John Ellerman and Mike Kesner are partners, and Lane Ringlee is managing partner at Pay Governance LLC. This post is based on their Pay Governance memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

In January 2021, Pay Governance conducted a comprehensive survey of the use of Environmental, Social, and Governance (ESG) metrics in incentive compensation as reported by 95 participating US companies. The survey documented the prevalence of this emerging trend and explored the types of metrics used, the ways in which they were measured, the types of incentive plans incorporating such metrics, and other important incentive design details. The survey revealed that only 22% of the US companies included ESG metrics in their 2020 incentive plans, whereas 29% of the same companies reported they were planning on including ESG measurements in their 2021 incentive plans. In summarizing the data and citing our conclusions about the survey results, Pay Governance stated that there appeared to be significant hesitancy among US companies to adopt such metrics, as companies considered which metrics and goals would be the most meaningful and consistent with their business objectives. Despite the reluctance on the part of many US companies in moving forward on this issue, we noted that “the inclusion of ESG in incentive plans is perhaps one of the most significant changes in executive compensation in over a decade.” [1]

In our desire to further study this issue, Pay Governance examined the use of ESG metrics in the incentive compensation plans of a select sample of companies in the United Kingdom (UK) and European Union (EU). Our research confirmed that UK and EU companies are well ahead of the US in the inclusion of ESG metrics in incentive plans, and their approach to measuring and rewarding ESG achievements could be a harbinger of strategies used by US companies over the next several years.

Pay Governance selected 30 companies from the UK’s FTSE 100 and EU’s STOXX 50 indices. Our research was based on public filings through April 2021. The companies selected reflect a broad spectrum of industry sectors and, in the case of the EU companies, a number of different countries. The 30 companies reported median 2020 revenues of $27B and a current median market capitalization of $73B.

Our Findings – UK/EU Versus US

Our survey of US companies earlier this year reported that 21 of the 95 participating companies (22%) included ESG metrics in their 2020 incentive compensation plans. Of the companies including ESG metrics in incentive plans, 95% included them in the annual incentive and 5% included them in the long-term incentive. By contrast, 90% of the UK and EU companies included ESG metrics in their incentive compensation plans. One UK/EU company that did not include ESG metrics in their 2020 incentives disclosed to its shareholders that ESG metrics would be included in both the 2021 annual and long-term incentives. The research revealed that 89% of the UK/EU companies included ESG metrics in the annual incentive and 41% in the long-term incentive. Thus, in addition to a much higher prevalence rate, UK/EU companies also had a much higher rate of inclusion in long-term incentive plans.

We did find a number of similarities in the use of ESG metrics between US companies and UK/EU companies as well, and the following text and charts highlight our main findings:

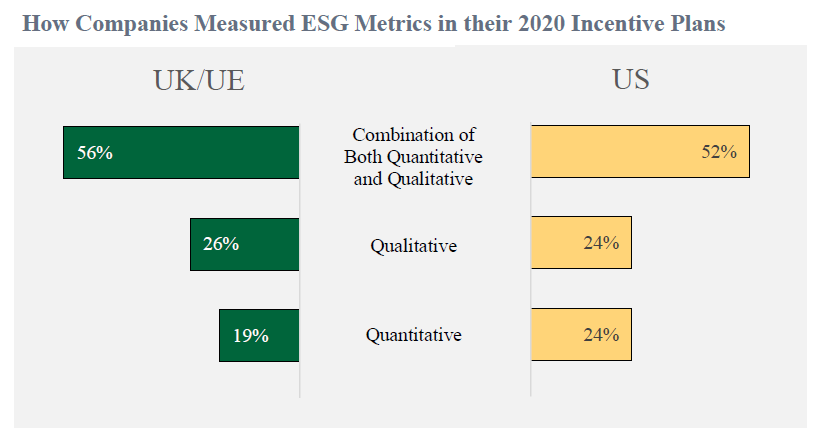

- Both US and UK/EU companies prefer using a combination of quantitative and qualitative metrics in measuring ESG

How Companies Measured ESG Metrics in their 2020 Incentive Plans

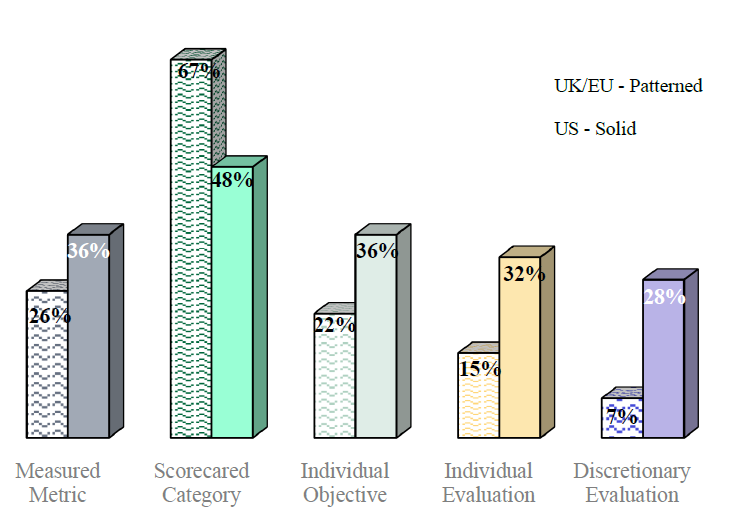

Approaches Used in 2020 Incentive Plans with ESG Metrics

- The scorecard approach is the most common method for measuring ESG among US and UK/EU companies, although both use a number of different incentive plan designs when measuring ESG

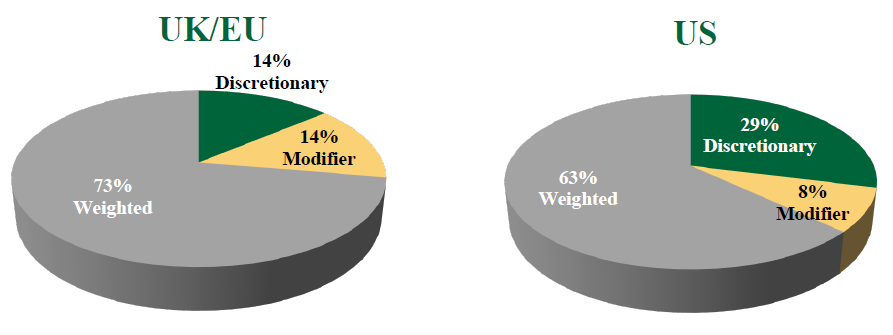

- Both US and UK/EU companies prefer using a weighted ESG metric rather than a modifier or discretionary adjustment when determining annual incentive plan payouts, and weighted metrics were exclusively used in long-term incentive plans

Influence of ESG in Annual Incentive Plan: Component Weight or Use of Discretionary Adjustment or Modifier

- When ESG metrics were implemented into the annual and/or long-term incentive plan, the weighting of such metrics was generally below 25% in both the US and UK/EU, with 10%-15% as the most common weighting

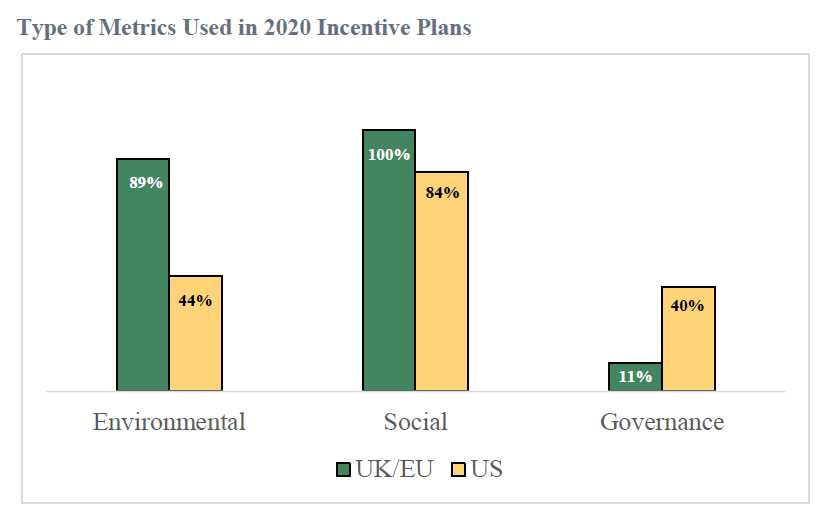

- UK/EU companies overwhelmingly included Environmental and Social metrics in their 2020 incentives. Based on our January 2021 US survey, companies reported a sharp increase (from 44% to 61%) in the use of Environmental metrics in 2021

- Governance metrics were far less common among UK/EU companies compared to the US

Type of Metrics Used in 2020 Incentive Plans

2020 Incentive Plans: Selected Environmental Metrics

| Measure | UK/EU Prevalence % | US Prevalence % |

|---|---|---|

| Energy efficiency/Renewable energy | 33% | 45% |

| Carbon emissions/Greenhouse gas | 67% | 36% |

| Compliance with applicable laws | 17% | 27% |

| Emissions / Containment | 17% | 27% |

| Waste reduction/Sustainable sourcing / PET reduction | 38% | 27% |

| Environmental stewardship | 33% | 0% |

| Sustainability | 25% | 0% |

- With respect to Environmental metrics, reduced carbon emissions / greenhouse gas was the number one metric selected by UK/EU companies followed by waste Among US companies, energy efficiency / renewable energy was the top metric followed by reduced carbon emissions / greenhouse gas. About 25% of UK/EU companies also included sustainability metrics

| Measure | UK/EU Prevalence % | US Prevalence % |

|---|---|---|

| Diversity | 59% | 67% |

| Human Capital | 30% | 52% |

| Inclusion and Belonging | 19% | 43% |

| Community Impact | 19% | 33% |

| Employee Safety | 22% | 29% |

- Diversity was the top Social metric among UK/EU and US companies, although US companies also selected a companion metric, inclusion and belonging, at a much higher rate (i.e., 43% compared to 19%)

What We Have Learned and Key Takeaways

Based on our January 2021 survey of US companies and UK/EU company research, we have a number of observations and key takeaways that may benefit US companies considering the inclusion of ESG metrics in their incentive plans:

- The prevalence of ESG metrics in incentive plans is much higher in the UK and EU compared to the US, and it is likely the US will close the gap within the next 2-3 years based on past trends (for example, Say on Pay was first adopted in the UK and EU) as well as potential enhanced regulatory requirements (current S.E.C. review of 2010 interpretative release) and investor and societal pressures to prioritize ESG;

- Both UK/EU and US companies will increase the inclusion of ESG metrics in their respective long-term incentive plans as investors and regulators focus on how companies intend on achieving their long-term sustainability goals;

- The types of ESG metrics and plan designs used by both UK/EU and US companies are largely the same, including the use of scorecards, quantitative and qualitative goals, and relatively modest weightings; and

- Once adopted, it will be difficult to turn back, and many US companies are conducting their materiality assessments to select the metrics and goals that will have the greatest impact on the company’s long-term Thus, as noted in our previous Viewpoint, we continue to believe “many [US] companies will use 2021 as a ‘launching pad’ for finalizing and rolling out ESG metrics” in 2022 incentive plans. [2]

Endnotes

1John Ellerman, Mike Kesner, and Lane Ringlee. “Inclusion of ESG Metrics in Incentive Plans: Evolution or Revolution?” Pay Governance. March 16, 2021. https://www.paygovernance.com/viewpoints/inclusion-of-esg-metrics-in-incentive-plans-evolution-or-revolution.(go back)

2Ibid.(go back)

Print

Print