John Galloway is global head of investment stewardship at Vanguard, Inc. This post is based on a publication by Vanguard Investment Stewardship.

Regional roundup

Topics and trends that shaped the global governance landscape in the first half of 2021

Good governance has never been more important. Boards of directors and company leaders continued to face challenges in the first half of the year. The pandemic disrupted operations and global supply chains and forced companies to make strategic decisions about capital allocation and executive compensation. Social issues remained in the spotlight as we saw an increase in shareholder proposals on a range of diversity, equity, and inclusion topics. Climate change proposals increased in volume, driven by Say on Climate proposals requesting that investors provide feedback on companies’ transition plans. We also engaged with company leaders on corporate political activity, human rights, and other important governance matters.

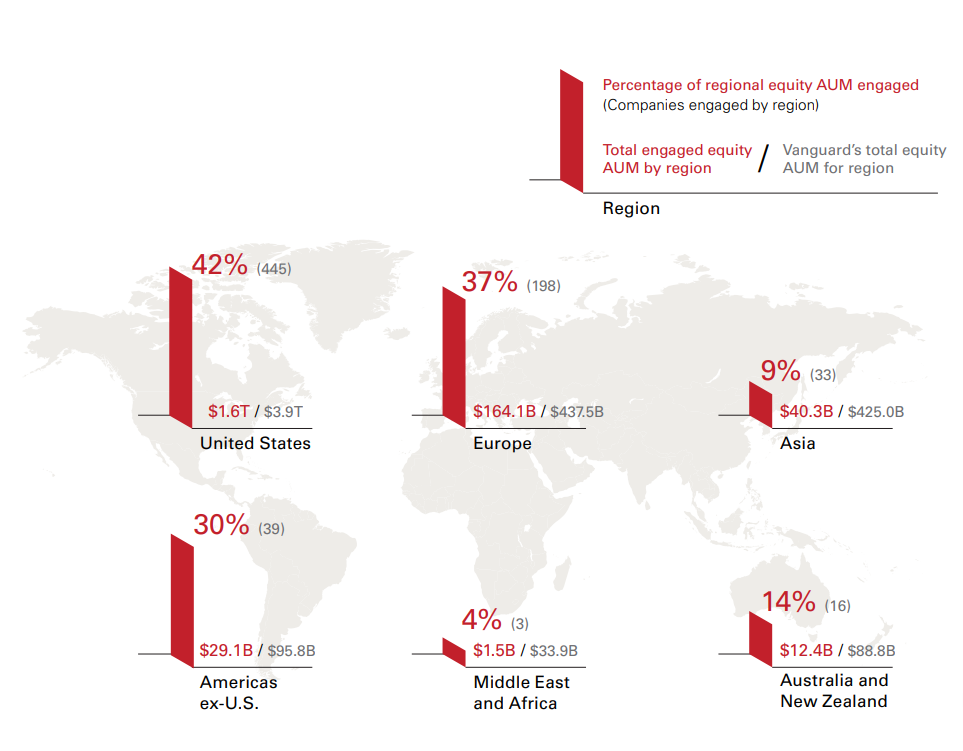

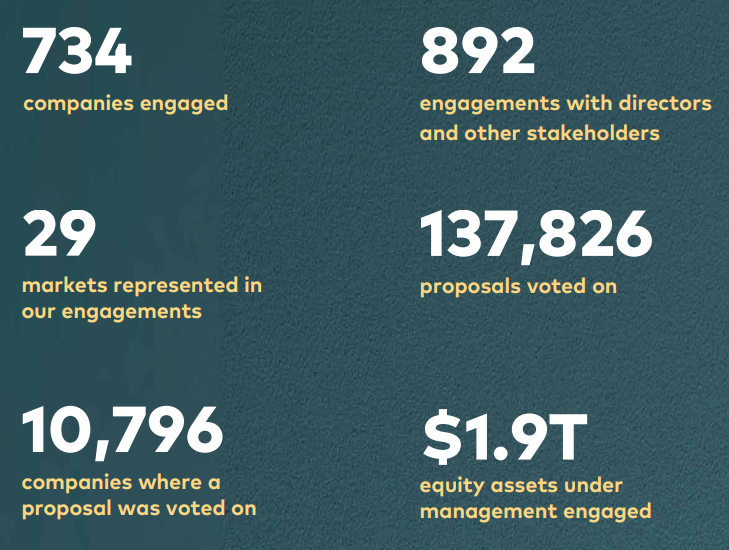

Vanguard’s Investment Stewardship team engaged with 734 companies in 29 countries and voted on 137,826 proposals at 10,796 companies in the six months ended June 30, 2021. Those engagements were made on behalf of investments that represented nearly $1.9 trillion in equity assets under management.

Americas

Throughout the region, companies continued to navigate challenges stemming from the COVID-19 pandemic. In the U.S. and Canada, many of our engagements focused on how companies adjusted their operations and managed the concerns of employees, shareholders, and other stakeholders. Vanguard’s Investment Stewardship team, on behalf of the funds, voted on resolutions that reflected pandemic-related issues such as compensation adjustments, worker health and safety, board entrenchment, and diminished shareholder rights. Those resolutions included company proposals for extending or adopting poison pills or exclusive forums for litigation. As the pandemic’s effects influence ongoing company operations, we will continue to assess boards’ abilities to oversee related risks and strategies.

Climate risk featured prominently in the first half of the year, with climate-related proposals that sought enhanced disclosures on companies’ energy transition plans and how those plans aligned with the Paris Agreement goals. We also saw the emergence of Say on Climate proposals. These proposals, put forth by both management and shareholders, asked companies to disclose greenhouse gas emission levels, create a plan to reduce emissions, and annually disclose their plan to shareholders for approval through nonbinding votes. We evaluate each climate-related proposal case by case and expect boards to effectively oversee climate-related risks and mitigation measures and provide comprehensive disclosures.

In Canada, we engaged with banks on how they plan to align their financing and disclosure with a new national emissions reduction ambition in line with the Paris Agreement.

Diversity was another key theme. Investors continued to seek disclosure on boardroom and workforce diversity levels, as well as the effectiveness of companies’ diversity, equity, and inclusion (DEI) strategies. While we have observed many companies make progress in this area over recent years, such as through disclosure of workforce diversity data in standardized frameworks (like EEO-1 in the U.S.), many companies continue to have an opportunity to better disclose both current data and programs, and the board’s role and expectations with regard to managing DEI risks and strategies.

Other proposals requested third-party racial equity audits primarily within the financial sector. These proposals are similar to previously discussed DEI proposals in that they request increased disclosure and oversight of DEI-related risks. However, they are notably different in that they call for third-party auditor intervention, in contrast to a focus on board intervention, which is the norm for most risk reports. Further, these racial equity audit proposals tended to emphasize impacts beyond human capital-related DEI risks, which are generally relevant across industry, and drew attention to possible inequities in a company’s distribution model. Both of these elements have made these proposals highly company- and industry-specific to evaluate.

In the U.S., corporate political activity remained a focus for shareholders. Some shareholder proposals sought enhanced disclosure of board oversight practices, lobbying expenditures, and trade association memberships, while others sought increased disclosure of climate-related lobbying and how activities aligned with the Paris Agreement goals. We expect companies and their boards to disclose their oversight policies to ensure that political activity is aligned with the company’s philosophy and strategy.

In the Latin American market, we observed increased receptiveness to shareholder feedback that asks companies to adopt governance best practices for board independence, risk oversight, and disclosure. We will continue our engagements and due diligence to enhance governance policies in these markets.

U.K., Europe, the Middle East, and Africa

Portfolio companies domiciled in the U.K., Europe, the Middle East, and Africa also continued to be affected by the pandemic. Many of our engagements included discussions with company leaders and directors on human capital management, workforce safety, and the continuing effects on their strategy and business plans as the pandemic evolved.

We continued our year-over-year engagement with companies to understand their approach toward diversity and inclusion. For us, it was important that these topics remained on the engagement agenda even as companies managed more immediate risks and issues. We were pleased to see that this approach had also prevailed among our portfolio companies, with many showing good progress on their diversity and inclusion disclosures and hiring practices. Unfortunately, we also continued to see poor practice. Where we failed to identify progress, the Vanguard funds selectively used an accountability vote against directors responsible for diversity policies.

Most jurisdictions extended and/or refined temporary legislation put in place last year to create the legal framework for virtual-only meetings. Even though all parties are still adjusting to the new format, meeting schedules nevertheless were more in line with what we observed before the pandemic. We also noted that several countries, such as Italy, updated their corporate governance codes. Where necessary, we amended our internal guidelines to take these changes into account.

With the adoption of the Shareholder Rights Directive II in the European Union, the number of remuneration-related votes increased significantly, with many companies seeking approval for their remuneration policies for the first time. While the quantity of proposals increased, in certain markets, such as Poland, the quality still left room for improvement. We published our perspective on executive remuneration ahead of the season to communicate our expectations. Furthermore, we engaged with many companies to discuss their remuneration policies and reports ahead of their annual general meetings.

In particularly affected industries, some issuers applied discretion to amend the remuneration for their top executives, and in the U.K., we saw examples of potential windfall gains for executives. For the Vanguard funds, it was important that pay continued to be aligned with performance and that all changes were accompanied by a clear explanation, underpinned by sound rationale. Where this was not the case, the Vanguard funds voted against the remuneration report.

There was also momentum on climate change risk management. In several countries, the first Say on Climate proposals appeared, asking shareholders to approve a company’s climate strategy. In France, portfolio companies Atos, Total, and Vinci put forward proposals. In the U.K., several of our largest portfolio companies put forward variations on this type of proposal. After careful analysis, the Vanguard funds approved company proposals that demonstrated progress, clearer disclosure, and more in-depth targets. Not all company Say on Climate proposals were universally supported, as shareholders raised concerns about the alignment with the Paris Agreement and the level of target setting. We will continue to evolve our approach to reviewing Say on Climate proposals and engage with companies to encourage further progress.

Asia

In the first half of 2021, we intensified our engagement and advocacy activities in Asia. Vanguard joined the Asian Corporate Governance Association (ACGA), which engages in an ongoing dialogue with financial regulators, stock exchanges, institutional investors, companies, and auditors on practical issues affecting the regulatory environment and the implementation of better corporate governance practices in Asia. We are contributing to the ACGA Japan Working Group, which focuses on the country’s specific governance issues. We also took part in a dialogue on corporate governance with the Japan Business Federation through the International Corporate Governance Network, where we shared our perspectives on the role of the board, and the importance of diversity and of an effective appointment process in the context of the changing regulatory environment in Japan.

Important governance topics in Japan this proxy season included board independence; board diversity across a range of characteristics, including experience (albeit board skills matrices are not commonly disclosed), background, gender, and nationality; shareholder rights topics such as poison pills and virtual annual general meetings; and environmental and climate concerns.

We saw several changes to corporate governance rules across the region. In China, a rule dating back to 2018 required all listed companies to establish an internal organization of the Communist Party Committee, while State-Owned Enterprises were mandated only to incorporate requirements on party-building activities in their Articles of Association. The new rule eases some of the restrictions on proposed amendments to the Articles of Association, which prompted concerns about sufficient disclosure to shareholders to enable decision-making on proposals. While disclosure overall remained a challenge in assessing certain proposals, the Vanguard funds supported several new, well-structured employee stock ownership plans that contained sufficient disclosure and reasonable vesting and performance hurdles.

The Hong Kong Stock Exchange introduced amendments to its listing rules to enhance the ESG Reporting Framework, a set of environmental, social, and governance guidelines that went into effect during the 2021 proxy season. We are encouraged by the new requirement to disclose significant climate-related risks that have affected or have the potential to affect a company, as this enhancement to companies’ risk oversight of key systemic issues aligns with our best practice principles.

The Taiwan Securities and Exchange Act mandated that Taiwan’s listed companies establish an audit committee composed of independent directors. This is in line with our views on key committee independence, and we believe it should help improve the supervisory system. However, we continue to have concerns about board independence and structures that have surfaced in some proxy contests.

In South Korea, we observed a rise in shareholder activism and continued to see issues associated with corporate structures. During the first half of the year, the Vanguard funds voted against the reelection of several directors because of misconduct, such as those accused in bribery scandals. Audit committees are now mostly chaired by independent directors, which demonstrates good corporate governance practice.

Across the region, we have observed tangible improvements in governance practices, such as improved ESG-related disclosures in Taiwan and Hong Kong. In addition, upcoming changes to the Corporate Governance code in Japan will require the boards of the largest companies to be one-third independent. Compared with other parts of the world, board gender diversity continues to lag across the region.

Australia and New Zealand

Following the restructure of our analyst team in 2020, coverage of the Australian and New Zealand markets has now been fully transitioned to our team in London. The transition has allowed more dedicated resources to be committed to this region as we further develop our voting policy and engagement strategy ahead of the main Australia and New Zealand voting season, which kicks off in October.

With Australian borders still closed because of the COVID-19 pandemic and the economy continuing to grow, the search for high-quality executives of leading ASX-listed companies has changed from a global search to one with a more domestic focus. We have seen an uptick in proposed remuneration plans that offer retention awards in differing forms for key management personnel. Boards are increasingly attuned to the risks to their business if key executives move to competitors who offer more attractive remuneration packages.

The Vanguard funds continue to evaluate these proposals on a case-by-case basis with the expectation that executive remuneration will be aligned with performance and the shareholder experience. In cases where a company’s remuneration plan lacks this alignment, as demonstrated in some of our engagement case study examples, the Vanguard funds have voted against management remuneration proposals.

Climate risk continues to be an important topic in the Australian market, with activists taking a particular interest in the mining and energy sectors. The recent focus has tilted toward Say on Climate shareholder proposals, which encourage companies to disclose climate-related risks, targets, and transition plans in line with the framework provided by the Task Force on Climate-Related Financial Disclosures (TCFD). We were encouraged to see more companies engage on this key risk, with some proposing to voluntarily adopt an advisory vote on their climate reports, leading to some shareholder proposals being withdrawn. We will carefully evaluate these reports in 2022 and beyond.

Regarding board composition and effectiveness, a key pillar of our stewardship framework, we take a favorable view of the provision in the ASX Corporate Governance Principles and Recommendations. This provision recommends that companies have a measurable objective of at least 30% of directors of each gender on their boards. This is encouraging guidance that supports Vanguard’s stewardship activities as we continue to engage with companies on their board and workforce diversity strategies.

At a glance

In the first half of 2021, we engaged with 734 companies representing $1.9 trillion in equity assets under management. Our team of more than 35 investment stewardship professionals conducted voting and engagement activities on behalf of Vanguard’s internally managed equity funds in a virtual work environment as the COVID-19 pandemic entered its second year.

The complete publication is available here.

Print

Print

2 Comments

i am disappointed that Africa did not deserve much of your attention. As a growing continent, given Governance is a journey and to follow in the tracks of Mr King – i request that Africa be looked at separately – using the hubs of East Africa (Kenya), Southern Africa ( RSA) , West Africa ( Nigeria) as a starting point. May Mr Mo Ibrahim views on Political governance and linking it to Corporate Governance could guide your actions. Thank You.

I am concerned when erratic swings in popular political fads infringe on the basics of corporate governance. If management truly believes that some sort of DEI or Climate based action or disclosure is warranted that is managements, or the boards call. However knuckling under to these fads is often simply weak, bad governance and negatively impacts shareholder value. I don’t invest with Vanguard to push the loud minorities political agendas and I hope and assume that Vanguard does not vote against its shareholders financial interests. Does Vanguard keep an online list of votes it makes on behalf of its funds? Thanks

Joe