Addison Holmes is an Associate in ESG Strategy & Integration at Pickering Energy Partners. This post is based on her Pickering Energy Partners memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

Executive Summary

- The Pickering Energy Partners ESG Consulting team ran an analysis of the 100 private equity firms most active in Energy deals over the last 5 years. [1]

- In analyzing those 100 firms and scoring them on their ESG disclosure, we saw that the competitive bell-curve based on disclosure completeness displays a positive skew. This indicates most firms are just beginning their ESG journey and there exists a great opportunity to establish a competitive advantage.

- 33% had no ESG integration at all

- 12% were in the “Crawl” phase, with either an ESG website or general ESG statement

- 20% were in the “Walk” stage, developing ESG policies that outline a firm’s approach to ESG evaluation and integration into the investment process

- 35% were in the “Run” stage, with a strong reporting infrastructure in place to monitor ESG-related KPIs among portfolio companies, aggregate this data, and report to stakeholders at a regular cadence

- Of the 100 firms analyzed, 45 were PRI signatories.

- However, only 28 had an ESG report. This implies many firms are not compliant with the current PRI requirements.

- Only 16 are actively considering TCFD, indicating that many GPs do not understand the requirements of being a PRI signatory will likely be non-compliant in the future.

- Firms that participate in more energy deals and which have higher committed capital tend to also have higher ESG reporting quality because they have more LPs that are requesting this data. That said, high quality reporting opens larger pools of capital and supports fundraising efforts.

- Of those firms with the highest ESG reporting quality, 80% are PRI signatories and 80% consider TCFD, and 70% consider GRI.

- High quality ESG reporting comes in the form of regular reports (including an annual ESG report), qualitative commentary supported by quantitative data, and disclosing data points that are common across frameworks, material to the businesses of portfolio companies, and influential for LPs.

- Low quality ESG reporting, on the other hand, comes at the risk of lost deals and increasing LP frustration.

- In conclusion, we recommend that GPs control the narrative by:

- Formally incorporating ESG-related considerations within the broader strategic considerations and directives of the firm

- Identifying material ESG data points relevant to the economic reality of portfolio companies and monitor these data points on a consistent basis to identify risks and opportunities in the portfolio

- Establishing and conveying an ESG narrative that highlights a distinct set of value drivers and is supplemented by data

Intro

ESG scoring, scrutiny and integration is a concept that generally originated and evolved in the public markets. However, it is now making its way into the world of private equity. Asset owners are seeking and, in some cases, requiring, sustainable options from their asset managers. We feel asset managers need to expand their current ESG by implementing a plan that allows them to navigate the evolving landscape. ESG concepts are beginning to be included throughout the fundraising, investing, and reporting processes. In order to compete for quality capital, General Partners needs to institute ESG reporting that consists of three key attributes—disclosure type and sophistication, balance between qualitative commentary and quantitative KPIs, and finally the prevalence and influence of reporting frameworks and metrics.

Why GPs Should Take the Next Step

ESG integration historically has faced skepticism within the private equity community, however it has become critical in the competition for capital and talent. This skepticism has resulted in superficial efforts to integrate ESG principles into the investment and reporting processes. Our analysis pinpoints a distinct gap between disclosure and materiality. For example, of those roughly 450 private equity firms that have signed the Principles for Responsible Investing (PRI), only 16 of them disclose ESG’s impact on financial returns. [2] A majority of these signatories have very limited ESG disclosure, and many just include boilerplate language on their websites about the importance of ESG.

That said, the tide is turning as a result of pressures from Limited Partners (LPs). This pressure from LPs culminates in ESG questionnaires, ESG questions in traditional DEI questionnaires, direct communication, and—most importantly—in investment. In 2021, 88% of LPs assess ESG factors as part of their investment decision. [3] For General Partners (GPs), this means that ESG is swiftly becoming critical to raising capital. GPs are responding, by creating dedicated ESG functions, developing ESG policies, and screening new investments for ESG risks and opportunities.

- 72% of GPs screen potential portfolio companies for ESG risks/opportunities [4]

- 65% of GPs have developed a responsible investing or ESG policy and the tools to implement it [5]

- 30% of GPs have at least one full-time corporate social responsibility officer, up from 14% two years ago [6]

We Care About ESG—Now What?

ESG in the fundraising process

As mentioned in the prior section, GPs’ ESG performance and disclosure can significantly impact their access to LP capital, both new and existing. Strong ESG policies and disclosures can open up new pools of capital in the fundraising process. For example: Carlyle Group obtained a first-of-its-kind $4.1 billion ESG-related credit facility for its private equity funds this year. This credit facility links the cost of debt to Carlyle’s goal of having 30% diverse directors on portfolio-company boards within two years of the firm’s ownership. [7] While Carlyle is relatively further along in its respective ESG journey, many GPs are still in the nascent stages of developing an ESG program. When it comes to committing capital, LPs are looking for progress, not perfection. LPs want to feel confident that ESG is materially embedded in GPs’ investment processes, rather than being an attempt to check some boxes in an LP agreement. They want to see KPIs that back up ESG commitments and monitor trends in those KPIs over time.

ESG in the investing process

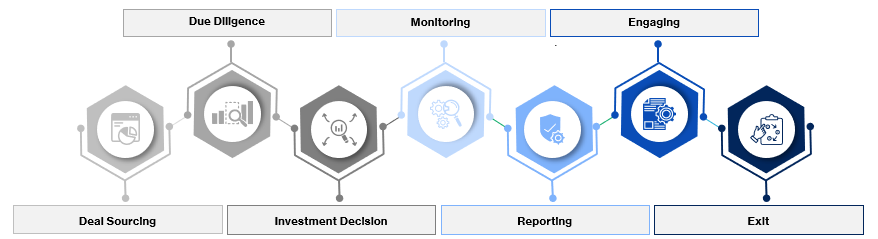

For those GPs that say they integrate ESG in their investing process, it is expected that ESG factors are included throughout the deal life cycle. During the deal sourcing stage, best in class GPs pre-screen investment opportunities to avoid any exposures that conflict with the firm’s principles. An example of such an exposure might be a recent environmental lawsuit, human rights violation, impactful supply chain disruption or controversy involving management. During the due diligence stage, GPs evaluate material ESG risks and opportunities and consider opportunities to partner with the company to drive value. The due diligence stage is under the most scrutiny when it comes to the topic of greenwashing (when funds market themselves as ESG-friendly but don’t have data to support this). Common due diligence approaches include questionnaires to gauge if the company has an ESG policy and related reporting, identifying opportunities to reduce risk through initiatives such as health and safety training, and assessing the performance impact of societal megatrends.

Next, ESG risks and opportunities are included in Investment Committee discussions and memorandums as the investment decision is made. After the investment, ESG KPIs are documented in internal reporting systems for ongoing tracking and internal and external reporting. These KPIs are monitored, and GPs document progress on relevant ESG and reputational issues. Where relevant, the GP engages with select companies on value creation efforts. Finally, as GPs prepare to exit their investments, they include ESG activities in marketing materials. Integration of ESG through the deal lifecycle often widens the pool of potential buyers at exit.

ESG in the reporting process

In addition to pressure regarding ESG integration within the investment process, GPs are beginning to face ESG reporting requirements by current and potential LPs. The Pickering Energy Partners ESG Consulting team assessed 500 questions across ESG and DEI LP questionnaires from this past year to better understand what topics LPs care most about. The most common question asked by LPs was about how ESG factors were integrated into the investment strategy. LPs require granularity on which percentage of investments utilize ESG integration and what the process is for selecting and monitoring investments. No longer is this a check-the-box exercise, LPs want to know the actual factors that are being evaluated and how portfolio companies have performed over time regarding those factors. Additionally, LPs are asking to what extent do GPs support ESG-related bodies or associations including the PRI, Taskforce on Climate-Related Financial Disclosures (TCFD), the United Nations Sustainable Development Goals (SDGs), the Global Reporting Initiative (GRI), and the Value Reporting Framework (formerly known as SASB). Where in the past LPs viewed ESG as a check-the-box exercise and would send out questionnaires to their GPs only to archive them, now we see appetite from LPs for in-depth ESG reporting. Today, the competitive landscape of ESG reporting among GPs consists of three key attributes:

- Disclosure type and sophistication

- Balance between qualitative commentary and quantitative KPIs

- The prevalence & influence of reporting frameworks and metrics

How To Compete for Capital With ESG

The Pickering Energy Partners ESG Consulting team ran an analysis of the top 100 private equity firms most active in Energy deals over the last 5 years. These firms include sector-specific names like Quantum, Riverstone, and NGP as well as generalist names like KKR, Carlyle, and Apollo. The team analyzed each firm’s ESG policies, websites, and reports and pulled out key insights around disclosure type and sophistication, length of qualitative commentary and ratio to quantitative data, and finally the prevalence and influence of reporting frameworks and metrics.

Disclosure Type and Sophistication

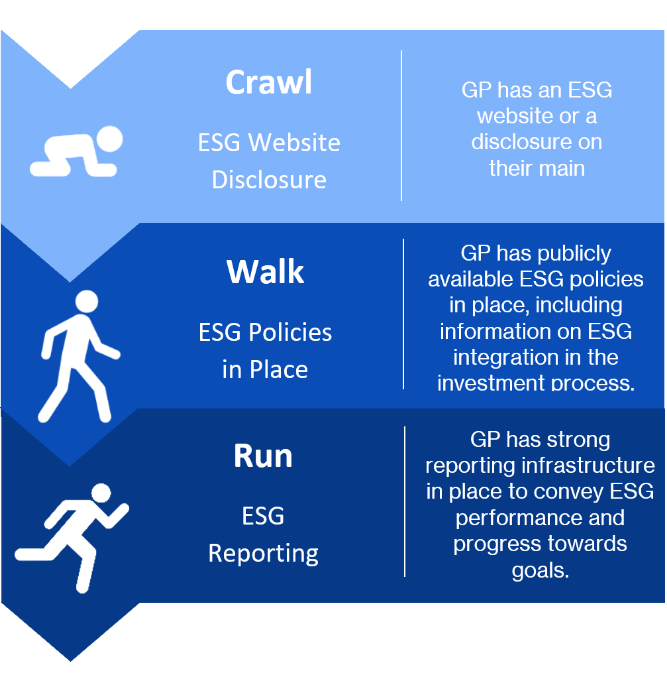

ESG disclosures can come in a variety of forms. For firms that are just beginning their ESG journey, many have a paragraph-long statement about the importance of ESG on their website. One level up from that would be an ESG webpage that discusses the firm’s approach to ESG. We would define these basic disclosures as the “Crawl” phase of ESG disclosure. Of the 100 firms we assessed, 12% were in the “Crawl” phase, with either an ESG website or ESG mentions on their general website. Next, we have the “Walk” stage. In this stage, we see firms developing ESG policies that outline a firm’s approach to ESG evaluation and integration into the investment process. Of the 100 firms analyzed, 20% were in the “Walk” stage. Finally, we have the “Run” stage. Firms in this stage are leaders in terms of ESG sophistication. These firms have a strong reporting infrastructure in place to monitor ESG-related KPIs among portfolio companies, aggregate this data, and report to stakeholders at a regular cadence. These firms produce annual ESG reports (also known as Impact, Sustainability, or Corporate Social Responsibility reports). Of the 100 firms analyzed, 35% were in the “Run” stage. Strategically, this implies that the bell curve is in its relative infancy and there exists a great opportunity to establish a competitive advantage.

Framework Alignment Increases with ESG Integration

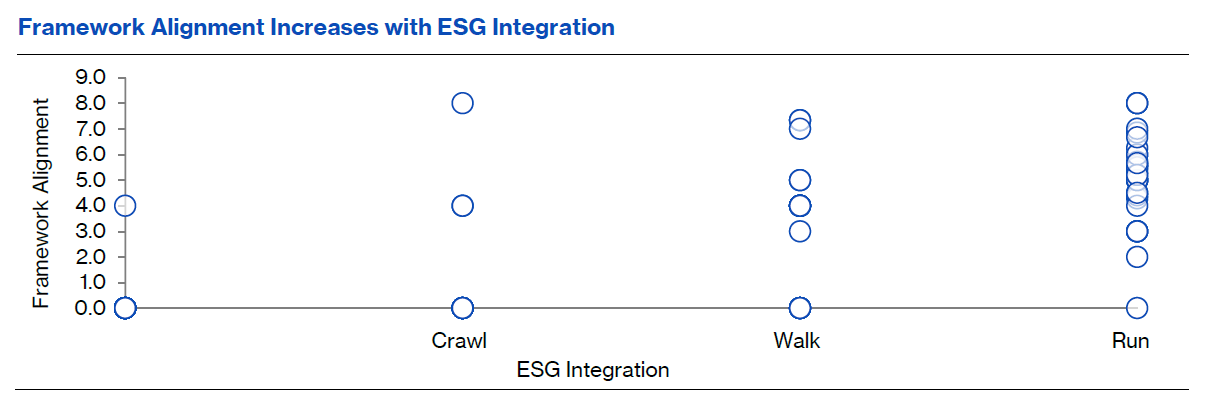

As firms become more sophisticated, and move between the “Crawl, Walk, Run” stages, we see increased reliance on ESG frameworks. Framework Alignment is a score between 0 and 10, where 0 is alignment with no frameworks, 1-5 represent increasing alignment with one or more simple frameworks (such as the SDGs), and 6-10 represent increasing alignment with more detailed frameworks (such as GRI and TCFD). In the chart to the right, we can see that a majority of firms in the “Run” stage report under at least one framework, and many report under multiple sophisticated frameworks.

Qualitative vs. Quantitative Reporting Components

The biggest risk when it comes to ESG reporting is greenwashing. LPs have hit out against private equity funds for being ‘too superficial’ in their environmental, social and governance (ESG) reporting. [8] They complain that many ESG reports are lacking in substance and don’t provide data to substantiate claims. In our assessment of firm’s reports, we looked at a few different measures of quantifiable topics vs. qualitative claims. The data points we analyze in this section include:

| Page length: | Number of pages in the report |

|---|---|

| Sentence length: | Number of sentences in the report |

| Character count: | Number of total characters in the report |

| Frameworks considered: | Number of ESG frameworks considered including SASB, GRI, TCFD, SDGs, etc. |

| Size: | a score between 1 and 10 generated based on committed capital |

| Total deals: | Number of total energy deals participated in |

| % Characters that are digits: | Percent of total characters that are numeric |

| % Sentences with KPIs: | Percent of total sentences that include metrics |

| Framework alignment: | Score between 1 and 10, defined earlier in this analysis as alignment with one or more increasingly complex frameworks. |

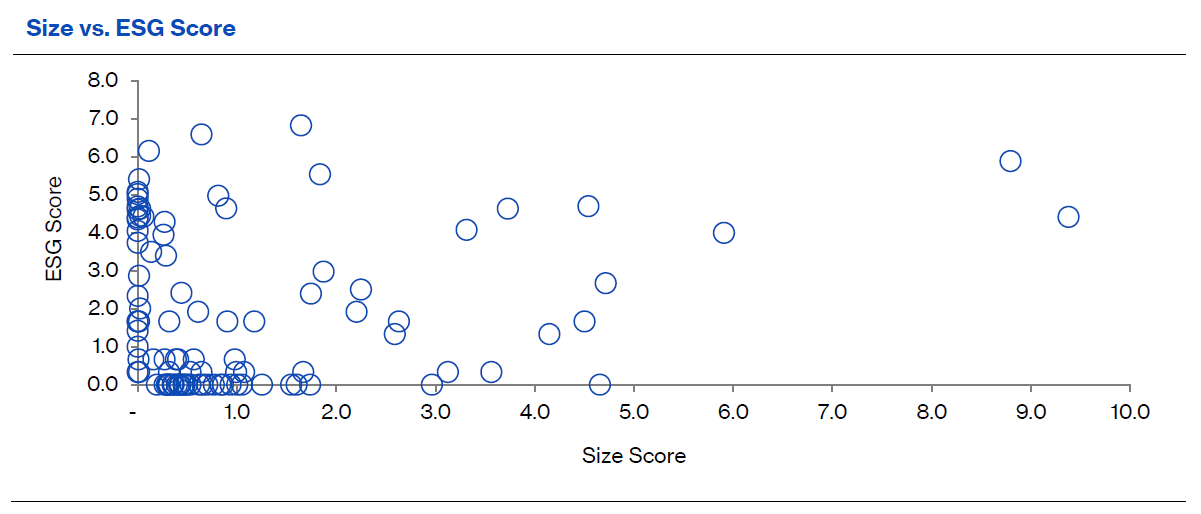

Of those firms that publish ESG reports, the average length of these reports was 43 pages. We saw a positive correlation between number of pages and percent of sentences including KPIs, indicating that lengthier reports also included a greater deal of quantification. That said, we saw a negative correlation between firm size and report length and number of frameworks, indicating that larger firms are more strategic about which frameworks they map to and how they communicate their performance—focusing on only those most material data points that are relevant to their economic reality. As ESG becomes more integrated in GPs’ investment strategies and reporting, a larger amount of KPIs and metrics are disclosed.

Prevalence and Influence of KPIs and Frameworks

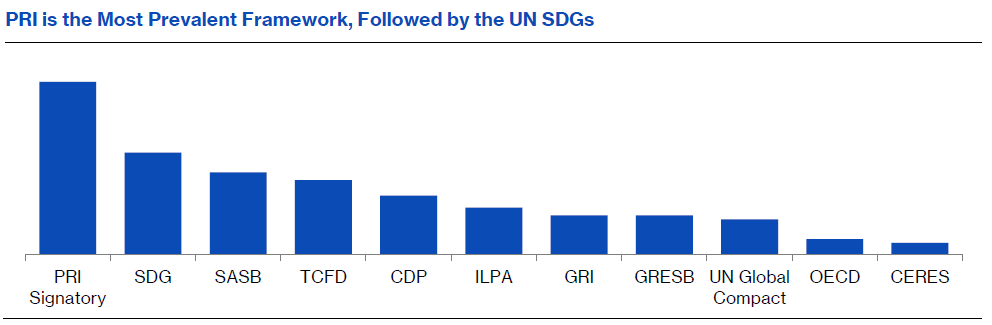

Finally, ESG datapoints and frameworks can be prioritized by prevalence and influence. Prevalence refers to how commonly used certain frameworks are and how frequently ESG metrics are reported on (across the broader landscape). Of the 100 firms analyzed, 45 were PRI signatories. The PRI requires that signatories integrate ESG principles across 50% of assets managed. However, not all of those funds had a public ESG policy and only 28 had an ESG report. This implies many firms are not compliant with the current PRI requirements. Going forward, supporting the adoption of the recommendations of TCFD is a high priority for the PRI as they provide a global framework for translating information about climate into financial metrics. [9] Only 16 of the 45 PRI signatories are actively considering TCFD, indicating that many GPs do not understand the requirements of being a PRI signatory and are either currently non-compliant or will likely be non-compliant in the future. After the PRI, the UN SDGs are the most commonly utilized framework. This is the most general framework, outlining 17 high level goals for peace and prosperity for people and the planet, now and into the future. [10] The 26 GPs that report under this framework map their investment goals and ESG initiatives to some, but not all, of the 17 SDGs. SASB and GRI provide more topic-by-topic guidance for reporting, requiring firms to disclose on all topics or provide a reason why that topic is not applicable. In the US, SASB is more commonly used. Internationally, GRI is much more common. On the less prevalent side, fewer firms report under the 10 UNGC principles, mention compliance OECD guidelines, or consider CERES’ initiatives.

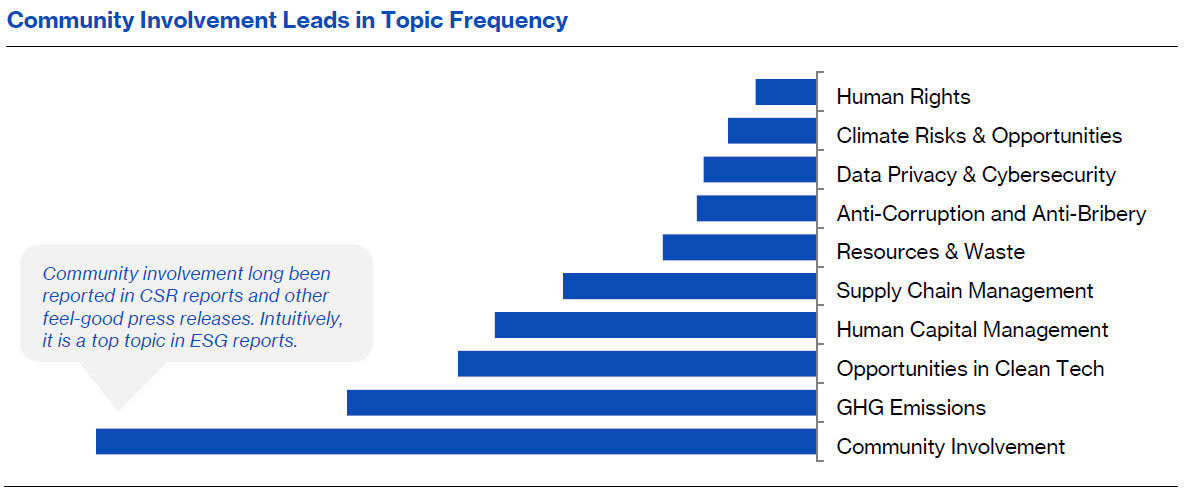

After assessing the prevalence and influence of relevant ESG frameworks, we drill down into the prevalence and influence of ESG data points. The Pickering Energy Partners team started by reviewing the data points across each framework identified above. We then layered in topics considered by the 7 most influential ratings agencies (including MSCI and Sustainalytics) and 4 primary data providers (including Bloomberg and Refinitiv). Finally, we aggregated all of the data points disclosed across the 100 GPs in this analysis and the 500 questions asked by LPs. We assessed the prevalence and overlap across this spectrum as well as the relative influence of each data point in order to funnel down to the 40 topics most important for GP ESG reporting. Of these 40, the topics discussed most frequently in GP ESG reports are community involvement, GHG emissions, opportunities in clean tech, human capital management, supply chain management, resources & waste, anti-corruption and anti-bribery policies, data privacy & cybersecurity, climate risks and opportunities, and human rights.

Implications for the Quality of Reporting

The competitive landscape of ESG reporting among GPs consists of three key attributes—disclosure type and sophistication, length of qualitative commentary and ratio to quantitative data, and finally the prevalence and influence or reporting frameworks and metrics. High quality ESG reporting comes in the form of regular reports (including an annual ESG report), qualitative commentary supported by quantitative data, and disclosing data points that are common across frameworks, material to the businesses of portfolio companies, and influential for LPs. To capture ESG reporting quality, we generated a “ESG Reporting Score” that combines a disclosure type and sophistication score, quantitative vs. qualitative score, and prevalence & influence score. We then analyzed the ESG Reporting Scores across the 100 firms analyzed. We can see that larger firms (and firms that participate in more energy deals) tend to have higher ESG reporting quality. In a lot of cases, this is because they have more LPs that are requesting this data. That said, high quality reporting opens up larger pools of capital and supports fundraising efforts. Of those firms with the highest ESG reporting quality, 80% are PRI signatories and 80% consider TCFD, and 70% consider GRI.

Conclusion

Remaining competitive in the pursuit and retention of quality capital now requires asset managers to convey an actionable ESG plan. As we outlined above, ESG reports are one of the most differentiated tools leveraged in competing for capital. When creating ESG reports, GPs must consider disclosure type and sophistication, balance between qualitative commentary and quantitative KPIs, and finally the prevalence and influence of reporting frameworks and metrics. Those GPs that are leading the ESG charge have a variety of disclosures, including robust ESG policies, ESG websites, and strong ESG reports. These reports proactively convey the economic reality of the business, using topics that overlap across the most influential frameworks, are most relevant to their portfolio companies, and provide valuable information to LPs. Successful ESG reports mitigate greenwashing risk by substantiating all claims with data points that tell the story “where were we last year, where are we now, and where will we go in the future?”.

The importance of ESG is unlikely to wane in the future. Within the next year, there are three regulatory changes likely to impact ESG disclosure: the Climate Corporate Accountability Act, SFDR in Europe, and the SEC’s increased focus on climate-related disclosure. Under the Climate Corporate Accountability Act, companies will make annual public disclosures with a complete carbon emissions inventory encompassing scopes 1, 2, and 3. [11] The Sustainable Finance Disclosure Regulation (SFDR) imposes mandatory ESG disclosure obligations for asset managers and other financial markets participants in Europe. [12] In early 2021, the SEC published a statement welcoming public feedback on the topic of climate-related disclosures. [13] Additionally, the SEC is increasingly concerned about greenwashing among asset managers. In the third quarter of 2021, the SEC reviewed asset managers and demanded the standards for classifying funds as ESG-focused. This review is the second of its kind and shows the issue is a priority for the agency. [14] This is all to say, ESG is not going away and, in order to stay ahead of the curve, GPs will need to invest time and resources into data-rich sustainability reporting.

In conclusion, we recommend that GPs control the narrative by:

- Identifying material ESG data points relevant to the economic reality of portfolio companies and monitor these data points on a consistent basis to identify risks and opportunities in the portfolio

- Establishing and conveying an ESG narrative that highlights a distinct set of value drivers and is supplemented by data

- Formally incorporating ESG related considerations within the broader strategic considerations and directives of the firm

Endnotes

1PEP leveraged Bloomberg and Refinitiv to identify these firms.(go back)

2https://www.bain.com/insights/esg-investing-global-private-equity-report-2021/(go back)

3https://www.bain.com/insights/esg-investing-global-private-equity-report-2021/(go back)

4https://www.pwc.com/gx/en/services/sustainability/publications/private-equity-and-the-responsible-investment-survey.html(go back)

5https://www.pwc.com/gx/en/services/sustainability/publications/private-equity-and-the-responsible-investment-survey.html(go back)

6https://capitalmonitor.ai/asset-class/equity/why-private-equity-is-finally-taking-esg-seriously/(go back)

7https://www.pionline.com/private-equity/carlyle-secures-41-billion-esg-related-credit-facility(go back)

8https://citywireselector.com/news/private-equity-funds-called-out-for-greenwashing/a1426637(go back)

9https://www.unpri.org/news-and-press/tcfd-based-reporting-to-become-mandatory-for-pri-signatories-in-2020/4116.article(go back)

10https://sdgs.un.org/goals(go back)

11https://sd11.senate.ca.gov/(go back)

12https://assets.kpmg/content/dam/kpmg/ie/pdf/2021/03/ie-sustainable-finance-disclosure-reg-sfdr.pdf(go back)

13https://www.sec.gov/news/public-statement/lee-climate-change-disclosures(go back)

14https://www.bloomberg.com/news/articles/2021-09-03/fund-managers-feel-heat-in-sec-crackdown-of-overblown-esg-labels(go back)

Print

Print