Jurgita Ashley is Partner and Co-chair of the ESG Collaborative at Thompson Hine LLP, and Randi Val Morrison is Senior Vice President at the Society for Corporate Governance. This post is based on their Thompson Hine/Society for Corporate Governance memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

I. Introduction

As with other matters, the role of the board of directors regarding environmental, social, and governance (“ESG”) issues is that of oversight. ESG encompasses a broad set of issues, ranging from human capital and compensation issues, to climate change, deforestation, and water and waste management, to supply chain management. Some of these issues are interrelated, and many are continually evolving.

There is no consensus on the key topics and issues encompassed within each of the “E,” “S,” or “G” categories (in fact, it may be easier to try to identify issues that are NOT encompassed within one or more of those categories). Investors’ and other stakeholders’ views differ widely—and are

changing regularly—with regard to which topics and issues are most important for corporate disclosure and investment purposes. Additionally, the importance of ESG issues may vary significantly depending upon company specifics, including industry, size, geographic scope, business operations, and business model (e.g., franchised vs. not).

As a result of the breadth of issues potentially encompassed within the term “ESG,” company-specific variations, the lack of investor consensus on preferences and priorities, and the continually evolving nature of this area, determining how to effect board oversight of ESG issues and how to develop and implement an effective ESG governance structure can be a challenge. At the same time, ESG issues are discussed in boardrooms with increasing frequency, [1] and many companies are considering enhanced board oversight of, and management responsibility for, business-relevant ESG issues. [2]

This post discusses various approaches to board oversight of ESG issues (Part II) and management implementation of ESG strategy (Part III), accompanied by relevant benchmarking information. [3]

II. Board Oversight of ESG Issues

A. Board Oversight Structure

No “One-Size-Fits-All” Approach

There is no “one-size-fits-all” approach for allocating ESG oversight responsibilities among the board and its committees, and delegation of responsibilities may change over time. How board oversight is effected at any given company depends on specific company circumstances, including:

- the company’s business and industry;

- board composition and culture;

- board committee structure, composition, scopes of responsibility, and workloads;

- existing company processes and practices relating to the oversight of the enterprise risk management (ERM) program;

- ESG-related functional areas;

- the significance of particular ESG issues to the company; and

- management-level expertise and staffing. [4]

The key for companies is to develop an oversight structure and associated accountability (e.g., via committee charters and/or corporate governance guidelines), as well as internal processes and procedures, that are appropriate for the company. Companies should then develop corresponding disclosure to inform investors and other stakeholders as to how the board is overseeing these issues and that the oversight is supported by appropriate documentation and processes.

Potential Alternatives for Allocation of ESG Oversight Responsibilities

Board oversight of ESG issues can reside with the full board, an existing board committee, or a newly formed, dedicated ESG committee. It can also be shared by the full board and one or more committees or by multiple committees covering ESG issues that fall within their charter mandates and areas of expertise. Companies may also use a combination of these approaches. [5] Notably, even absent a process to allocate ESG oversight responsibilities, existing board committees often already oversee some ESG- related matters or some components of them. Companies should select the approach that is the most effective for them based on their particular facts and circumstances, guided by the considerations enumerated above, as we discuss in further detail below.

The company examples included in this publication are intended to illustrate a spectrum of potential approaches to oversight of ESG issues. For example, in some benchmarking data and company examples, it can be difficult to distinguish whether oversight of ESG issues rests with the full board and one or more of its committees, or only with the full board, or only one or more board committees. Most companies state that their board retains ultimate oversight over ESG issues, which is accurate even if the board has delegated various issues to one or multiple committees. In many cases, oversight of ESG issues does not neatly fit into any particular category and is more of a hybrid approach, which may evolve over time. The examples merely illustrate the wide variation in approaches companies may consider in designing an oversight structure that is the most effective for them based on their particular facts and circumstances.

Full Board

Since an effective ESG strategy is one that is aligned with and incorporated into the company’s long-term business strategy, some boards may retain primary oversight for sustainability issues at the full board level. This full board-only approach may be particularly suitable for smaller companies and/or smaller boards, with a limited number of independent directors who may serve on all board committees. Although this approach can raise the profile of ESG issues within the company, the board may not have sufficient time on its agenda to examine in depth the ESG issues that the company has determined to be most relevant to its business. [6]

More commonly, companies employ a mix of full board and committee oversight, which may consist of, for example, standing committees retaining continued responsibility for discrete matters that already fall within their remit and/or being delegated primary oversight of discrete topics or certain aspects of topics (e.g., strategy), with the full board retaining primary responsibility for other areas. [7] If this approach is selected, the aim will be ensuring that the full board is focusing on the most significant ESG matters, with board committees undertaking oversight of ESG issues relevant to their responsibilities, and then integrating committee work on these issues in their reports to the full board.

Existing Board Committee

For some companies, it may be more effective to specifically delegate oversight of ESG issues to an existing board committee (e.g., the nominating and governance committee), particularly when the development of the ESG strategy is a relatively new focus area for the company, the undertaking is significant, and/or the expertise currently resides (or is more easily developed) at that committee level. [8] This approach could help integrate ESG considerations into business functions, particularly when those issues are not directly linked to short-term reputational, financial, or risk considerations. [9] Some companies that use this approach are changing the names of those committees in a way that signals their expanded responsibilities. [10] Other companies, particularly in certain industries, have long maintained a sustainability-focused committee that may assume additional responsibilities as the notions of what sustainability encompasses continue to evolve. [11]

New Board Committee

A new standalone committee to oversee sustainability or ESG-related matters is another option that companies may consider. [12] This approach provides a forum for regular and in-depth discussion of ESG issues but may present the risk of separating the discussion of ESG from the broader business, finance, and strategy discussions. [13] To mitigate that risk, a standalone sustainability or ESG committee can be structured to include chairs or other representatives of the audit, compensation, nominating and governance, risk, regulatory, and/or other board committees involved with specific ESG issues. By having one committee rather than multiple committees report to the full board, this approach can also streamline board reporting on ESG matters and facilitate coordination across committees to enable more effective synthesis of ESG issues for the board.

Multiple Existing Board Committees for Oversight of Discrete ESG Matters

At some companies, the audit, compensation, nominating and governance, and perhaps other committees are assigned respective responsibilities for oversight of discrete ESG matters that are most consistent with their current responsibilities and expertise, without specific involvement of the full board or with only periodic committee reports to the full board. Allocating responsibility to a committee with relevant knowledge and experience may improve the effectiveness of the board’s oversight. Additionally, since specific ESG matters often already fall within existing committees’ areas of responsibility, it is common to formally delegate those specific ESG issues to multiple existing committees, [14] as described above, even where ESG oversight resides with the full board or has been delegated by the board to one specific committee. [15]

Current Company Practices

Company practices regarding board oversight of discrete and collective ESG matters vary, and there is no one-size-fits-all approach. [16]

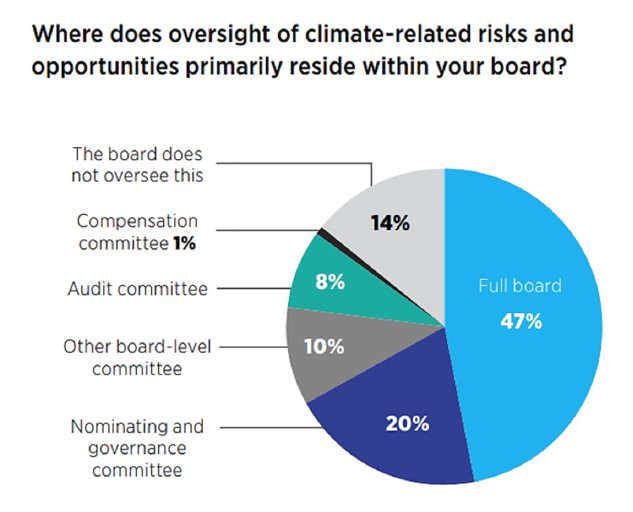

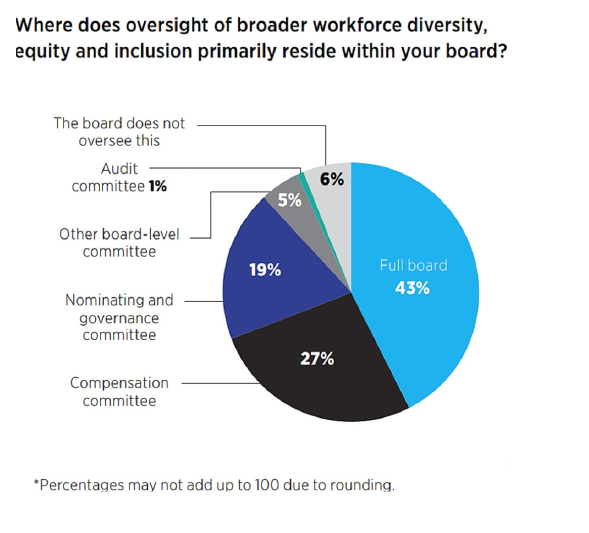

For example, based on a Corporate Board Member and EY Center for Board Matters survey of nearly 400 public company directors on their views regarding ESG practices (conducted in February and March of 2021), the full board most commonly oversees climate-related risks and opportunities and workforce diversity, equity, and inclusion (“DE&I”). [17]

Source: Corporate Board Member/EY Center for Board Matters

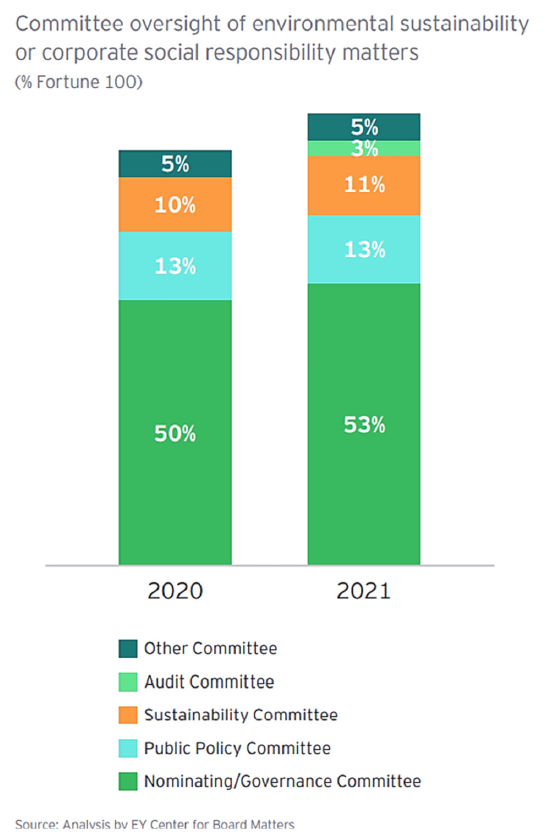

EY’s review of the 79 Fortune 100 companies that filed proxy statements as of June 22, 2021, revealed that of the 85% of companies disclosing board committee oversight of environmental and social or corporate social responsibility matters (compared to 78% in 2020), most allocate this responsibility to the nominating and governance committee, as shown here. [18]

EY’s report emphasizes, however, that disclosures also evidence the full board’s active oversight in sustainability risks and opportunities notwithstanding committee delegations. [19]

Additional benchmarking data based on member surveys conducted by the Society for Corporate Governance is presented below. [20] The data relates to the board’s oversight of DE&I; corporate culture; corporate social responsibility, sustainability, and social impact; cybersecurity; human capital management and talent; legal and regulatory risks; and technology strategy (e.g., IT infrastructure, innovative and disruptive technology, and social media).

The following graphic illustrates the extent to which oversight of ESG-related risks and opportunities varies by topic, with the full board most commonly retaining responsibility for corporate culture, legal and regulatory risks, and technology strategy, and various committees assuming greater oversight responsibility with respect to other discrete topics: [21]

Source: Society for Corporate Governance/Deloitte Center for Board Effectiveness

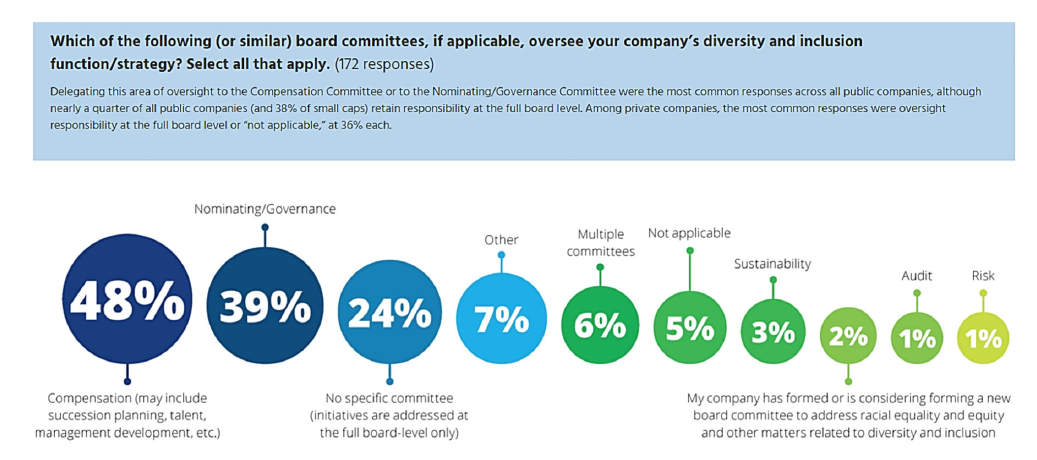

As shown below, companies most commonly delegate oversight of the company’s diversity and inclusion function/strategy to the compensation committee and/or nominating and governance committee, although nearly one-quarter of companies retain responsibility at the full board-only level: [22]

Source: Society for Corporate Governance/Deloitte Center for Board Effectiveness

While most companies charge the audit committee with cybersecurity oversight, more than one-third identified the full board and committee(s) as having that responsibility, and more than one-quarter identified other committees including risk, cyber, governance, and compliance committees. Another 12% reported retaining this responsibility at the full board-only level. [23]

The below graphic presents benchmarking data relating to the board’s oversight of cybersecurity. [24]

Source: Society for Corporate Governance/Deloitte Center for Board Effectiveness

The foregoing benchmarking data illustrates the absence of any “one-size-fits-all” approach to how board oversight of discrete ESG topics is effected in practice. With few exceptions, benchmarking surveys on other discrete ESG topics show similar variation in oversight approaches.

Sample Allocation of ESG Issues Among Existing Board Committees

While the approach to board oversight of ESG issues is (and should be) company-specific, below is but one example of many that illustrates how this oversight could be allocated among the full board and its committees. [25] Some companies have additional board committees (such as risk, regulatory, technology and innovation, public affairs, etc.) that already exercise oversight for components of these matters or allocate ESG responsibilities differently among their audit, compensation, and nominating and governance committees, or to a standalone sustainability or similar committee.

EXAMPLE ONLY – Oversight of ESG Issues: Full Board and Multiple Existing Committee Approach

Full Board

Oversight of:

- ESG risks and opportunities at a strategic level

- Alignment with business strategy

- Progress against most significant ESG objectives and commitments

- Overall ESG communications strategy

| Audit Committee | Compensation Committee | Nominating and Governance Committee |

|---|---|---|

Oversight of:

|

Oversight of:

|

Oversight of:

|

Documenting Oversight Responsibilities for ESG Issues

Once the board decides on its oversight approach, companies should consider updating company policies, corporate governance guidelines, and/or committee charters to reflect the allocation of these responsibilities, with the level of detail depending on specific company circumstances and the understanding that ESG issues are continually evolving. For example, in a recent report, audit committee chairs echoed the importance of delineating ESG responsibilities in committee charters. [26] Due to the continually evolving nature of ESG issues, in some cases, companies may opt for more general rather than detailed descriptions in their policies in order to limit the frequency of necessary updates.

If a standalone sustainability or similar board committee is formed, it should follow the same practices as other board committees, including adopting a committee charter, holding regular meetings, taking meeting minutes, and providing reports to the full board. [27]

Once responsibilities are allocated and captured in committee charters or other governance documents, they should also be reflected in annual calendars for inclusion on committee and board agendas (as appropriate), just as is the case for other committees and the board.

B. Reporting up to the Board

Assessing the Board’s ESG Competencies

Under state law, directors have fiduciary duties (the duty of care and the duty of good faith/duty of loyalty) to adequately inform themselves, to understand and assess material issues (including ESG-related issues) in making business decisions, to implement oversight structures and, in some cases, to investigate “red flags” relating to such issues. Although the expertise of the board on a particular ESG topic may often be gained through ongoing professional responsibilities, self-study, other board service, and/or reports from senior management (discussed in more detail below), in some instances, directors could benefit from training on ESG matters. [28] Some companies may also choose to add directors with specific expertise in certain ESG areas, especially if any particular ESG topic is a transformational issue to the company (e.g., renewable energy, artificial intelligence, electric vehicles, or industry transformation). In June 2021, SEC Commissioner Allison Herren Lee specifically called on companies to “consider ways to enhance the ESG competence of their boards,” which “efforts could include integrating ESG considerations into their nominating processes in order to recruit directors that will bring ESG expertise to the board; training and education efforts to enhance board members’ expertise on ESG matters; and considering engagement with outside experts to provide advice and guidance to boards.” [29]

ESG Topics and Metrics to Share with the Board

ESG metrics determined to be the most significant to the company should be reported to the board. ESG- oriented presentations to the board should show trends over time and progress against established targets, potentially including benchmarking data to place the information in context and modeling scenarios, as needed, to show potential future impact. As a result of the breadth and distinctiveness of potential ESG topics and company-specific variations, there is no uniform template or dashboard for ESG issues or metrics. Some potential resources are referenced in the footnote below [30]; however, the information reported to the board naturally varies from company to company.

Frequency of Management Reporting to the Board on ESG Issues

Similarly, there is no one right approach as to how often management should report on ESG issues to the board and board committees. Practices vary based on specific company circumstances, including board oversight structure; management structure and staffing; company size, type, and industry; regulatory developments and trends; the significance of each respective ESG issue to the company; investor and other stakeholder pressures and priorities; and the company’s strategies with respect to these issues. Different “E,” “S,” and “G” issues may likely warrant a different cadence and process. [31]

In any event, a regular reporting cadence is important in light of directors’ fiduciary oversight responsibilities. At many companies, the full board receives reports on the overall ESG strategy and investor engagement and communications strategy at least annually. Discrete ESG issues (and related risks and opportunities), such as climate change, DE&I, human capital management, ethics and compliance, supply chains and responsible sourcing, and so forth, have different cadences, with particularly significant or emerging issues (specific to company circumstances) addressed more frequently, and progress against prior targets and company commitments, if any, regularly included in board reports. Depending on company-specific circumstances and specific ESG issues, some issues are discussed quarterly, others annually or semiannually, and yet others, at every meeting or on an as- needed basis. When a specific board committee is delegated more detailed oversight of the company’s ESG strategy and meets to discuss these matters more frequently, reports to the full board may be less frequent, but again vary depending on the issue. The specific issues and metrics reviewed will also vary based on what is important to the company, its customers, and its investor base.

III. Management Organization Relating to ESG Governance

Composition of Management-Level ESG Committees

As with other matters, day-to-day implementation of the ESG strategy usually rests with senior management, and companies employ different approaches in creating and staffing their ESG teams, delineating internal reporting lines, and determining whether any formal procedures are used for such management-level ESG governance.

Since the role of the board is that of oversight, a cross-functional, senior management team (“management-level ESG committee”) can be critical for driving the development and implementation of the company’s ESG strategy. Whether or not such team is formalized as a “committee” or a “council,” its members frequently include the Chief Sustainability Officer, Corporate Secretary, General Counsel, Chief Financial Officer, Chief Human Resources Officer, and senior members from the areas of public/community affairs, environmental, health and safety, investor relations, corporate communications, risk management, and cybersecurity. It may also include representatives from the company’s lines of business, real estate, innovation, and/or other areas.

In July 2019, the Society for Corporate Governance conducted a survey on executive-level ESG committee organization and practices among its members (the “July 2019 Survey”). [32] More than 20% of the survey’s 177 respondents indicated that their company had a senior-level ESG committee, and another nearly 30% were considering forming one. Examples of management-level ESG committees are reflected in the footnotes. [33] As illustrated by these examples, [34] committees commonly reflect cross- functional representation.

Formal Procedures for Management-Level ESG Committees

As to the level of formalities followed by management-level ESG committees (such as adoption of a charter [35] and taking of minutes), company practices vary widely.

In the July 2019 Survey conducted by the Society for Corporate Governance and described above, 45% of respondents indicated that their management-level ESG committee had a formal charter. Based on a prior Society survey, [36] for those that have them, such charters are usually not subject to board approval. In the July 2019 Survey, [37] 32% of the respondents who indicated that their company had a formal committee structure to govern management-level committees noted that the company’s senior-level ESG committee fell under that structure, and 30% indicated that their ESG committee followed formal procedures. Reporting up to the board or a board committee was reported as the most common procedure, followed by taking and/or approval of minutes. Committees most commonly met quarterly.

ESG Staffing and Reporting Lines

ESG staffing and annual spend vary significantly from company to company, from less than one full-time professional (leveraging multiple internal areas and/or external resources) to larger teams [38] handling ESG reporting, in-house modeling of future climate scenarios, investor engagement, employee engagement, and/or supply chain auditing. ESG staffing and spend can be difficult to quantify on a comparable basis among companies since some issues that are now deemed to be under the “ESG” umbrella (such as ethics and compliance, enterprise risk management, cybersecurity, and corporate governance relating to shareholder rights and engagement) are encompassed within preexisting roles or responsibilities. Some companies count such preexisting spend while others only focus on new positions, expanded responsibilities, and additional spend. [39]

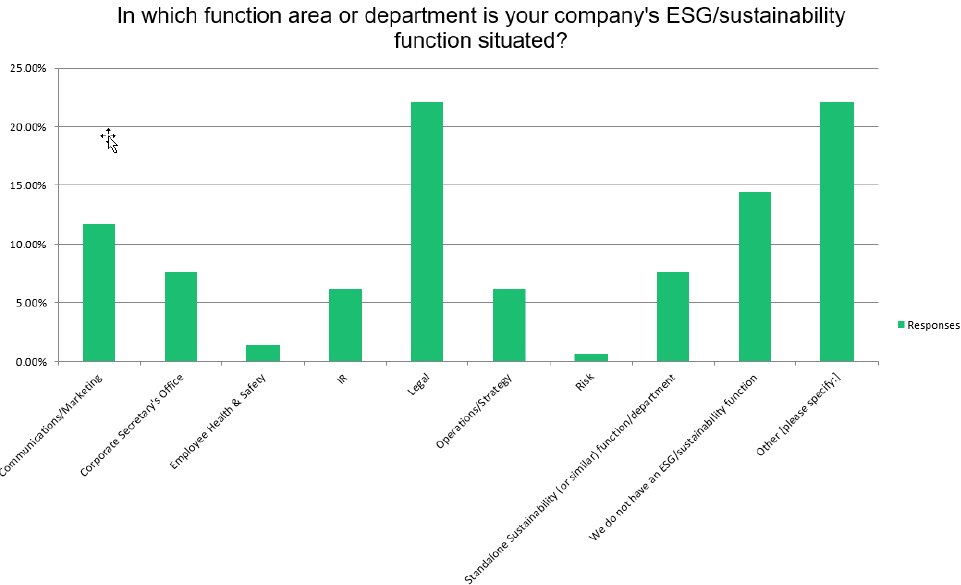

In August 2020, the Society for Corporate Governance conducted a survey on ESG internal organization and reporting lines among its members. [40] When asked in which function area or department the company’s ESG function is situated, the most common pre-populated answer choice was Legal (22%); however, an equal percentage selected “Other,” with many noting a cross-functional team.

Source: Society for Corporate Governance

The company’s ESG function most commonly reports into (i.e., direct reporting relationship) Legal (26%); however, 24% selected “Other,” with responses including unassigned, multiple areas, and various designated functions such as Chief Financial Officer, Corporate Development, Human Resources, Public Affairs, each department head, business unit leader, board committee, etc., as shown here:

Source: Society for Corporate Governance

The responsibility for ESG reporting can reside in one department or may be split among multiple functions. [41] Based on the Society’s January 2019 Survey, the ESG reporting function often resides with one of the following groups: the Corporate Secretary, Sustainability/Corporate Social Responsibility team, General Counsel, Public Relations / Corporate Communications, and/or Investor Relations. [42]

Company size, industry, internal organizational structure, and geographic scope are among the many factors that may account for these differences.

IV. Disclosure Regarding ESG Governance

Considerations for Disclosing ESG Governance Structure

Investors and other stakeholders increasingly seek information, in an easily understandable manner, explaining how board composition, expertise, and oversight tie into the company’s ESG and business strategy. They often seek to ensure that companies have corporate governance processes in place that are effective for overseeing the company’s management of significant ESG risks [43] and whether and how it capitalizes on relevant ESG opportunities.

In addition, SEC regulations [44] require disclosure of the board’s role in risk oversight, which may increasingly include ESG-related risks.

Similarly, the Task Force on Climate-related Financial Disclosures (TCFD) framework, which is frequently used to report on climate-related issues on a voluntary basis, elicits information about the board’s oversight of climate-related risks and opportunities, including (i) processes and frequency of reporting to the board and its committees regarding climate-related issues, (ii) whether the board and its committees take climate-related issues into account “when reviewing and guiding strategy, major plans of action, risk management policies, annual budgets, and business plans as well as setting the organization’s performance objectives, monitoring implementation and performance, and overseeing major capital expenditures, acquisitions, and divestitures,” and (iii) the board’s oversight of the company’s progress against its targets for addressing climate-related issues. [45]

With investor interest in these disclosures on the rise, companies are increasingly highlighting the board’s oversight of ESG issues relevant to the company’s business in proxy statements, sustainability reports, on the company’s website, and/or in other communications with shareholders.

Approaches to Disclosure of ESG Governance

Whether on company websites, in sustainability reports, or in proxy statements or other reports or filings, ESG disclosures are usually drafted with investors (as well as employees and other constituents) in mind and take into account the input that companies receive through their shareholder engagement processes. Such disclosures often include a discussion of the allocation of oversight responsibilities over various ESG issues between the board and its committees, reasons for such allocation, and if/how the oversight is documented in committee charters and company policies. Some companies disclose their key ESG issues, including risks, mitigation strategies, and business opportunities; how board oversight aligns with the company’s long-term business strategy; processes that demonstrate the board’s agility to adapt to emerging and continually evolving ESG issues; directors’ ESG expertise and training; and the frequency and structure of reporting on ESG issues to the board and applicable committees. [46] Some companies also discuss management’s roles and responsibilities relating to various ESG issues.

Some companies address the board’s oversight of ESG matters in one section of their report, filing or website, while others include subsections throughout relating to how the board oversees the specific ESG topic discussed in that section (e.g., climate or human capital). As with other disclosures, controls and procedures to ensure the reliability of the data and the accuracy and completeness of disclosures are critical. [47]

V. Conclusion

Investors, employees, regulators, and other stakeholders are increasingly calling for additional information on ESG issues. The ESG landscape is continually evolving and so are practices relating to the board’s oversight of ESG issues, management’s roles and responsibilities and ESG governance more broadly, and related disclosures. There is no uniform approach to these issues, and companies should consider their specific facts and circumstances in designing ESG governance structures and disclosures.

Appendix

Sample Disclosures of Management-Level ESG Committee Composition

American Airlines, 2019-2020 ESG Report, 4-5, aag-esg-report-2019-2020.pdf (sustainability steering committee, which is a cross-functional and cross-operational group of leaders from across the company’s business, led by EVP of Corporate Affairs)

Amgen Inc., 2021 Proxy Statement, 28, DEF 14A (sec.gov) (executive-level governance council, chaired by SVP of Corporate Affairs, oversees the continuing evolution of the company’s approach to corporate responsibility and ESG, with the oversight of executive leadership, individual programmatic elements managed at a functional level)

AT&T Inc., 2021 Proxy Statement, 27, https://otp.tools.investis.com/clients/us/atnt2/sec/sec- show.aspx?FilingId=14792553&Cik=0000732717&Type=PDF&hasPdf=1 (corporate social responsibility governance council led by Chief Sustainability Officer and comprised of officers from operating companies; also five core issue committees: community, employee activation, environmental, human rights, and online safety)

Capital One Financial Corporation, 2021 Proxy Statement, 45, https://investor.capitalone.com/static- files/7b11ae39-d84e-4e42-b6fa-6422f840b56f (cross-functional management-level ESG advisory committee)

Cardinal Health, Inc., 2020 Proxy Statement, 23, CardinalHealth3020ProxyStatement (sec.gov) (formally chartered, cross-functional management ESG steering committee)

FirstEnergy Corp., 2021 Proxy Statement, 82, DEF 14A (sec.gov) (cross-functional, executive-level steering committee reviews the company’s corporate responsibility strategy and initiatives and includes senior leadership from the community involvement, corporate governance, environmental, human resources, investor relations, risk and strategy departments)

Flex Ltd., 2021 Proxy Statement, 18, FLEX LTD. – DEF 14A (sec.gov) (corporate sustainability leadership committee, a multidisciplinary group composed of global leaders throughout the company who represent the key functional areas with responsibility for sustainability efforts, including operations, human resources, supply chain, regulatory compliance, account management, and communications)

General Mills, Inc., 2021 Proxy Statement, 31, https://www.sec.gov/Archives/edgar/data/40704/000120677421002220/gis3839766-def14a.htm (sustainability governance committee, comprised of the Chairman and CEO, CFO, Chief Transformation and Enterprise Services Officer, Chief Innovation, Technology and Quality Officer and General Counsel and Secretary, is responsible for the company’s global responsibility, sustainability, environmental and regeneration programs; Global Sustainability team is led by Chief Sustainability and Social Impact Officer who reports to Chief Transformation and Enterprise Services Officer)

Lowe’s, 2021 Proxy Statement, 19, https://corporate.lowes.com/sites/lowes-corp/files/2021-05/low-2021- proxy-statement-v1.pdf (sustainability council comprised of executives and subject matter experts across the company)

PayPal, 2021 Proxy Statement, 32, https://s1.q4cdn.com/633035571/files/doc_financials/2021/ar/PYPL001_PXY_2021_Bookmarked.pdf (ESG steering committee)

Rayonier Inc., 2021 Proxy Statement, 13, Document (sec.gov) (internal ESG working group comprised of subject matter experts, which is responsible for the company’s ESG short-and long-term goals, initiatives and strategies)

Teradata Corporation, 2021 Proxy Statement, 25-26, https://d18rn0p25nwr6d.cloudfront.net/CIK- 0000816761/eb0eaebb-9534-4594-a90d-505138e5d3d4.pdf (cross-functional corporate citizenship council)

Visa Inc., 2021 Proxy Statement, 20, DEFINITIVE PROXY STATEMENT (sec.gov) (corporate responsibility and sustainability leadership council, including cross-functional representation from more than a dozen senior leaders, coordinates the company’s ESG strategy and reporting efforts)

Willis Towers Watson Public Limited Company, 2020 Year-End Proxy Statement, 20, https://investors.willistowerswatson.com/static-files/13ad2c3f-ca30-4430-8e0e-fb40369e346f (cross- functional management committee with the responsibility to coordinate and communicate on the company’s ESG initiatives)

Endnotes

1For example, in PwC’s survey conducted in September 2020 (base: 624), 45% of surveyed directors indicated that ESG issues were regularly included on the board’s agenda, an increase from 34% in October 2019 (base: 660). See PwC, ESG oversight: The corporate director’s guide (November 2020). In DFIN’s surveys, in 2020, 73% of surveyed public companies (across various industries and market capitalizations) indicated that their boards provided oversight of ESG issues, an increase from 56% in 2019. Donnelley Financial Solutions (DFIN), Board Oversight of ESG – NOW! (2020).(go back)

2For example, in Spencer Stuart’s annual survey of S&P 500 Nominating and Governance Committee chairs (77 committee chairs), nearly 70% of surveyed directors identified expanding/enhancing ESG oversight as among their top five priorities over the next three years. See Spencer Stuart, Nominating / Governance Chair Survey (2021).(go back)

3This publication is intended for U.S.-based companies and companies subject to U.S. laws and regulations and does not address requirements or governance practices in foreign jurisdictions.(go back)

4For example, board oversight may entail a higher level of active engagement, and even management, at smaller, less mature companies than is typically the case at larger companies. See Deloitte, An Alternate Universe: The Small, Young Company Board (July 2021), https://higherlogicdownload.s3.amazonaws.com/GOVERNANCEPROFESSIONALS/a8892c7c-6297-4149-b9fc-378577d0b150/UploadedImages/us-deloitte-otba-july-2021-small-young-company-board-2-1.pdf.(go back)

5According to Shearman & Sterling’s review of governance documentation and disclosures of the 100 largest U.S. public, noncontrolled companies that have equity securities listed on the NYSE or Nasdaq, ESG oversight responsibility was most commonly allocated to the board and committee(s). Of the 82 of the 100 companies that disclosed which board committee(s) had responsibility for ESG oversight, six had two or more committees responsible for such oversight. Shearman & Sterling LLP, Corporate Governance & Executive Compensation Survey, 60 (2020), https://higherlogicdownload.s3.amazonaws.com/GOVERNANCEPROFESSIONALS/a8892c7c-6297-4149-b9fc- 378577d0b150/UploadedImages/Shearman Sterlings_18th_Annual_Corporate_Governance Executive_Compensation_Survey. pdf. Based on Sidley Austin’s review of proxy statements of Fortune 50 companies, approximately 60% of the companies reported oversight of ESG matters by two or more board committees. In cases where one committee was reported as overseeing ESG matters, that responsibility was most frequently delegated to the nominating and governance committee, closely followed by a public affairs committee. In only four cases, a separate ESG committee was reported as exclusively exercising oversight over ESG issues. In general, companies reported that they delegated oversight among their nominating and governance committee (60%), compensation committee (40%), audit committee (24%), public affairs committee (26%), and/or a separate ESG committee (18%). See Sidley Austin LLP, Environmental, Social, and Governance Disclosures in Proxy Statements: Benchmarking the Fortune 50 | Insights | Sidley Austin LLP (August 2021), which also includes additional benchmarking information based on the company’s industry.(go back)

6Ceres, View from the Top: How Corporate Boards Can Engage on Sustainability Performance (October 2015).(go back)

7See, e.g., Matson, Inc., 2019-2020 Sustainability Report, 28; Owens Corning, 2020 Sustainability Report, 57, https://www.owenscorning.com/en-us/corporate/sustainability/docs/2021/2020-Owens-Corning-Sustainability-Report.pdf. See also, e.g., 3M Company, 2021 Proxy Statement, 35-36, https://www.sec.gov/Archives/edgar/data/66740/000120677421000799/mmm3819441-def14a.htm; Cardinal Health, Inc., 2020 Proxy Statement, 22-23, CardinalHealth3020ProxyStatement (sec.gov); Flex Ltd., 2021 Proxy Statement, 18-20 and 26, FLEX LTD. – DEF 14A (sec.gov); General Electric Company, 2021 Proxy Statement, 18-20, https://www.sec.gov/Archives/edgar/data/40545/000120677421000774/ge3816561-def14a.htm; Regions Financial Corporation, 2020 Annual Review & ESG Report, 35, https://www.corporatereport.com/Regions2020AnnualReviewandESGreport/Regions_2020_Annual_Review_and_ESG_Report.pdf?v2; The Travelers Companies, Inc., 2021 Proxy Statement, 18-19, https://d18rn0p25nwr6d.cloudfront.net/CIK-0000086312/7607cb07-15ea-46bb-acaf-0b7b5789da9b.pdf; PwC, ESG oversight: The corporate director’s guide, 15, https://www.pwc.com/us/en/services/governance-insights-center/esg-guidebook-layout-final.pdf (November 2020). For example, Thompson Hine LLP’s survey found that the board oversight of ESG issues at private companies most frequently resided with the ESG committee, followed by the full board of directors; in surveyed public companies, either the ESG committee or the nominating and governance committee played the primary oversight role, with the full board of directors following closely thereafter (with discrete ESG issues such as DE&I, human capital, and climate potentially also allocated to other committees of the board) (with responses collected from 134 in-house counsel and other senior business executives nationwide, representing a diverse mix of industries, company sizes, and locations), https://www.thompsonhine.com/uploads/1135/doc/An_ESG_Snapshot.pdf (September 2021).(go back)

8See, e.g., Capital One Financial Corporation, 2021 Proxy Statement, 45, https://investor.capitalone.com/static-files/7b11ae39-d84e-4e42-b6fa-6422f840b56f (governance committee); Cheniere Energy, Inc., 2021 Proxy Statement, 25, https://d1io3yog0oux5.cloudfront.net/_9425a95d1afb572969a81b57bbc25190/cheniere/db/804/7414/proxy_statement/Cheniere+Energy+Inc+2021+Proxy+Statement.pdf (governance committee); Kansas City Southern, 2021 Proxy Statement, 23, https://investors.kcsouthern.com/~/media/Files/K/KC-Southern-IR-V2/proxy/kcs-2021-proxy-statement.pdf (nominating committee); PayPal, 2021 Proxy Statement, 23-24, https://s1.q4cdn.com/633035571/files/doc_financials/2021/ar/PYPL001_PXY_2021_Bookmarked.pdf (governance committee).(go back)

9Ceres, View from the Top: How Corporate Boards Can Engage on Sustainability Performance (October 2015).(go back)

10See, e.g., American Airlines Group Inc., 2021 Proxy Statement, 35, https://americanairlines.gcs-web.com/static-files/6657dbc8-f482-42a0-99fa-43b901beee76 (amending the charter of the corporate governance and public responsibility committee to reflect its primary responsibility of coordinating ESG oversight, while the full board also oversees ESG efforts); Bonanza Creek Energy, Inc., 2021 Proxy Statement, 14, https://www.sec.gov/Archives/edgar/data/1509589/000104746921001048/a2243211zdef14a.htm (reorganizing the environmental, health, safety & regulatory compliance and reserves committee into the ESG committee).(go back)

11See, e.g., AT&T Inc., 2021 Proxy Statement, 27, https://otp.tools.investis.com/clients/us/atnt2/sec/sec-show.aspx?FilingId=14792553&Cik=0000732717&Type=PDF&hasPdf=1 (public policy and corporate reputation committee).(go back)

12For example, based on Labrador’s review of 248 of the S&P 250 proxy statements (companies listed in Appendix A) filed between August 16, 2019 and August 14, 2020, 32% of companies had a standalone board-level sustainability or public responsibility committee, and 76% disclosed board oversight of sustainability risk. See Labrador, 2020 Proxy Statement Trends and Analysis (December 2020); ADM, 2020 Corporate Sustainability Report, 12, https://assets.adm.com/Sustainability/2020-Corporate-Sustainability-Report_210521_121113.pdf; Archer-Daniels-Midland Company, 2021 Proxy Statement, 14, https://d18rn0p25nwr6d.cloudfront.net/CIK-0000007084/fdb1eef9-8e9d-49e0-a853-50d67e8e445e.pdf; Bonanza Creek Energy, Inc., 2021 Proxy Statement, 14, https://www.sec.gov/Archives/edgar/data/1509589/000104746921001048/a2243211zdef14a.htm; Lowe’s, 2021 Proxy Statement, 19, https://corporate.lowes.com/sites/lowes-corp/files/2021-05/low-2021-proxy-statement-v1.pdf (with full board also involved); Tenet Healthcare Corporation, 2021 Proxy Statement, 3, 17 and 20-21, https://www.sec.gov/Archives/edgar/data/70318/000119312521096716/d132672ddef14a.htm.(go back)

13See PwC, Questions to ask before forming a new board committee (September 2021); Ceres, View from the Top: How Corporate Boards Can Engage on SustainabilityPerformance (October 2015).(go back)

14See also Tapestry Networks’ Adding value: Perspectives on the audit committee’s dynamic role (July 2021), noting that most boards are still trying to determine how to allocate oversight over ESG, with many companies allocating responsibilities across several committees. Based on virtual meetings with the audit committee chairs of approximately 100 large U.S. public companies held from May 13 to June 25, 2021, Tapestry Networks found that the audit committee frequently oversees ESG reporting quality and associated internal controls. Some audit chairs expressed concerns in potentially assuming ESG responsibilities for several reasons, including existing committee workload, wide scope of ESG, management commitments that may be unsupportable and would outlast current management’s tenure, and the fact that those responsible internally for ESG information, such as diversity and greenhouse gas (GHG) emissions, might not be accustomed to the rigorous controls and procedures that support conventional financial reporting. See also, e.g., Radian Group Inc., 2021 Proxy Statement, 12-14, https://www.sec.gov/Archives/edgar/data/890926/000089092621000029/radianproxy2021.htm (with compensation committee exercising oversight over “S” aspects, and governance committee overseeing “G” aspects of ESG).(go back)

15See, e.g., American Eagle Outfitters, Inc., 2021 Proxy Statement, 42, https://www.sec.gov/Archives/edgar/data/919012/000119312521124945/d95737ddef14a.htm; Brighthouse Financial, Inc., 2021 Proxy Statement, 11, https://investor.brighthousefinancial.com/static-files/dfa99c45-e3bb-4901-a6b7-8fc5c6a3e766; Teradata Corporation, 2021 Proxy Statement, 25, https://d18rn0p25nwr6d.cloudfront.net/CIK-0000816761/eb0eaebb-9534-4594-a90d-505138e5d3d4.pdf; Willis Towers Watson Public Limited Company, 2020 Year-End Proxy Statement, 20-21, https://investors.willistowerswatson.com/static-files/13ad2c3f-ca30-4430-8e0e-fb40369e346f.(go back)

16This is illustrated by the numerous approaches disclosed in companies’ proxy statements, sustainability reports, and other governance documents footnoted on the preceding pages of this publication.(go back)

17Corporate Board Member/EY Research Report, Four Opportunities for Enhancing ESG Oversight (2021), https://higherlogicdownload.s3.amazonaws.com/GOVERNANCEPROFESSIONALS/a8892c7c-6297-4149-b9fc-378577d0b150/UploadedImages/ey-cbm-four-ways-to-enhance-esg-oversight-1.pdf.(go back)

18EY, What boards should know about ESG developments in the 2021 proxy season (July 2021), https://higherlogicdownload.s3.amazonaws.com/GOVERNANCEPROFESSIONALS/a8892c7c-6297-4149-b9fc-378577d0b150/UploadedImages/ey-what-boards-should-know-about-esg-developments-2021-proxy-season-cbm-1.pdf.(go back)

19Id.(go back)

20Throughout this publication, in some cases, percentages may not total 100 due to rounding and/or a question that allowed respondents to select multiple choices. In all cases throughout this publication, referenced member surveys conducted by the Society of Corporate Governance, including those reflected by joint reports published by the Society for Corporate Governance and Deloitte Center for Board Effectiveness, are voluntary, resulting in discrete respondent groups that may or may not represent the overall membership composition of the Society for Corporate Governance.(go back)

21Society for Corporate Governance/Deloitte Center for Board Effectiveness, Board Practices Report: Common threads acrossboardrooms (March 2019), https://higherlogicdownload.s3.amazonaws.com/GOVERNANCEPROFESSIONALS/a8892c7c-6297-4149-b9fc-378577d0b150/UploadedImages/1202241_2018_Board_Practices_Report_FINAL.pdf.(go back)

22Society for Corporate Governance/Deloitte Center for Board Effectiveness, Board Practices Quarterly: Diversity, Equity &Inclusion (September 2020), https://www.societycorpgov.org/governanceprofessionals/currenttopiclandingpages/tpboardpractices/2020-board-practices-report. See also State Street Global Advisors, Russell Reynolds Associates, and The Ford Foundation’s The Board’s Oversight of Racialand Ethnic Diversity, Equity and Inclusion (July 2021), which found that many boards discuss DE&I at both committee and full board levels. “The full-board discussions often center on the interplay between DE&I and strategy and on DE&I as a component of corporate culture.” The guide is based on input from academic and policy experts and interviews with 27 S&P 500 and FTSE 100 directors.(go back)

23Society for Corporate Governance/Deloitte Center for Board Effectiveness, Board Practices Quarterly: 2021 Cyber Oversight (May 2021), https://www.societycorpgov.org/currenttopiclandingpages/tpboardpractices/2021-board-practices-cyber-oversight.(go back)

24Ibid.(go back)

25Additional examples are reflected in footnotes 5-15 and see PwC, ESG oversight: The corporate director’s guide (November 2020), https://www.pwc.com/us/en/services/governance-insights-center/esg-guidebook-layout-final.pdf.(go back)

26Tapestry Networks, Adding value: Perspectives on the audit committee’s dynamic role (July 2021).(go back)

27See, e.g., Tenet Healthcare Corporation, ESG Committee Charter, https://s23.q4cdn.com/674051945/files/doc_governance/2021/ESG-Committee-Charter.pdf (May 6, 2021).(go back)

28In the Corporate Board Member and EY Center survey of nearly 400 public company directors, directors expressed a much greater level of confidence in their understanding of their company’s material Governance issues than Social or Environmental issues. On a scale of 1- 5 (1 = Low understanding / 5 = Great understanding), directors rated their understanding of their company’s shareholders’ expectations on Governance matters as 4.1, and as 3.4 for both Social and Environmental matters. Nearly one- quarter of directors said that a better understanding of which ESG issues are material to their company would enhance their ESG oversight. See Corporate Board Member/EY Research Report, Four Opportunities for Enhancing ESG Oversight (2021).(go back)

29SEC Commissioner Allison Herren Lee, SEC.gov | Climate, ESG, and the Board of Directors: “You Cannot Direct the Wind, ButYou Can Adjust Your Sails” (June 28, 2021), referencing Ceres, Lead from the Top: Building Sustainability Competence onCorporate Boards (2017).(go back)

30Some have suggested reporting metrics on discrete ESG topics. See, e.g., DE&I sample dashboard in PwC’s Leading ondiversity, equity, and inclusion (January 2021), DE&I indicators (appendix) in State Street Global Advisors, Russell Reynolds Associates, and The Ford Foundation’s The Board’s Oversight of Racial and Ethnic Diversity, Equity and Inclusion (July 2021), and cybersecurity metrics (Tool F) in NACD’s Cyber-Risk Oversight 2020 (2020). See also Question 6 in the member survey conducted by the Society for Corporate Governance, 2021 Sustainability Practices Benchmarking Survey (January 2021).(go back)

31See, e.g., Society for Corporate Governance/Deloitte Center for Board Effectiveness, Board Practices Report: Common threadsacross boardrooms (March 2019), 16 and 43-46 regarding variations by company size and industry of particular topics on the full board meeting agenda, https://higherlogicdownload.s3.amazonaws.com/GOVERNANCEPROFESSIONALS/a8892c7c-6297-4149-b9fc-378577d0b150/UploadedImages/1202241_2018_Board_Practices_Report_FINAL.pdf; Society for Corporate Governance/Deloitte Center for Board Effectiveness, Board Practices Quarterly: Diversity, Equity & Inclusion (September 2020), https://www.societycorpgov.org/governanceprofessionals/currenttopiclandingpages/tpboardpractices/2020-board-practices-report. (see as to the frequency on the board agenda, including the results by company size, type, and industry); Society for Corporate Governance/Deloitte Center for Board Effectiveness, Board Practices Quarterly: 2021 Cyber Oversight (May 2021), https://www.societycorpgov.org/currenttopiclandingpages/tpboardpractices/2021-board-practices-cyber-oversight (see as to the frequency on the board agenda, including the results by company size, type, and industry).(go back)

32Society Quick Survey, Executive-Level ESG Committee Organization & Practices (July 2019). A total of 189 members responded, comprising about 43% large-cap or above (over $10 billion in market capitalization), 31% mid-cap (between $2 billion and $10 billion), 20% small-cap or below (below $2 billion), and 7% private or non-profit.(go back)

33See, e.g., American Airlines Sustainability Steering Committee in its 2019-2020 ESG Report, 4-5, https://www.aa.com/content/images/customer-service/about-us/corporate-governance/aag-esg-report-2019-2020.pdf; Cheniere Energy executive-level corporate responsibility steering committee and management-level corporate responsibility working group in its 2020 Corporate Responsibility Report, 8, https://www.cheniere.com/pdf/Cheniere_CR_report.pdf; First Energy executive level steering committee in its 2020 Corporate Responsibility Report, https://fecorporateresponsibility.com/downloads/FirstEnergy_CorporateResponsibilityReport.pdf; General Mills Sustainability Governance Committee, webpage: https://www.generalmills.com/en/Responsibility/Sustainability/leadership-governance; Lowe’s Sustainability Steering Committee in its 2020 Corporate Responsibility Report, 55, https://corporate.lowes.com/sites/lowes-corp/files/2021-07/2020_CSR_FINAL.pdf; PayPal ESG Steering Committee and ESG & Environmental Working Groups, webpage: https://investor.pypl.com/esg-strategy/default.aspx; Rayonier ESG Working Group in its 2020 Sustainability Report, 43, https://www.rayonier.com/media/11454676/rayonier_sustainability_report_2020.pdf; Visa Corporate Responsibility and Sustainability Leadership Council in its 2020 Environmental, Social & Governance Report, 5, https://usa.visa.com/content/dam/VCOM/global/about-visa/documents/visa-2020-esg-report.pdf.(go back)

34See appendix of this publication for a list of sample disclosures.(go back)

35See, e.g., Radian Group Inc., ESG Steering Committee Charter, https://radian.com/-/media/Files/Enterprise/Corporate-Governance/ESG/ESG-Steering-Committee-Charter.pdf (February 2021).(go back)

36In June 2019, the Society for Corporate Governance conducted a survey on management-level sustainability committees among its members. A total of 170 members responded, comprising about 53% large-cap or above (over $10 billion in market capitalization), 28% mid-cap (between $2 billion and $10 billion), and 19% small-cap or below (below $2 billion). 29% of 164 respondents indicated that their company had a management-level sustainability committee. Of those respondents whose companies had a management-level sustainability committee, 42% indicated that the committee had a charter or a similar document describing its responsibilities, which in most cases was not subject to board approval. Society Quick Survey, Management-Level(non-Board) Sustainability Committees (June 2019).(go back)

37Society Quick Survey, Executive-Level ESG Committee Organization & Practices (July 2019).(go back)

38In January 2019, the Society for Corporate Governance conducted a survey on organizational responsibilities and staffing in connection with ESG reporting among its members (the “January 2019 Survey”). A total of 205 members responded, comprising about 49% large-cap or above (over $10 billion in market capitalization), 36% mid-cap (between $2 billion and $10 billion), and 15% small-cap or below (below $2 billion). When asked about the number of staff members devoted to ESG, 45% of 157 respondents indicated 1-3, 15% – 4-5, 5% – 6-9, 6% – 10 or more, and 29% selected “other” (with responses ranging from zero, to ESG responsibilities shared by multiple team members on a part-time basis, to no centralized staff, but with different functions having their own staff, to a handful of individuals charged with ESG reporting, but with hundreds feeding into the process, to unable to quantify). Society Quick Survey, ESG Reporting – Organizational Responsibilities & Staffing (January 2019).(go back)

39Responsibilities for various ESG issues can also be divided among multiple individuals and multiple departments without full-time “ESG roles,” ESG issues are continually evolving, and there is no consensus on which issues are encompassed by “ESG.”(go back)

40A total of 146 members responded, comprising about 47% large-cap or above (over $10 billion in market capitalization), 36% mid- cap (between $2 billion and $10 billion), and 17% small-cap or below (below $2 billion). Society Quick Survey, ESG/SustainabilityInternal Organization & Reporting Lines (August 2020).(go back)

41In the January 2019 Survey, out of 194 respondents, 23% reported that responsibility for their company’s ESG reporting was vested in one department, 44% reported that it was divided between two or more departments, 19% reported that no particular area(s) or function(s) owned that responsibility, 12% responded that their company did not do ESG reporting, and 2% selected “other.” Society Quick Survey, ESG Reporting – Organizational Responsibilities & Staffing (January 2019).(go back)

42In the January 2019 Survey, when asked where their company’s ESG reporting function resided, 168 respondents answered as follows: Corporate Secretary (46%), Sustainability/Corporate Social Responsibility team (45%), General Counsel (37%), Public Relations/Corporate Communications (36%), Investor Relations (24%), EHS function (21%), HR (13%), Compliance (8%), Procurement/Sourcing (7%), and/or Financial Reporting/CFO’s office (7%). 14% indicated that no particular area(s) or function(s) owned that responsibility, and 13% selected “other.” Most (34% out of 156 respondents) indicated that General Counsel/Chief Legal Officer held ultimate responsibility over ESG reporting, with remaining responses widely dispersed. Society Quick Survey, ESGReporting – Organizational Responsibilities & Staffing (January 2019).(go back)

43See Veena Ramani and Hannah Saltman, Ceres, Running the Risks: How Corporate Boards Can Oversee Environmental, SocialAnd Governance Issues (harvard.edu) (November 25, 2019).(go back)

44Item 407(h) of Regulation S-K.(go back)

45Recommendations of the Task Force on Climate-related Financial Disclosures (June 2017).(go back)

46For proxy statement examples, see Donnelley Financial Solutions (DFIN), Board Oversight of ESG – NOW! (2020). See also Ceres, Running the Risks: How Corporate Boards Can Oversee Environmental, Social And Governance Issues (harvard.edu) (November 25, 2019).(go back)

47See Skadden, Arps, Slate, Meagher & Flom LLP and the Society for Corporate Governance, Enhancing Disclosure Controls andProcedures Relating to Voluntary Environmental and Social Disclosures (June 2021), https://higherlogicdownload.s3.amazonaws.com/GOVERNANCEPROFESSIONALS/a8892c7c-6297-4149-b9fc-378577d0b150/UploadedImages/Enhancing_Disclosure_Controls_and_Procedures_Relating_to_Voluntary_Environmental_and_Social_Disclosures.pdf(go back)

Print

Print