John Ellerman and Mike Kesner are partners, and Lane Ringlee is managing partner at Pay Governance LLC. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

Environmental, Social, and Governance (ESG) issues are some of the most prominent facing Corporate America: shareholders and other stakeholders have significantly increased the focus on a corporation’s social responsibilities, including promoting a fair and diverse workplace, providing employees with a living wage, and improving the environment. Large institutional investors are demanding enhanced disclosure of employee demographics and diversity efforts as well as a full discussion of the near- and long-term steps that will be taken to attain net-zero emission goals.

Given the intense focus on ESG, Pay Governance LLC conducted a survey of companies in January 2021 to document how companies have been responding to the focus on ESG and whether it is resulting in a change in the design of incentive compensation plans. We had several goals in mind in conducting the survey.

- First, we wanted to establish if companies had already incorporated ESG metrics into either their annual or long-term incentive plans.

- Second, we wanted to determine if companies that had not included ESG metrics in prior incentive plans were adding or considering adding them to their 2021 incentive plans.

- Third, we wanted to ascertain if companies that had already incorporated ESG metrics in incentives plans were retaining the same approach or altering either the metrics or plan design.

- Fourth, we wanted to develop a more detailed understanding of the specific ESG metrics selected and how they are measured to better equip companies that are considering including ESG in their incentive plans with key design details.

- Fifth, we wanted to get a better understanding of shareholder input into the use of ESG in incentive plans.

In reviewing the survey results, Pay Governance found some emerging trends and considerable insight into the mechanisms, metrics, weightings, and shareholder views for including ESG in incentive compensation programs. Some of the key takeaways from the survey include:

- In 2020, 22% of survey respondent companies indicated they included ESG metrics in their incentive compensation plans; for 2021, 29% of companies reported they have incorporated ESG metrics in their incentive plans while 21% of companies indicated they were still uncertain if ESG metrics would be included in 2021 incentive compensation. This finding suggests companies are still hesitant to include ESG metrics in incentive compensation programs despite considerable social and investor support for the subject. Some of the hesitancy may be due to companies’ ability to accurately capture and report the data, establish appropriate targets for each metric and concerns over the potential fallout if ESG targets are not attained.

Companies incorporating ESG Metrics into Incentive Plans in 2020 vs. 2021

- Of the companies that included ESG in incentive plans, 76% stated they used either solely quantitative or a combination of quantitative and qualitative measurements in the design of their 2020 incentive plans. For 2021, survey companies reported they plan on using these same measurement techniques for their ESG metrics. The use of quantitative goals suggests some companies are able to establish specific ESG targets and measure them with a relatively high degree of accuracy/

- Most companies include ESG metrics in the annual incentive plans, with a minority of companies including ESG metrics in the long-term incentive plan. For 2021, our study sample reported a slight increase in companies intending to include ESG metrics in their long-term incentive plan. While most ESG metrics are intended to improve a company’s long-term results, annual measurement of some metrics may have better pay-performance outcomes for the organization. For example, a metric based on establishing employee resource groups and measuring their effectiveness on an annual basis may be an excellent approach for improving the company’s culture of inclusivity in the long term and may set the stage for setting a 3-year diversity goal in the future.

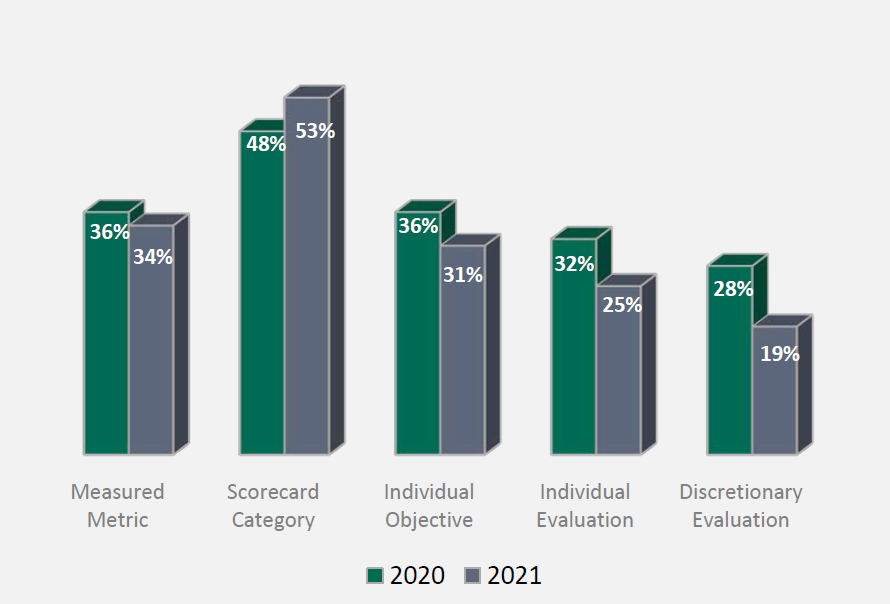

- The scorecard approach, where ESG is measured within a scorecard category, but the individual ESG metrics are not individually weighted, is the most common approach for incorporating ESG metrics into incentive compensation (2020 = 48% and 2021 = 53%). However, many companies use more than one approach for incorporating ESG results in compensation decisions (for example, some companies used a measured metric and/or individual performance factors in addition to the scorecard approach). The scorecard approach has a significant advantage over a measured metric approach, as it allows a company to select a number of ESG metrics (e.g., diversity and waste reduction) in addition to other strategic metrics (e.g., market share) whereas a measured metric is often based on a single metric.

Approaches Used in 2020 vs. 2021 Incentive Plans with ESG Metrics

The weighting of ESG metrics contemplated for 2021 incentive plans is typically less than 25%. In general, most companies tend to weight non- financial measures less than 25%. Given the lack of experience some companies have in using ESG metrics in incentive plans, many are taking a conservative approach in weighting ESG metrics.

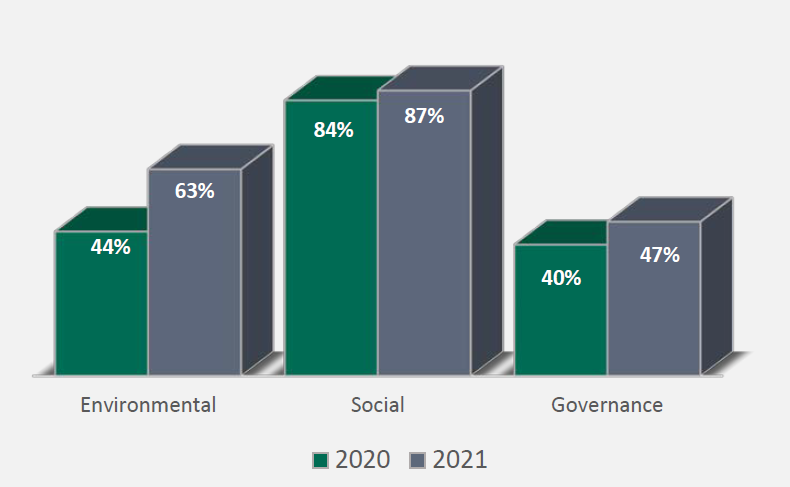

- The most common ESG category was social, with 84% of companies including a social metric in 2020 incentive plans and 87% in 2021 incentive plans. The prevalence of the environmental category increased significantly in 2021 with 63% of companies including environmental metrics in incentive compensation — up from 44% in 2020 — reflecting, in part, significant investor interest in environmental issues.

Type of Metrics Used in 2020 vs. 2021 Incentive Plans

- Diversity was the most commonly used social metric (67% in 2020 and 88% in 2021); a related metric, inclusion and belonging, was also highly preferred (43% in 2020 and 50% in 2021).

- Based on a closer look at the different types of diversity metrics, gender representation, race representation, and attracting and retaining diverse talent were the most prevalent choices.

- Human capital metrics were also a commonly used social metric with many companies using employee engagement and succession planning/talent management in their 2020 and 2021 incentive plans.

- The environmental metrics most often cited for use in incentive compensation plans were carbon emissions and greenhouse gases along with waste reduction and energy efficiency.

- The survey also found that shareholders are taking an active interest in ESG, with 74% of the survey companies reporting they discussed ESG with shareholders in the last 6 months and 40% reporting that shareholders requested ESG metrics be included in incentive plans.

Our Conclusions

Our survey reveals that an increasing number of companies are including ESG metrics in their incentive plans in 2021, with most utilizing social and environmental metrics. The inclusion of ESG in incentive plans is perhaps one of the most significant changes in executive compensation in over a decade; as an emerging trend, several companies have selected approaches that provide a high level of flexibility (such as the scorecard approach) but have also incorporated metrics that can be measured quantitatively (e.g., employee engagement, diversity/representation levels, reduced waste, etc.) to provide goal clarity and measure progress towards longer-term objectives.

The survey also documents most companies are taking a “wait and see” approach to incorporating ESG metrics in their incentive plans. At the time we closed our survey (late February 2021), only 29% of the survey respondents had committed to including ESG metrics in their 2021 incentive plans. We believe that many companies will assess the proxy disclosures of their peers and other leading companies during the 2021 proxy season to evaluate how other companies are using ESG metrics while, at the same time, reviewing which ESG metrics best fit their business strategy and are suitable for inclusion in their incentive plans. Based on client experience, we also believe the uncertain financial outlook resulting from the COVID-19 pandemic has made some companies reluctant to institute significant incentive compensation plan changes until a full and robust economic recovery is underway. Another potential stumbling block to ESG metric adoption is the ability to properly measure certain environmental and social metrics as well as the lack of readily accessible databases with clear insights as to expected norms.

We expect many companies will use 2021 as a “launching pad” for finalizing and rolling out ESG metrics in 2022 given the strong interest of institutional shareholders and the investment community in ESG. As the old proverb goes, “whatever gets measured gets managed,” and linking ESG to executive incentives is a sure-fire way to make sure a company’s ESG priorities are given the attention required to ensure its sustainability.

William Thomson, the Scottish physicist also known as Lord Kelvin, once shared this sentiment:

“I often say that when you can measure what you are speaking about, and express it in numbers, you know something about it; but when you cannot express it in numbers, your knowledge is of a meagre and unsatisfactory kind; it may be the beginning of knowledge, but you have scarcely, in your thoughts, advanced to the stage of science, whatever the matter may be.” [1]

Endnotes

1William Thomson. “Electrical Units of Measurement.” Popular Lectures and Addresses, Volume 1, Page 73. May 3, 1883.

https://archive.org/details/popularlecturesa01kelvuoft/page/73/mode/2up?view=theater.(go back)

Print

Print