Benjamin Colton is Global Head of Asset Stewardship, and Devika Kaul and Michael Younis are Vice Presidents in Asset Stewardship at State Street Global Advisors. This post is based on their SSgA memorandum.

At State Street Global Advisors, we believe climate change poses a systemic risk to all companies in our portfolios. Managing climate-related risks and opportunities is a key element in maximizing long-term risk-adjusted returns for our clients. As a result, we have a longstanding commitment to enhance investor-useful disclosure around this topic. We have encouraged our portfolio companies to report in accordance with recommendations of the Task Force for Climate-related Financial Disclosures (TCFD) [1] since we first endorsed the framework in 2017. Since then, companies have improved the quality and quantity of climate-related disclosure and investors have matured their expectations. Yet, there is more progress to be made.

This post outlines our expectations with respect to climate-related disclosure and our approach to voting and engagement on this important topic. It draws upon insights from our engagement with portfolio companies, including over 250 climate-focused engagements conducted in 2021. We will continue to use our voice and our vote to ensure investors receive the information we need to assess how companies are approaching climate-related risks and opportunities and hold them accountable on their progress.

Our Expectations for Climate-related Disclosures

With disclosure aligned with relevant Sustainability Accounting Standards Board (SASB) standards as a floor, State Street Global Advisors aims to enhance TCFD adoption across the market. Momentum around TCFD-aligned reporting is growing, evident in the increase of regulatory mandates for TCFD disclosure and the use of this framework as the basis for efforts of international standard-setting bodies. [2]

We expect all companies in our portfolios to offer public disclosures in accordance with the four pillars of the TCFD framework: Governance, Strategy, Risk Management, and Metrics and Targets.

- Governance The TCFD recommends companies describe the board’s oversight of, and management’s role in, assessing and managing climate-related risks and opportunities.

- Strategy The TCFD recommends companies describe identified climate-related risks and opportunities and the impact of these risks and opportunities on their businesses, strategy, and financial planning.

- Risk Management The TCFD recommends companies describe processes for identifying, assessing, and managing climate-related risks and describe how these processes are integrated into overall risk management.

- Metrics and Targets The TCFD recommends companies disclose metrics and targets used to assess and manage climate-related risks and opportunities.

Disclosure Expectations for Carbon-Intensive Sectors

State Street Global Advisors first articulated climate-related disclosure expectations for carbon-intensive sectors [3] in 2017. Building upon our earlier guidance, as of 2022, we expect companies in these sectors to disclose:

- Interim GHG emissions reduction targets to accompany long-term climate ambitions We expect companies in carbon-intensive sectors to adopt short- and/or medium-term green house gas (GHG) emissions reductions targets. Companies that commit to long-term ambitions, such as net-zero by 2050, are expected to accompany these commitments with interim GHG targets to provide accountability.

- Discussion of impacts of scenario-planning on strategy and financial planning We expect companies, especially in carbon-intensive sectors, to conduct climate scenario-planning exercises to better understand and position themselves to respond to climate-related risks and capitalize on opportunities. We encourage companies to demonstrate the link between scenario-planning and strategic outcomes as opposed to an isolated exercise. As recommended by the TCFD, we encourage companies to take multiple scenarios into account. While State Street Global Advisors is not prescriptive on scenario selection, we believe it is best practice to consider a scenario that limits global temperature increase to well-below 2°C consistent with the Paris Agreement [4] or a scenario aligned with a net-zero by 2050 pathway.

- Use of carbon pricing in capital allocation decisions We expect companies in carbon-intensive sectors to incorporate climate considerations into capital allocation decisions, such as for existing or planned projects, portfolio decisions, and financial planning. Companies are establishing a price for carbon (also known as a “carbon price”) to capture and monetize the costs/impacts of their activities as they relate to climate change. It allows for companies to express and incorporate the cost of operations, compliance, and future regulations into strategic decision-making. We evaluate if companies take forecasted carbon pricing into account for project assessment and encourage disclosure of the average and/or range of carbon price assumptions used.

- Scope 1, 2, and material categories of Scope 3 GHG emissions We expect companies in carbon-intensive sectors to disclose Scope 1, Scope 2, and material categories of Scope 3 emissions. We consider it best practice for companies to obtain independent assurance of GHG emissions reporting. We recognize the inherent challenges associated with Scope 3 GHG emissions reporting, including data availability and uncertainty, double counting, and methodological challenges. However, Scope 3 emissions can account for the largest portion of a company’s footprint—especially in certain carbon-intensive sectors—and is an area of increased focus for investors. Therefore, we expect companies to report Scope 3 emissions estimates, focusing on material categories [5] of Scope 3 emissions that contribute most significantly to the overall footprint. We also encourage companies to assess and begin implementing actions to achieve incremental Scope 3 emissions reductions where feasible.

Disclosure Expectations for Effective Climate Transition Plans

State Street Global Advisors is a signatory to the Net Zero Asset Managers initiative, reflecting our commitment as long-term stewards of capital to help companies effectively plan for the low-carbon transition and to hold companies accountable on progress. To that end, we believe it is our responsibility to provide portfolio companies with clarity on our expectations for effective climate transition plan disclosure.

We recognize that there is no one-size-fits-all approach to reaching net-zero and that climate-related risks and opportunities can be highly nuanced across and within industries. As a first step, our expectations serve to provide transparency on the core criteria we expect companies to address when developing climate transition plans. Further information on our approach to developing these expectations can be found here.

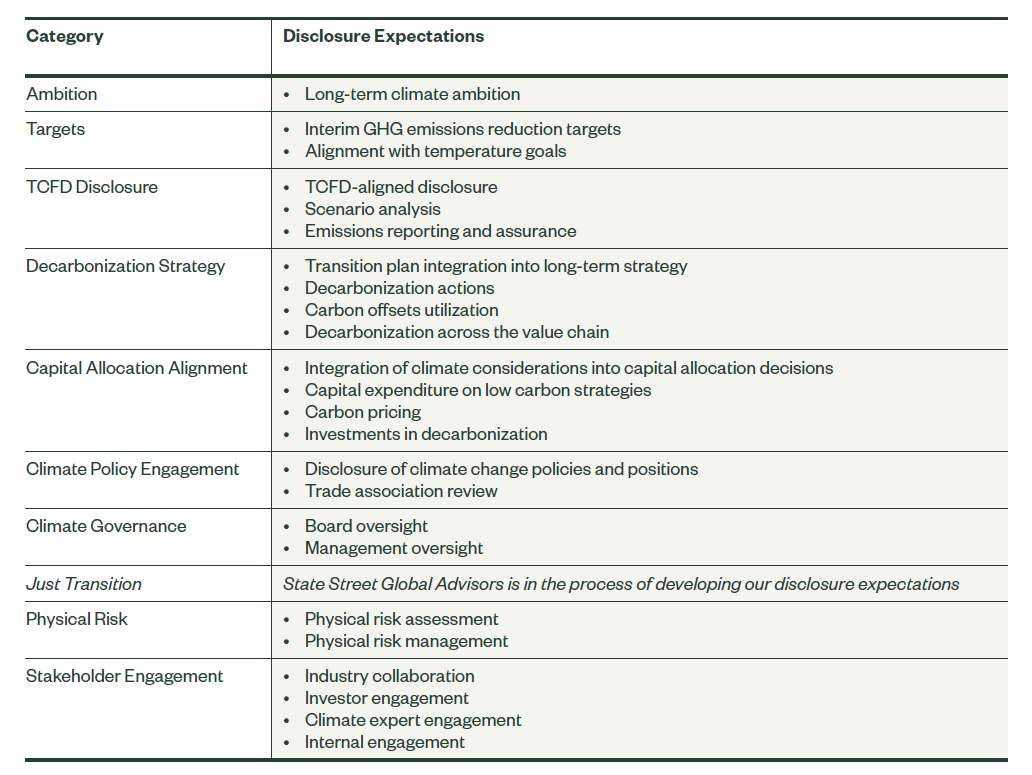

Figure 1. Key Areas of Climate Transition Disclosure

Voting

Incorporating Our Expectations into our Proxy Voting Policies

As is typical across ESG issues, we will first approach our climate-related disclosure expectations outlined above with companies through engagements, focusing on companies and industries with the greatest risk and opportunity. If we encounter laggards that are not making sufficient progress regarding climate-related disclosure as a result of our engagements, we will consider taking action using our votes, either by supporting relevant shareholder proposals or voting against directors at an upcoming shareholder meeting.

Director Elections

Climate-related Disclosure Expectations

State Street Global Advisors has publicly supported the global regulatory efforts to establish a mandatory baseline of climate risk disclosures for all companies. Until these consistent disclosure standards are established, we find that the TCFD framework is the most effective framework by which companies can develop strategies to plan for climate-related risks and make their businesses more resilient to the impacts of climate change. As such, State Street Global Advisors has implemented the following proxy voting guidelines:

- Starting in the 2022 proxy season, we will begin taking voting action against companies in the S&P 500, S&P/TSX Composite, FTSE 350, STOXX 600, and ASX 100 indices if companies fails to provide sufficient disclosure in accordance with the TCFD framework, including:

- Board oversight of climate-related risks and opportunities

- Total Scope 1 and Scope 2 GHG emissions

- Targets for reducing GHG emissions

- If a company fails to adequately meet our expectations, State Street Global Advisors may vote against the independent board leader. We view this policy as a natural escalation of our previously-stated expectations on climate-related disclosure and history of proxy voting and engagement on the TCFD framework. We expect to continue to expand this policy in the coming years.

Climate Transition Plan Disclosure Expectations for Significant Emitters

As a complement to this 2022 director voting policy, we will launch an engagement campaign on climate transition plan disclosure targeting significant emitters in carbon-intensive sectors. Starting in 2023, we will hold directors accountable if companies fail to show adequate progress on meeting our climate transition disclosure expectations (highlighted in Figure 1). Through our engagements, we will aim to better understand climate transition plans and strategies, and gain insight on each company’s unique set of climate-related risks and strategic opportunities presented by the transition.

Shareholder Proposals

Climate-related Shareholder Proposals

We evaluate climate-related proposals on a case-by-case basis taking several factors into consideration, including, but not limited to: the reasonableness of the proposal, alignment with the TCFD framework and the SASB standards where relevant, emergent market and industry trends, peer performance, and dialogues with company management, boards, and other stakeholders. When analyzing climate-related proposals at companies in carbon-intensive sectors, we will consider alignment with our disclosure expectations outlined above.

Climate-focused Corporate Political Activity Shareholder Proposals

Below we outline our approach to assessing climate-related lobbying proposals specifically, given the growing prevalence of these proposals in recent years. These proposals request that the company reports on how its lobbying activities, including through membership in trade associations, align with the goals of the Paris Agreement. State Street Global Advisors evaluates the following when considering such a proposal:

- The board’s role in overseeing the company’s participation in the political process, including membership in trade associations.

- If the company performed a gap analysis of its stated positions on climate change versus those of its trade associations.

- If the company disclosed a list of its trade association memberships.

Engagements

Incorporating Our Expectations into Conversations with Companies

Climate continues to be a core stewardship priority for State Street Global Advisors. In 2021, we conducted over 250 climate-focused engagements, a 72% increase compared to the previous year, reflecting our increased focus on this topic. During engagement, we may ask companies one or more of the questions outlined below. For more information on our climate engagement efforts, see our Annual Climate Stewardship Review.

Governance

- Where is the responsibility for climate oversight housed at the board level? How frequently does the board discuss the topic of climate change?

- How is climate—and other ESG—experience considered in the board refreshment process?

- How is the board incorporating key sustainability drivers into the performance evaluation of management?

- How does management and the board utilize external expertise to stay abreast of the emerging areas of climate?

Strategy

- How does the company integrate climate considerations into business strategy and financial planning?

- What actions are being considered to support efforts to reduce GHG emissions across the value chain, such as with suppliers and customers?

- Where does the company identify the greatest opportunities for decarbonization in the short- and medium-term?

- How does the company engage employees on the development and integration of climate efforts into corporate culture and strategy?

- For relevant industries, how does the company consider carbon pricing in project assessment and portfolio decisions?

Risk Management

- How does the company consider climate-related risks as part of overall risk management? What is the board’s role?

- Has the company assessed the potential impacts of physical risk on its assets and operations?

- How does the company manage climate-related policy risks? Has the company conducted an assessment of its stated climate positions versus those of its trade and industry associations?

- As investor interest in the intersection of environmental and social issues grows, how is the company considering emerging topics such as just transition?

Metrics and Targets

- What metrics does the company utilize to track progress on achieving its climate goals?

- What sources of GHG emissions contribute most significantly to the company’s carbon footprint?

- What are the biggest challenges facing the company in achieving its GHG emissions reduction targets?

- What are the company’s perspectives on using a lower hurdle rate or IRR for low-carbon projects?

Conclusion

We encourage companies in our portfolios to align their climate-related disclosures and practices with our expectations and at the same time we endeavor to communicate these expectations clearly to the market.

Endnotes

1https://www.fsb-tcfd.org/publications/(go back)

2https://www.ifrs.org/news-and-events/news/2021/11/ifrs-foundation-announces-issb-consolidation-with-cdsb-vrf-publication-of-prototypes/(go back)

3Oil and gas, utilities and mining sectors(go back)

4Article Two of the 2015 Paris Agreement commits parties to “holding the increasing in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels.”(go back)

5As defined by the GHG Protocol’s Corporate Value Chain (Scope 3) Accounting and Reporting Standard(go back)

Print

Print