Stephanie Avakian is the Director of the Division of Enforcement of the U.S. Securities and Exchange Commission. This post is based on a publication by the Staff of the Division of Enforcement. The views expressed in this post are those of Ms. Avakian and do not necessarily reflect those of the Securities and Exchange Commission or its staff.

Introduction

The Division of Enforcement’s efforts to deter misconduct and punish securities law violators are critical to protecting millions of investors and instilling confidence in the U.S. securities markets. Each year, the Division recommends, and the Commission brings, hundreds of enforcement actions against individuals and entities for fraud and other misconduct and secures remedies that protect investors by punishing misconduct, deterring wrongdoing, removing bad actors from our markets, and, where possible, compensating harmed investors. This report summarizes some of the major accomplishments and key priorities of the Division over the last fiscal year.

Focus on Financial Fraud and Issuer Disclosure

Integrity and accuracy in financial statements and issuer disclosures are critical to the functioning of our capital markets. During the last fiscal year, the Division maintained its ongoing focus on identifying and investigating securities laws violations involving different components of the financial reporting process.

In addition to traditional case sources, the Division took a proactive, risk-based analytic approach to identifying potential violations, which resulted in several important actions. For example, the Division’s EPS (Earnings Per Share) Initiative uses risk-based data analytics to uncover potential accounting and disclosure violations caused by, among other things, earnings management practices to mask unexpectedly weak performances. Investigations under the EPS Initiative resulted in settled actions against Interface Inc. and two of its former executives, and against Fulton Financial Corporation, for improper accounting practices that resulted in the reporting of quarterly EPS that met or exceeded analyst consensus estimates. The Division also used risk-based data analytics to uncover potential violations related to corporate perquisites, which led to a settled enforcement action against Hilton Worldwide Holdings Inc. for failing to fully disclose perquisites and personal benefits provided to executive officers.

The Division’s financial fraud and issuer disclosure focus remained on matters involving financial statement misstatements and the executives responsible for the violations. For example, the Commission brought actions against:

- Revolution Lighting Technologies, Inc. and four executives, including the CEO and former CFO, for allegedly falsely inflating its reported revenues over a four-year period;

- Super Micro Computer, Inc. and its former CFO for prematurely recognizing revenue and understating expense over a period of at least three years;

- Power Solutions International Inc. and three individuals, for the fraudulent overstatement of revenues by nearly $25 million;

- Iconix Brand Group Inc. and its former CEO and COO for allegedly devising a fraudulent scheme to create fictitious revenue, allowing Iconix to meet or beat Wall Street analysts’ consensus estimates in the second and third quarters of 2014;

- MiMedx Group Inc. its former CEO, CFO and COO for allegedly defrauding investors by misstating the company’s revenue and attempting to cover up their misconduct by misleading the company’s auditor, audit committee and outside lawyers;

- Manitex International, Inc. and its former COO, former Controller and CFO, and General Manager of a subsidiary for engaging in two accounting fraud schemes that resulted in the issuance of materially misstated financial statements;

- Outcome Health, a private healthcare advertising company, and four former executives with alleged fraud in raising nearly half a billion dollars by falsely portraying the company as an overwhelming success to investors, clients, and auditors; and

- Hill International, Inc., a Pennsylvania-based construction management consulting company, and two of its former executives for allegedly engaging in fraudulent accounting practices.

Accurate corporate disclosures that include material information about an issuer’s condition lie at the heart of our securities laws. Last fiscal year, the Commission confirmed the importance of such disclosures with several cases charging issuers with materially misleading and incomplete disclosures. In February 2020, the Commission announced settled charges against alcohol producer Diageo plc for failing to make required disclosures of known trends relating to the shipments of unneeded products by its North American subsidiary to distributors. In the same month, the Commission charged SCANA Corp., two of its former top executives, and South Carolina Electric & Gas Co. with allegedly defrauding investors by making false and misleading statements about a nuclear power plant expansion that was ultimately abandoned. Similar disclosure issues animated the Commission’s settled action against Fiat Chrysler Automobiles N.V. for misleading disclosures about an internal audit of its emissions control systems. Further, the Commission settled with HP Inc. for misleading investors by failing to disclose the impact of sales practices undertaken in an effort to meet quarterly sales and earnings targets.

Another priority for the Division is recommending actions against issuers that distort non-GAAP metrics, key performance indicators, and related disclosures. The Commission brought actions against:

- Wells Fargo & for misleading investors about the success of its core business strategy at a time when it was opening unauthorized or fraudulent accounts for unknowing customers and selling unnecessary products that went unused;

- BMW AG and two of its U.S. subsidiaries for disclosing inaccurate and misleading information about BMW’s retail sales volume in the U.S.;

- Bausch Health, formerly Quebec, Canada-based Valeant Pharmaceuticals, and three former executives for improper revenue recognition and misleading disclosures in SEC filings and earnings presentations, including by touting double-digit same store organic growth, a non-GAAP financial measure, when much of that growth came from sales to a mail order pharmacy Valeant helped establish, fund and subsidize;

- BCG Partners, Inc. for allegedly false and misleading disclosures concerning how it calculated a key non-GAAP financial measure, which it called post-tax distributable earnings; and

- Publicly-traded real estate investment trust VEREIT, Inc., formerly known as American Realty Capital Properties, Inc., with intentionally overstating a key performance metric.

Focus on Investment Professionals

The Division continued to prioritize identifying misconduct that occurs in the interaction between investment professionals and retail investors. Investment professionals occupy positions of tremendous importance to those who entrust them with their children’s college funds, their retirement funds, and other savings.

One such responsibility—long recognized under federal law—is an adviser’s fiduciary obligation to disclose to their clients material conflicts of interest. Disclosure of such conflicts remains a priority. The importance of such disclosures is illustrated by the Share Class Selection Disclosure Initiative (Share Class Initiative) that we concluded during Fiscal Year 2020. Ultimately, this initiative resulted in the SEC ordering nearly 100 investment advisory firms that voluntarily self-reported to the Division to return more than $139 million to investors.

Other potential undisclosed conflicts can include advisers’ use of cash sweep arrangements. Cash in advisory accounts is often automatically swept into a money market mutual fund or a bank deposit sweep program. In some cases, an adviser that is either dually-registered or has an affiliated broker-dealer has a conflict of interest in recommending one cash investment over another because it receives revenue sharing payments from its clearing broker when selecting particular cash sweep products. Just as with mutual fund share class selections, advisers recommending or choosing between different cash sweep products must make full and fair disclosure of these types of conflicts. In bringing settled charges against Fresno, California-based SCF Investment Advisors, Inc., the Commission found that SCF failed to disclose conflicts related to revenue sharing from cash sweep money market funds.

Another potential area of concern for advisory clients is the transparency of fee structures around their accounts. For example, “wrap fee programs” offer accounts in which clients pay an asset-based “wrap fee” that covers investment advice and brokerage services, including trade execution. In May 2020, the Commission found that Morgan Stanley Smith Barney had disseminated marketing and client communications that gave the misleading impression that wrap fee clients were not likely to incur additional trade execution costs, even though the firm’s order routing practices resulted in some instances in the clients paying additional transaction fees that were not visible to them. In settling the charges, Morgan Stanley agreed to pay a $5 million penalty and create a Fair Fund to distribute the penalty moneys to harmed investors.

Initiatives

Protecting investors remains a critical focus of our Enforcement program. Investor protection takes a variety of forms, as illustrated by the below examples.

COVID-19 Steering Committee

Recognizing that the pandemic posed significant risks to investors and market integrity across a variety of market segments and types of conduct, in late March, we established a Coronavirus Steering Committee to centralize and coordinate our efforts. The Steering Committee’s mandate was to ensure a consistent Division-wide approach to coronavirus-related matters, ensure appropriate allocation of our resources, avoid duplication of efforts, and coordinate as appropriate with state and federal agencies. The Steering Committee also worked to proactively identify and monitor areas of potential misconduct associated with COVID-19, and to detect and address potential misconduct in areas such as insider trading, financial fraud and issuer disclosure, and misconduct by regulated entities and individuals. As a result of our efforts to uncover potential wrongdoing in these and other areas, between mid-March and the end of the fiscal year the Division opened more than 150 COVID-related inquiries or investigations, many of which are ongoing.

Given the widespread switch to remote work and the increased market volatility, we recognized the potential for the misuse of material nonpublic information and, on March 23, 2020, put out a public statement addressing our concerns in this regard. The statement highlighted that material nonpublic information was potentially even more valuable amid the dynamic market conditions of the pandemic’s early days than under normal market conditions. The statement reminded issuers and registrants to follow their disclosure controls and procedures to protect against the improper dissemination and use of such information.

Finally, the Steering Committee also included members of the Division’s Retail Strategy Task Force (RSTF) who, in collaboration with the SEC’s Office of Investor Education and Advocacy, issued an Investor Alert warning of potential COVID-19-related scams targeting retail investors, highlighting specific types of frauds investors should be wary of, and providing specific steps that retail investors could take to protect themselves.

Retail Investor Protection

Staff across the Division continued to work to protect retail investors from threats apart from those related to COVID-19. Cases in this area span a wide range of conduct, and address violations that affected a variety of investor populations, including seniors, the Hispanic community, African immigrants, Amish and Mennonite community members, police officers and other first responders, and cadets at the U.S. Air Force Academy.

In addition, staff, and particularly the RSTF, worked to educate vulnerable investors about potential scams targeting members of identifiable groups, such as religious or ethnic communities, the elderly, or the differently abled. For example, in Fiscal Year 2020, the RSTF helped create a video designed to teach investors in the Deaf, Hard of Hearing, and Hearing Loss communities about how to spot frauds in their communities. This was tied to the Commission’s September 2020 action against a Swedish national living in Thailand who allegedly conducted a multi-million dollar online offering fraud that victimized thousands of retail investors worldwide. According to the complaint, at least 847 of the investors were members of a community for the Deaf that invested more than $2 million in the scheme since 2015 as their retirement investment.

Preserving Market Integrity

As a number of the Commission’s enforcement actions demonstrate, the Division remains focused on uncovering violations at major financial institutions over the last year. Such matters are essential to maintaining the integrity of the securities markets.

One market structure issue that has been a major area of ongoing focus is the “pre-release” of American Depository Receipts (ADRs). ADRs are U.S. securities that represent foreign shares of a foreign company and require a corresponding number of foreign shares to be held in custody at a depositary bank. The practice of pre-release allows ADRs to be issued without the deposit of foreign shares, provided the broker receiving them has an agreement with a depositary bank and the receiving broker or its customer owns a number of foreign shares that corresponds to the number of shares the ADRs represent. Since late 2018, and continuing through Fiscal Year 2020, the Commission has brought enforcement actions against depositary banks and brokers comprising some of the world’s largest financial institutions, including JP Morgan Chase, Citibank, and Merrill Lynch, for engaging in improper conduct that undermined market integrity in connection with the “pre-release” of ADRs. In total, the Commission brought actions against 15 firms and 4 individuals, ordering more than $432 million in disgorgement and penalties. This important initiative, which has now concluded, illuminated misconduct in the gateway to U.S. markets for issuers from across the world.

In 2020, the Commission also brought several actions in connection with order routing practices. In May 2020, the Commission charged Bloomberg Tradebook LLC with making material misrepresentations and omitting material facts about how the firm handled certain customer trade orders. The Commission found that Tradebook allowed unaffiliated broker-dealers to make order routing decisions for certain customer orders, contradicting its marketing materials, which represented that orders would be routed by Tradebook’s own “advanced” technology. In August 2020, the Commission charged affiliated registered investment advisers WBI Investments Inc. and Millington Securities Inc. with making material misrepresentations to clients about compensation Millington received in an institutional payment for order flow arrangement for routing client orders to certain brokerage firms for execution.

Nationally recognized statistical rating organizations (NRSROs), or credit rating agencies, also play a critical role in ensuring market integrity. Over the last year, the Commission brought several actions addressing issues in the credit rating process. For example, the Commission charged Morningstar Credit Ratings LLC with violating a conflict of interest rule designed to separate credit ratings and analysis from sales and marketing efforts, finding that Morningstar had permitted a wholesale integration of its ratings analysts into its business development efforts. The Commission also instituted two actions against Kroll Bond Rating Agency, Inc. (KBRA) relating to the rating of commercial mortgage-backed securities (CMBS) and of collateralized loan obligation (CLO) combination notes. In connection with the CMBS ratings matter, the Commission found that KBRA permitted analysts to make adjustments that had a material effect on the final ratings, but did not require any analytical method for determining when and how those adjustments should be made, and that KBRA’s internal controls failed to monitor whether analysts were making adjustments at the loan level, as KBRA’s procedures required, or at the portfolio level. With regard to the CLO combo notes matter, the Commission found that KBRA’s policies and procedures were not reasonably designed to ensure that KBRA rated the notes in accordance with their terms.

Uncovering and Prosecuting Abusive Trading

Detecting and punishing those who engage in insider trading, and those who trade on the basis of misappropriated information, remain central to our mission. The Commission, often in coordination with criminal law enforcement authorities, brought a number of actions covering a wide array of such abusive trading practices. For example, the Commission charged a former finance manager at Amazon.com Inc. and two family members with insider trading in advance of Amazon earnings announcements between January 2016 and July 2018. The Commission also charged a former IT administrator at Palo Alto Networks Inc., who allegedly used his IT credentials and work contacts to obtain highly confidential information about Palo Alto Network’s quarterly earnings and financial performance, then traded in the company’s securities based on the confidential information and tipped his friends, four of whom were also charged.

In addition to such “classical” insider trading cases, the Commission brought enforcement actions against financial professionals for allegedly misappropriating material nonpublic information that they and/or others then traded on. In one action, the Commission charged a senior index manager at a globally recognized index provider and his friend with perpetrating an insider trading scheme that generated more than $900,000 in illegal profits. The pair allegedly purchased call or put options of publicly traded companies hours before public announcements that those companies would be added to or removed from a popular stock market index that the index manager helped his employer manage, and then liquidated their options positions for a substantial profit. And in a series of enforcement actions arising from an alleged international insider trading scheme, the Commission charged an investment banker at a large investment bank and a New York-based trader, two former investment bankers and a London-based trader, and two traders based in Switzerland. These actions, like a number of other significant cases involving complex, abusive trading, originated from the Analysis and Detection Center housed within the Division’s Market Abuse Unit, which uses data analysis tools to detect suspicious trading patterns, such as improbably successful trading across different securities over time.

Notably, parallel criminal actions were filed by separate U.S. Attorney’s Offices in connection with each of the four cases mentioned above. This reflects the success of our ongoing efforts to coordinate with our criminal law enforcement counterparts as appropriate. Fittingly, Fiscal Year 2020 began with a Criminal Coordination Conference that the Division hosted on October 3, 2019. The main goals of this event were to continue to build relationships between the Division and our criminal law enforcement counterparts and to strengthen our coordination.

A critical element in preventing illegal trading is robust corporate controls and compliance policies around the use and safeguarding of material nonpublic information. The importance of such policies was central to the Co-Directors’ Statement of March 23, 2020, referenced above, and it also animated the Commission’s enforcement action against Ares Management LLC, a Los Angeles-based private equity firm and registered investment adviser. In that matter, the Commission found that Ares’s compliance policies failed to account for the special circumstances presented by having an employee serve on the portfolio company’s board while that employee continued to participate in trading decisions regarding the portfolio company.

Our efforts to curb abusive trading extend beyond insider trading. For example, the Commission filed an emergency action and obtained an asset freeze against eighteen traders in a complex scheme to manipulate more than 3,000 U.S.-listed securities for more than $31 million in illicit profits. The Commission alleged that the traders, who are primarily based in China, manipulated the prices of thousands of thinly traded securities by creating the false appearance of trading interest and activity in those stocks, artificially boosting or depressing stock prices.

Achieving Results Through Litigation

The majority of the Commission’s enforcement actions are filed as settled matters, but the Division stands ready to litigate matters where necessary to protect investors, markets, and the Commission’s interests. Over 40% of the standalone matters the Commission brought in Fiscal Year 2020 were filed in whole or in part as litigated actions. These matters, against both entities and individuals, span a wide range of misconduct and represent the Division’s commitment of resources to litigation when a satisfactory resolution by settlement cannot be reached.

The Division had a number of significant wins before juries, in bench trials, and in contested administrative and cease-and-desist proceedings in Fiscal Year 2020. In fact, every proceeding that the Division litigated to a verdict or decision this year resulted in a win for the Commission. The Division’s ability to prevail before a jury on even the most complex fact patterns was on display in the Commission’s action against Ukraine-based trading firm Avalon FA Ltd. and its principals for allegedly manipulating the U.S. markets hundreds of thousands of times and generating more than $25 million in illicit proceeds. The Commission alleged that Avalon engaged in layering, which involved placing and canceling orders to trick others into buying or selling stocks at artificial prices, and cross-market manipulation, which involved buying or selling stocks to artificially impact options prices. In November 2019, following a three week-long trial, the jury found Avalon and its principals liable for its unlawful trading schemes.

Another win came on September 24, 2020, when, after a nine-day bench trial, a New York federal judge ordered a former private equity executive liable on the Commission’s charges that he had fraudulently spent his clients’ funds on vacations, salon trips, clothing and other personal expenses.

The Commission also obtained asset freezes and emergency relief in a number of actions. One particularly significant example was the Commission’s October 2019 emergency action against Telegram. The court issued a preliminary injunction barring delivery of the tokens at issue and finding that the Commission had shown a substantial likelihood of proving that Telegram’s sales were part of a larger scheme to unlawfully distribute “Gram” tokens to the secondary public market. Ultimately, the Commission reached a settlement whereby Telegram agreed to return more than $1.2 billion to investors.

Further, the Commission also had success at the summary judgment stage. For example, in August 2020, the District Court for the Southern District of Florida granted the Commission summary judgment in a case charging a Florida-based individual and his company with acting as unregistered dealers in the sale of billions of shares of numerous penny stock issuers. And on September 30, 2020, the District Court for the Southern District of New York awarded the Commission summary judgment on its charges against Kik Interactive Inc. in connection with that company’s 2017 initial coin offering. The court found that undisputed facts established that Kik’s sales of “Kin” tokens were sales of investment contracts, and therefore of securities, and that Kik violated the federal securities laws when it conducted an unregistered offering of securities that did not qualify for any exemption from registration requirements. The court further found that Kik’s private and public token sales were a single integrated offering.

Through such actions, the Division obtained significant relief on behalf of the Commission and investors. These and other cases also remind potential bad actors that the Commission will aggressively litigate even the most difficult cases where appropriate.

Discussion and Analysis of Fiscal Year 2020

Overall Results

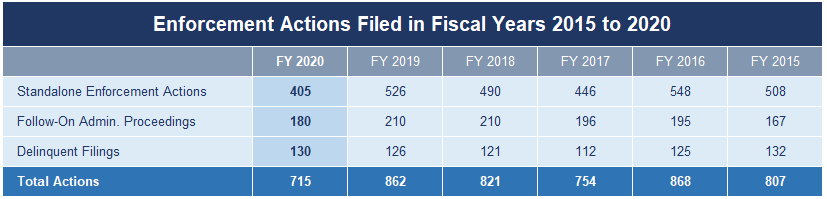

Fiscal Year 2020 was another successful year for the Division of Enforcement, despite the unprecedented challenges posed by the global COVID-19 pandemic. Since mid-March, the entire Division has been working from home, which has created unique impediments to several important aspects of our work, such as taking testimony from live witnesses, gathering evidence, and litigating our cases in court. Nevertheless, the Division found ways to recommend meaningful cases to the Commission and to protect the investing public. In the face of great adversity, the Commission brought 715 enforcement actions in Fiscal Year 2020. Impressively, the Commission brought 492 of these cases after the instituting mandatory telework in mid-March. Of the cases brought this fiscal year:

- 405 were “standalone” actions brought in federal court or as administrative proceedings;

- 180 were “follow-on” proceedings seeking bars based on the outcome of Commission actions or actions by criminal authorities or other regulators; and

- 130 were proceedings to deregister public companies–typically microcap–that were delinquent in their Commission Filings. (In Fiscal Year 2020, the Commission’s deregistration and/or suspension orders instituted a proceeding as to a single issuer. In prior years, such orders typically instituted a proceeding as to two or more, usually unrelated, issuers. This change in practice achieves consistency with the Commission’s general practice of issuing separate orders for individual respondents except when charges arise from related investigations, and streamlines the process relating to contested orders.)

Notwithstanding the challenges we faced, the total numbers of cases were down only 17% from last year.

Types of Cases

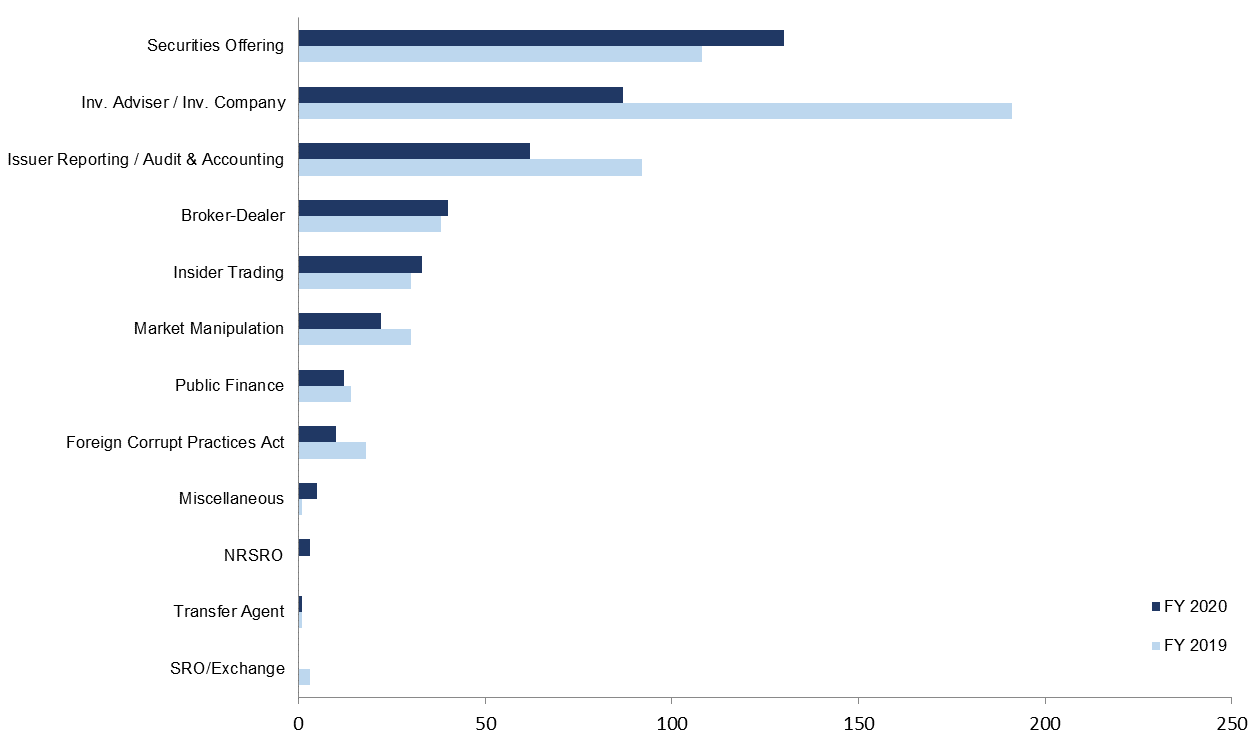

As the chart below illustrates, the majority of the SEC’s 405 standalone cases in Fiscal Year 2020 concerned securities offerings (32%), investment advisory and investment company issues (21%), and issuer reporting/accounting and auditing (15%) matters. The SEC also continued to bring actions relating to broker-dealers (10%), insider trading (8%), and market manipulation (5%), as well as other areas such as Public Finance (3%) and FCPA (2%).

A breakdown of the number and percentage of the types of actions brought in Fiscal Year 2020 is set forth in the attached appendix.

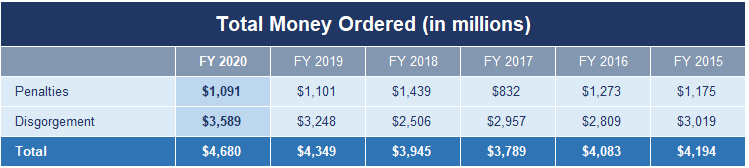

Disgorgement and Penalties Ordered

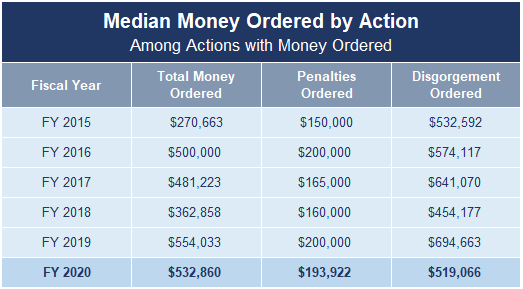

In Fiscal Year 2020, the Commission obtained record-breaking monetary remedies in enforcement actions. All told, parties in the Commission’s actions and proceedings were ordered to pay a total of $3.589 billion in disgorgement of ill-gotten gains. Penalties imposed totaled $1.091 billion, in line with Fiscal Year 2019’s $1.101 billion penalty total. Total monetary relief ordered in Fiscal Year 2020 was $330 million higher than in Fiscal Year 2019, an approximately 8% increase.

Money ordered is also high when viewed in terms of the median case: the median amount of total money ordered in Fiscal Year 2020 was over $530,000.

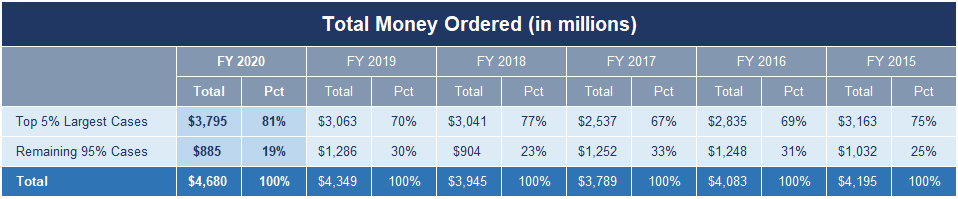

In Fiscal Year 2020, the 5% of cases that involve the largest financial remedies again accounted for the majority of all financial remedies the Commission obtained.

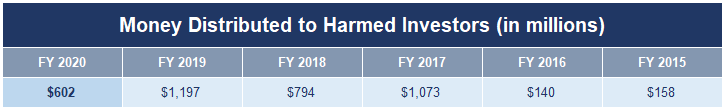

The Commission places a significant priority on returning funds to harmed investors whenever possible. Consistent with that goal, the Commission returned $602 million to harmed investors in Fiscal Year 2020. These distributions comprised over 800,000 individual payments to investors from 91 fair funds and court-appointed administrators.

Tips, Complaints, and Referrals

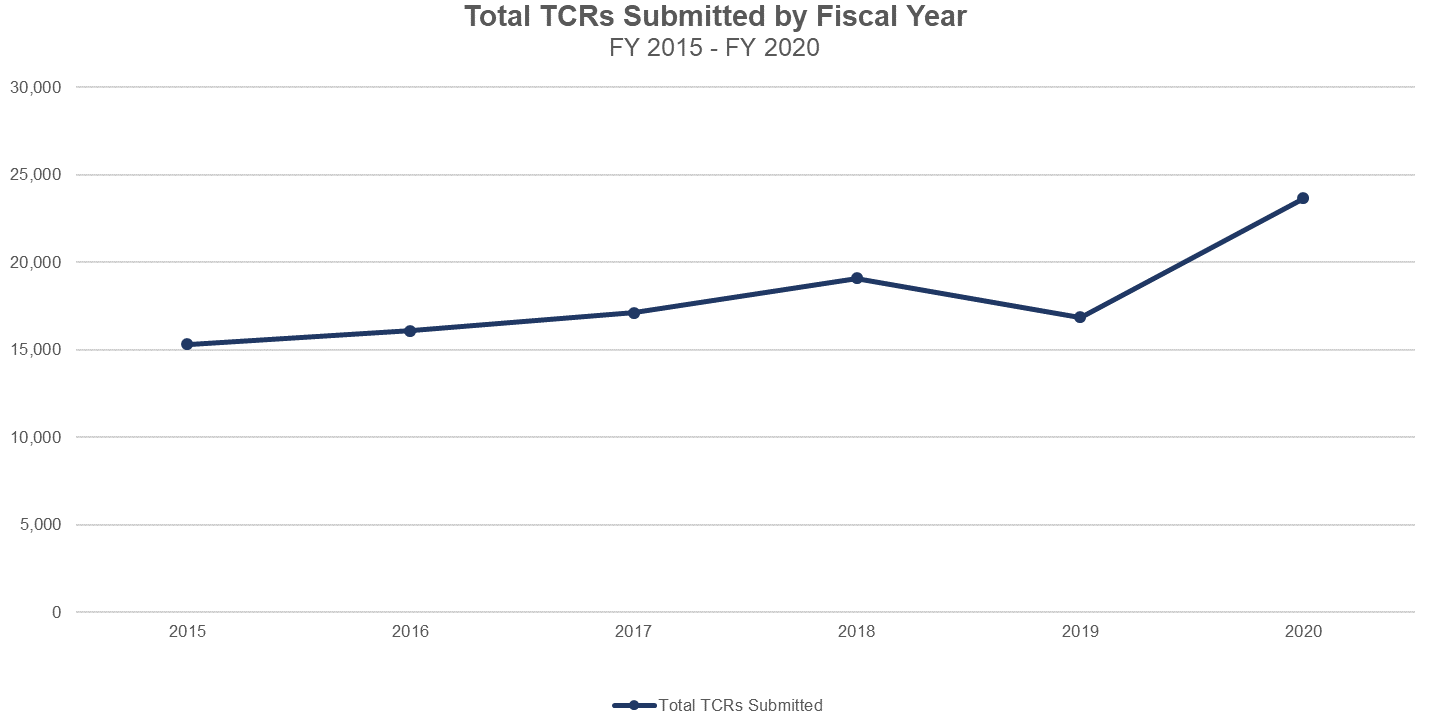

Each year, the Commission receives thousands of tips, complaints, and referrals, or TCRs, that need to be reviewed and analyzed by Enforcement staff to identify those that warrant potential further investigation or response. Staff quickly triages each TCR to determine whether we should open an inquiry or investigation. In Fiscal Year 2020, the Commission received over 23,650 TCRs, a substantial increase over the approximately 16,850 TCRs received in Fiscal Year 2019. Further, the Commission received a majority of these TCRs during the pandemic: between mid-March and the end of the fiscal year, the Division triaged approximately 16,000 TCRs, a 71% increase from the same time period in 2019. We also saw an increase in the number of new inquiries and investigations. Overall, we opened 1,181 new inquiries and investigations in Fiscal Year 2020, compared to 1,082 in Fiscal Year 2019. From mid-March through the end of the fiscal year, we opened over 640 new inquiries/investigations, a 7% increase over the same period in Fiscal Year 2019. The staff’s dedication to quickly assessing TCRs and opening new cases is extraordinary. In addition, we believe this work has created a strong pipeline for future enforcement actions.

Whistleblower Program

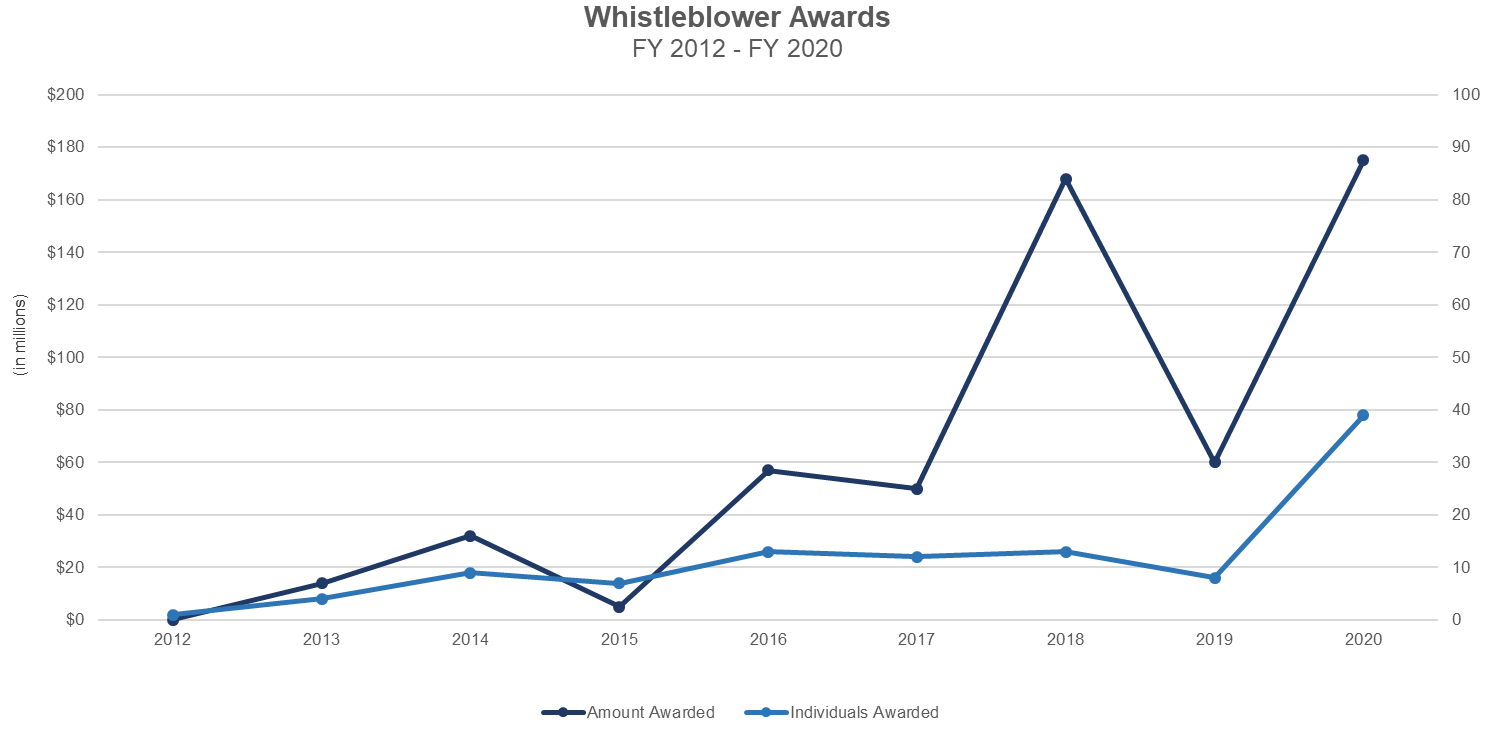

Over the past ten years, the whistleblower program has been a critical component of the Commission’s efforts to detect wrongdoing and protect investors in the marketplace, particularly where fraud is concealed or difficult to detect. Enforcement actions from whistleblower tips have resulted in more than $2.5 billion in ordered financial remedies, including more than $1.4 billion in disgorgement of which almost $750 million has been, or is scheduled to be, returned to harmed investors. Recognizing the importance of rewarding meritorious whistleblowers in a timely manner, we have made efforts to streamline and substantially accelerate the evaluation of claims for whistleblower awards. These efforts paid off. Fiscal Year 2020 was a record-breaking year for the whistleblower program. The Commission issued awards totaling approximately $175 million to 39 individuals, both greater than any other year in the program’s history.

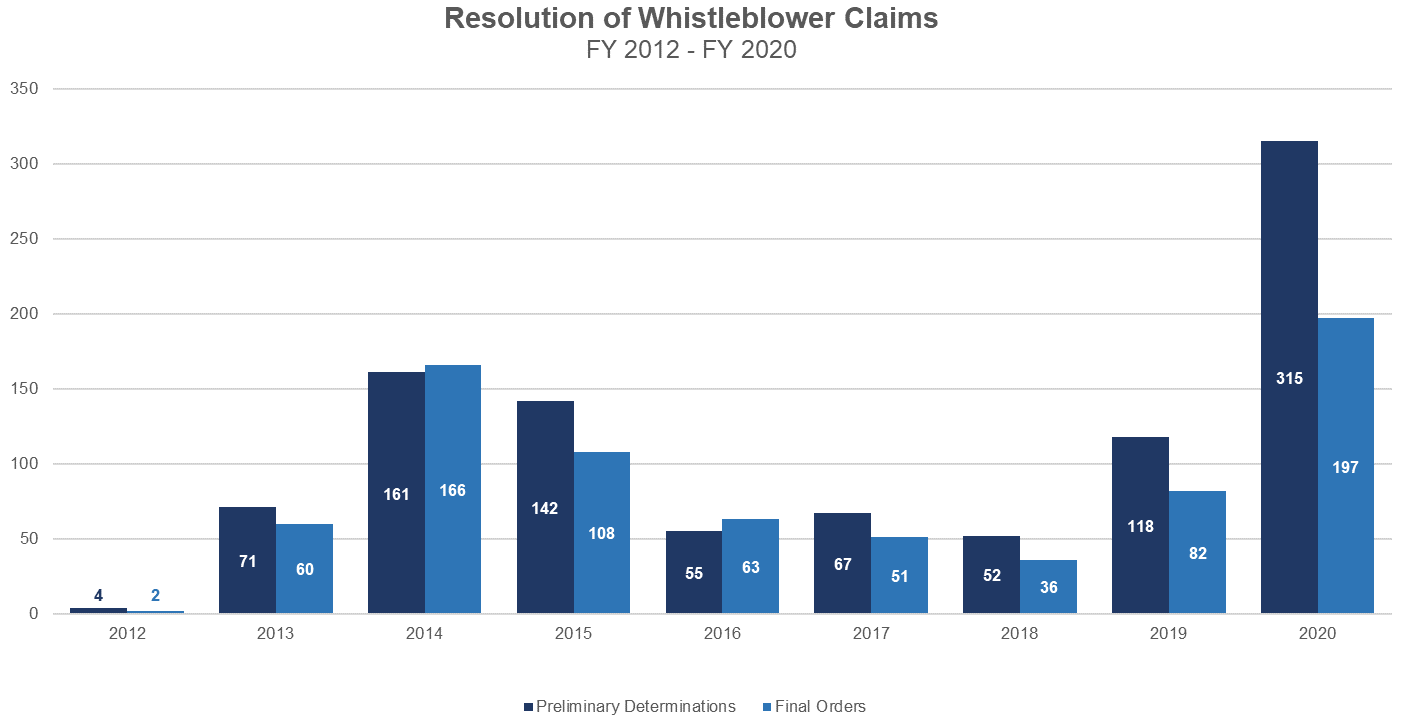

Importantly, the Division also issued substantially more preliminary determinations, which set forth its assessment of whether a claim should be approved or denied and, if approved, the proposed award amount, and final Commission orders of awards and denials. (Note that in Fiscal Years 2014 and 2015, a large number of preliminary determinations denials were issued to two serial submitters (both of whom were barred from the program), and these preliminary determinations became final orders during those same years. Specifically, in Fiscal Year 2014, 144 denials were issued to one claimant and, in Fiscal Year 2015, 40 denials were issued to another.) In Fiscal Year 2020, the Division issued 315 preliminary determinations, a more than 95% increase over the next highest year, and the Commission issued 197 final orders, an approximately 19% increase over the next highest year.

Further, in Fiscal Year 2020, the Commission adopted amendments to the rules governing the whistleblower program that were designed to provide greater clarity to whistleblowers and increase the program’s transparency and efficiency, including around the review and processing of whistleblower award claims.

Individual Accountability

Holding individuals accountable is among the Commission’s most effective methods of achieving deterrence. Experience teaches that individual accountability drives behavior and can also broadly impact corporate culture. In Fiscal Year 2020, 72% of the Commission’s standalone actions involved charges against one or more individuals. This percentage is in line with the results of the last several fiscal years. The individuals charged in our actions include those at the top of the corporate hierarchy—including chief executive officers, chief financial officers, and chief operating officers—as well as gatekeepers like accountants, auditors, and attorneys.

Non-Monetary Relief Obtained

In every enforcement action, the Division seeks appropriately tailored sanctions that advance enforcement goals. In addition to the monetary relief discussed above (disgorgement and penalties), there are a variety of potential non-monetary remedies available in the Commission’s actions. Non-monetary remedial relief is important to the Commission’s effort to ensure future compliance with the securities laws. For example, the Commission may seek undertakings, the appointment of independent compliance consultants, and/or conduct-based injunctions to protect the investing public on a going-forward basis. In each case, the Division seeks authorization to pursue those non-monetary remedies that will have the greatest impact. In Fiscal Year 2020, the Division continued to think creatively about how to craft relief to best protect investors. Some of these remedies are discussed in more detail below.

Undertakings

Undertakings require a defendant to take affirmative steps—either in conjunction with entry of the order or in the future—to come into and remain in compliance with the specific terms of a court’s order. The Commission also has authority to impose similar obligations on respondents in administrative proceedings. Undertakings are a forward-looking remedy, specifically designed with an eye toward what happens after settlement. Well-designed undertakings provide unique long-term benefits to investors, and are one of the most effective forms of equitable relief in SEC enforcement actions.

Many undertakings require a settling party to retain a compliance consultant or monitor to make recommendations to the issuer and report to the staff. In some cases, undertakings may reflect different affirmative steps to remediate structural or other problems. Several actions from Fiscal Year 2020 illustrate the Division’s use of undertakings that are tailored to remedial objectives and specific to the wrongful conduct at issue. For example, in the matter involving VFA’s failure to disclose to teachers practices that generated millions of dollars in fees and other financial benefits for VFA, VFA agreed to certain undertakings, including capping management fees for Florida K-12 teachers participating in 403(b) and 457(b) retirement plans under VFA’s management and certain other VFA advisory products.

Another example of tailored undertakings in Fiscal Year 2020 comes from the BitClave PTE Ltd. matter, involving an unregistered sale of digital tokens. As part of the relief obtained, the Commission ordered BitClave to transfer all of its digital tokens to a fair fund administrator to allow the fund administrator to permanently disable the tokens and take action to remove its tokens from digital asset trading platforms. These undertakings seek to remedy the harm from the illegal token offering by BitClave and the risks associated with the tokens trading freely without proper disclosure.

Bars and Suspensions Imposed

Bars and suspensions are also important forms of remedial relief available to the Commission. Bars and suspensions remove bad actors from positions where they can engage in future wrongdoing and thereby cause harm to investors and markets. Accordingly, the Division frequently asks the Commission to bar, or suspend for a period of time, wrongdoers from serving as officers or directors of public companies, dealing in penny stocks, associating with registered entities such as broker-dealers and investment advisers, or appearing or practicing before the Commission as accountants or attorneys. Enforcement actions resulted in 477 bars and suspensions of wrongdoers in Fiscal Year 2020.

Trading Suspensions

The federal securities laws allow the SEC to suspend trading in a security for up to ten business days when the SEC determines that a trading suspension is required in the public interest and for the protection of investors. In Fiscal Year 2020, the Commission suspended trading in the securities of 196 issuers.

Court-Ordered Asset Freezes

Court-ordered asset freezes are important to the Commission’s ability to protect investors because they prevent alleged wrongdoers from dissipating assets that could be distributed to harmed investors. Wrongdoers often attempt to hide assets and/or move them offshore, and the Commission’s ability to obtain meaningful financial remedies and to return money to harmed investors may therefore depend on the ability to obtain an asset freeze at an early stage. These circumstances require seeking federal court action on an emergency basis.

In Fiscal Year 2020, the Commission obtained 24 court-ordered asset freezes. These actions involve a range of misconduct. For example, in the Telegram Group Inc. matter, the Commission obtained an asset freeze against two offshore entities that conducted an unregistered digital

token offering in the U.S. and overseas, raising more than $1.7 billion. The Commission also obtained an asset freeze that halted a series of alleged microcap market manipulation schemes aimed at defrauding retail investors. These matters demonstrate swift action by the Commission designed to preserve investor funds.

Challenges

The COVID-19 pandemic has disrupted many of the Division’s traditional methods of conducting investigations as it works to promote the safety and well-being of its staff while bringing meaningful cases to protecting investors. The ability to take live witness testimony, conduct in-person Wells meetings, and litigate cases in court, for example, have all been impacted. Although these methods cannot be completely replaced, the Division has worked hard to find innovative ways to ensure that investigations continue to move efficiently and quickly.

While under mandatory telework orders, the Division of Enforcement has conducted numerous remote testimony sessions through internet-based video platforms, which allow staff to share documents with the witness while asking questions. The Division also held Wells meetings by video with multimedia presentations. Even courts have begun conducting remote hearings and bench trials by video, allowing our trial unit to successfully litigate several important cases as a result. As it is uncertain when we will be able to return to our offices and begin live meetings and testimony, we will continue to find ways to improve upon our remote capabilities and ways to conduct investigations efficiently remotely.

The complete publication, including footnotes, is available here.

Print

Print