Sandra Boss is Global Head of Investment Stewardship and Michelle Edkins is Managing Director of Investment Stewardship. This post is based on a BlackRock Investment Stewardship memorandum by Ms. Boss, Ms. Edkins, Giovanni Barbi, Victoria Gaytan, Hilary Novik-Sandberg, and Ariel Smilowitz.

BlackRock Investment Stewardship (BIS) undertakes all investment stewardship engagements and proxy voting with the goal of advancing the economic interests of our clients, who have entrusted us with their assets to help them meet their long-term financial goals. Our conviction is that companies perform better when they are deliberate about their role in society and act in the interests of their employees, customers, communities and their shareholders. We use our voice as a shareholder to urge companies to focus on important issues, like climate change, the fair treatment of workers, and racial and gender equality, as we believe that leads to durable corporate profitability.

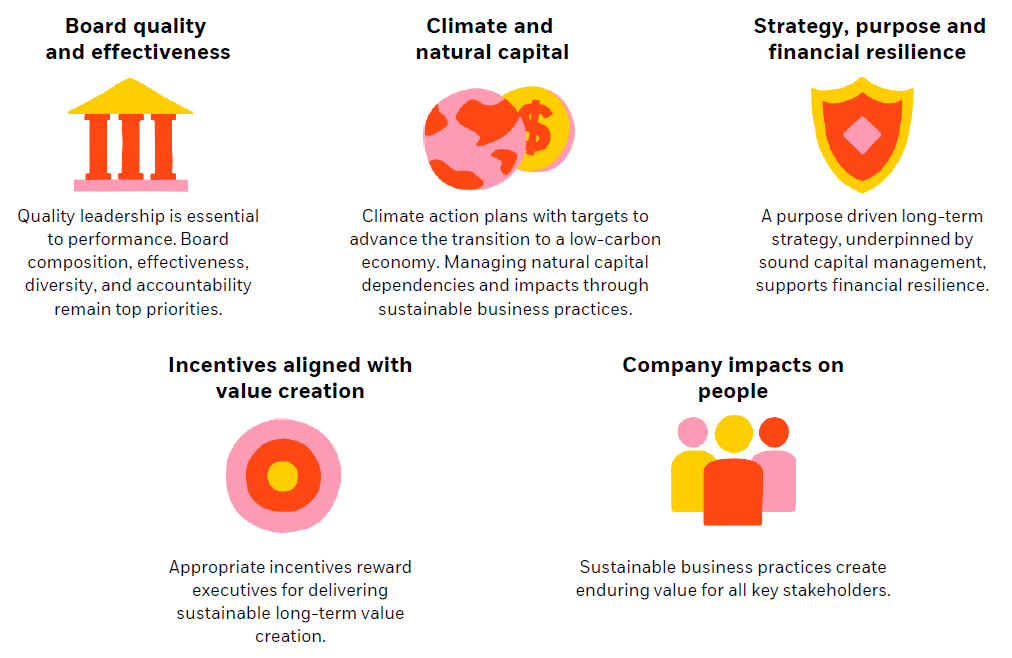

2021 Priorities

Engagement is core to our stewardship efforts as it enables us to provide feedback to companies and build mutual understanding about corporate governance and sustainable business practices. Each year, we set engagement priorities to focus our work on the governance and sustainability issues we consider to be top of mind for companies and our clients as shareholders. We believe an intensified focus on these issues advances practices and contributes to companies’ ability to deliver the sustainable long-term financial performance on which our clients depend.

As we flagged in Our 2021 Stewardship Expectations, our priorities build on themes that we have focused on for the past several years. We hope that by explaining our areas of focus, company boards and management are better able to assess gaps in their practices and whether they might need to engage with BIS. The priorities provide clients with insight into how we are conducting engagement and voting activities on their behalf. Some issues have long been core components of BIS’ work. Other issues have become priorities more recently, driven by our observations of emerging risks and opportunities for companies, market developments, and changing client and societal expectations.

In 2021, our priorities reflect our continuing emphasis on board effectiveness alongside the impact of sustainability-related factors on a company’s ability to generate long-term financial returns. We have mapped our priorities to specific United Nations Sustainable Development Goals, such as Gender Equality and Clean and Affordable Energy, and provided high level, globally relevant Key Performance Indicators (KPIs) for each priority so companies are aware of our expectations.

Where we believe a company is not adequately addressing a key business risk or opportunity, or is not responsive to shareholders, our most common course of action is to hold the responsible members of the board accountable by voting against their re-election.

Board quality and effectiveness

Board composition, effectiveness, and accountability remain a top priority. In our experience, most governance issues, including how material sustainability issues are managed, require effective board leadership and oversight. We encourage companies to establish shareholder engagement protocols that foster constructive and meaningful dialogue, including with independent directors when an engagement addresses board practices and oversight. As we believe that high quality boards provide a competitive advantage, we seek to understand how boards assess their effectiveness and individual director performance, and determine the skills and expertise needed to guide a company in delivering its long-term strategy. To that end, we expect companies to disclose the board’s approach to director responsibilities and commitments, turnover, succession planning, and diversity. Boards should demonstrate that they have the capability and capacity to support and advise management not only in times of business as usual but in times of crisis, such as when a company experiences significant operating events, macroeconomic or geopolitical shocks, sudden departures of senior executives, or a challenge from a shareholder activist. Boards are often required to be actively involved in responding to crisis situations given the potential adverse impacts on company performance, which may require a significant additional time commitment by directors.

We expect boards to include directors with diverse personal and professional experiences to support comprehensive and constructive dialogue on board matters. In identifying potential candidates, boards should consider the full breadth of diversity, including personal factors such as gender, race, ethnicity, and age, as well as professional characteristics such as a director’s industry experience, areas of specialist expertise, and market knowledge. We encourage boards to disclose their approach, actions, and progress towards achieving diverse representation, including the demographic profile of the incumbent board. Where we consider a board to be insufficiently diverse, we may vote against directors on the nominating and governance committee or equivalent for an apparent lack of commitment to board effectiveness.

Finally, we encourage governance structures that enhance board accountability (e.g. proxy access in the United States) and limit entrenchment (e.g. regular election of directors and board evaluations).

- Board effectiveness KPI – BIS seeks to understand how, and how effectively, a board oversees and advises management. A core component of BIS’ evaluation is direct engagement with a board member. For those companies with which we seek to engage, we expect to have access to a non-executive, and preferably independent, director(s) who has been identified as being accessible to shareholders where appropriate.

- Board diversity KPI – BIS expects companies to disclose their approach to ensuring appropriate board diversity and, in those markets where we consider demographic diversity a priority, a demographic profile of the incumbent board.

Climate and natural capital

We have engaged with companies on environmental risk and opportunity for several years. Each year we build on our expectations of companies as we seek to understand how they are mitigating climate-related risks and implementing plans to transition to a low-carbon economy. Climate risk presents significant investment risk—it carries financial impacts that will reverberate across all industries and global markets, affecting long-term shareholder returns, as well as economic stability.

We expect companies to have clear policies and action plans to manage climate risk and realize opportunities presented by the global energy transition. Investors and other stakeholders will look at companies’ disclosures to analyze how climate risk is integrated into their long-term strategies and evaluate their preparedness for a transition to a low-carbon economy.

In addition, the consideration of climate-related risks necessitates that companies consider their impact and dependence on natural capital, i.e. the supply of the world’s natural resources from which economic value and benefits can be derived. The management of these factors can be a defining feature in companies’ ability to generate long-term sustainable value for shareholders. All companies rely on natural capital in some way and, as the world transitions to a low-carbon economy, we ask companies to demonstrate how they are minimizing their negative impacts on, and ideally enhancing the stock of, the natural capital on which their long-term financial performance depends. Companies should consider their reliance and impact on natural capital as integral to their operations, and their responsible use of these resources as interdependent to their license to operate.

- Climate KPI – We expect companies to articulate how they are aligned to a scenario in which global warming is limited to well below 2° C, consistent with a global aspiration [1] to reach net zero greenhouse gas (GHG) emissions by 2050. Companies should provide disclosures aligned with the four pillars of the TCFD framework, including scope 1 and scope 2 emissions, along with accompanying GHG emissions reduction targets. Carbon-intensive companies should also disclose scope 3 emissions.

- Natural capital KPI – We encourage companies to disclose how their business practices are consistent with the sustainable use and management of natural capital, including natural resources such as air, water, land, minerals and forests. These disclosures should address companies’ impact in the communities in which they operate. Companies with material dependencies or impacts on natural habitats should publish “no–deforestation” policies and strategies on biodiversity.

Strategy, purpose, and financial resilience

For several years we have asked companies to articulate their strategic frameworks for long-term value creation and to affirm that their boards have reviewed those plans. Investors expect the board to be fully engaged with management on the development and implementation of strategy, particularly when a company needs to enhance its competitiveness or pivot in response to unanticipated developments. This demonstrates to investors that boards are engaged and prepared to support management, when necessary, to transition and adapt in a fast-moving business environment.

Corporate strategy disclosures should clearly explain a company’s purpose, i.e. what it does every day to create value for its stakeholders. We believe that companies with a clearly articulated purpose that is reflected in their long-term strategy are more likely to have engaged employees, loyal customers, and support from other key stakeholders. This gives a company a competitive advantage and a stronger foundation for generating superior financial returns.

Companies should succinctly explain their long-term strategic goals, the applicable measures of value creation, milestones that will demonstrate progress, and steps taken in response to challenges.

This explanation should include a company’s approach to managing financial resilience and how a changing business environment might affect how a company prioritizes its capital allocation, including capital investments, research and development, technological adaptation, employee development, and capital return to shareholders, i.e. dividend, buy-back, or other return opportunities.

- KPI – In explaining their long-term strategy and financial resilience, companies should set out how they have integrated business relevant sustainability risks and opportunities. Companies should demonstrate long-term value creation, evidenced by metrics relevant to their business model. BIS encourages companies to report in line with the sector-specific metrics issued by the Sustainability Accounting Standards Board (SASB) to support their explanations of how they have considered key stakeholders’ interests in their business decision-making.

Incentives aligned with value creation

We expect boards to establish incentive structures and determine pay outcomes in the context of a company’s long-term strategy and its implementation. We believe that compensation policies should incentivize executives to deliver on strategic and operational objectives that contribute to sustainable long-term value creation. In general, we expect a meaningful portion of executive pay to be tied to the long-term returns of the company, as opposed to short-term increases in the stock price. The metrics used to trigger payments under incentive plans should be explained and justified in the context of a company’s business model and sector. Companies should explain and justify pay outcomes, paying particular attention when pay may seem to be misaligned with performance. We would normally seek to engage with independent directors if a company’s published explanations fail to address our concerns.

Context is a factor in our assessment of pay outcomes. Increasingly, we expect boards will be asked to explain the extent to which internal pay equity, the likely reactions of key stakeholders, and broader macroeconomic conditions are taken into consideration when setting pay. We believe that companies should use appropriately benchmarked peer groups to maintain an awareness of peer pay levels and practices so that pay is market competitive, while mitigating potential ratcheting of pay that is disconnected from actual performance.

We may vote against the election of compensation committee members in instances, including but not limited to, where a company has not demonstrated the connection between strategy, long-term shareholder value creation, and incentive plan design.

- KPI – Incentives should be aligned with performance and value creation and outcomes correlated with business-relevant long-term performance metrics, such as 3-5-year total shareholder returns or returns on invested capital.

Company impacts on people

We believe that BlackRock’s clients, as shareholders, will benefit if companies create enduring sustainable value for all stakeholders. [2] While stakeholder groups may vary across industries, they are likely to include employees; business partners (such as suppliers and distributors); clients and consumers; government and regulators; and the communities in which companies operate. In our experience, companies that build strong relationships with their stakeholders are more likely to meet their own strategic objectives, while poor relationships may create adverse impacts that expose a company to legal, regulatory, operational, and reputational risks and jeopardize their social license to operate.

BIS seeks to understand how companies are making prudent decisions that benefit the stakeholders on which they depend. We expect companies to:

- Report on how they have identified their key stakeholders and considered their interests in business decision-making

- Implement processes to identify, manage, and prevent adverse impacts to people, and to provide robust disclosures on these practices

We have engaged with companies on human capital management for several years to understand how boards and management support a diverse and engaged workforce. Specifically, we advocate for improved disclosures on a company’s key human capital priorities—referring to SASB’s industry-specific human capital metrics, regional frameworks like the US Equal Employment Opportunity Commission’s EEO-1 Survey, and international guidance on responsible business conduct from organizations such as the United Nations and the Organization for Economic Cooperation and Development (OECD). We also encourage business practices that foster a diverse, equitable, and inclusive workforce culture; enhance job quality and employee engagement; facilitate positive labor relations, safe working conditions, and attractive wages; and prioritize human rights.

In addition to addressing workforce needs and expectations, we expect companies to mitigate adverse impacts to people that could arise from their business practices, exposing them to material risks. Failure to address these risks can reverberate across a company’s value chain, which may affect critical relationships with key stakeholders and impact shareholder value. Specifically, we ask that companies put in place the appropriate board oversight, due diligence processes (e.g. human rights risk assessments, supply chain tracing, recruitment procedures, and auditing and grievance mechanisms, etc.), and remediation efforts, and communicate externally on their performance.

This year, we are prioritizing engagement with companies whose business practices have breached international norms set forth by the UN Guiding Principles on Business and Human Rights (UNGPs) and the OECD Guidelines for Multinational Enterprises. In particular, we are engaging with companies that have experienced severe social controversies to assess their board oversight, due diligence, and remediation efforts.

KPIs:

- We expect that companies demonstrate a robust approach to human capital management and provide shareholders with the necessary information to understand how it aligns with their stated strategy and business model.

- Companies should disclose actions they are taking to support a diverse and engaged workforce and, in those markets where we consider demographic diversity a priority, a demographic profile of its workforce.

- We ask that companies provide evidence of board oversight, due diligence, and remediation of adverse impacts to people arising from their business practices.

Engagement in practice

BIS engages with portfolio companies to encourage corporate governance and business practices aligned with sustainable long-term financial performance. The team of more than 50 professionals across the world (with team members in New York, San Francisco, London, Amsterdam, Tokyo, Singapore, Hong Kong, and Sydney), takes a local approach with companies while benefiting from global insights. BIS is positioned within the firm as an investment function and works closely with BlackRock’s active investment teams. Our stewardship perspectives are available to them through the Aladdin platform as core tenets of good governance—board oversight, management quality, and sustainable business practices—are factors in the investment decision-making of both equity and debt investors.

The team engages companies from the perspective of a long-term investor and irrespective of whether a holding is in an active or indexed investment strategy. Engagement is a critical mechanism for providing feedback on or signaling concerns about governance and sustainability factors affecting long-term performance. This is particularly important for our clients invested in indexed funds, which represent a significant majority of BlackRock’s equity assets under management, as they do not have the option to sell holdings in companies that are not performing as expected.

We assess whether to initiate an engagement or accept an invitation to engage with individual companies based on a range of factors, including our prior history of engagement with the company, our thematic priorities, whether there are substantive governance or sustainability issues to address from either the company’s or our perspective, and our assessment that engagement would advance the interests of our clients as long-term investors. We generally engage with management representatives but expect to be able to meet with the appropriate board director if we are concerned about board level matters such as board composition, oversight, or policies.

We initiate many of our engagements because a company’s disclosures do not provide the information necessary for us to assess the quality of their governance or business practices. We recommend companies review their reporting in light of their investors’ changing expectations of company disclosures. In our view, companies that embrace corporate governance and sustainability reporting as a broad-based platform for engagement with shareholders and other stakeholders are more likely to benefit from enduring support from those on whom they depend for success.

BIS emphasizes direct dialogue with companies on governance issues that have a material impact on financial performance. We seek to engage in a constructive manner and ask probing questions, but we do not tell companies what to do. Where we believe a company’s governance or business practices fall short, we explain our concerns and expectations. As a long-term investor, we generally support companies when our engagement affirms that they are taking appropriate steps to address shareholders’ concerns. However, when we do not see progress despite ongoing engagement, or companies are insufficiently responsive on matters we believe contribute to long-term value creation, we would signal our concern by voting against management.

Voting against management can take different forms in different markets and our approach will depend on the items on the agenda at the shareholder meeting. Most commonly we hold the responsible members of the board accountable when a company’s practices or disclosures fall short by voting against their re-election. We might also vote against or withhold from the discharge of the board in markets where that is an option. In 2021, we see voting on shareholder proposals playing an increasingly important role in our stewardship efforts, particularly on sustainability issues. As a long-term investor, BIS has historically engaged to explain our views on an issue and given management ample time to address it. However, given the need for urgent action on many business relevant sustainability issues, we will be more likely to support a shareholder proposal without waiting to assess the effectiveness of engagement. Accordingly, where we agree with the intent of a shareholder proposal addressing a material business risk, and if we determine that management could do better in managing and disclosing that risk, we will support the proposal. We may also support a proposal if management is on track, but we believe that voting in favor might accelerate their progress.

The complete publication, including appendix, is available here.

Endnotes

1The framework recommended by the Task Force on Climate-related Financial Disclosure covers governance, strategy, risk management, and metrics and targets—and provides an opportunity for companies to disclose standardized information, in both data and narrative form.(go back)

2https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter(go back)

Print

Print