Tim Ryan is Senior Partner and Chairman and Maria Castañón Moats Governance Insights Center Leader at PricewaterhouseCoopers LLP. This post is based on their PwC memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

Strategy: don’t just approve it. Measure it, check it, change it.

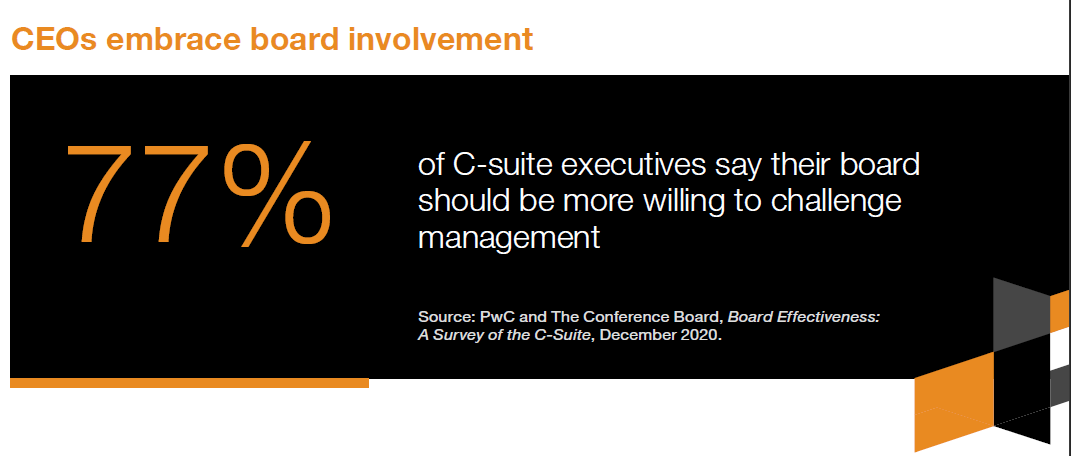

It’s management’s job, of course, to set company strategy. But board oversight is absolutely critical, and to really get it right, many boards could be even more involved. Directors see this, and many told me so in our conversations. Specifically, boards could spend more time analyzing strategic options that were considered and rejected—not just the path that was taken. They could look to competitive intelligence and widen the aperture beyond the short- and the medium term to focus on the long-term strategy.

Also important: monitoring whether the strategy is really working. The typical once-a-year discussion just doesn’t cut it anymore. Boards need to be armed with timely metrics that will give early and often indications when strategy isn’t delivering the promised results. And they need to be willing to initiate change where necessary.