Fortune’s Most Admired Companies list and the Forbes’ Just 100 list delivered median cumulative total shareholder return that was 41.5% higher than the median of the S&P 500 index.

Corporate Purpose Benefits Shareholders Too

To further study the impact of corporate purpose on company financial performance, market valuation and shareholder value creation, we analyzed these measures in relation to a new corporate purpose metric developed by BERA Brand Management, the world’s largest brand-equity assessment platform. BERA captures over a million consumer perceptions across 4,000+ brands in 200 different categories to provide a real-time measure of a brand’s evolution, prescribe brand actions and predict future financial performance.

“This is a milestone study. Attention CEOs and CFOs: the authors show with ample and compelling data that purpose activation and shareholder value creation are strongly linked. And this became even more dramatic as the 2020 pandemic swept the world. With this data, Purpose is no longer a choice. The companies who activate and amplify their purpose—with passion and authenticity—are the ones who will win…the ones who will deliver superior financial results and shareholder value.”

—Jim Stengel, Former P&Amp;G Global Marketing Officer

With this data we can test whether brands with high Purpose scores delivered better financial performance and were more highly valued by the market, and whether the outperformance of high Purpose brands widened during times of crisis.

We sorted the brands according to their average Purpose scores, which are measured on a monthly basis on a scale of 1 to 100, and categorized those with scores below 50 as “Low Purpose” brands and those above 50 as “High Purpose” brands.

High Purpose brands outperformed on common measures of financial performance, market valuation and shareholder value creation.

This may be counterintuitive to many who are aware of companies that have achieved financial and even stock market success via strategies and tactics that seem at odds with the ideals of corporate purpose and that may take advantage of some stakeholder groups. This certainly happens, but the findings that follow show that these companies must be short-term anomalies or in non-competitive environments since the opposite holds true across the broader market; most companies that achieve success do so with actions consistent with the corporate purpose and stakeholder paradigms.

Consumers increasingly favor brands that demonstrate a commitment to corporate purpose. In fact, research shows that fifty percent of CPG growth from 2013 to 2018 came from sustainability marketed products. This translates to financial performance—all else equal, a company more closely aligned to consumer preferences will need to spend less per dollar of revenue to acquire and serve that consumer than will a company that is misaligned with consumer preference, hence the nearly 6% better Return on Capital we see from High Purpose brands.

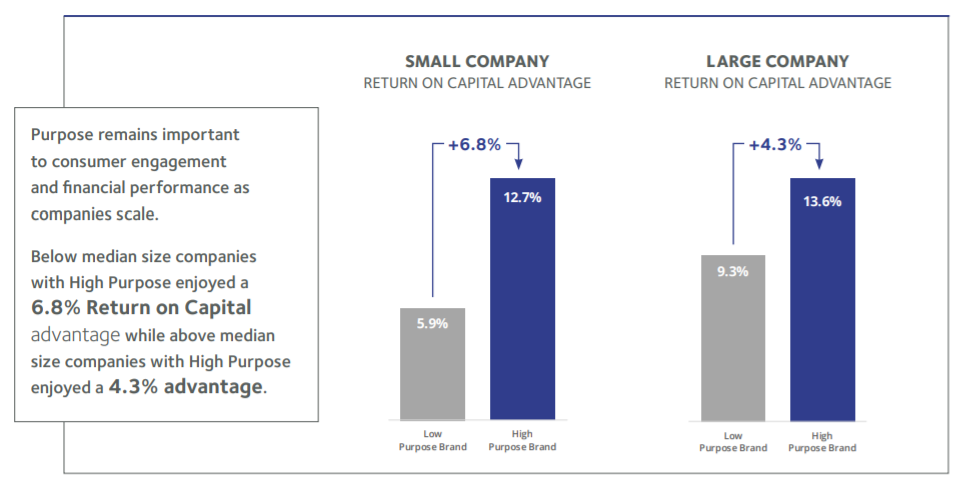

Profitable growth in competitive environments is enhanced by purpose. As a company grows, consumer acquisition costs tend to increase with the need to reach beyond early adopters. Companies must consider how to engage with and build relevance to a broader consumer group. So long as competition for those consumers remains (i.e., non-monopolistic competition), companies that better engage with their consumers should outperform.

To test whether purpose remains important to consumer engagement and financial performance as companies scale, we compared the purpose-related Return on Capital advantage for companies at both below and above the median size of companies in the dataset. We found that this advantage still held. Below median size companies with High Purpose enjoyed a 6.8% Return on Capital advantage while above median size companies with High Purpose enjoyed a 4.3% advantage.

Importantly, capital market investors recognize this advantage and believe it will persist—the average EBITDA valuation multiple earned by High Purpose brands is over 4 turns higher than that of Low Purpose brands.

Better financial performance and better valuation multiples combine to deliver better long-term shareholder value creation, as evidenced here by the nearly 20 percentage point advantage in annualized total shareholder returns for companies with High Purpose scores versus Low Purpose scores. If sustained over time, this means High Purpose brands would double their market value over 4x faster than Low Purpose brands.

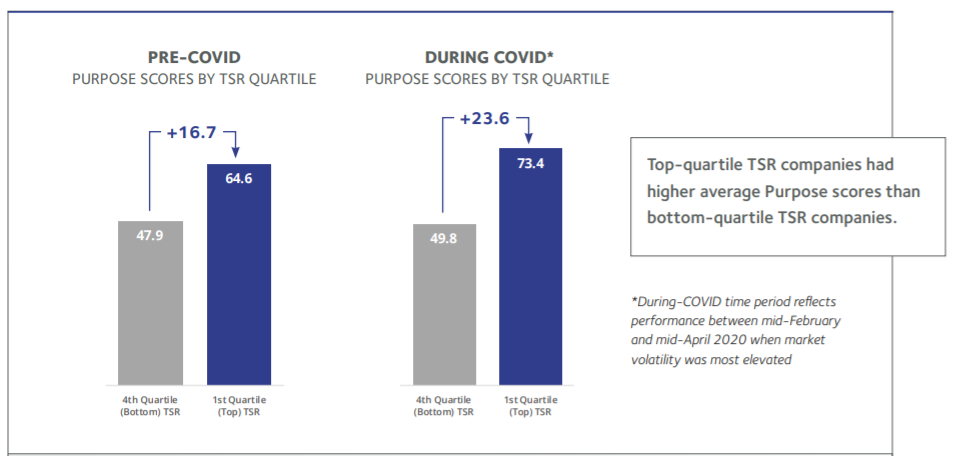

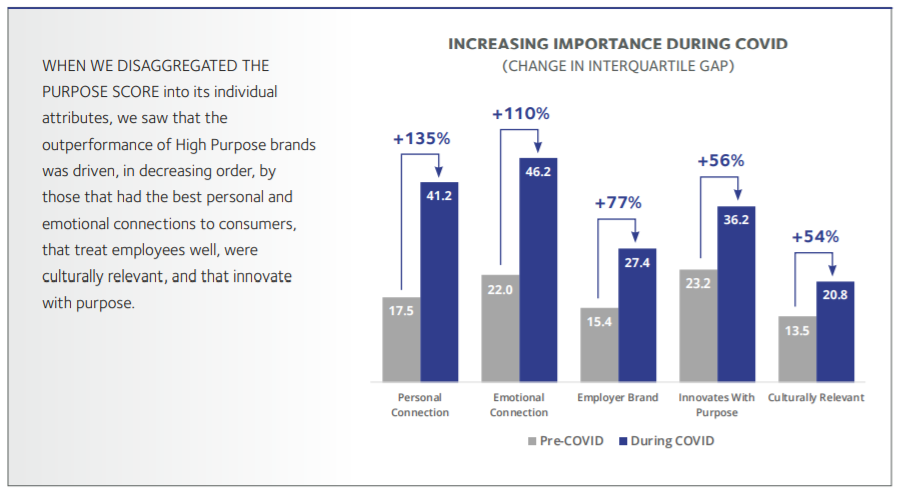

The COVID crisis provides an opportunity to test whether the outperformance of High Purpose brands widens during times of crisis. Given the time delay of reported financials, we look instead at the real-time impact on market valuations, which reflect investor expectations of the future impact of the crisis on financials. We sorted all companies by their total shareholder returns “pre-COVID” and “during-COVID”, and looked at the average Purpose score for companies that realized top-quartile TSR compared to the Purpose score for companies with bottom-quartile TSR.

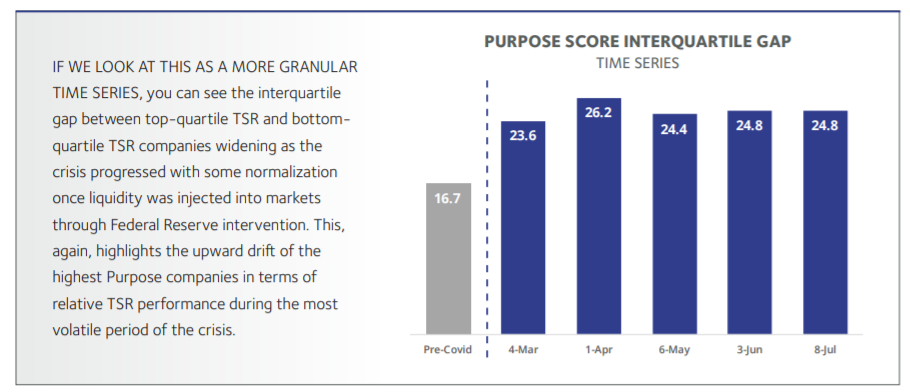

As a pre-COVID baseline, we measured this as the trailing twelve months as of January 31, 2020. As we would expect given the analysis above, top-quartile TSR companies had higher average Purpose scores than bottom-quartile TSR companies by 16.7 points, a 35% difference (see chart below).

During COVID, we saw the advantage of Top Quartile versus Bottom Quartile widen to 23.6 points, a 47% difference.

The analysis demonstrates that companies with the best Purpose scores generally moved up and into the top quartile of TSR performance, suggesting that capital market investors viewed corporate purpose as a leading indicator of stronger consumer connections and more resilient financial performance.

While the severity, length and character of crises will change, these results highlight that companies that invest well in purpose improve their odds of outperforming during such periods—outperformance that ultimately benefits each of their stakeholder groups.

Purpose in Practice through Crisis—the Voice of the CEO

Complementary to the above analysis, we wanted to look at whether the COVID-19 crisis has impacted companies’ approach to their corporate purpose across key stakeholder groups. To do this, the authors conducted a survey of the Fortune 500 CEOs in their respective professional networks. As our study suggests, purpose takes on amplified significance in the context of crisis management.

The survey asked the CEOs whether purpose operates as the basis for competitive advantage. It also sought to explore whether CEOs are making purpose-driven decisions and if these require trade-offs among different stakeholder groups. To interrogate this, we asked whether these firms had taken action to support their supply chain during the COVID crisis. [5]

CEOs identified corporate purpose as a core competitive differentiator that plays a role in enhancing corporate resilience and alignment across stakeholder groups. As one CEO responded,

“whether it is consumers or prospective employees, suppliers or clients, it has been our experience that being anchored by purpose has helped us differentiate ourselves significantly. It has also shaped our culture, values, governance and leadership, helping us leverage our strengths to serve our customers, employees and communities equally. The advantage is also demonstrated in our market-leading growth, our industry-benchmark retention, high valuation and other competitive performance metrics.”

Corporate purpose during a crisis can also unite different stakeholder groups. One CEO said:

“both employees and customers have very visibly and vocally rallied around the company and expressed their happiness that they work with/for a company that keeps corporate purpose as the North Star for decision making.”

Beyond the fluff, our prior work does suggest that corporate decision-making stands on a foundation of operational processes. The work to map, prioritize, and respond to stakeholders in the context of business strategy takes time and coordination. Corporations are adopting operational processes to integrate stakeholder analysis and engagement into decision-making and strategy. This is work that connects directly to risk management, operational performance and financial prospects. As a result, leading companies have begun to disclose high-level materiality assessments in investor conference presentations. This affords investors a high-level understanding of process and outcomes of stakeholder-focused strategy and decision-making.

While key stakeholders tend to include customers, employees and communities, COVID has revealed a spotlight on company engagement with its suppliers. In a rare effort to focus on the sustainability of their suppliers throughout the pandemic, our survey found that several companies proactively took action to support their suppliers by ensuring they are paid on an immediate basis in order to provide liquidity, and by shortening scheduled payment terms. Other examples included paying suppliers in advance of delivery or in some instances, refunding them in full.

Bruce Broussard, CEO of Humana, provided the following insight:

“At Humana, we set out a detailed crisis-response effort that went beyond merely adjusting supplier payment terms. This included distributing a small business supplier guidebook to provide our suppliers with government options for COVID-related assistance and opening a channel for discussion related to current supplier needs. In addition, we established an enterprise-wide process for suppliers to send COVID-related inquiries to our procurement teams. We also relaxed in-office work requirements for supplier partners, permitting work-at-home for services partners (domestic and overseas). Our company is also preparing a return-to-work playbook and resource center to provide guidance and considerations for suppliers.”

Unilever, a leading consumer-goods company, offered €500m of cash-flow relief to support its suppliers across its extended supply chain. The company administered early payments for their most vulnerable small- and medium-sized suppliers, supporting their ongoing liquidity. In addition, Unilever has extended credit to a select group of small-scale retail customers to help them manage and preserve employment levels. Other examples of brands prioritizing their suppliers during the crisis include Walmart, Vodafone, and Morrisons.

As we have argued and demonstrated above, this is not merely good corporate citizenship. Smart CEOs recognize suppliers can serve as important centers of efficiency, innovation and growth. Though value can be won in the short-term at the expense of suppliers, CEOs can achieve much greater long-term value creation through effective reinvestment in the supplier ecosystem, especially during periods of crisis.

Conclusions

- Corporate purpose is a dynamic and complex concept with significant implications for chief executives, investors, policy makers and consumers. We have demonstrated that an authentic corporate purpose, experienced through the brand and lived through the strategy, can help create shareholder value.

- Corporate purpose has the potential to create value across stakeholder groups; though we do not see the stakeholder value paradigm as a world free of trade-offs. Quite the opposite—it requires a clear strategic vision to decide who and what to invest in and why. We also acknowledge the skepticism that the dialogue around corporate purpose generates.

- As a result, corporations should continue to demonstrate that they have an authentic purpose, how it was arrived at, how it impacts the way the business is managed and overseen, and how the company interacts with key stakeholder groups. As our study suggests (building on the emerging field of analysis of corporate purpose), those corporations that develop and demonstrate a clear corporate purpose are well positioned to realize a return on purpose over the long term and through the uncertainty of crises.

The complete paper is available here.

Endnotes

1A survey was sent to over 100 CEOs of corporations within the authors’ professional networks. Responses from the CEOs have been anonymized, except where specific permission was sought to quote the relevant CEO directly (go back)

2Quiring, Kevin, Accenture Strategy Global Consumer Pulse Research. “From Me to We: The Rise of the Purpose-led Brand” (December 8, 2018).(go back)

3Atz, Ulrich; Van Holt, Tracy; Douglas, Elyse and Whelan, Tensie, The Return on Sustainability’ Investment (ROSI): Monetizing Financial Benefits of Sustainability Actions in Companies (July 8, 2019). Review of Business: Interdisciplinary Journal on Risk and Society 39, no. 2, 1–31.(go back)

4Gartenberg, Claudine; Prat, Andrea and Serafeim, George. “Corporate Purpose and Financial Performance.” Organization Science 30, no. 1 (January–February 2019): 1–18.(go back)

5The CEO survey was conducted between June 9 and July 1, 2020(go back)

Print

Print