Rebecca Sherratt is Corporate Governance Editor at Insightia. This post is based on her Insightia memorandum. Related research from the Program on Corporate Governance includes Politics and Gender in the Executive Suite by Alma Cohen, Moshe Hazan, and David Weiss (discussed on the Forum here).

Director support among U.S.-listed companies is dropping this year as investors expect boards to accelerate their diversity commitments for not only gender, but also racial and ethnic diversity. Average support for director elections at S&P 500 companies dropped to 96.1% in the first half of 2021, and a similar decline has also been exhibited in the U.K.

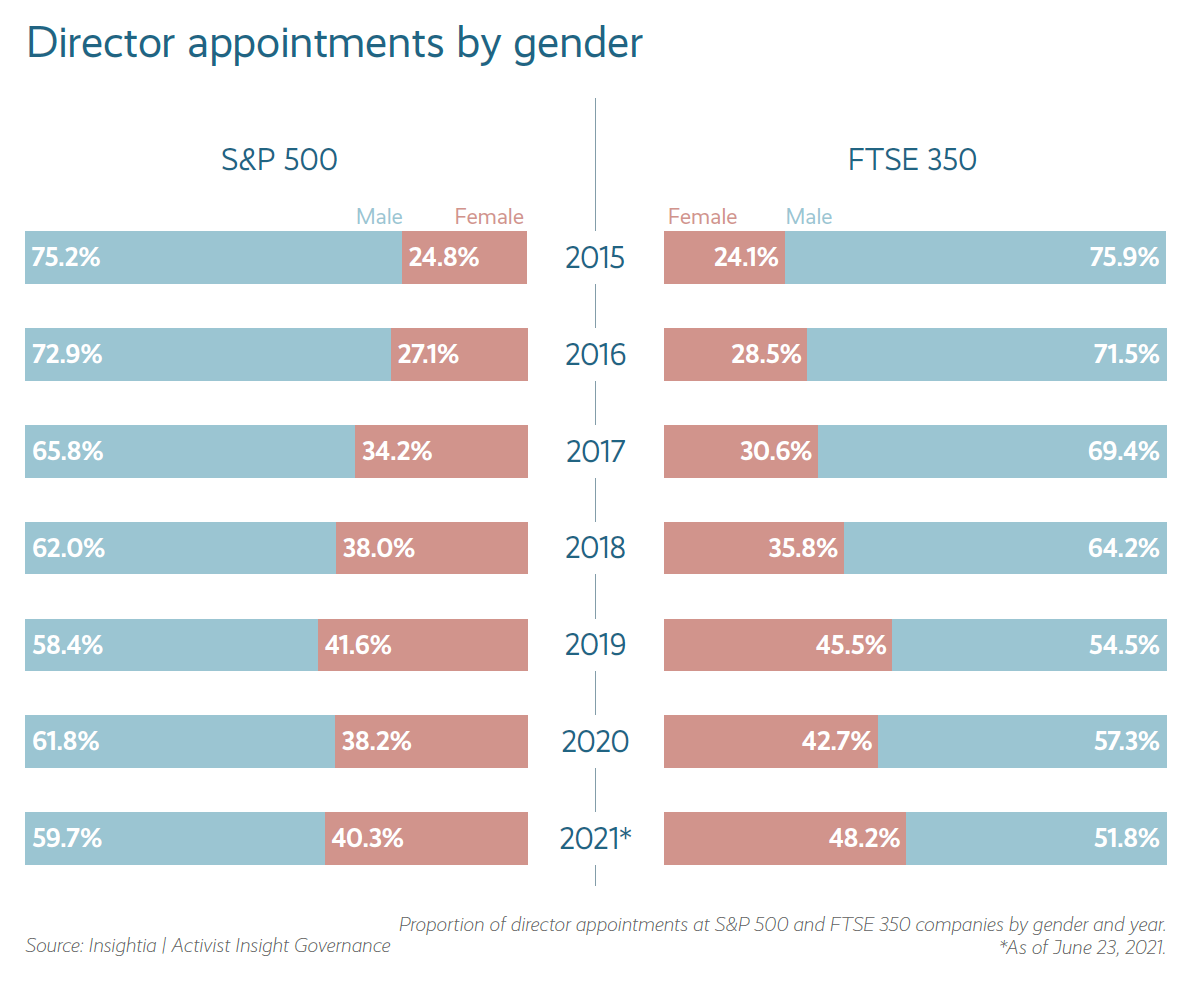

In the S&P 500, 41.6% and 38.2% of director appointments were female in 2019 and 2020 respectively, according to Activist Insight Governance data. This significant number of diverse director appointments assured investors that gender diversity issues were being sufficiently managed by boards, but now investor expectations are tightening once more.

The emphasis on racial and ethnic representation on boards has increased, in response to the 2020 Black Lives Matter protests, which highlighted to investors that minority representation on boards still leaves much to be desired.

“Of course, diversity isn’t just about gender, it’s also about racial and ethnic equality, and with what happened in the U.S. last year we recognized that companies that weren’t tackling this issue effectively would potentially have a higher risk profile,” Robert Walker, global co-head of asset stewardship at State Street Global Advisors (SSGA), told Proxy Insight Online in an interview.

Pressure Mounts

Of the 10 U.S. companies that have experienced the highest level of opposition toward director elections so far this year, seven were directly related to a lack of board diversity, according to Proxy Insight Online data.

“Diversity of perspectives is a key ingredient for effective boards,” said David Shammai, ESG analyst at Allianz Global Investors, in an interview with Proxy Insight Online. “This is why we included specific expectations in our global governance guidelines requiring boards to seek at least 30% representation of each gender. Compared with several years ago, in the U.S. it is notable that many companies have been making a deliberate effort to focus on this.” Allianz has also committed this year to “call out” boards that fall behind by voting against accountable directors, Shammai added.

Arrowhead Pharmaceuticals director Michael Perry received just 36.8% support at the U.S. biotechnology company’s March 18 annual meeting, owing to the board being less than 30% diverse and failing to sufficiently promote diversity at the executive management level, according to investor voting rationales.

Similar rationales from investors in the U.S. and U.K. suggest that investors are holding U.S. directors to the same diversity expectations as that of their European counterparts, despite having yet to establish similarly stringent diversity quotas.

Informa directors Stephen Davidson and Helen Owers received 53.4% and 78.1% support respectively at the FTSE 100 publishing company’s June 3 annual meeting, similarly in response to the board being less than 40% diverse and comprising of fewer than two ethnically diverse directors.

“This year, expectations for corporate diversity are rising, and we increased our standards for board diversity,” said John Wilson, director of corporate engagement at Calvert Research and Management, in an interview with Proxy Insight Online. “For companies in the U.S., U.K., Australia, and Canada, Calvert votes against the nominating committee at companies that have fewer than two people of color or are less than 40% diverse.”

Heightened Expectations

BlackRock has stepped up its engagement with board diversity, voting against 9% of director-related management proposals at U.S.-listed companies in the first quarter of 2021, compared to 8% the previous year. In total, the fund manager voted against 130 directors in the first quarter of 2021, due to concerns over a lack of board diversity, according to its global first-quarter report.

BlackRock voted against the re-election of AT&T nominating committee chair Matthew Rose at the U.S. telecommunications company’s April 30 annual meeting, due to concerns over insufficient steps taken to address board diversity. As part of BlackRock’s newly established key performance indicators (KPIs), the fund manager expects companies to “disclose their approach to ensuring appropriate board diversity and disclose a demographic profile of the incumbent board.”

Ontario Teachers’ Pension Plan similarly voted against Rose at AT&T’s annual meeting, noting its expectation for boards of U.S.-listed companies to set “clear commitments (including targets) to increase gender diversity within a meaningful time frame.”

Looking forward, pressure on companies to ensure their boards are sufficiently diverse is likely only to increase, as fund managers hold companies accountable for laggardness. SSGA is one of many companies that has recently revised its strategy to hold diversity laggards accountable.

“For the first time this year, we are asking S&P 500 and FTSE 100 companies to disclose the racial diversity of their board,” Walker added. “We will be taking voting action against S&P 500 companies and FTSE 100 companies that don’t have at least one director from an underrepresented community, starting in 2022.”

As more fund managers highlight diversity as a priority in their coming engagements, nominating committees will face heightened opposition if they lag behind their peers. Issuers would be wise to proactively showcase their commitments to enhancing board diversity, lest they fall victim to increased opposition from shareholders.

The complete publication, including footnotes, is available here.

Print

Print