Maria Castañón Moats is Leader and Paul DeNicola is Principal at the Governance Insights Center, PricewaterhouseCoopers LLP. This post is based on their PwC memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

For many, the term ESG (environmental, social, governance), conjures notions of investors chasing feel-good stories of sustainability, diversity, and ethics. But given the heightened interests from various stakeholders, corporate directors know ESG is much more.

Far from being just window dressing, making organizations appear socially responsible to the outside world, there are real risks at play when it comes to ESG issues. And there are even more opportunities to be seized.

What is ESG?

ESG is on the minds of many investors today. It can represent risks and opportunities that will impact a company’s ability to create long-term value. This includes environmental issues like climate change and natural resource scarcity. It covers social issues like labor practices, product safety, and data security. And it involves governance matters that include board diversity, executive pay, and tax transparency.

Figure 1 paints a picture of the breadth of topics that can fall under the ESG umbrella. Not all of them will be relevant or material for every company. For example, a financial services firm might focus more on human capital and data security, while a food and beverage manufacturer may be more interested in how they source raw materials.

What is ESG reporting?

ESG reporting is known by many names, including purpose-led reporting, sustainability reporting,

corporate social responsibility reporting, and ESG risks and opportunities reporting. The market wants

to know how companies are weighing risks and shaping business strategy in the context of ESG issues. Providing this information can help burnish a company’s reputation, while withholding ESG information could potentially harm a company’s valuation, access to capital, or its brand reputation in the market. In short, ESG reporting is disclosure of material ESG risks and opportunities, from both a qualitative and quantitative perspective. It also includes explaining how and where those ESG risks and opportunities inform the company’s business strategy.

Why does the board oversee ESG?

As management teams look to improve the long-term value of the company, they need a strategic plan that takes advantage of market opportunities and addresses material risks. In its oversight role, the board is responsible for ensuring that the company’s strategy is appropriate and will deliver results, and for overseeing associated material risks.

Some directors may not make the immediate connection to ESG issues when considering strategy and think of the ESG component as a “nice-to-have,” rather than a necessity. But this ignores the point of ESG. It’s about the ways in which value could be created or destroyed. For example, a consumer company might look to sustainable packaging as an opportunity to be responsive to consumer concerns. Or a manufacturing company might emphasize product safety or quality as part of their social obligations, even if it sacrifices short-term profits. Companies that don’t think this way are risking their long-term value.

Investors want to know about the company’s ESG efforts

Institutional investors tend to view ESG through the lens of long-term value creation. In addition, a growing population of ESG investors (also called socially responsible investors or impact investors) focus specifically on sustainable companies. Combined, the investor voice in this area is getting louder.

Long-term shareholders: Institutional investors are urging companies to build ESG considerations into their long-term strategy, bringing it up during engagements and sometimes using shareholder proposals to force companies to take action. Some of the world’s largest asset managers have voted against directors at companies that, in their view, lag on ESG. They say that identification and management of the ESG issues material to a company are essential to resiliency and risk mitigation, as well as strategy execution. They also say it leads to long-term increases in shareholder value. These investors are looking for more disclosures from companies, both qualitative and quantitative, so that they can better assess how the company is addressing ESG risks and opportunities. They want transparent reporting that demonstrates where companies are today and the goals they are striving to achieve in the future.

ESG investors: These investors focus on non-financial factors related to environmental, social, and governance topics as part of their analyses to identify risks and growth opportunities. They might focus on ESG risks along with financial performance, or specifically eliminate or select investments based on ethical guidelines. They may also track for positive impact that will benefit society or the environment. They rely on ESG disclosures to inform these investment decisions.

In general, companies with articulated ESG strategies are well positioned to access capital, as more and more investors look to invest in these types of companies.

Companies must also consider how investors obtain ESG information. Some investors obtain the information directly from the company, while others use ESG data compiled or determined by rating agencies (such as proxy advisory firms, ESG raters, and credit rating agencies). Other investors may use the data from rating agencies as a base to support their own independent analysis.

Ratings and rating agencies

What do they do?

Rating agencies gather data about a company’s ESG efforts through direct surveys (which can be time consuming) or through the company’s publicly available disclosures. They then provide ESG scores based on their view of a company’s risk exposure versus their industry peers. Qualitative and quantitative data inform these ratings. Rating agencies also guide investors through the publication of benchmarking data. And some use their ratings to create ESG indices that might be licensed to asset managers and others to create ESG funds and other financial products.

Who are they?

MSCI, Institutional Shareholder Services (ISS), Sustainalytics, and S&P Global are among the most prominent. The methodologies used by these agencies vary and the resulting ratings are not consistently aligned with a particular ESG disclosure framework or set of standards and may not meet the needs of all institutional investors.

As investors and rating agencies use what ESG information is available, a company’s ratings, access to capital, and brand perception can hinge on the messaging and disclosures a company chooses to make.

Other stakeholders want to know about the company’s ESG efforts

A company’s customers, employees, communities, and suppliers are typically looking for management to drive value creation, while balancing broader obligations that impact the bottom line. But they also have a significant voice. For example, ESG’s impact is being felt in purchasing decisions. Half of consumer packaged goods growth between 2015-19 came from sustainability-marketed products and products marketed as sustainable grew 7.1 times faster than those that were not. [1] And if the company wants to attract and retain top talent from the next generations, know that Gen Z and Millennials (who will make up 72% of the global workforce by 2029) [2] are bringing their values to work and exhibiting greater concern about where their employers stand on environmental and social issues.

Regulators are focused on ESG information

Some overseas regulators have already incorporated elements of ESG into mandatory reporting regimes. So those companies operating internationally may already be familiar with the disclosure requirements of foreign regulators. For public companies in the United States, the SEC does not mandate specific ESG disclosures. Instead, they focus on the broader requirement to disclose material risks. Many companies already provide voluntary disclosures to address investor and other stakeholder interests.

In the US, the SEC recently introduced new disclosure requirements designed to provide stakeholders insight into human capital management—from the operating model, to talent planning, learning and innovation, employee experience, and work environment. The disclosures may help stakeholders evaluate whether a business has the right workforce to meet immediate and emerging business challenges and the nature and magnitude of the related investments.

“If certain information that happens to fall in any of the ESG categories is material to that company, the company needs to disclose it. We expect management and the board to do that, and we will come after them when they don’t.”

— SEC Commissioner Elad L. Roisman, July 2020 [3]

What exactly is the board overseeing?

Understanding why the board of directors should oversee ESG issues is the first step. But as with many things, the real work is in the details.

Management is responsible for developing and executing the company’s strategy under the board’s oversight. ESG risk and opportunity considerations should be embedded in the strategy.

If the company is already providing ESG metrics in a variety of places (such as on its corporate website, or through social responsibility reports), you may be well served to step back and consider whether the messaging is clear and consistent across channels. Is it tied to the company’s purpose, and aligned with the business strategy? Does it focus on stakeholder needs and address material risks? In this section, we take you through the important considerations.

The maturity scale for ESG disclosure

Judged by how well they tell their ESG story through disclosures, companies generally fall into one of the three stages of maturity:

- Laggards. Companies that don’t have anything documented on corporate social responsibility, either in a report, on the website, or anywhere else. They haven’t identified material ESG topics. In addition, they have not taken into consideration insights from investors or other stakeholders and their views on ESG topics. Essentially, ESG efforts of companies in this stage of maturity may still be anchored in philanthropy efforts rather than incorporating a strategic business focus.

- Middle of the pack.

Companies that may be publishing a sustainability or corporate responsibility report or disclosing information on a webpage, but do not have a cohesive ESG strategy that is linked to their business purpose and embedded in their core operations. They likely do not have standardized metrics to measure progress or the data gathering processes and controls required to do ESG reporting consistently and on a timely basis. Board oversight is scant at best. - Front runners. ESG strategy is regularly reviewed by board/committees and embedded in core operations. The company has adopted commonly accepted ESG/sustainability standards and reporting frameworks to guide their ESG disclosures. Robust processes, controls, and governance are in place to ensure disclosures are “investor grade.”

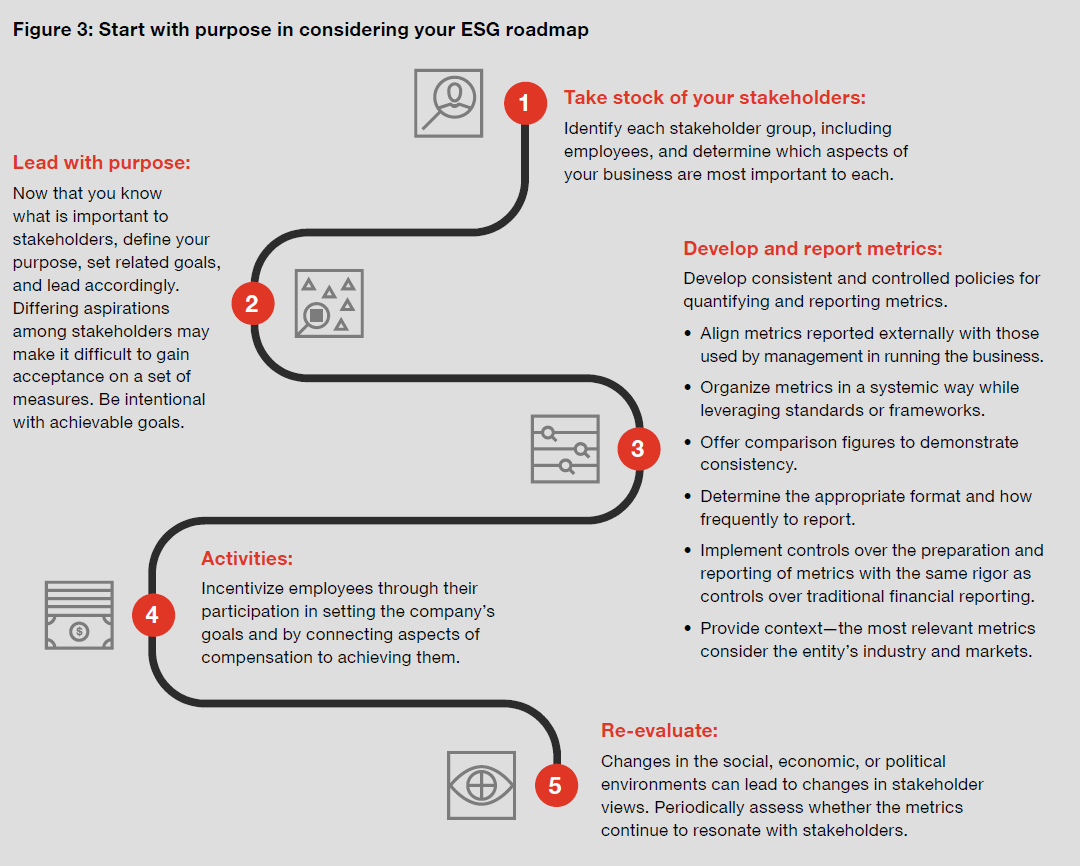

Purpose, messaging, and activities: A company’s purpose is often expressed as the reason it’s in business. But it’s more than that. A company’s purpose, as well as messaging and activities, need to be aligned to the overall business strategy—how the company will achieve long-term sustainable returns. As companies create value among a diverse group of stakeholders, including investors, employees, customers, suppliers, and communities, it shouldn’t come as a surprise that companies may struggle balancing all those interests. To help find a balance, the board and management need to work together to define what’s important and find the best way for the company and its stakeholders to measure progress. Figure 3 lays out a roadmap to consider as boards focus on ESG strategies grounded in the company’s purpose.

Risks: As the board considers the company’s purpose, think about it from a risk perspective, incorporating a broad stakeholder group. Environmental and social factors heavily influence some of the thorniest business challenges companies must overcome, including workforce challenges, innovating and incorporating new technologies, and supply chain disruptions. Companies should regularly review competitor disclosures as a means to surfacing additional ESG-related risks and should consider sharing the results with the board. As risk profiles are expanding, and as companies improve how they assess ESG risks, they need to step back and examine their enterprise risk management (ERM) process. The probability and impact of ESG risks should be captured in the ERM effort. As a result, management will have a structured framework to use to manage and mitigate those risks.

Qualitative and quantitative messaging: Stakeholders want a comprehensive, cohesive story when it comes to ESG. Qualitative ESG messaging should reinforce the company’s purpose statement, while metrics provide the quantitative facts that bring that purpose to life and help companies measure their progress toward goals. ESG metrics are already making their way into disclosures, as a way of helping investors compare companies across industries. The metrics should focus on current state and milestones along the way to achieving long-term goals, all of which should be monitored by the board.

Materiality is an important criteria in deciding which metrics to disclose. The challenge is thinking about materiality from both a financial and social perspective, as discussed below.

Weighing double materiality

Most times, when you think about materiality, it is from the perspective of the company’s financial statements. But companies should consider materiality as it relates to all stakeholders, balancing financial materiality against the interest of those same collective stakeholders. “Double materiality” encompasses both of these factors.

- Financial materiality takes into account how ESG issues will impact a company’s financial performance, and its impact on the company’s ability to create long-term value.

- Social materiality focuses on how a company’s actions impact people and the earth.

Depending on the company’s customers or employees, this could have a significant impact on its brand and long-term value. When thinking about materiality, companies should consider the materiality concept most important to their stakeholders. Usually, financial investors are interested in financially material information, while a broader range of stakeholders (including many ESG investors), desire socially material information about environmental and social impacts.

Companies are turning to a materiality analysis—formally engaging with internal and external stakeholders to identify the issues uniquely material to the company—as a strategic business tool. Companies need to examine how they look for opportunities in the market as well as their overall risks and risk management practices. It is essential to connect the analysis back to the broader business strategy.

Companies also need to ensure the accuracy of the information they disclose. Are adequate internal controls in place for quantitative, data-based metrics? And when choosing to adopt a framework or standard that incorporates specific metrics, has the company considered whether it is feasible to meet the commitments of the chosen framework/standard?

In addition, when thinking about qualitative disclosure and quantitative metrics, companies should assess its competitors’ disclosures to gauge how they compare. And finally, the company should assess its third-party ratings. Are they weaker than their peers in certain areas? Understanding the company’s scores and how they compare to peer companies could also help highlight areas for improvement.

ESG standards and frameworks: Using standards and frameworks allows for consistent and comparable disclosures, aiding investors in their decisions. It also helps companies to have guidance to follow and obtain assurance over disclosed information.

In order to make sense of the options, it is important to understand the difference between standards and frameworks. Generally speaking, standards, which follow a typical process (including receiving public comments), offer specific guidance for measurement and disclosure. Frameworks, on the other hand, provide general guidelines on disclosure.

Disclosure standards, frameworks, and others with a point of view

The major standards and frameworks

A number of business associations have also developed recommendations to help members standardize ESG disclosures within their industries. The National Association of Real Estate Investment Trusts (NAREIT), for instance, produced a guide designed to help members better understand and navigate the ESG reporting frameworks, and the Edison Electric Institute (EEI) launched an ESG template to help member electric companies provide uniform ESG/sustainability information. Separately, the World Economic Forum’s International Business Council issued a white paper that outlines a common set of metrics to enable consistent reporting.

| Standards: | According to their website: |

|---|---|

| Global Reporting Initiative (GRI): | |

| The GRI provides ESG standards that address disclosures of socially material topics affecting a company’s stakeholders. It also requires that companies determine the issues that are material in consultation with stakeholders. | GRI helps business and governments worldwide understand and communicate their impact on critical sustainability issues such as climate change, human rights, governance, and social well-being. This enables real action to create social, environmental, and economic benefits for everyone. The GRI Sustainability Standards are developed with true multi-stakeholder contributions and rooted in the public interest. |

| Sustainability Accounting Standards Board (SASB): | |

| The SASB recommends topics and metrics for 77 different industries across all three pillars of ESG. These standards provide guidance on how organizations can align their reporting with investor needs and how companies gather standardized data. | The SASB’s mission is to establish and improve industry specific disclosure standards across financially material environmental, social, and governance topics that facilitate communication between companies and investors about decision-useful information. |

| Frameworks: | According to their website: |

| The Carbon Disclosure Project (CDP): | |

| The CDP supports various users to measure their risks and opportunities on climate change, deforestation, and water security. | CDP is a framework which focuses investors, companies, and cities on taking urgent action to build a truly sustainable economy by measuring and understanding their environmental impact. The CDP has created a system that has resulted in unparalleled engagement on environmental issues worldwide. |

| The Task Force on Climate-related Financial Disclosures (TCFD): | |

| The TCFD provides 11 recommendations across four pillars: governance, strategy, risk management, and metrics & targets. | The TCFD’s mission is to develop recommendations for more effective climate-related disclosures that could promote more informed investment, credit, and insurance underwriting decisions and, in turn, enable stakeholders to understand better the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risks. |

| Others: | |

| A number of business associations have also developed recommendations to help members standardize ESG disclosures within their industries. The National Association of Real Estate Investment Trusts (NAREIT), for instance, produced a guide designed to help members better understand and navigate the ESG reporting frameworks, and the Edison Electric Institute (EEI) launched an ESG template to help member electric companies provide uniform ESG/sustainability information. Separately, the World Economic Forum’s International Business Council issued a white paper that outlines a common set of metrics to enable consistent reporting. | |

Where to disclose: Once a company has decided on its purpose, messaging, metrics, and which standards and frameworks to use, it will have to consider where to disclose the information. Among the most common platforms are proxy statements, CSR/sustainability reports, company websites, and annual reports. It is important to understand the common location for the company’s industry as well as evolving stakeholder preferences.

Disclosure platforms

Proxy statements: More companies are including ESG information in their proxy statements as a way to communicate directly with investors. This disclosure often includes discussion of:

- the ESG risks and opportunities identified by the company, and their areas of focus,

- the governance and operations structures from a management perspective (for example, whether a committee or a specific person is responsible for developing and executing the company’s ESG strategy and frequency of reporting to the board),

- how and how often the topic is discussed with various stakeholders, such as whether the topic was specifically targeted for shareholder engagement,

- progress against implementation goals, including the company’s current state, periodic milestone goals, and other long-term goals, and links to the company’s other sustainability information, including reports or materials on the company’s website.

CSR/sustainability reports: A sustainability report has been the historic channel for many companies to communicate sustainability performance and impact—whether positive or negative. Often these reports describe employee volunteer opportunities, in-office recycling programs, or recruitment efforts at local colleges, rather than the material risks and opportunities impacting long-term value creation that are of interest to investors. If a company is planning to use its CSR report as a platform for delivering ESG disclosures, be sure to consider whether it reports material risks and opportunities that would be considered relevant to investors, as well as other stakeholders. Also, think about whether the sustainability activities described link to the company’s purpose and overall business strategy. The biggest concern with most current CSR reporting today is that it does not focus on long-term value creation or address material risks to the business—both of which are on the minds of investors.

Websites: Companies also often house ESG information on their websites, with pages dedicated to their sustainability goals and efforts. The websites often include links to additional sustainability information, such as ESG score cards.

SEC annual and quarterly reportings: To the extent issues are material, companies disclose them in the risk section or management’s discussion and analysis section of their SEC reporting.

Earnings calls: Some companies are also using their earnings calls to showcase their ESG efforts. This approach allows them to improve corporate communication with investors on material ESG issues and demonstrate how their ESG efforts are embedded in their overall value creation plan.

The number of companies that have chosen to publish annual sustainability or ESG reports has grown significantly in recent years, with 90% of companies in the S&P 500 publishing such reports. [4] But often, these reports do not address what investors are looking for.

Measuring and monitoring progress: The company should set specific goals and milestones when developing its strategy. And, as the company moves through the process, it should track its progress against these goals and milestones. We recommend that the company consider disclosing how it is tracking against those milestones and goals to keep all stakeholders informed.

How does the board oversee ESG?

Now that you know what the board is overseeing when it comes to management’s development and execution of an ESG strategy, how exactly does the board go about overseeing these efforts? The board will have to consider a number of different topics/issues.

Where responsibility lies: Because ESG strategy should align with business strategy and focus on material risks and business drivers, the full board will want to understand the ESG messaging and how those risks are being mitigated. If this is a new area of focus for the board and the company, directors may need to assign detailed oversight to specific committees to help the ESG strategy launch smoothly. Ultimately, ESG issues will be relevant to all committees. For example, the nominating and governance committee will be interested in the shareholder engagement element, while the compensation committee will be interested in accountability through compensation. The audit committee will be interested in the disclosure, messaging, and metrics.

As the board determines where ESG oversight will be assigned, it may want to consider the following questions:

- Do we have a specific committee with the capacity, interest, and skills to take the lead on overseeing the company’s overall ESG efforts? If not, will the full board take on this responsibility or should we create a new committee?

- Have we considered how the committees will stay aligned on ESG considerations? Have committee charters and proxy disclosures been updated to transparently disclose to shareholders and other stakeholders the board’s allocation of ESG oversight responsibility?

Board oversight and investors’ expectations:

Investors are continuing to expect more and more transparency from boards in how they oversee particular topics. ESG oversight is no exception. Boards can find a number of ways to provide shareholders with the information they seek.

- Robust disclosure in the proxy statement describing the board’s oversight efforts

- Updates to board committee charters to address committee oversight responsibilities related to ESG

- Additional information about directors’ skills that enhance their contribution to ESG oversight efforts

Integrating ESG into board oversight responsibilities

Full board

Oversee:

- Strategy: Are ESG risks and opportunities integrated into the company’s long-term strategy? How is the company measuring and monitoring its progress against milestones and goals set as part of the strategy?

- Messaging: Do ESG messaging and activities align with the company’s purpose and stakeholder interests?

- Risk assessment: Have material ESG risks been identified and incorporated into the ERM? Has the board allocated the oversight of these risks to the full board or individual committees?

- Reporting: What is the best communication platform to use for the company’s ESG disclosures?

Audit committee

Oversee:

- Disclosures: Are the ESG disclosures (both qualitative and quantitative) investor grade? Which ESG frameworks and/or standards is the company using?

- Processes and controls: Are there processes and controls in place to ensure ESG disclosures are accurate, comparable, and consistent?

- Assurance: Should independent assurance be obtained to ensure ESG disclosures are reliable?

Compensation committee

Oversee:

- Accountability: Are the ESG goals and milestones effectively integrated into executive

compensation plans? - Talent and culture: How is management organized to execute the ESG strategy? Are the right people and processes in place? Does the company have a culture which embraces ESG efforts?

Nominating and governance committee

Oversee:

- Engagement: Is the company’s ESG story being effectively communicated to investors and other stakeholders?

- Board composition: Does the board have the necessary expertise and skills to oversee ESG risks and opportunities?

- Education: Does the board understand why ESG is important to investors and other stakeholders? Is the board appropriately educated on ESG?

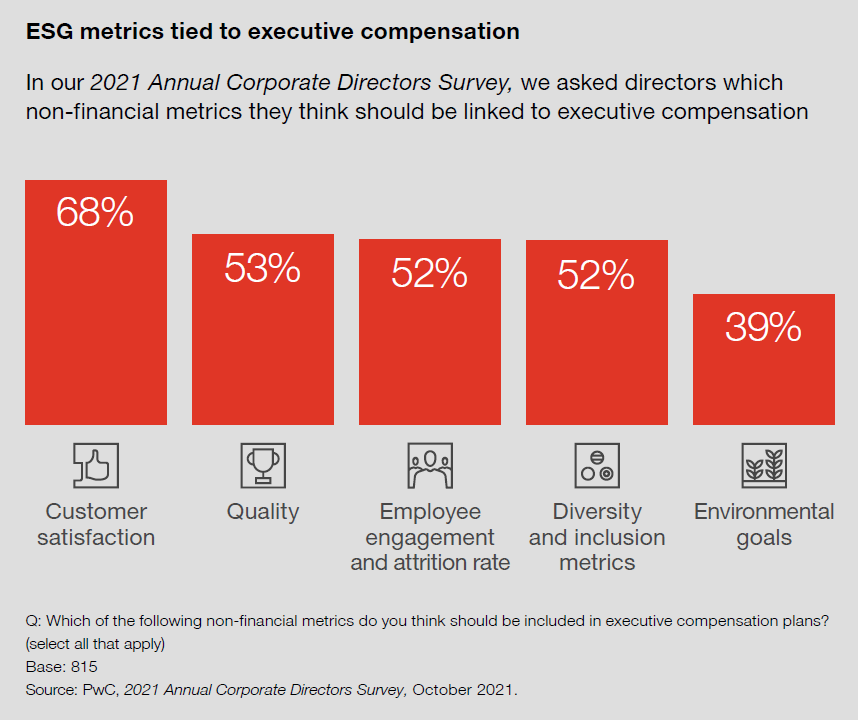

Considering ESG goals and milestones as elements of executive compensation

Many investors are focused on the connection between ESG goals and executive compensation. By tying incentive plan metrics explicitly to the company’s ESG strategy, a company is not only encouraging the achievement of those ESG goals, it is also signalling the importance of those issues. A growing number of shareholder proposals are asking companies to link the two. And a number of large companies have already taken steps to do so.

Linking purpose, risks, and messaging: The company should ensure that its purpose is reflected through its messaging and activities, while looking at it with a risk lens. And as part of its oversight role, the board should engage with management to understand how the company’s purpose, messaging, and risks all tie together. For example, in considering the company’s purpose and the metrics management uses to measure performance, the board should keep sight of the risk landscape. You may want to ask the following questions of management:

Purpose and stakeholders

- Has the company clearly articulated a purpose that considers key stakeholder needs and aligns with business strategy?

- Has the company considered how its purpose compares to that articulated by its competitors?

Risks and ERM

- Do the company’s existing risk processes include identification of any ESG risks? Should any of the risk identification processes be expanded to allow for a broader scope of risks to be captured?

- Does the ERM process include assessment and mitigation plans for all ESG-related risks that

have been identified? - How does management prioritize ESG risks and opportunities? Are these ESG risks and

opportunities included in capital allocation decisions?

Messaging

- How is the company communicating its purpose and its goals in furtherance of long-term sustainable success? Is the company using both quantitative information, such as metrics, and

qualitative information to measure its progress? - How does the company monitor what competitors are doing, what the rating agencies are reporting, and other benchmarking data?

- Is the company transparently tracking their performance against milestone goals, as well as long-term goals, so stakeholders and others can monitor progress?

- Has the company evaluated various ESG standards and frameworks to determine whether it is addressing the most significant risks and issues facing its industry?

Reliability of ESG information: Once the company has settled on the qualitative and quantitative messaging it will disclose, the board will want to verify the information is consistently prepared and reliable. After all, investors will be using it to analyze the company and make investment decisions.

The board needs to understand management’s policies and procedures supporting the assessment of internal controls over these disclosures. Determining that the right controls are in place to ensure consistency and accuracy of reporting will be key as well as whether the company should consider obtaining some type of assurance over the ESG information disclosed. You may want to ask:

- Does the company have robust policies and procedures to support the development of their disclosures? Do their disclosures adhere to the requirements of particular frameworks or standards? Are the disclosures investor-grade?

- Has management found any gaps in the internal controls that support the completeness and accuracy of the disclosures? If so, how does management plan on mitigating those gaps? Is the disclosure committee one of the controls used by the company to ensure its disclosures are appropriate?

- Would stakeholders be confident with the accuracy of the disclosure without independent assurance? Could independent assurance serve as a differentiating factor among peers?

Disclosures: With the messaging determined and an assessment of the reliability of the information complete, the board should understand where the company will be disclosing its messaging. Boards may want to consider the following questions:

- Are disclosures made in the right place and does that address various stakeholder preferences? For example, a customer or an employee will most likely refer to the company’s website for ESG information, while an investor would more likely refer to either corporate responsibility reporting, annual reports, or proxy statements.

- Are disclosures consistent across various platforms and appropriate for the different audiences of each? For example, are material risks disclosed in a corporate responsibility report aligned with those identified in the company’s Form 10-K filing?

- Is the messaging being incorporated in operational discussions, such as quarterly analyst calls?

- Has the company considered its exposure when including ESG information in SEC filings?

Conclusion

Rapid strides have been made in unlocking the business value of ESG in recent years. The ESG issues a company faces vary widely by industry and company maturity, and there’s no one-size-fits-all solution. But the one thing that’s a sure bet is that directors have a big role to play in guiding management to allocate the appropriate resources and attention. Forward-looking companies value being a frontrunner on ESG issues because they see the connection to the company’s long-term success.

Endnotes

1NYU Stern Center for Sustainable Business, Sustainable Market Share Index™, March 2021.(go back)

2GreenBiz, “Workforce strategy in the time of coronavirus: The role of ESG,” June 22, 2020.(go back)

3Securities and Exchange Commission, “Keynote Speech at the Society for Corporate Governance National Conference,” July 7, 2020.(go back)

4Governance & Accountability Institute, 2020 Flash Report S&P 500, July 2020.(go back)

Print

Print