Anna T. Pinedo and Brian Hirshberg are partners and Carlos Juarez is a manager at Mayer Brown LLP. This post is based on their Mayer Brown memorandum.

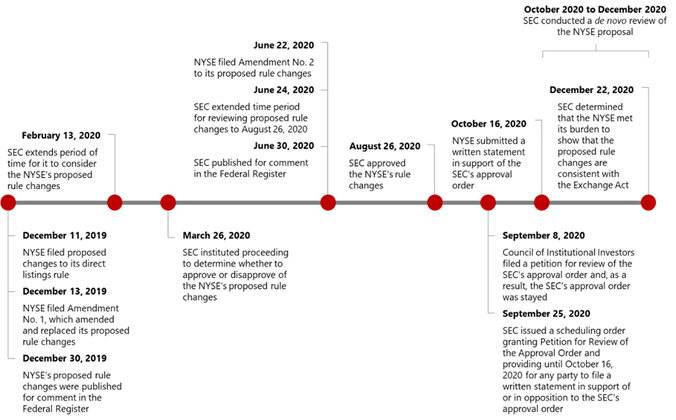

Shortly before the end of his tenure as Chair of the Securities and Exchange Commission (SEC), Chair Jay Clayton presided over the SEC as it considered and approved the New York Stock Exchange’s (NYSE) proposed rule change modifying the NYSE’s rules in order to permit, as described below, primary issuances in connection with a direct listing of a class of the issuer’s equity securities on the exchange. As summarized in the timeline, the SEC’s consideration of the NYSE’s proposed rule change and the proposed rule change includes a number of twists and turns.

NYSE Proposal Approval Timeline

Summary of the NYSE Rules

The NYSE rules contemplate that companies that have not previously had their common equity securities registered under the Securities Exchange Act of 1934 (Exchange Act) but that have sold common equity securities in a private placement may want to list their common equity securities on the NYSE at the time of effectiveness of a resale registration statement filed for the benefit of allowing their existing shareholders to sell their shares from time to time. The exchange defines this type of direct listing, which is already permitted by its rules, and which is the type of direct listing that already has been undertaken by several companies, as a “Selling Shareholder Direct Floor Listing.”

The NYSE proposed to recognize an additional type of direct listing in which a company that has not previously had its common equity securities registered under the Exchange Act would list its common equity securities on the exchange at the time of effectiveness of a registration statement pursuant to which the company itself would sell shares in an opening auction on the first day of trading on the NYSE in addition to, or instead of, facilitating sales by selling shareholders (a “Primary Direct Floor Listing”). Under the amended rule, the NYSE would, on a case by case basis, exercise discretion to list companies through a Selling Shareholder Direct Floor Listing or a Primary Direct Floor Listing.

Market Value of Publicly-Held Shares Listing Requirement

With respect to the Selling Shareholder Direct Floor Listing, the NYSE rules retain the existing standards regarding how the NYSE determines whether a company has met its market value of publicly-held shares listing requirement. The NYSE will continue to determine that a company has met the $100 million aggregate market value of publicly-held shares requirement based on a combination of both:

- an independent third-party valuation of the company, and

- the most recent trading price for the company’s common stock in a trading system for unregistered securities operated by a national securities exchange or a registered broker-dealer (Private Placement Market); or

- alternatively, in the absence of any recent trading in a Private Placement Market, the NYSE will determine that the company has met its market value of publicly-held shares requirement if the company provides a valuation evidencing a market value of publicly-held shares of at least $250 million.

With respect to a Primary Direct Floor Listing, the NYSE will deem a company to have met the applicable aggregate market value of publicly-held shares requirement if:

- the company will sell at least $100 million in market value of the shares in the NYSE’s opening auction on the first day of trading on the exchange; or

- alternatively where a company is conducting a Primary Direct Floor Listing and will sell shares in the opening auction with a market value of less than $100 million, the NYSE will determine that the company has met its market value of publicly-held shares requirement if the aggregate market value of the shares the company will sell in the opening auction in the first day of trading and the shares that are publicly-held immediately prior to the listing is at least $250 million, with such market value calculated using a price per share equal to the lowest price of the price range established by the issuer in its registration statement.

In each case, shares held by officers, directors of owners of more than 10% of the company stock are not included in calculations of publicly-held shares for purposes of the listing rules summarized above.

A company seeking to undertake either a Selling Shareholder Direct Floor Listing or a Primary Direct Floor Listing would also need to meet all other applicable initial NYSE listing requirements including requirements related to the number of round lot holders, publicly‑held shares outstanding and minimum per share price.

Concerns had been raised by commentators that the Primary Direct Floor Listing approach might lead to listed companies with illiquid trading markets. However, the market value standard for a Primary Direct Floor Listing is at least two and half times greater than the market value standard under the NYSE rules for a traditional IPO and comparable to those for a Selling Shareholder Direct Floor Listing.

Order Type and Auction Rules

The NYSE rules include a new order type for use in connection with Primary Direct Floor Listings, called an Issuer Direct Offering Order (IDO Order). The IDO Order is essentially a limit order to sell, submitted by the issuer, that is to be traded in a direct listing auction for a Primary Direct Floor Listing. The NYSE Designated Market Maker (DMM) would effect a Direct Listing Auction manually and the DMM would be responsible for determining the auction price. The limit price of the IDO Order has to equal the lowest price of the price range in the registration statement (referred to as the Primary Direct Floor Listing Auction Price Range) and the IDO Order must be for the quantity of shares that are offered by the issuer, which is the amount that is disclosed in the issuer’s prospectus. The DMM cannot conduct the Direct Listing Auction if the auction price would be below the lowest price or above the highest price of the Primary Direct Floor Listing Auction Price Range, or if there is insufficient interest to satisfy both the IDO Order and better-priced sell orders in full. The exchange rules provide for allocation of orders according to specified priorities, which are outlined in detail in its rules. Securities will be allocated based on matching buy and sell orders, which will be different than the traditional initial public offering book-building process, and at least has the potential of providing an alternative price discovery mechanism. However, there have been prior experiments with auction-based IPO pricing mechanisms in the past, and these cannot be said to have met with great success.

The SEC found that the NYSE’s auction rules ensure that the issuer cannot unduly influence the opening price given that the issuer is required to submit an IDO Order with a limit price equal to the low end of the IPO price range and for the full quantity of offered shares and once submitted, the IDO Order cannot be modified or canceled by the issuer. The NYSE has retained FINRA pursuant to a regulatory services agreement to monitor compliance with Regulation M and other anti-manipulation provisions of the federal securities laws, including compliance by financial advisors involved with direct listings.

Lack of Gatekeeper and Securities Act Section 11 and Tracing Concerns

Commentators have been concerned for some time about a gatekeeper in the form of a traditional underwriter that performs diligence in the context of a direct listing. Now, with the possibility that more companies may perceive a direct listing with a primary capital raise as an attractive alternative to a traditional initial public offering, these concerns have been heightened. As a result, commenters reacted to

the NYSE rule proposal, expressing fear that direct listings could weaken investor protections. However, the SEC noted in its approval that the financial advisors to issuers in Primary Direct Floor Listings have incentives to engage in robust due diligence, given their reputational interests and potential liability, including as statutory underwriters under the broad definition of that term. Additionally, exchange-listed companies often engage in offerings that do not involve a firm commitment underwriting.

Highly Publicized Direct Listings

Other commenters raised questions regarding the availability of Section 11 protections. Generally, in order to assert claims under Section 11 of the Securities Act of 1933 (Securities Act), plaintiffs are required to “trace” their purchases to a registration statement. It may be more difficult to do so in the case of a direct listing. However, in April 2020, in a case of first impression, this presumption regarding the tracing requirement for Section 11 claims (relating to alleged material misstatements and omissions in a registration statement for securities) in a case involving a direct listing was dispensed with as it would lead to a result that was at variance with the policy objective of the legislation. The SEC noted that the

“concerns regarding shareholders’ ability to pursue claims pursuant to Section 11 of the Securities Act due to traceability issues are not exclusive to nor necessarily inherent in Primary Direct Floor Listings. Rather, this issue is potentially implicated anytime securities that are not the subject of a recently effective registration statement trade in the same market as those that are so subject.”

Nasdaq Proposal

The Nasdaq Stock Market has filed a similar proposed rule change that would allow for a comparable alternative of a primary offering direct listing alternative. Following the SEC’s approval of the NYSE’s amendment to its rules, the Nasdaq submitted a proposed rule change and requested immediate effectiveness without a prior public comment period. An SEC Staff statement notes that the SEC Staff intends to “work to expeditiously complete, as promptly as possible accommodating public comment, a review of these proposals, and as with all self-regulatory organizations’ proposed rule changes, will evaluate, among other things, whether they are consistent with the requirements of the Exchange Act and Commission rules.”

The Tyranny of Choice

So, is more better? This seems like an eternal question. Will issuers, entrepreneurs, CEOs, CFOs and their boards of directors be better served by choice? Or just confused by it. We close 2020, the year of the SPAC, with private companies that would like to have a class of equity security that trades on a national securities exchange having a choice among: a traditional initial public offering, a merger into a SPAC, for life sciences companies, a reverse merger into an operating company, a direct listing, and, now, a direct listing with a primary offering. Will this choice overwhelm market participants or enhance the capital markets?

Print

Print