Tim Ryan is Senior Partner and Chairman and Maria Castañón Moats Governance Insights Center Leader at PricewaterhouseCoopers LLP. This post is based on their PwC memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

Strategy: don’t just approve it. Measure it, check it, change it.

It’s management’s job, of course, to set company strategy. But board oversight is absolutely critical, and to really get it right, many boards could be even more involved. Directors see this, and many told me so in our conversations. Specifically, boards could spend more time analyzing strategic options that were considered and rejected—not just the path that was taken. They could look to competitive intelligence and widen the aperture beyond the short- and the medium term to focus on the long-term strategy.

Also important: monitoring whether the strategy is really working. The typical once-a-year discussion just doesn’t cut it anymore. Boards need to be armed with timely metrics that will give early and often indications when strategy isn’t delivering the promised results. And they need to be willing to initiate change where necessary.

At a time when shareholder activism is back on the upswing, this is more important than ever. Directors acknowledge that an activist’s outside-in view of the company can often come as a shock—but it shouldn’t. When boards evaluate performance and strategy they should do so also through the eyes of an activist. Many directors who I spoke with aren’t consistently seeking out that type of objective analysis of the company and how it stacks up against competitors. Without that, they are less able to timely course correct, and their companies are unable to fend off activists when they come knocking.

Getting strategy right is critical, and executing on that strategy is even more critical. Shareholder value can be lost in the time it takes to correct strategy—or worse, not correct it. Companies can lose their relevance or even fail.

Strategy: what the best boards are doing

- Go over the “chess board” at every board meeting. Review trends, discuss possible disruptors, examine upcoming transactions in the industry, and evaluate M&A opportunities and implications. Objectively, and without an ego, look at the company from the viewpoint of competitors, customers, investors, analysts and regulators.

- Use dashboards and metrics to monitor progress on strategy at every board meeting. Boards need quantitative and qualitative reports on progress. Review whether agreed-upon financial and non-financial metrics and milestones are being met.

- Push a course correction when needed. The metrics will show when strategy isn’t working. Push management on why goals were missed and what changes need to be made.

- Take the outside-in perspective. Spend time thinking and analyzing data like an activist. Understand the company’s vulnerabilities from an outsider’s perspective—not just management’s. Take a critical look at untapped value and whether each piece of the company fits.

CEO performance: move on when things don’t work out.

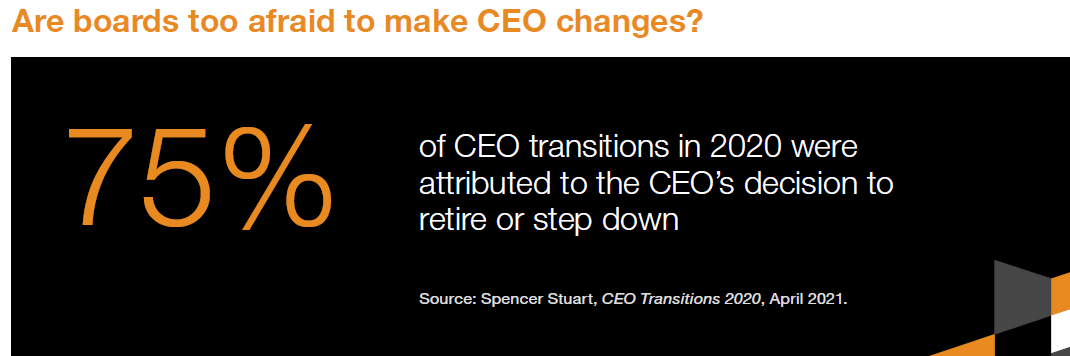

While the board is tasked with oversight over the entire company, the most important piece of that job, by far, is hiring, overseeing—and, sometimes, firing—the CEO. Having the right leader in place really is the most important thing. Even if everything else at the company is perfect—great market positioning, strong technology, good products, vibrant company culture—the wrong CEO could, at a minimum, lead to mediocrity and in some cases spell disaster.

Sometimes boards get it right, but the truth is that they many times don’t. It is hard to know how well an individual will perform until they step inside the pressure cooker. Failure isn’t forcing an untimely CEO change—it’s keeping the wrong CEO in place for too long. This is hard stuff, and directors know they can be too slow to act when changes are needed. Some even shared specific regrets about times their board waited too long, hoping things would improve, and wasting valuable time. It’s a drastic step to replace the CEO. But the consequences can be dire when it’s delayed too long.

CEO performance: what the best boards are doing

- Don’t be afraid to provide frequent, honest and challenging feedback to the CEO. Boards have to bypass comfort and give the CEO direct and actionable feedback and help the CEO become a better leader. A formal evaluation process with frequent touchpoints should be in place to measure the CEO’s success. Where there are shortcomings, board leadership needs to share collective concerns, observations and challenges, and come up with a plan forward.

- Watch for early warning signs. The board needs to keep a very careful eye on progress and performance. At a certain point, coaching is no longer useful, and the focus needs to turn to making a leadership change. Identifying that moment is the biggest challenge.

- Don’t be afraid to make a change. Boards should be ready to act when a leadership change is needed. Have the courage to voice your opinion and initiate action.

Recognize an information asymmetry problem

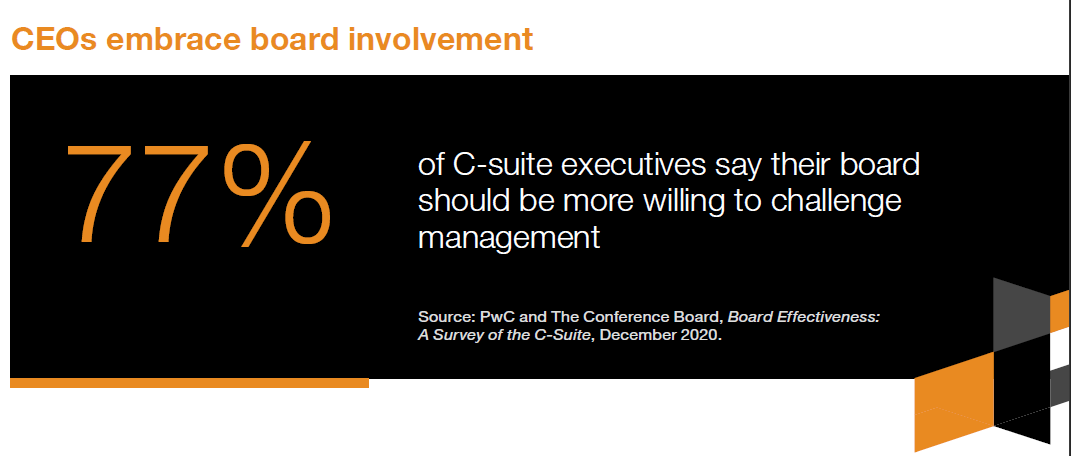

There is often natural friction between the CEO and board. Sometimes the CEO thinks the board is crossing the line into management’s role. Other times they might want the board to be more involved. One director, who also is a sitting CEO, traces this back to what they call “the asymmetry of information.”

The board will never have access to the amount and type of information that management has. And they shouldn’t—it would overwhelm and distort the role of the board. But directors need to keep an eye on the areas where they need more reporting, and they need to make sure they get it. The best boards have a CEO who recognizes this asymmetry of information and works hard to get the board the information they need and put it in the right context. CEOs who struggle with this reality often struggle in the role.

Board composition: address the elephant in the room.

Large investors and others have been focused on board composition for years, and corporate boards have come a long way in terms of their diversity and their range of skill sets. By and large, boards look different than they did a decade or two ago—but it’s not enough. Boards need to not only diversify and bring in new directors, they also need to hold themselves to the highest level of excellence.

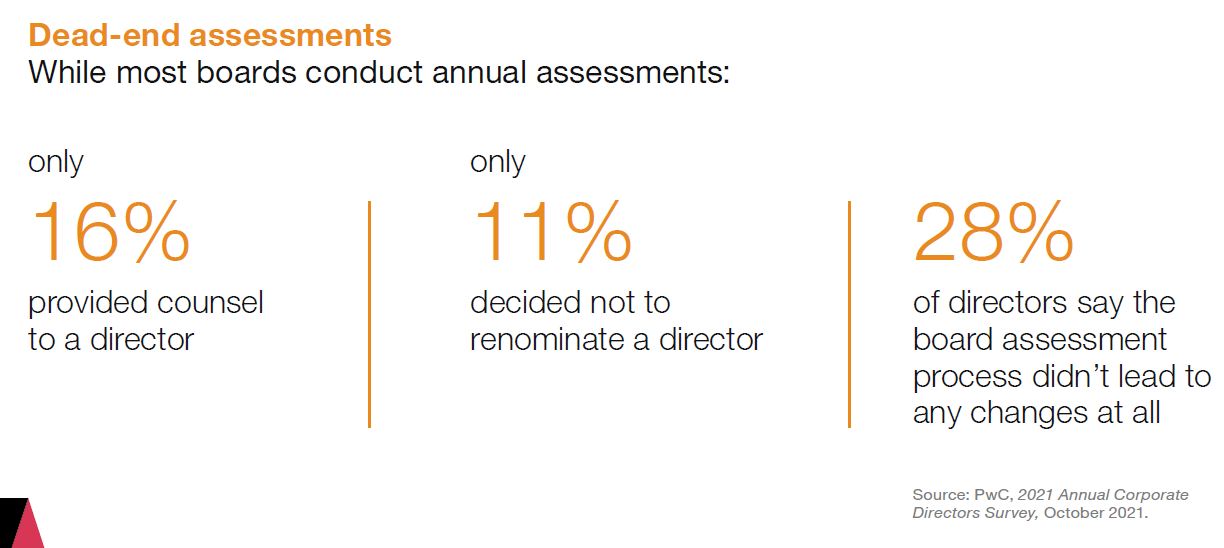

Every year, about half of directors tell us that at least one fellow board member needs to be replaced, [1] and yet board turnover numbers remain stubbornly low. [2] Virtually all of the directors I spoke with see this on their boards. Many told me about underperforming directors. Sometimes it’s a director who takes on a new role and has less time to devote to their board service. Other times the person’s expertise has become less relevant, or they just aren’t the right fit anymore. Or it could be a director who derails conversations with off-topic questions or suggestions.

Board leadership can make or break a board. The right person keeps the board focused on the important topics and doesn’t let distractions—or distracting directors—derail the discussion.

Assessments are one of the most important tools in this discussion. Yet many boards still only evaluate the board or committees as a whole, avoiding candid individual assessments. When assessments are conducted, feedback isn’t shared, and little changes as a result. Collegiality often gets in the way of refreshment.

Isn’t it time for this problem to get fixed? Boards and companies deserve better, and the way to get there is to ensure that each member of the board is contributing to the board in meaningful ways.

“Board members spend their whole professional lives getting feedback and improving their performance. We can’t put a stop to that in the boardroom in the name of collegiality.”

Board composition: what the best boards are doing

- Conduct individual director assessments every year. Directors are professional superstars. They spend their entire careers being assessed, getting feedback and earning performance ratings. They can handle an assessment in this role, too. Board chairs or lead directors should hold a one-on-one meeting with each director and share honest, candid (especially if uncomfortable) feedback each year.

- Expect honest self-assessments, too. Each board member needs to do their part as well. Each year, honestly answer the question: “Am I still the right fit for this board?”

- Embrace shorter board tenures. Set an expectation that at least some directors will leave after five or seven years. This can encourage fresh thinking about renewing boards.

The value of actively employed executives on boards

Boards tend to focus on recruiting retired executives with long careers—and ample time for board service. But the pace of change and development today is so fast that perspectives can become stale. That’s where an outside sitting CEO or other executive can play an important role. An outside CEO in particular can better understand the complexity of what the CEO and management team are dealing with.

69% of first-time directors are actively employed

Source: Spencer Stuart, 2020 U.S. Spencer Stuart Board Index, December 2020.

ESG: be ready for the ESG tsunami.

ESG dominates boardrooms today. Directors tell us that ESG is the number one topic shareholders want to discuss directly with directors. [3] But my discussions highlighted that boards are just beginning to understand the topic, and oversight varies wildly. Some boards have just begun to incorporate ESG into their strategy and processes. Others have established new board committees to oversee certain ESG topics, like sustainability or environmental issues. But even then, it’s often unclear how to allocate oversight of issues like workers’ rights or business ethics. Many topics are dispersed among different committees, or to more than one committee.

Currently, many boards take an ad hoc approach to ESG oversight. With such a large and sprawling topic, it’s easy to lose sight of the forest for the trees and to focus on the wrong topics. A current challenge is the lack of an agreed-upon framework or standards to help companies and boards better navigate this topic.

Of course, ESG is a relatively new topic for most boards, and like any new area of oversight, it takes time to get comfortable. The process is evolving and will continue to mature. But the importance of ESG will only increase, especially as the SEC eyes new rules in this area. These significant risks could cost the company shareholder value, brand reputation, customers, employees and the like. Boards have to be ready to lead on this issue now, and it starts with a strategy and framework.

ESG: what the best boards are doing

- Establish clear ESG oversight among board committees. Have a clear roadmap of which committee oversees which issue, and how they can work together. [4]

- Embed ESG goals in the strategy and business plan. Identify the company’s key financial and non-financial ESG goals and embed them into company strategy. Make them a clear part in the business plan.

- Be transparent with your shareholders. Don’t just wait for the questions to come from your investors. Look for ways to proactively tell the company’s ESG story and share its strategy in an open and transparent way.

Next-level board challenges

There is no shortage of challenges facing boards. As we look ahead, some of the other issues topping directors’ minds include:

- Avoiding audit committee overload. For years, audit committees’ agendas have continued to grow. When new risks emerge, it can seem natural to allocate oversight to the audit committee. But with already-packed agendas, boards need to resist the urge to overload the audit committee. Look carefully at the role other standing committees, and the full board, can play in crucial oversight areas.

- Looking for culture red flags. It is hard to measure corporate culture, and to know if the board is getting it right. Metrics can help, but boards need to be alert and connect the dots on what they see and hear—a challenge intensified in a remote or hybrid work environment. Look for a defensive management team, a lack of transparency or executive failure to admit mistakes.

- Evaluating the looming talent war. Understand what the company is doing now to differentiate itself and attract talent, and how that strategy will evolve in the future. Take a close look at diversity, equity and inclusion and make sure the approach and advancement of goals are happening.

- Staying ahead on cyber. Cybersecurity is one of the most challenging areas of oversight for boards. Make sure the board has access to cyber expertise to guide decisions. Double down on education sessions by internal resources and third parties to really understand what’s happening.

- Navigating the proxy advisors. The power and influence of proxy advisors has waxed and waned over the years, but when it comes to corporate governance, they continue to be a significant driver of shareholder expectations and agenda-setting. Being an engaged public company director means understanding the proxy advisors’ positions and their views on your company.

Endnotes

1PwC, 2021 Annual Corporate Directors Survey, October 2021.(go back)

2Spencer Stuart, 2020 U.S. Spencer Stuart Board Index, December 2020.(go back)

3PwC, 2021 Annual Corporate Directors Survey, October 2021.(go back)

4See PwC’s ESG oversight: The corporate director’s guide for more information.(go back)

Print

Print