Pamela Marcogliese and Lori Goodman are partners and Elizabeth Bieber is counsel at Freshfields Bruckhaus Deringer LLP. This post is based on a Freshfields memorandum by Ms. Marcogliese, Ms. Goodman, Ms. Bieber, and Maj Vaseghi.

ISS 2021 Proxy Voting Guidelines

ISS’ revised polices for the 2021 proxy season indicate a significant focus on social and environmental issues, the importance of board diversity, shareholder litigation rights and COVID-19 recovery era policies

Social and Environmental Issues

- Governance failures – Material E&S Risk Oversight: Recommend withhold votes against directors, committees or the entire board for E&S issues (including climate change) which constitute a material risk oversight failure

- Mandatory arbitration: Recommend voting for shareholder proposals requesting reports about a company’s use of mandatory arbitration in employment claims on a case-by-case basis, taking into account the company’s existing policies, public standing with respect to any controversies and the company’s disclosure of policies compared to its peers

- Sexual harassment: Recommend a case-by-case analysis of shareholder proposals requesting reports on the actions taken by a company to prevent sexual harassment or on the risks posed by the company’s failure to take such actions, taking into account the company’s existing policies, any recent controversies and the company’s disclosure of policies compared to its peers

Board Diversity

- Racial and ethnic diversity: Beginning in 2022, recommend withhold votes against the chair of the nominating committee or individual directors on a case-by-case basis if the boards of companies in the Russell 3000 or S&P 1500 do not have apparent racially or ethnically diverse directors;

- Negative voting recommendations may not be made if a company makes a firm commitment to appoint at least one racially and/or ethnically diverse director within a year

- Gender diversity: Recommend withhold votes against the chair of the nominating committee or individual directors on a case-by-case basis of companies in the Russell 3000 or S&P 1500 where there are no female directors

- An exception may be made if the company had a female director in the preceding year and makes a commitment to restoring gender diversity within the following year

Shareholder Rights

- Shareholder litigation rights: Recommend a vote for proposals that specify the district courts of the US as the exclusive forum for federal securities law claims, but withhold votes against proposals that designate a particular federal district court

- ISS will generally recommend votes for charter or bylaw provisions specifying Delaware as the exclusive forum for state law matters, but will also consider other states on a case-by-case basis

COVID-19 Recovery Era Considerations

- Poison pills: Recommend withhold votes against directors that adopted poison pills with a deadhand or slowhand feature (a change that was made in consideration of the handful of companies that adopted short-term poison pills during the COVID-19 pandemic)

- Virtual shareholder meetings: Recommend voting for management proposals permitting virtual shareholder meetings, so long as the proposals do not preclude in-person meetings

- ISS also encourages companies to provide disclosure regarding the reasons to hold virtual-only meetings and provide information on shareholder rights and participation opportunities at virtual meetings compared with in-person meetings

- Recommend evaluating shareholder proposals for virtual-only meetings a case-by-case basis

Other Board Changes

- Gender, race and ethnicity pay gaps: Updated its existing policy to consider on a case-by-case basis, including the following additional factors when analyzing proposals requesting companies pay gap analysis report: local laws regarding employee categorization and comparison against industry peers

- Board term limits: Review proposals to implement term limits on a case-by-case basis, considering a number of factors, including the rationale and flexibility of the proposed director tenures and the robustness of the board’s evaluation process

- Director classification: Employees, including employee representatives, will not be considered “executive directors”

- Independence: Directors who receive pay on par with pay for Named Executive Officers for multiple years will be classified as non-independent

ISS Updates to Methodologies

QualityScore

Changes reflect a focus on significant ESG issues, including 17 new factors relating to diversity and inclusion, compensation, board practices and information security risk management

Diversity and Inclusion

- A new factor has been added that will examine ethnic and racial diversity on the board:

- “Does the board exhibit ethnic or racial diversity?”

Compensation

- A new factor has been added that evaluates the level of disclosure of diversity and inclusion performance metrics and two new factors that evaluate the presence and proportion of special grants awarded to executives:

- “What is the level of disclosure on diversity and inclusion performance measures for short-term or any long-term incentive plan for executives?”

- “Has the company made special grants to executives (excluding the CEO) in the most recent fiscal year?”

- “What percentage of the CEO’s total compensation was due to special grants in the most recent fiscal year?”

Board Structure

- A new factor will consider the independence of the sustainability committee given that more public companies are beginning to delineate responsibilities for environmental and social oversight:

- “What percentage of the sustainability committee is independent?”

Analyzing materiality: in addition to reviewing ISS’ internal ratings systems, including the QualityScore and Climate Awareness Scorecard, ISS will also consider external environmental and social ratings including:

- CPA Zicklin Index

- Corporate Human Rights Benchmark

- CDP Scorecard

Glass Lewis 2021 Guidelines

Glass Lewis’ revised polices for the 2021 proxy season also indicate a focus on ESG issues

Social and Environmental Issues

- Diversity reporting: Recommend in favor of proposals that seek disclosure of EEO-1 reports

- Social and environmental risk oversight: Beginning in 2022, recommend withhold votes against the chair of the governance committee of S&P 500 companies if there is a failure to provide specific disclosure concerning the board’s role in overseeing social and environmental issues

- Management-proposed ESG Resolutions: Recommend a case-by-case analysis of management-proposed ESG resolutions, considering the company’s general responsiveness

to shareholders and ESG issues, the binding nature of the proposal, and whether there is a related shareholder proposal on the topic - Climate Change:

- Recommend in favor of proposals requesting enhanced disclosures related to climate change where there are no existing climate policies or reports that sufficiently address the issues described in the proposals

- Recommend in favor of shareholder proposals that seek enhanced disclosure of climate-related lobbying

Board Diversity

- Gender diversity: Beginning in 2022, Glass Lewis will recommend voting against the nominating chair at a company with more than six directors without at least two female directors on its board; provided that a company’s disclosure of diversity considerations and goals may mitigate a potential adverse recommendation

- Racial diversity: While there are no current recommendations, Glass Lewis indicated this as an area of interest, particularly in light of state law requirements

- Disclosure of director diversity and skills: Beginning in the 2021 proxy season, S&P 500 company Glass Lewis reports will include an assessment of the company’s disclosure with respect to:

- Racial and ethnic diversity on the board

- Whether the board defines diversity to include gender and race ethnicity explicitly

- Whether the board has adopted a “Rooney Rule”-type policy requiring women and minorities to be included in the initial pool of candidates

- Board skills

- Board refreshment: Beginning with the 2021 proxy season, Glass Lewis reports will note the lack of board refreshment as a concern if the average tenure of non-executive directors is more than 10 years and no new independent directors have joined the board in the last five years

Glass Lewis 2021 Guidelines and Supplemental Expectations

Compensation clarifications

- Short-term incentives: Added additional factors in consideration of short-term incentive plans

- Expects companies to provide justification for any significant changes to a short-term incentive plan structure, particularly when the target and maximum performance levels were lowered from the prior year

- Expanded description of application of updated discretion to include retroactively prorated performance periods

- Long-term incentives: Added additional factors in consideration of long-term incentive plans

- Inappropriate performance-based award allocation may be a factor, when taken into account with other concerns, when making a negative recommendation

- Decisions to roll back performance-based award allocation, absent exceptional circumstances, may result in a negative recommendation

Virtual Annual Meetings

Glass Lewis released expectations for companies holding virtual annual meetings regarding disclosure and indicated a willingness to, and did, recommend against companies that failed to include expected disclosure

- However, Glass Lewis also showed a willingness to revise its recommendation after a company provided supplemental disclosure

Expectations include:

- Discussion of logistics for the ability of shareholders to ask questions, including the timeline for submitting questions, appropriate questions, and how rules would be disseminated

- Disclosure of restrictions on the ability of shareholders to ask questions

- Commitment to answering questions in a manner accessible to all shareholders

- Disclosure of procedures and requirements to participate in the meeting

- Disclosure of technical support availability

ISS and Glass Lewis Agree to Disagree

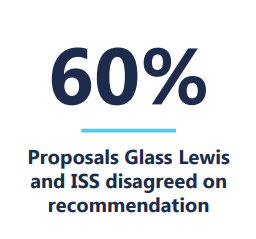

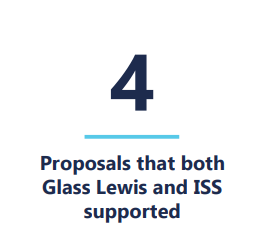

In an analysis of 25 ESG-related shareholder proposals at 12 of the largest market cap companies:

The complete publication, including footnotes, is available here.

Print

Print