Jim Rossman is Managing Director and Head of Shareholder Advisory; Mary Ann Deignan is Managing Director; and Rich Thomas Managing Director and Head of European Shareholder Advisory at Lazard. This post is based on their Lazard memorandum. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

Observations on the Global Activism Environment in 2020

COVID “Pause” Is Over

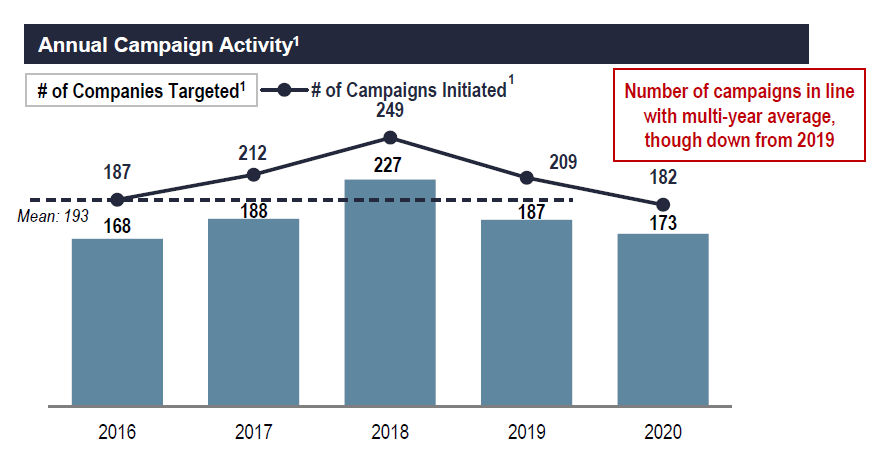

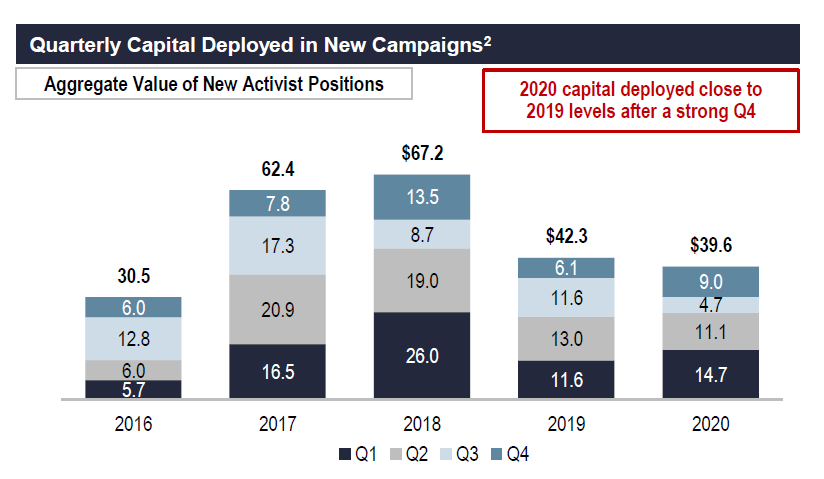

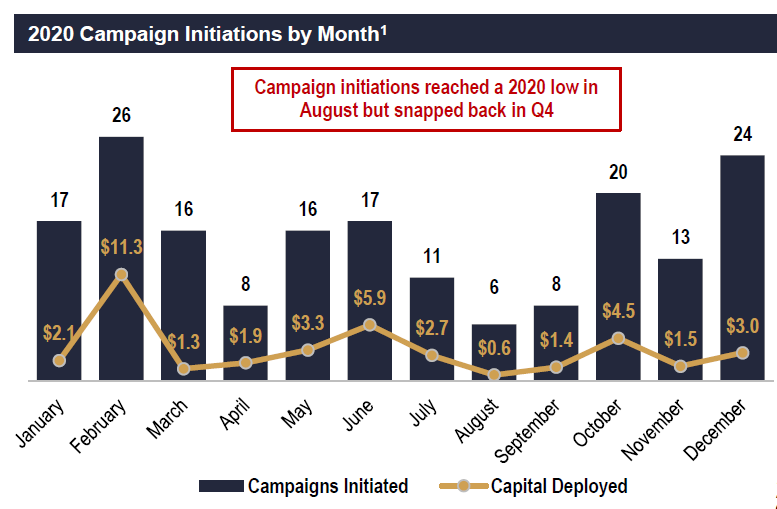

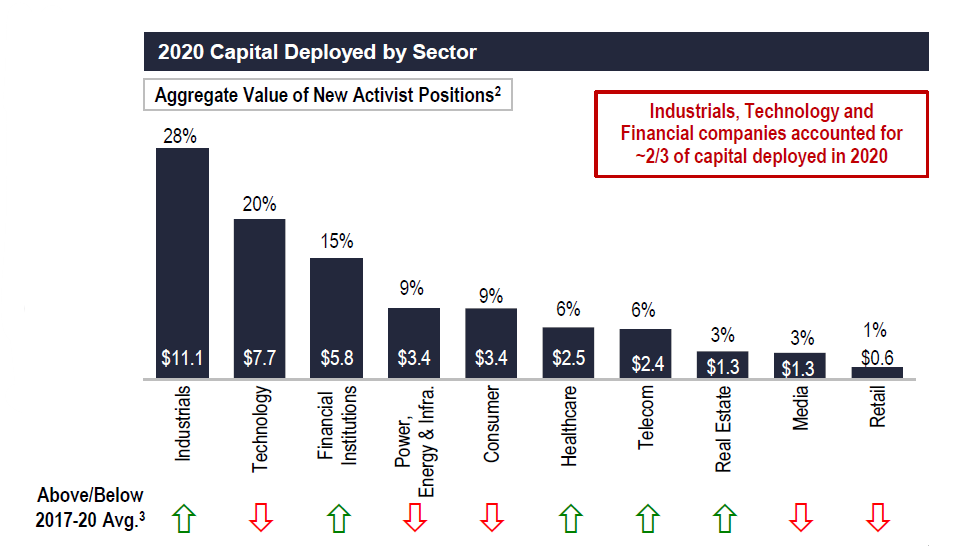

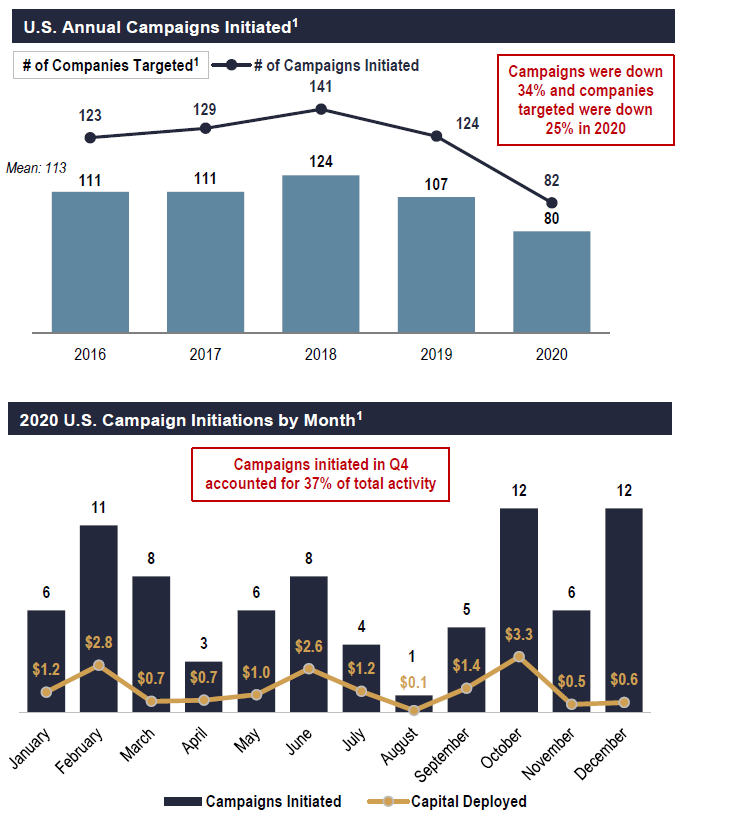

- Global activity saw a strong snap back in Q4, with 57 new campaigns launched (up 128% from Q3 level)

- As a result, 2020’s final global campaign tally (182 new campaigns launched) was down only 13% from 2019

- The Q4 rebound was most pronounced in the U.S., where 30 new campaigns represented a 200% increase from Q3 levels

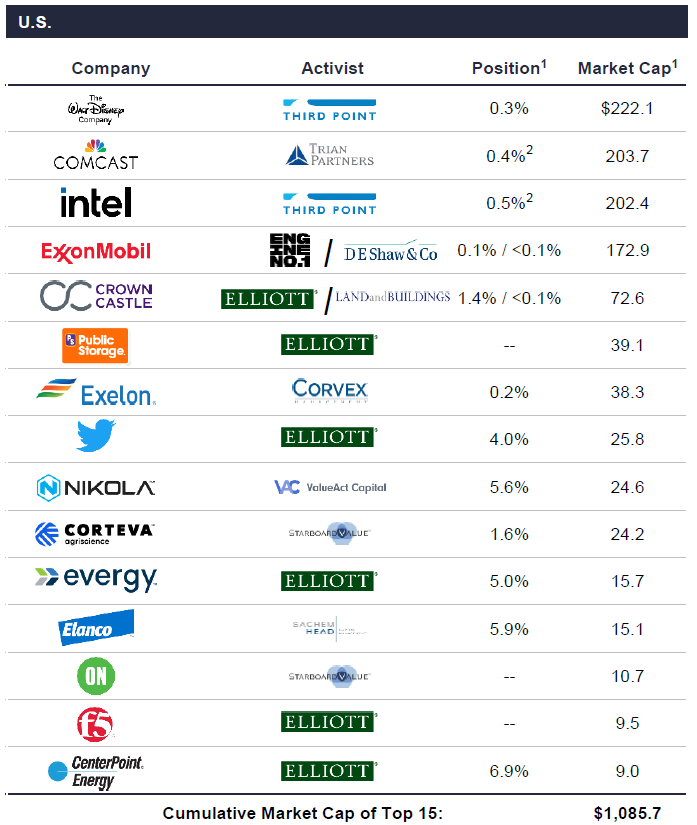

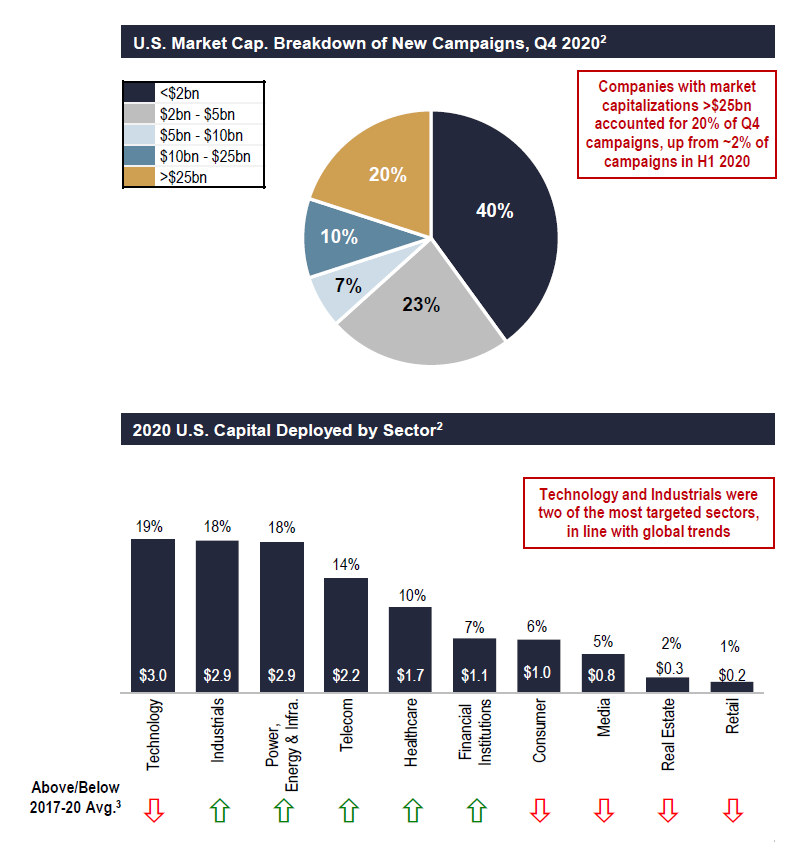

- Among U.S. targets, mega-cap ($25bn+) companies returned to the spotlight, accounting for ~20% of Q4 activity and featuring prominent campaigns such as Intel / Third Point, Elliott / Public Storage, Exxon / Engine No. 1 and Disney / Third Point

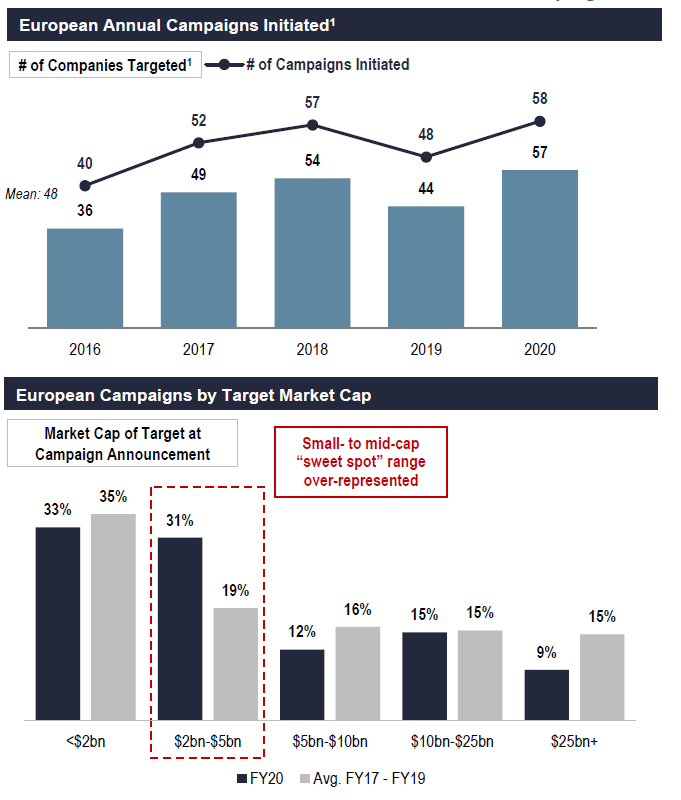

- Non-U.S. activity saw an uptick for the year, with European and APAC campaign levels up 21% and 11%, respectively, over 2019 levels

- With two-thirds of U.S. nomination windows opening from December 2020 through February 2021 and strong momentum in Europe and APAC, 2021 is poised for heavy campaign activity

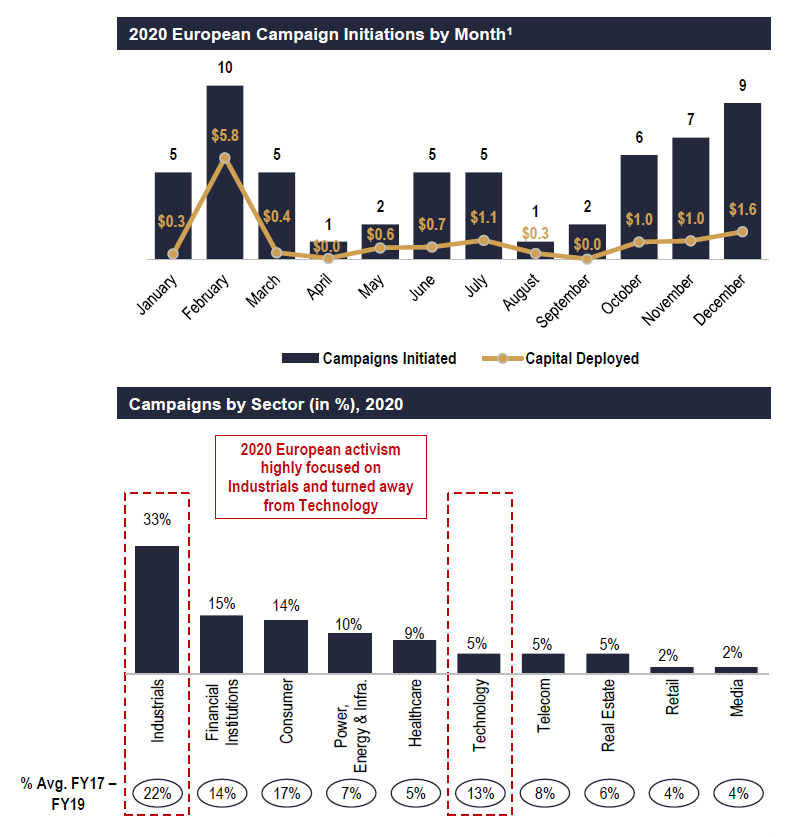

A New European Activism Landscape

- Europe’s 21% Y-o-Y increase in campaign activity owed largely to the year beginning and ending at a blistering pace, with industrial companies and small to mid-cap players sharply in the crosshairs, resulting in Europe witnessing in 2020 a record year for activism

- The activism landscape is broadening across large European markets and the “face of the agitator” is diversifying

- Institutional and occasional activists now account for roughly half of all campaigns

- Frustrated shareholders are increasingly attacking management and Boards as they seek to control the strategy and direction of targeted companies

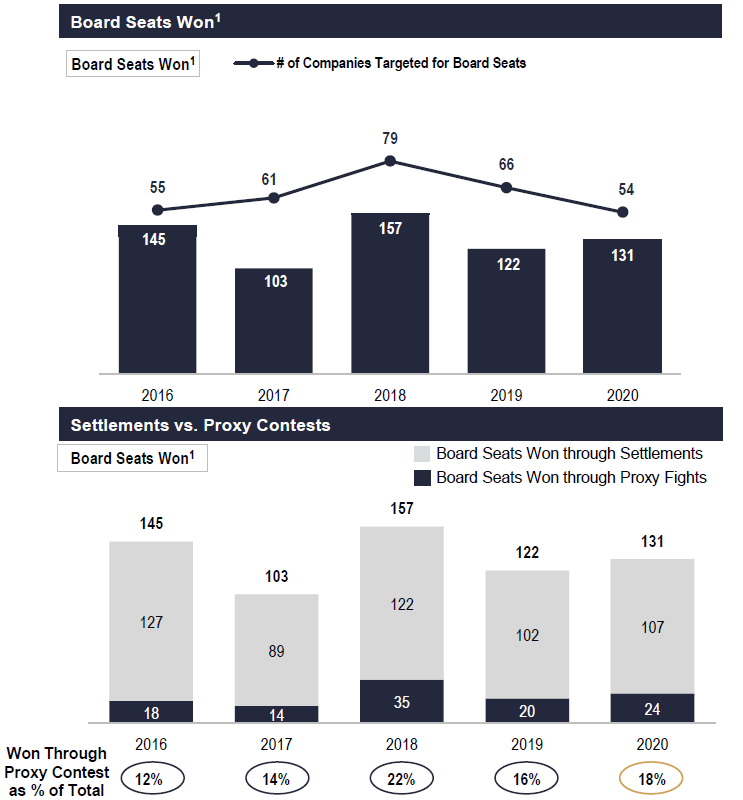

Board Seats and M&A Still in Focus

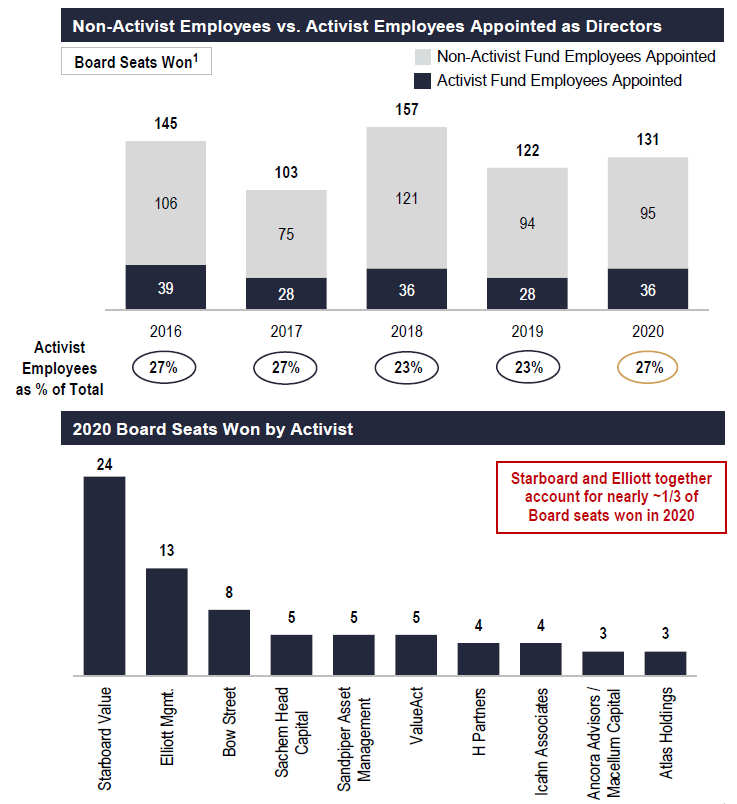

- 131 Board seats were won by activists in 2020, in line with the multi-year average

- Consistent with past years, the majority of Board seats were secured via negotiated settlements (~82% of Board seats)

- The relative stability in Board seats won in 2020, in spite of fewer campaigns, owes to the fact that many campaigns launched prior to 2020 gave rise to Board seats in 2020

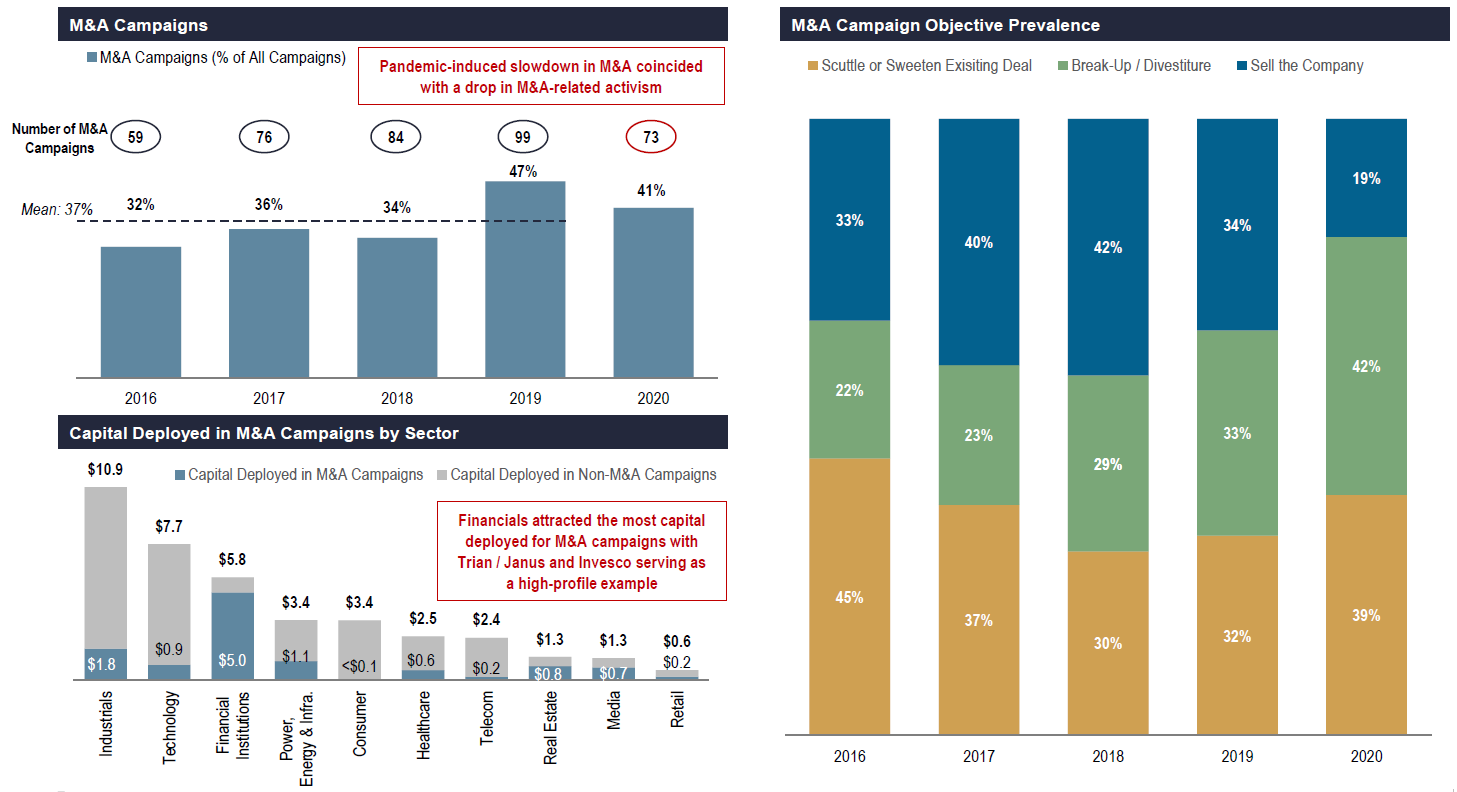

- As in prior years, M&A was the most common objective, featuring in 41% of campaigns (consistent with multi-year averages)

- This consistency with prior year levels was reached thanks to M&A accounting for ~47% of Q4 campaigns, up from only ~34% in Q1 and Q2

ESG Pressure Mounts in the Boardroom

- Investors, proxy advisors, exchanges and governments alike called for greater diversity at public companies in 2020

- Progress continued for unified sustainability reporting as numerous investors pushed for issuers to adhere to SASB and TCFD, while IFRS announced it would develop its own sustainability standards board and IIRC merged with SASB to form the Value Reporting Foundation

- As passive investors grow their AUM and active investors adopt sustainability strategies, the pressure for public companies to adhere to best ESG practices will continue to intensify

Other Key Developments

- ESG activism gained momentum with the launch of Engine No. 1, which initiated a campaign in early December against ExxonMobil and joins the ranks of other ESG-focused funds, such as Inclusive Capital Partners and Impactive Capital

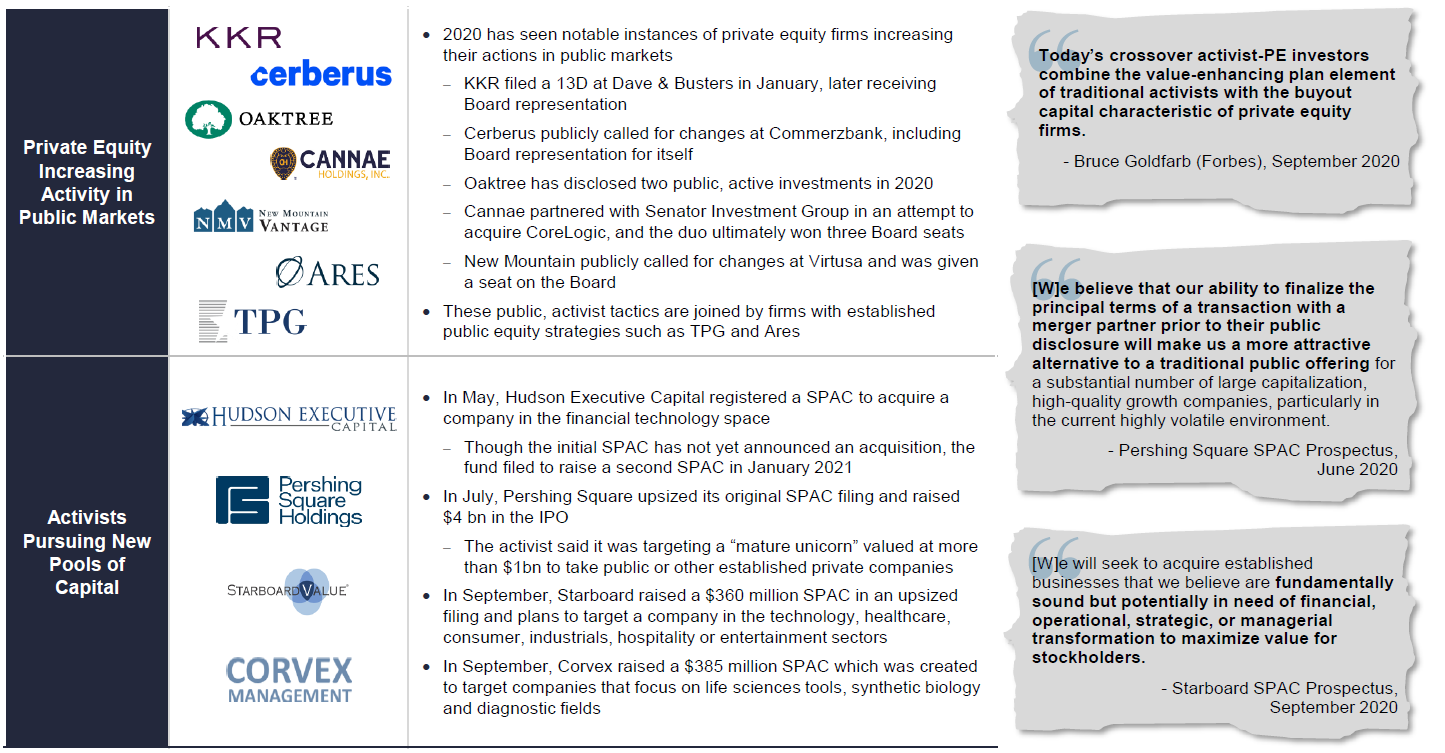

- Leading activists (e.g., Starboard, Pershing Square and Corvex) embraced the market’s strong appetite for SPACs in 2020 as a new source of funds; however, there has not yet been “spac-tivism,” i.e., using the SPACs for activist campaigns

- Private equity firms continue to use “activist-like” tactics at public companies, including Cannae partnering with Senator to force M&A at CoreLogic

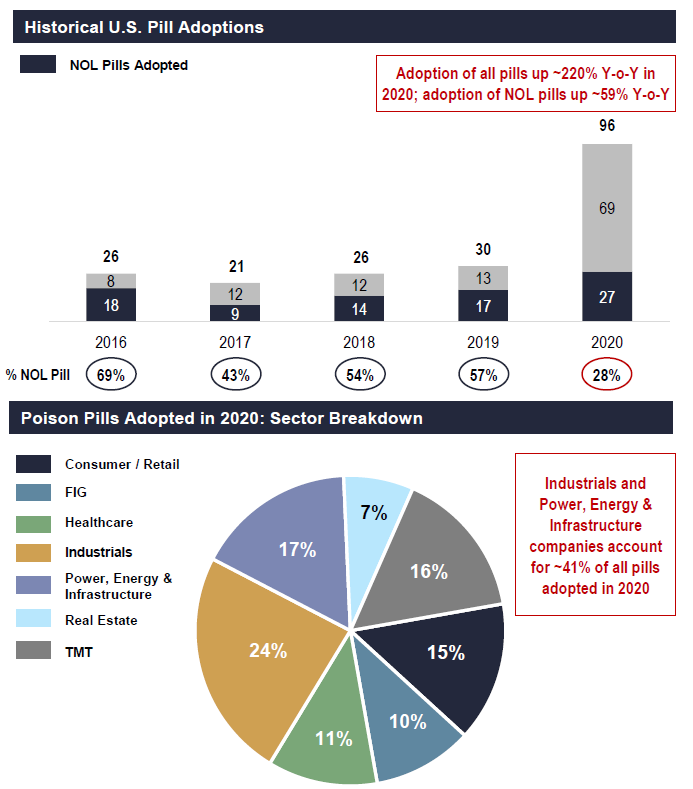

- Amid depressed equity prices during the pandemic, the adoption of poison pills surged in the U.S. with 96 adoptions in 2020 versus 30 in 2019

Global Activism Activity

Global Campaign Activity and Capital Deployed

($ in billions)

Source: FactSet, press reports and public filings.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn.

1 Companies spun off as part of campaign process counted separately.

2 Calculated as of campaign announcement date.

3 4-year average based on aggregate value of activist positions.

Global Activist Activity in 2020

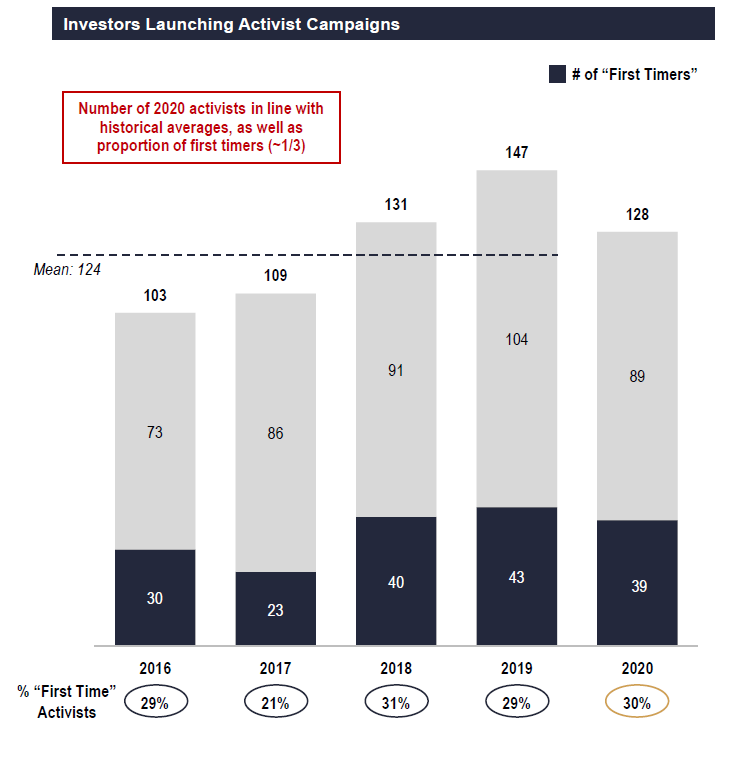

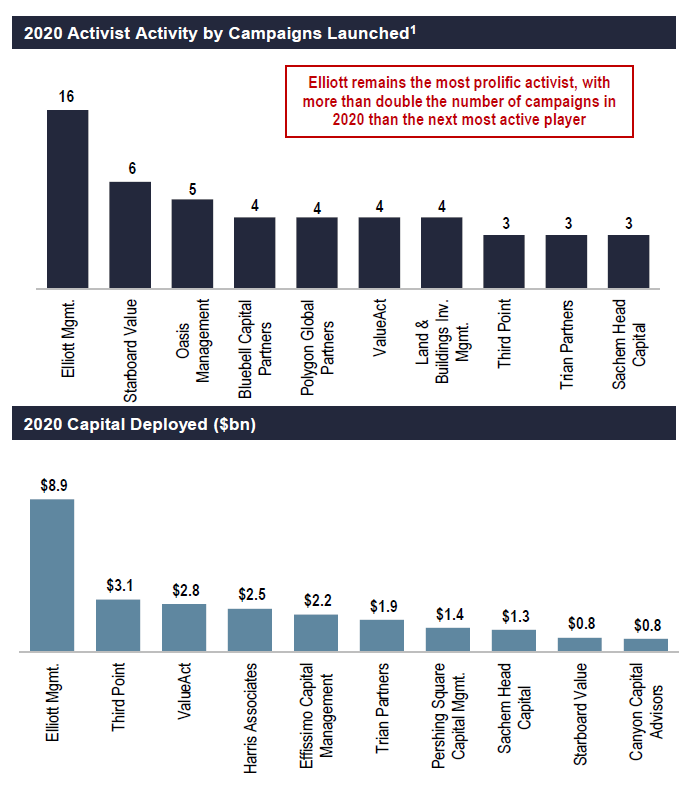

Although Elliott remains the most prolific in terms of activity and capital deployed, first time activists continued to represent a high proportion of new activity

Source: FactSet, press reports and public filings.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with

market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn.

1 Ranked secondarily on capital deployed in the event of a tie on campaigns launched.

Largest Activist Targets in 2020–U.S. and Rest of World

($ in billions)

Source: FactSet, press reports and public filings as of 12/31/2020.

1 Calculated as of campaign announcement date.

2 Estimated based on reported value of investment.

3 Represents aggregate ownership of Effissimo Capital Management (15.0%), 3D Investment Partners (2.4%) and Farallon Capital Management (5.4%).

U.S.: Campaign Activity and Capital Deployed

($ in billions)

Source: FactSet, press reports and public filings.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn.

1 Companies spun off as part of campaign process counted separately.

2 Calculated as of campaign announcement date.

3 4-year average based on aggregate value of activist positions.

U.S.: Notable 2020 Public Campaign Launches and Developments

($ in billions)

| Launch Date |

Company (Market Cap) | Activist | Highlights |

|---|---|---|---|

| 12/20 | Intel ($202.4) | Third Point |

|

| 12/20 | Public Storage (39.1) | Elliott |

|

| 12/20 | ExxonMobil (172.9) | Engine No. 1

CalSTRS D.E. Shaw & Co |

|

| 10/20 | The Walt Disney Company (222.1) | Third Point |

|

| 10/20 | Invesco (5.4)

Janus Henderson Group Plc (4.6) |

Trian Partners |

|

| 7/20 | Crown Castle (72.6)1 | Elliott

Land and Buildings |

|

| 2/20 | Twitter (25.8) | Elliott |

|

| 1/20 | Evergy (15.7) | Elliott |

|

Source: FactSet, press reports and public filings as of 12/31/2020.

1 Represents market cap as of Elliott initiation.

Europe: Campaign Activity

($ in billions)

The COVID crisis led to a dramatic reduction in new campaigns from April to September, but campaigns rebounded at the end of the year

Source: FactSet, press reports and public filings as of 12/31/2020.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn.

1 Companies spun off as part of campaign process counted separately.

Non-U.S.: Notable 2020 Public Campaign Launches and Developments

($ in billions)

| Launch Date |

Company (Market Cap) | Activist | Highlights |

|---|---|---|---|

| 11/20 | RioTinto (82.1) UK | Odey Asset Management |

|

| 11/20 | Sampo Group (24.5) Finland | Elliott |

|

| 10/20 | Unibail-Rodamco-Westfield SE (6.7) France | Aermont Capital

NJJ Holding |

|

| 6/20 | Toshiba (14.6) Japan | Effissimo Capital Management

3D Investment Partners |

|

| 4/20 | Nintendo (56.3) Japan | ValueAct Capital |

|

| 2/20 | Prudential (47.8) UK | Third Point |

|

| 2/20 | NN (13.9) UK | Elliott |

|

| 5/20 | SoftBank (89.8) Japan | Elliott |

|

Source: FactSet, press reports and public filings as of 12/31/2020.

Board Seats and M&A

2020 Global Board Seats Won

Although 2020 has seen subdued activist activity, Board seats won by activists remain in line with historical averages due to campaigns launched in 2019 resulting in Directorships in 2020

Source: FactSet, press reports and public filings as of 12/31/2020.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with

market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn.

1 Represents Board seats won by activists in respective year, regardless of the year in which the campaign was initiated.

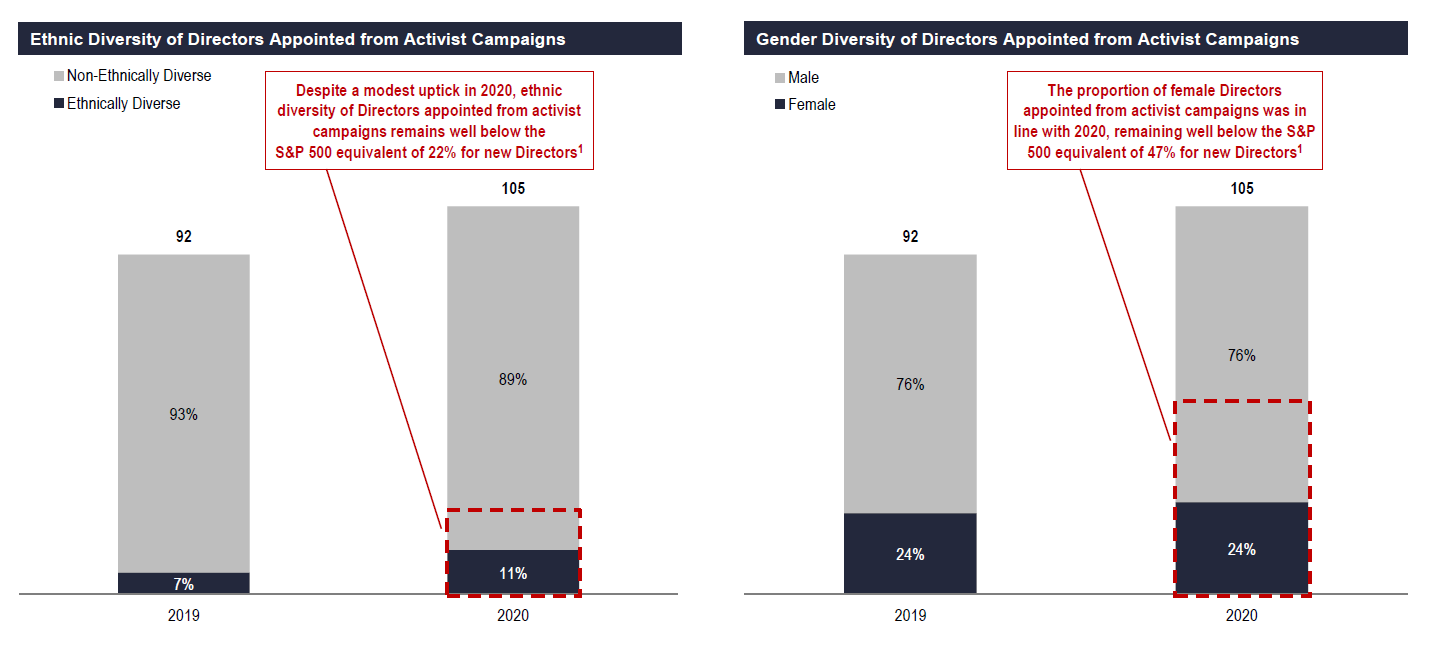

Profile of 2020 U.S. Activist Director Appointments

Despite recent initiatives to improve Board diversity, Directors added as a result of U.S. activism in 2020 were generally non-diverse

- Women comprised 24% of Directors appointed from activist campaigns, compared to 47% of new Directors in the S&P 500; 11% of Directors appointed from activist campaigns were ethnically diverse, versus 22% for new Directors in the S&P 500

Source: FactSet, BoardEx, 2020 Spencer Stuart Board Index, press reports and public filings as of 12/31/2020.

Note: All data is for campaigns conducted globally at companies with market capitalizations greater than $500 million at time of campaign announcement.

1 Based on Spencer Stuart data for 2020 proxy year (defined as 5/24/2019 – 5/20/2020).

Sustained Prominence of M&A-Related Campaigns

2020 saw a downtick in the proportion of M&A-related activist campaigns (41% relative to 47% in 2019) due to a slower M&A market in Q2; however, it nevertheless remained the most common campaign objective

Source: FactSet, press reports and public filings as of 12/31/2020.

ESG

Renewed Demands for Diversity and Inclusion at Public Companies

Throughout 2020, institutional investors, proxy advisors and other stakeholders have increased expectations for greater diversity at public companies and Boards

| Investor | BlackRock |

|

|---|---|---|

| State Street |

|

|

| Vanguard |

|

|

| Proxy Advisor | ISS |

|

| Glass Lewis |

|

|

| Exchange | Nasdaq |

|

| Government | State of California |

|

Source: Company websites, press reports and public filings.

1 Nasdaq specifically seeks to require that listed companies have at least one Director who self-identifies as female and one who self-identifies as either an underrepresented minority or

LGBTQ+.

Latest Efforts in Establishing Unified Sustainability Reporting Standards

The standardization of sustainability reporting frameworks across regulators, investors and corporates will dominate the 2021 agenda

- Collaboration initially announced in January 2020, released initial industry-agnostic framework in September

- Framework centered on four main pillars: Governance, People, Planet and Prosperity

- Involvement of the International Business Council of the WEF indicates strong corporate buy-in

- Metrics used draw from existing frameworks (SASB, TCFD, GRI, etc.)

- In September 2020, the above organizations announced a statement of intent on collaborating on a comprehensive corporate ESG reporting framework incorporating insights and standards from each organization

- Will emphasize “dynamic materiality”, or those sustainability topics that have broad, shifting impacts on broad stakeholder concerns and enterprise value creation

- In November, SASB and IIRC announced they were deepening their collaboration by merging into the Value Reporting Foundation, to provide investors and corporates with a framework combining SASB’s disclosure and IIRC’s integrated reporting frameworks

- In September 2020, IFAC stated it would push for a new sustainability standards board under the IFRS Foundation: the International Sustainability Standards Board (ISSB)

- Intends to leverage existing frameworks to develop global standards for ESG disclosures

- In October 2020, BlackRock released a white paper endorsing the IFAC approach and the formation of the ISSB to be the global standards-setter

- In February 2020, IOSCO (whose members regulate 95% of the world’s securities markets) announced it would establish a board-level task force to pursue a standardized global ESG disclosure framework

- IOSCO is concerned with three areas: the numerous extant sustainability frameworks, “lack of common definitions of sustainable activities” and “challenges to investor protection”, including

greenwashing

Source: Company websites, press reports and public filings.

Regulatory Expectations for ESG

The EU and the U.S. under the Biden administration will likely continue to push ESG objectives, including more transparent disclosures and encouraging sustainability-focused capital

- The Biden administration’s plan to rejoin the Paris Climate Accords may further spur the growth of sustainable investing strategies

U.S. Under the Biden Administration

Likely Priority ESG Regulatory Actions

- Clarify or reverse recently adopted rules that limit ERISA plans from considering funds that offer “non-pecuniary” benefits

- Revisit recently adopted changes affecting thresholds for shareholder proposal submission and re-submission1

- Establish clear rules to standardize how mutual funds describe their usage of ESG in the investment process

- Investigate and establish standardized ESG-related disclosures of material information related to topics such as climate change and diversity

U.S. ESG Disclosure Considerations

- SEC-mandated ESG disclosures are likely to rely heavily on the recommendations of the Investor-as-Owner Subcommittee of the SEC Investor Advisory Committee from May 2020:

- Develop “principles-based” mandatory disclosures around material ESG issues that are applicable to issuers regardless of size

- Rely on existing frameworks like GRI, SASB and TCFD

- Required disclosures should include forward-looking analysis to the extent applicable, drawing on precedent disclosures such as for MD&A

- In her 11/5 PLI keynote, SEC Commissioner Allison Herren Lee noted the need for standardized disclosures related to climate change to “protect investors, facilitate capital formation, and maintain fair, orderly and efficient markets”

- Financial companies may potentially face requirements to disclose climate change-related risks associated with their financing of fossil fuel companies

- Mapping of climate and ESG risks to existing GAAP standards is also a potential consideration

EU Taxonomy

- The EU Taxonomy has been established to provide companies, financial institutions and investors with a common language to identify to what degree economic activities can be considered “environmentally sustainable” as part of the EU’s broader Green Deal and aims to encourage increased capital flows towards sustainable objectives

- It focuses on performance thresholds for six key environmental objectives2 with sustainable economic activity required to substantially contribute to at least one of these without harming any others

- The regulation applies to asset managers with a financial product that either has environmental sustainability as its objective or promotes environmental aspects; EU member states; and certain large companies, but it will also have follow on demands for other financial market participants and other issuers seeking to attract sustainability focused capital and is expected to drive broader market expectations of disclosure

- Disclosure requirements relating to the climate change mitigation and adaptation objectives will be in application from January 1, 2022, and the requirements for all other environment-related objectives from January 1, 2023

- Social and governance objectives are expected to be proposed as additions to the existing framework in the coming year

Source: Press reports, public filings and EU Commission.

1 Under the new rules, an investor must own at least $25,000 worth of stock for one year to be able to propose a resolution, or $15,000 for two years, or $2,000 for three or more years (prior, the rules required ownership of at least $2,000 for a year or more). For resubmission, a proposal must secure at least 5% support in the first year, and then 15% and 25% in subsequent years, up from 3%, 6% and 10%.

2 Climate change mitigation; climate change adaptation; sustainable use and protection of water and marine resources; transition to a circular economy; pollution prevention and control; and protection and restoration of biodiversity and ecosystems.

Other Key Developments

Intersection of ESG and Shareholder Activism

The rise in the launch of ESG-related funds and campaigns focused on sustainability issues enables activists to improve perceived ESG weaknesses in businesses but also bolster fundraising by branding themselves as forward-thinking and socially conscious

- This trend is likely to continue as more limited partners intensify their focus on allocating capital in a way that betters society

Selected Recently Launched Funds

| Engine No. 1 |

|

|---|---|

| Inclusive Capital Partners |

|

| Impactive Capital |

|

Selected Recent ESG-Focused Initiatives

| Solvay Bluebell Capital Partners |

|

|---|---|

| ExxonMobil Engine No. 1 CalSTRS |

|

| Strategic Education, Inc. Inclusive Capital Partners |

|

| Canadian National Railway Canadian Pacific Railway TCI Fund Management |

|

| Berry Canyon Partners, LLC |

|

Source: Company websites, press reports, public filings and Morningstar.

New Developments in Activism

The activism environment continues to evolve as private equity firms adopt more aggressive public postures and activist hedge funds take advantage of SPACs as a new source of capital

- “Spac-tivism” did not take place in 2020 but may emerge in 2021

Source: Press reports, Activist Insight, Activist Monitor.

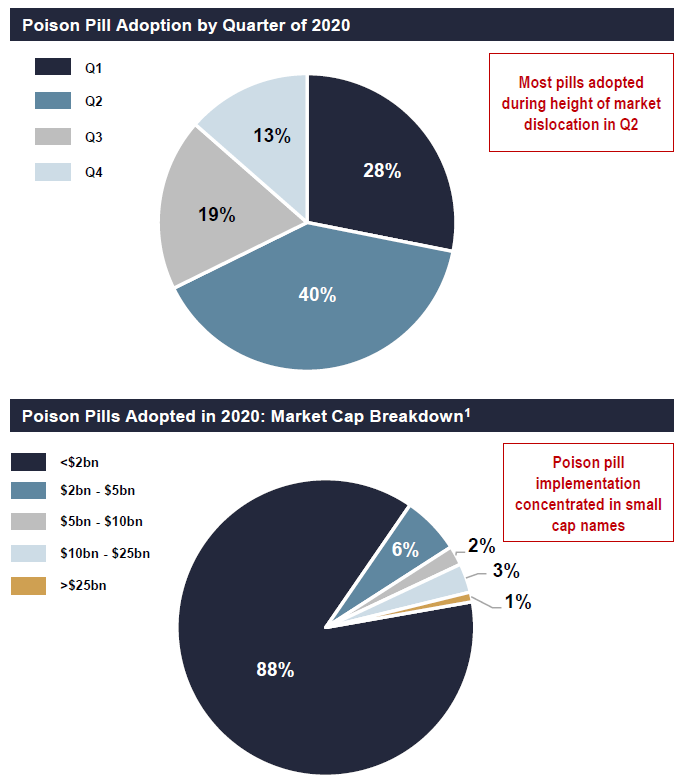

Resurgence of Poison Pills

Poison pills staged a return in 2020 amid severe market dislocation, with the number of pills implemented significantly exceeding prior year figures

Source: FactSet.

1 Market cap data as of the date of poison pill adoption.

Key Questions for Activism in 2021 and Beyond

- Does the Q4 snap back in activity portend record campaign volume in 2021?

- How will the regulatory focus of the Biden administration affect the shareholder landscape?

- Will ESG-focused campaigns generate alpha or just attention?

- How will activists react to lofty equity valuations?

- Will a standardized ESG reporting framework become universally accepted in 2021?

- Will the U.S.’s share of activism recover?

- How will activists react to lofty equity valuations?

- Will recently introduced diversity initiatives prove to be effective at the Board level in 2021?

- Will buybacks and dividends return in 2021?

The complete publication, including footnotes, is available here.

Print

Print