Brian Breheny and Joseph Yaffe are partners at Skadden, Arps, Slate, Meagher & Flom LLP. This post is based on a Skadden memorandum by Mr. Breheny, Mr. Yaffe, Caroline Kim, Andrew Bond and Stephanie Birndorf.

Incorporate Lessons Learned From the 2021 Say-on-Pay Votes and Compensation Disclosures and Prepare for 2022 Pay Ratio Disclosures

Companies should consider their recent annual say-on-pay votes and general disclosure best practices when designing their compensation programs and communicating about their compensation programs to shareholders. This year, companies should understand key say-on-pay trends as they addressed the COVID-19 pandemic, including overall 2021 say-on-pay results, factors driving say-on-pay failure (i.e., those say-on-pay votes that achieved less than 50% shareholder approval) and equity plan proposal results, as well as guidance from the proxy advisory firms firms Institutional Shareholder Services (ISS) and Glass Lewis.

Overall Results of 2021 Say-on-Pay Votes

Below is a summary of the results of the 2021 say-on-pay votes from Semler Brossy’s annual survey [1] and trends over the last 10 years since the SEC adopted its say-on-pay rules. Overall, despite the uncertain climate during much of 2020, say-on-pay results at Russell 3000 companies surveyed in 2021 were generally the same or slightly below those in 2020, at least due in part related to COVID-19 related responses.

- Approximately 97.2% and 97.7% of Russell 3000 companies, in 2021 and 2020, respectively, received at least majority support on their say-on-pay vote, with approximately 93% receiving above 70% support in both years. This demonstrates slightly reduced say-on-pay support in 2021 compared with 2020.

- ISS’ support for say-on-pay proposals in 2021 through September 2021 continues to be among the highest observed over the last 10 years with 89% of companies surveyed receiving an ISS “For” recommendation—the same result as in 2020.

- Russell 3000 companies received an average vote result of 90.5% approval in 2021, which is slightly lower than the average vote result of 91% approval in 2020.

- The average vote result exceeded 90% approval in 2021 across multiple industry sectors, including utilities, materials, industrials, consumer staples, energy, financials and consumer discretionary.

- The communication services sector had the lowest level of average support of 84.6% compared with other industry sectors.

- Approximately 2.8% of say-on-pay votes for Russell 3000 companies failed in 2021 as of September 2021, which was slightly higher than the 2.3% failure rate for 2020 measured in September 2020.

- Approximately 11% of Russell 3000 companies and 12% of S&P 500 companies surveyed have failed to receive a majority support for say-on-pay at least once since 2011.

- 37% of S&P 500 companies and 30% of Russell 3000 companies surveyed have received less than 70% support at least once since 2011.

Factors Driving Say-on-Pay Failure

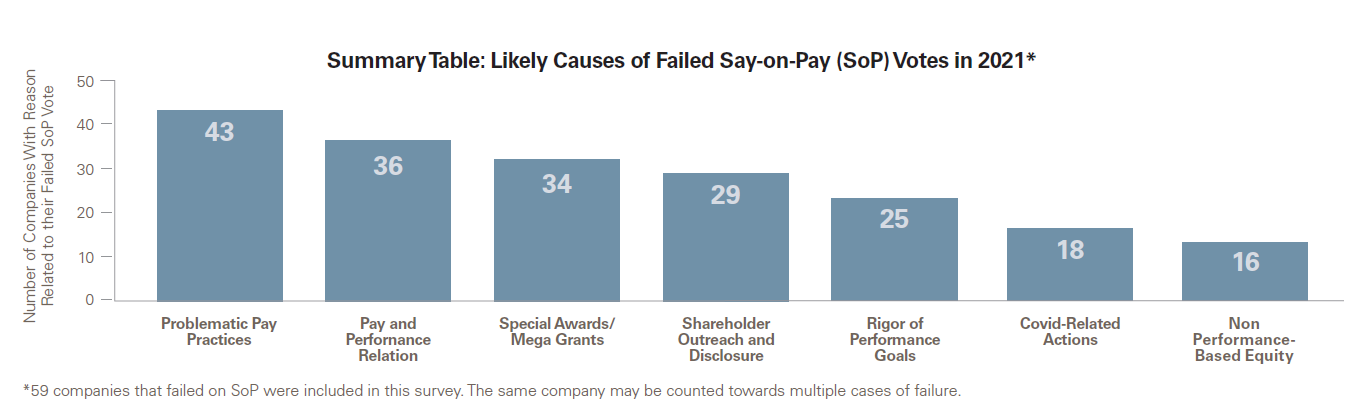

Overall, the most common causes of say-on-pay vote failure were problematic pay practices, pay and performance relation, special awards, shareholder outreach and disclosure, rigor of performance goals, COVID-related actions and nonperformance-based equity awards, as summarized in the chart below. [2]

Notably, special awards have increased from the fifth most frequently cited likely cause of say-on-pay vote failure in 2020 to the third in 2021, possibly due to increases in special awards made in connection with the COVID-19 pandemic, some of which were not reported as COVID-related actions. Otherwise,

the likely causes of say-on-pay failure remained largely consistent between 2020 and 2021, with problematic pay practices and pay and performance relation (i.e., a disconnect between pay and performance) as the continuing frontrunners.

ISS Guidance

When evaluating pay practices, proxy advisory firms tend to focus on whether a company’s practices are contrary to a performance-based pay philosophy. In December of each year, ISS publishes FAQ to help shareholders and companies understand changes to ISS compensation-related methodologies. In December 2020, ISS published its most recent general United States Compensation Policies FAQ, [3] which included the following key updates:

- ISS’ Multiple of Median (MOM) high concern threshold for S&P 500 companies is now three times the peer median rather than 3.33 times the peer median. This change was effective for

meetings on or after February 1, 2021. - MOM is one of ISS’ quantitative pay-for-performance screens that expresses the prior year’s CEO pay as a multiple of the median CEO pay of its comparison group for the most recently available annual period.

- ISS indicated that it would assess COVID-related pay decisions based on its “U.S. Compensation Policies and the COVID-19 Pandemic” FAQ published on October 15, 2020. [4] However, ISS may release updated guidance about its approach to COVID-related compensation developments in the coming weeks, especially given that companies could better predict the impact of COVID-19 on their businesses and compensation programs in 2021 compared with 2020. Highlights from ISS’ COVID-19 Pandemic FAQ are as follows:

- The common theme underlying executive compensation and incentive plan design during the pandemic is to permit discretion to address novel issues that generally arise only during periods of extreme market volatility while expecting companies to offer robust disclosure about their compensation decisions.

- The following should be disclosed to help investors evaluate COVID-19 pandemic-related changes to an annual incentive program:

- specific pandemic-related challenges that arose and how those challenges rendered the original program design obsolete or the original performance targets impossible to achieve, as well as how changes to compensation programs are not reflective of poor management performance;

- the rationale for making mid-year changes to bonus program design as opposed to the grant one-time discretionary awards (or vice versa) and how such decision

relates to investor interests; - performance-based conditions that apply to discretionary awards; and

- how resulting payouts appropriately reflect individual and company annual performance and how they compare with payouts that would have been made under the original program design.

- ISS generally does not support changes to long-term incentive programs that are driven by the pandemic; provided that movement to relative or qualitative metrics may be viewed as reasonable under certain circumstances. ISS continues to frown upon shifts to predominantly time-vesting equity or short-term measurement periods.

- For additional information about ISS’ “U.S. Compensation Policies and the COVID-19 Pandemic” FAQ, see our December 14, 2020, client alert “Matters to Consider for

the 2021 Annual Meeting and Reporting Season.”

ISS also made clear that companies will no longer receive credit for having stock ownership guidelines if such guidelines permit unearned performance awards or unexercised stock options (including vested unexercised options and “in the money” value of options) to count toward meeting stock ownership requirements. Unvested full value awards that require no exercise, such as time-based restricted stock and restricted stock units, may count toward stock ownership requirements without jeopardizing ISS credit. [5]

ISS’ general United States Compensation Policies FAQ summarized which problematic practices are most likely to result in an adverse ISS vote recommendation. The problematic practices include the following and are expected to remain problematic in 2022: [6]

- repricing or replacing of underwater stock options or stock appreciation rights without prior shareholder approval (including cash buyouts and voluntary surrender of underwater options);

- extraordinary perquisites or tax gross-ups, likely including gross-ups related to personal use of corporate aircraft, executive life insurance, secular trusts, restricted stock vesting, home-loss buyouts or any lifetime perquisites;

- new or extended executive agreements that provide for

- termination or change in control severance payments exceeding three times the executive’s base salary and bonus;

- change in control severance payments that do not require involuntary job loss or substantial diminution of duties;

- change in control payments with excise tax gross-ups, including modified gross-ups; (iv) multiyear guaranteed awards that are not at-risk due to rigorous performance conditions; (v) a “good reason” termination definition that presents windfall risks, such as definitions triggered by potential performance failures (e.g., company bankruptcy or delisting); or (vi) a liberal change in control definition combined with any single-trigger change in control benefits; and

- any other egregious practice that presents a significant risk to investors.

Other issues contributing to low say-on-pay support include:

- inadequate disclosure around changes to performance metrics, such as disclosures that fail to explain changes and how they relate to performance;

- high-target incentives for companies that are underperforming relative to their peers;

- special bonuses and mega equity grants without sufficient rationale or risk-mitigating design features; and

- insufficient shareholder outreach and disclosure, including inadequate response to compensation-related concerns raised by shareholders.

ISS is expected to release a full set of updated compensation FAQ in December 2021, which will provide robust guidance for 2022.

Glass Lewis Guidance

Glass Lewis published its 2022 Policy Guidelines [7] for the United States, which included the following compensation updates that are expected to be in effect for the 2022 proxy season:

Environmental and Social Criteria and Executive Pay

Glass Lewis indicated that a company’s particular circumstances should inform its decisions about whether and how to feature environmental and social (E&S) metrics in company compensation programs. Specifically, companies should consider factors such as their industry, size, risk profile, maturity, performance, financial condition and other relevant internal and external factors when determining whether and how to feature E&S metrics in their compensation programs.

Additionally, Glass Lewis expects companies to provide robust disclosure when they introduce E&S criteria into their executive incentive plans.

Such disclosure should include:

- how the E&S criteria align with the company’s strategy;

- the rationale for selecting specific E&S metrics;

- a description of the target-setting process and corresponding payout opportunities;

- the basis on which E&S metrics will be assessed, particularly with respect to qualitative metrics; and

- targets for quantitative E&S metrics on an ex ante basis or why the board believes it is unable to make such a disclosure.

Glass Lewis made clear that some behaviors should be regarded as baseline requirements for executive performance and therefore should not generally need to be incentivized. For example, Glass Lewis indicates that it would support shareholder challenges

to using metrics to reward executives for ethical behavior or compliance with policies and regulations.

Glass Lewis acknowledged that it generally supports company flexibility to determine whether to incorporate E&S metrics into their compensation programs, on both a general basis and with respect to short-term and long-term incentive compensation. In addition, Glass Lewis does not maintain a policy on the inclusion of such metrics.

Please see the section below titled “Consider Trends and Developments on Employee, Environmental, Social and Governance Metrics in Executive Compensation” for additional information on how environmental and social metrics are being featured in companies’ compensation plans.

Short-Term and Long-Term Incentive Awards and Front-Loaded Awards

Glass Lewis clarified the following in its 2022 Policy Guidelines:

- It may consider adjustment to GAAP financial results and the basis for such adjustments when it analyzes both short-term incentive awards and long-term incentive awards for their effectiveness at tying executive pay with performance. Clear disclosure of reconciliations between non-GAAP or bespoke metrics and GAAP figures in audited financial statements is expected.

- Threshold, target and maximum performance goals under short-term incentive plans should be disclosed, in addition to the corresponding payout levels.

- Glass Lewis may consider the total potential dilutive effect on shareholders of a front-loaded equity award in addition to considering the quantum of the award on an annualized basis.

Recommended Next Steps

Overall, companies continue to attract attention from proxy advisory firms, institutional investors, the news media, activist shareholders and other stakeholders with respect to their executive compensation programs, especially in light of recent global talent shortages and workers’ rights initiatives, the continued disproportionate impact of COVID-19 on low income workers and the Biden-Harris administration’s economic recovery plans. This year’s proxy season provides an opportunity for companies to clearly disclose the link between pay and performance and efforts to engage with shareholders about executive compensation. As always, these disclosures should explain the company’s rationale for selecting particular performance measures for performance-based pay and the mix of short-term and long-term incentives. Companies also should carefully disclose the rationale for any increases in executive compensation, emphasizing their link to specific individual and company performance.

In the year following a say-on-pay vote, proxy firms conduct a thorough review of companies whose say-on-pay approval votes fall below a certain threshold: 70% for ISS and 80% for Glass Lewis. ISS’ FAQ explain that this review involves investigating the breadth, frequency and disclosure of the compensation committee’s stakeholder engagement efforts, disclosure of specific feedback received from investors who voted against the proposal, actions taken to address the low level of support, other recent compensation actions, whether the issues raised were recurring, the company’s ownership structure and whether the proposal’s support level was less than 50%, which should elicit the most robust stakeholder engagement efforts and disclosures.

Looking ahead to 2022, companies that received say-on-pay results below the ISS and Glass Lewis thresholds should consider enhancing disclosures of their shareholder engagement efforts in 2022 and the specific actions they took to address potential shareholder concerns. Companies that fail to conduct sufficient shareholder engagement efforts and to make these disclosures may receive negative voting recommendations from proxy advisory firms on say-on-pay proposals and compensation committee member reelection.

Recommended actions for such companies include:

- Assess results of the most recent say-on-pay vote. As part of this analysis, identify which shareholders were likely the dissenting shareholders and why.

- Engage key company stakeholders by soliciting and documenting their perspectives on the company’s compensation practices. Analyze stakeholder feedback, determine recommended next steps and discuss findings with relevant internal stakeholders, such as the compensation committee and the board of directors.

- Review ISS and Glass Lewis company-specific reports and guidance to determine the reason for their vote recommendations in 2021. Carefully consider how shareholders and proxy advisory firms will react to planned compensation decisions for the remainder of the current fiscal year and recalibrate as necessary. For example, consider compensation for new hires, leadership transitions and any special one-time grants or other arrangements.

- Determine and document which changes will be made to the company’s compensation policies in response to shareholder feedback.

- Disclose specific shareholder engagement efforts and results in the 2022 proxy statement. Such disclosures should include information about the shareholders engaged, such as the number of them, their level of ownership in the company and how the company engaged them. They also should reflect actions taken in response to shareholder concerns, such as a company’s decision to offer more robust disclosures or to adjust certain compensation practices.

Companies that have not changed their compensation plans or programs in response to major shareholder concerns should consider disclosing (i) a brief description of those concerns, (ii) a statement that the concerns were reviewed and considered, and (iii) an explanation of why changes were not made.

Say-on-Golden-Parachute Proposal Results

Say-on-golden-parachute votes historically have received lower support than annual say-on-pay votes, and this trend was even stronger in 2020. Average support for golden parachute proposals dropped from 79% in average support in 2019 to 76% in average support from January 1, 2020, through December 31, 2020. [8] ISS’ negative vote recommendations were up in 2020 at 34%, from 28% in 2019. Companies should beware of including single-trigger benefits (i.e., automatic vesting upon a change in control) in their parachute proposals, given that stakeholders cite single-trigger vesting as a primary source of concern, with tax gross-ups and performance awards vesting at maximum as significant secondary concerns. In addition, companies historically have also cited excessive cash payouts as a significant secondary concern.

Equity Plan Proposal Results

Equity plans continue to be widely approved, with 1% of equity plan proposals at Russell 3000 companies receiving less than a majority vote in 2021 through September 2021. [9] Average support for 2021 equity plan proposals as of September 2021 was 89%, which was lower than the 89.4% average support observed in September 2020. [10]

Most companies garner strong equity plan proposal support from shareholders, regardless of the say-on-pay results. As of September 2021, Russell 3000 companies with less than 70% say-on-pay approval that presented an equity plan proposal still received 85% support for the equity plan proposal. [11]

The threshold number of points to receive a favorable equity plan proposal recommendation from ISS is expected to remain at 57 points for the S&P 500 model, 55 points for the Russell 3000 model and 53 points for all other Equity Plan Scorecard models. [12]

ISS also provided guidance for companies that are intending to terminate an existing equity plan (including canceling any remaining shares reserved for awards thereunder) upon shareholder approval of a new equity plan. Under such circumstances, companies may make certain disclosures to dissuade ISS from including the shares available for issuance under the existing equity plan in ISS’ Shareholder Value Transfer (SVT) analysis. [13] Such disclosures would typically be made in the company’s annual report on Form 10-K filed prior to the proxy statement that requests shareholder approval of the new equity plan and include the following:

- the total number of shares remaining available for future awards under the existing equity plan, including any impact from fungible counting provisions, that will no longer be available upon approval of the new equity plan;

- the total number of full value awards and appreciation awards outstanding, disclosed separately and including the weighted average exercise price and remaining term of appreciation awards (and for performance-based awards, the number of shares with respect to the earned and unearned portions); and

- a commitment as of the date of the securities filing that no further shares will be granted as awards under the existing equity plan unless the new equity plan is not approved by shareholders.

Other Proxy Advisory Firm Takeaways

ISS’ updated methodology for evaluating whether nonemployee director (NED) pay is excessive has taken effect and is expected to continue to apply in 2022. Under such policy, ISS may issue adverse vote recommendations for board members responsible for approving/setting NED pay. Such recommendations could occur where ISS determines there is a recurring pattern (two or more consecutive years) of excessive director pay without disclosure of a compelling rationale for those prior years or other mitigating factors.

Each year, companies should consider whether to make any updates to the compensation benchmarking peers included in ISS’ database. ISS uses these company-selected peers when it determines the peer group it will use for evaluating a company’s compensation programs. This year, ISS accepted these updates through December 3, 2021. [14]

Prepare for 2022 Pay Ratio Disclosures

The year 2022 marks the fifth year that SEC rules require companies to disclose their pay ratio, which compares the annual total compensation of the median company employee to the annual total compensation of the CEO. [15] This section helps companies prepare for the fifth year of mandatory pay ratio disclosures by considering the following:

- Can the same median employee be used this year, and, if not, what new considerations should be taken into account when identifying the median employee?

- What else do companies need to know for 2022?

Determining Whether To Use the Same Median Employee. Under Regulation S-K Item 402(u), companies only need to perform median employee calculations once every three years, unless they had a change in the employee population or compensation arrangements that could significantly affect the pay ratio. This requires companies to assess annually whether their workforce composition or compensation arrangements have materially changed.

When selecting a median employee for pay ratio disclosures about compensation in fiscal 2021, companies should consider the following:

- If the company has been using the same median employee for three years, they will need to perform median employee calculations for fiscal 2021.

- Other companies that were originally planning to feature the same median employee as last year should not do so if their employee populations or employee compensation arrangements significantly changed in the past year, including, without limitation, in response to the COVID-19 pandemic.

When selecting a median employee for pay ratio disclosures regarding fiscal 2021, companies should carefully consider how to incorporate furloughed employees, if applicable. For information on how to incorporate furloughed employees into pay ratio calculations, see our December 14, 2020, client alert “Matters to Consider for the 2021 Annual Meeting and Reporting Season.”

Additionally, companies should consider how headcount changes may impact their ability to exclude certain non-U.S. employees from their pay ratio calculation under the commonly relied upon de minimis exception in Item 402(u)(4)(ii). Therefore, companies should evaluate whether non-U.S. employees in the aggregate and by jurisdiction newly constitute or no longer constitute more than 5% of the company’s total employees.

- The de minimis exception generally allows a company to exclude non-U.S. employees when identifying their median employee, if excluded non-U.S. employees constitute 5% or less of their workforce.

- If a company’s non-U.S. employees account for 5% or less of their total employees, the company may either exclude all non-U.S. employees or include all non-U.S.

- Alternatively, if over 5% of a company’s total employees are non-U.S. employees, the company may exclude up to 5% of its total employees who are non-U.S. employees; provided that the company exclude all non-U.S. employees in a particular jurisdiction if it excludes any employees in that jurisdiction, and employees excluded under Item 402(u)’s data privacy exception count toward this limit.

- Non-U.S. jurisdictions with employees that exceed 5% of a company’s total employees may not be excluded from the pay ratio calculation under the de minimis exception, although they may be permitted to be excluded under the data privacy exception.

Even if a company uses the same median employee in its proxy statement filed in 2022 as in 2021, it must disclose that it is using the same median employee and briefly describe the basis for its reasonable belief that no change occurred that would significantly affect the pay ratio.

To determine whether a material change occurred, companies should generally continue to evaluate the following:

- How has workforce composition evolved over the past year?

- Review hiring, retention and promotion rates.

- Consider the applicability of exceptions under the pay ratio rules:

- Determine whether to incorporate employees from recent acquisitions or business combinations into the consistently applied compensation measure (CACM). For example, for the fiscal year in which a business combination or acquisition becomes effective, a company may exclude individuals that become its employees as the result of the business combination or acquisition, as long as the company discloses the approximate number of employees it is omitting and identifies the acquired business that is being excluded.

- Determine whether the de minimis exception applies within the context of the company’s 2021 workforce composition. As described above, under this exception, non-U.S. employees may be disregarded if the excluded employees account for less than 5% of the company’s total employees or if a country’s data privacy laws make a company’s reasonable efforts insufficient to comply with Item 402(u).

- Analyze how the workforce used for the CACM is distributed across the pay scale and how the distribution has changed since last year.

- How have compensation policies changed in the past year compared to the workforce composition? For example, an across-the-board bonus that benefits all employees may not materially change the pay ratio, while new special commission pay limited to a company’s sales team would do so.

Have the median employee’s circumstances changed since last year? Consider changes to the employee’s title and job responsibilities alongside any changes to the structure and amount of the employee’s compensation, factoring in the company’s broader workforce composition. Additionally, if the median employee was terminated, companies must identify a new median employee.

Although the SEC provides companies with substantial flexibility in calculating their pay ratios, to satisfy the SEC staff and engage with investors, employees and other stakeholders, companies should continue to diligently document and disclose their pay ratio methodology, analyses and rationale.

Consider Trends and Developments on Employee, Environmental, Social and Governance Metrics in Executive Compensation

EESG Metrics and Incentive Compensation Programs. Employee, environmental, social and governance (EESG) issues, [16] continue to be a high priority item for board and management teams as shareholders, customers and employees increasingly recognize EESG issues can materially impact company value. From an executive compensation perspective, EESG goals are most frequently reinforced through incentive compensation programs and clawback policies, with 57% of S&P 500 companies disclosing the use of some form of EESG metrics tied to incentive compensation. [17]

In recognition of growing expectations that companies confront EESG issues, companies are increasingly tying executive incentive compensation performance metrics to EESG factors, with the most common implementation of EESG metrics in annual incentive plans versus long-term incentive plans.

Quantitative research suggests that large public companies are spearheading implementation of EESG metrics in incentive plans with an emphasis on employee and social metrics:

- One study found that of the S&P 500 companies that incorporate EESG measures in their executive compensation programs, 28% use D&I metrics. Customer satisfaction was second at 27% and safety third at 24%. [18]

- The use of different EESG metrics is driven largely by business models and strategy, as expected, such as employee safety metrics in the energy and materials industry sectors. However, implementation of D&I metrics in incentives was prevalent across all industries, with implementation by 25% or more of the companies within seven of the 11 survey industries. [19]

- Another study found that 35% of surveyed companies (consisting of public, privately held and not-for-profit organizations) had already incorporated D&I metrics into their annual executive incentive plans and 9% had incorporated them into long-term incentive plans. [20]

- D&I prevalence in incentives is expected to continue to grow, and D&I metric prevalence increased by 19% year-over-year in S&P 500 proxy statements filed between January and March of 2021 versus 2020. [21]

- More companies are implementing EESG metrics in annual incentive plans (as opposed to long-term incentive programs), which may ultimately reach a larger population of employees. However, only a small fraction of the bonus is typically tied to achievement of EESG metrics, such as between 5% and 10% of the annual bonus. [22]

- One study found that of the S&P 500 companies that incorporate EESG metrics in incentive plans, it is most commonly incorporated as a scorecard (36%) or part of individual components (28%), with weighted metrics (20%) and modifiers (16%) being less common. [23]

- Based on a 2021 study that included publicly traded, private for-profit and nonprofit organizations, 13% of all respondents and 19% of public company respondents (21% for those with revenues of $10 billion or more), reported that they intend to add one or more formal EESG metric in 2022. [24]

The practice of linking executive compensation to achievement of EESG metrics continues to attract attention as companies grapple with implementing both qualitative and quantitative metrics. A few examples are as follows:

- McDonald’s Corporation [25] announced earlier this year that it added new metrics to its executive short-term incentive plans, which focus on human capital management to reinforce the company’s values and to hold executives accountable for advances in diversity, equity and inclusion. 15% of bonus achievement will be generally based on human capital metrics.

- Chipotle Mexican Grill, Inc. [26] is implementing EESG goals into its annual incentive program by tying executive compensation to EESG goals, which are categorized by Food & Animals, People and the Environment. For 2021, 10% of the overall annual incentive for executives will be based on achieving the new EESG factor.

- Medtronic PLC [27] announced that beginning in fiscal year 2022, its management incentive plan will include, in addition to key financial metrics, a qualitative scorecard to measure key non-financial metrics such as quality, strategic priorities, culture and inclusion, diversity, and equity. Performance against the non-financial metrics will be qualitatively evaluated by the compensation committee.

- The Proctor & Gamble, Co. [28] announced following an August 2021 meeting of its compensation and leadership development committee that an EESG factor will be applied to the 2021-22 annual incentive program for senior executives, which links pay to long-term equality and inclusion and environmental sustainability The EESG factor will serve as a modifier of the company performance factor by consisting of a multiplier between 80% and 120% depending on such EESG performance.

- Seagate Technology Holdings PLC [29] also announced following a July 2021 meeting of its compensation committee that it intends to implement EESG modifiers with respect to PSUs, which will impact PSU achievement level based on the company’s performance against both a social (gender diversity) goal and an environmental (greenhouse gas reduction) goal.

Although companies are increasingly considering how to feature EESG metrics in incentive plans, one study found that less than 3% of approximately 3,000 companies disclosed that fulfilling diversity goals was linked to a portion of their chief executives’ pay, and few companies provided details on their diversity goals or the share of compensation that is contingent on them. [30] A recent survey of general counsel and senior legal officers in large and mid-sized companies sheds some light on the disparity, finding that although on average general counsel support EESG-related activities, there is significant concern for the legal and regulatory risk of disclosing these activities. [31] In fact, the survey found that companies currently disclose only a portion of the information they track relating to EESG initiatives. [32]

Evaluate Hart-Scott-Rodino Act Implications on Executive Compensation

Officers and directors who hold at least $92 million in voting securities in their companies should consider the need to make Hart-Scott-Rodino (HSR) filings whenever they increase their holdings through an acquisition of voting securities. [33] A company’s annual preparation of its beneficial ownership table provides a regular opportunity to assess whether any of its officers or directors may be approaching an HSR filing threshold, in which case consulting HSR counsel is highly recommended. Importantly, HSR counsel also can advise when exemptions are available to obviate the need to file notifications.

An acquisition only is considered to occur when the officer or director obtains beneficial ownership of the shares. Therefore, acquisitions may include, without limitation:

- grants of fully vested shares as a component of compensation;

- the vesting or settlement of restricted stock units and performance-based restricted stock units;

- the exercise of stock options;

- open market purchases of shares; and

- the conversion of convertible non-voting securities into voting shares.

However, an officer or director would not be deemed to “acquire” shares underlying restricted stock units or performance-based restricted stock units that have not vested or shares underlying stock options that have not yet been exercised.

Generally, an “acquisition” can trigger a filing obligation. [34] For example, a filing requirement is not triggered solely by an increase in the value of an officer’s holdings from $90 million to $95 million as a result of share price appreciation. However, if such officer subsequently wanted to exercise a stock option, an HSR obligation could be triggered.

The need for a filing is triggered whenever—after the acquisition of voting securities—an officer or director’s holdings of voting securities in the company exceed an HSR filing threshold (the lowest of which is currently $92 million). Current holdings plus the proposed acquisition are considered to determine whether the threshold has been met.

Higher voting securities thresholds triggering additional HSR filings exist as well, with the next two currently fixed at $184 million and $919.9 million. [35]

If a filing is required, the individual would need to make an HSR filing and wait 30 days before completing the triggering acquisition. The filer has one year from clearance to cross the applicable acquisition threshold and the filer may make additional acquisitions for five years thereafter with no further HSR filings; provided that the filer does not cross the next HSR threshold above the level for which the notification was filed.

The Federal Trade Commission and Department of Justice have historically followed an informal “one free bite at the apple” enforcement practice when it comes to certain missed HSR filings, such that, if an officer or director inadvertently failed to make a required HSR filing, they should notify the agencies and submit a corrective filing detailing their previous acquisitions and how they plan to meet filing obligations in the future. This one “free bite” may cleanse all prior missed filings that occurred before the corrective filing.

However, the Federal Trade Commission and Department of Justice have been known to pursue enforcement actions and may impose material civil penalties of up to $43,792 per day if an executive officer or director subsequently fails to make a required HSR filing, even if such failure was truly inadvertent. [36] Therefore, officers and directors who have made a corrective filing should be especially vigilant and consult HSR regularly before a potential subsequent “acquisition” event is expected to occur.

Note Status of Pending SEC Rulemaking Relating to Clawback Policies Under Dodd-Frank

Executives are frequently paid based on how well their companies are performing. In some cases, however, the evaluation of company performance is based on inaccurate financial reporting, including objective financial targets such as revenue and overall business profits. If an error is discovered, executives may have been paid for meeting certain performance-based milestones that were not actually achieved. The pending SEC rulemaking relating to clawback policies under the Dodd-Frank Act will determine whether executives must pay back any portion of such erroneously awarded incentive-based compensation.

As explained below, members of the public are invited to comment on the proposed rule, and companies may consider taking various actions in connection with the proposed rule.

Brief History of the Clawback Rule Proposal and Comments

Congress first mandated clawbacks under Section 304 of the Sarbanes-Oxley Act of 2002 (SOX 304), which requires public companies to clawback incentive-based compensation paid to their CEOs and CFOs in the event of an accounting restatement due to material noncompliance with financial reporting requirements. [37] SOX 304 applies only to incentive-based compensation received during the 12-month period following the filing of any financial statement that the company is required to restate as a result of misconduct.

Following the financial crisis of 2007-08, Congress broadened its clawback requirements pursuant to the Dodd-Frank Act. Under Section 954 of the Dodd-Frank Act, Congress requires the SEC to adopt a rule that directs national securities exchanges to prohibit the listing of any security of a company that fails to develop and implement a clawback policy. [38] In particular, the clawback policy must provide that, in the event the company is required to prepare an accounting restatement due to material noncompliance with financial reporting requirements, the company must recover from any current or former executive officer up to three years of any incentive-based compensation that was based on the erroneous data, regardless of whether any misconduct occurred.

This clawback rule was previously proposed by the SEC in 2015. [39] In October 2021, the SEC re-opened comment on the clawback rule so that members of the public can submit further comments to the proposed rule, including the potential accounting and economic effects of the rule in light of any new developments since 2015. [40] In connection with the most recent proposal, Chair Gensler released a statement that he believes the SEC has an opportunity to strengthen the transparency and quality of corporate financial statements, as well as the accountability of corporate executives to their investors under the proposed rule. [41]

Clawback Requirements

The clawback rule, as proposed, would require national securities exchanges to establish listing standards that require public companies to adopt and comply with a clawback policy. Noncompliant companies would be subject to delisting. While this rule would affect nearly every listed company, it is important to note that, since 2015, many companies have already adopted clawback policies for governance reasons and to garner shareholder support. In particular, clawback policies are viewed favorably by ISS, and more than 90% of the companies in the S&P 500 index already have a clawback policy in place. [42] Therefore, the main focus of public comments to the proposed rule concern the substance of the SEC’s clawback policy rather than the proposed adoption or disclosure of a policy in general.

Under the proposed rule, the clawback policy would apply specifically to incentive-based compensation that is based on financial information. This means that if there is an accounting restatement due to material noncompliance with applicable financial reporting requirements, the company would have to recover, from any current or former executive officer, the excess between what they actually received and the amounts that would have been paid under the numbers in the restated financial statements. This recovery would apply to the three fiscal years preceding the date of the restatement. In other words, the clawback policy would apply

to anyone who was a Section 16 officer of the company at any time during the three-year lookback period. The clawback policy would also apply on a “no fault” basis, without regard to whether any misconduct occurred, or whether an executive officer had any responsibility related to the financial statements.

Moreover, companies must recover compensation in compliance with their clawback policy, except in the following two circumstances: (i) where it would be impracticable to do so, such as where the direct expense of enforcing recovery would exceed the amount to be recovered, and (ii) where recovery would violate home country law with respect to foreign private issuers. One common criticism to these exceptions is that they are too narrow and fail to address the application of state laws. For example, in California, labor laws prohibit the recovery of wages after they have been paid.

Finally, companies would be prohibited from indemnifying executives against the loss of any recovered compensation pursuant to the clawback policy.

In addition to adopting a clawback policy, each listed company would also be required to file the clawback policy as an exhibit to its annual report and disclose the company’s actions to enforce the clawback policy, including information regarding recoveries, such as the amounts and the names of the executives involved.

Summary of Prior Comments and Proposal Timeline

Key concerns of various commenters in 2015 included the following:

- The proposed rule applies not only to incentive-based pay tied to financial reporting measures, but also to compensation based on stock price or total shareholder return (TSR). For awards that are tied to stock price or TSR, it is unclear how to calculate the amount that would be required to be clawed

- Almost all issuers are subject to the proposed rule, including issuers that are otherwise excluded from other disclosure requirements, such as emerging growth companies and smaller reporting companies.

- Boards of directors are afforded too little discretion and would not be permitted to allow an executive to repay in installments under a payment plan.

- The three-year lookback period under the proposed rule could impact executives who have already left the company and/or served as executive officers for a very short period of

- Recovery of incentive-based compensation is on a pre-tax and not an after-tax basis, meaning the calculation does not take into account that executives may have already paid taxes on the earned amounts.

- The obligation to recover compensation is not triggered by a clear, objectively determinable date, but rather the date the company’s board of directors concludes, or reasonably should have concluded, that the company’s previously issued financial statements contain a material error, or a series of immaterial errors that in the aggregate could necessitate a restatement.

The SEC will review all comments submitted on the 2015 proposal as well as the 2021 proposal before revising and reproposing the clawback rule in the spring of 2022. Afterward, it is possible that the rule will become effective in 2022 and apply to any fiscal period that ends on or after the effective date of the new rule.

Compensation Committee Action Items

Given the concerns raised by commenters and the SEC’s renewed interest in finalizing the clawback rule, compensation committees may consider taking the following three actions for 2022:

- review the company’s existing clawback policies and procedures for compliance with the proposed clawback rule;

- ensure processes are in place for careful recordkeeping to comply with the three-year clawback period applicable to current and former executives; and

- review the compensation committee’s charter to confirm the committee is able to enforce any required clawback policy.

The complete publication, including footnotes, is available here.

Endnotes

1See Semler Brossy’s report “2021 Say on Pay & Proxy Results” (September 30, 2021). See also Semler Brossy’s report “2020 Say on Pay & Proxy Results” (September 24, 2020). Unless otherwise noted, Semler Brossy’s report is the source of pay ratio, say-on-pay and equity plan proposal statistics in this post.(go back)

2See Semler Brossy’s report “2021 Say on Pay & Proxy Results” (September 30, 2021).(go back)

3See ISS’ FAQ “United States Compensation Policies” (December 21, 2020).(go back)

4See ISS’ FAQ “U.S. Compensation Policies and the COVID-19 Pandemic” (October 15, 2020).(go back)

5See ISS’ FAQ “United States Procedures & Policies (Non-Compensation)” (October 4, 2021).(go back)

6See ISS’ FAQ “United States Compensation Policies” (December 21, 2020), FAQ Nos. 43 and 44.(go back)

7See Glass Lewis’ “2022 Policy Guidelines” (November 15, 2021).(go back)

8See Willis Towers Watson’s “U.S. Executive Pay Votes—2020 Proxy Season Review” (March 2021).(go back)

9See Semler Brossy’s report “2021 Say on Pay & Proxy Results” (September 30, 2021); see also Semler Brossy’s report “2020 Say on Pay & Proxy Results” (September 24, 2020).(go back)

10See Semler Brossy’s report “2021 Say on Pay & Proxy Results” (September 30, 2021).(go back)

11See Id.(go back)

12See ISS’s FAQ “United States Equity Compensation Plans” (December 21, 2020); ISS’ FAQ “U.S. Compensation Policies and the COVID-19 Pandemic” (October 15, 2020).(go back)

13See ISS’s FAQ “United States Equity Compensation Plans” (December 21, 2020), FAQ No. 11.(go back)

14See ISS’ article “Company Peer Group Feedback” (2021).(go back)

15Emerging growth companies, smaller reporting companies and foreign private issuers are exempt from the pay ratio disclosure requirement. Transition periods are also available for newly public companies.(go back)

16These topics are often referred to as ESG issues, but in recognition of the importance of employee-specific concerns regarding worker health and safety, pay equity and diversity in the workplace, this annual client alert adds an “E” for employee to such term. Otherwise, employee issues typically are grouped together with social issues, under the “S” in ESG.(go back)

17See Semler Brossy’s “ESG + Incentives 2021 Report (Part 1)” (June 14, 2021) (according to public disclosures filed between March 2020 and March 2021).(go back)

18See Id.(go back)

19See Semler Brossy’s “ESG + Incentives 2021 Report (Part 2)” (August 2, 2021).(go back)

20See Pearl Meyer’s “Tracking and Reporting on Diversity, Equity, and Inclusion—Executive Summary” (October 2021).(go back)

21See Semler Brossy’s “ESG + Incentives 2021 Report (Part 1)” (June 14, 2021) (according to public disclosures filed between March 2020 and March 2021).(go back)

22See Semler Brossy’s “How To Translate ESG Imperatives into Executive Compensation” (September 22, 2021).(go back)

23See Semler Brossy’s “ESG + Incentives 2021 Report (Part 3)” (September 13, 2021).(go back)

24See Pearl Meyer’s “Looking Ahead to Executive Pay Practices in 2022—Executive Summary” (November 2021).(go back)

25See McDonald’s Corporation’s “Definitive Proxy Statement on Schedule 14A” (April 8, 2021).(go back)

26See Chipotle Mexican Grill, Inc.’s “Definitive Proxy Statement on Schedule 14A” (April 5, 2021).(go back)

27See Medtronic PLC’s “Definitive Proxy Statement on Schedule 14A” (August 27, 2021).(go back)

28See Proctor & Gamble Co.’s “Definitive Proxy Statement on Schedule 14A” (August 27, 2021).(go back)

29See Seagate Technology Holdings PLC’s “Definitive Proxy Statement on Schedule 14A” (August 30, 2021).(go back)

30See The New York Times’ article by Peter Eavis “Want More Diversity? Some Experts Say Reward C.E.O.s for It” (July 14, 2020).(go back)

31See Stanford Closer Look Series “The General Counsel View of ESG Risk” by Michael J. Callahan, David F. Larcker and Brian Tayan (September 14, 2021).(go back)

32See Id.(go back)

33The HSR Act establishes a set of notification thresholds that are adjusted annually based on changes to the gross national product. The initial threshold for 2021 is $92 million and the new thresholds will be established in the first quarter of 2022.(go back)

34Note that an HSR reporting obligation also can be triggered by an increase in one’s voting power (i.e., holding or acquiring voting securities that provide more than one vote per share). HSR counsel can assist with analyzing the impact on the filing requirements.(go back)

35See the Federal Trade Commission’s “HSR Threshold Adjustments and Reportability for 2021” (February 17, 2021).(go back)

36See the Federal Trade Commission’s “FTC Fines Capital One CEO Richard Fairbank for Repeatedly Violating Antitrust Laws” (September 2, 2021).(go back)

37See 15 U.S.C. § 7243.(go back)

38See 15 U.S.C. § 78j-4(b).(go back)

39See the SEC’s proposing release “Listing Standards for Recovery of Erroneously Awarded Compensation” (July 1, 2015).(go back)

40See the SEC’s reopening release “Reopening of Comment Period for Listing Standards for Recovery of Erroneously Awarded Compensation” (October 14, 2021).(go back)

41See the SEC’s press release “SEC Reopens Comment Period for Listing Standards for Recovery of Erroneously Awarded Compensation” (October 14, 2021).(go back)

42See Equilar’s “Corporate Governance Outlook 2018” (December 2017).(go back)

Print

Print