Mary Jo White, Andrew Ceresney, and Jon Tuttle are partners at Debevoise & Plimpton LLP. This post is based on a Debevoise memorandum by Ms. White, Mr. Ceresney, Mr. Tuttle, Julie Riewe, and Rob Kaplan.

On November 18, 2021, the U.S. Securities and Exchange Commission’s (the “SEC” or “Commission”) Division of Enforcement (the “Division”) announced its enforcement results for fiscal year 2021 (“FY 2021”). [1] The first partial year of the Democratic administration came with an uptick in enforcement, with the SEC bringing 434 new enforcement actions—a 7% increase from fiscal year 2020 (“FY 2020”). According to Chair Gensler, the results demonstrated the SEC’s pursuit of misconduct “wherever we find it in the financial system, holding individual companies accountable, without fear or favor, across the $100-plus trillion capital markets we oversee.” The Director of the Division of Enforcement, Gurbir Grewal, described FY 2021 as a year with “a number of critically important and first-of-their-kind enforcement actions.”

The actions that the SEC chose to highlight in its press release provide a roadmap to understanding the priorities of Chair Gensler and the likely future focus of the Commission’s enforcement efforts. In line with an emphasis expressed in published rulemaking priorities and a number of recent public statements, the Division put front and center its actions against entities in the digital asset space and Special Purpose Acquisition Companies (“SPACs”).

Although touted by the Division for exceeding last year’s metrics, the results are still relatively low by recent historical standards, reflecting the fact that many of these actions were the product of the previous administration; the lull that often results from transitions in administrations when acting heads are in place; and the ongoing challenges stemming from the COVID-19 pandemic.

Moreover, this year’s enforcement results notably were not accompanied by an annual report—a document that the agency has previously released in recent years to provide a detailed look into the Enforcement Division’s efforts and priorities.

FY 2021 Statistics

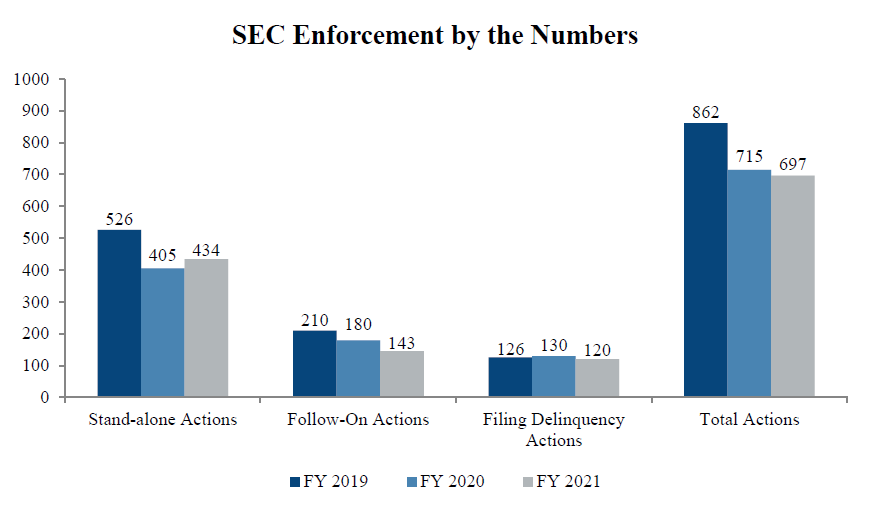

The SEC brought 434 new stand-alone enforcement actions in FY 2021, a 7% increase over FY 2020. At first glance, the number indicates a more active Division. However, when stacked up against pre-pandemic numbers, we see a continued decline in overall enforcement. In FY 2019, for example, the SEC brought 526 stand-alone actions. As displayed in the chart below, the total number of actions, including “follow-on” administrative proceedings and actions against issuers who were delinquent in making required filings with the SEC, actually declined for the third straight year.

The continued decline this year can be attributed in part to the ongoing effects of the COVID-19 pandemic and the challenges associated with conducting government business remotely. The numbers also likely reflect the fewer investigations that were opened and progressed through the pipeline during the SEC’s Clayton era and the four-month interregnum between the Clayton and Gensler chairmanships.

A few types of actions made up the majority of stand-alone actions brought during FY 2021:

- Securities offerings (33% of the total);

- Investment adviser and investment company matters (28% of the total); and

- Issuer reporting/accounting and auditing matters (12% of the total).

While investment adviser and investment company matters experienced a 21% year-over-year jump, securities offerings and issuer reporting/accounting and auditing matters held relatively steady compared to FY 2020. Enforcement in other areas included broker-dealer matters (8%), insider trading (6%), and public finance abuse (3%). Notably, the staff brought only five FCPA matters in FY 2021 (comprising 1% of the overall docket), and the total number of issuer reporting, audit and accounting matters (53) was over 44% lower than the total for FY 2017 (95).

Stand-Alone Enforcement Actions by Primary Classification

| Primary Classification | FY 2019 | FY 2020 | FY 2021 | |||

|---|---|---|---|---|---|---|

| Investment Adviser / Investment Co. | 36% | 191 | 21% | 87 | 28% | 120 |

| Broker Dealer | 7% | 38 | 10% | 40 | 8% | 36 |

| Securities Offering | 21% | 108 | 32% | 130 | 33% | 142 |

| Issuer Reporting / Audit & Accounting | 17% | 92 | 15% | 62 | 12% | 53 |

| Market Manipulation | 6% | 30 | 5% | 22 | 6% | 26 |

| Insider Trading | 6% | 30 | 8% | 33 | 6% | 28 |

| FCPA | 3% | 18 | 2% | 10 | 1% | 5 |

| Public Finance Abuse | 3% | 14 | 3% | 12 | 3% | 12 |

| SRO / Exchange | 1% | 3 | 0% | 0 | 0% | 1 |

| NRSRO | 0% | 0 | 1% | 3 | 0% | 2 |

| Transfer Agent | 0% | 1 | 0% | 1 | 0% | 2 |

| Miscellaneous | 0% | 1 | 1% | 5 | 2% | 7 |

Certain of these trends in enforcement activity likely reflect the “exhaust” from Chairman Clayton’s legacy enforcement focus on retail investors. For instance, offering frauds comprised one-third of all stand-alone actions this year (a slight uptick from 32% in FY 2020). By contrast, offering frauds comprised only 21% of all stand-alone actions in FY 2019 and—looking further back—16% in FY 2016. The slight decrease in insider trading matters to a level lower than historical levels also likely reflects Chairman Clayton’s retail focus: in contrast to this year’s 6% tally of such matters, insider trading matters comprised 9% of the enforcement docket in FY 2017.

Similarly, the total amount of relief obtained by the SEC declined in FY 2021. The Commission obtained approximately $1.45 billion in penalties and $2.4 billion in disgorgement, for a total of $3.85 billion. These figures represent a significant reduction compared to the approximately $4.7 billion in relief ordered during FY 2020. The amount of money distributed to harmed investors also declined, with a reduction from $602 million to $521 million returned. In a broader context, these numbers remain far below pre-pandemic levels. In FY 2019, for example, the SEC distributed nearly $1.2 billion to harmed investors.

While penalties rose, disgorgement in particular saw a significant drop, down from $3.6 billion in FY 2020 to $2.4 billion this year. Moreover, 25% of this year’s total disgorgement figure stemmed from a single action—the SEC’s settlement with Goldman Sachs related to FCPA violations stemming from the 1MDB scandal, for which the SEC credited amounts paid to the government of Malaysia towards its total. [2]

Given the enhanced disgorgement authority granted in this past January’s National Defense Authorization Act (“NDAA”), [3] the uncertainty caused by the Supreme Court’s prior decisions over the SEC’s ability to seek disgorgement is now largely resolved.

Going forward, we expect an aggressive Commission to pursue the remedy with renewed vigor, particularly given the longer statute of limitations under the NDAA for scienter-based violations.

The Year’s Record-Breaking Whistleblower Activity

The SEC’s press release also highlighted the record-breaking sums awarded to whistleblowers in FY 2021 and the milestone attained in the process. The SEC issued 108 whistleblower awards this year, totaling $564 million. As a result, the cumulative total amounts awarded under the SEC’s whistleblower program have now surpassed the $1 billion mark. To underscore the magnitude of the awards made this year, the total of FY 2021’s awards equaled the sum of all distributions made since the program’s inception in 2012. [4]

This year’s figure was also driven in part by several sizable awards, including awards of $114 million and $110 million, which represent the highest bounties paid in the program’s history. These large award amounts helped push the Commission past the $1 billion threshold. [5] The whistleblower program is also off to a strong start for FY 2022, having issued approximately $67.4 million in awards as of November 22, 2021. [6]

Roadmap for Enforcement: Emerging Risks

As mentioned above, the SEC’s press release prominently featured the Commission’s actions in the digital asset and SPAC space, which is not surprising, given Chair Gensler’s stated priorities for enforcement activity. It seems all but certain that we will continue to see enforcement activity on these fronts.

Digital Assets

The SEC touted its digital asset enforcement efforts across multiple fronts. The Commission cited its settlement with Poloniex for operating as an unregistered online digital asset exchange, [7] as well as its suit against a cryptocurrency lending platform, BitConnect, and its founder, alleging a fraudulent securities offering. [8] Regarding digital asset exchanges in particular, Chair Gensler has previously spoken about his belief that a large portion are operating as unregistered security exchanges, noting that “the probability is quite remote that . . . any given platform has zero securities.” [9] As the Division moves forward into its first full fiscal year under the helm of Chair Gensler and Director Grewal, unregistered exchanges are likely to receive additional scrutiny.

SPACs

Key SEC officials targeted SPACs with a number of public statements this spring that were likely intended to chill the market. [10] In late May, the SEC also released an Investor Bulletin urging awareness about the specifics of the SPAC investment vehicle. [11] Unsurprisingly, the FY 2021 results highlighted the Momentus settlement this July against a SPAC, its sponsor, its CEO, and the target company for making misleading statements about the target’s space transportation technology [12]—the first settlement of its kind against a SPAC. In the press release accompanying the Momentus settlement, Chair Gensler emphasized that the case “illustrates risks inherent to SPAC transactions, as those who stand to earn significant profits from a SPAC merger may conduct inadequate due diligence and mislead investors.” [13]

The Momentus settlement’s terms—along with the speed with which the action was filed—illustrates the SEC’s concern with SPAC transactions and the likelihood of further enforcement in this area. The settlement required the target company to retain an independent compliance consultant to review its ethics and compliance programs, and also required that the SPAC sponsor forfeit the founder shares that it ultimately received from the de-SPAC transaction, which was consummated in August 2021. The de-SPAC transaction was initially announced on October 7, 2020, and the SEC brought its case just eight months later—and a month ahead of the planned vote on the transaction. Given the timing of the impending vote, the SEC was likely trying to dampen prospects for the merger’s approval. Though the merger was ultimately approved, swift investigation followed by settlement or litigation is a strategy the Division may well deploy again.

The SEC also made a splash with a second SPAC-related enforcement action this year, alleging that the CEO of electric truck manufacturer Nikola disseminated a number of false and misleading statements both before and after a SPAC combination. [14] Though the SEC has not to date pursued charges against the business entity itself, the Division was clearly aiming for a high-profile action in the SPAC space.

As a further indication of the Commission’s enforcement attitude toward SPACs, a statement released earlier this year by Acting Chief Accountant Paul Munter laid out considerations on financial reporting, internal controls, and governance among other areas for businesses merging with SPACs. [15] Additionally, during the SEC Speaks conference in October, Matt Jacques, the Chief Accountant of the Enforcement Division, highlighted Munter’s statement as reflecting a list of issues that the Division considers when scrutinizing SPACs. It is a safe bet that future SPAC actions will cover a wide range of disclosure and accounting issues stemming from SPAC transactions.

Additional New, Notable Actions

In addition to the top-line items related to digital assets and SPACs, the SEC highlighted other “noteworthy enforcement actions across new areas.” These actions show that the Commission is content to make use of its current toolkit to approach a number of novel technologies.

Such actions included the App Annie settlement this past September. The action concerned the respondent’s use of non-anonymized material nonpublic information in aggregated data models, which App Annie sold to its customers for use in their trading decisions. [16] The Commission‘s order emphasized that App Annie had misled its customers, many of which were private fund managers, but in doing so put down a clear marker that vendor due diligence is on its radar more generally. In another first-of-its-kind settlement, the SEC settled charges with Neovest, an order execution management system provider, for failing to register as a broker-dealer. [17]

The Focus on Traditional Enforcement

As noted above, cases involving securities offerings, investment adviser and investment company issues, and issuer reporting/accounting and auditing matters comprised 73% of the SEC’s enforcement actions. Despite the absence of an annual report with the Division’s detailed commentary on these matters, the steady flow of these actions year-over-year demonstrates that the Commission continues to prioritize core areas of the securities laws.

Investment Adviser and Investment Company Actions

Although the SEC’s Share Class Initiative accounted for a significant number of actions in the investment adviser space during the Clayton SEC, the final cases brought as part of that effort settled in April of 2020. [18] The 7% rise in investment adviser and investment company actions over FY 2020 therefore reflects the Division’s enforcement focus on fraudulent and misleading conduct by financial professionals in this space.

Accounting and Auditing Actions

Accounting and auditing actions are a perennial area of focus for the Commission. Although these cases comprised only 12% of actions in FY 2021 (down from 15% in FY 2020, 17% in FY 2019, and 21% back in FY 2017), recent cases demonstrate that the SEC remains intensely focused on accounting and auditing misconduct. For example, this year’s settlement with Under Armour [19] is an example of a growing number of cases in which the SEC did not find violations of GAAP, but instead charged the company with disclosure violations based on the impact on reported revenue of its undisclosed accounting practices.

In another notable accounting settlement against Kraft Heinz, the SEC demonstrated its willingness to look past core gatekeepers in its charging decisions and to pursue senior individuals involved in business operations. [20] The SEC reached a settlement with Kraft Heinz’s Chief Operations Officer and is litigating against the company’s Chief Procurement Officer over allegations that the company recognized unearned discounts from suppliers and maintained false and misleading supplier contracts to reduce costs of goods sold and meet cost savings targets.

Additionally, the SEC’s Earnings Per Share Initiative (“EPS Initiative”), first announced in September 2020, began to demonstrate results at the end of FY 2020 with two settled actions involving alleged earnings mismanagement. [21] Additionally, at the end of FY 2021, the SEC brought its third EPS Initiative case, settling with Healthcare Services Group over allegations that the company failed to properly record loss contingencies in the correct quarters, which, the SEC claimed, allowed the company to meet or nearly meet analysts’ EPS estimates. [22] The Healthcare Services matter demonstrates that the SEC’s EPS Initiative remains active and we expect that the Division likely has in its investigative pipeline future cases focusing on earnings management.

Gatekeepers

On the topic of gatekeeping more broadly, the Division also highlighted five actions in which it charged gatekeepers for failing to meet their obligations. In one such action, the SEC reached settlements with two auditors for allegedly issuing unqualified audit opinions when they had failed to obtain crucial information related to the audit. [23] The Division suspended both of these auditors from appearing before the Commission. As the importance of gatekeeping is another area where the SEC has expressed a likely focus [24]—and which raises difficult and troubling issues for gatekeepers such as auditors, lawyers, and compliance personnel—we expect continued actions zeroing in on auditor, CFO, and CAO misconduct.

Conclusion

As the world continues to emerge from the COVID-19 pandemic and as the new administration moves into its first full fiscal year, we expect to see a significant ramp-up in investigative and enforcement activity during FY 2022. The SEC’s whistleblower awards will likely amplify the effects of the Division’s enforcement push, as the Commission has sent clear signals to the market that tips are welcomed and will be well-rewarded. In addition, whistleblowers have already provided the Division with more than enough fodder for current and future investigation, as indicated by recent tip numbers. As noted in the SEC’s FY 2021 Office of the Whistleblower (“OWB”) annual report to Congress. [25] OWB recorded a 76% increase in whistleblower tips, up to a record 12,210 tips from 6,911 in FY 2020 and 5,212 in FY 2019.

The SEC, clearly content to utilize its traditional toolkit to pursue emerging risks, is likely to keep bringing actions against companies in the digital asset and SPAC spaces. The SEC will further assert its authority over new technologies employed in the securities industry. While increased enforcement activity will likely boost total relief ordered on its own, amounts will further rise as the Division takes advantage of the disgorgement authority granted in the NDAA and as penalties increase in light of the more aggressive posture of the Commission majority.

Endnotes

1Press Release, SEC Announces Enforcement Results for FY 2021 (Nov. 18, 2021), https://www.sec.gov/news/press-release/2021-238.(go back)

2Press Release, SEC Charges Goldman Sachs with FCPA Violations (Oct. 22, 2020), https://www.sec.gov/news/press-release/2020-265.(go back)

3Debevoise Update, The SEC’s Expanded Disgorgement Authority Complicates Investigations and Settlements (Jan. 4, 2021), https://www.debevoise.com/insights/publications/2021/01/the-secs-expanded-disgorgement-authority.(go back)

4Press Release, SEC Issues First Whistleblower Program Award (Aug. 21, 2012), https://www.sec.gov/news/press-release/2012-2012-162htm.(go back)

5Press Release, SEC Surpasses $1 Billion in Awards to Whistleblowers with Two Awards Totaling $114 Million (Sept. 15, 2021), https://www.sec.gov/news/press-release/2021-177; Press Release, SEC Issues Record $114 Million Whistleblower Award (Oct. 22, 2020), https://www.sec.gov/news/press-release/2020-266.(go back)

6Press Release, SEC Issues Whistleblower Awards Totaling Approximately $10.4 Million (Nov. 22, 2021), https://www.sec.gov/news/press-release/2021-243; Press Release, SEC Issues Awards Totaling More Than $15 Million to Two Whistleblowers (Nov. 10, 2021), https://www.sec.gov/news/press-release/2021-232; Press Release, SEC Awards More than $2 Million to Whistleblower for Successful Related Action (Oct. 29, 2021), https://www.sec.gov/news/press-release/2021-220; Press Release, SEC Awards $40 Million to Two Whistleblowers (Oct. 15, 2021), https://www.sec.gov/news/press-release/2021-211.(go back)

7In the Matter of Poloniex, LLC, Exchange Act Rel. No. 92607 (Aug. 9, 2021), https://www.sec.gov/litigation/admin/2021/34-92607.pdf.(go back)

8Press Release, SEC Charges Global Crypto Lending Platform and Top Executives in $2 Billion Fraud (Sept. 1, 2021), https://www.sec.gov/news/press-release/2021-172.(go back)

9Statement, Chair Gary Gensler, Remarks Before the Aspen Security Forum (Aug. 3, 2021), https://www.sec.gov/news/public-statement/gensler-aspen-security-forum-2021-08-03.(go back)

10See Statement, Staff Statement on Accounting and Reporting Considerations for Warrants Issued by Special Purpose Acquisition Companies (“SPACs”) (Apr. 12, 2021), https://www.sec.gov/news/public-statement/accounting-reporting-warrants-issued-spacs; Statement, John Coates, SPACs, IPOs and Liability Risk under the Securities Laws (Apr. 8, 2021), https://www.sec.gov/news/public-statement/spacs-ipos-liability-risk-under-securities-laws.(go back)

11Investor Bulletin, What You Need to Know About SPACs—Updated Investor Bulletin (May 5, 2021), https://www.sec.gov/oiea/investor-alerts-and-bulletins/what-you-need-know-about-spacs-investor-bulletin.(go back)

12In the Matter of Momentus, Inc. et al., Securities Act Rel. No. 10955 and Exchange Act Rel. No. 92391 (July 13, 2021), https://www.sec.gov/litigation/admin/2021/33-10955.pdf.(go back)

13Press Release, SEC Charges SPAC, Sponsor, Merger Target, and CEOs for Misleading Disclosures Ahead of Proposed Business Combination (July 13, 2021), https://www.sec.gov/news/press-release/2021-124.(go back)

14Press Release, SEC Charges Founder of Nikola Corp. With Fraud (July 29, 2021), https://www.sec.gov/news/press-release/2021-141.(go back)

15Statement, Paul Munter, Financial Reporting and Auditing Considerations of Companies Merging with SPACs (Mar. 31, 2021), https://www.sec.gov/news/public-statement/munter-spac-20200331#_ftn5.(go back)

16In the Matter of App Annie Inc. and Bertrand Schmitt, Exchange Act Rel. No. 92975 (Sept. 14, 2021), https://www.sec.gov/litigation/admin/2021/34-92975.pdf.(go back)

17In the Matter of Neovest, Inc., Exchange Act Rel. No. 92285 (June 29, 2021), https://www.sec.gov/litigation/admin/2021/34-92285.pdf.(go back)

18Press Release, SEC Orders Three Self-Reporting Advisory Firms to Reimburse Investors (Apr. 17, 2020), https://www.sec.gov/news/press-release/2020-90.(go back)

19In the Matter of Under Armour, Inc., Securities Act Rel. No. 10940, Exchange Act Rel No. 91741, Accounting and Auditing Enforcement Rel. No. 4220 (May 3, 2021), https://www.sec.gov/litigation/admin/2021/33-10940.pdf.(go back)

20Press Release, SEC Charges the Kraft Heinz Company and Two Former Executives for Engaging in Years-Long Accounting Scheme (Sept. 3, 2021), https://www.sec.gov/news/press-release/2021-174.(go back)

21Press Release, SEC Charges Companies, Former Executives as Part of Risk-Based Initiative (Sept. 28, 2020), https://www.sec.gov/news/press-release/2020-226.(go back)

22In the Matter of Healthcare Services Group et al., Securities Act Rel. No. 10967, Exchange Act Rel. No. 92735, Accounting and Auditing Enforcement Rel. No. 4244 (Aug. 24, 2021), https://www.sec.gov/litigation/admin/2021/33-10967.pdf.(go back)

23Press Release, SEC Charges Two Former KPMG Auditors for Improper Professional Conduct During Audit of Not-for-Profit College (Feb. 23, 2021), https://www.sec.gov/news/press-release/2021-32. The other four actions mentioned were In the Matter of Christopher E. Knauth, In the Matter of Paul L. Chancey, Jr., SEC v. Rubin and Craft, and SEC v. Lawler and Bannister. Elsewhere in its announcement, the Commission prominently featured its auditor misconduct case against Ernst & Young, three audit partners, and a former public company CAO. Press Release, SEC Charges Ernst & Young, Three Audit Partners, and Former Public Company CAO with Audit Independence Misconduct (Aug. 2, 2021), https://www.sec.gov/news/press-release/2021-144.(go back)

24Speech, Gurbir Grewal, PLI Broker/Dealer Regulation and Enforcement 2021 (Oct. 6, 2021), https://www.sec.gov/news/speech/grewal-pli-broker-dealer-regulation-and-enforcement-100621.(go back)

25U.S. Securities and Exchange Commission, 2021 Annual Report to Congress on the Dodd-Frank Whistleblower Program (Nov. 16, 2021), https://www.sec.gov/files/2021_OW_AR_508.pdf.(go back)

Print

Print