Rich Thomas is Managing Director and Head of European Shareholder Advisory, Christopher Couvelier is a Managing Director, and Leah Friedman is an Associate at Lazard. This post is based on a Lazard memorandum by Mr. Thomas, Mr. Couvelier, Ms. Friedman, Emel Kayihan, and Lauren Ortner. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

Observations on the Global Activism Environment in 2021

U.S. Activity Leads Global Market

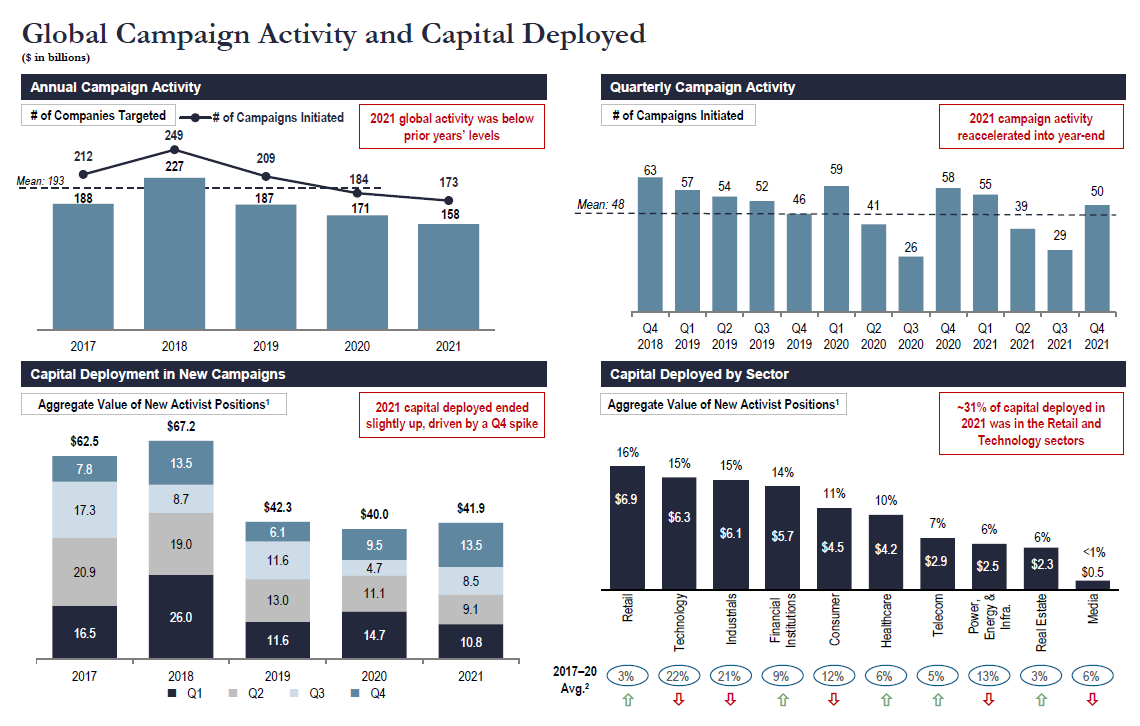

- 173 campaigns launched globally in 2021, in line with 2020’s slower pace; capital deployed by activists was also roughly flat Y-o-Y ($42bn vs. $40bn)

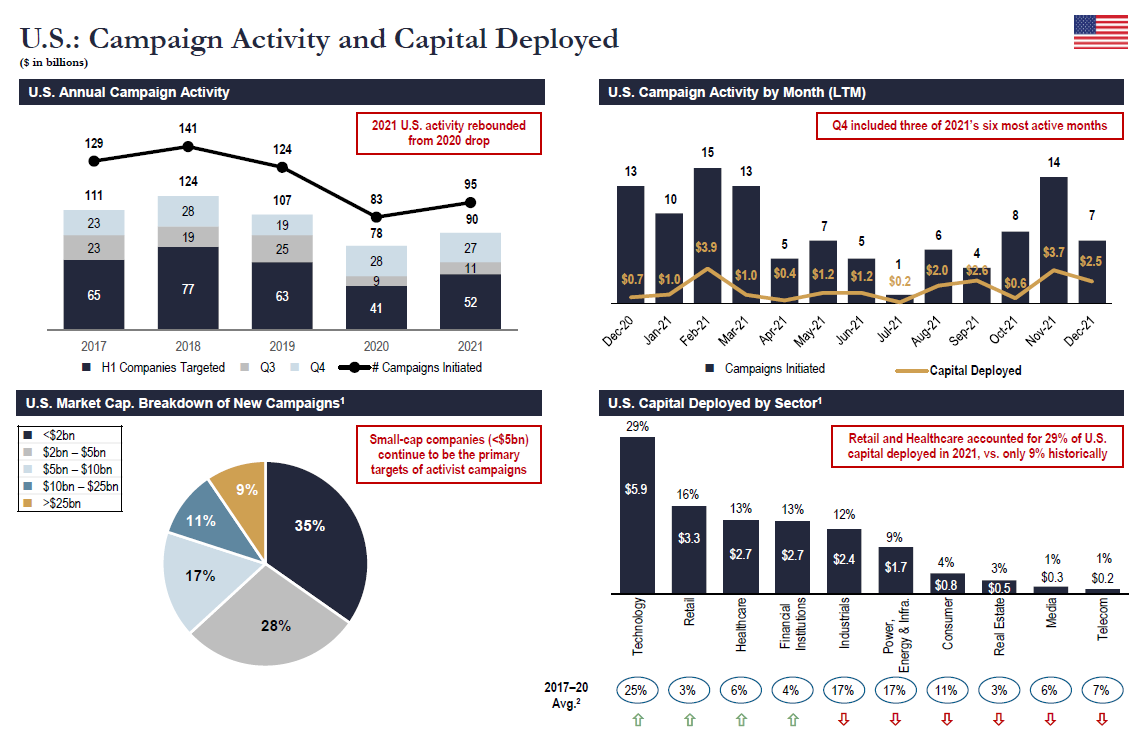

- New campaigns launched in the U.S. increased 14% Y-o-Y, and U.S. activity accounted for 55% of all global activism (up from 45% in 2020)

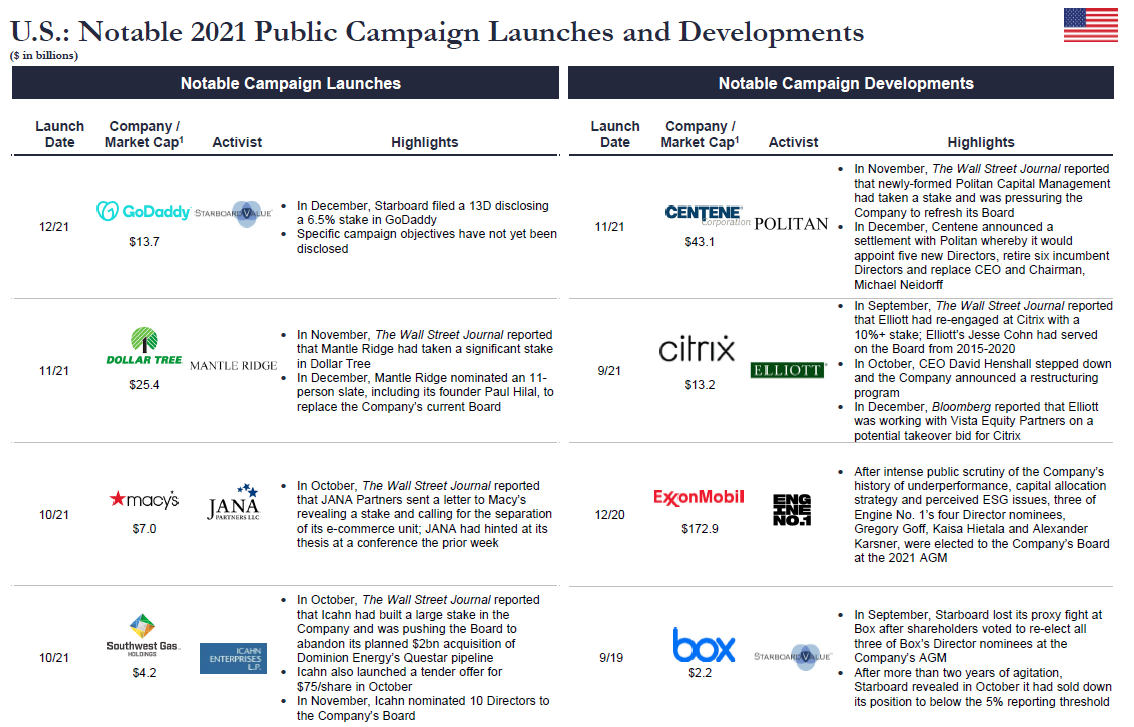

- Numerous high-profile campaigns, including several launched in prior years, reached inflection points in 2021 – including ExxonMobil becoming the

largest issuer to lose a proxy fight, Toshiba announcing a break-up following persistent activist criticism and Box prevailing in its proxy fight against

Starboard following its controversial “white squire” investment from KKR - The year culminated with a very active Q4 that saw 50 new campaigns launched, resulting in numerous live situations heading into 2022

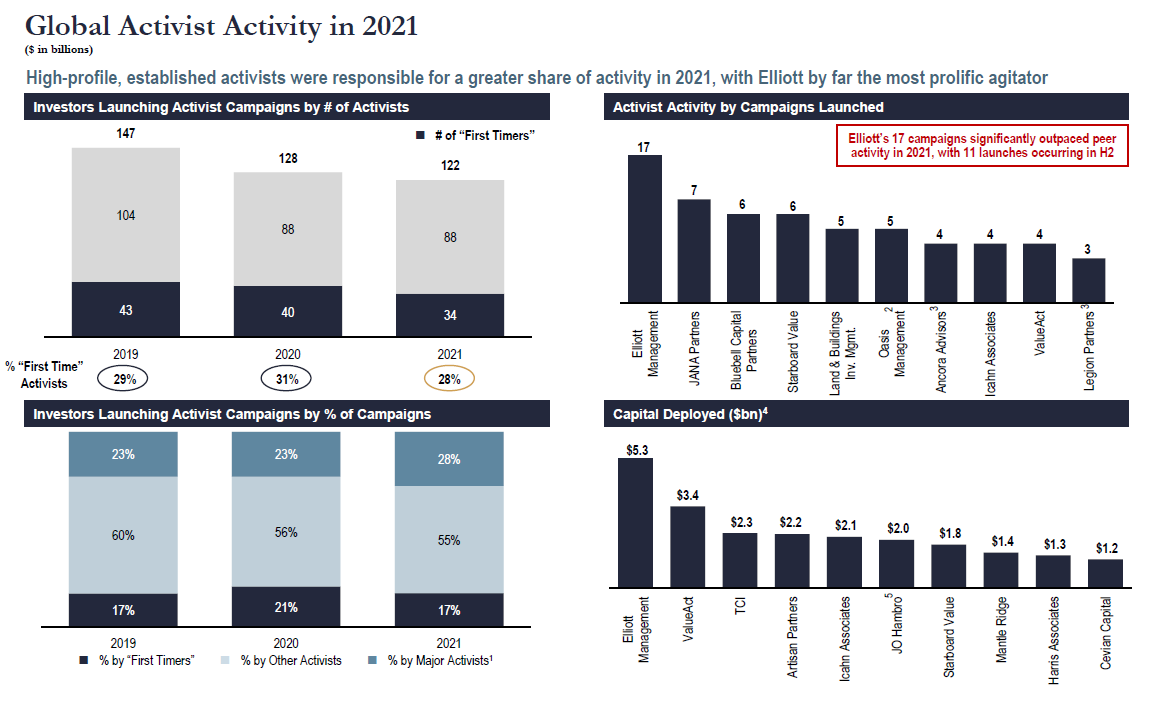

- Elliott launched 17 campaigns, its most active year since 2018, including notable situations at GSK, Duke Energy, Citrix and Willis Towers Watson

- JANA’s seven campaigns (including Treehouse and Zendesk) made it the next most prolific fund and matched JANA’s 2014 high-water mark for new launches

Resurgence of Leading Activists in Europe

- Following a record 2020, Europe registered 50 new campaigns in 2021, down 12% Y-o-Y but with a strong finish in Q4 with 16 new campaigns

- Leading large-cap activists [1] are back in Europe, waging 26% of all campaigns (up from 16% in 2020), with Elliott alone launching nine

- Accounting for 40%+ of all European campaigns, the share of activism in the UK was more than 3x the next most targeted jurisdiction

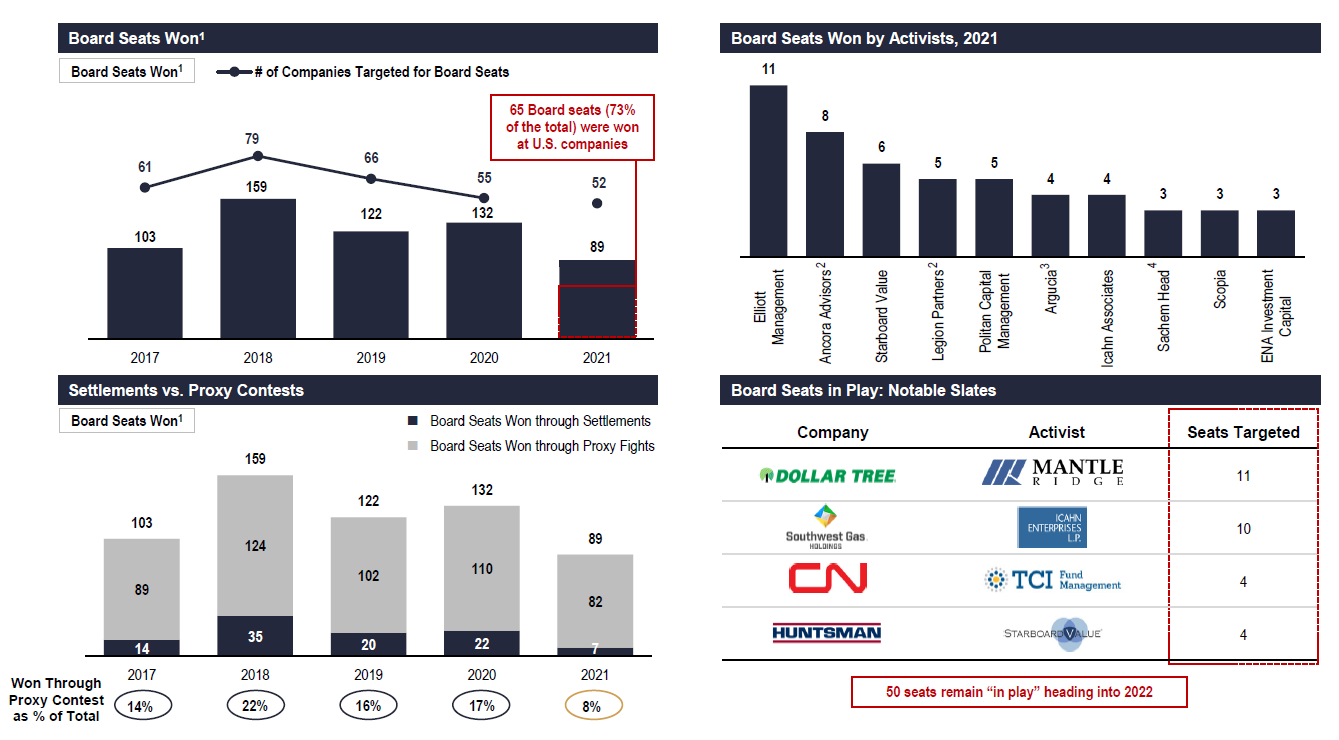

Fewer Board Seats Won, Largely via Settlement

- Although the 89 Board seats secured by activists was lower than in recent years, 50 seats remain “in play” heading into 2022, including notable potential contests at Dollar Tree (11 seats), Southwest Gas (10 seats), Canadian National (4 seats) and Huntsman (4 seats)

- Over 90% of Board seats secured by activists were through settlements, rather than final proxy votes – the highest level in recent years

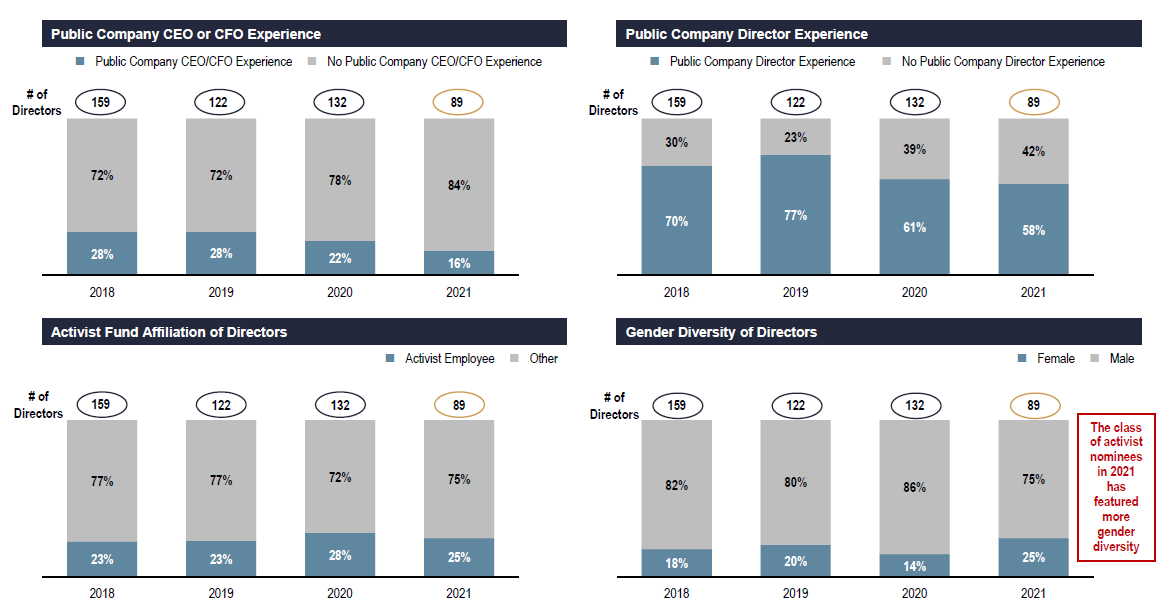

- Activist appointed Directors reflected greater gender diversity and less public company CEO/CFO and directorship experience than in prior years, suggesting activists are broadening their candidate recruitment efforts

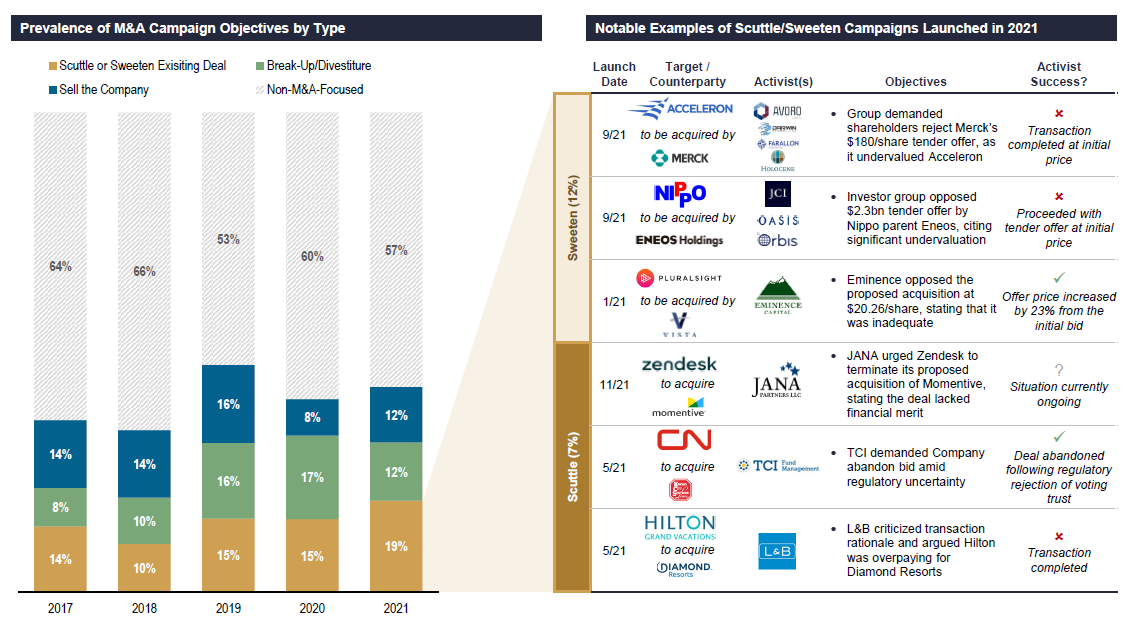

M&A-Related Activism Dominates

- 43% of activist campaigns in 2021 featured an M&A-related thesis, slightly above the multi-year average of 39%

- Opposition to announced deals was the most common M&A theme, accounting for 19% of all activist campaigns

- Within opposition campaigns, campaigns seeking sweetened transaction terms were more common and achieved higher rates of activist success than campaigns seeking to call off deals altogether

Regulatory and Voting Changes Likely to Impact Activism in 2022

- The SEC’s November adoption of a universal proxy rule is poised to lower barriers to entry for nominations from both traditional activists and other constituencies (e.g., ESG activists, current/former employees)

- While the rule does not take effect until August 31, 2022, activists could start requesting the use of universal proxies in the upcoming proxy season

- Amid increasing scrutiny of ownership concentration by the “Big 3” index funds, BlackRock’s decision to permit devolution of voting rights to its ultimate investors in certain cases may incentivize other institutions to follow suit

Escalation in ESG Activism

- 2021 saw the rapid proliferation of ESG as a key plank in activists’ platforms

- The use of ESG in campaigns ranged from fundamental strategic attacks (e.g., Third Point urging Shell to separate its renewables and refining businesses) to more ancillary “wedge” criticisms intended to curry favor with index funds and other ESG-focused investors

- ESG attacks are no longer just the domain of a small crop of ESG-first activists (Engine No. 1, Inclusive, Impactive); 2021 also saw more traditional activists incorporate ESG vectors into their campaigns

Source: FactSet, press reports and public filings as of 12/31/2021.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn; companies spun off as part of campaign process counted separately. Stakes and capital deployed may not reflect positions held through derivatives.

1Calculated as of campaign announcement date, or as of initial date of disclosure. Does not include campaigns in which the size of the activist stake is not publicly disclosed.

24-year average based on aggregate value of activist positions.

1Includes Cevian, Elliott, Glenview, Icahn Associates, JANA Partners, Land & Buildings, Pershing Square, Starboard Value, Third Point, Trian and ValueAct.

2Includes campaign launched by Oasis, Japan Catalyst and Orbis Investment Management at NIPPO.

3Includes campaign launched by Ancora Advisors, Legion Partners, Macellum Advisors and 4010 Capital at Kohl’s.

4Calculated as of campaign announcement date, or as of initial date of disclosure. Does not include campaigns in which the size of the activist stake is not publicly disclosed.

5Includes $1.7bn stake from joint campaign with Silchester International Investors, Legal & General and M&G.

Regional Trends in Global Activity

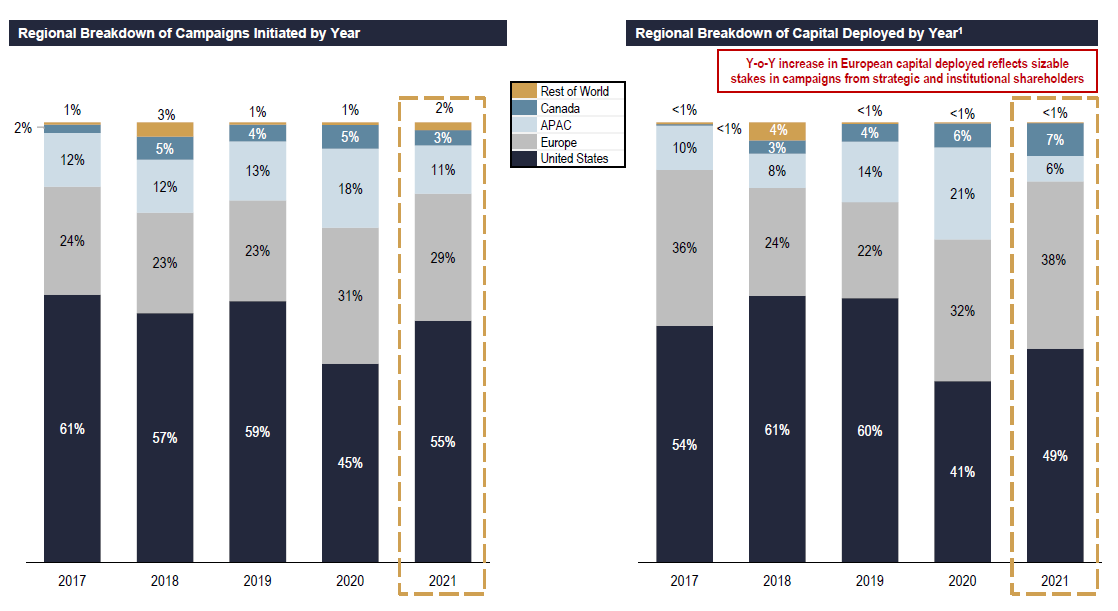

2021 U.S. activity increased from 2020, representing 55% of global campaigns and 49% of global capital deployed, but remained below historical levels as Europe has become a greater share of global activity; campaign activity in APAC and Canada stalled in H2 2021 after a strong start to the year and trailed levels seen in 2020, a period when ROW accounted for an out-sized share of global campaigns

1Calculated as of campaign announcement date, or as of initial date of disclosure. Does not include campaigns in which the size of the activist stake is not publicly disclosed.

1Calculated as of campaign announcement date, or as of initial date of disclosure; size of stake may not reflect positions held through derivatives.

1Calculated as of campaign announcement date, or as of initial date of disclosure.

24-year average based on aggregate value of activist positions.

1Calculated as of campaign announcement date, or as of initial date of disclosure.

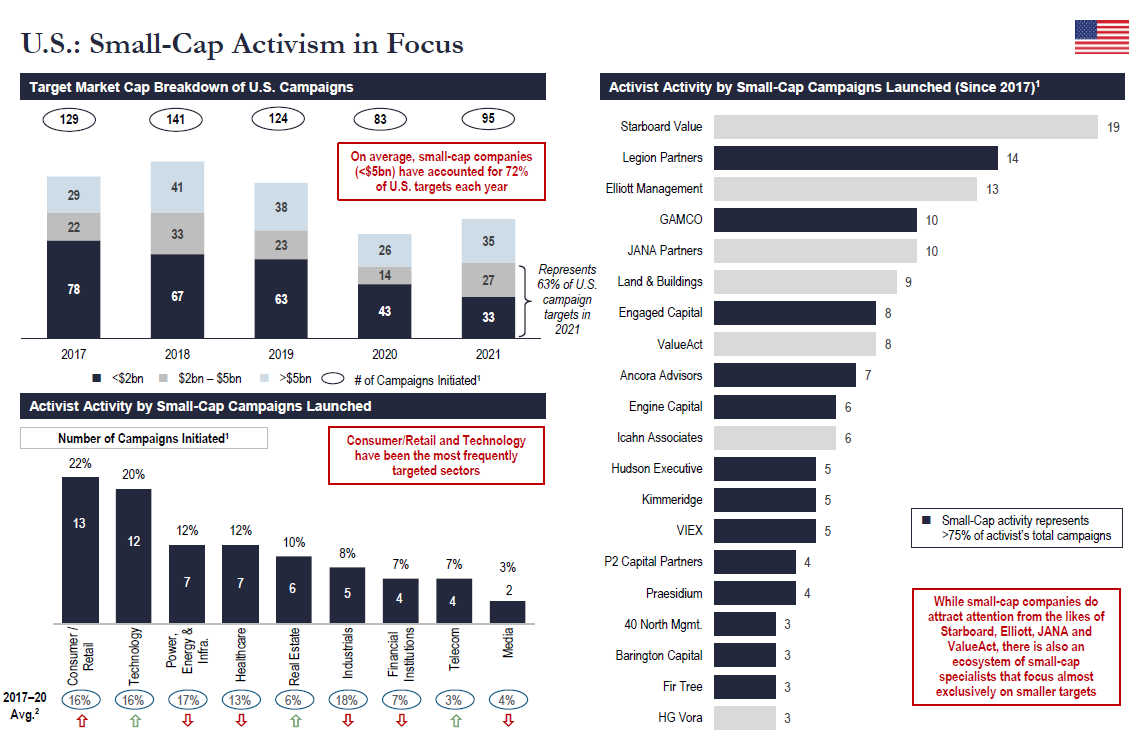

1Includes campaigns targeting U.S. companies with market capitalizations <$5bn.

24-year average based on aggregate value of activist positions.

Global Board Seats Won

89 Board seats were won by activists in 2021, below historical averages, and 92% of seats secured have been through settlements

1Represents Board seats won by activists in respective year, regardless of the year in which the campaign was initiated.

2Includes seats won by Ancora, Legion Partners, Macellum Advisors and 4010 Capital at Kohl’s.

3Includes seats won by Argucia, Sparta and Tempo Capital at Vale.

4Includes seats won by Sachem Head Capital and Clearfield Capital at Bottomline Technologies.

Profile of 2021 Activist Director Appointments

Director appointments from activists have increasingly broadened to individuals outside of the public company Executive or Director ecosystem and reflect greater attention to gender diversity

Source: FactSet, BoardEx, press reports and public filings as of 12/31/2021.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement.

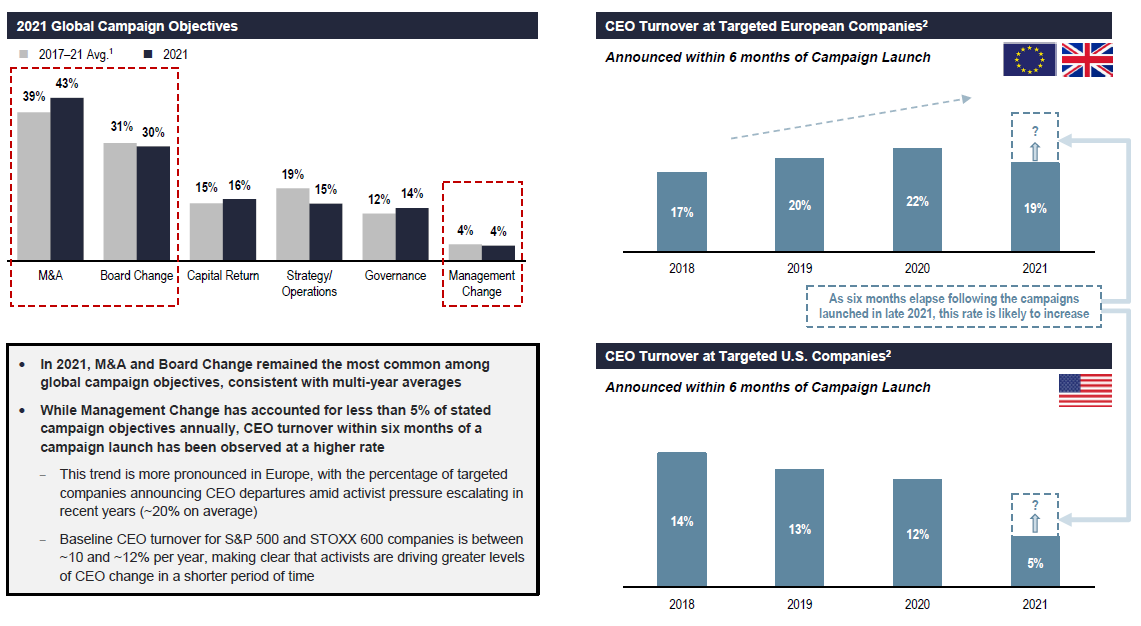

Leadership Change Following Activist Campaign Launches

CEO turnover occurs with surprising frequency following the initiation of an activist campaign, whether or not the activist publicly demands it

Source: FactSet, Spencer Stuart, press reports and public filings as of 12/31/2021.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn; companies spun off as part of campaign process counted separately. Campaigns may feature multiple objectives; as such, percentages will not equal 100% if added up.

14-year average based on aggregate counts of campaign objectives.

2Based on announcements at targeted companies, including CEO change due to the sale of the company (excludes CEO change in relation to campaigns to scuttle/sweeten

existing transactions).

Sustained Prominence of M&A-Related Campaigns Globally

The mix of M&A-related activism continued to shift towards challenging existing transactions in 2021

Source: FactSet, press reports and public filings as of 12/31/2021.

Note: All data is for campaigns conducted globally by activists at companies with market capitalizations greater than $500 million at time of campaign announcement; select campaigns with market capitalizations less than $500 million at time of announcement included during the COVID-19 pandemic-induced market downturn; companies spun off as part of campaign process counted separately.

Key Development in Focus: Potential Impacts of Universal Proxy

The SEC’s recent adoption of a universal proxy rule has the potential to significantly increase the number of contested Director elections in 2022 and beyond

Overview

- In November 2021, the SEC adopted a rule requiring parties in a contested election to use a universal proxy card listing all available candidates, allowing investors to pick and choose which combination of candidates to vote for

- The change contrasts the existing binary proxy voting regime, in which investors must choose between company and dissenting shareholder proxy cards, which list only their respective nominees

- The SEC has called this an “important aspect of shareholder democracy,” putting investors voting in person and by proxy on “equal footing”

- The new rules require Director nominees’ consent to be named and introduce a minimum solicitation requirement in which the activist must solicit the holders of shares representing at least 67% of voting power

- While the changes will not take effect until August 31, 2022, there is potential for activists to start demanding the use of universal proxies in advance of that date

- Companies may find it more difficult to reach such requests, with mandatory use of universal proxies coming so soon

Key Takeaways

- Lower barriers to entry for nominations from both traditional activists as well as former founders/CEOs, employees and upstart ESG-focused funds

- Solicitation requirement (67% of voting power) is unlikely to be a deterrent given extreme concentration of most shareholder bases

- Individual Directors, rather than just the Company, may become more direct targets of a public activist campaign

- Unclear what the eventual impact on activist election success will be

Notable SEC Developments in 2021

Recent actions from the SEC reflect an increased focus on climate change and other ESG disclosures as well as greater market transparency

Ownership Disclosure Requirements

- In June 2021, SEC Chairman Gary Gensler announced that he had requested SEC staff propose changes to the Section 13(d) beneficial ownership requirements, including the possibility of accelerating the 10-day deadline that investors currently have to notify the market of >5% ownership

- Accelerating this deadline would force activists to disclose their stakes earlier, potentially giving target companies more time to formulate a response

Environmental Disclosure Requirements

- In a July 2021 speech, Gensler discussed the SEC’s focus on meeting increasing investor demand for greater climate risk disclosure, in particular “for consistent, comparable, and decision-useful disclosures”

- In September 2021, a sample letter from the SEC highlighted the approach it may take in scrutinizing environmental disclosures by issuers, including requests for quantified disclosure of capital expenditures on climate-related projects and carbon credits/offsets

Climate & Social Proposals on the Ballot

- In November, the SEC issued guidance that should make it easier for shareholder proposals related to climate change and social issues to be included on proxy ballots

- The agency indicated companies should not exclude shareholder plans from proxy ballots simply on the basis that they may be unrelated to the business’ competencies

- Company requests to withhold proposals thought to be “inappropriately intrusive” are now to be treated with additional skepticism

Reversal of Proxy Advisor Regulation

- The SEC proposed an amendment to undo changes adopted in 2020 that had imposed stricter conditions on the ability of proxy advisors (ISS, Glass Lewis) to rely on exemptions from information and filing requirements

- Proxy advisors and investors alike expressed strong concerns about the possibility that these incremental conditions would impair the independence and timeliness of proxy voting advice

- These proposed amendments are not yet final, subject to a 30-day comment period and a final vote on adoption

Increased Transparency on Swap Positions

- In December, the SEC proposed that “major security-based swap participants” be required to disclose derivative positions representing more than 5% of a class of equity securities

- Such changes would complicate position building for activists, as they are currently not required to file a 13D disclosing a position or intent if the stake is held in derivatives without owning any common share equity

- The proposal also includes new restrictions on when corporate insiders can sell stock, including a measure to disclose repurchase plans in more detail and more frequently

The Emerging Spectrum of ESG Activism

The varying degrees of ESG-oriented demands within a campaign reflect the rapid and broad escalation of ESG in activism in 2021

- ESG activism is expanding beyond dedicated funds, like Inclusive Capital and Impactive Capital, with several blue-chip activists incorporating ESG into 2021 campaigns

Source: Press reports, public filings, ISS Governance, company websites.

Key Questions for Activism in 2022

- Will the newly adopted universal proxy rule fuel a spike in dissident nominations, and will traditional activists or other players (ESG funds, employee groups and labor unions, former founders and executives, etc.) take more advantage?

- What will the new permutations of ESG as an attack vector be, and which types of activists will deploy them?

- Will pushes for sales and split-ups return to prominence, or will scuttle/sweeten activism remain the most common M&A theme?

- Will a greater number of proxy fights arise and go to a final vote, or will negotiated settlements continue to predominate?

- Will BlackRock’s new voting policy invite other institutions to make similar changes, and what effect will this have on proxy voting?

The complete publication, including footnotes, is available here.

Endnotes

1Defined as campaign activity from Cevian, Elliott, Third Point, Trian and ValueAct.(go back)

Print

Print