Matteo Tonello is managing director at The Conference Board and Olivia Voorhis and Justin Beck are consultants at Semler Brossy Consulting Group LLC. This post is based on a live database and ongoing analysis conducted by Mr. Tonello, Ms. Voorhis, Mr. Beck, Blair Jones, Kathryn Neel, and Greg Arnold. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

The COVID-19 crisis significantly altered operational priorities and financial results for companies in nearly all sectors. In recent months, to address some of these issues, many compensation committees have been disclosing executive base salary reductions as well as changes to in-flight and go-forward incentive plans.

The Conference Board, in collaboration with Semler Brossy’s research team and ESG data analytics firm ESGAUGE, is keeping track of SEC filings (Forms 8-Ks, 10-Qs, and proxy statements) by Russell 3000 companies announcing these changes. For the live database and some helpful visualizations of key trends across business sectors and company size groups, click here.

The following are some key observations from disclosures made since March 1, 2020 and update previously disseminated findings on a smaller sample of companies. The Russell 3000 index was chosen because it represents more than 98 percent of the total capitalization of the US publicly traded equity market. (Note: The commentary below refers to disclosures as of October 9, 2020, but the database is updated bi-weekly; please review the database and visualizations for the most current information).

Incentive Design Changes

From March 1 to October 9, 2020, 177 Russell 3000 companies announced structural changes to their in-flight and/ or go-forward incentive plans. An additional 43 Russell 3000 companies disclosed only payout suspension, adjustments, or deferrals for a recently completed compensation program; these companies are excluded from the analysis of structural changes.

- In-flight changes cover any structural changes to an ongoing plan and go-forward changes cover any forward-looking structural changes to a recently started or upcoming plan.

- All but four of the 177 companies explicitly disclosed that such changes were in response to economic distress caused by COVID-19. The other four companies did not make such an explicit link in the disclosure document.

- Consumer discretionary (29 percent), industrials (16 percent), and information technology (15 percent) companies make up slightly more than half the sample; consumer discretionary and industrials representation in the sample is higher than the broader Russell 3000 Index.

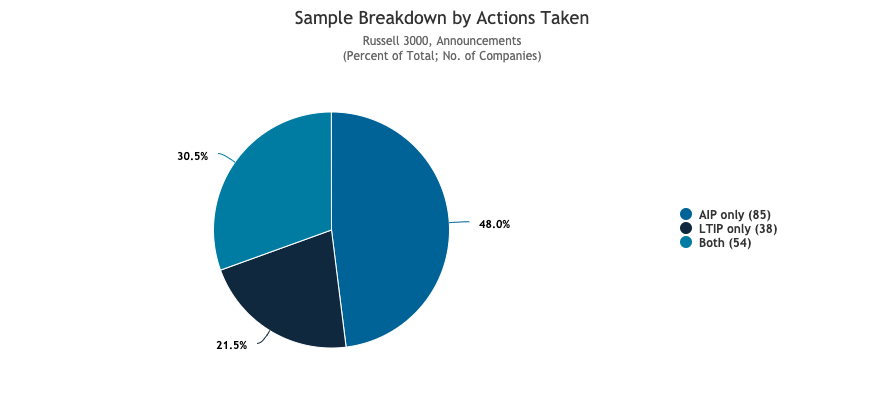

- About half (48 percent) the sample announced changes to their annual incentive plan only, about 30 percent announced changes to both the annual and long-term incentive plans, and about one-fifth (21 percent) announced changes to the long-term incentive plan only.

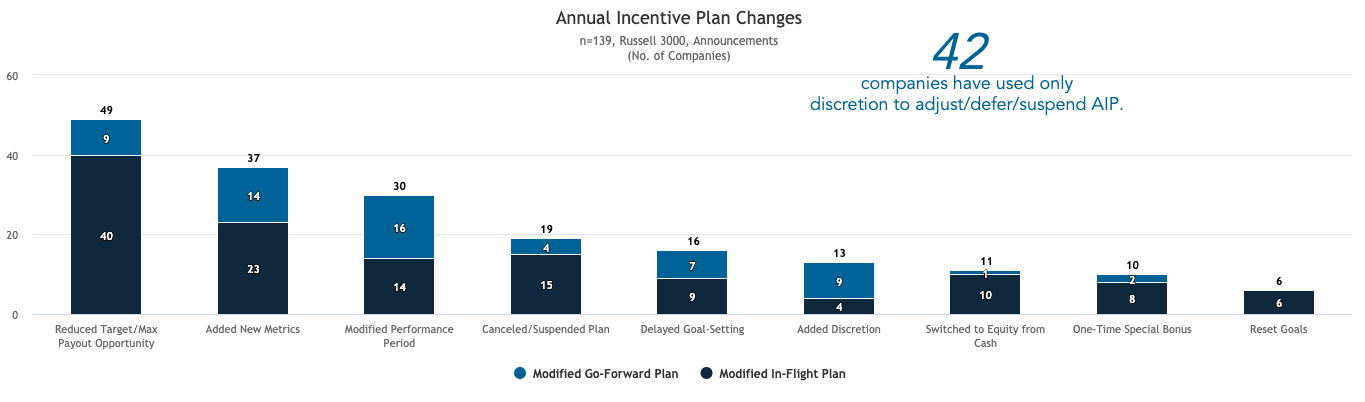

Annual Incentive Plan Changes. In the examined period, 139 of 177 companies in the sample disclosed annual incentive plan changes. Of those, 93 companies disclosed changes to in-flight programs only, 37 companies disclosed changes to go-forward programs only, and nine companies disclosed changes to both the programs.

- The most common structural annual incentive plan change has been to reduce the target and/ or max payout opportunity (35 percent, or 49 companies); this change has commonly been applied in concert with changes to re-calibrate the annual incentive plan with revised performance projections and operational priorities (e.g., add new metrics and reset goals).

- The second most common change has been to add new metrics (27 percent, or 37 companies); commonly added metrics are focused on liquidity or strategic measures in the context of the pandemic.

- 30 companies modified the annual incentive plan performance period (typically to measure partial year performance or separate the year into halves).

- 19 companies canceled or suspended the annual incentive plan entirely and 11 companies switched to paying the annual incentive plan in equity instead of cash

- Six companies reset goals part-way through the performance period based on updated performance projections and 16 companies delayed goal setting to later in the fiscal year; although we recognize this practice may be more prevalent among companies that have not disclosed such actions.

- 13 companies proactively added Committee discretion to determine payouts (although, this approach may be more prevalent in practice given the qualitative measurement of certain additional metrics). 42 companies have already disclosed the application of Committee discretion to adjust, suspend, or defer the payout for the recently completed annual incentive plan.

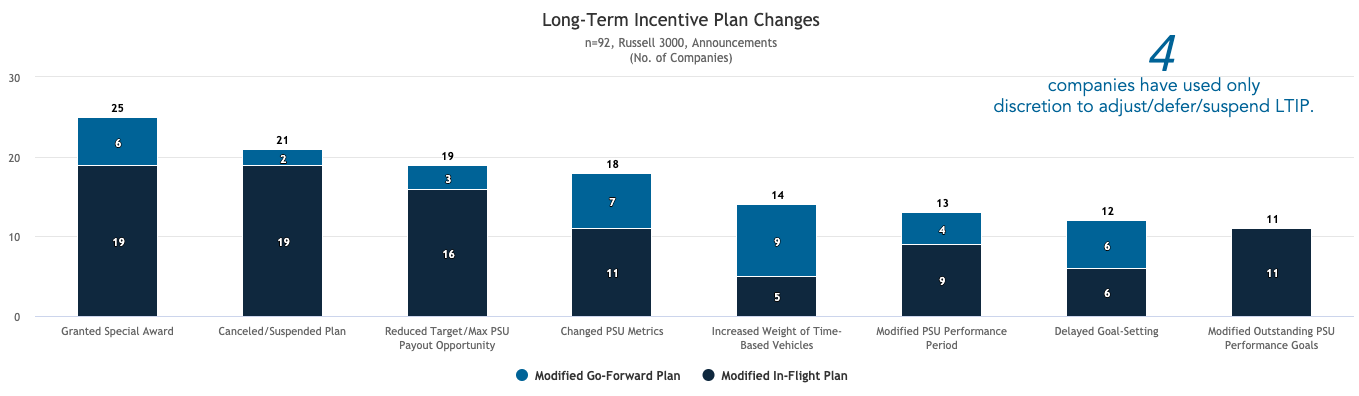

Long-Term Incentive Plan Changes. In the examined period, 92 of 177 companies in the sample disclosed long-term incentive plan changes. Of these, 65 companies disclosed changes to in-flight programs only, 24 companies disclosed changes to go-forward programs only, and three companies disclosed changes to both the programs.

- 18 companies switched PSU metrics, typically to measure metrics that are (i) more focused on operational health (e.g., cost reduction); (ii) more easily forecasted; and/ or (iii) relative metrics.

- 25 companies granted special awards to one or more NEOs (with varying rationale) and 21 companies elected to cancel outstanding LTI grants and/ or suspend granting new awards. Six companies from this group applied both actions together.

- 11 companies disclosed modifications to in-flight PSU awards’ performance goals.

- 19 companies reduced the PSU target and/ or max payout opportunity, 13 companies modified the PSU performance period, and 12 companies delayed goalsetting for PSUs.

- 14 companies adjusted the long-term incentive vehicle mix to a higher weighting on time-based vehicles (i.e., RSUs or stock options).

Base Salary Reductions

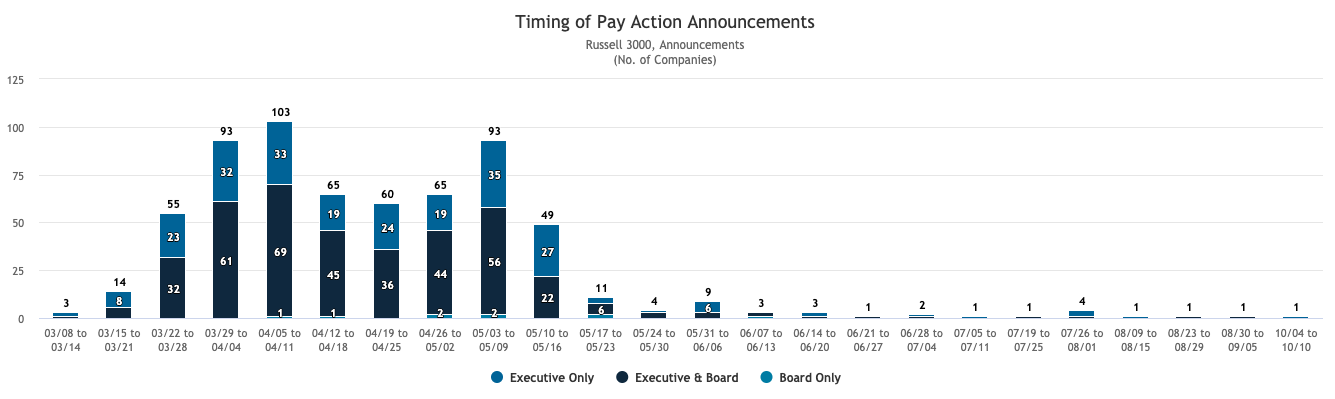

To date, about one-fifth of the companies in the Russell 3000 index have announced executive base pay cuts in light of COVID-19. The number of announcements saw two peaks in the spring, during the lockdown, then softened and was reduced to a trickle over the summer and in recent weeks. In total, 643 companies had announced some type of base salary reduction for their leaders as of the end of the week of June 4. The week of April 5, 2020 saw the highest number of announcements (103 in the Russell 3000, up from 93 in the previous week) and was followed by a second wave at the beginning of May (93 announcements in the week of May 3, up from 65 in the previous week). The number declined rapidly afterward, first to 49 announcements in the week of May 10, then to 11 in the week of May 17, and finally and then to a single-digit number in each of the following weeks and throughout the summer. As the pandemic evolves and if the United States were to experience a new wave of infections in the winter months, we may see a resurgence in the number of announcements. Rising infections and unemployment numbers, in particular, could prompt other companies to implement similar decisions.

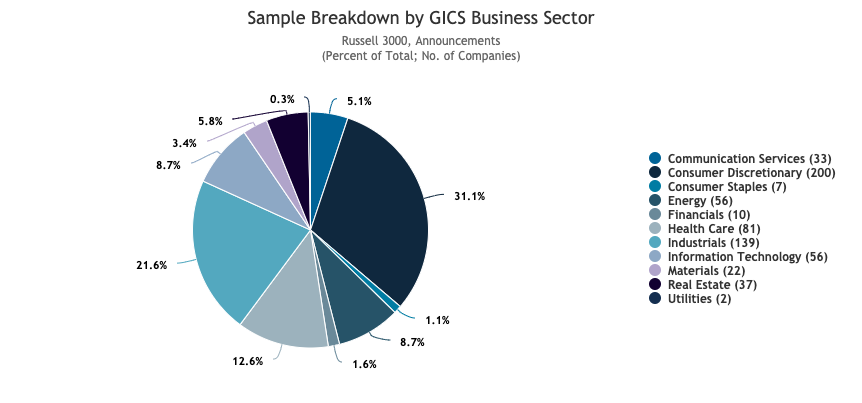

More than half of the announcements came from hard-hit business industries such as hospitality and retail, but the list also includes tens of health care firms and several small information technology companies. The consumer discretionary sector, including industries such as specialty retail and hospitality, is by far the most represented among companies announcing leadership pay reductions (31.1 percent of the total). It is followed by the industrials sector, including the airlines and aerospace industries (21.6 percent). However, the list also includes 81 health care companies of various sizes and 56 information technology companies, especially of smaller sizes. The energy and communication services sector represent 9 percent and 5 percent, respectively, of the total number of announcements. The sectors that have not, to date, announced a significant number of executive pay reductions include financials (10 companies), consumer staples (seven), and utilities (two).

Most of the pay reductions have been announced at mid-market companies. Forty percent of the announcements were made by companies reporting annual revenue between $1 billion and $4.9 billion, and 29 percent by companies reporting annual revenue between $100 million and $999 million. Two percent of the pay-cut filings came from the largest companies in the Russell 3000 (with annual turnover exceeding $50 billion), and another 2 percent by the second-largest company size groups (with annual revenue between $25 billion and $49.9 billion). The analysis of financial and real estate companies by asset value shows that most announcements were made by hospitality-focused REITs in the $1-9.9 billion asset value group (40 percent) or in the $10-49.9 billion asset value group (27 percent).

In most cases, executives beyond the C-Suite are also receiving pay cuts. Seventy percent of the companies announcing reductions are applying them to compensation for senior managers beyond the top five highest-paid executives. However, 24 percent of the companies that disclosed reductions limited them to the CEO and other named executive officers (NEOs), whereas 6 percent cut CEO pay only.

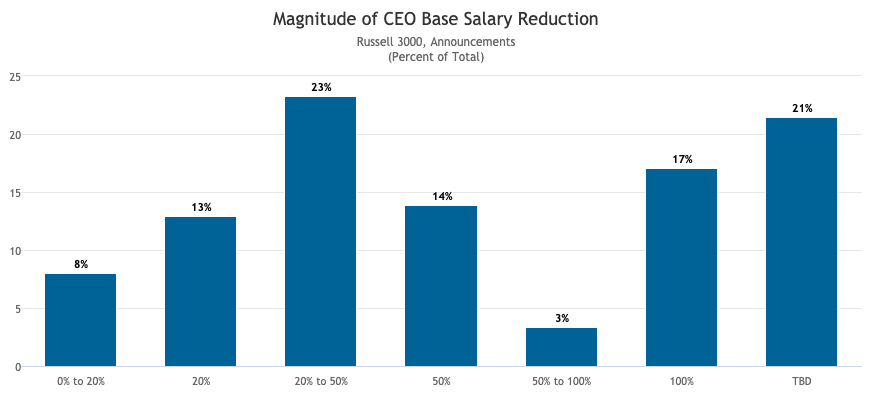

Among those that announced pay cuts, about one-sixth of CEOs won’t collect a base salary this year. Seventeen percent of the Russell 3000 companies that announced reductions to the CEO salary cut it in its entirety, while 14 percent cut it by 50 percent. Twenty-one percent of the sample applied a reduction of 20 percent or less and 21 percent announced the intention to reduce the CEO salary without disclosing to what extent it will be reduced. Communications services, consumer discretionary, and real estate companies reported the largest median CEO pay cut (50 percent each), followed by health care, industrials, and information technology (each with a 30 percent CEO pay cut, at the median). The least affected CEOs are those of consumer staples and energy companies (20 percent, at the median). Across the 11 GICS business sectors, the median CEO base salary cut was 30 percent.

A tiered approach is used for NEOs and other senior executives. The reduction percentage applied to NEOs and other senior managers is generally quite lower than the one seen for CEO salaries. For NEOs, the most common cut falls between 20 percent and 50 percent (23 percent of the sample), whereas 17 percent reported base salary reductions of 20 percent, 20 percent disclosed cuts of less than 20 percent, and only 2 percent said they were forfeiting their entire base salary. Across the 11 GICS business sectors, the median NEO base salary cut was 21.3 percent. For other executives below the top-five, the most common base pay cut is of less than 20 percent (24 percent of the announcement sample); but it should also be noted that as much as 40 percent of the announcements regarding senior managers were not further quantified in the disclosure document. None of the senior managers to which these measures were applied saw their full base salary cut. These findings confirm a tiered approach, where the percentage of the pay cut rises with salary level.

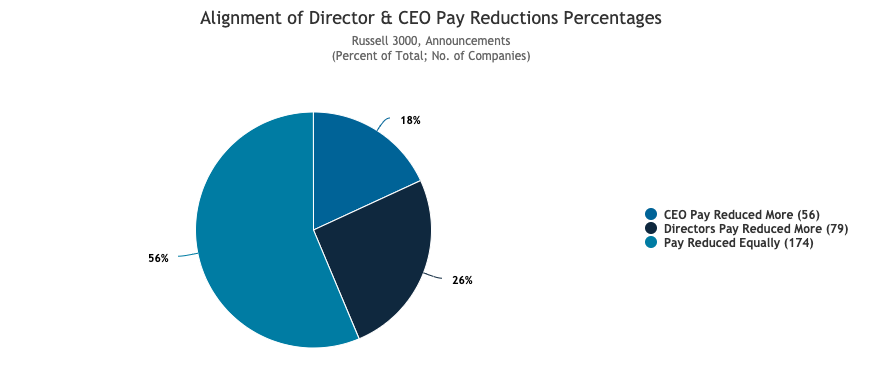

When announced for executives, cuts tend to extend to cash retainers for board members, and in a quarter of cases directors took an even bigger hit (in percentage terms) than CEOs. The majority (61 percent) of companies reducing executive base salaries are extending cuts to the cash retainers paid to their board’s non-employee directors. In a show of solidarity with the executive team, in most cases (56 percent) the percentage of the reduction applied to director cash retainers is the same disclosed for the company’s CEO, while 26 percent reported that director pay was reduced by a higher percentage than CEO pay and 18 percent stated that director pay was reduced by a lower percentage than CEO pay. Of those companies that announced director pay reductions, 24 percent of directors forgo their full retainer, 22 percent cut it by less than 25 percent and 15 percent cut it by half. Of all announcements, 13 percent of companies stated that they had not yet finalized the magnitude of the cut.

Print

Print