Torsten Jochem is Associate Professor of Finance at the University of Amsterdam; Gaizka Ormazabal is Associate Professor of Accounting and Control at University of Navarra IESE Business School; and Anjana Rajamani is Associate Professor of Finance at Erasmus University Rotterdam School of Management. This post is based on their recent paper.

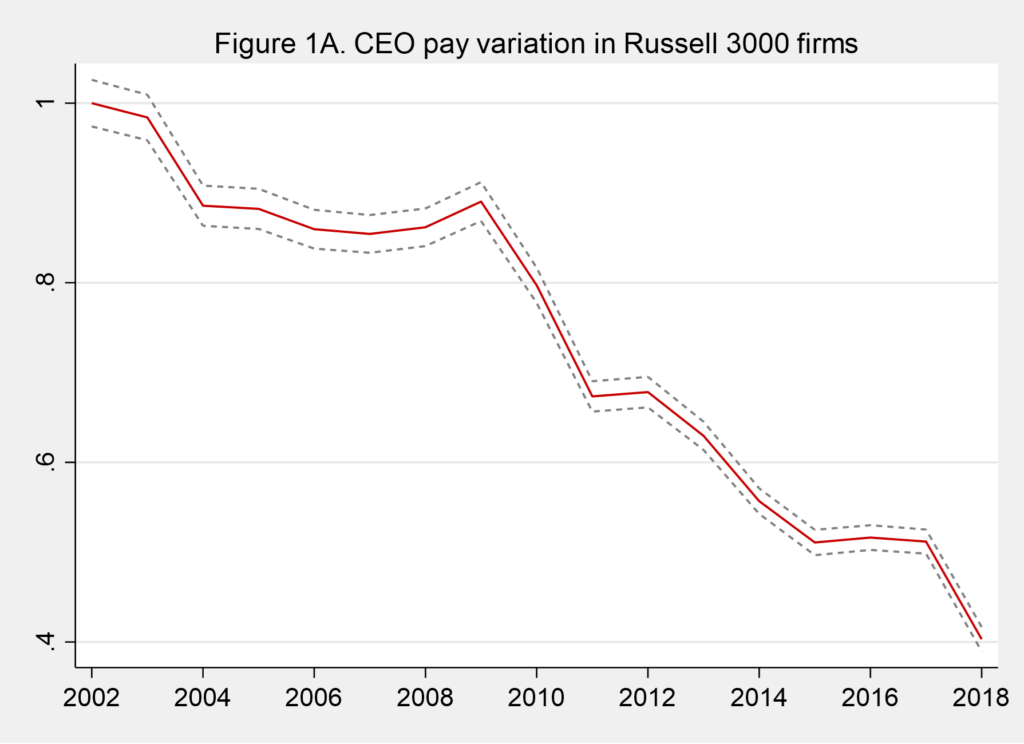

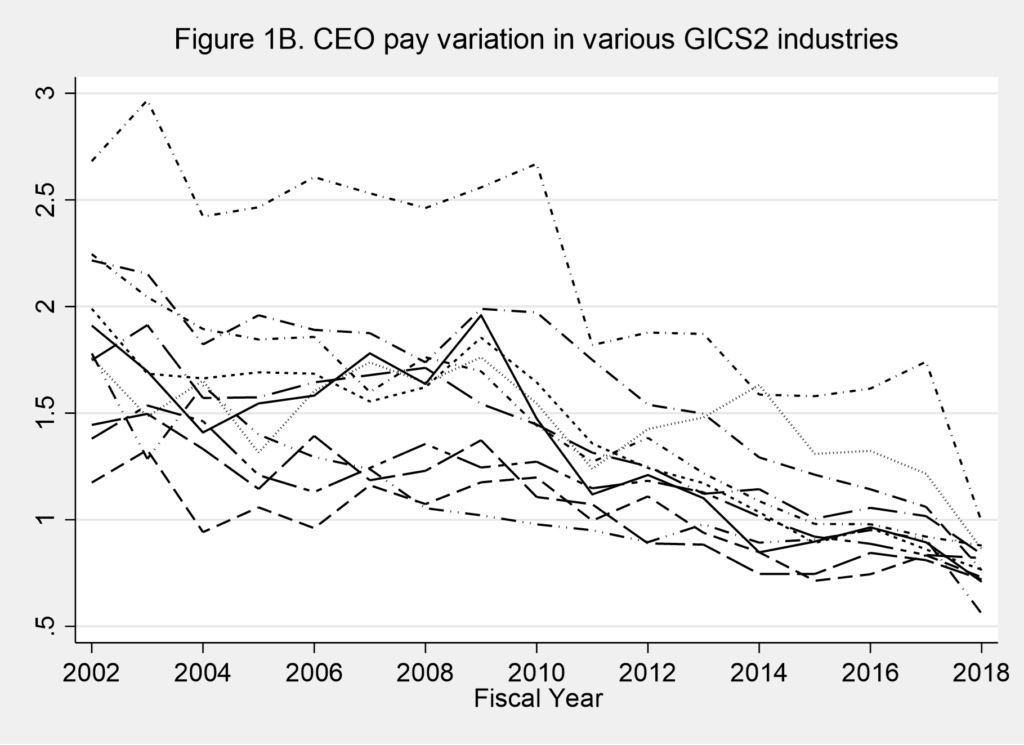

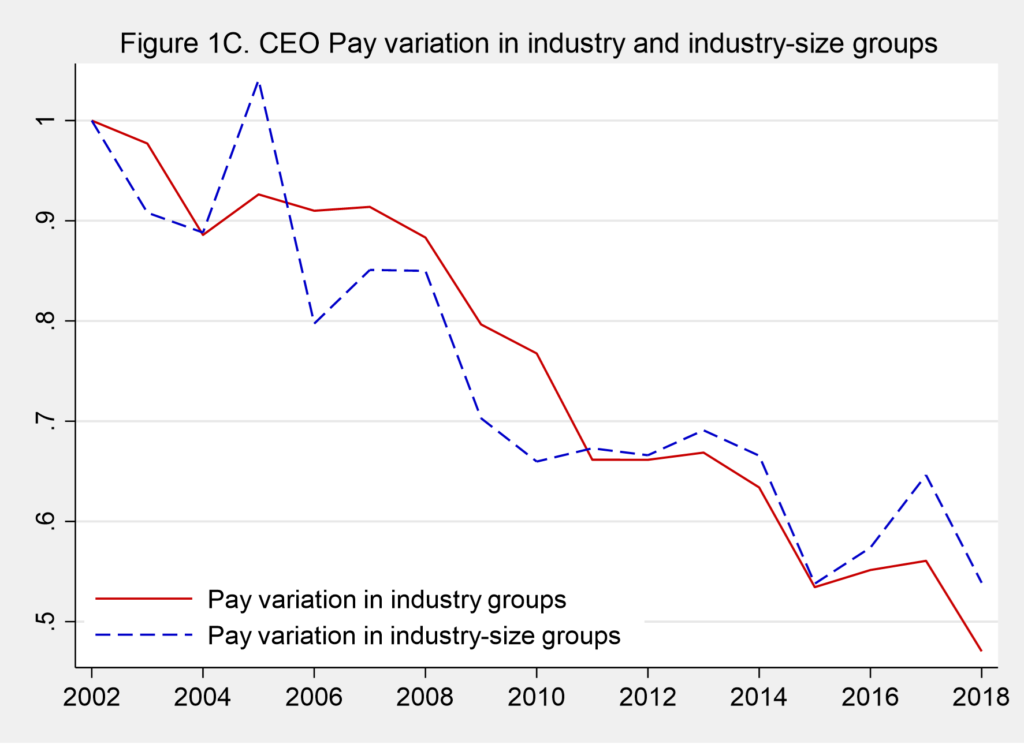

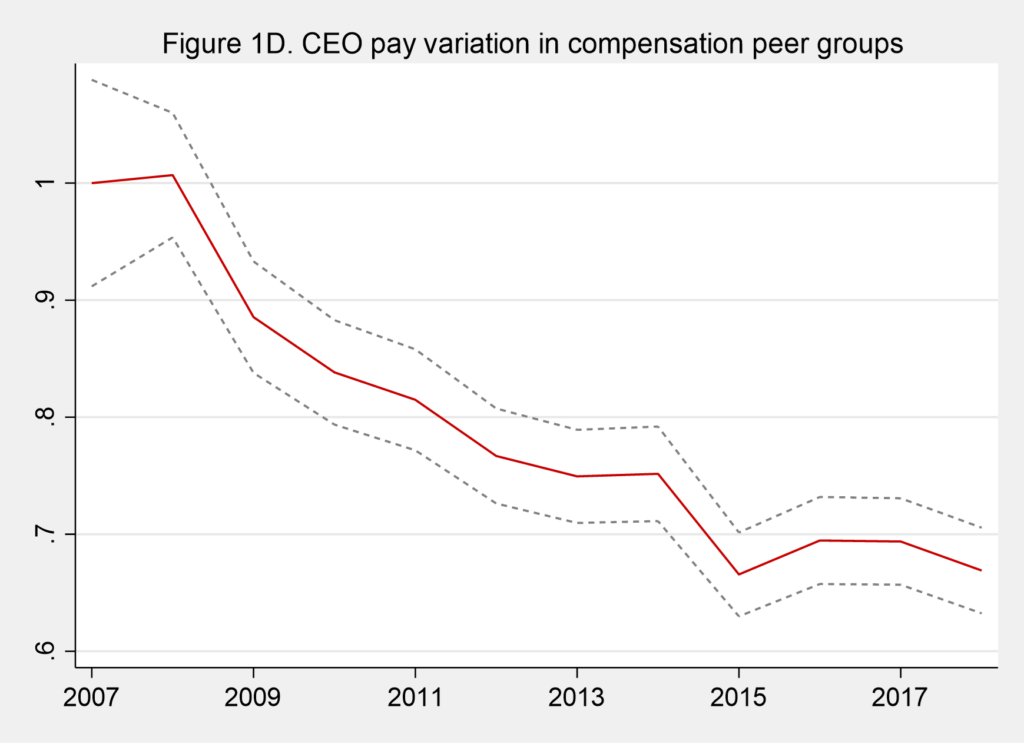

In our working paper, we examine the evolution of cross-sectional variation in CEO pay levels. Using a wide sample of over 5,000 U.S. public firms, spanning from 2002 to 2018, we document a new stylized fact: Over the last decade, the variation in CEO pay levels across firms (i.e., the “second moment of pay”) has declined precipitously. The decline in CEO pay level variation not only holds at the economy-level but also within industry groups, within industry-size groups, and in firms’ compensation peer groups (see Figure 1).

Figure 1: Figure A shows variation in CEO pay levels among Russell 3000 firms between 2002 and 2018. Figure B shows the evolution of CEO pay variation for GICS2 industries. Figure C shows CEO pay variation within same-industry groups and within same-industry and same size-quintile groups, averaged across groups in a given year. Figure D shows pay variation within compensation peer groups starting 2007 (which is the first year with mandated peer group disclosure). CEO pay variation is defined as the median-scaled standard deviation of CEO pay in a given year; to show relative changes, CEO pay variation is rebased to 2002.

We find that the decline in pay dispersion cannot be attributed to changes in firm characteristics such as size or profitability, or to changes in the measurement of total compensation. Rather, we find support that the secular decrease in pay variation is related to a rising incidence of reciprocal benchmarking—i.e., firms including one another in their compensation peer groups used to benchmark pay levels. A trend toward mutual consideration invariably leads to less pay variation because pay levels are often set based on the median pay in the compensation peer group (with upward deviations being difficult to justify). Intuitively, if every mining company sets its CEO pay to the median CEO pay of other mining companies, pay variation in the mining industry declines. Rising reciprocal benchmarking can thus result in clusters of firms with similar pay levels.

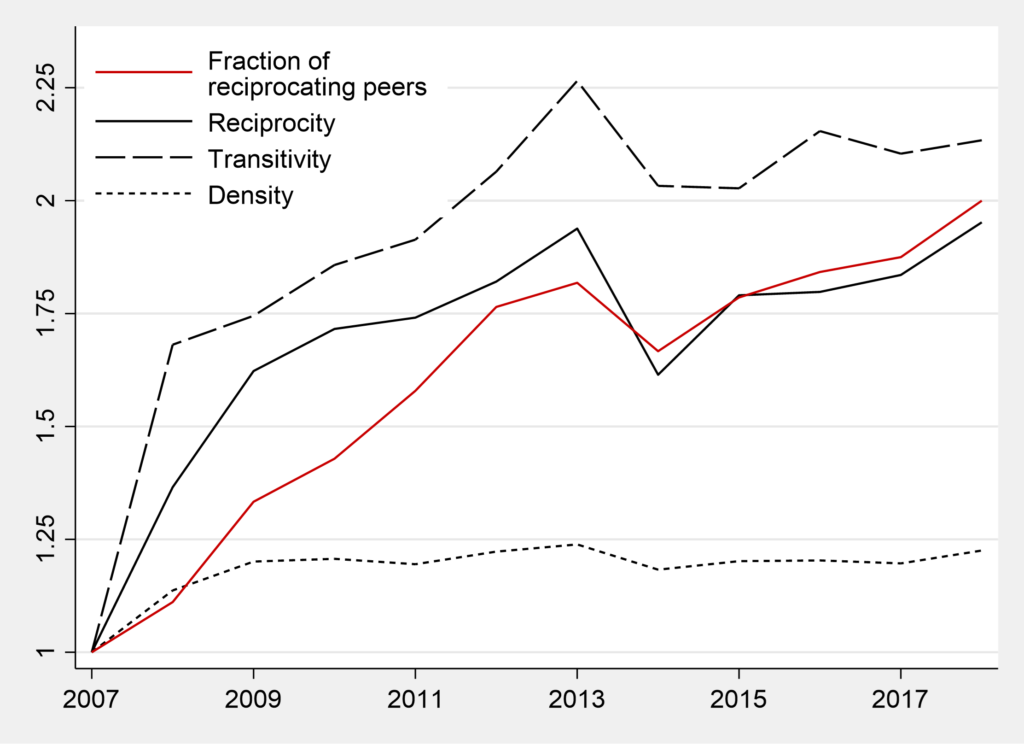

Drawing from the social network literature, we construct three well-established metrics of the “degree of clustering” or “closedness” of a compensation peer network—reciprocity, transitivity and density. An increase in these measures indicates more in-group and fewer out-of-group connections and hence a greater incidence of reciprocal benchmarking within a group of firms. We construct these measures for the period 2007-2018, as before 2007 the public disclosure of compensation peers was not mandatory. As visualized in Figure 2, we find stark increases in the closedness of compensation peer networks of firms in the same industry-size group. We further find that an increasing fraction of compensation peers also reference back the base firm in their compensation peer groups (a simplified measure of reciprocal benchmarking at the firm level). This increase in reciprocal benchmarking within industry-size groups and within compensation peer groups are confirmed in multivariate settings after including a robust set of fixed effects and controlling for a large set of firm characteristics.

Figure 2: The figure shows the evolution of the three network clustering measures—reciprocity, transitivity and density—within the compensation peer networks of industry-size groups. It further shows the evolution of the Fraction of reciprocating peers which is the fraction of compensation peers that reference back the base firm, averaged across all firms in a given year. The measures are rebased to the first year in which compensation peer group references are made public.

We conjecture and find support in our data for three institutional developments that contribute to the increase in reciprocal benchmarking and the subsequent decline in pay dispersion.

- The SEC’s mandate to disclose compensation peer groups: The mandatory disclosure of compensation peers could have induced reciprocal benchmarking because, under the public disclosure regime, it becomes publicly observable that a firm deviates from the standard practice of benchmarking compensation to firms in the same industry and size group, and such deviation is often interpreted as poor governance. Consistent with this idea, we find that pay dispersion only starts dropping in the years after the disclosure regime came into effect, and industry-size groups and compensation peer groups with less reciprocal benchmarking in the first year of the mandate had greater pay dispersion prior to the mandate and experienced larger declines soon after the mandate.

- Introduction of advisory votes on executive compensation (Say on Pay): Deviations from benchmarking compensation to peers in the same industry-size group could trigger negative say on pay votes. While say on pay proposals are not binding, failing to obtain majority support can trigger lawsuits and cause reputational losses for directors (Brunarski et al., 2016). Boards may hence change compensation peer groups to address potential shareholder concerns (we provide several supporting anecdotes in the paper’s appendix). Using a difference-in-differences framework, we find that firms that receive a weak say on pay vote significantly increase their reciprocal peer benchmarking in the two years following such weak votes relative to a set of control firms without such weak votes.

- Growth of passive investing and an increasing reliance on proxy advisory firms: Prior literature has documented the significant influence that proxy advisers’ recommendations carry for firms’ proxy voting outcomes (e.g., Iliev and Lowry, 2015; Ertimur Ferri and Oesch, 2013). Proxy advisers’ voting recommendations on executive compensation are commonly based on benchmarking the firm’s compensation to that of peer firms in the same industry and size percentile. We posit that firms which are susceptible to adverse proxy advisor recommendations and firms with greater share of passive institutional ownership (who are more likely to vote with proxy adviser recommendations) will increase their level of reciprocal benchmarking. We test this conjecture using a regression discontinuity design proposed by Malenko and Shen (2016), which exploits that ISS’s scrutiny on executive pay policies in 2010 and 2011 was based on an arbitrary performance threshold. We find that firms whose performance falls below the threshold modify their compensation peer groups in ways that result in a strengthening of reciprocal benchmarking. We further relate reciprocal benchmarking to the growth of passive investing and proxy adviser influence by examining the effects of ownership concentration and investors’ historic reliance on proxy advisers’ voting recommendations. We find that reciprocal benchmarking decreases with block ownership, increases with ownership dispersion, and increases with the fraction of a firm’s investors who routinely vote with proxy adviser recommendations.

In our final set of results, we examine the consequences of the decline in pay variation. We find strong evidence of declining tournament incentives in industries and compensation peer groups, which is strongly related to the changes in reciprocal benchmarking in the respective industries or compensation peer groups. As shown by Coles, Li and Wang (2018) a reduction in tournament incentives has a significant effect on firm outcomes, and in particular on corporate risk-taking (external tournament incentives induce managers to improve performance through greater risk-taking). Consistent with this, we find that firms’ future equity return volatility is positively related to pay variation in its peer group, and negatively related to the level of reciprocal benchmarking in its peer group.

Overall, our paper documents a precipitous decline in CEO pay level diversity among publicly-listed U.S. firms. We show that this trend is related to firms converging to a standardized practice of benchmarking CEO pay to firms in the same industry and size group. We find that this new standard is fostered by three institutional developments—mandatory peer group disclosure, say on pay, and passive investing combined with proxy adviser reliance—with implications for industry tournament incentives and managerial risk-taking.

The complete paper is available for download here.

Print

Print

One Comment

excellent paper and consistent with our experience as executive compensation advisors to the boards of major companies. We did similar research in 2017. it is available at our website.