Maria Castañón Moats is a Leader and Paul DeNicola is a Principal at the Governance Insights Center, PricewaterhouseCoopers LLP. This post is based on their PwC memorandum.

Key Findings

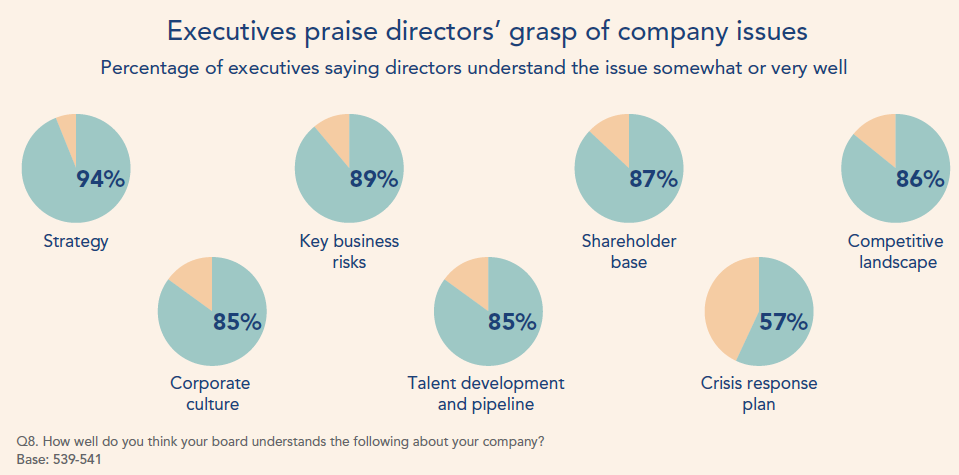

- Executives say that directors have a deep understanding of the company. Roughly 9 out of 10 executives say their board understands the company’s strategy, key business risks, competitive landscape, culture, shareholders, and talent development and pipeline.

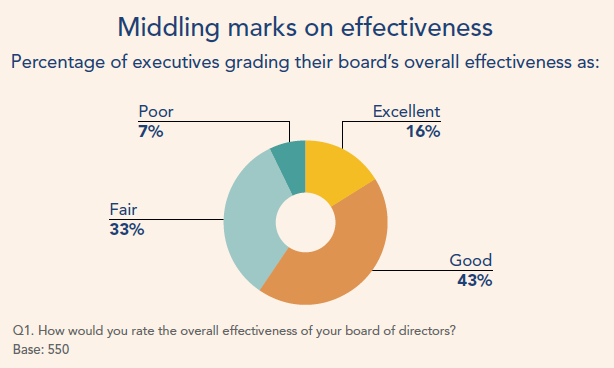

- Yet almost half of executives think the board falls short in overall effectiveness. 40% say their boards are doing a fair or poor job overall.

- But views are not consistent across the C-suite. 74% of IT executives view board performance as fair or poor, compared to just 25% of CEOs and CFOs.

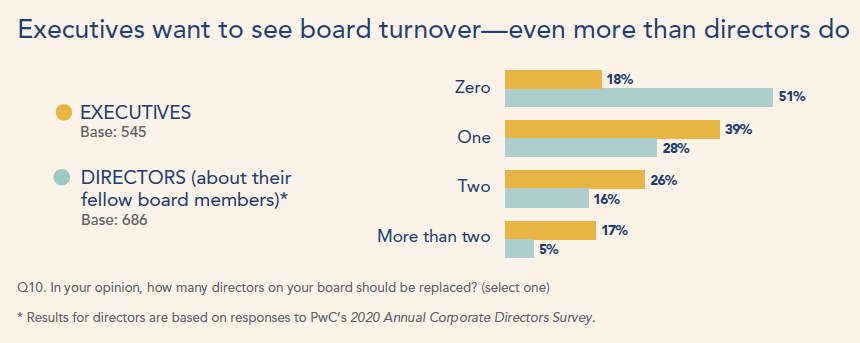

- Executives want director turnover. 82% of executives think that at least one member of their company’s board should be replaced. 43% think two or more directors should go.

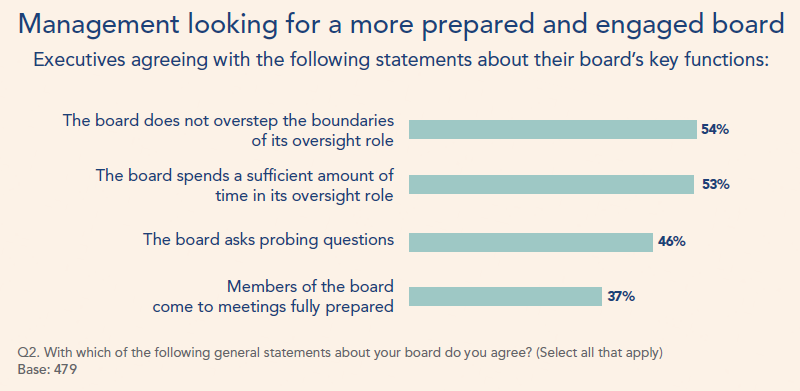

- Director preparedness falls short. Only 37% of executives say their board comes to meetings fully prepared.

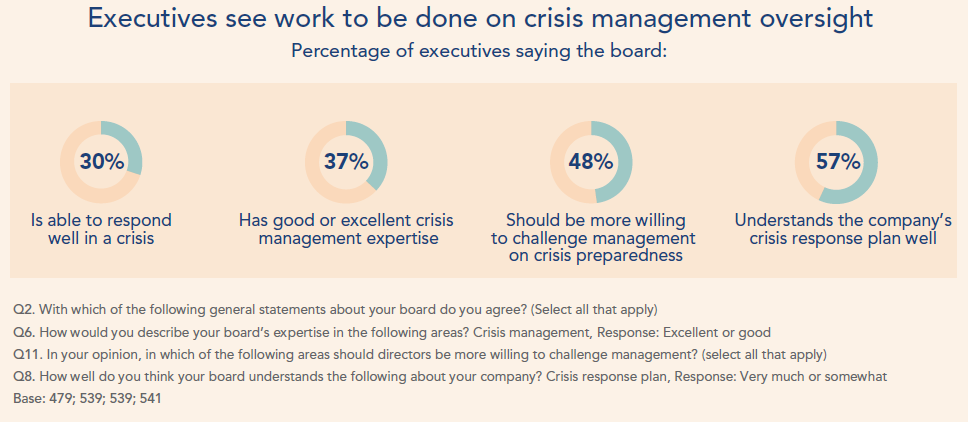

- The COVID-19 pandemic put a special spotlight on issues with crisis management oversight. Only 30% of executives say their board is able to respond well in a crisis.

- Management wants boards to be more engaged, not less. Only 9% of executives say the board oversteps its oversight authority, while many more think the board should be more willing to challenge management in areas like crisis preparedness (48%) and risk management (37%).

Introduction: Executives Want More from Their Boards

For almost two decades, PwC’s Annual Corporate Directors Survey has compiled board members’ views on governance, their own performance, the performance of their peers, and the performance of their management teams. For 2020, PwC has joined with The Conference Board to turn the spotlight on management’s views. We surveyed over 550 public company C-suite executives to gather their opinions about the performance of their company’s board of directors. And the results surprised us.

Because of the nature of the board’s oversight role, management typically has very little opportunity to give “upward feedback” to its directors. The survey results give us a glimpse from their perspective. And what they see is a gap between, on one hand, the deep understanding directors have of the company, and on the other, their board’s effectiveness. By and large, executives say that directors “get it”—they understand not just the company’s strategy and business risks, but also its shareholder base, competitive landscape, corporate culture, and talent pipeline. That’s impressive, but from the perspective of many executives, it’s not enough.

Sixty percent (60%) of executives give their board a positive rating of good or excellent on overall effectiveness. They identify concerns including directors’ lack of preparedness, overboarding, and aging board members who are not as effective as they once were. While they give boards high marks in areas such as financial and operational expertise, they also find certain expertise is missing. This is especially true in specialized areas like IT, ESG, and crisis management. And not surprisingly, management wants to see board refreshment. More than 4 out of 5 executives think that at least one director on the board needs to be replaced.

Boards are, and should remain, largely independent from management. They are not directly accountable to their executive teams and should not be afraid of acting in ways that displease them. But the findings from this survey point to some of the ways in which boards, and their management teams, can work to enhance both substance and perception of board performance. With a view into C-suite opinions, these findings may also help investors refine their future engagements with boards and management teams.

Understanding and Working with the Company

Directors are in sync with company challenges and goals

From their seat in the boardroom, it can be a challenge for directors to fully grasp the day-to-day at a company. Directors are not present at the company every day and are there to provide oversight, not management. Yet executives praise their directors’ understanding of the company and the way it operates.

More than 9 out of 10 executives (94%) say that the board understands the company strategy somewhat or very well. Eighty-nine percent (89%) say the same about the company’s key business risks, and between 85% and 87% of executives think the board has a good understanding of the shareholder base, competitive landscape, culture, and talent development and pipeline. Many of these are areas that have received special attention in recent years, as boards have pushed for more reporting and a better understanding of internal operations. That work has paid dividends.

But as discussed further later in this post, the area of the company executives believe that directors understand the least is its crisis response plan. This may have been influenced by the backdrop of the COVID-19 pandemic. About three-quarters (73%) of executives The Conference Board surveyed separately said that their crisis management plans were also inadequate to the challenges of the time. [1] This highlights an area for additional attention from both boards and management going forward, so that boards can evaluate whether the right issues are being elevated at the right time. Boards need to be able to judge whether the company was prepared for a crisis before it happened, whether the right people were involved, and whether the response was effective.

Board Performance

Executives say boards miss the mark on overall effectiveness

As discussed later in this post, according to management, directors have a good grasp of what’s going on at the company. And while a majority rate their board’s overall effectiveness as good (43%) or excellent (16%), a surprising percentage give a grade of fair (33%) or poor (7%). Where is the disconnect between management’s views of the board’s understanding and its perception of board performance?

This gap may be linked to some of the complaints we heard from executives, including unprepared or overburdened board members and disappointing levels of expertise in many areas. The latter may be especially true when it comes to IT. Executives in IT roles were the most critical of board members, with almost three-quarters (74%) giving the board a grade of fair or poor, compared to just 25% from the office of the CEO or CFO giving similar assessments. Yet since executives in this area may have more limited interaction with the board, it could also reflect a lack of understanding about the board’s role and directors’ general oversight function.

According to the C-suite, directors are not doing their homework

The job of a director is a challenging one. It requires oversight without micromanagement, perspective without the daily details. Directors are not involved in everyday details, but are expected to have a strong understanding of the entire company. They rely heavily on their management teams to help them do their jobs.

When asked about directors’ overall engagement and preparation, management sees room for improvement. A slight majority say that the board is not overstepping its role and is spending sufficient time in its role (54% and 53%, respectively). But fewer (46%) see probing questions from the board, and only 37% say that members of the board come to meetings fully prepared. Among executives in IT roles, only 7% think their board members are prepared.

The global COVID-19 pandemic and related economic crisis may have contributed to this perception. The crises companies have faced have led to an increased volume of board reporting and materials, and directors may have been asked to address topics relating to employee and customer health and safety that had not previously been a focus of board attention. [2]

Board Composition

More than 80% of executives think a member of their board should be replaced

In PwC’s 2020 Annual Corporate Directors Survey, almost half of directors (49%) said that one or more of their fellow board members should be replaced. This figure indicates that directors themselves see the need for turnover on boards.

Even more executives are looking for change. Eighty-two percent (82%) of executives say that at least one director on their board should be replaced. Forty-three percent (43%) think that two or more board members should go, compared to 21% of directors.

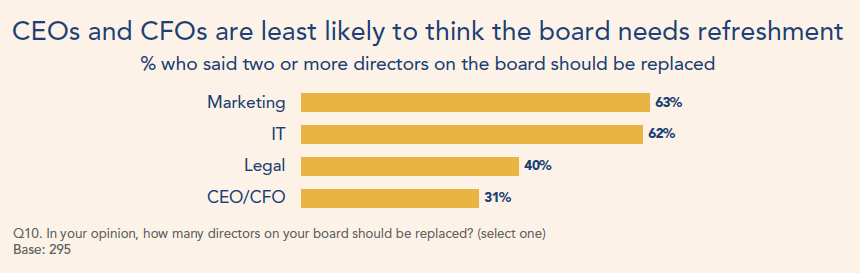

By comparison, the average turnover on S&P 500 and Russell 3000 boards is less than one director per year. [3] There is a gap between how boards and management perceive the performance of individual directors—with management seeing more room for improvement. While the desire for board turnover is most pronounced among members of management who may have relatively limited interaction with boards, it is notable that 31% of CEOs and CFOs and 40% of Chief Legal Officers support replacing two or more directors.

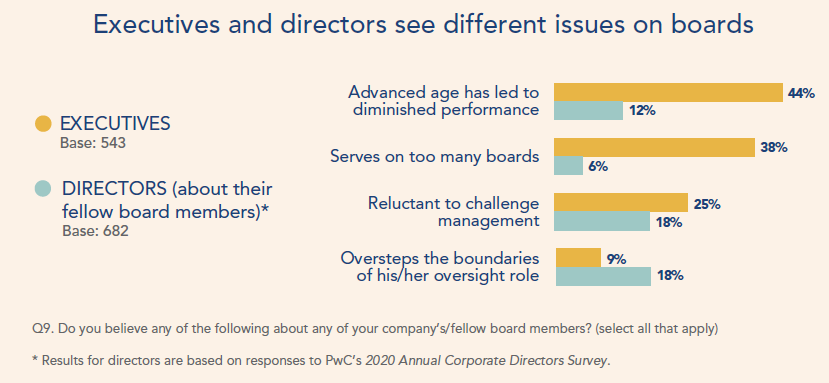

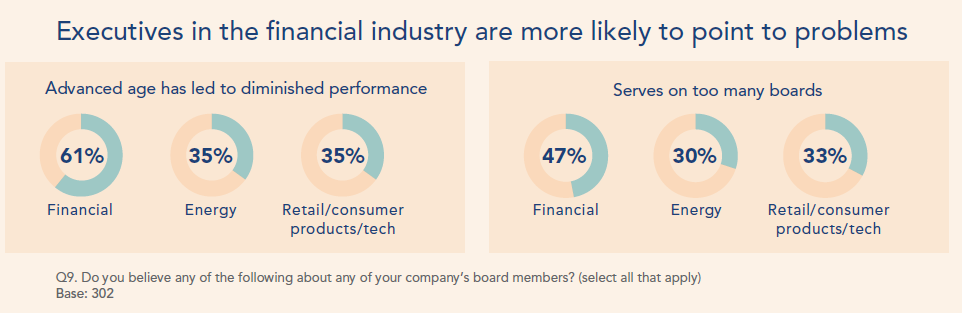

Executives concerned about director age and bandwidth

A number of executives express concern about their directors’ ability to contribute to boardroom deliberations. Forty-four percent (44%) of executives say diminished performance due to director age is an issue on their board—something that directors do not see as a particular problem. Thirty-eight percent (38%) say that directors serve on too many boards. That is consistent with shareholder concerns about overboarding, even as relatively few directors say they see overboarding as an issue among their peers. [4]

On the other hand, executives are less likely than directors to think that board members overstep their oversight authority. It’s among the most common complaints from directors (18%), but only 9% of executives identify it as a problem. They are more likely to say that their board is reluctant to challenge management (25% versus 18% of directors). In particular, executives say that the board should be more willing to challenge management on its crisis preparedness. As further discussed later in this post, crisis management stands out as a particular area of concern with board oversight.

Management questions directors’ expertise

Director recruitment is often driven by the need for certain skills, experiences, and expertise. Directors often view themselves and their peers as experts in certain areas. This mix helps to create a well-rounded and high-functioning board.

But executives aren’t convinced of their board members’ subject matter expertise. They gave the highest marks in operations and finance, with nearly two-thirds of executives saying the board’s expertise is good or excellent (65% and 63% respectively).

In other areas, however, the numbers were lower. Less than half ranked director expertise as good or excellent in areas like IT/digital/data privacy (48%), ESG (47%), and cyber risk (46%). Crisis management expertise is also a particular area of concern, with only 37% of executives giving a positive score to their directors’ level of expertise.

Board Diversity

Finding common ground on board diversity

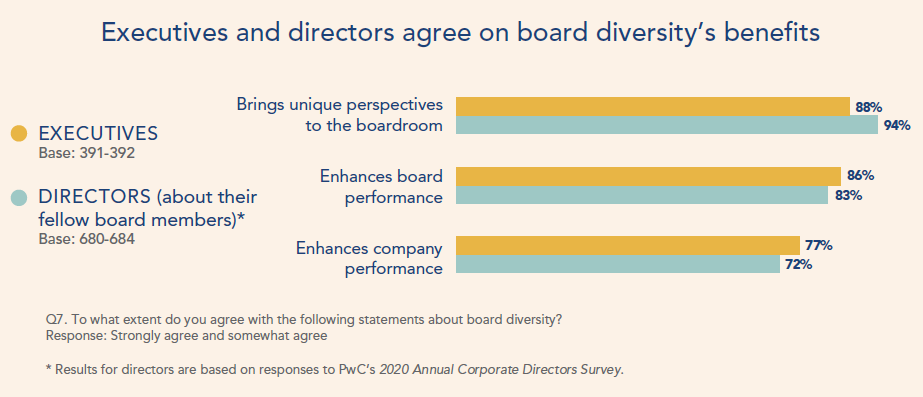

For years, as institutional investors have pushed boards to consider and improve their board diversity, directors themselves have reported seeing the value of that diversity. The vast majority of them say that board diversity brings unique perspectives to the

boardroom and that it enhances board performance. [5]

Executives’ views of board diversity are similar. Eighty-eight percent (88%) of executives say that board diversity brings unique perspectives to the boardroom, and 86% agree that it enhances board performance. Executives are even more likely to say that diversity improves the board’s strategy and risk oversight (83%) compared to 71% of board members. [6] And they are also slightly more likely to say that diversity enhances company performance, with 77% of executives agreeing (compared to 72% of board members). [7]

As boards have worked hard to diversify, they can be encouraged that executives see some of the same benefits that directors and investors see.

Crisis Management

C-suite concerns with crisis management oversight

Amid the continuing COVID-19 pandemic and its economic impact, executives say their boards are not measuring up on crisis management oversight. But management is also critical of its own plans. About three-quarters (73%) of senior legal, governance, and investor relations executives surveyed said that their crisis management plans were not adequate, and over half (53%) of the companies did not include key functions—such as HR—in their executive-level crisis management teams. [8]

As the crisis hit in 2020, companies struggled to contain the impact on their employees, customers, and supply chain—and on their bottom lines—putting crisis management plans to the test. Managing a crisis day-to-day falls to management. But the board plays an important role as well.

As an area of board oversight, the C-suite finds crisis management lacking. It’s the oversight area that executives say directors understand the least, with only 57% giving directors a positive rating. Only 37% of executives said the board has good or excellent crisis management expertise—the lowest figure in any category of expertise. Almost half (48%) say that crisis preparedness is an area where directors need to challenge management more, making it the number one response. Moreover, less than one-third of executives (30%) say their boards respond well in a crisis.

With the pandemic highlighting gaps in crisis management at both the board and management levels, companies cannot waste this opportunity to learn from their crisis response and to be better prepared for when the next crisis hits.

Finding a Better Way Forward

Confident that their boards understand the company’s business, executives are viewing the board as a strategic resource—and they want more from their directors. More expertise, more preparation, and more engagement in critical areas. Some tips for directors—and management—to help boards meet that challenge:

Board performance evaluations

Directors: Reassess the board and committee self-evaluation processes, including considering the best way to receive input from management on how the board as a whole is adding value, and areas they may need to improve in or spend more (or less) time on.

Management: As part of the board evaluation process, seek feedback from directors on how agenda, materials, and presentations could be improved, so that you can make it easier for the board to fully engage.

Board education

Directors: Keep up the good work by continuing to stay on top of key company issues in the boardroom. But take advantage of other opportunities to deepen your understanding of more specialized topics outside meetings. Contact management in advance of a meeting if the material you’ve received assumes knowledge you don’t have or uses terms that are unfamiliar, or if you want to have a deeper conversation with management or a company consultant.

Management: Ensure that the board has the right baseline information to be effective. Directors are not living these issues every day and don’t need to be subject matter experts in every area, but they may benefit from educational sessions from management and from outside advisers. Make sure that executives with specialized expertise can speak effectively to the board in terms that an educated layperson can understand.

Directors and management: Work together to increase interaction and elevate board transparency, as seen from those in the C-suite. Ensure that members of the executive management team have more insight into board operations—how the board functions and why—so management can provide the support the board needs.

The complete publication, including appendix, is available here.

Endnotes

1Rusty O’Kelley, Paul Rodel, Matteo Tonello, and Paul Washington, Corporate Governance Challenges in the COVID-19 Crisis, The Conference Board, May 2020.(go back)

2For similar findings, also see Corporate Governance Challenges in the COVID-19 Crisis, The Conference Board, May 2020.(go back)

3Matteo Tonello, Corporate Board Practices in the Russell 3000 and S&P 500: 2020 Edition, The Conference Board/ESGAUGE, October 2020.(go back)

4PwC, 2020 Annual Corporate Directors Survey, September 2020.(go back)

5Ibid.(go back)

6Ibid.(go back)

7Ibid.(go back)

Corporate Governance Challenges in the COVID-19 Crisis, The Conference Board, May 2020. Over 28% of companies do not have a C-suite-level crisis management team. Of those that do, only 47% include members of HR and only 34% include the risk management function. Print

Print