Hannah Orowitz is Senior Managing Director of Corporate Governance; Talon Torressen is Director of Research; and Michael Maiolo is a Senior Institutional Analyst at Georgeson. This post is based on their Georgeson memorandum.

Introduction

With only one month remaining in the 2021 proxy season, an examination of early voting statistics [1] among Russell 3000 companies reveals that investors’ heightened focus on environmental, social and governance (ESG) risks and opportunities are having a meaningful impact on the 2021 season.

This is not surprising, given the continued focus paid to this topic by a range of major institutional investors. The rapid shift in investor voting both with respect to shareholder proposals and director elections year over year has resulted in several groundbreaking results:

- A total of 30 environmental and social proposals have already passed, the highest number on record and a 50% increase compared to the total number of such proposals receiving majority support during the 2020 proxy season

- More than one third of environmental shareholder proposals voted on to date have passed

- The election of three dissident directors occurred, on the basis of investors’ climate concerns, including support from BlackRock, Vanguard and State Street

- Record-breaking support for shareholder proposals focused on plastic pollution, political contributions and board diversity

- A sizeable increase in negotiated settlements of shareholder proposals as compared to the 2020 and 2019 proxy seasons

Director Elections

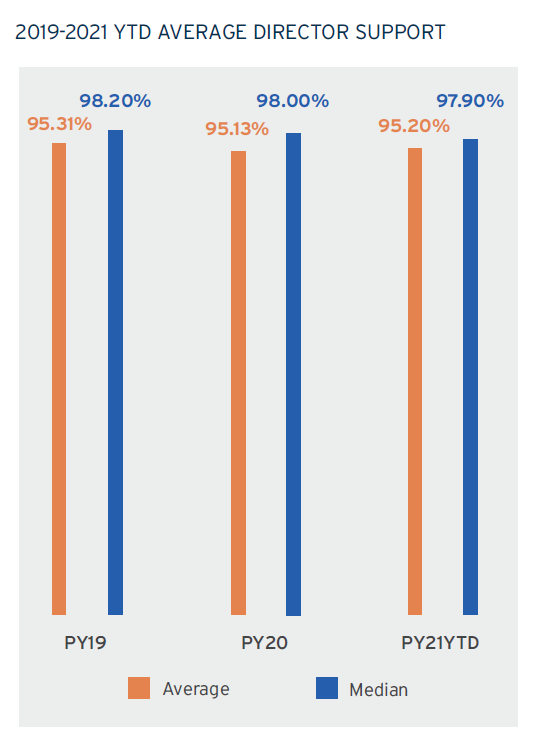

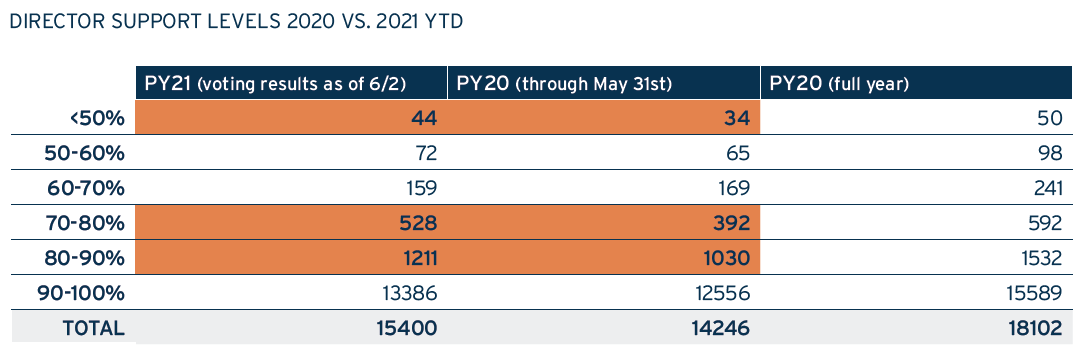

While average support for directors to date in 2021 is within the range of average support directors experienced in the 2019 and 2020 seasons, a closer look at the numbers reveals a significant uptick year over year in the number of directors that received less than 90% support for their (re)election.

To date this season, 44 directors failed to receive at least 50% shareholder support for their election or re-election—an increase of over 29% compared to a similar point in time in the 2020 proxy season. [2] Sizable increases also appear to exist in the number of directors who received support in the 80% to 90% and 70% to 80% ranges as well—at 17.6% and 34.7% respectively.

Investors’ specific voting decisions will not be known until late August, however our voting intelligence to-date and certain investors’ pre-disclosed voting rationales suggests that issues such as board composition (and particularly board diversity) and companies’ management and disclosure of ESG issues are increasingly influencing investors’ decisions to vote against incumbent directors. For example, at Berkshire Hathaway’s annual meeting, BlackRock expressed concerns over the company’s board structure and succession planning generally, and specifically cited concerns “over shortfalls in the company’s governance practices and climate action planning and disclosure” as driving its decision to vote against the company’s former audit committee and current governance committee chairs. [3] Neuberger Berman similarly noted practices pertaining to material ESG issues as a factor influencing its decision to vote against four of Berkshire Hathaway’s directors. [4]

Overboarding concerns also continue to influence director voting decisions at annual meetings; one such example this season involved Charter Communications.

A confluence of ESG considerations were at play at Exxon Mobil’s 2021 annual meeting, one of the most closely watched contested director elections in our collective memory. While the company’s strategy to manage the transition to a low carbon economy was a key focal point of Engine No. 1’s campaign, issues such as corporate culture, board skills and director accountability all featured prominently in investors’ rationales for supporting Engine No. 1’s director slate.

The preliminary outcome of Exxon’s contested director election, which at present looks to have resulted in at least three of Engine No. 1’s proposed directors gaining board seats—demonstrates that systemically significant issues like climate change can be core drivers of a dissident’s campaign. All companies would be wise to take note that the prevalence of ESG activism is likely to increase dramatically going forward.

Say On Pay

As the 2021 season progresses, it appears that executive compensation results in the 2021 proxy season will not unfold as predicted by many market observers.

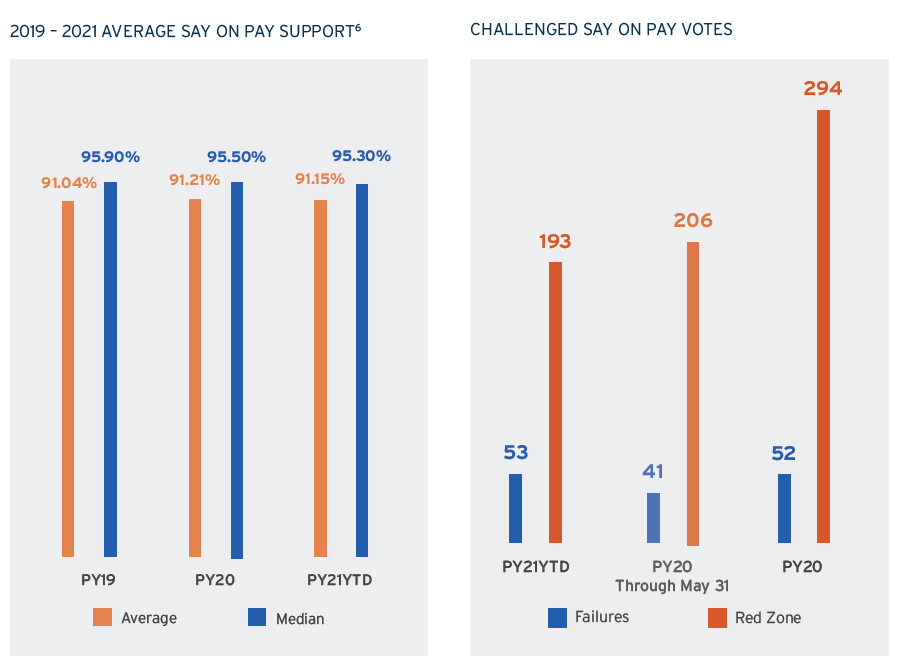

Heading into annual meeting season, many large institutional investors and both ISS and Glass Lewis signaled that pandemic-related compensation adjustments that resulted in increased payouts and compensation committees’ use of positive discretion would be scrutinized. While there have been several high profile say-on-pay failures within the S&P 500, and a notable 29% increase in the number of failed say on pay votes within the Russell 3000 compared with a similar point in the 2020 proxy season, overall it appears that both average and median support for say on pay proposals in 2021 are in line with support experienced in prior years. Furthermore, it appears that the number of “red zone” [5] say on pay outcomes has decreased slightly as compared to a similar point in time in 2020. [6]

Shareholder Proposals

As discussed in more detail below, the 2021 proxy season demonstrates a fundamental shift in investors’ approach to using their votes to voice opinions on companies’ management and disclosure of environmental and social issues.

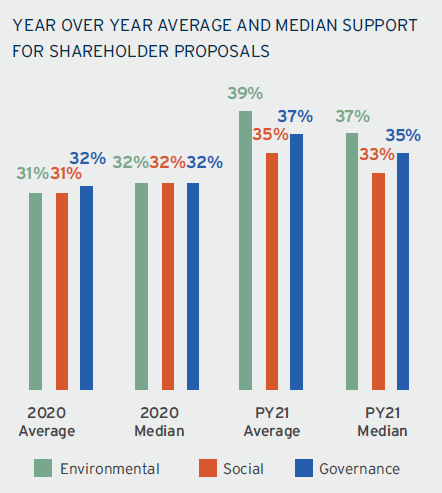

With one month of meeting results still outstanding, the 2021 proxy season has already broken a number of records on the shareholder proposal front. Investors have shown unprecedented levels of support for both environmental and social proposals, and the number of both environmental and social proposals that have received majority support have already meaningfully exceeded prior year results.

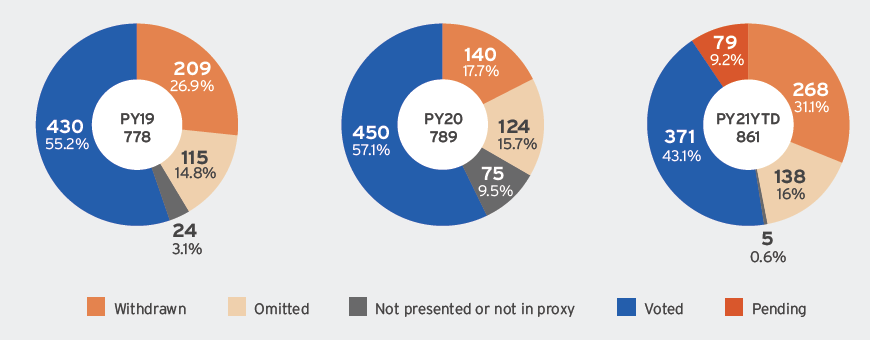

Assuming all proposals pending as of June 2nd are voted upon at upcoming meetings, it appears that the number of shareholder proposals reaching a vote will be largely consistent with recent seasons. At the same time, the total volume of proposal submissions increased by about 10% compared to both 2019 and 2020. That difference can be accounted for largely by the increase in the number of proposals that were withdrawn or not presented as compared to prior seasons.

In the lead up to the 2021 season, many institutional investors, including BlackRock, Vanguard and State Street, were quite vocal and transparent regarding their expectations, particularly with respect to climate and diversity matters. Their pronouncements likely influenced many companies to reach agreements with shareholder proponents. As for proposals receiving no-action relief, those numbers have held relatively steady, representing approximately 16%, 16% and 15% of all proposals for 2021, 2020 and 2019, respectively.

2019-2021 YTD Shareholder Proposals Submissions

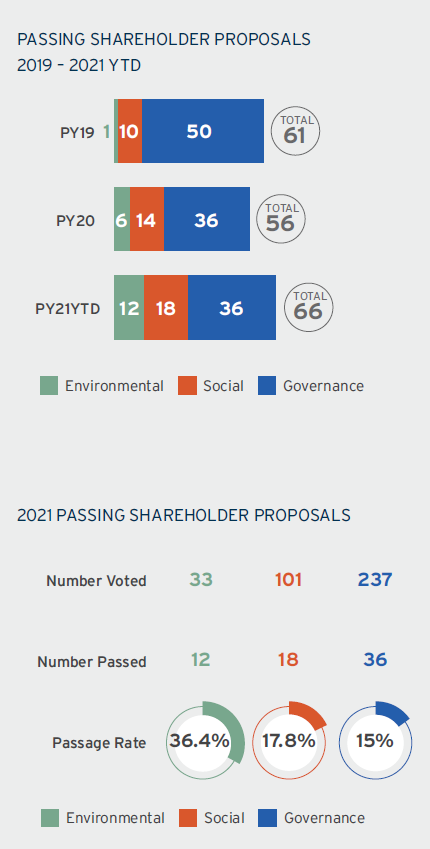

As of June 2nd, 66 shareholder proposals have passed, already surpassing the 56 that received such support in the entire 2020 season.

Considering that 79 shareholder proposals remained pending at June 2nd, and that average support levels across environmental, social and governance proposals have trended upwards this season, we anticipate that an additional handful of proposals, at least, will receive majority support in the final weeks of the season. Of those proposals that have passed to date, 36 addressed traditional governance matters—such as majority voting and shareholder right to act by written consent—18 addressed social topics and 12 addressed environmental matters.

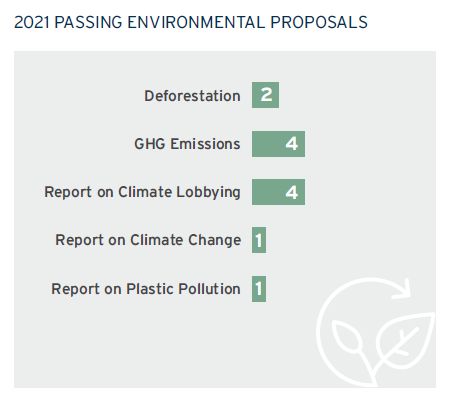

Record-Breaking Support for Environmental Proposals

To date 12 of 33 environmental shareholder proposals that reached a vote have passed. That translates into a passage rate of over 36% of environmental proposals voted upon, and is double the number that passed in all of the 2020 proxy season.

Beyond the volume of environmental proposals receiving majority support this season, in some cases the percentage of support received is also unprecedented. The proposals voted upon at Dupont and Bloomin’ Brands demonstrate the significant year-over-year shift we are seeing in investors’ support of these proposals. The proposal at Dupont regarding plastic pollution received more than 81% support, the highest level we are aware of for such a proposal. By contract, a nearly identical proposal at Dupont received only 6% support in 2019. Similarly, a proposal at Bloomin’ Brands regarding emissions within the company’s supply chain received approximately 26% support in 2020, while a broader proposal this year, which referenced supply chain emissions concerns in the broader context of climate reporting, received over 75% support.

It also merits noting that several companies recommended that shareholders vote in favor of shareholder proposals this season, leading to near unanimous (and record high) support for proposals at General Electric and Bunge Limited. While such practice is not unheard of, it is atypical and we do not recall seeing multiple instances in the context of environmental proposals in prior seasons.

Ceres’s CEO and President Mindy Lubber last month observed that prior to this proxy season, Ceres had only recorded three climate-related shareholder proposals ever receiving majority support at U.S. oil majors. Accordingly, that number has now almost tripled, with an additional five proposals at four oil majors having already passed this season. All four companies are among those targeted by the Climate Action 100+ investor initiative focused on climate change, which continued to gain momentum this proxy season: Notably, State Street became a Climate Action 100+ signatory in November 2020. BlackRock, which became a Climate Action 100+ signatory in January 2020, historically has been criticized for its lack of support for climate-related shareholder proposals.

In line with revisions to its voting guidelines early in the season indicating its intention to increasingly support shareholder proposals addressing material ESG issues, BlackRock appears to have markedly shifted its voting practices this season. Indeed, its most recent global stewardship report discloses support for 75% of environmental and social shareholder proposals during the first quarter of 2021. [7] Consistent with updates to Vanguard’s proxy voting guidelines earlier this year, [8] early disclosures by Vanguard on certain key votes this season also suggest that it is increasingly supporting these proposals. [9] Once N-PX filings are available, the full extent of institutions’ shifting voting patterns will become apparent.

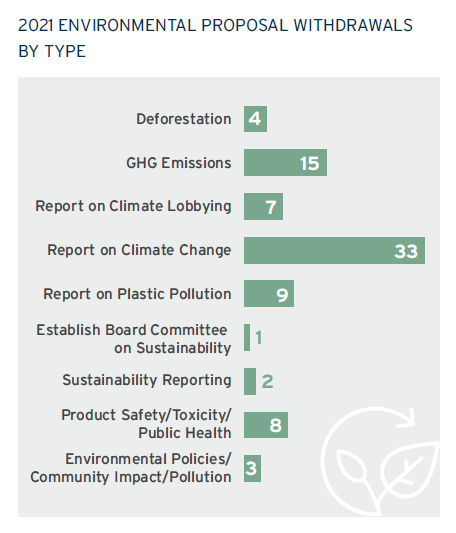

In addition to majority supported proposals, significant activity surrounding climate change during the 2021 proxy season took place outside of the proxy voting process. A review of withdrawn proposals shows 82 environmentally-focused proposals where presumably the subject company and the proponent reached an agreement on the subject matter of the proposal—almost double the number observed in the prior year.

While no “say on climate” shareholder proposals have received majority support this season, this “say on climate” new category of proposal merits some discussion. TCI Fund Management (TCI), a UK-based hedge fund, has spearheaded this campaign globally, with As You Sow also filing resolutions within the U.S. Similar to say on pay proposals, say on climate proposals request that the target company provide shareholders with the opportunity to approve or disapprove of the company’s publicly available climate policies and strategies. Unlike many traditional shareholder proponents, who tend to own small stakes in the companies at which they present resolutions, TCI owns significant stakes in all the companies at which it presented proposals in the 2021 proxy season, likely providing it with increased influence and access to management. At both Moody’s and S&P Global, the companies moved to support TCI’s campaign, in each case presenting management-sponsored resolutions that asked shareholders to approve the company’s climate transition plan, which received support of 93.3% and 99.5% of shareholders, respectively.

Notably, the proposals at both Moody’s and S&P Global committed to presenting advisory votes at the company’s 2022 AGM, but did not speak to future meetings. That construct was likely positively viewed by investors, given some of the concerns expressed with the shareholder-sponsored proposals discussed below.

Unlike the management-sponsored proposals at Moody’s and S&P Global, which extend only through 2022, Say on Climate shareholder resolutions request ongoing future annual advisory votes on companies’ emission reduction plans. Some of the proposals, such as those at Charter Communications and Union Pacific Corp, request future advisory votes on a climate action plan that explicitly includes an emissions reduction strategy. Others, like those at Monster Beverage and Booking Holdings, request a future advisory vote approving the companies’ climate policies and strategies. While those proposals reference consideration of the company’s alignment with climate-related benchmarks, they do not explicitly reference emissions reduction targets.

With regard to the companies where shareholder-sponsored Say on Climate resolutions have or will be voted upon, each target company highlighted its efforts in place to reduce emissions and other environmental impacts, and/or existing or forthcoming ESG reporting and emissions targets, in its statement in opposition of the proposal. Notably, the proposal at Union Pacific Corp, the only proposal recipient to have already set Science Based Targets Initiative (SBTi) approved scope 1 and 2 emissions reduction targets, received lower support (and against recommendations from both proxy advisory firms) than did the proposal at Charter Communications, where the company has committed to set ESG targets, but has not yet disclosed specific GHG reduction target plans. [10] While no shareholder-sponsored say on climate proposal has received majority support, both voted upon as of June 2 received support in excess of 30%, a level at which responsiveness is generally expected, and which ensures that the proponent can resubmit the proposal at the subsequent annual meeting.

2021 Say on Climate Proposals

| Company | AGM | Proponent | Proposal |

|---|---|---|---|

| Charter Communications | 27 April 2021 | Shareholder (TCI) | Proposal requesting a report disclosing GHG emissions levels consistent with TCFD recommendations as well as strategies to reduce GHG emissions and YoY progress, and opportunity for shareholders to express an advisory vote approving or disapproving of GHG reduction plan |

| Union Pacific | 13 May 2021 | Shareholder (TCI) | Proposal requesting annual emissions reduction plan and annual advisory vote on emissions reduction plan (Note: As You Sow also submitted a SoC proposal that was omitted) |

| Alphabet | 2 June 2021 | Shareholder (TCI) | Withdrawn; resolution text not available |

| Booking Holdings | 3 June 2021 | Shareholder (As You Sow) | Proposal requesting annual vote on whether shareholders’ approval or disapprove of the company’s publicly available climate policies and strategies |

| Monster Beverage | 15 June 2021 | Shareholder (As You Sow) | Proposal requesting an amendment to the Company’s bylaws to provide for an annual advisory vote approving or disapproving the company’s climate policies and strategies, in consideration of key climate benchmarks, and authorizing annual reporting regarding the scale and pace of the company’s responsive measures associated with climate change |

| Moodys Corp | 20 April 2021 | Management (initially Shareholder (TCI); subsequently withdrawn and presented as a management proposal) |

Proposal seeking an advisory vote on the company’s plan for reducing GHG emissions (the 2020 Decarbonization Plan). The board has also agreed with TCI to hold an advisory vote on the company’s decarbonization plan at its 2022 annual meeting. It does not provide for advisory votes beyond 2022 |

| S&P Global | 5 May 2021 | Management (initially Shareholder (TCI); subsequently withdrawn and presented as a management proposal) | Approve, on an advisory basis, the Company’s Greenhouse Gas (GHG) Emissions Reduction Plan, as described in this Proxy Statement. Commits to holding an advisory vote in 2022, but not beyond |

Investors’ Focus on Diversity, Lobbying and Political Contributions Gains Momentum

Of just over 100 socially-focused shareholder proposals voted to date, 18 have passed. [11] Consistent with the 2020 proxy season, the bulk of these proposals address either diversity or political contributions and lobbying payments.

The most notable socially-focused campaign of the 2021 season was spearheaded by the New York City Comptroller’s Office and occurred primarily outside of the proxy ballot. As widespread civil unrest last summer focused corporations’ attention on efforts to combat systemic racism, many company CEOs issued statements in support of racial equality or affirming corporate commitments to diversity, equity and inclusion initiatives. The Comptroller launched a letter writing campaign to CEOs at 67 of those companies within the S&P 100, seeking public disclosure of each company’s EEO-1 Report data. The comptroller withdrew the most of those proposals prior to reaching a vote, having reached agreements with the target companies to disclose their EEO-1 data. A handful of other proponents also submitted EEO-1 proposals this season, including Calvert Research & Management and Trillium Asset Management. Ultimately, only three of these proposals reached a vote, two of which passed.

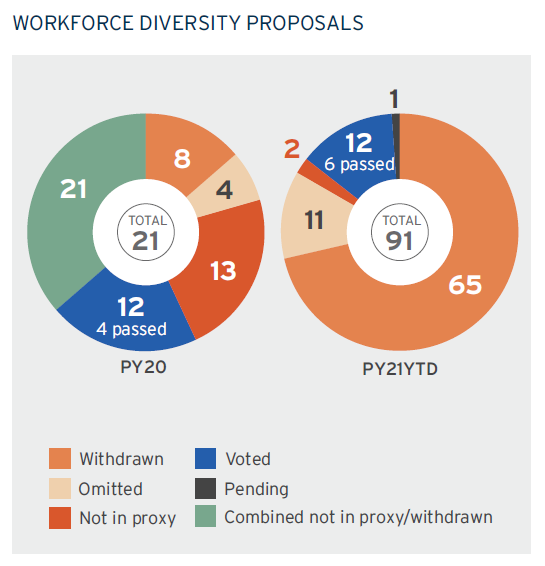

Looking at workforce diversity-focused shareholder proposals in general, of the 91 that were submitted during the 2021 proxy season only have or will be voted upon; of the 12 voted upon to date, 50% passed.

Heading into the 2021 proxy season, the Comptroller’s Office reported 31 public companies that disclosed their EEO-1 reports, of which 14 were in the S&P 100. [12] Accordingly, between proposal withdrawals and majority-supported proposals, EEO-1 disclosure transitioned from a minority to majority practice within the S&P 100 within the proxy season.

Several other workforce diversity-related proposals have also passed so far this season, all of which related to reporting on diversity, equity and inclusion practices. Three board diversity proposals also passed, including one at First Solar that received what appears to be record high 91.2% support.

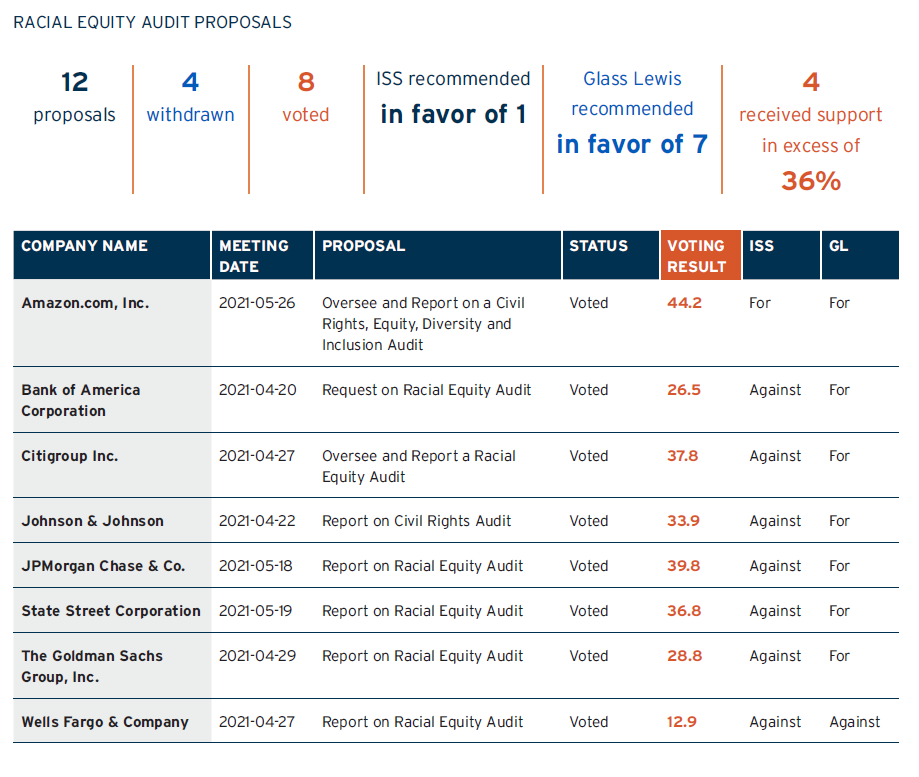

In addition, while none of the racial equity audit proposals received majority support, half of those voted received support in excess of 30%, which is notably high support for a first-time proposal. Like the EEO-1 campaign, the racial equity audit campaign also tied companies’ statements expressed in support of efforts to dismantle systemic racism with actions by the companies targeted, and asked in each case that the company conduct a third party audit and prepare a report assessing company behavior through a racial equity lens. Change to Win (CTW Investment Group) and the Services Employees Union International (SEIU) were primary proponents of these proposals, and largely focused on companies within the financial services industry. A handful of additional proponents, including the New York State Common Retirement Fund, Northstar Asset Management and Trillium Asset Management, filed proposals at additional companies in various industries.

Proposals seeking reporting on political contributions and lobbying payments have also been prevalent in the 2021 proxy season. 74 such proposals were filed this season—comparable to the 70 filed in the 2020 season—of which 46 have or will be voted upon. To date, 4 proposals in each category have passed—including record-high 79.3% support for a political contributions proposal at Chemed Corporation—more than double than the number that received such support in the 2020 season.

While investor scrutiny of companies’ political contributions and lobbying activities is not new, the 2020 presidential election and subsequent events of this past January in Washington, D.C. both likely catalyzed support for these proposals in the 2021 proxy season. More broadly, investors’ increased focus on ESG issues in general was also a likely factor in many instances.

Corporate Governance Areas of Focus Remain Steady

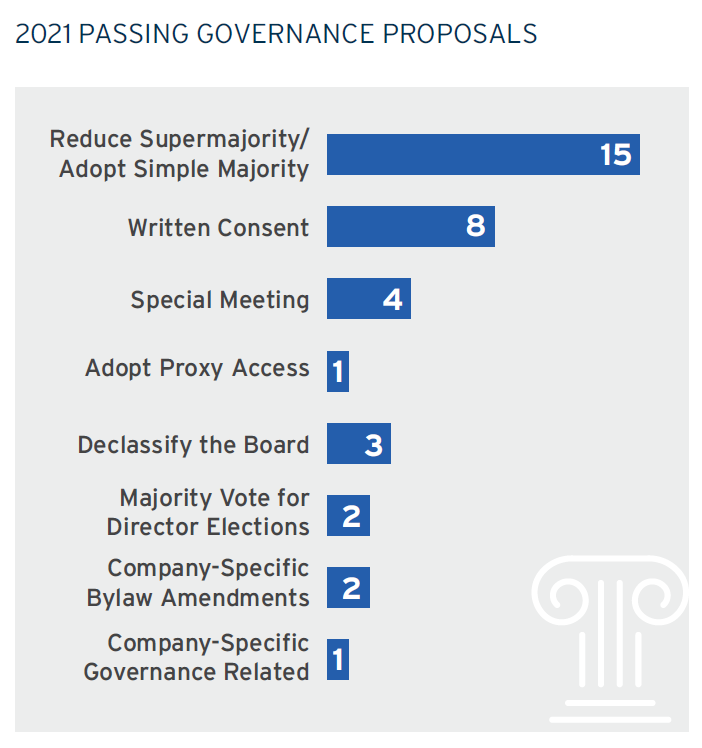

Of 237 governance-related proposals voted upon to date, 36 have passed. [13] The topics addressed by these proposals are neither new or particularly noteworthy. However, we do observe that no proposals seeking to separate the roles of chair and CEO have received majority support to date this season, as compared to [two] that did in the prior season, although seven did receive support in excess of 40%.

Conclusion

With one month of voting results still remaining, the 2021 season has already proved historic in a number of ways.

Given the fundamental shift in investors’ consideration of ESG risks and opportunities in proxy voting decisions, companies would be well-served to better understand their specific investors’ ESG expectations generally, and particularly those relating to climate change, diversity equity and inclusion, and political spending.

The complete publication, including appendix, is available here.

Endnotes

1Results discussed herein are for companies within the Russell 3000. All data used in this report has been sourced via ISS Corporate Solutions Voting Analytics, unless otherwise indicated, as supplemented and confirmed through Georgeson’s own research leveraging additional data sources, such as Ceres’ shareholder resolution database. For purposes of this article, the proxy season refers to July 1 to June 30 for prior year 2019 and 2020 results discussed. For example, the 2020 proxy season includes meeting results from July 1, 2019 to June 30, 2020. With respect to the 2021 season, annual meeting results examined are for meeting dates held July 1, 2020 through June 2, 2021, unless otherwise indicated. In some cases, the applicable voting standard in place for the director’s election was a plurality of votes cast. Accordingly, failure to receive majority support does not necessarily indicate a failure to receive the support necessary for reelection under the applicable voting standard.(go back)

2In some cases, the applicable voting standard in place for the director’s election was a plurality of votes cast. Accordingly, failure to receive majority support does not necessarily indicate a failure to receive the support necessary for reelection under the applicable voting standard.(go back)

3BlackRock’s May 2021 voting bulletin on Berkshire Hathaway’s annual meeting is available at https://www.blackrock.com/corporate/literature/press-release/blk-vote-bulletin-berkshire-hathaway-may-2021.pdf.(go back)

4Voting decisions made public as part of Neuberger Berman’s NB Votes initiative are available at https://www.nb.com/en/global/esg/nb-votes.(go back)

5Red zone outcomes indicate instances where a company received support of less than 80%; outcomes are based on the voting standard applicable to each company in question (such that in some cases abstentions are considered).(go back)

6All percentages discussed herein for purposes of average proposal support levels have been calculated on the basis of F/F+AG (i.e., abstentions have not been taken into account).(go back)

7BlackRock’s stewardship report is available at https://www.blackrock.com/corporate/literature/publication/blk-qrtly-stewardship-report-q1-2021.pdf.(go back)

8Those updates indicated that Vanguard is likely to support climate proposals that (1) request disclosure on how climate change risks are incorporated into strategy and capital allocation decisions, or (2) ask for an assessment of climate impact on business (including scenario analysis) or feasibility analysis for environmental disclosure. Our full summary of key updates to Vanguard’s proxy voting guidelines is available at https://www.georgeson.com/us/insights/corporate-governance-proxy/vanguard-2021-voting-policy-updates.(go back)

9For example, Vanguard disclosed voting in favor of the ConocoPhillips shareholder proposal regarding emissions reduction targets on the basis that it was lagging peers in its investment in emerging and renewable technologies. See https://about.vanguard.com/investment-stewardship/perspectives-and-commentary/INSCHART_052021.pdf.(go back)

10Although notable, it is unlikely that Union Pacific’s targets were the influencing factor in investors‘ voting decisions, as the Union Pacific proposal included a time-bound request that the company produce reporting of its emissions reduction plan within 60 days of its annual meeting. For example, in electing to vote against the proposal, Vanguard indicated being encouraged by the

company‘s recently established targets, but perceived there to be a gap between the company’s disclosure of climate risk mitigation goals and plans to achieve those goals, but ultimately deemed

the 60 day time frame to be unreasonable. See https://about.vanguard.com/investment-stewardship/perspectives-and-commentary/UnionPacific_1660080_062021.pdf. The proposal at Charter Communications did not provide such a timeline.(go back)

11An additional proposal regarding employee arbitration received majority support at Goldman Sachs, but did not pass because the applicable voting standard treated abstentions as a vote against the proposal.(go back)

12See https://comptroller.nyc.gov/newsroom/comptroller-stringer-nyc-funds-escalate-campaign-calling-on-major-companies-to-publicly-disclose-workforce-demographics(go back)

13Two additional proposals – addressing board size and director vacancies, respectively – received majority support but did not pass as the applicable voting standards were based on shares outstanding rather than votes cast on the proposals.(go back)

Print

Print