Brian V. Breheny and Joseph M. Yaffe are partners and Caroline S. Kim is an associate at Skadden, Arps, Slate, Meagher & Flom LLP. This post is based on a memorandum by Mr. Breheny, Mr. Yaffe, Ms. Kim, and other Skadden attorneys. Related research from the Program on Corporate Governance includes Stealth Compensation via Retirement Benefits by Lucian Bebchuk and Jesse Fried.

Companies should also consider their recent annual say-on-pay votes and general disclosure best practices when designing their compensation programs and communicating about their compensation programs to shareholders. This year, companies should understand key say-on-pay trends, including overall 2020 say-on-pay results, factors driving say-on-pay failure (i.e., those say-on-pay votes that achieved less than 50% shareholder approval), say-on-golden-parachute results and equity plan proposal results, as well as recent guidance from the proxy advisory firms ISS and Glass Lewis.

Overall Results of 2020 Say-on-Pay Votes

Below is a summary of the results of the 2020 say-on-pay votes from Semler Brossy’s annual survey and trends over the last nine years since the SEC adopted its say-on-pay rules. Overall, say-on-pay results at Russell 3000 companies surveyed in 2020 were generally the same or slightly better than those in 2019, despite the impact of the COVID-19 pandemic on compensation.

- Approximately 97.7% of Russell 3000 companies received at least majority support on their say-on-pay vote, with approximately 93% receiving above 70% support. This demonstrates slightly stronger say-on-pay support in 2020 compared with 2019, when approximately 97.3% of Russell 3000 companies received at least majority support, with approximately 91% receiving above 70% support.

- ISS’ support for say-on-pay proposals in 2020 through September 2020 has been the highest observed over the last 10 years, with 89% of companies surveyed receiving an ISS “For” recommendation, compared with the historical average through 2019 of approximately 2%.

- Russell 3000 companies received an average vote result of 5% approval in 2020, which is the same as the average vote result in 2019.

- The average vote result exceeded 95% approval in 2020 across multiple industries, including automotive retail, paper packaging, electronic components, human resource and employment services, commodity chemicals, electronic manufacturing services and electronic equipment and instruments.

- The oil and gas drilling industry had the lowest level of average support of 79.3% compared with other industries, while the following industries received an average vote result of less than 83.1%: internet services and infrastructure, air freight and logistics, movies and entertainment, and steel.

- Approximately 2.3% of say-on-pay votes for Russell 3000 companies failed in 2020 as of September 2020, which was slightly lower than the 2.7% failure rate for 2019 measured in October 2019.

- Approximately 10% of Russell 3000 companies and 8% of S&P 500 companies surveyed have failed to receive a majority support for say-on-pay at least once since 2011.

- One-third of S&P 500 companies and 28% of Russell 3000 companies surveyed have received less than 70% support at least once since 2011.

Factors Driving Say-on-Pay Failure

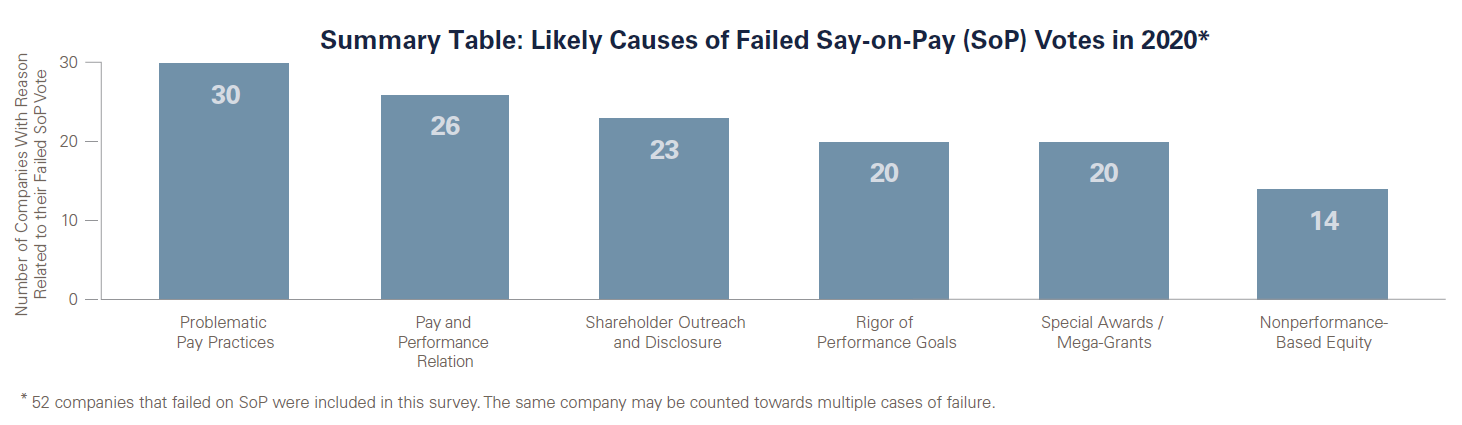

Overall, the most common causes of say-on-pay vote failure were problematic pay practices, pay and performance relation, shareholder outreach and disclosure, rigor of performance goals, special awards/mega-grants and nonperformance-based equity awards, as summarized in the chart above.

Notably, shareholder outreach and disclosure efforts have increased from the sixth most frequently cited likely cause of say-on-pay vote failure in 2019 to the third in 2020, highlighting the importance of robust shareholder engagement efforts during this time, especially if a company’s compensation has changed in connection with the COVID-19 pandemic. Otherwise, the likely causes of say-on-pay failure remained largely consistent between 2019 and 2020, with problematic pay practices and pay and performance relation (i.e., a disconnect between pay and performance) as the continuing frontrunners.

ISS Guidance

When evaluating pay practices, proxy advisory firms tend to focus on whether a company’s practices are contrary to a

performance-based pay philosophy. In December of each year, ISS publishes FAQs to help shareholders and companies understand changes to ISS compensation-related methodologies. In December 2019, ISS published its most recent general United States Compensation Policies FAQ summarizing which problematic practices are most likely to result in an adverse ISS vote recommendation. The problematic practices include the following and are expected to remain problematic in 2021:

- repricing or replacing of underwater stock options or stock appreciation rights without prior shareholder approval (including cash buyouts and voluntary surrender of underwater options);

- extraordinary perquisites or tax gross-ups, likely including gross-ups related to personal use of corporate aircraft, executive life insurance, secular trusts, restricted stock vesting, home-loss buyouts or any lifetime perquisites;

- new or extended executive agreements that provide for

- termination or change in control severance payments exceeding three times the executive’s base salary and bonus;

- change in control severance payments that do not require involuntary job loss or substantial diminution of duties;

- change in control payments with excise tax gross-ups, including modified gross-ups; (iv) multiyear guaranteed awards that are not at-risk due to rigorous performance conditions; (v) a “good reason” termination definition that presents windfall risks, such as definitions triggered by potential performance failures (e.g., company bankruptcy or delisting); or (vi) a liberal change in control definition combined with any single-trigger change in control benefits; and

- any other egregious practice that presents a significant risk to investors.

Other issues contributing to low say-on-pay support include:

- inadequate disclosure around changes to performance metrics, such as disclosures that fail to explain changes and how they relate to performance;

- high-target incentives for companies that are underperforming relative to their peers;

- special bonuses and mega equity grants without sufficient rationale or risk-mitigating design features; and

- insufficient shareholder outreach and disclosure, including inadequate response to compensation-related concerns raised by shareholders.

ISS is expected to release a full set of updated compensation FAQ in December 2020, which will provide robust guidance for 2021.

Glass Lewis Guidance

Glass Lewis published its 2021 Proxy Paper Guidelines for the United States, which include several compensation updates for 2021. Generally, Glass Lewis’ 2021 Proxy Paper Guidelines encourage robust disclosure of equity-granting practices and changes to compensation programs, emphasize Glass Lewis’ continued preference for performance-based awards and disapproval of excise tax gross-ups, and shed light on Glass Lewis’ process for evaluating option exchange and repricing proposals and selecting peer groups for its pay-for-performance analysis.

For additional information, see our December 7, 2020, client alert “ISS and Glass Lewis Release Updated Proxy Voting Guidelines.”

Recommended Next Steps

Overall, executive compensation remains in the spotlight, with companies facing pressure from proxy advisory firms, institutional investors, the news media, activist shareholders and other stakeholders, especially in light of the disproportionate impact of COVID-19 on low income workers. This year’s proxy season provides an opportunity for all companies to clearly disclose the link between pay and performance and efforts to engage with shareholders about executive compensation. These disclosures should explain the company’s rationale for selecting particular performance measures for performance-based pay and the mix of short-term and long-term incentives. Companies also should carefully disclose the rationale for any increases in executive compensation, emphasizing their link to specific individual and company performance.

In the year following a say-on-pay vote, proxy firms conduct a thorough review of companies whose say-on-pay approval votes fall below a certain threshold: 70% approval for ISS and 80% for Glass Lewis. ISS’ FAQs explain that this review involves investigating the breadth, frequency and disclosure of the compensation committee’s stakeholder engagement efforts, disclosure of specific feedback received from investors who voted against the proposal, actions taken to address the low level of support, other recent compensation actions, whether the issues raised were recurring, the company’s ownership structure and whether the proposal’s support level was less than 50%, which should elicit the most robust stakeholder engagement efforts and disclosures.

Looking ahead to 2021, companies that received say-on-pay results below the ISS and Glass Lewis thresholds should consider enhancing disclosures of their shareholder engagement efforts in 2021 and the specific actions they took to address potential shareholder concerns. Companies that fail to conduct sufficient shareholder engagement efforts and to make these disclosures may receive negative voting recommendations from proxy advisory firms on say-on-pay proposals and compensation committee member reelection.

Recommended actions for such companies include:

- Assess results of the most recent say-on-pay vote. As part of this analysis, identify which shareholders were likely the dissenting shareholders and why.

- Engage key company stakeholders by soliciting and documenting their perspectives on the company’s compensation Analyze stakeholder feedback, determine recommended next steps and discuss findings with relevant internal stakeholders, such as the compensation committee and the board of directors.

- Review ISS and Glass Lewis company-specific reports and guidance to determine the reason for their vote recommendations in 2020. Carefully consider how shareholders and proxy advisory firms will react to planned compensation decisions for the remainder of the current fiscal year and recalibrate as necessary. For example, consider compensation for new hires, leadership transitions and any special one-time grants or other arrangements.

- Determine and document which changes will be made to the company’s compensation policies in response to shareholder feedback.

- Disclose specific shareholder engagement efforts and results in the 2021 proxy statement. Such disclosures should include information about the shareholders engaged, such as the number of them, their level of ownership in the company and how the company engaged them. They also should reflect actions taken in response to shareholder concerns, such as a company’s decision to offer more robust disclosures or to adjust certain compensation practices.

Companies that have not changed their compensation plans or programs in response to major shareholder concerns should consider disclosing (i) a brief description of those concerns; (ii) a statement that the concerns were reviewed and considered; and (iii) an explanation of why changes were not made.

Say-on-Golden-Parachute Proposal Results

Say-on-golden-parachute votes historically have received lower support than annual say-on-pay votes, and this trend was even stronger in 2020. Average support for golden parachute proposals dropped from 79% in 2019 to 74% from January 1, 2020, through July 17, 2020. Companies should beware of including single-trigger benefits (i.e., automatic vesting upon a change in control) in their parachute proposals, because stakeholders cite single-trigger vesting as a primary source of concern, with tax gross-ups and excessive cash payouts as significant secondary concerns. Companies historically have also cited performance awards vesting at maximum as a significant secondary concern.

Equity Plan Proposal Results

Equity plans continue to be widely approved, with less than 1% of equity plan proposals at Russell 3000 companies receiving less than a majority vote in 2020 through September 2020. Average support for 2020 equity plan proposals as of September 2020 was 89.5%, which was higher than the 88.5% average support observed in October 2019.

Most companies garner strong equity plan proposal support from shareholders, regardless of the say-on-pay results. As of September 2020, Russell 3000 companies with less than 70% say-on-pay approval that presented an equity plan proposal still received 82% support for the equity plan proposal.

Equity plan proposals are expected to become more common in 2021, because companies are expected to request shares to mitigate the dilution of equity compensation that corresponds with the macroeconomic impacts of COVID-19. Prior to the COVID-19 pandemic, equity plan proposals were becoming increasingly rare, and such decrease may have been driven by the elimination of the performance-based compensation deduction under Section 162(m) of the Internal Revenue Code of 1986, which diminished the need for regular shareholder approval of performance goals in incentive plans.

Effective in 2021, the threshold number of points to receive a favorable equity plan proposal recommendation from ISS is expected to increase from 55 points to 57 points for the S&P 500 model and from 53 points to 55 points for the Russell 3000 model, while remaining at 53 points for all other Equity Plan Scorecard models. This will raise the bar for many companies seeking large share increases in response to the pandemic’s impact on their compensation programs, leading some companies to require subsequent equity plan proposals over the coming years.

Other Proxy Advisory Firm Takeaways

ISS’ updated methodology for evaluating whether nonemployee director (NED) pay is excessive has taken effect and is expected to continue to apply in 2021. Under such policy, ISS may issue adverse vote recommendations for board members responsible for approving/setting NED pay beginning with meetings occurring on or after February 1, 2020. Such recommendations could occur where ISS determines there is a recurring pattern (two

or more consecutive years) of excessive director pay without disclosure of a compelling rationale for those prior years or other mitigating factors.

Each year, companies should consider whether to make any updates to the compensation benchmarking peers included in ISS’ database. ISS uses these company-selected peers when it determines the peer group it will use for evaluating a company’s compensation programs. This year, ISS accepted these updates through December 4, 2020.

Prepare for 2021 Pay Ratio Disclosures

The year 2021 marks the fourth year that SEC rules require companies to disclose their pay ratio, which compares the annual total compensation of the median company employee to the annual total compensation of the CEO. This section helps companies prepare for the fourth year of mandatory pay ratio disclosures by considering the following:

- Can the same median employee be used this year, and if not, what new considerations should be taken into account when identifying the median employee?

- What else do companies need to know for 2021?

Determining Whether To Use the Same Median Employee. As a reminder, under Regulation S-K Item 402(u), companies only need to perform median employee calculations once every three years, unless they had a change in the employee population or compensation arrangements that could significantly affect the pay ratio. This requires companies to assess annually whether their workforce composition or compensation arrangements have materially changed.

Companies may encounter important challenges when selecting a median employee for pay ratio disclosures about compensation in fiscal 2020:

- Companies that have been using the same median employee since pay ratio disclosures were first required will need to perform calculations to identify the median employee for fiscal 2020, because they have used the same median employee for the three-year maximum.

- Other companies that were originally planning to feature the same median employee as last year should not do so if their employee populations or employee compensation arrangements significantly changed in the past year, including, without limitation, in response to the COVID-19 pandemic, such as widespread layoffs, furloughs and compensation adjustments.

- Companies may again be required to perform calculations to identify a median employee for pay ratio disclosures regarding fiscal 2021, given continued evolution in workforce composition and compensation arrangements.

When selecting a median employee for pay ratio disclosures regarding fiscal 2020, companies should carefully consider how to incorporate furloughed employees:

- First, determine whether such furloughed individuals should still be considered “employees” as of the date the employee population is determined for the pay ratio calculation (the “determination date”), based on the facts and circumstances about the furlough.

- SEC staff guidance does not elaborate on how companies should take facts and circumstances into account when determining whether to include furloughed employees in the pay ratio calculation; provided that it does direct companies to categorize furloughed individuals who are ultimately identified by the company as employees as full-time, part-time, temporary or seasonal employees for determining whether to annualize their compensation.

- Instruction 5 to Item 402(u) considers permanent employees on an unpaid leave of absence to be employees, which may help companies reason by analogy when determining whether furloughed individuals should be considered employees for the pay ratio calculation. For example, individuals on an unpaid furlough with a defined end date could be considered analogous to employees on an unpaid leave of absence and therefore included in the calculation. Moreover, if individuals on furlough receive pay or continued health benefits, such furlough may be analogous to a paid leave of absence, tipping the balance toward inclusion of such furloughed individuals in the pay ratio calculation.

- Next, if the company determines that furloughed individuals are employees as of the determination date, it should then evaluate whether to annualize their pay for the pay ratio calculation. In general, such furloughed employees’ compensation should be determined under the same method that applies to analogous non-furloughed employees.

- Instruction 5 to Item 402(u) permits annualizing compensation for full-time or part-time employees that were employed by the company for less than the full fiscal year, such as newly hired employees or permanent employees on an unpaid leave of absence. However, pursuant to such instruction, companies may not annualize total compensation for temporary or seasonal employees.

- Companies should determine based on the facts and circumstances of the furlough whether such furloughed employees should be classified as full-time, part-time, temporary or seasonal, and determine whether to annualize their compensation accordingly.

Additionally, companies should consider how headcount changes may impact their ability to exclude certain non-U.S. employees from their pay ratio calculation under the commonly relied upon de minimis exception in Item 402(u)(4)(ii). Therefore, companies should evaluate whether non-U.S. employees in the aggregate and by jurisdiction newly constitute or no longer constitute more than 5% of the company’s total employees.

- The de minimis exception generally allows a company to exclude non-U.S. employees when identifying their median employee, if excluded non-U.S. employees constitute 5% or less of their workforce.

- If a company’s non-U.S. employees account for 5% or less of their total employees, the company may either exclude all non-U.S. employees or include all non-U.S. employees.

- Alternatively, if over 5% of a company’s total employees are non-U.S. employees, the company may exclude up to 5% of its total employees who are non-U.S. employees; provided that the company exclude all non-U.S. employees in a particular jurisdiction if it excludes any employees in that jurisdiction, and employees excluded under Item 402(u)’s data privacy exception count toward this limit.

- Non-U.S. jurisdictions with employees that exceed 5% of a company’s total employees may not be excluded from the pay ratio calculation under the de minimis exception, although they may be permitted to be excluded under the data privacy exception.

Even if a company uses the same median employee in its proxy statement filed in 2021 as in 2020, it must disclose that it is using the same median employee and briefly describe the basis for its reasonable belief that no change occurred that would significantly affect the pay ratio.

To determine whether a material change occurred, companies should generally continue to evaluate the following:

- How has workforce composition evolved over the past year?

- Review hiring, retention and promotion rates.

- Consider the applicability of exceptions under the pay ratio rules:

- Determine whether to incorporate employees from recent acquisitions or business combinations into the consistently applied compensation measure (CACM). For example, a company may exclude employees from a 2019 business combination from its 2020 pay ratio calculations, but those excluded employees should probably factor into the company’s 2021 median employee calculations.

- Determine whether the de minimis exception applies within the context of the company’s 2020 workforce composition. Under this exception, non-U.S. employees may be disregarded if the excluded employees account for less than 5% of the company’s total employees or if a country’s data privacy laws make a company’s reasonable efforts insufficient to comply with Item 402(u).

- Analyze how the workforce used for the CACM is distributed across the pay scale and how the distribution has changed since last year.

- How have compensation policies changed in the past year compared to the workforce composition? For example, an across-the-board bonus that benefits all employees may not materially change the pay ratio, while new special commission pay limited to a company’s sales team would do so.

Have the median employee’s circumstances changed since last year? Consider changes to the employee’s title and job responsibilities alongside any changes to the structure and amount of the employee’s compensation, factoring in the company’s broader workforce composition. Additionally, if the median employee was terminated, companies must identify a new median employee.

Other Points To Keep in Mind

Although the SEC provides companies with substantial flexibility in calculating their pay ratios, to satisfy the SEC staff and engage with investors, employees and other stakeholders, companies should continue to diligently document and disclose their pay ratio methodology, analyses and rationale. In addition, companies may elect to make supplemental disclosures regarding the pay ratio in the context of the COVID-19 pandemic, to the extent applicable.

Companies also should recognize that state and local governments are increasingly viewing pay ratios as a tax revenue generating opportunity. For example, on November 3, 2020, San Francisco voters approved a proposition to impose an additional gross receipts tax or an administrative office tax on some businesses engaging in business in San Francisco when their highest-paid managerial employee earns more than 100 times the median compensation paid to their employees based in San Francisco. Such tax will range from 0.1%-0.6% of the business’s taxable gross receipts or between 0.4%–2.4% of payroll expense for those businesses in San Francisco, with the tax rate depending on the degree to which such ratio exceeds 100:1 and whether the business is an administrative or a non-administrative business. It will take effect commencing in tax years beginning on or after January 1, 2022, and will generally apply to both public and private companies.

Lawmakers in at least eight U.S. states—including California, Connecticut, Illinois, Massachusetts, Minnesota, New York, Rhode Island and Washington—and federal representatives have launched proposals relating to taxation based on CEO-worker pay ratios.

The complete publication, including footnotes, is available here.

Print

Print