Kristen Sullivan is Partner, Sustainability and KPI Services, at Deloitte & Touche LLP; Maureen Bujno is Managing Director and Audit & Assurance Governance Leader at the Center for Board Effectiveness, Deloitte & Touche LLP; and Leeann Galezio Arthur is Senior Manager at the Center for Board Effectiveness, Deloitte & Touche LLP. This post is based on a Deloitte memorandum by Ms. Sullivan, Ms. Bujno, Ms. Arthur, and Jenny Lynch. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here); and Toward Fair and Sustainable Capitalism by Leo E. Strine, Jr (discussed on the Forum here).

Introduction

While 2020 has been a challenging year for many companies, the pandemic has provided a reason to spotlight the importance of a purpose-driven strategy to drive business and societal value and highlighted the interrelationship between long-term corporate strategy, the environment, and society. Many companies have also reevaluated their corporate purpose and ability to drive the long-term sustainability of their enterprise by addressing environmental, social, and governance (ESG) strategies and challenges.

The ”G” in ESG and the important role the board of directors and each board committee plays in overseeing the company’s transparency around sustainability initiatives continues to be a primary focus in the ESG conversation. The “G” can be described as the governing structure, policies, and practices employed by an organization to define responsibilities and decision-making rights that provide the foundation for overall accountability and credibility. Included in this is how the board defines its committee structure and delegates oversight responsibility across the board and its committees.

Maturing the ESG initiative

There is heightened pressure and focus by investors and other stakeholders to understand how companies create long-term value by incorporating ESG objectives into strategy and key decisions.

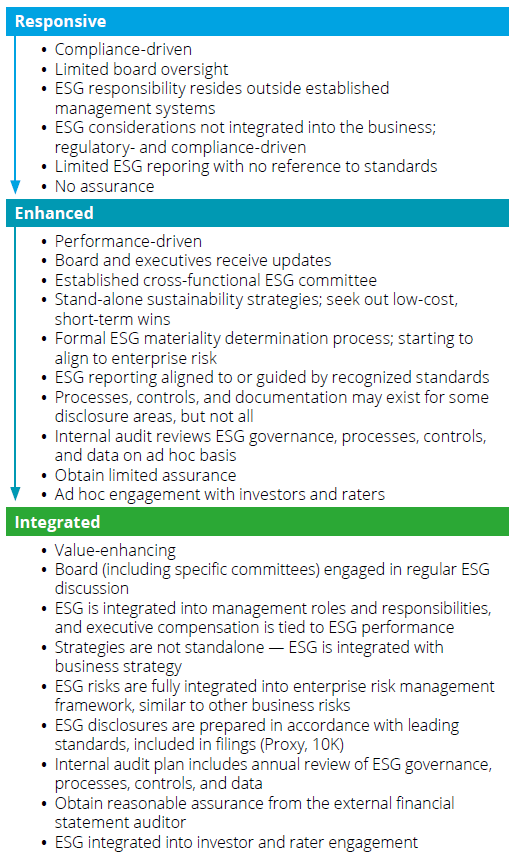

While some companies are just beginning to think through how their corporate purpose and ESG objectives are integrated with their strategy, others have already assessed their material ESG factors and have robust board oversight of management infrastructure that defines, monitors, measures, and communicates their story to stakeholders. As companies consider how to best integrate ESG into the business strategy, it may be helpful to consider the current state of its ESG program and determine how the company will mature the ESG program from one that is responsive to one that is proactive, intentional, and integrated into the core business strategy and risk program. In many cases, the effects of the COVID-19 pandemic and the social justice movement have prompted companies to move along the maturity scale at a quicker pace.

Figure 1. Deloitte ESG maturity model

As companies evolve from “Responsive” to “Enhanced” and, ultimately, to an “Integrated” ESG initiatives program (see figure 1), the role of the board in prioritizing oversight of ESG initiatives will also increase, requiring further maturity of the board’s governance structure. Boards have a role in guiding management on ESG initiatives, as well as making clear, stakeholder-informed decisions that can position the company as a leader in its industry and among its peers.

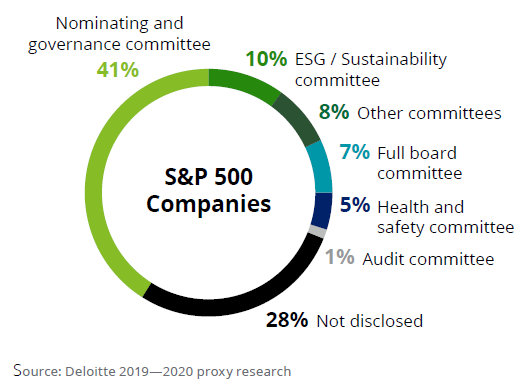

In order to better understand the governance structure companies are implementing to oversee ESG initiatives, Deloitte analyzed S&P 500 [1] 2020 proxy statements and considered whether the full board or a specific board committee was noted as the primary oversight governing body for ESG initiatives.

According to Deloitte’s research (see figure 2), there is currently significant variability in board oversight of ESG. Although it appears as though a large percentage of companies have delegated oversight responsibility for ESG initiatives to the nominating and governance committee, some have chosen to establish a formal ESG/Sustainability committee, and many currently have the full board taking the lead. Even with rising stakeholder interest and increased accountability for board oversight of ESG, 28% of the S&P 500 companies still do not disclose how the board has defined the governance structure.

Figure 2. S&P 500 board committee oversight of ESG

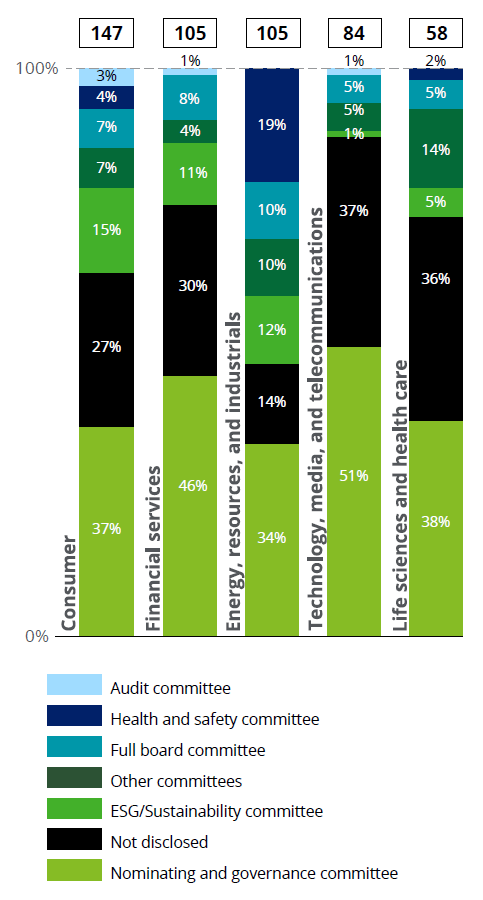

In addition, the research highlighted variability in ESG oversight by industry. Not surprisingly, given core business objectives, regulatory requirements and a long history of focus on employee safety, the energy, resources, and industrials industry has a higher percentage of health and safety, ESG/Sustainability-specific, or other types of committees overseeing ESG. In contrast, within the technology, media, and telecom industry, which generally may not have the same level of environmental, health, and safety compliance requirements, 37% of companies have not disclosed information about ESG oversight at the board level. The variety in the committee names overseeing ESG was notable in that many companies created new committees to oversee ESG. See below for some examples and figure 3 for detailed industry charts.

Example ESG-specific committee names

- Corporate Social Responsibility and Sustainability Committee

- Governance and Public Responsibility Committee

- Public Policy and Sustainability Committee

- Environmental, Safety, and Sustainability Committee

- Sustainability Committee

- Sustainability and Innovation Committee

- Technology, Environmental, Safety, and Security Committee

- Corporate Responsibility Committee

- Public Responsibility Committee

Figure 3. Industry committees structures to oversee ESG: Which committee has primary oversight?

Source: Deloitte 2019—2020 proxy research

Aligning ESG and risk to the board committee structure

The current variability in committee oversight of ESG will likely evolve to fit the unique ESG objectives of each company, and there is a precedent for the development of board governance. For many boards, the audit committee is the designated primary owner of risk oversight. However, there has been an evolution with regard to risk oversight governance structures, whereby the audit committee retains oversight of the company’s overall risk management efforts, as well as financial risk, and other significant risks are allocated

to other committees for more regular updates. As governance structures evolve, the same may be true for ESG oversight at the board level. An important consideration with regard to ESG oversight is the intersection of risk oversight responsibilities and the need for alignment of key risks that may fall under the environmental or societal categories of ESG. While the research indicates that, in many cases, the nominating and governance committee currently has primary oversight around ESG efforts and how management is integrating those into the business, it is a key business risk, and other committees will likely have a role in ESG oversight that aligns with the responsibilities outlined in their charters.

For example, the SEC recently released a final rule that will amend and modernize Regulation S-K to require enhanced human capital management disclosure in financial filings, further reinforcing that both the compensation and audit committees will likely have an increased role in ESG disclosures. Human capital management initiatives, including diversity and inclusion initiatives, may fall under the “S” category and be allocated to the compensation, management development committee, or its equivalent. However, the audit committee should be involved in understanding whether there are appropriate disclosure and internal control procedures associated with any metrics being disclosed.

The audit committee plays a significant role in how companies tell their story and communicate ESG disclosures. Committee members should understand how ESG risks are identified, prioritized, and serve to inform disclosure objectives and practices. They should also understand how materiality is defined when identifying ESG metrics for disclosure, the framework being used to tell the ESG story, the internal controls in place around associated metrics, and how those metrics are included on the company’s website and/or disclosed (i.e., in a separate sustainability report or integrated in an SEC filing).

While 90% of the S&P 500 provide some form of sustainability or ESG disclosure, [2] investors and broader stakeholders are still asking for more high-quality, consistent, and reliable ESG disclosures in accordance with recognized standards. Utilizing recognized Standards, such as the Sustainability Accounting Standards Board (SASB) and the Global Reporting Initiative (GRI), or other recognized sustainability frameworks, such as the Task Force on Climate-Related Financial Disclosures (TCFD), can help provide consistent and meaningful disclosure.

In addition to the oversight of the disclosures, a significant component of an effective governance structure is assurance on ESG/Sustainability information—which is a process whereby an independent practitioner assesses and provides an opinion on the reliability of the ESG information. The market may use ESG data provided by companies as well as third-party providers in investment decisions. Assurance can play an important role in signaling the quality of the information to the market and give decision-makers more confidence in the quality and reliability of ESG information.

However, currently, only 29% of S&P reporting companies obtained external assurance on their sustainability or ESG reports as of 2019. [3] As recently noted by The Center for Audit Quality (CAQ), US public company auditors play a critical role in the flow of reliable information for decision-making and could be consulted by companies considering how to evolve their ESG programs to meet the increasing demands of investors and other stakeholders.

As companies evolve their ESG programs to an integrated model, the audit committee will likely have a larger role to play in setting the tone with regard to the importance of assurance on ESG information. Notably, in a recent speech [4] to the International Corporate Governance Network (ICGN), Jay Brown, a board member of the Public Company Accounting Oversight Board (PCAOB), discussed the developing role of both the independent auditor and the audit committee as it relates to assurance over ESG information. Although there have been few ESG critical audit matters (CAMs) [5] included in auditors’ reports to date, Brown’s remarks to ICGN suggest that inclusion of CAMs would indicate that the independent auditor had discussed ESG-related risks with management and the audit committee. This could cause audit committees to take a “fresh look” at “their own company’s disclosure.”

Conclusion

As companies begin to mature in integrating their ESG programs with their business strategies, boards will also have to mature their own governance structures to provide the appropriate oversight. While the nominating and governance committee currently appears to be the most prevalent committee for oversight of a company’s ESG program, this may evolve over time. As disclosure within recognized ESG frameworks or standards is increasingly demanded by investors and other stakeholders, roles for other board committees, such as the audit committee, will also become increasingly important.

Questions for audit committees to consider asking

- Has the board defined its governance structure to facilitate effective oversight of the company’s ESG matters? Has the board defined the “primary” governance owner and further allocated key E&S factors to other relevant committees or the full board?

- How has management determined priority ESG impacts and dependencies and identified material ESG measures?

- What ESG standards or frameworks are being used to prepare ESG disclosures?

- Are ESG disclosures subject to disclosure controls and procedures?

- Has management considered obtaining assurance on its ESG disclosures? What level of engagement has management had with the independent auditor on ESG reporting?

Endnotes

1The population analyzed included 499 proxy statements from S&P 500 companies filed between October 1, 2019, and September 30, 2020.(go back)

2https://www.ga-institute.com/research-reports/flash-reports/2020-sp-500-flash-report.html(go back)

3https://www.ga-institute.com/research-reports/flash-reports/2020-sp-500-flash-report.html(go back)

4https://pcaobus.org/News/Speech/Pages/Brown-revealing-ESG-Critical-Audit-Matters.aspx?utm_source=PCA(go back)

5https://pcaobus.org/Rulemaking/Docket034/2017-001-auditors-report-final-rule.pdf(go back)

Print

Print