Todd Sirras is Managing Director, Justin Beck is Consultant, and Austin Vanbastelaer is Senior Consultant at Semler Brossy LLP. This post is based on a Semler Brossy memorandum by Mr. Sirras, Mr. Beck, Mr. Vanbastelaer, Alexandria Agee, Sarah Hartman, and Kyle McCarthy. Related research from the Program on Corporate Governance includes the book Pay without Performance: The Unfulfilled Promise of Executive Compensation, and Executive Compensation as an Agency Problem, both by Lucian Bebchuk and Jesse Fried.

2021 Say On Pay Results

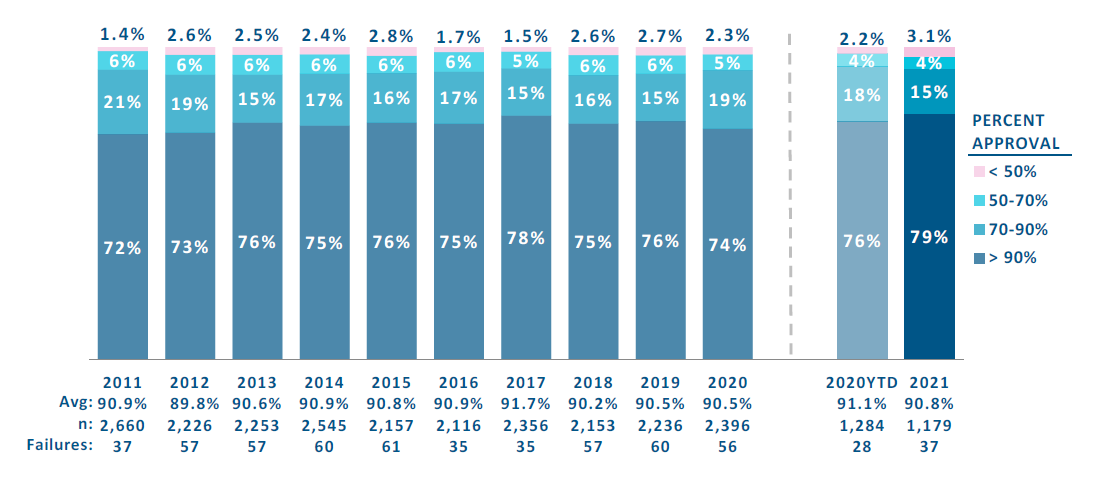

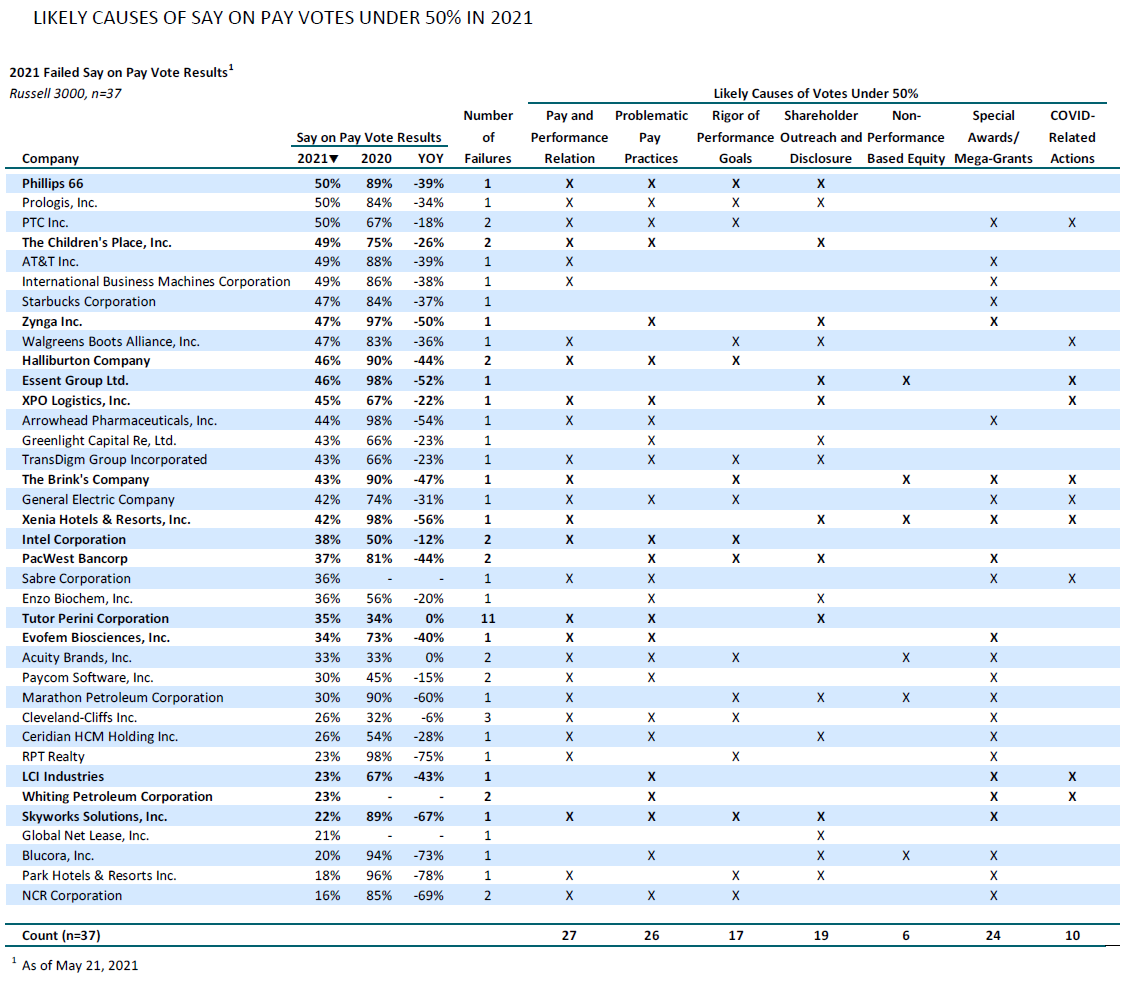

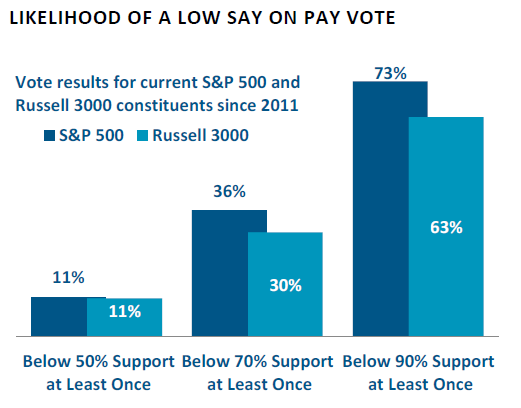

37 Russell 3000 companies (3.1%) failed Say on Pay thus far in 2021, 14 of which are in the S&P 500. 15 companies failed since our last report and are highlighted in bold later in this post. Our evaluation of the likely reasons for failure indicates that ten of the thirty-seven failed Say on Pay votes are due in part to Covid-19 related actions.

Say On Pay Observations

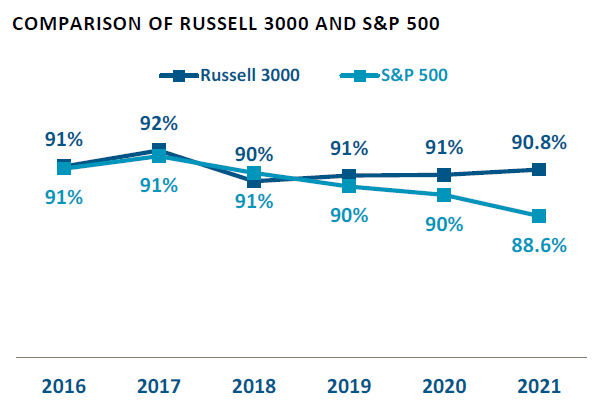

- The current failure rate (3.1%) remains above the failure rate at this time last year (2.2%), but is an overall decline from our 5/13 report failure rate of (3.3%); however, the percentage of Russell 3000 companies receiving greater than 90% (79%) is greater than the percentage at this time last year’s support (76%)

- The current average vote results of 90.8% for the Russell 3000 and 88.6% for the S&P 500 are below the average vote results at this time last year

- The average Russell 3000 vote result thus far is 220 basis points higher than the average S&P 500 vote result, which is 120 basis points higher than the spread at this time last year

Data provided by ESGAUGE and Semler Brossy; analysis by Semler Brossy. Russell 3000 sample as of July 1, 2020; S&P 500 sample as of March 22, 2021.

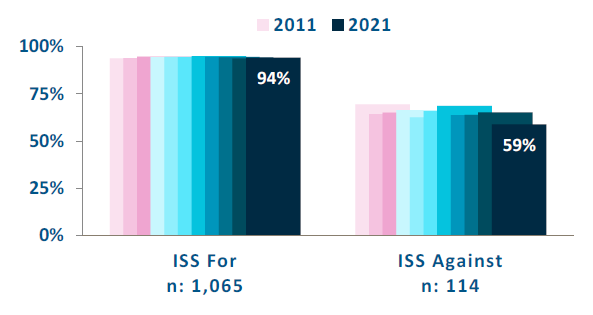

ISS Impact On Say On Pay Vote Results

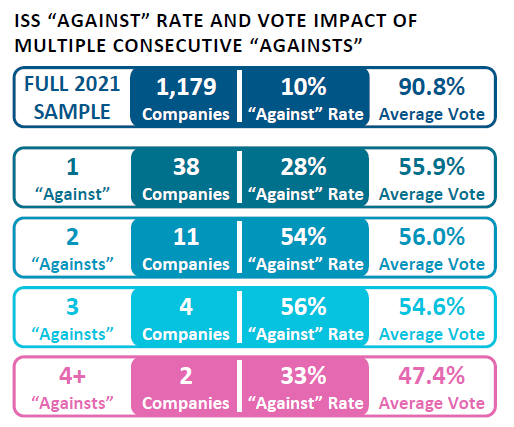

- The current average Say on Pay vote result for companies that received an ISS “Against” recommendation is 35 percentage points lower than for companies that received an ISS “For” recommendation

- The 35-percentage point gap is above the historical average range of 24 to 32 percentage points; ISS “For” rate is consistent with the rate at this time last year

- The current ISS against rate is 10% which is lower than 2020 rate of 11%

Data provided by ESGAUGE and Semler Brossy; analysis by Semler Brossy. Russell 3000 sample as of July 1, 2020; S&P 500 sample as of March 22, 2021.

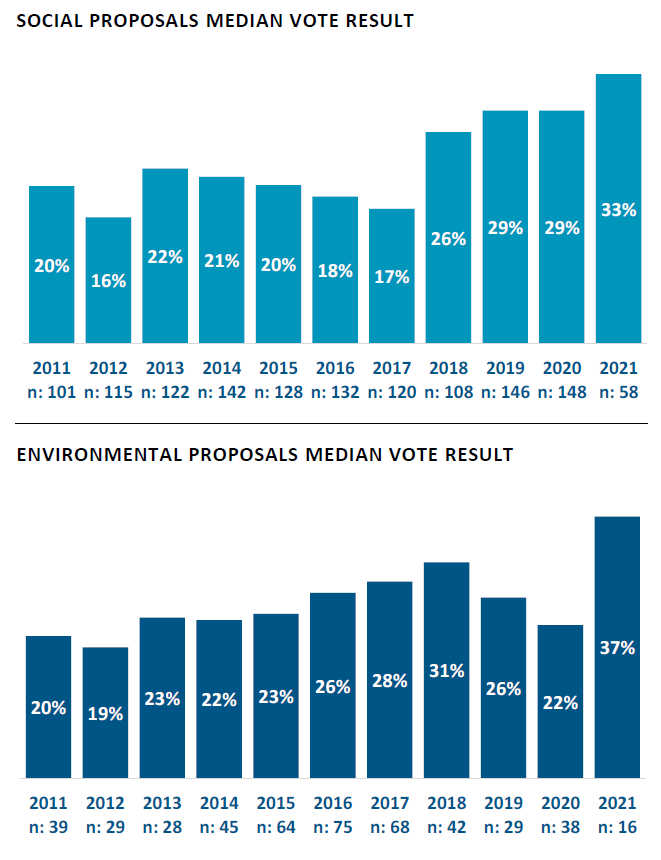

2021 E&S Proposal Results

- Thus far in the proxy season, shareholders have voted on 58 social proposals and 16 environmental proposals

- Median support for social proposals is 33% and median support for environmental proposals is 37%

- Thirteen social proposals (22%) and seven environmental proposals (44%) have received greater than 50% support in 2020; this is much higher than the 9% of social proposals and 16% of environmental proposals that received greater than 50% support in 2020

- We have observed significantly higher support (often above 70%) for proposals that request reporting on EEO-1 statistics, diversity and inclusion efforts, Board diversity, lobbying payments, climate impact reporting, and emission reduction target disclosure

Spotlight: Phillips 66

Shareholders submitted a proposal requesting that Phillips 66 adopt greenhouse gas (GHG) emissions reduction targets for emissions caused by its operations and certain products.

The proposal passed with 79% vote support

- The proponents of the proposal noted that climate-related risks are a source of financial risk and that limiting climate change is essential to risk management

- The proponents also requested that the company report on the strategy and policies for reaching the targets

- The Board recommended “Against” the proposal. They referenced a previous announcement that the company was working toward setting targets as well as noted its dual obligation to provide affordable energy and address climate change; the Board stated that the company added two metrics to its annual bonus plan focused on emissions

- ISS recommended “For” the proposal and noted that the company has not yet disclosed GHG emissions reduction targets, and reports on year-over-year emissions are lagging peers

The Company also received a shareholder proposal for a report on climate lobbying (passed with 62% vote support )

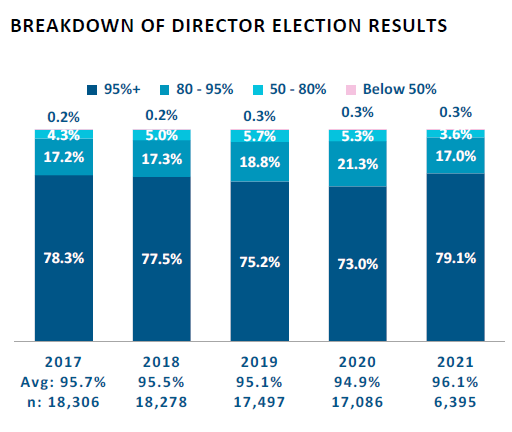

2021 Director Election Results

Director Election Observations

- Thus far, average vote support for Director nominees of 96.1% is 120 basis points higher than the year-end support observed in 2020; however, average vote support was 96.0% as of this time last year before declining to the year-end level (94.9%)

- The high level of shareholder support to-date may suggest a shareholder preference for continuity over the past year

- Over the past five years, average Director election vote support at companies that received a Say on Pay vote below 50% in the prior year is five percentage points lower than at companies that received above 70% support

- Thus far in the proxy season, average vote support for female Director nominees is 120 basis points higher than average support for male nominees, which is slightly smaller than the difference observed in the last two years

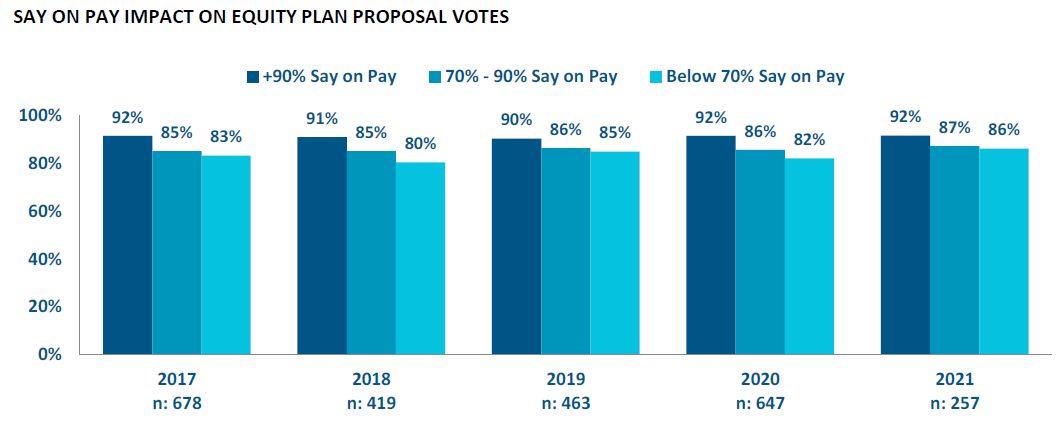

2021 Equity Proposal Results

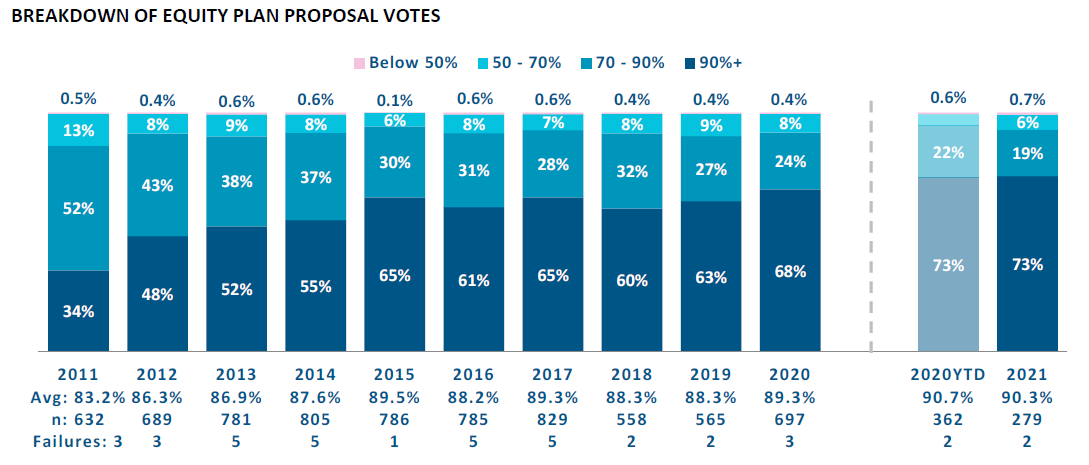

- Average vote support for equity proposals thus far in the proxy season (90.3%) is 40 basis points lower than the average vote support observed at this time last year (90.7%), but is higher than the year-end levels observed over the past several years

- Two proposals (Simulations Plus and Cassava Sciences) have received vote support below 50% thus far in 2021, and none since our last report; three proposals received vote support below 50% in 2020

Print

Print