Thomas Kohn is a Consultant and Erin Bass-Goldberg is Managing Director at FW Cook. This post is based on their FW Cook report. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here); Toward Fair and Sustainable Capitalism by Leo E. Strine, Jr (discussed on the Forum here); Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

Introduction

Driven by multiple stakeholders embracing the premise that a strong ESG proposition is an essential element to sustainable long-term company performance, attention on company ESG behavior and transparency is rapidly increasing. Following are recent developments contributing to enhanced focus on ESG:

Institutional Investors: Large institutional investors are encouraging companies to increase transparency in their disclosure of various ESG measures. Examples include State Street’s August 2020 letter to companies advocating that they articulate “risks, goals, and strategy as related to racial and ethnic diversity” [1] and BlackRock’s January 2020 letter to companies stating that it “will be increasingly disposed to vote against management and board directors when companies are not making sufficient progress on sustainability-related disclosures and the business practices and plans underlying them.” [2]

Employee and Shareholder Activists: A number of high-profile employee and shareholder activist criticisms on ESG issues have garnered significant media attention in recent years, including the heir to Disney criticizing the company for its pay practices, [3] Google employees’ protest over the company’s handling of sexual harassment allegations, [4] and the employee-backed shareholder proposal at Amazon for the company to release a comprehensive plan on addressing climate change. [5]

Proxy Advisors: ISS expanded its proxy reports to include ESG scorecards focusing on the degree and transparency of disclosure and added factors evaluating the level of disclosure of E&S measures in incentive plans into its QualityScore model, while Glass Lewis expanded its proxy reports to evaluate companies’ exposure to ESG risk. The proxy advisors have not yet incorporated E&S practices into director re-elections or Say-on-Pay voting recommendations.

SEC: New SEC rules approved in August 2020 require a description of a registrant’s human capital resources including measures or objectives used to manage the business to the extent such disclosure is material to an understanding of the business. [6]

Corporations: In August 2019, the Business Roundtable released a new “Statement on the Purpose of a Corporation” to emphasize a commitment to delivering value to all stakeholders, specifically customers, employees, suppliers, communities, and shareholders. This superseded previous, long-standing statements that corporations exist principally to serve shareholders. [7]

A consequence of ESG proliferation is a growing trend of companies incorporating ESG measures into incentive programs. By tying a portion of executive compensation to ESG outcomes, companies are holding executive teams accountable for such initiatives and communicating to external stakeholders that such measures are critical to long-term company success and sustainable value creation.

Against this backdrop, FW Cook studied current practices among the largest U.S. public companies with respect to use of ESG measures within incentive programs.

Summary of Key Findings

FW Cook Commentary

We anticipate increased use of ESG measures in 2020 and 2021 incentive plans due to COVID-19 and social injustice issues, both of which are a reminder of how ESG topics can trigger financial risks and threaten sustainability. Despite the growing emphasis on ESG, companies should evaluate whether incorporation of ESG measures into pay programs carries potential unintended consequences and represents the best mechanism for incentivizing progress in key areas of focus. Inclusion of ESG measures in incentive plans may raise challenges regarding goal setting and measurement, disclosure, and proxy advisor reaction. It also creates potential for embarrassment due to goal underachievement, poor decision making if management concludes a particular goal simply cannot be missed, and investor criticism for subjective measurement. In determining whether to incorporate ESG measures into incentive programs, companies should consider the following questions:

- Is it feasible to set reasonable targets and make meaningful progress on the chosen initiatives within the time frames typically used for measuring performance in incentive programs (i.e., one year for annual incentives and three years for long-term performance awards)?

- Are they prepared to communicate such targets internally to the employee population and externally to shareholders in the proxy statement? If not, are they prepared to defend their decision to reward executives for progress on ESG initiatives without providing transparency as to the specificity and robustness of the goals?

- Is there a recognized standard for measurement of progress on the ESG initiatives, and if not, can the company track progress in a quantifiable manner?

- Will they create outsized risk of embarrassment if they disclose underperformance, and could the risk of embarrassment lead management to make non-ideal short-term decisions that might impair the longer-term objectives?

- Is it appropriate to compensate executives for achievement of ESG initiatives, particularly if financial performance and shareholder returns are below expectations?

The research that follows summarizes the most recently disclosed practices among the largest U.S. public companies with respect to use of ESG measures within incentive programs.

Methodology

FW Cook conducted a study of the use of ESG measures in annual and long-term incentives among the largest U.S. public companies, consisting of all U.S.-listed companies with market capitalizations in excess of $25 billion as of June 30, 2020 (excluding Foreign Private Issuers that do not have the same disclosure requirements). This resulted in a 237-company sample, with the industry breakdown as follows:

| Sector | Cos. |

|---|---|

| Communication Services | 13 |

| Consumer Discretionary | 22 |

| Consumer Staples | 23 |

| Energy | 8 |

| Financials | 32 |

| Health Care | 37 |

| Industrials | 30 |

| Information Technology | 46 |

| Materials | 9 |

| Real Estate | 7 |

| Utilities | 10 |

| Total | 237 |

Data was sourced from the latest proxy filings (as of July 31, 2020) and represents annual and long-term incentive programs in place during fiscal year 2019/20.

Background

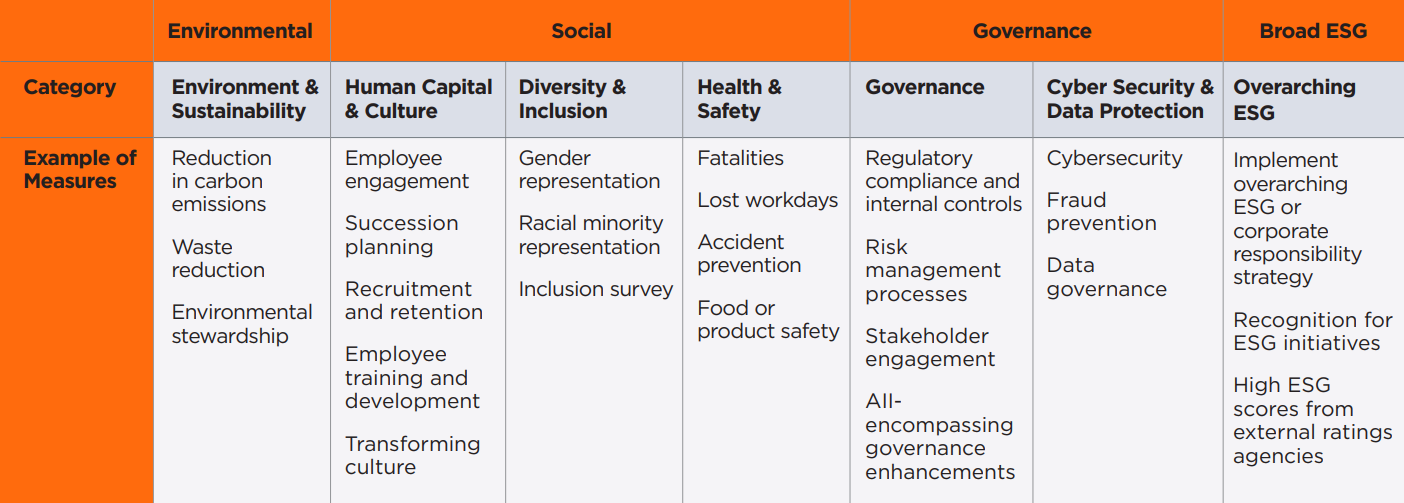

The first step for companies considering the integration of ESG initiatives into incentive programs is to determine which measures are most critical to emphasize internally and communicate their importance externally. For purposes of this report, we grouped ESG measures into the seven broad categories below:

Note – certain measures are better suited for use in a qualitative evaluation, while others are more conducive to use in a quantitative evaluation against pre-determined goals

Companies using ESG measures in incentive plans must also determine how to best incorporate the measures and disclose performance outcomes in the proxy statement. We outline various methods of ESG incorporation and degree of disclosure below:

ESG Incorporation

| Individual Performance Consideration | Team-Wide Scorecard | Formulaic Metric or Modifier |

|---|---|---|

| ESG measures are incorporated into a broader assessment of individual performance. The particular ESG measures and/or achievement against the ESG objectives may vary by NEO | ESG measures are incorporated into a scorecard of objectives by which all NEOs are evaluated. The ESG measures are not a formally-weighted component of the scorecard, and instead are typically considered as part of a holistic evaluation of performance used to determine payouts | ESG measures are formally weighted and achievement is considered as part of a formulaic determination of the incentive payout |

Disclosure of ESG Performance

| No ESG-Specific Performance Disclosure | Qualitative Performance Disclosure | Quantitative Performance Disclosure |

|---|---|---|

| ESG measures are listed among the factors that are considered in arriving at an incentive payout, but specific performance achievements are not described. Most common among companies using ESG qualitatively as an individual performance consideration | ESG performance is described qualitatively without any quantitative performance results disclosed. Includes companies that disclose a payout score for ESG measures without disclosing the underlying quantitative performance that wasused to calculate the payout | ESG performance that was considered in arriving at a payout is disclosed quantitatively. Most common among companies using a formulaic ESG metric or modifier |

Note—it is possible to evaluate ESG performance quantitatively using preestablished goals but disclose the performance achievement qualitatively or not specifically describe achievement at all

Key Findings

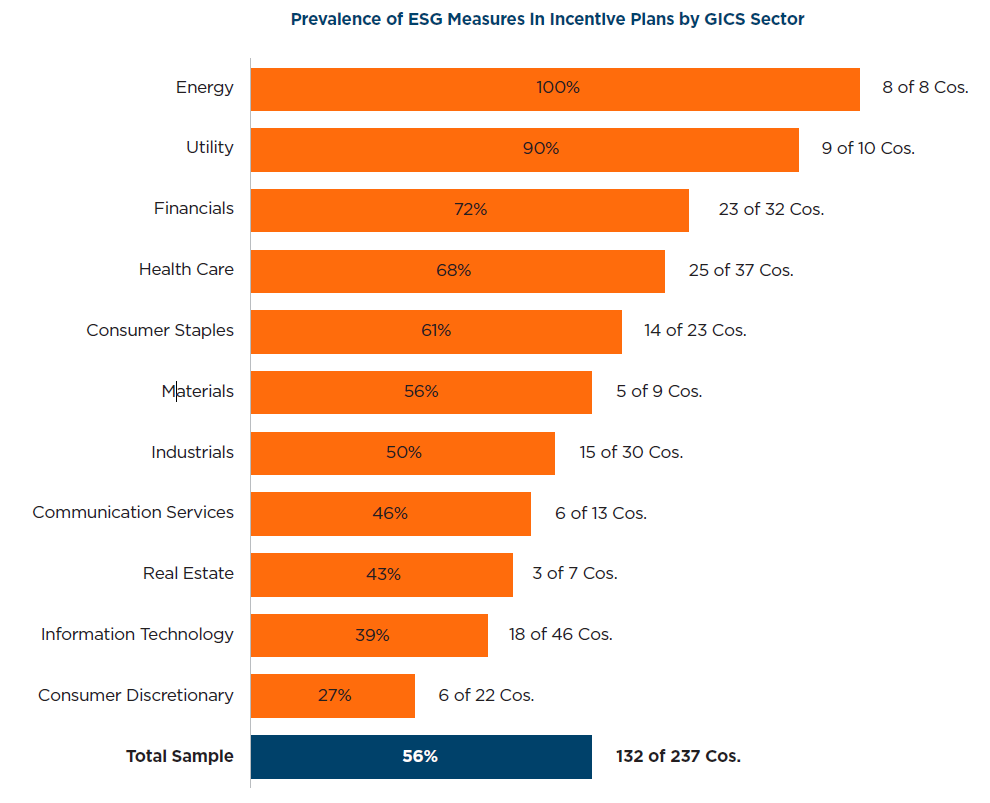

- 132 companies in the 237-company sample (56%) use one or more ESG measures in the annual or long-term incentive plan

- 125 companies use ESG in the annual incentive program only (53% of companies)

- Seven companies use ESG in both the annual and long-term incentive programs (3% of companies)

- No companies use ESG solely in the long-term incentive program

- Use of ESG measures by GICS sector varies meaningfully:

- All eight of the Energy companies and nine of the ten Utilities companies in the 237-company sample use some form of ESG measures in their incentive programs

- Half or more of all companies in the Financials, Health Care, Consumer Staples, Materials, and Industrials sectors use ESG measures

- Less than half of companies in the Communication Services, Real Estate, Information Technology, and Consumer Dictionary sectors use ESG measures (small sample size for Real Estate companies)

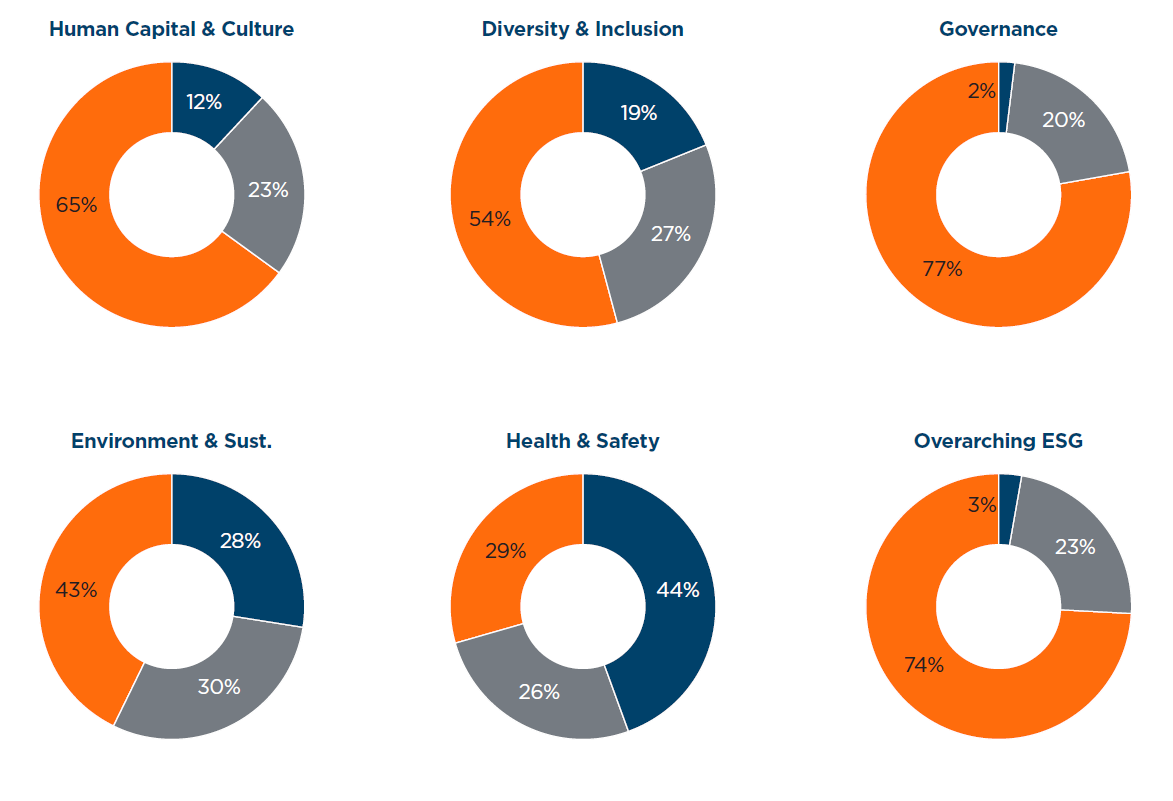

Human Capital & Culture and Diversity & Inclusion are the two most common ESG categories used in incentive plans. However, they are typically incorporated as part of the team-wide scorecard or individual performance assessments and are therefore not as impactful on payouts as other types of measures, such as Environment & Sustainability and Health & Safety measures, which are more commonly used as formulaic metrics or modifiers.

Among the 132 companies using ESG measures, only 22% are incorporating such measures as formulaic metrics or modifiers, with the remainder incorporating ESG in a non-formulaic manner as part of an individual performance assessment or team-wide scorecard.

Note—prevalence sums to greater than 100% because some companies incorporate ESG into incentive plans in more than one way (e.g., use one measure formulaically and another as part of an individual performance assessment)

Following is a breakdown of ESG inclusion in incentive plans by category:

Note—in cases where companies incorporate the same ESG category in more than one way (e.g., formulaic and individual), they are counted according to their most impactful incorporation of ESG (i.e., formulaic > scorecard > individual)

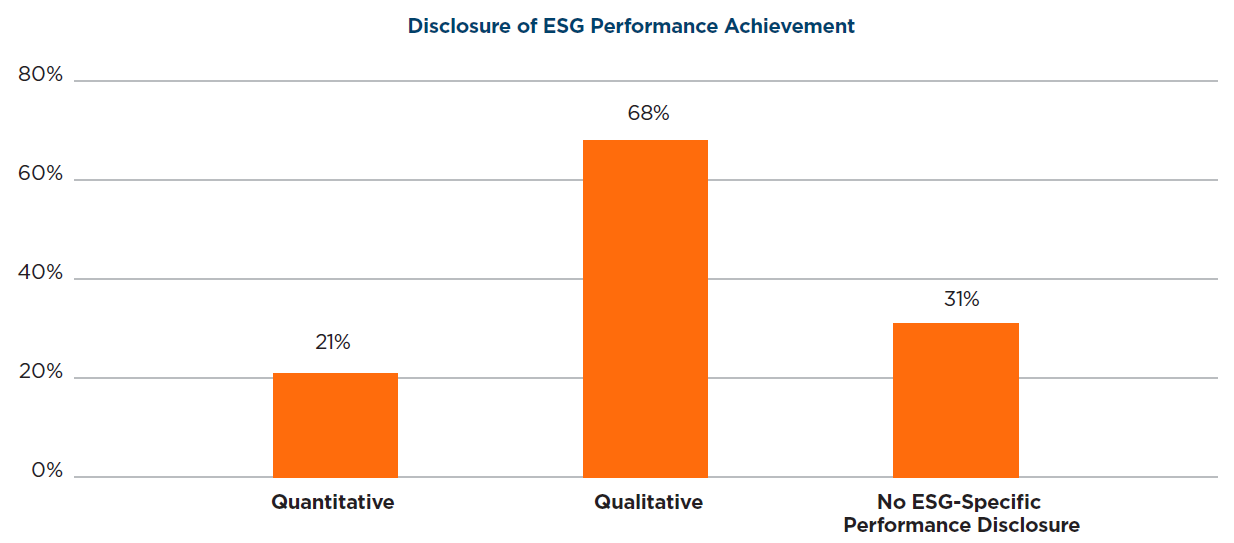

Only 21% of companies using ESG measures disclose the performance achievement used to arrive at an incentive payout in a quantitative manner. Companies most commonly describe the performance achievement qualitatively (e.g., met/exceeded expectations, improved relative to last year, etc.). 31% of companies did not specifically describe how they performed on a given ESG measure, only noting that the measure was considered in arriving at the payout (most common for companies that use ESG measures as part of individual performance assessments).

Note—prevalence sums to greater than 100% because some companies disclose performance in different ways for different ESG measures (e.g., quantitative disclosure for one measure and qualitative disclosure for another)

The ESG categories most commonly used in a formulaic manner are also the categories that most often have quantitative performance disclosure. Notably, not all companies that incorporate ESG measures formulaically disclose performance quantitatively, and some companies that use ESG as part of a team-wide scorecard or individual performance assessment do disclose specific performance achievements quantitatively.

Endnotes

1https://www.ssga.com/us/en/individual/etfs/insights/diversity-strategy-goals-disclosure-our-expectations-for-public-companies(go back)

2https://www.blackrock.com/uk/individual/larry-fink-ceo-letter(go back)

3https://www.nytimes.com/2019/04/23/business/media/disney-heiress-attacks-pay-practices.html(go back)

4https://www.latimes.com/business/technology/story/2019-11-06/google-walkout-demands(go back)

5https://amazonemployees4climatejustice.medium.com/public-letter-to-jeff-bezos-and-the-amazon-board-of-directors-82a8405f5e38(go back)

6https://www.sec.gov/rules/final/2020/33-10825.pdf(go back)

7https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans(go back)

Print

Print