Myrto Kontaxi is Partner at the Biopharma Sustainability Roundtable (BSRT) and Brian Tomlinson is Director of Research, CEO Investor Forum at Chief Executives for Corporate Purpose (CECP). This post is based on a BSRT/CECP memorandum by Ms. Kontaxi, Mr. Tomlinson, Maggie Kohn, Thomas Scheiwiller, and Sandor Schoichet.

Executive Summary

Corporate leaders and institutional investors are looking for effective, efficient, and decision-useful information about long-term business strategy, and how it connects with the most important environmental, social, and governance (ESG) issues in each sector. This need is driven by many trends in management, capital markets, regulation, and civil society, two of which stand out:

- Growing evidence that a focus on ESG performance is strongly accretive to long-term value creation and financial performance, and that the elements of an effective ESG strategy are specific to each sector.

- Growing recognition of how valuable it can be to effectively communicate long-term plans to investors, employees, and other stakeholders.

Long-term planning is especially important for the biopharma sector right now, as we look toward a global recovery from the COVID-19 pandemic. A sustainable, long-term response by the sector is required not only to meet the direct therapeutic and diagnostic development and production challenges, but also to create new solutions and to communicate the industry’s efforts and outcomes more effectively to all stakeholders.

In response, the Biopharma Sustainability Roundtable (BSRT) and the CEO Investor Forum at Chief Executives for Corporate Purpose (CECP) have joined forces to convene the first sector-specific Biopharma CEO Investor Forum. The Forum is planned for June 7th and 8th, 2021. This report and a companion Practitioner’s Guide were created to provide practical tools for biopharma CEOs and their teams as they prepare their Sustainable Long-Term Plan presentations for the Forum. These documents combine CECP’s Long-Term Plan Framework, honed through use at previous CEO Investor Forums, with the Biopharma Investor ESG Communications Guidance, broadly validated and supported by investors to tailor the content and perspective for the biopharma sector.

Introduction

Today, ESG is widely understood to be a strategic long-term driver of corporate value. A significant volume of evidence indicates that companies that effectively manage their most material ESG challenges often outperform peer firms. The strategic business case for managing ESG issues more effectively has been increasingly recognized by corporate leaders and the capital markets; regulators and stock exchanges in a number of jurisdictions have more recently come on board as well.

ESG reporting is in a period of transformation. Calls for standardization and comparability are being made by both issuers and institutional investors. It is also recognized that the materiality of ESG issues tends to vary systematically by sector. Disclosure initiatives recognize the need to have a sector-specific focus and to engage and co-ordinate with leading companies within each sector.

Short-Termism

CEOs, institutional investors, academics, and NGOs have expressed concern about the negative consequences of equity markets that focus too much on short-term value. A growing wealth of evidence supports the thesis that short-termism is a problematic market feature that demands our attention. For example, we have seen that when faced with missing a short-term earnings target, many issuers will cut planned R&D or other long-term oriented spending to meet that target. CFOs confirm this behavior, expect it of their peers, and the data indicate that these short-term moves occur. These decisions may avoid short-term trouble, like a downward price correction caused by an earnings miss. However, data from both individual firms and the wider economy suggest that such behavior is value-destructive.

Short-termism may also cause themes and factors that play out over the long term to be neglected or under-analyzed. ESG is a classic example of this. Recent studies have indicated that investors that prioritize ESG in investment analysis may be more patient in the face of near-term negative earnings announcements; this is largely because the focus on long-term themes such as ESG renders near-term misses less salient.

We are beginning to see ESG themes featured during some quarterly earnings calls. This has been amplified by the COVID crisis, which has made disclosure on topics such as human capital, supply chain resilience, and license to operate part of demonstrating a realistic and constructive response. But raising ESG topics during quarterly analyst calls also reflects the fact that an issuer’s short-term disclosures and longer-term outlook must be coherent and strategically aligned. For this reason, we expect that ESG topics will increasingly feature in discussions of quarterly results.

Corporate Purpose

Expectations for corporate practice have also been changing over the past decade. This trend, which began in Europe, is now gaining traction globally. Companies have begun to respond to these expectations by indicating that they are moving away from a shareholder-first model, to one that has a stakeholder focus. The implications of this transition are significant and complex for managers, institutional investors, and policy makers. As companies seek to navigate this socially charged context, the time horizon over which the business is managed and performance of key ESG themes (in terms of both financial value and stakeholder impact) take on greater significance. A growing number of institutional investors are asking issuers to disclose their approach to corporate purpose and are making purpose and culture part of their engagement agenda with portfolio companies, while recent surveys suggest a stakeholder approach is expected to deliver enhanced returns. Given this, corporate disclosure across multiple channels needs to reflect the purpose-led, stakeholder approach a company seeks to follow.

Simplifying the Landscape

An unprecedented collaboration and consolidation of the complex landscape of organizations that set ESG standards, frameworks, and ratings is taking place against a backdrop of strong regulatory signals. While the increased attention to ESG is positive, it is also confusing for companies and investors alike, who are called upon to respond to these fast-evolving developments with greater and more focused transparency. Simplification will come by looking at issues through the industry lens, and not from a one-size-fits-all solution.

Integrating ESG and Long-Term Planning

The CEO Investor Forum at CECP and Biopharma Sustainability Roundtable (BSRT) have collaborated to help address the need for biopharma companies to develop and effectively communicate sustainable long-term plans that drive long-term value creation.

CECP: The Long-Term Plan Framework provides a user-friendly, investor-facing disclosure instrument to communicate long-term themes to capital markets. To date, more than 30 CEOs have used the framework to deliver a long-term plan at CECP’s CEO Investor Forums.

BSRT: The BSRT works across the sector to drive collaboration between senior biotech and pharma executives, helping move their sustainability agendas forward. Following two years of dialogue between biopharma companies and institutional investors, BSRT published their Biopharma Investor ESG Communications Guidance in April 2020. The goal: Improve the effectiveness and efficiency of communicating the sector’s most important ESG topics.

By combining our two sets of guidance, we hope to provide an integrated approach to preparing and articulating sustainable long-term plans that address the most important ESG topics for both biopharma companies and investors, and doing so in a way that focuses on long-term value creation. We explore each of these elements below.

CECP’S Long-Term Plan Framework

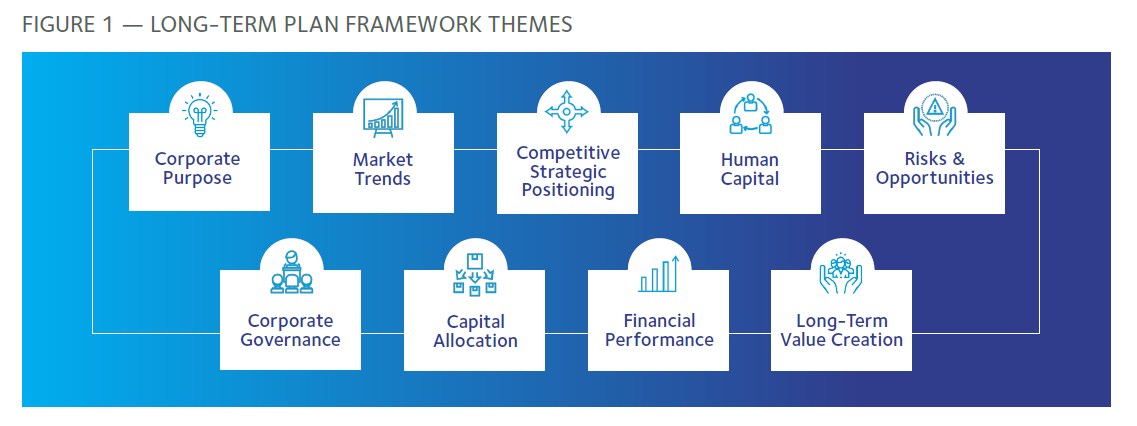

The Long-Term Plan Framework developed by the CEO Investor Forum provides public companies with a set of nine themes designed to effectively communicate the critical elements of a long-term strategic plan and respond to the informational needs of institutional investors.

The Long-Term Plan Framework was developed in collaboration with Professor George Serafeim at Harvard Business School and KKS Advisors. The development process drew on several resources, including:

- Long-term plan presentations by over 30 CEOs at CEO Investor Forums since 2017;

- Feedback from institutional investors across business sectors and strategies; and

- Research by organizations helping articulate the links between ESG and long-term value, such as the Sustainability Accounting Standards Board (SASB) and FCLTGlobal.

CECP’s Long-Term Plan Framework encourages issuers to develop an integrated narrative for the capital markets, setting out a forward-looking story across an extended time horizon (3-5 years). The Framework encourages integration of disclosures on key financial performance and capital allocation indicators with meaningful forward-focused information on themes such as human capital, corporate purpose, and other material ESG factors.

The Framework is supplemented by a variety of materials that help respond to the imperative for more and better long-term oriented information:

| Illustrative Examples | CECP has published a Guide with examples and emerging practices in disclosing long-term plans, leveraging CECP’s Long-Term Plan Framework. |

|---|---|

| Principles | CECP has defined a set of guiding principles for the type of disclosures issuers should offer to the capital markets. These are set out in CECP’s whitepaper on Emerging Practice in Long-Term Plans, and include topics such as:

|

| Operational Processes | CECP recommends internal process adaptations to help ensure all relevant teams are engaged and coordinated and critical information is not trapped in silos. Some of these recommendations are set out in our whitepaper The Method of Productions of Long-Term Plans. |

These supplementary materials enable an issuer to build a first-cut of their long-term plan, tailored to an investor audience. They also help infuse the themes of the Framework throughout the investor relations calendar, including investor days and earnings calls. The Long-Term Plan Framework is intended to be adaptable for any issuer, with the themes providing an overview for the issuer to adapt to its own sector and business model. Through this flexibility, CECP has been able to work with issuers across sectors, from automotive to biopharma and consumer packaged goods (among others), enabling them to communicate sector-specific and idiosyncratic elements of their long-term value proposition.

Operational And Capital Market Benefits Of A Longer-Term Focus

Choose your investors—and keep them loyal: How management talks to the capital markets and the type of information it chooses to share shapes the way a company is perceived. Over time, the mix of information a company discloses influences its mix of shareholders, as many studies demonstrate, indicating that issuers are not entirely subject to the whims of the capital markets. Supplementing well-constructed investor targeting efforts, the mix of information you disclose can be a key feature of investor cultivation. Additionally, sharing a long-term plan, and its accompanying ESG disclosures, helps build relationships with longterm investors, from long-only investors to the major index funds. Given the assets under management (AUM) of such investors, ensuring that they have a strong understanding of your strategic vision and direction can be outcome determinative in the context of an activist or business challenge.

An integrated and coherent story: In a recent study, CECP wanted to understand how many different sources of disclosure it was necessary to review to reach an understanding, even at an overview level, of an issuer’s full long-term value story. The study found that reaching a meaningful understanding typically required analysis of 13 different disclosures, across both mandatory and voluntary formats. Given this complexity, and the volume of surveys and questionnaires issuers are asked to complete, there is real value in constructing a tight, integrated and coherent story for the capital markets that helps communicate the key metrics across the broad expected set of themes.

Cross-functional knowledge: Disclosure can operate as a forcing function within issuers and across teams; in order to disclose new things you have to do new things. The act of disclosing new information can generate new skills, awareness, datasets, and, crucially, cross-functional collaboration. This can assist a company in developing a deeper sense of its capacities and sources of value-creation. In CECP’s work with past CEO Investor Forum participants, it was evident that the collaboration between investor relations and corporate sustainability functions is key, supplementing the existing connections with treasury, strategy, and the corporate secretary.

BSRT’S Biopharma Investor ESG Communications Guidance

The Biopharma Investor ESG Communications Guidance (the Guidance) was developed through a sector-focused initiative to address the common interests of leading biopharma companies and investors in achieving more effective, efficient, and decision-useful communications about the sector’s highest-priority ESG issues.

The Challenge: Superior performance in the most relevant ESG areas is positively related to long-term corporate financial performance. However, deciding which ESG topics are most relevant to disclose, and how to structure the ESG communications for the capital markets, has been challenging. Corporates and investors alike share frustrations on several fronts, including misalignments on the most important sector-specific ESG topics, laborious ESG reporting and research processes, and the lack of transparency and uneven quality of third-party ESG ratings and performance analyses. These factors were identified during the 2018 Biopharma Sustainability Roundtable and Investor Day, hosted by Roche and UBS in Basel, Switzerland. Shortly after, the Biopharma Investor ESG Communications Initiative was launched, facilitated by the BSRT. Over the next two years, the BSRT brought together more than 45 senior executives from 17 biopharma and 18 investor companies in a frank, open, and structured dialogue.

Dialogue-Driven Consensus

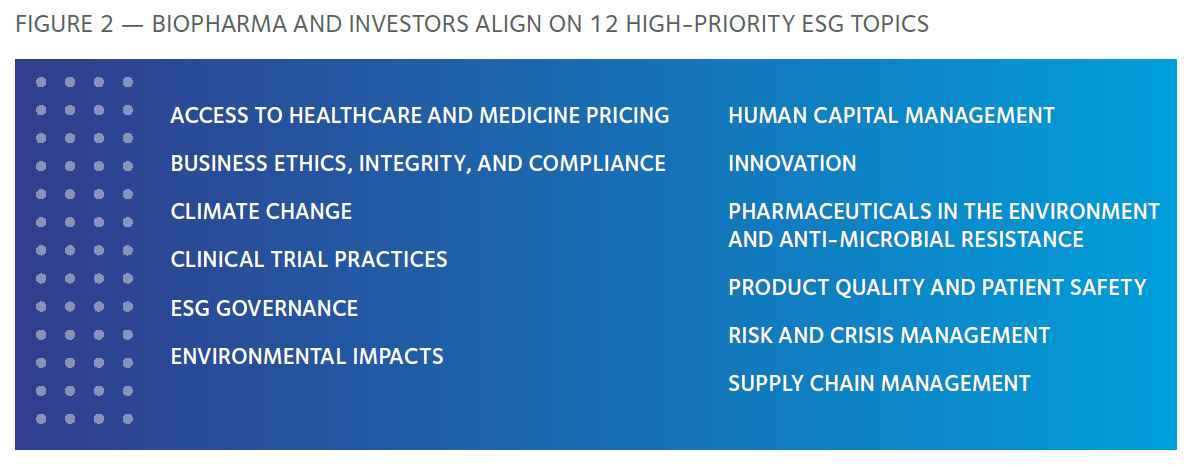

The Initiative’s first step was to build consensus among biopharma companies and investors about the sector’s highest-priority ESG topics. A core pool of 12 high-priority ESG topics judged by the participants to be most relevant and decision-useful—often termed most material—for both the investment community and the biopharma sector was mutually agreed (See Figure 2). Topics included in the SASB Biotechnology & Pharmaceuticals Sustainability Accounting Standard were taken into consideration as a baseline reference. The final list has overlaps with SASB, but extends beyond to topics that may become financially material over the mid- to long-term. Of course, each company must address its own priorities as appropriate for its business model and strategy. Topics may also be considered related to their interconnection with each other, or resource dependencies.

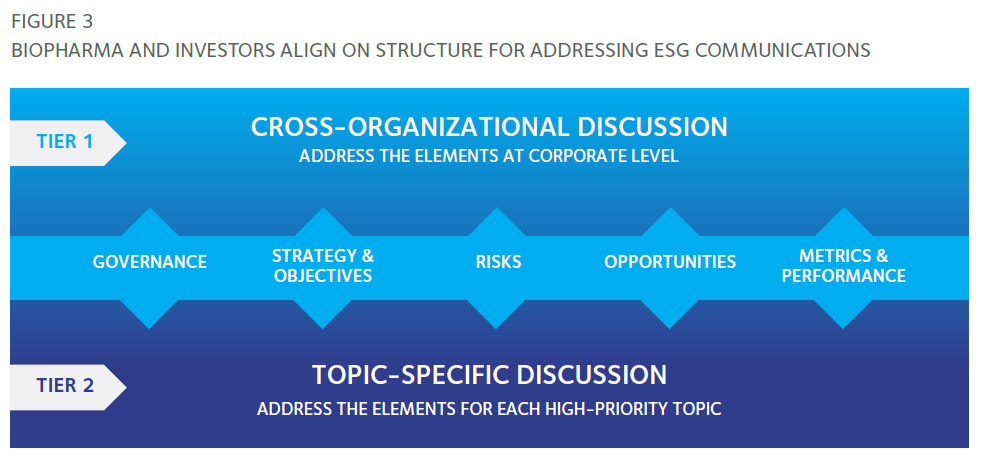

The second step was to discuss and agree on how to structure the information and disclosures around ESG communications between companies and investors so that it can be meaningful and decision-useful. During a series of working meetings between biopharma and the investment community it was agreed that while there are useful components in many frameworks, none will serve every purpose on their own. Best practices were considered, with special attention given to SASB and the Task Force on Climate-related Financial Disclosures (TCFD). Biopharma companies and investors agreed that ESG communications should address five key elements, including governance, strategy and objectives, risks, opportunities, and performance, with discussion at both the corporate and topic-specific levels (See Figure 3)

The Initiative’s work built a best-practice consensus around investor information needs, distilled in the Biopharma Investor ESG Communications Guidance (Guidance 2.0) launched in April 2020. Intended as a resource for both biopharma companies and investors, it provides a high-level roadmap that identifies ESG topics of shared priority and gives recommendations that can be adapted to each company’s own strategy, business model, and readiness. The Guidance also incorporates key learnings from the biopharma-investor dialogue, providing insights into current investor thinking and considerations when assessing a biopharma company’s ESG profile. It can be used to help inform stand-alone print or web-based ESG investor communications, investor presentations, roadshows, and one-on-one investor engagements, or to help prepare CEO and Board members’ narratives about ESG strategy, or in preparing a long-term plan.

Working Group: Sponsors of the initiative include Amgen, Bristol-Myers Squibb, Johnson & Johnson, Merck & Co., and Novartis. The High Meadows Institute (HMI), a think tank and policy institute focused on strengthening the role of business leadership in creating a sustainable society, also participated as part of a pilot for a broader Institutional Investor Industry Engagement project. Other participants included GlaxoSmithKline, Novo Nordisk, Pfizer, Roche, and Takeda. Investor participants to date include Aberdeen Standard, Acadian Asset Management, APG, BlackRock, Calvert, Chardan, Domini, Federated Hermes, Fidelity, Manulife, Morgan Stanley, PGGM, Rockefeller Capital, State Street, TPG Capital, Wellington, UBS, and Vanguard.

Use Case Experience: Since the Guidance 2.0 was released, biopharma companies and investors have used it not only to streamline their ESG communications, but also as a tool for thinking about ESG strategy. Early feedback has been positive, with both biopharma companies and investors noting that the Guidance is a valuable resource for internal and external engagement. As the product of a collaborative dialogue between sector peers and the investor community, it reflects best practice and engenders a high level of trust.

Investors have said they find the Guidance useful in their portfolio company engagements for several reasons. It provides an overarching perspective for addressing ESG topics that is flexible enough for a wide range of biopharma companies, while still improving comparability. Investors also appreciate that the Guidance encourages a more consistent interpretation across companies as they address rating questionnaires, surveys, and topical requests. It provides clarity about the most strategically relevant issues, some of which may not yet be financially material, or may be difficult to quantify, and which most existing standards and questionnaires therefore miss. Investors appreciate that the Guidance highlights the need to identify company-specific risks, but also emphasizes the need to focus on potential opportunities related to each ESG topic, something that they want to understand. In their engagements with small- and mid-cap portfolio companies still in the early stages of their ESG journeys, investors have been offering the Guidance to help communicate the information they are looking for, and feedback so far indicates it is a valuable strategic planning tool.

Biopharma companies have started using the Guidance to inform their ESG reporting and disclosure strategies. They say it has helped provide clarity to their internal sustainability disclosure teams about the information that investors really want to see. It has also helped drive engagement with senior executives and other corporate functions, including investor relations, corporate communications, and risk management, because it is seen as a credible resource. The Guidance also helps set the stage for thinking about integrated reporting, emphasizing the interconnectedness of high-priority ESG topics and overall business strategy.

Outlook: Looking forward, the Initiative will continue to facilitate discussions between biopharma companies and investors, drive broad implementation of the Guidance, and build consensus around a collection of sector metrics for the 12 high-priority ESG topics that reflect the sector’s “best thinking.” The dialogue is also expanding to other stakeholder groups, including standard setters (an engagement with SASB began in the second half of 2020), industry and trade associations, and third-party ESG rating agencies. The BSRT partnership with the CEO Investor Forum at CECP is a core element of the Initiative’s outreach and implementation program.

Long-Term Planning for the Biopharma Sector

Given the imperative for issuers to deliver integrated, forward-looking disclosures to the capital markets, in early 2020, CECP and BSRT sought to identify how the Framework and the Guidance could complement one another in a cohesive and practical manner. Over the course of several months, the organizations worked together to create a joint approach to help biopharma issuers develop sector-relevant long-term plans for their investors. This jointly conceived approach addresses each theme of the Long-Term Plan Framework, and adds sector-specific context from the Biopharma ESG Communications Guidance. We illustrate this approach below using a few examples selected from our Practitioner’s Guide to Biopharma Sustainability and Long-Term Planning.

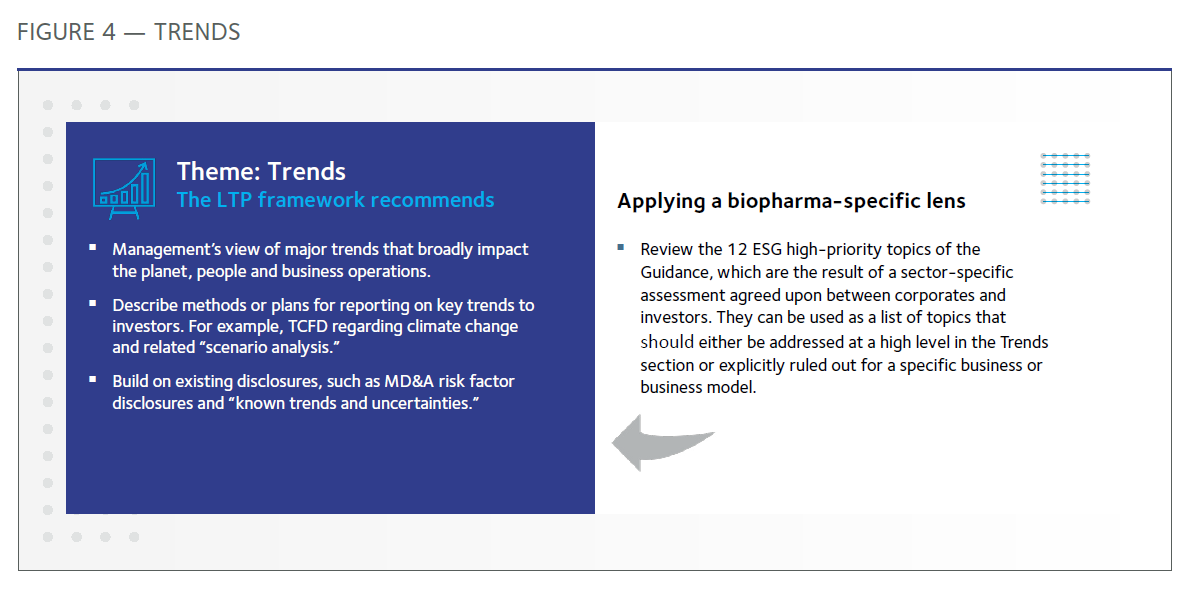

Mega-Trends: A key means for setting out a long-term view is for management to give a strategic overview of the major trends that are broadly affecting the planet, people, and business operations. Part of management’s job is to respond strategically to these and explain their impact on the business and its prospects on a go-forward basis. This may include identifying issues that, though not financially material today, are expected to become so over the long-term. This type of commentary builds on existing disclosures, such as MD&A around known trends and uncertainties, but provides commentary that is not boilerplate or unnecessarily legalistic. Strategic and relevant commentary on the ESG profile and performance of the business is a critical element of the discussion of mega-trends.

Risks and Opportunities: Issuers are expected to set out an assessment of their financially material ESG issues; these can be based on the issues that are commonly considered to be material for the sector, plus those that are unique to the business model. In using our guidance to provide insights on ESG, frameworks such as the SASB can be useful. It can also be extremely helpful for an issuer to not just show the key performance indicators, metrics and targets (to help investors understand the rate of change on key ESG indicators), but also to indicate how those targets were arrived at, offering a sense of the process within the organization.

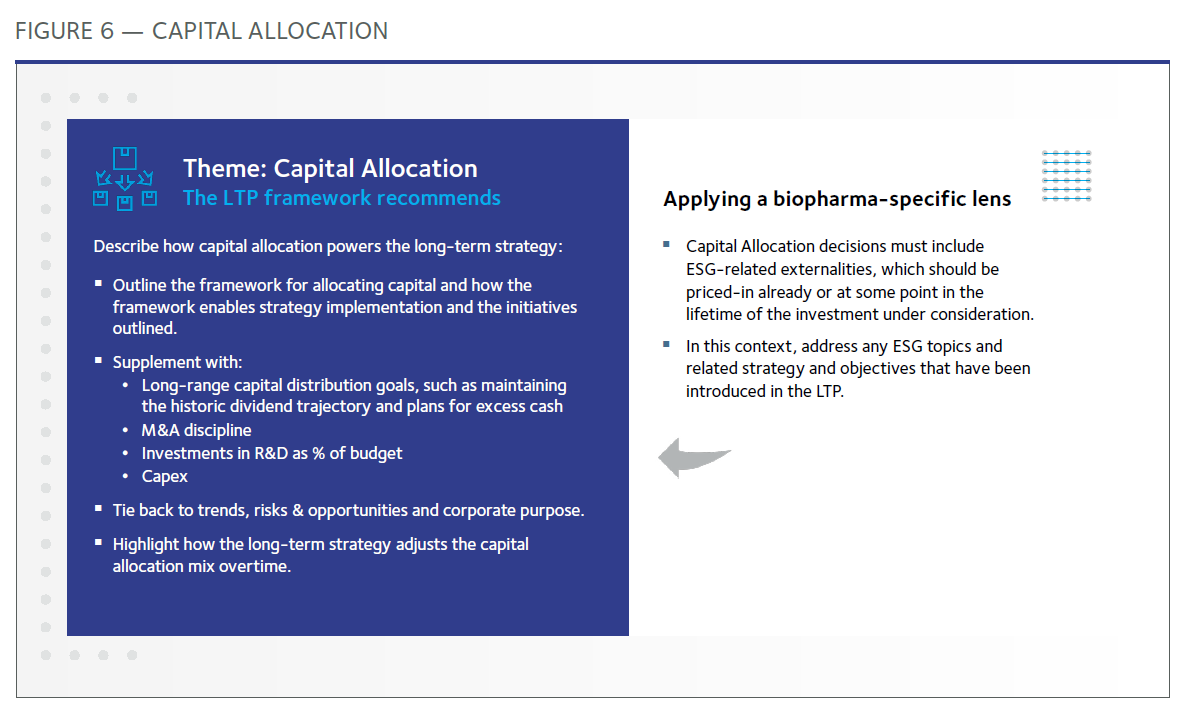

Capital Allocation: Forward-looking commentary on capital allocation is critical information for investors to understand an issuer’s outlook and the credibility of its plans. Issuers can provide details of the framework they use to think through capital allocation and communicate the shape of future allocations, for example:

- Long-range capital distribution goals (e.g., dividend trajectory and plans for excess cash)

- M&A discipline

- Capex

- R&D

In providing such commentary, issuers should contextualize the capital allocation plan with relevant assumptions. For example, an issuer could talk about the way in which ESG themes or mega-trends make certain investments essential or increase the expense associated with certain investments (e.g., retro-fitting real estate assets to adjust to climate-related risks).

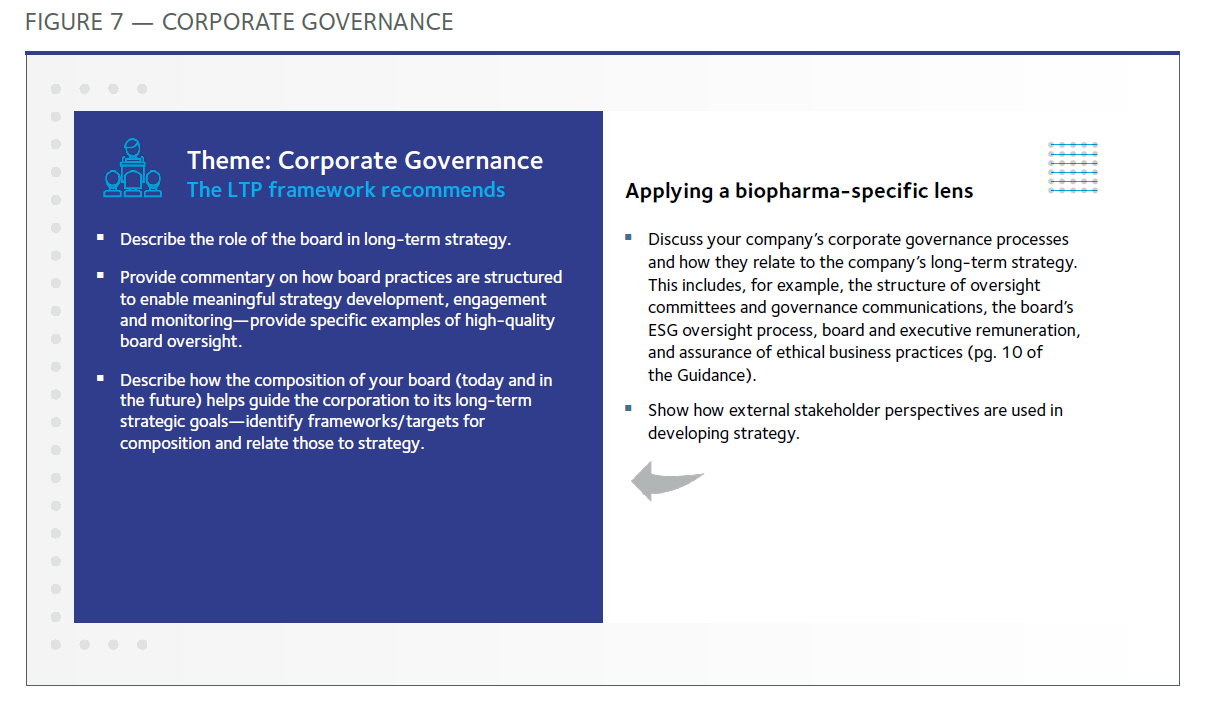

Corporate Governance: Good governance is a key factor in long-term success. Institutional investors use different benchmarks for assessing board quality, from skills set and independence to refreshment and the absence of board entrenchment devices (such as staggered boards).

Management can add to institutional investors’ assessment of a corporation’s prospects by providing meaningful commentary on the role of the board in long-term strategy. For example, how are board practices structured to enable meaningful strategy development, engagement, and monitoring? Can management provide specific examples of high-quality board oversight?

In addition to credibly indicating that the board functions as a strategic partner, it is also important to demonstrate how board refreshment approaches reflect the long-term strategic requirements of the long-term plan outlined. Critical to an understanding of the board’s role are the governance arrangements put in place for ESG. How and with what frequency are these overseen? Issuers can take a number of different approaches to illustrate the extent of its planning and competence in these areas, including skills matrices, board assessment structures, refreshment practices, and diversity attributes of the board—accompanied by future goals as relevant.

Conclusion: Communicating Your Long-Term Vision

Recent events underscore the urgent imperative for companies to rethink the time frames and information they communicate to the capital markets and the broader universe of stakeholders. In the midst of the global pandemic-induced recession, growing social justice movements worldwide, and the ongoing climate emergency, we believe it is essential for issuers to communicate more long-term forward-looking information. This information must include ESG considerations, including governance, risks, opportunities, and performance, and it must be communicated in a well-structured and decision-useful manner comparable across companies within a sector.

Through the facilitation of the Biopharma Sustainability Roundtable, the biopharma industry will continue to engage with investors to review and develop consensus on metrics and key performance indicators for the priority ESG topics identified in the Guidance. Because issues affecting the sector continuously change, the Guidance is a living tool that will be updated over time to reflect current topics and investor insights.

Along with CEOs, investors are playing an important role in supporting long-termism. Many are doing this by encouraging their portfolio companies to develop and share long-term strategies that incorporate ESG factors—and are encouraging use of the BSRT’s Guidance in doing so.

Regulation of ESG disclosure is on the rise in many markets around the globe. Taking voluntary steps as a sector to identify key ESG issues and better align them with long-term business strategies can serve as a wise preemptive move.

The Biopharma Sustainability Roundtable and the CEO Investor Forum hope our collaboration will inspire other sectors on their own journeys.

The complete publication, including footnotes, is available here.

Print

Print