Hannah Orowitz is Senior Managing Director of ESG, Brigid Rosati is Managing Director of Business Development and Corporate Strategy, and Rajeev Kumar is Senior Managing Director at Georgeson LLC. This post is based on a Georgeson memorandum by Ms. Orowitz, Ms. Rosati, Mr. Kumar, Ed Greene, Aaron Miller and Michael Maiolo.

Shareholder Proposals

The 2021 proxy season produced unprecedented results, including record high proposal submission levels, average support levels and passage levels, among other notable results related to shareholder proposals. These results reveal that investors’ heightened focus on ESG risks and opportunities is having a meaningful impact on voting decisions, such as:

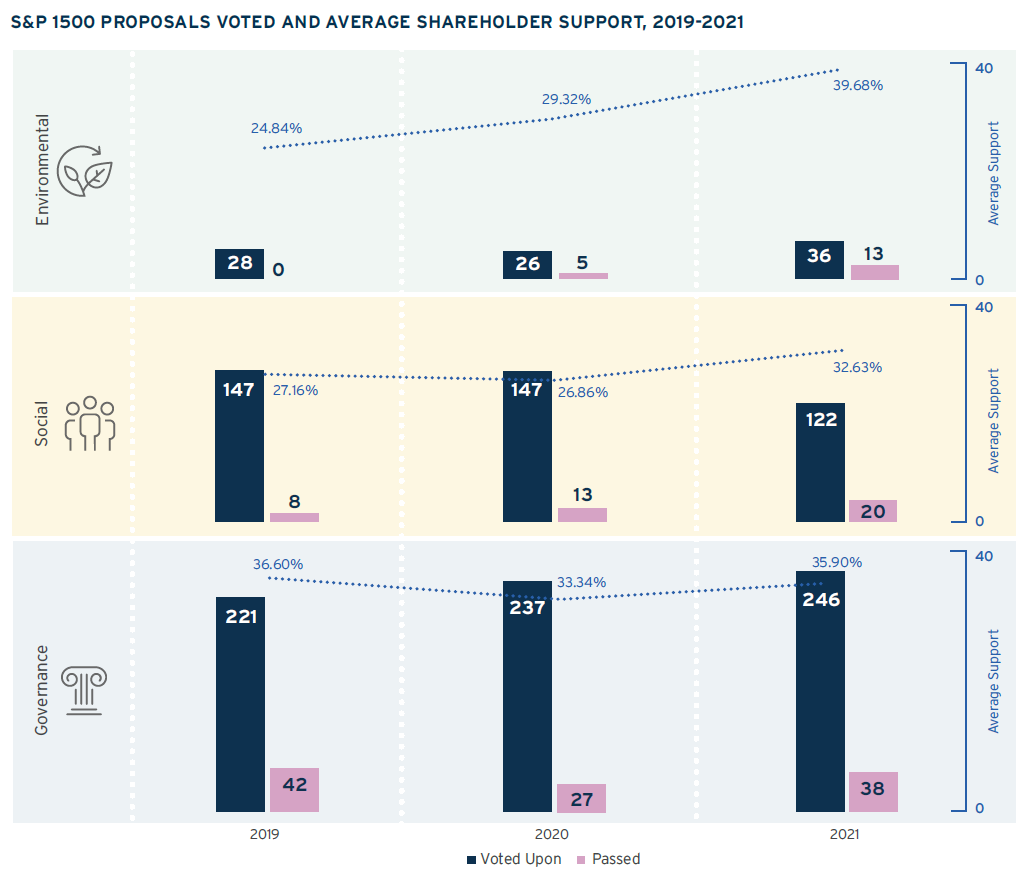

- A total of 71 shareholder proposals passed, compared to 45 in 2020 and 50 in 2019

- 33 environmental and social proposals passed, [1] the highest number on record and an 83% increase compared to the 2020 proxy season

- Over one third of environmental shareholder proposals voted upon passed; average support across voted proposals exceeded 39%

- Average support for social proposals increased to 32.6%, compared to approximately 27% average support in both the 2020 and 2019 seasons

- Record-breaking support for shareholder proposals focused on political spending, plastic pollution, greenhouse gas emissions, deforestation and board and workforce diversity, as well as management-supported proposals relating to climate change, diversity, equity and inclusion (DE&I) and human rights

- A sizeable increase in negotiated settlements (withdrawals) of shareholder proposals compared to the 2020 and 2019 proxy seasons

To analyze proposal results, we separated proposals into environmental (E), social (S) and corporate governance (G) categories, with ESG-linked compensation proposals classified as either environmental or social proposals depending on the metrics focused upon in the proposal. While shareholder proposal recipients tend to be concentrated within the S&P 500, these proposals serve as a bellwether for where investors’ priorities lie. Accordingly, we believe these trends are important for all companies to understand.

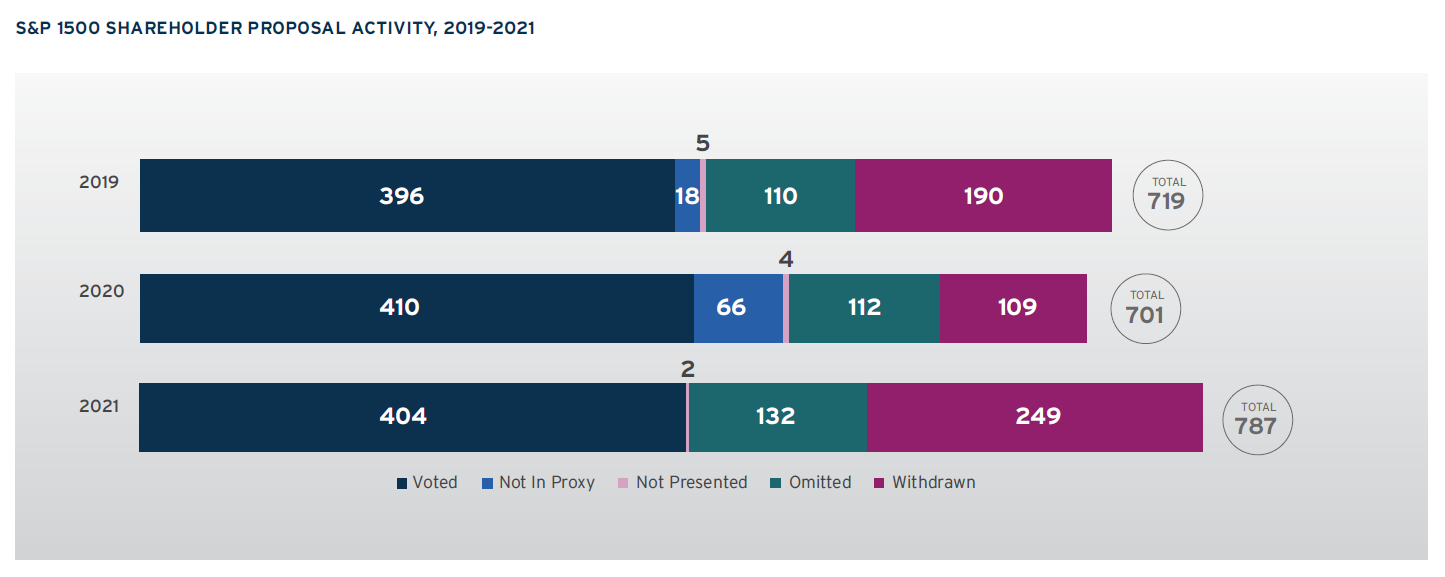

Across shareholder proposal categories, proponents submitted 787 proposals in the 2021 season, the highest on record since we began publishing the ACGR. However, due to the high number of proposals withdrawn or not included in proxy statements in 2021 (249 in 2021 versus 175 in 2020), the number of proposals voted upon was roughly in line with the number voted upon in 2020 and 2019, while passages increased significantly.

The number of proposals submitted in each category increased, with environmental proposals increasing most dramatically—by almost 25%; social and governance proposals increased by 14% and 7%, respectively. Notwithstanding these record submission levels, the number of social proposals voted upon decreased this year, with withdrawals of proposals addressing workforce diversity-related matters having a particularly notable impact on the number of such proposals that went to a vote (accounting for 62 withdrawals).

A large number of withdrawals also occurred among environmental proposals, with climate-related proposals accounting for 51 withdrawals, although the number voted upon year over year increased slightly due to the significant increase in submissions. As for proposals receiving no-action relief, those numbers have held relatively steady, representing approximately 17%, 16% and 15% of all proposals for 2021, 2020 and 2019, respectively.

Average support increased across environmental, social and governance proposals, with environmental proposals accounting for the largest year over year increase. This result is not surprising given investors’ significant focus on climate-related issues and accompanying revisions to proxy voting guidelines to incorporate that focus heading into the peak 2021 proxy season.

The most active shareholder proponents during the 2021 season are all familiar names, and included individuals, socially responsible investors, pension funds, labor unions and faith-based organizations. The Chevedden group [2] of investors accounted for the largest number of proposals submitted. As in previous years, the individuals comprising that group largely focused on traditional governance matters, although they did file more environmental and social proposals than in previous years, with particular focus on political spending and corporate purpose.

The table below identifies the number of environmental, social and governance proposals filed by the top 10 proponents by submission volume. [3]

Governance proposals

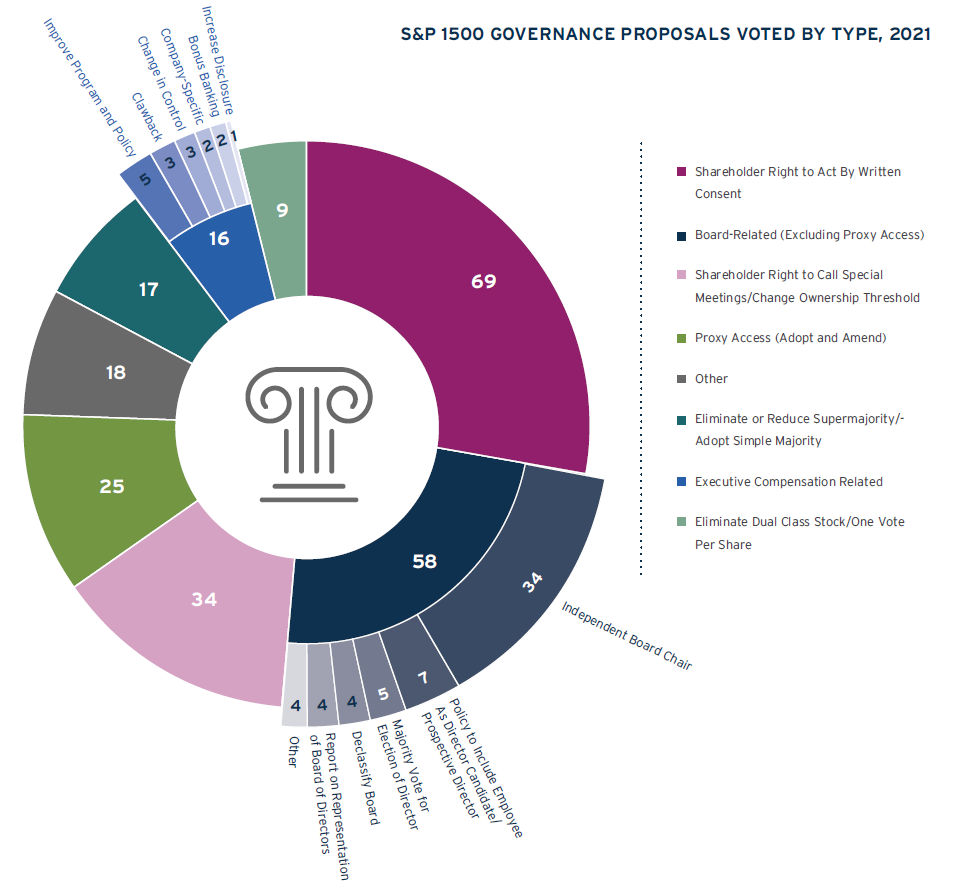

The number of governance proposals voted upon in 2021 (246) increased slightly compared to the 2020 and 2019 proxy seasons (237 and 221, respectively). Proposals addressing the right to act by written consent was the most prevalent category of proposals, followed by a variety of proposals addressing topics such as separation of chair and CEO, as well as majority voting and board declassification, and proposals relating to special meeting rights.

38 governance-related proposals passed, with those relating to majority voting standards and shareholder action by written consent accounting for the majority of such proposals.

As in prior years, we observed fewer withdrawals of governance-related proposals as compared to environmental or social proposals, and the topics addressed by such proposals were largely consistent with prior years, with some variation to the specifics of such proposals. For example, the Chevedden group’s proposals seeking to amend written consent rights to lower the ownership threshold necessary to set a record date adjusted the ownership threshold sought upwards to 10%, compared to the 3% threshold proposed in the 2020 season. [4] Nine written consent proposals passed this season, up from two passing in 2020. ISS’ recommendations may have contributed to this increased support, as it recommended votes against all amended proposals in 2020, whereas it supported all proposals in 2021, although institutional investors likely also viewed the higher threshold as a more appropriate balance of shareholder rights and company protections.

Unlike written consent proposals—most of which are focused on the adoption of such rights given this is not yet a majority practice within the S&P 500—most of the proposals addressing the right to call a special meeting focused on amendment of existing rights to lower the ownership threshold necessary to call a special meeting, given the vast majority of S&P 500 companies have already adopted such a right. Where such adoption proposals are voted upon, they tend to be highly supported, with 3 of 6 such proposals passing during the 2021 season. On the other hand, only 1 of 28 proposals seeking to amend an existing right passed, suggesting that the majority of investors generally continue to be accepting of the 20%+ thresholds that are currently majority practice within the S&P 500.

Consistent with prior years, compensation-related shareholder proposals that reached a vote during 2021 tended to receive relatively low support, and none passed during 2021. Such results are not surprising given that investors primarily rely on say-on-pay votes and director elections to express concerns regarding compensation practices. Shareholder proposals seeking to link executive compensation program metrics to environmental and social issues are addressed in the environmental and social proposal discussions later in this post.

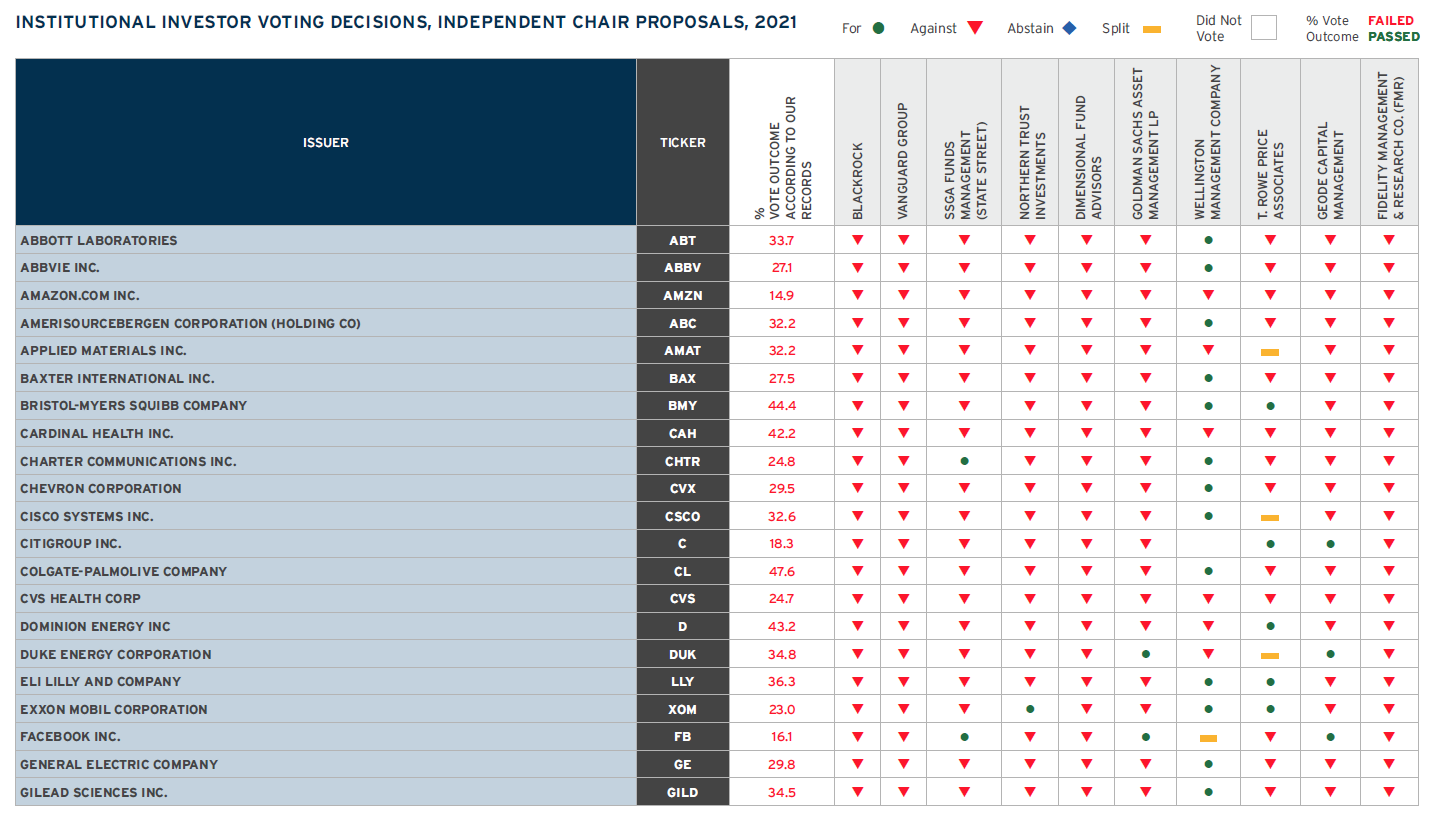

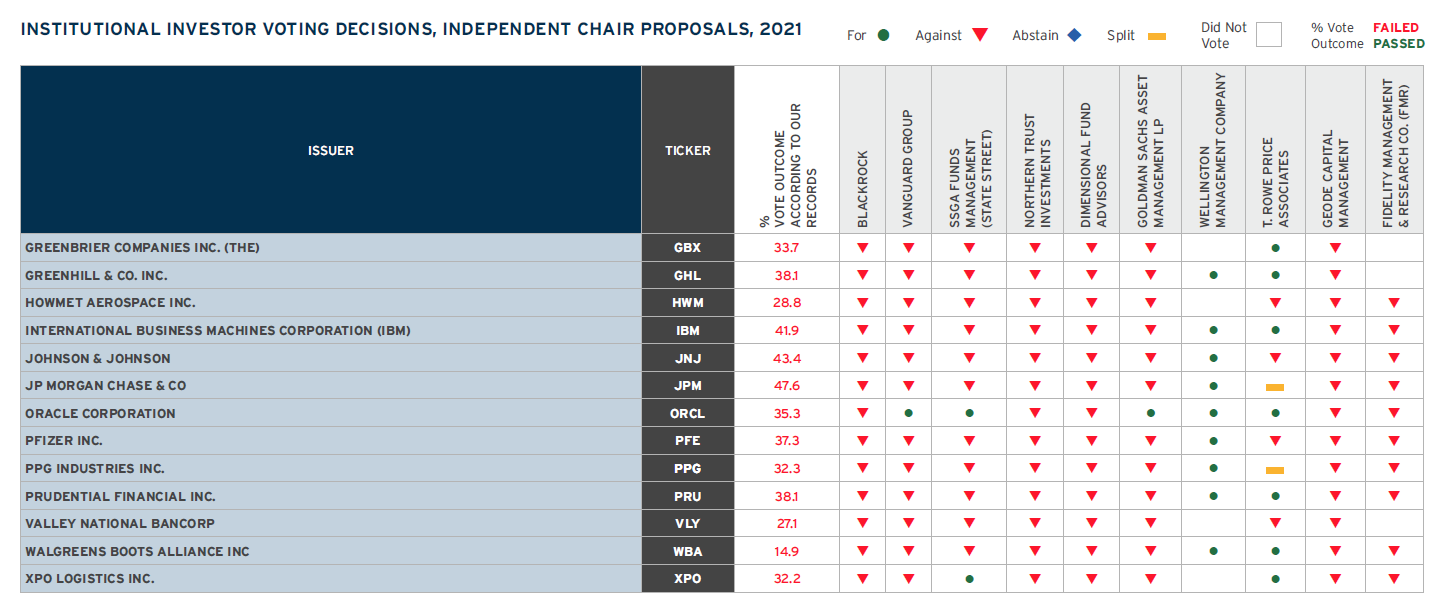

Looking at board-related proposals, no proposals seeking to separate the roles of chair and CEO received majority support, as compared to two that did in the prior season. As the table below shows, many institutions were largely unsupportive of these proposals. In the few instances where institutions such as Vanguard, State Street and Northern Trust were supportive, their decisions often did not align with one another or with the institutions that tended to be more supportive, like Wellington and T.Rowe Price. Notably, none of the investors reviewed supported the independent chair proposal at CVS or Cardinal Health, both of which had independent chairs in place. The average support for these proposals decreased slightly during 2021, with 32.5% average support as compared to 34.5% in 2020.

A review of N-PX filings shows that, on average, support for independent chair shareholder proposals from BlackRock, State Street and Vanguard remained low and has decreased slightly from last year. Notably, BlackRock supported zero proposals at companies in the S&P 1500 this year. All three institutional investors generally support the designation of a lead independent director when the roles of chairman and CEO are combined. Among additional investors reviewed, Dimensional Fund Advisors supported no such proposals, while Northern Trust supported only one of the 34 proposals that went to a vote in 2021. By contrast, Wellington Management Company voted in favor of almost three out of every four proposals.

The independent chair proposal that attracted the most support from the investors reviewed in the table below was at Oracle Corporation, where five of the investors reviewed voted in favor. Although the roles of chair and CEO at Oracle’s board are currently filled by separate individuals, Mr. Ellison, the Company’s founder and current Chief Technology Officer, serves as the chairman. The ongoing concerns regarding the Company’s compensation practices may have contributed to investors’ support for the proposal.

Environmental Proposals

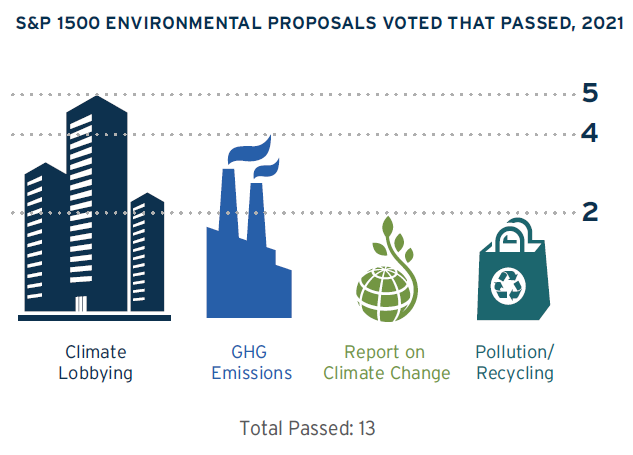

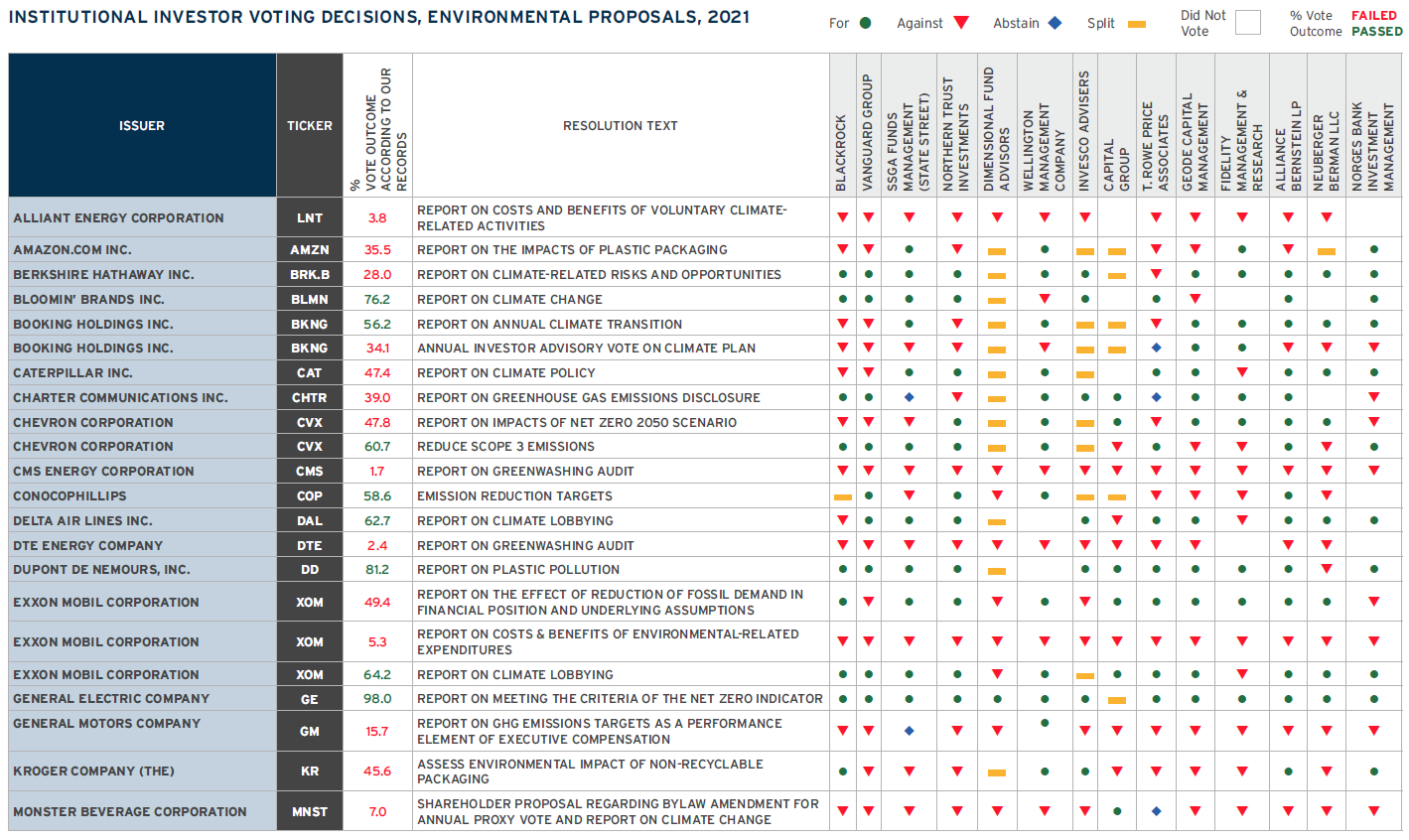

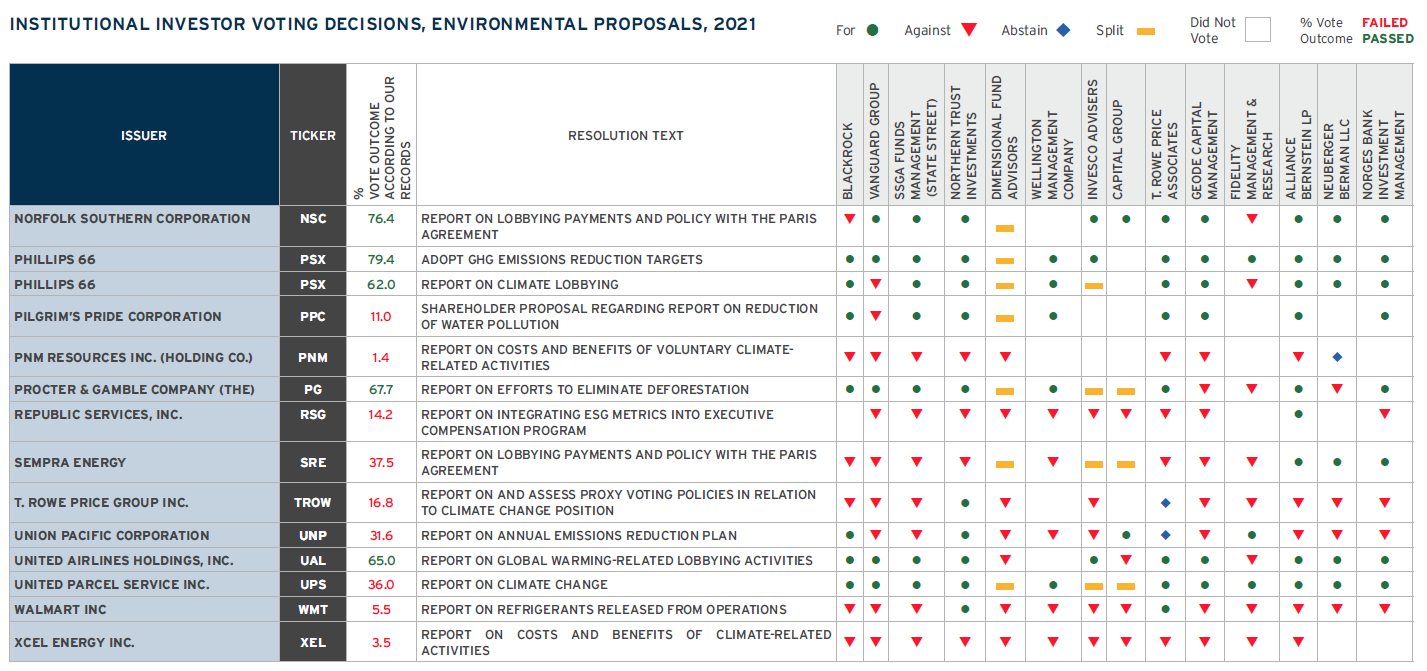

Climate change was the prevailing theme across the vast majority of the 36 environmental proposals that reached a vote during the 2021 season.

13 of the 36 environmental shareholder proposals that reached a vote passed. That equates to a passage rate of over 36% and is more than double the number that passed in the 2020 proxy season (5 proposals).

Beyond the record-breaking volume of environmental proposals that passed this season, the level of support received is also unprecedented. As previously discussed, average support for environmental proposals increased notably and if we exclude the six environmental proposals associated with the pro-coal activist group Burn More Coal, average support for environmental proposals increased to 47%. [5] Further excluding the two proposals seeking to link executive pay to environmental criteria, which received relatively low shareholder support, average support further increases to 49%. Many companies have already adopted ESG-related metrics, primarily within their short-term incentive programs. In general, investors tend to focus on the structure of executive compensation programs but avoid asserting prescriptive direction regarding specific metrics, which they believe are the purview of the compensation committee. Therefore, these proposals have not gained significant traction.

The proposals voted upon at Dupont and Bloomin’ Brands particularly demonstrate the monumental shift we saw in investors’ support of environmental topics this season. At Dupont, the proposal regarding plastic pollution received greater than 81% support, the highest level we are aware of for such a proposal. By contrast, a nearly identical proposal at Dupont received only 6% support in 2019. At Bloomin’ Brands, the proposal regarding emissions within the company’s supply chain received approximately 26% support in 2020, while a related, but broader, proposal this year received over 75% support. Further, this season several companies recommended that shareholders vote in favor of E&S shareholder proposals on their ballots, leading to near unanimous (and record high) support for the shareholder proposal regarding GHG emissions reduction goals at General Electric. While such practice is not unheard of, it is atypical and we do not recall seeing multiple instances of management support in the context of E&S proposals in prior seasons.

Prior to this season, the non-profit Ceres had recorded only three climate-related shareholder proposals ever receiving majority support at US oil majors. [6] That number has now almost tripled, with five proposals at four oil majors having received majority support in 2021. All four companies are among those targeted by the Climate Action 100+ investor initiative focused on climate change, which continued to gain momentum this proxy season. Notably, State Street became a Climate Action 100+ signatory in November 2020. [7] BlackRock, which became a Climate Action 100+ signatory in January 2020, historically has been criticized for its lack of support for climate-related shareholder proposals. [8]

Among the investors’ specific voting decisions we examined, we saw several instances of increased willingness to support climate-focused proposals. For example, BlackRock markedly shifted its voting practices this season, in line with revisions to its voting guidelines indicating its intention to increasingly support shareholder proposals addressing material ESG issues. Looking at all environmental proposals voted upon during the 2021 proxy season, BlackRock’s most recent global stewardship reporting discloses support for 64% of such proposals. [9] Our review of its voting on the 36 environmental proposals in the 2021 season indicated approximately 50% support compared to approximately 13% for such proposals in 2020. Similarly, Vanguard’s recently released stewardship report indicates support globally for 37% of environmental proposals, and 43% of climate related proposals. [10] At US company meetings, Vanguard supported approximately 47% of proposals voted upon, compared to 21% of such proposals in 2020. Remarkably, however, notwithstanding the marked shifts in support seen at Vanguard and BlackRock, they continued to be among the institutions more likely to vote in accordance with managements’ recommendations. We found that Northern Trust, Alliance Bernstein and Norges Bank were the most supportive of the institutions we examined across the climate-focused proposals itemized below. A significant number of split votes also occurred at Invesco, Capital Group and Dimensional, underscoring the importance of engaging with investors on these issues.

In addition to majority supported proposals, significant corporate activity surrounding climate change during the 2021 proxy season took place outside of the four corners of a proxy ballot. A review of withdrawn proposals shows 72 environmentally-focused measures were withdrawn during the year. Presumably, the company and the proponent reached an agreement on the subject matter of the proposal, an increase from 2020 (41).

While no “say on climate” shareholder proposals received majority support this season, this new category of proposals is relevant to the 2021 proxy season narrative. TCI Fund Management (TCI), a UK-based hedge fund, has spearheaded this campaign globally, with As You Sow also filing resolutions within the US Similar to say-on-pay proposals, say on climate proposals request that the target company provide shareholders with the opportunity to approve or disapprove of the company’s publicly available climate policies and strategies. Unlike many traditional shareholder proponents, who tend to own small stakes in the companies at which they present resolutions, TCI generally owned significant stakes in the companies at which it presented proposals in the 2021 proxy season, likely providing it with increased influence and access to management. At both Moody’s and S&P Global, the companies moved to support TCI’s campaign, in each case presenting management-sponsored resolutions that asked shareholders to approve the company’s climate transition plan, which received support of 93.3% and 99.5% of shareholders, respectively. Notably, the proposals at both Moody’s and S&P Global committed to presenting advisory votes at the company’s 2022 AGM, but did not speak to future meetings. That construct was likely positively viewed by investors, given some of the concerns expressed regarding shareholder-sponsored say on climate proposals discussed below.

Unlike the management-sponsored proposals at Moody’s and S&P Global, which extended only through 2022, say on climate shareholder resolutions requested ongoing future annual advisory votes on companies’ emission reduction plans.

Interestingly, there was no consistency across the proposals submitted to companies. Some of the proposals, such as those at Charter Communications and Union Pacific Corp, requested future advisory votes on a climate action plan that explicitly included an emissions reduction strategy. Others, like those at Monster Beverage and Booking Holdings, requested a future advisory vote approving the companies’ climate policies and strategies. While those proposals referenced consideration of the company’s alignment with climate-related benchmarks, they did not explicitly reference emissions reduction targets. Furthermore, the proposal at Monster Beverage sought an amendment to the company’s bylaws to implement the advisory vote, which was likely a significant factor in investors’ low support for the proposal.

Across the companies where shareholder-sponsored say on climate resolutions were voted upon, the companies highlighted efforts in place to reduce emissions and other environmental impacts, and/or existing or forthcoming ESG reporting and emissions targets. Notably, the proposal at Union Pacific Corp, the only proposal recipient to have already set scope 1 and 2 emissions reduction targets, received lower shareholder support (and “Against” recommendations from both proxy advisory firms) than did the proposal at Charter Communications, where the company had committed to set ESG targets, but had not yet disclosed specific GHG reduction target plans.

While no shareholder-sponsored say on climate proposal received majority support, three voted upon received support in excess of 30%, a level at which responsiveness is generally expected. Importantly, in light of investor concerns expressed regarding the advisory vote construct of these proposals, proponents have indicated that for 2022 they have dropped the “say on” element of these proposals in the US and instead are seeking annual reporting regarding companies’ climate transition plans. Accordingly, the three “net zero benchmark” proposals submitted by As You Sow during 2021, which received 48%, 49% and 98% respectively, are instructive as we look to the 2022 proxy season. [11]

Social Proposals

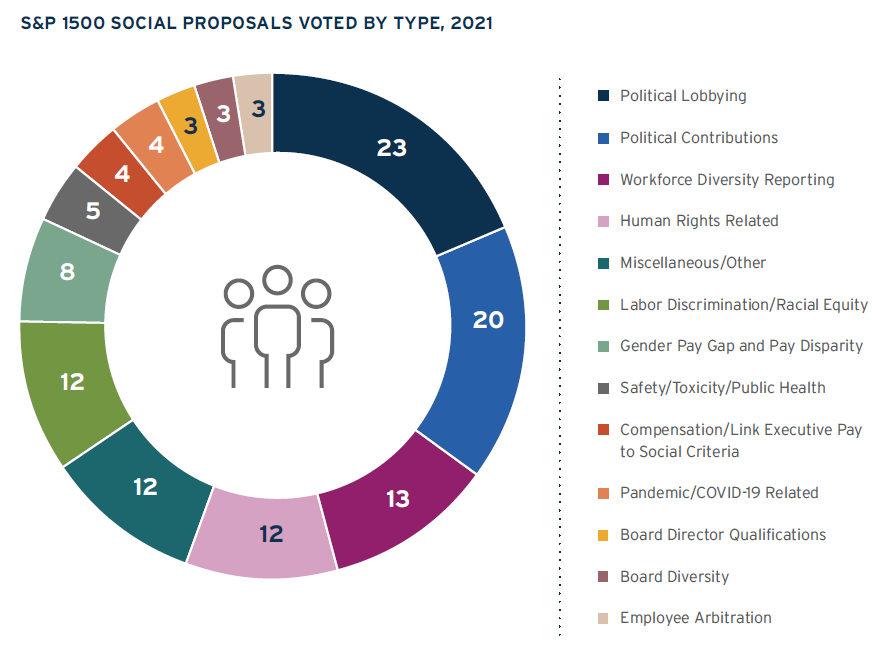

122 socially-focused shareholder proposals went to a vote during 2021. Proposals relating to political spending accounted for almost 35% of such measures, and proposals relating to workforce diversity, racial equity and human rights each accounted for approximately 10% of proposals voted.

Twenty social proposals passed in the 2021 season, and consistent with those voted on, the majority that passed related to political spending and diversity-related matters.

S&P 1500 Breakout of EEO/DE&I/Employment Diversity Reporting

The most notable workforce diversity-focused campaign of the 2021 season was spearheaded by the New York City Comptroller’s Office and occurred primarily outside of the proxy voting process. As widespread civil unrest during the summer of 2020 focused corporations’ attention on efforts to combat systemic racism, many company CEOs issued statements in support of racial equality or affirming corporate commitments to diversity, equity and inclusion initiatives. In 2020, the Comptroller launched a letter writing campaign to CEOs at 67 of those companies within the S&P 100, seeking public disclosure of each company’s EEO-1 Report data. The Comptroller withdrew a majority of its proposals prior to reaching a vote, having reached agreements with the target companies to disclose their EEO-1 data. A handful of other proponents also submitted EEO-1 proposals this season, including Calvert Research & Management and Trillium Asset Management. Ultimately, only three of these proposals reached a vote, two of which passed.

Heading into the 2021 proxy season, the Comptroller’s Office reported 31 public companies that disclosed their EEO-1 reports, of which 14 were in the S&P 100. [12] Accordingly, between proposal withdrawals and majority-supported proposals, EEO-1 disclosure transitioned from a minority to majority practice within the S&P 100 within the proxy season. [13]

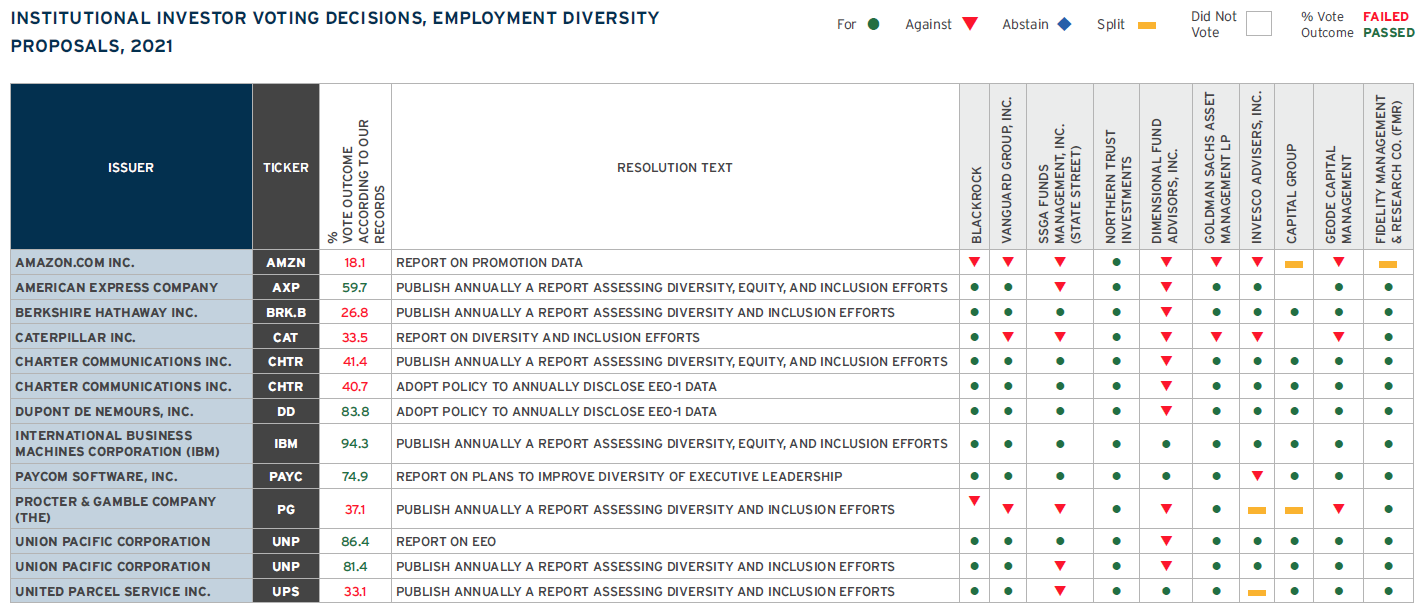

Looking at workforce diversity-focused shareholder proposals in general, this is a topic where we have seen exponential growth in submissions over the past few seasons, from only 15 proposals in the 2019 season to 90 such proposals in 2021. Likewise, average support for these proposals increased dramatically, from approximately 35% in 2020 to over 55% in 2021.

The snapshot of investors’ voting decisions below further illustrates the uptick in support observed year over year. With the exception of Dimensional—who was the least supportive of workforce diversity proposals among the investors examined—all investors reviewed supported a majority of the proposals upon which they voted. However, it is notable given State Street’s vocal focus on diversity matters that it was the second-least supportive investor examined, after Dimensional. At the other end of the spectrum, Fidelity and Northern Trust were most supportive, in each case supporting all but one of the proposals upon which they voted.

The snapshot of investors’ voting decisions below further illustrates the uptick in support observed year over year. With the exception of Dimensional—who was the least supportive of workforce diversity proposals among the investors examined—all investors reviewed supported a majority of the proposals upon which they voted. However, it is notable given State Street’s vocal focus on diversity matters that it was the second-least supportive investor examined, after Dimensional. At the other end of the spectrum, Fidelity and Northern Trust were most supportive, in each case supporting all but one of the proposals upon which they voted.

Racial equity audit proposals were a notable new topic in the 2021 season. While none of these proposals received majority support, over half of those voted on received support in excess of 30%, which is notably high support for a first-time proposal. Like the EEO-1 campaign, the racial equity audit campaign also tied companies’ statements expressed in support of efforts to dismantle systemic racism with actions by the companies targeted. In each case the proponents requested the company conduct a third party audit and prepare a report assessing company behavior through a racial equity lens. Change to Win and the Service Employees International Union (SEIU) were primary proponents of these proposals, and largely focused on companies within the financial services industry. A handful of additional proponents, including the New York State Common Retirement Fund, Northstar Asset Management and Trillium Asset Management, filed proposals at additional companies in various industries.

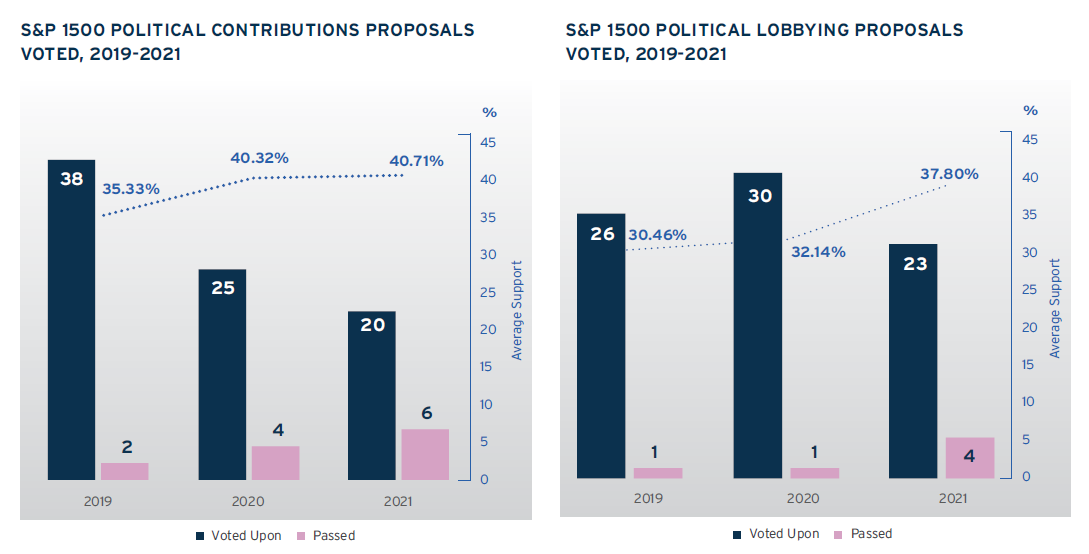

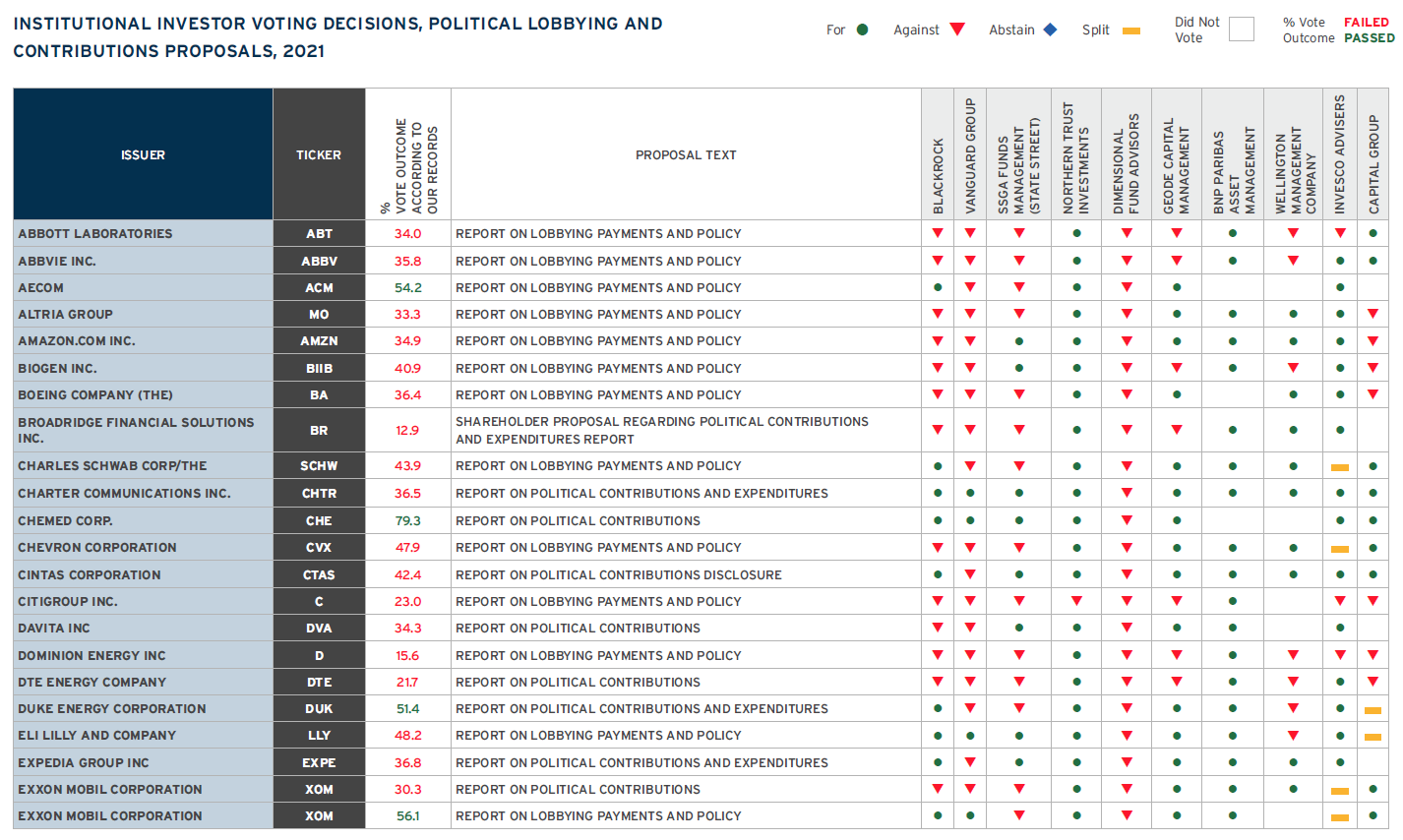

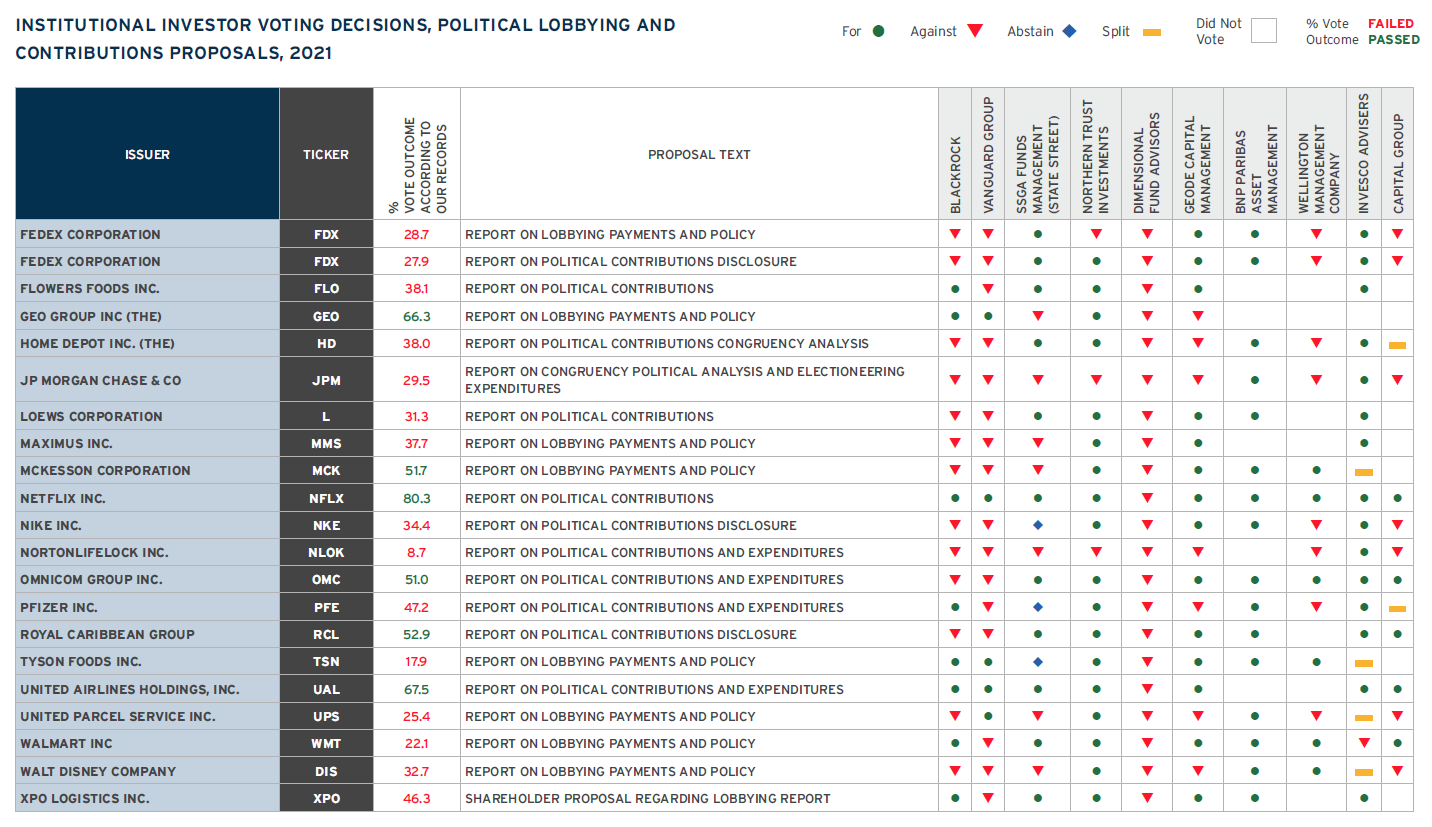

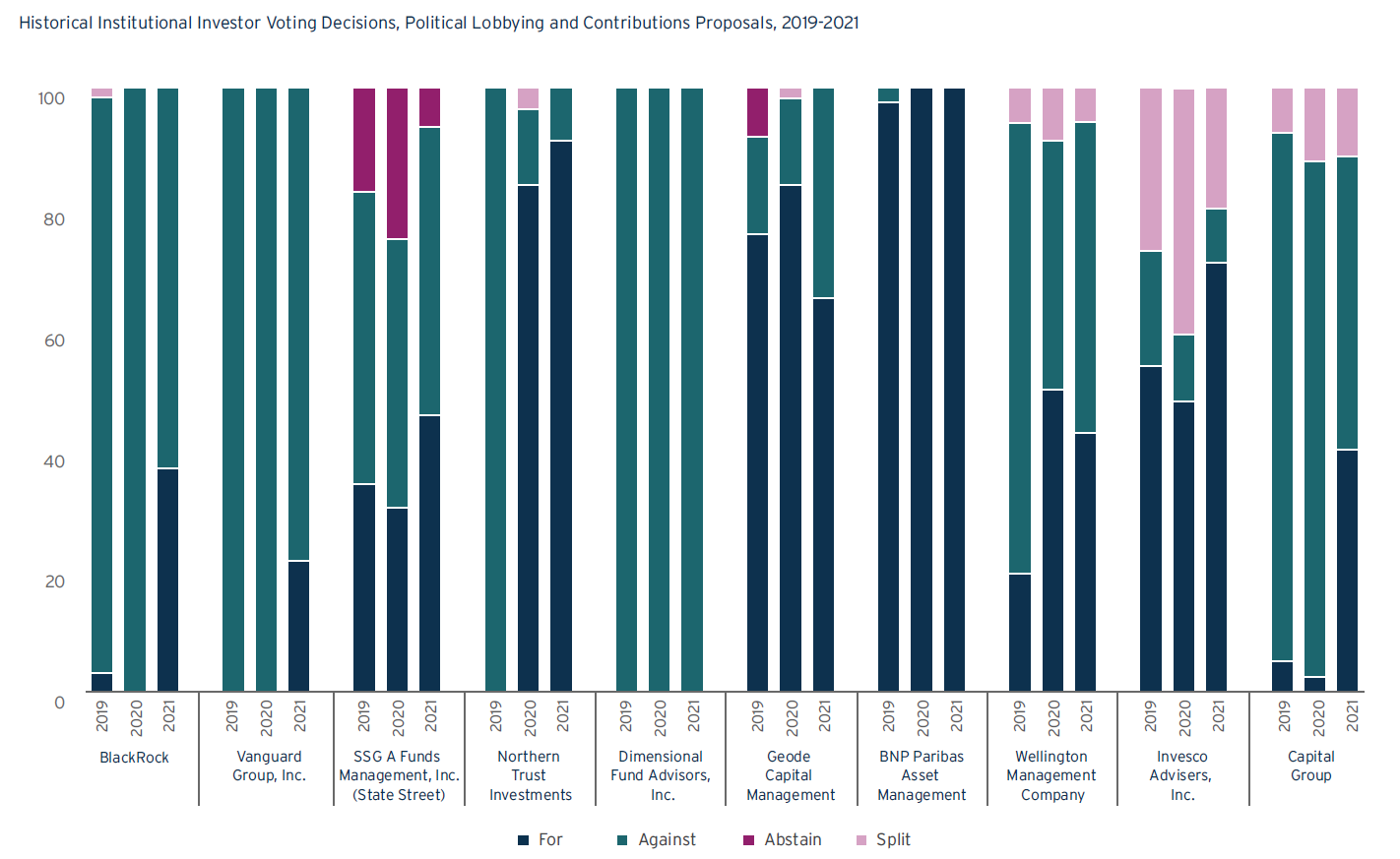

Proposals seeking reporting on political contributions and lobbying payments were also prevalent in the 2021 proxy season. 73 such proposals were filed this season, which is relatively consistent with the 70 filed during 2020. Of the 43 voted upon this year, six contributions proposals passed and four lobbying proposals passed, representing a 50% and 300% increase, respectively, compared to the number of each that passed in the 2020 season. While investor scrutiny of companies’ political contributions and lobbying activities is not new, the 2020 presidential election and subsequent events of this past January in Washington, D.C. both likely catalyzed submission of and support for these proposals in the 2021 proxy season. More broadly, investors’ increased focus on ESG issues in general was also a likely factor in many instances.

Consistent with the workforce diversity proposals examined, Dimensional was the least supportive of the investors examined with respect to political spending proposals—supporting none of the proposals voted upon—followed by Vanguard, BlackRock and State Street. BNP Paribas was the most supportive of the investors we examined, followed by Northern Trust.

The complete publication, including footnotes, is available here.

Endnotes

1One additional proposal received majority support but did not pass under the company’s applicable voting standard.(go back)

2Includes John Chevedden, Kenneth Steiner, William Steiner, Myra Young and James McRitchie.(go back)

3Includes proposals where the proponent was either a lead or co-filer, and aggregates proposals filed by pensions within each of the New York City and New York State pension systems.(go back)

4These proposals typically seek to lower the threshold from a higher threshold provided in the target company’s organizational documents.(go back)

5Stephen Milloy, co-lead of Burn More Coal, is the proponent of five of these proposals and presumed to be the proponent behind the 6th “unknown” proposal.(go back)

6See Why This Proxy Season Is A Record Breaker For Climate Proposals (forbes.com)(go back)

7https://www.ssga.com/us/en/institutional/cash/insights/why-were-joining-climate-action-100 BlackRock Climate Action January 2020 statement(go back)

8See https://www.ceres.org/news-center/press-releases/blackrock-joins-climate-action-100-ensure-largest-corporate-emitters-act(go back)

9BlackRock’s report is available at https://www.blackrock.com/corporate/literature/publication/2021-voting-spotlight-full-report.pdf(go back)

10Vanguard’s stewardship report covers voting for January 1 – June 30, 2021 and is available at https://about.vanguard.com/investment-stewardship/perspectives-and-commentary/inv_stew_2021_semiannual_report.pdf.(go back)

11The management supported proposal at General Electric previously noted also sought to assess the company’s responsiveness to Climate Action 100+’s net zero benchmark.(go back)

12See https://comptroller.nyc.gov/newsroom/comptroller-stringer-nyc-funds-escalate-campaign-calling-on-major-companies-to-publicly-disclose-workforce-demographics/(go back)

13See https://www.asyousow.org/our-work/social-justice/workplace-equity(go back)

Print

Print

One Comment

I’m not sure how inclusive the results are.

Orowitz reports 1 proxy access proposal passed. Mine at Impinj passed. She reports 3 declassify proposals passed. I won majorities at Tesla, Schwab and 2U. I won special meeting rights at Thermo Fisher and Kellogg. Was that really half the wins? I won elect uncontested directors by majority vote at AreoVironment, Invitae, Axon and Redfin. Was that really all of them? On that same topic, I withdrew majority vote proposals at Organovo Holdings, Assembly Bio, Beyond Meat, Costco, EXACT Sciences, Iovance Bio, Orthofix Med, Tandem Diabetes, Teledoc, TravelZoo, Upwork, Veracyte, and Workday when boards agreed to implement my proposals.