Brian Johnson is Associate Director and Jared Sorhaindo is an Associate at ISS Corporate Solutions. This post is based on their ISS memorandum.

Executive Summary

“Realizable” pay assessments are often included in the Compensation Discussion & Analysis (“CD&A”) section of the proxy filing to provide a more accurate view of the actual value of compensation delivered to an executive, as opposed to the pay data disclosed in the Summary Compensation Table, which does not take into account the impact of recent share price movements on an executive’s compensation package. A common reason for including these supplemental analyses in the CD&A is to secure higher support levels for the Say-on-Pay proposal during periods of underperformance for a company: they can illustrate that executives are sharing the pain with broader shareholders as the actual value of their equity holdings has declined in lock-step with the decline in shareholder value. However, based on our review of S&P 500 companies, we have found no discernible aggregate positive impact on Say-on-Pay outcomes when disclosing realizable pay assessments in the proxy, even after controlling for key factors such as an ISS vote recommendation for Say-on-Pay or elevated concern levels exhibited under quantitative pay-for-performance frameworks.

Background

The advent of Say-on-Pay (“SOP”) in 2011 for U.S. corporate issuers ushered in a new era of dialogue between shareholders and executive management teams regarding the alignment between CEO pay and company performance. As a result, CD&A discussions have expanded significantly as companies have made a concerted effort to demonstrate that their executive pay program is sufficiently linked to shareholders’ interests. One key tool used by companies to illustrate the alignment of their pay program is a “realizable” or “realized” pay analysis that attempts to capture the value potentially or actually delivered to an executive, which oftentimes can be much different than the grant date value reported in the Summary Compensation Table (“SCT”), which does not take into account the impact of subsequent stock price movements on equity awards after the date of grant. Because these disclosures are not required in the proxy statement, an oft-cited rationale for including such an analysis in the already complex CD&A is to show investors that the pay program is “working” in the hopes of securing a favorable vote result for the Say-on-Pay proposal. Given the considerable time and effort (and related third-party fees, which can cost several thousand dollars) associated with these analyses, we thought it would be interesting to see if the inclusion of a realizable or realized pay analysis in the proxy statement leads to higher levels of support for Say-on-Pay in the past year. In other words, are realizable pay analyses earning their return on investment when shareholders cast their vote for Say-on-Pay?

Analysis

To study the impact of realizable/realized pay analyses on Say-on-Pay outcomes, our analysis focused on the Say-on-Pay vote results and proxy disclosures for the S&P 500 constituents holding annual meetings between July 1, 2019 and June 30, 2020. References in the CD&A to “realizable” or “realized” pay analyses were captured in our study sample (collectively referred to as “realizable” in this paper). Mandatory disclosures of the “Value Realized on Exercise” or “Value Realized on Vesting” under the “Option Exercises and Stock Vested” table were not classified as realizable pay disclosures for our study. Further, our study focused on specific comparisons between a realizable pay value and a granted/target value of compensation for the CEO/NEOs or a comparison of realizable pay percentile rank outcomes versus TSR percentile rank outcomes. Simple references to the use of a realizable pay analysis as part of the Committee’s compensation-setting process for NEOs were also excluded. Based on these parameters, a total of 89 companies from the S&P 500 (17.8 percent) disclosed a realizable pay analysis in their proxy for annual meetings occurring between July 1, 2019 and June 30, 2020.

Findings

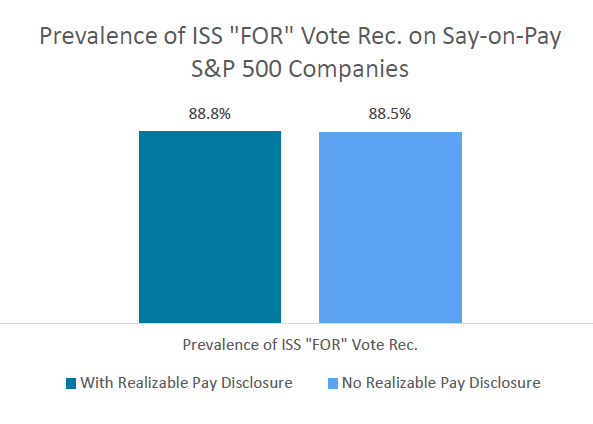

Our first step in analyzing the impact of realizable pay analyses on SOP outcomes focused on the prevalence of positive SOP vote recommendations from ISS, i.e., do companies that disclose a realizable pay analysis in their proxy receive a higher proportion of FOR vote recommendations from ISS compared to those companies that do not disclose a realizable pay assessment? Based on our study sample and the data below, there appears to be no clear signal that realizable pay assessments in the proxy statements are materially impacting ISS SOP vote recommendations at S&P 500 companies. Both study samples received support from ISS on SOP in approximately 89 percent of cases, which is directly in line with the broader ISS SOP outcomes in 2020. This intuitively makes sense, as ISS has established its own rigorous framework and protocol for evaluating the alignment between pay and performance for issuers, which includes its own calculation of a realizable pay analysis in the proxy research report.

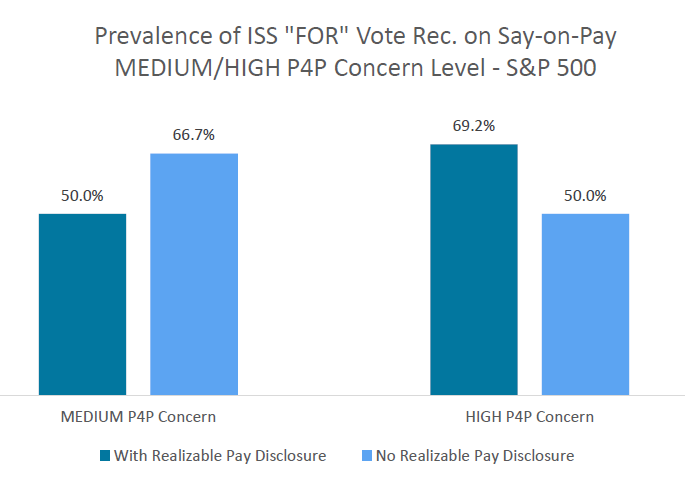

While the data above provide some insight into the impact of disclosing a realizable pay analysis on the ISS SOP vote recommendation, it’s important to recognize that ISS supports SOP proposals at different rates based on the initial pay-for-performance (P4P) concern levels identified in their quantitative frameworks. Companies with elevated concern levels, i.e., MEDIUM or HIGH concerns, receive positive SOP vote recommendations at a much lower rate relative to those companies with a LOW concern on the quantitative P4P test. For those companies with elevated P4P concern levels, does the inclusion of a realizable pay assessment in the CD&A lead to a better chance of securing a positive vote recommendation from ISS on SOP? The data below present mixed results – companies with a MEDIUM P4P concern received “FOR” vote recommendations on SOP at a lower rate when they included a realizable pay analysis in their CD&A, but companies with a HIGH P4P concern received “FOR” vote recommendations on SOP at a higher rate when they included a realizable pay analysis in their CD&A:

These results suggest there is no definitive link between the inclusion of a realizable pay analysis in the proxy statement and subsequent support by ISS on the SOP proposal, i.e., it appears to be associated with a negative impact for MEDIUM P4P cases, but a positive impact for HIGH P4P cases (small sample size caveats apply here, as both realizable pay control groups have fewer than 15 cases each).

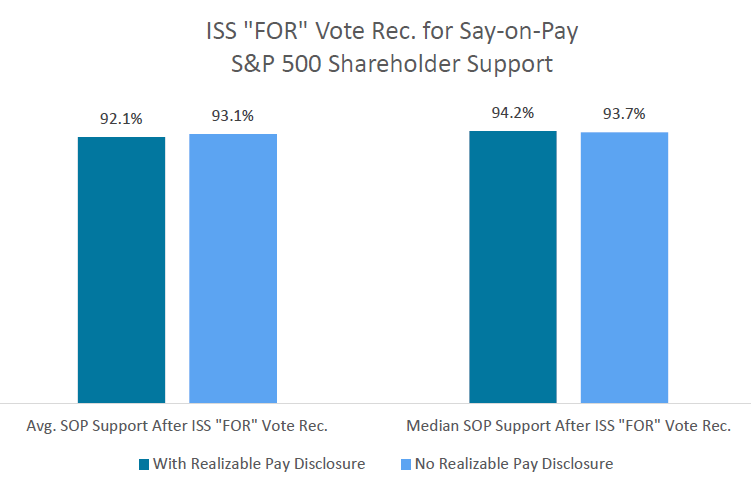

Our next step in analyzing the impact of the inclusion of a realizable pay analysis in the CD&A was to assess the level of support for SOP after receiving a positive or negative vote recommendation from ISS. Given the impact an ISS vote recommendation may have on the final outcome of investor support for SOP, it was important to isolate our study sample into two control groups, otherwise we would be comparing results on an apples-to-oranges basis.

If the general tenet for including a realizable pay analysis in the proxy statement is valid, i.e., they provide a better assessment of measuring pay/performance alignment for investors (particularly during periods of lagging TSR results), then we would expect to see higher support for SOP for those companies utilizing and disclosing realizable pay assessments.

However, this doesn’t appear to be the case when looking at the results from our study samples. For companies receiving a FOR vote recommendation on SOP in the past year (n = 441), average and median support was essentially the same for companies disclosing a realizable pay assessment compared to companies that did not disclose a realizable pay assessment:

Similar to the first outcome analyzed, this finding isn’t particularly surprising. Companies that receive positive vote recommendations from ISS on SOP generally exhibit strong alignment between pay and performance to begin with, even based on SCT pay. The disclosure of a realizable pay analysis in the CD&A doesn’t add much, if any, value for these companies, since investors and shareholders are generally pleased with how the pay program is working for executives.

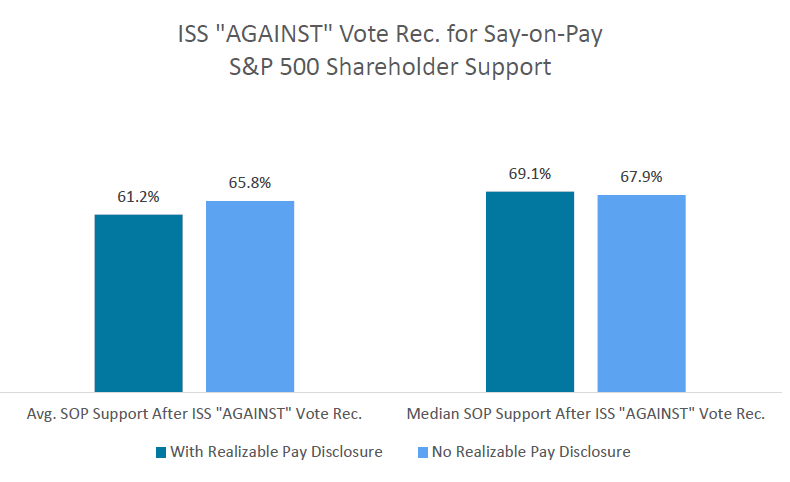

Shifting gears, what about companies that receive an AGAINST vote recommendation from ISS on SOP in the past year (n = 57)? These companies typically have a perceived misalignment between pay and performance when evaluated by ISS’ quantitative frameworks, often due to high SCT pay coupled with lagging TSR results for the period under review. This is where the true value of a realized pay assessment should be reflected, as the analysis would show that the actual or “take home” value of a CEO/NEO’s compensation is far lower than what the intended value was at the time of grant, which should mitigate the P4P disconnect generated under the ISS framework based on SCT pay. Do companies that disclose a realizable pay assessment in their proxy achieve higher levels of SOP support from investors after receiving a negative vote recommendation from ISS?

Based on our findings, the results are somewhat surprising as average support for SOP (after receiving an AGAINST vote recommendation for ISS) was actually lower for companies disclosing a realizable pay assessment (61.2 percent) compared to companies that did not disclose a realizable pay assessment (65.8 percent); however, median support for SOP was slightly higher (+1.2 percentage points) for those companies disclosing a realizable pay assessment:

This outcome appears to be disconnected with the intended purpose of providing a supplementary disclosure in the proxy statement focusing on realizable pay, which is to help tell a better pay story for investors. While average support was lower for the realizable pay group of companies, median support was only modestly higher. What could be driving this result? Similar to the first outcome analyzed, ISS and other well-informed investors have developed their own version of realizable pay analyses into their evaluation frameworks, so the inclusion of a different framework in the proxy statement, likely based on a different time period analyzed and methodology used to calculate realizable pay, likely won’t impact the vote decision for a proxy advisor or investors. To test this hypothesis, we reviewed the proxy research reports for the 89 companies that disclosed a realizable pay analysis in their proxy to see if ISS referenced the analysis in forming their vote recommendation for SOP. Overall, we found that in only 4 cases did ISS comment on the issuer’s disclosure of their own realizable pay assessment in their evaluation of the SOP proposal. Based on our advisory experience in evaluating hundreds of SOP proposals each year, we find that disclosures of actual performance outcomes relative to target goals under short- and long-term incentive programs are viewed much more favorably by ISS and are more highly correlated with positive vote recommendations on SOP than disclosures of realizable pay assessments. We believe this may also speak to the idea that the quality of the disclosure is going to be potentially more important than just the inclusion of the disclosure. Specifically, highlighting that the value of the executives’ holdings declined commensurately with stock price is likely less meaningful to sophisticated investors than demonstrating an alignment between pay and performance via robust, performance-based award programs.

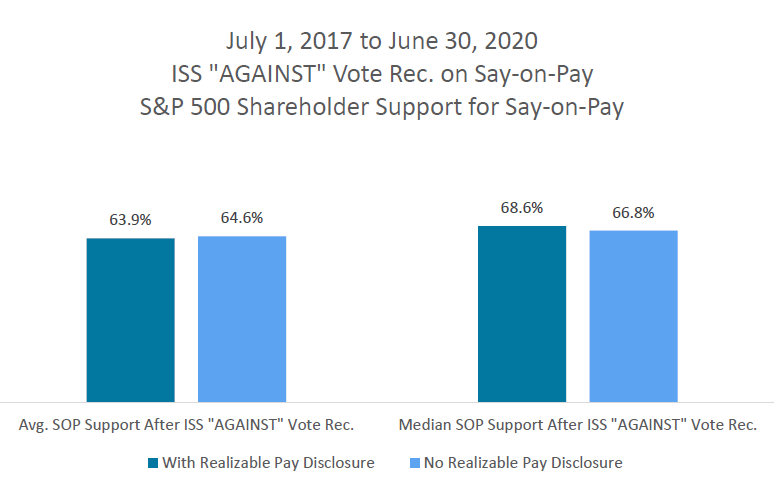

As with any data study using different populations to analyze findings, it’s possible this outcome could be due to small sample size issues for the AGAINST vote recommendation group of companies. To control for this possibility, we analyzed the SOP outcomes over a three-year time period (July 1, 2017 to June 30, 2020) to form a larger sample size and found similar results, albeit with a less pronounced difference between the two groups. Average SOP support for companies including a realizable pay analysis in their proxy statement (after receiving a negative vote recommendation) was essentially the same for companies that did not disclose realizable pay assessment, while median support for SOP was slightly higher (+1.8 percentage points) for the realizable pay group:

This longer-term finding reinforces the view that the inclusion of realizable pay analyses in proxy statements has mixed results on SOP outcomes, i.e., there is negligible difference in the average SOP support levels between the two groups and only a modest uptick in median SOP support for the realizable pay group.

Conclusion

Based on our study, it does not appear that there is a discernible aggregate positive impact on Say-on-Pay outcomes of disclosing realizable pay assessments in the proxy for S&P 500 companies. As such, companies should carefully assess whether they are including a realizable pay assessment in the CD&A as a “kitchen sink” item or as information that is material to the company’s compensation story. Ultimately, if the compensation committee considers realizable pay and discusses executive compensation with its investors using a realizable pay lens, then including these analyses in the proxy statement will continue to be important for those conversations.

Print

Print