Frederik Otto is Founder and Business Advisor, Nicolas Alexander is Policy Advisor, and Tias van Moorsel is Sustainability Advisor at the Sustainability Board Report. This post is based on The Sustainability Board Report 2021. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

The Sustainability Board Report 2021 At a Glance

Executive Summary

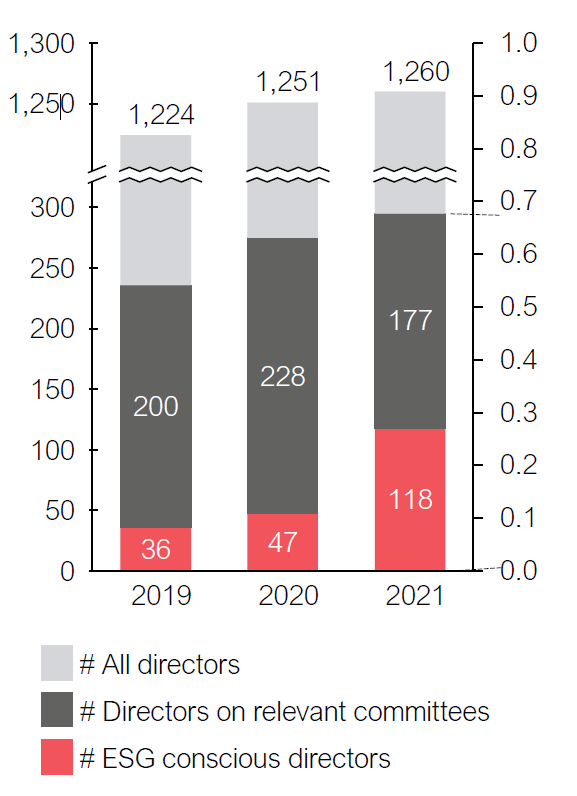

TSBR releases an annual report on ESG preparedness of BoD of the world’s largest 100 publicly listed companies. Last year we found that only 17% of directors on relevant sustainability committees are ESG competent.

Feedback over the last year from many executive and non executive board members and advisors has confirmed our findings. There is generally a very low level of hard ESG competence on BoD .

That said, BoD are increasingly conscious of ESG matters. This is attained primarily via engagement and dialogue with auditors, consultancies, law firms, board assessors, or short webinars and (virtual) roundtables provided by think tanks and other knowledge organisations . That has also resulted in the lines between consciousness (awareness and knowledge of issues) and competence (capacity to act on issues) becoming increasingly blurred.

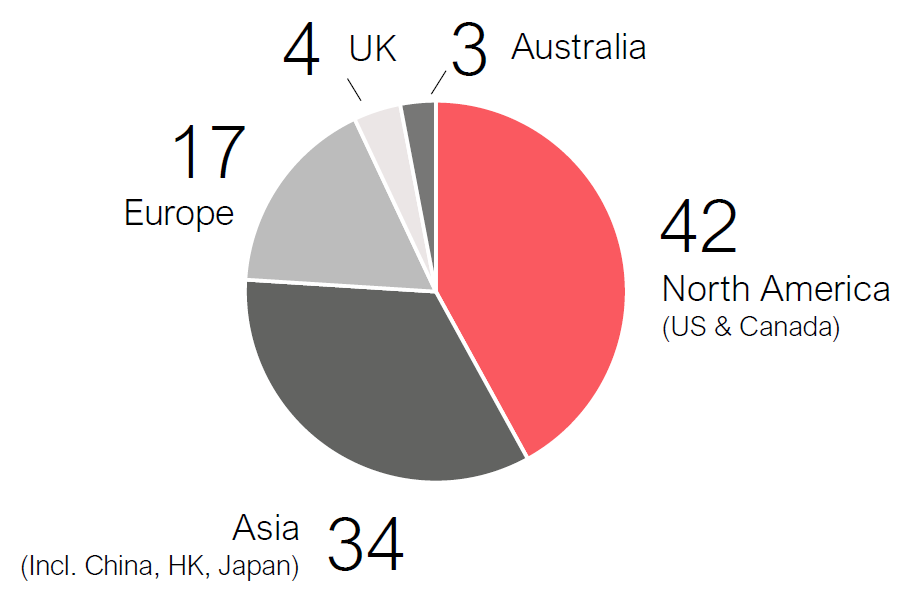

Geographical Makeup of our Sample Size

Our report has three main conclusions:

Terminology & Scope

For the avoidance of doubt, regarding the use of certain terminology, we have added a small glossary below. In earlier editions of this report, we referred to sustainability and ESG interchangeably. Most corporate governance policy now uses the ESG term which we also adopt. In cases where we use ‘sustainability’, it refers to broader concepts.

CSR

CSR stands for ‘Corporate Social Responsibility’. This term is somewhat outdated when referring to sustainability issues and rarely used anymore, as it is supposed to be reflective of an organisation’s philanthropic pillar. TSBR still recognises any CSR policy as part of our scope.

ESG

Environmental, Social and Governance (ESG) has become the preferred term in business lingo. The terminology has moved from sustainability to ESG as it better captures what issues are being addressed.

Sustainability

Sustainability in business in essence refers to ‘doing well by doing good’. The drawback of this term is that it casts a wide net, and therefore is not accurate about the specific issue it wants to address besides ‘doing good’.

Impact

Impact is an emerging term. It is primarily used in finance, where it refers to ‘doing good’ and in ESG to ‘avoiding harm’.

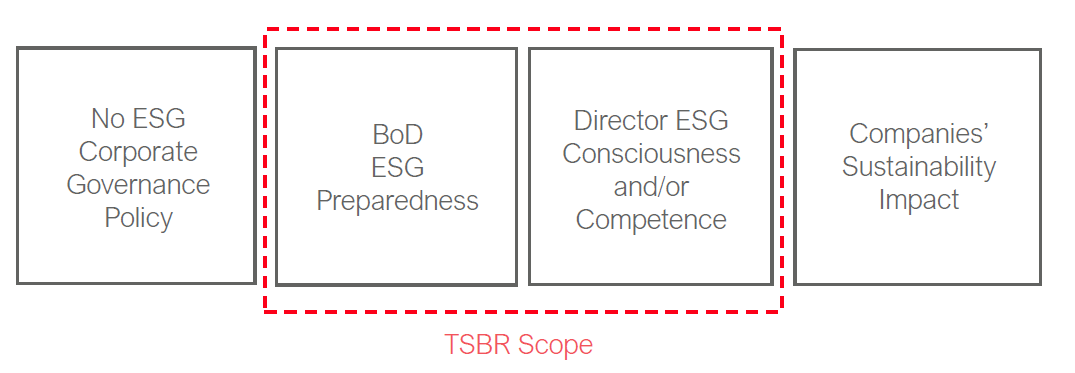

TSBR survey scope

Methodology

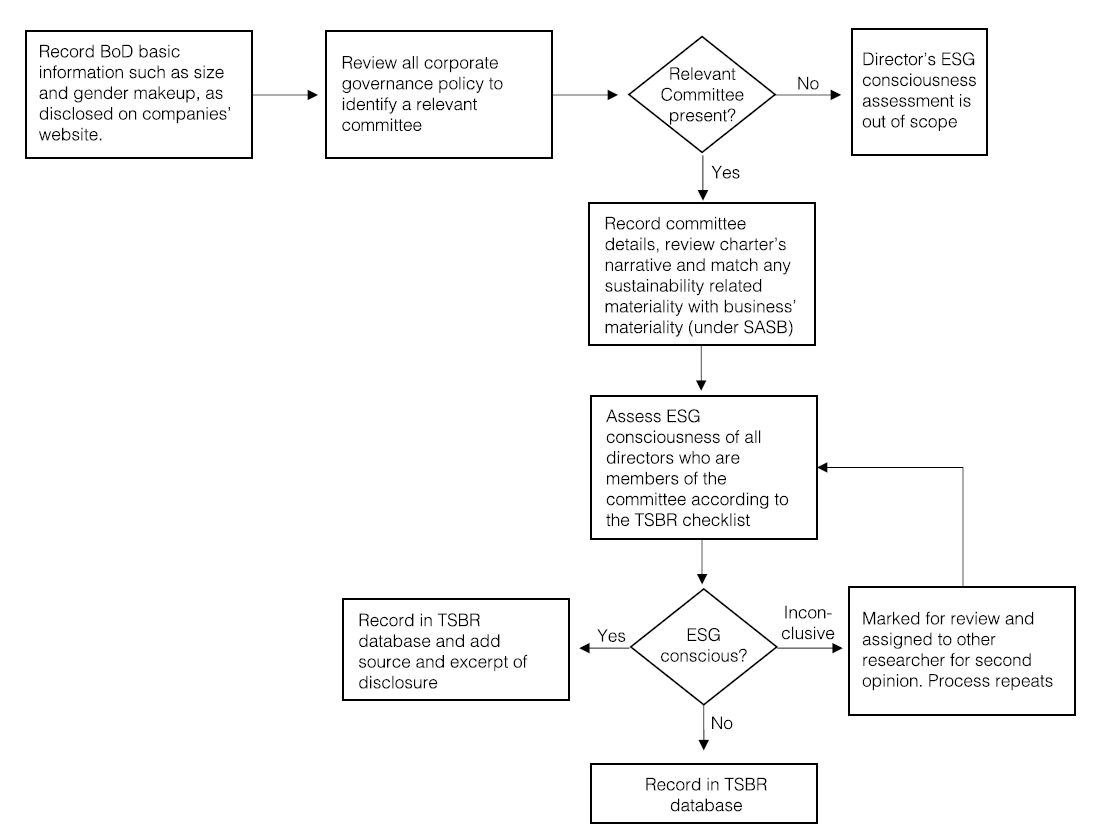

Assessment Sequence and Process

Board ESG Policy Assessment

All data were collected from July to August 2021 and taken from the surveyed companies’ websites. Since all organisations are publicly listed, the publishing of their corporate governance policy details is a legal obligation.

The proxy used for ESG preparedness at board level is the presence of a relevant board committee that stipulates ESG issues in its committee charter.

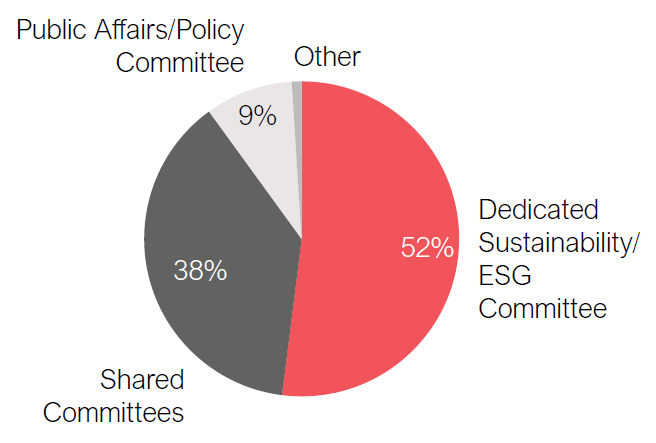

Terminology for ‘sustainability committee’ varies. Some committees are named ‘ESG’ or ‘CSR’ committee. Some sustainability responsibilities are part of shared committees such as Corporate Governance and/or Nomination Committee, Risk, or Public Policy/Affairs committees.

So long as a sustainability narrative is clearly stipulated in their charters, these are referred to as relevant committees. Businesses that do not disclose any sustainability policy as part of their board committee charters do not qualify for the directors ESG consciousness assessment. Directors must be assigned to a relevant committee to qualify.

Director’s ESG Consciousness Assessment

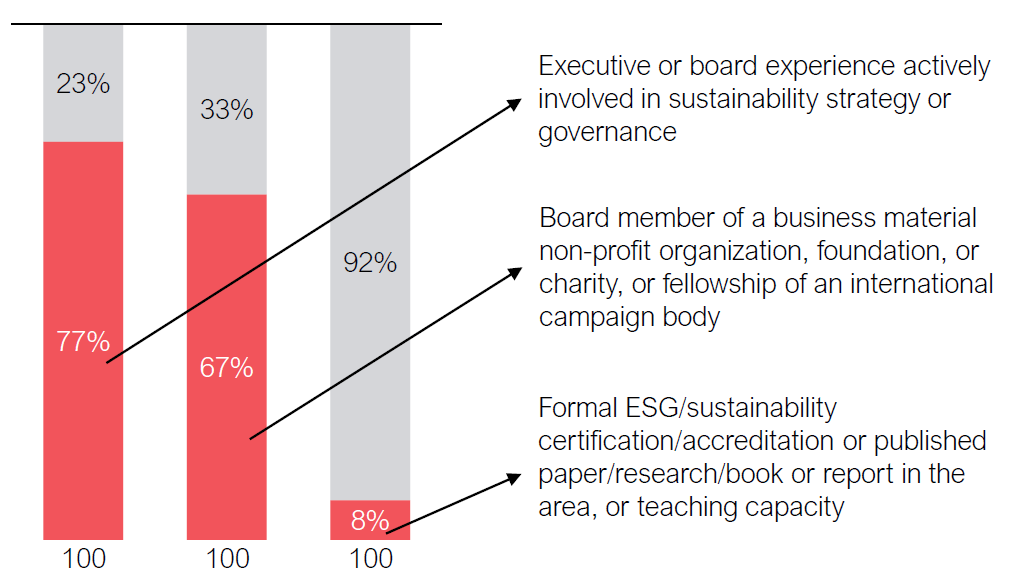

Directors’ ESG consciousness was assessed against an ESG checklist. The checklist reads:

- Executive or board experience actively involved in sustainability strategy or governance [1]

- Board member of a business material (under SASB) non profit organisation , foundation, charity, or fellowship of an international campaign body [2]

- Formal ESG/sustainability certification/accreditation or published paper/research/book or report in the area, or teaching capacity [3]

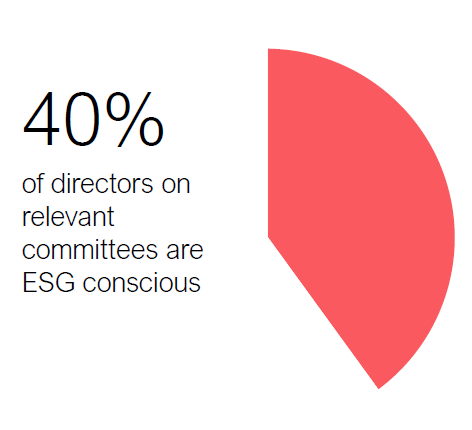

For the 2021 report, a broader data screening was applied. For example, significant data was found through media screenings that took notable sustainability exposure, as per our checklist, into account. New data points uncovered were for example those of disclosed public speeches of directors, or minutes of relevant seminars and forums. This additional data of directors’ ESG consciousness, lead to a significantly improved result than in previous years, shifting from 17% in 2020 to 40%. We will continue to use this methodology for future reports.

Adjudication

In cases where the ESG consciousness of a director was questionable, the data point was marked ‘for review’ and the assessment was then adjudicated by a different researcher.

2021 Findings & Recommendations

BoD ESG Preparedness

Half of the surveyed boards have a dedicated sustainability, ESG or CSR committee with most of the remaining having sustainability policy as part of another committee.

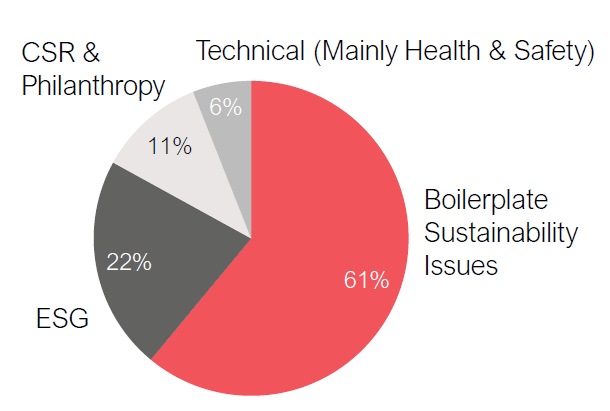

Narratives of sustainability governance, as stipulated in committee charters, read overwhelmingly as boilerplate excerpts. However, comprehensiveness varies. ESG narratives tend to be more relevant.

Directors’ ESG Consciousness

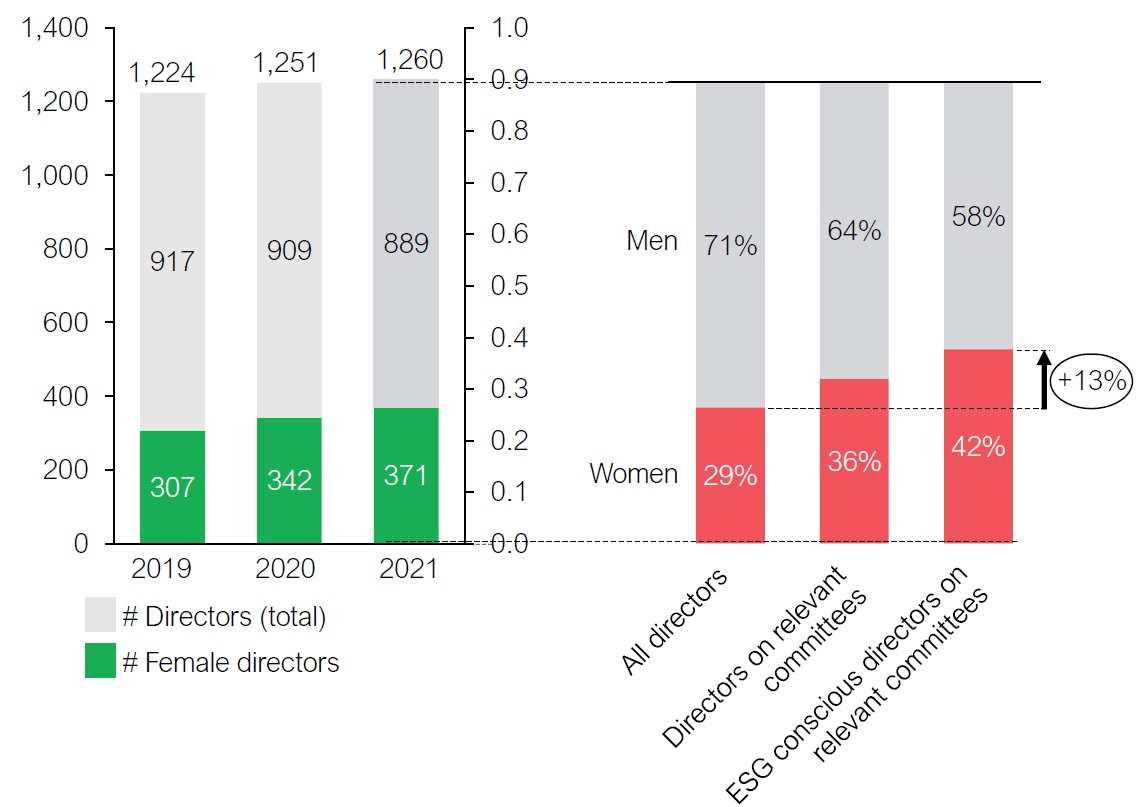

On average, only 40% of directors on ESG committees are ESG conscious. Most of that consciousness derives from board experience or having been actively involved in sustainability strategy or governance.

ESG Consciousness Drivers

Gender & Director ESG Consciousness

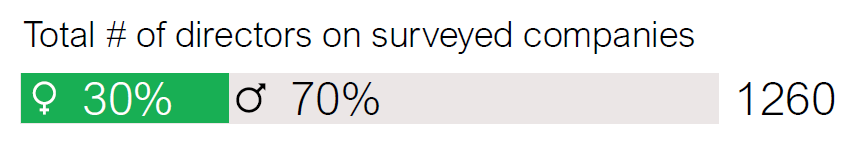

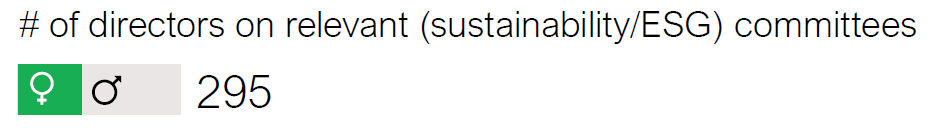

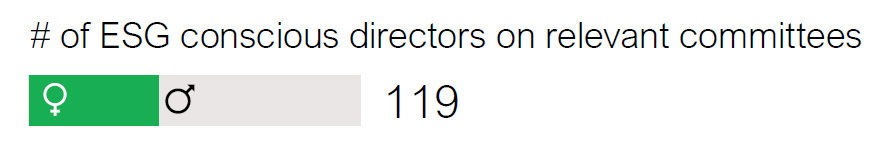

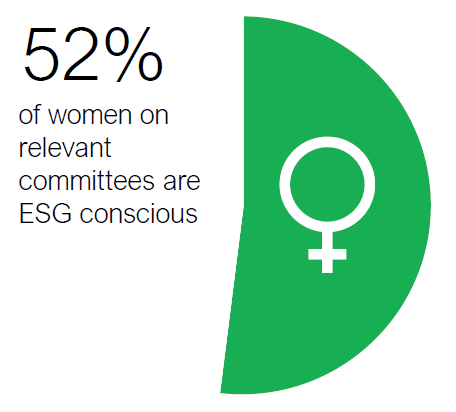

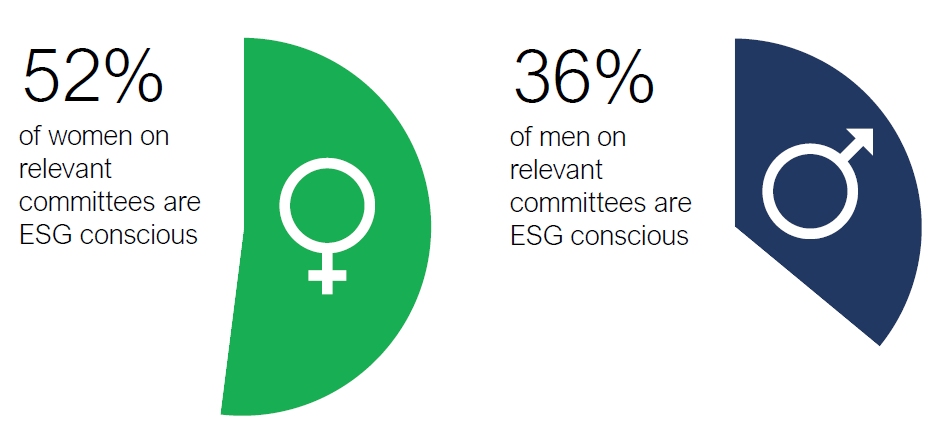

Not only are women, on average, more likely to be on ESG committees, but they are also more likely to be ESG conscious.

Findings & Recommendations

Firstly, our results across more than 600 historic data points show that there is a strong and significant correlation between ESG consciousness and gender. Women are on average more conscious of ESG issues. They can therefore be said to be driving the conversation on sustainability. This finding has been consistent ever since TSBR’s first annual report in 2019.

Various research, including a comprehensive literature review by Alexandre Di Miceli and Angela Donaggio, [4] has had similar findings. Indeed, there seems to be substantial evidence connecting increased gender diversity at the top with enhanced environmental, social, and governance standards.

Why might this be? Rachel Howell, a lecturer in sustainable development at the University of Edinburgh, notes that “women have higher levels of socialisation to care about others and be socially responsible, which then leads them to care about environmental problems and be willing to adopt environmental behaviours.” [5]

Whatever the cause, given the clear evidence connecting strong ESG with corporate performance, this makes another business case for greater gender diversity on boards and in senior management.

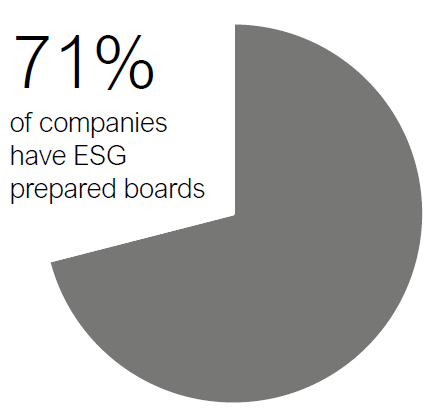

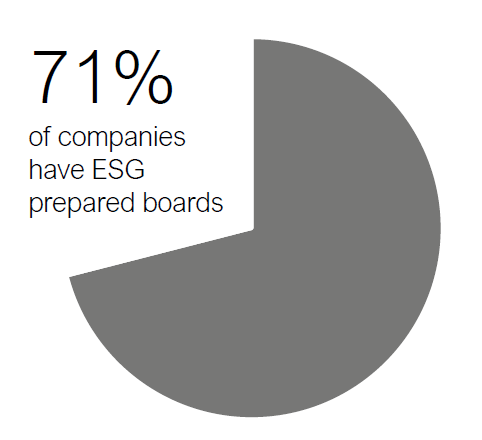

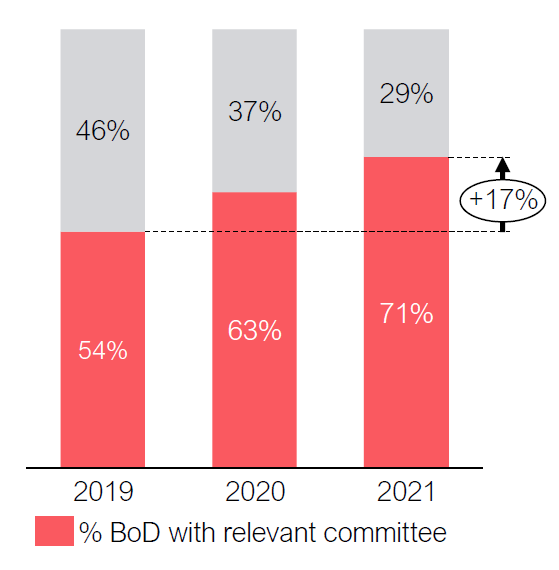

Secondly, the ESG preparedness of BoD and the ESG consciousness of directors themselves is increasing. Not only are more ESG committees being created (71% of companies, compared to 63% in 2020), but more directors are becoming ESG conscious too.

That said, most corporate governance sustainability policy, usually in the form of a committee charter, remains lacklustre. The lack of disclosure of material ESG issues and detail of what exactly the board’s role is, suggests sustainability policy all too often remains a box ticking exercise.

When creating sustainability policies at board level, material factors of the business’ industry must be clearly articulated. Simplistic and general stipulations like: ‘oversee sustainability issues’ or ‘govern ESG factors’ should not and cannot provide stakeholders confidence that relevant issues are being monitored and adequately addressed.

Moreover, BoD should sign off all CSR/sustainability/ESG reports and make sure that all relevant material factors are being reported on. Although produced by nearly all the companies in our sample, such reports should not, however, replace governance policy. Indeed, sustainability reporting is often a siloed exercise conducted by internal ESG professionals and outside advisors.

Sustainability reports cannot replace in depth conversations about material ESG issues, discussing potential strategic changes in relevant BoD committee meetings. By definition, these factors impact all stakeholders, particularly shareholders, and should be central to long term strategy.

Lastly, business leaders have a moral responsibility to society. We explored these dynamics in our scenario report on ‘Sustainable Business Leadership in 2030’. [6] If BoD don’t act, someone else will step in and push the agenda on sustainability. Hence creating ESG preparedness also functions as a defence mechanism.

Directors need to upskill and become at least conscious about ESG issues, but better competent. What that exactly means will be up to every individual and their specific context.

Endnotes

1For example: Published interviews with individuals expressing details about their’ business’ approach to ESG/sustainability, or e.g. published speeches or strategy.(go back)

2For example: WEF (most common), UN Global Compact, CECP, WBCSD, think tanks with sustainability focus such as Aspen Institute, Salzburg Global Seminar, etc.(go back)

3For example: GCB.D, ICD.P, Harvard Corporate Governance Forum publication, author of a relevant book.(go back)

4https://www.ifc.org/wps/wcm/connect/60a2e87d-5c50-433f-b831-b77ee6d300cf/IFC+PSO_Women_Business_Leadership_web.pdf?MOD=AJPERES&CVID=nvUDNLJ(go back)

5https://www.theguardian.com/environment/2020/feb/06/eco-gender-gap-why-saving-planet-seen-womens-work(go back)

6https://www.boardreport.org/sustainable-business-leadership-in-2030(go back)

Print

Print