Claire Liu is Assistant Professor of Finance at the University of Sydney; Ronald Masulis is Scientia Professor of Finance at the University of New South Wales; and Jared Stanfield is Assistant Professor of Finance at the University of Oklahoma. This post is based on their recent paper. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

Option compensation is an important component of executive pay in the United States. By providing convex payoffs, option-based compensation is viewed as a standard mechanism to reduce manager risk aversion and align manager and shareholder interests by encouraging value-enhancing risk taking. In aligning manager-shareholder interests, chief executive officer (CEO) stock option compensation can also intensify conflicts of interests with other key stakeholders by encouraging potentially excessive firm risk taking (see, e.g., John and John, 1993; Opler and Titman, 1994; Kuang and Qin, 2013; Akins et al., 2019). In this study, we take a novel approach to further our understanding of the effects of these conflicts of interest by studying the impact of competitive shocks to important product market relationships and executive option compensation.

Generating sales and preserving valuable product market relationships, such as with major customers, is arguably one of the most crucial factors for a firm’s success. In the United States, nearly half of public firms depend on at least one large customer for a substantial portion of their sales, i.e., representing at least 10% of sales (Ellis, Fee, and Thomas, 2012). It is also common for firms to make relationship-specific investments (RSI) in their major customer relationships, and the health of these valuable trading relationships can significantly affect firm value. As a result, suppliers that depend on an important customer commonly state that the loss of a major customer would negatively impact their firm. For example, Scientific Atlanta Inc., a cable and telecommunications equipment manufacturer, states in its 2005 Form 10-K filing: “A failure to maintain our relationships with customers that make significant purchases of our products and services could harm our business and results of operations. A decline in revenue from one of our key customers or the loss of a key customer could have a material adverse effect on our business and results of operations.” Networking server and storage manufacturer Qlogic Corp. states in its 2005 10-K filing: “Any such reduction, delay or loss of [major customer] purchases could have a material adverse effect on our business, financial condition or results of operations.”

Surprisingly, the existing academic literature provides little evidence on whether boards of directors consider their major customers in making CEO compensation decisions. From a customer’s perspective, supplier reliability is critically important to the value of the ongoing customer-supplier relationship. As supplier risk taking increases, customers face heightened uncertainty about supplier reliability, including product quality, the ability to service products, and the timeliness of deliveries. Anecdotal evidence suggests that customers take active steps to evaluate the financial risks of supplier firms, which could weaken their suppliers’ reliability. For example, Dell Technologies states that “[w]e consistently evaluate the financial health of our supplier base,” and Verizon Communications states that any supplier-induced disruptions “could increase our costs, decrease our operating efficiencies and have a material adverse effect on our business, results of operations and financial condition.”

The above anecdotal examples illustrate how CEO risk-taking incentives, of which stock option compensation is a major component, can lead to less stable and less reliable customer relationships. We hypothesize that CEO risk-taking incentives from stock option compensation can reduce the value of important customer relationships, leading boards to decrease CEO option compensation to lower their risk-taking incentives. Empirically, we expect that the existence of major customers to affect a board’s choice of CEO option compensation contracts. Thus, boards of supplier firms with major customer relationships are on average predicted to adopt lower option-based compensation to reduce CEO risk-taking incentives than firms without a major customer.

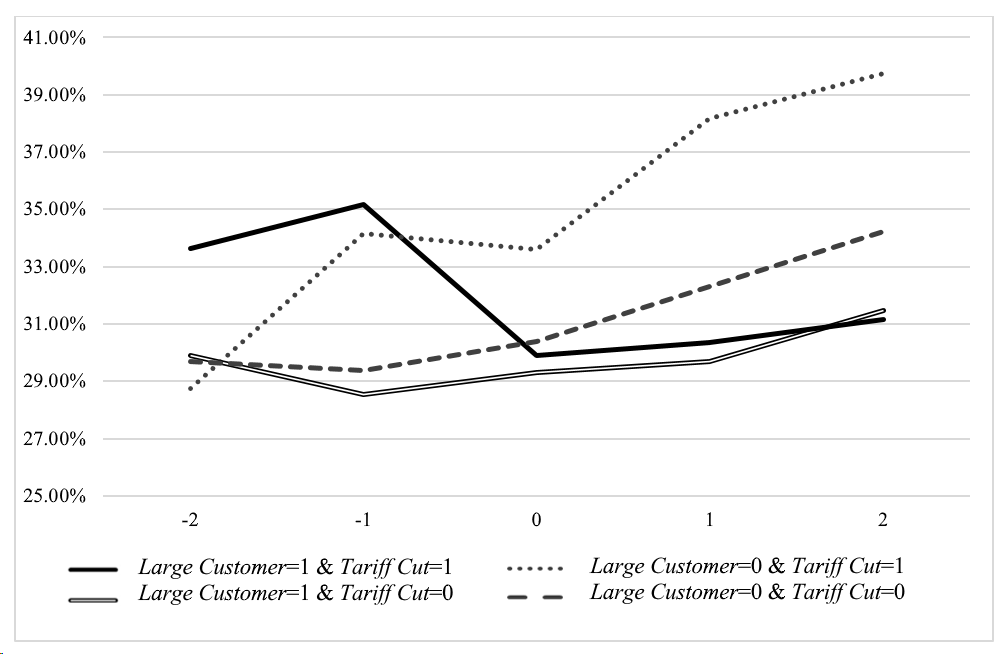

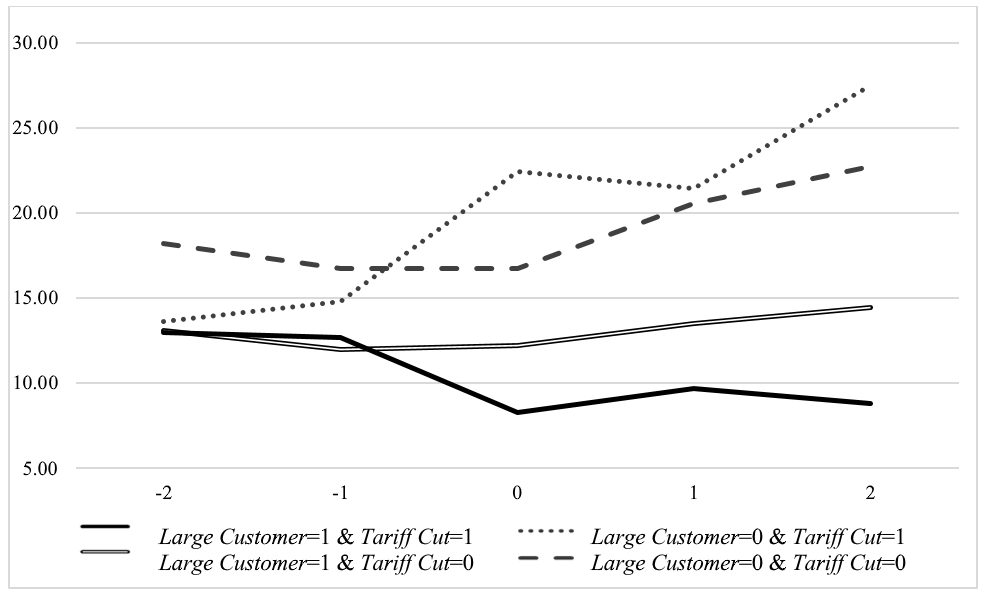

To test the above hypothesis, we exploit U.S. tariff reductions of at least 2.5 times larger than its industry’s median tariff change that occur in different manufacturing industries at different points in time as exogenous shocks to existing customer-supplier relationships over the 1992-2015 sample period. We find novel evidence that this negative shock to the bargaining power of suppliers relative to large customers has a first-order negative effect on the proportion of a supplier CEO’s option-based compensation. Our main option compensation measures are Pct Option and Flow Vega from new annual option grants to CEOs. Pct Option is the portion of CEO compensation composed of stock options, which is calculated from the Black-Scholes value of a CEO’s stock options as a fraction of annual total compensation. Flow Vega is the dollar sensitivity of CEO wealth changes relative to firm risk changes, which is calculated as inflation-adjusted dollar change in a CEO’s new options granted during the current year for a 1% change in the annualized standard deviation of the firm’s daily stock returns. As demonstrated in Figure 1 below, we find that following large tariff reductions, firms with major customers experience greater reductions in CEO option compensation and risk-taking incentives (measured by Pct Option and Flow Vega) relative to firms without a large customer. Further, results from our difference-in-differences regressions, where we match firms with and without a large customer on industry, a variety of firm characteristics and calendar time, suggest that firms with major customers reduce the proportion of annual CEO compensation awarded in the form of stock options by an average of 22.6% compared to firms without major customers.

Our empirical results also provide evidence that CEO option compensation significantly affects the strength of a firm’s relationships with its preexisting major customers. Following tariff reductions, higher CEO option-based compensation and risk-taking incentives lead to significantly lower growth in sales to a firm’s major customers and a higher probability of relationship termination. Following a tariff reduction, a 1 standard deviation rise in a supplier CEO’s Flow Vega from new option grants leads to a 7% decline in sales growth to its major customer. It also leads to a 5.2% rise in the termination probability of the major customer relationship, relative to an unconditional probability of relationship termination of 16%, which raises the relationship termination probability by one-third. We also show that this rise in the termination probability adversely impacts a supplier’s overall performance. Economically, we find that conditional on the existence of large customers, a 1% increase in the fraction of CEO option-based compensation is predicted to reduce a supplier’s Tobin’s Q by about 2%-3%. Our main empirical results above remain robust to a number of alternative methodologies and additional robustness analysis.

The negative relation between major customer bargaining power and supplier CEO option compensation also exhibits significant cross-sectional differences based on customer and supplier characteristics. Our results are stronger for suppliers more likely to lose valuable major customers, such as firms with higher leverage, a higher probability of financial distress, or facing larger impacts of tariff cuts. The results are also stronger for firms that face greater costs of losing valuable major customers, such as firms with greater asset specificity or product differentiation. These findings suggest that suppliers significantly reduce CEO option compensation, especially when they expect to experience the greatest impacts from tariff cuts.

Our study sheds new light on the importance of customer-supplier relationships on firm value and performance, as well as on optimal CEO compensation policy. Our findings support the view proposed by Williamson (1979) that firms modify their major governance mechanisms to bond their actions to reassure important stakeholders. These results suggest that when making governance decisions, firms can face serious implicit or explicit constraints imposed by important stakeholders. Finally, our results help explain the inconclusive findings on the option-performance link in the academic literature. We show that despite option compensation’s benefits in reducing managerial risk-aversion, it can intensify conflicts of interests between shareholders and important stakeholders with debt-like claims such as large customers or bondholders. Overall, we provide the first evidence that the presence of a large commercial contract measurably affects CEO compensation contracts.

The complete paper is available for download here.

Fig. 1. Option compensation surrounding tariff reductions by firm type.

Panel A: Median proportion of option compensation surrounding tariff reductions

Panel B: Median Flow Vega (in $000s) surrounding tariff reductions

Print

Print