Dorothy Flynn is President of Corporate Issuer Solutions and Keir Gumbs is Corporate Vice President and Chief Legal Officer at Broadridge. This post is based on their Broadridge memorandum.

On December 14, 2021, Broadridge hosted its annual Corporate Governance Outlook event. The purpose of the event was to bring together corporate governance industry experts and thought leaders to discuss regulatory trends poised to shape the landscape in 2022 and beyond.

Below is a summary of the topics and insights they shared.

Universal Proxy Rulemaking

Adopted in 2021, the Universal Proxy is designed to replicate the same voting options that are available to shareholders at in-person meetings. Before the rule, shareholders who voted by proxy could only vote for a slate of board nominees (either management or dissident). Once effective, they will be able to vote for any combination of nominees they believe serve their interests (just like at an in-person meeting). It’s unclear how this will ultimately impact proxy contests, but it looks like a clear win for shareholder access and democracy from the perspective of many retail and institutional investors.

At the same time, there are concerns that have been expressed by corporate issuers and proxy soliciting firms that the new rules may result in an increase in proxy contests. This is something that we’ll monitor as the rules become effective in the Fall of 2022.

Proxy Advisor Rules

In 2020, the SEC adopted several amendments to proxy rules relating to proxy advisory firms. Believing that proxy advisors wield outsized influence, the rules were designed to improve disclosure and mitigate potential conflicts of interest.

Since the rule adoption, however, many investors worried that the rules are raising the costs of proxy advisory services and potentially impacting their independence. Now the SEC has proposed amendments that would rescind some of the rules, namely those requiring proxy advisors to provide advance notice to issuers and give issuers an opportunity to respond.

“Proxy advisors play an important role,” said Ray Cameron, “and their independence is critical.” The other panelists agreed that any rule changes should aim to ensure proxy advisory remains independent and their services remain cost effective.

Shareholder Proposals

The SEC recently rescinded several staff bulletins issued under the previous administration (Staff Legal Bulletin Nos. 14I, 14J and 14K). The bulletins provided guidance on the “ordinary business exception,” and the “economic relevance exception.” These exceptions enable issuers to exclude shareholder proposals that seek to guide the routine functioning of an organization or that will impact less than five percent of an organization’s business. The bulletin revisions will make it more difficult for companies to exclude shareholder proposals from their proxy materials, especially if the proposals raise important social policy considerations.

The net result: Expect to see significantly more shareholder proposals, especially those surrounding environmental and social issues.

Proxy Voting Choice Initiative (aka “Pass-Through Voting”)

BlackRock recently announced plans to give its large investors more options with respect to investments managed on their behalf by BlackRock. Among other things, investors will be able to vote according to their own policy, submit their votes using their own infrastructure, or continue to rely on BlackRock to vote. The change will apply to approximately $2 trillion in investments tied to index-tracking assets that BlackRock manages in institutional accounts. This represents about 40% of roughly $4.8 trillion of indexed equities managed by BlackRock.

Among other things, change is intended to promote shareholder democracy.

Since this initiative was announced, some issuers have raised serious questions related to the potential costs of implementation. In addition, issuers have expressed concerns about losing visibility into who is voting their proxies and with whom they should be engaging during the proxy season.

While this will certainly introduce some uncertainty, many companies already engage with many of the same investors who will take advantage of this new ability. So hopefully the impact will be minimal.

End-To-End Vote Confirmation

It’s been a question in the industry for a long time: How do we provide assurance that votes are cast as instructed and accurately tabulated? In other words, how can investors have confidence in the “plumbing” of the proxy global proxy infrastructure?

Broadridge has been a leader in this arena, participating in a pilot program that gave 101 issuers end-to-end confirmation in 2021. In 2022, Broadridge will provide end-to-end confirmation to all 2,000 issuers for which it serves as tabulator.

“This has been the holy grail for some time—and now it’s looking to be more like a reality,” said Borrus.

Importantly, end-to-end vote confirmation doesn’t yet extend to proxy contests because proxy contests involve two different proxies and, usually, two different tabulators. This makes vote reconciliation and end-to-end vote confirmation significantly more difficult. Industry leaders, however, are working together to streamline the process, and we should eventually see end-to-end confirmation even for contested proxies.

ESG Update

Looking ahead to 2022, everyone seems to be focused on environmental, social, and governance (ESG) issues. Keir Gumbs highlighted two hotspots worth keeping an eye on.

Harmonizing standards. In the past, we’ve had an alphabet soup of standards, including SASB, CDP, GRI, MSCI, and TCFD. But now we’re inching toward a consolidation of these standards. In November 2021, the IFRS announced the creation of the International Sustainability Standards Board (ISSB), which marks the first international accounting standards for ESG. According to the press release, the ISSB aims to “deliver a comprehensive global baseline of sustainability-related disclosure standards.” This could help drastically simplify reporting for issuers and may even inform the SEC’s likely rulemaking around ESG disclosure.

SEC Rulemaking. The SEC agenda is heavily focused on climate change, human capital, and cybersecurity. Don’t be surprised to see new rules announced in 2022. The good news is that many issuers on the S&P 500 are at least releasing an annual corporate sustainability report. The panelists expect to see more of the Russel 1000 step up ESG disclosure and reporting next year.

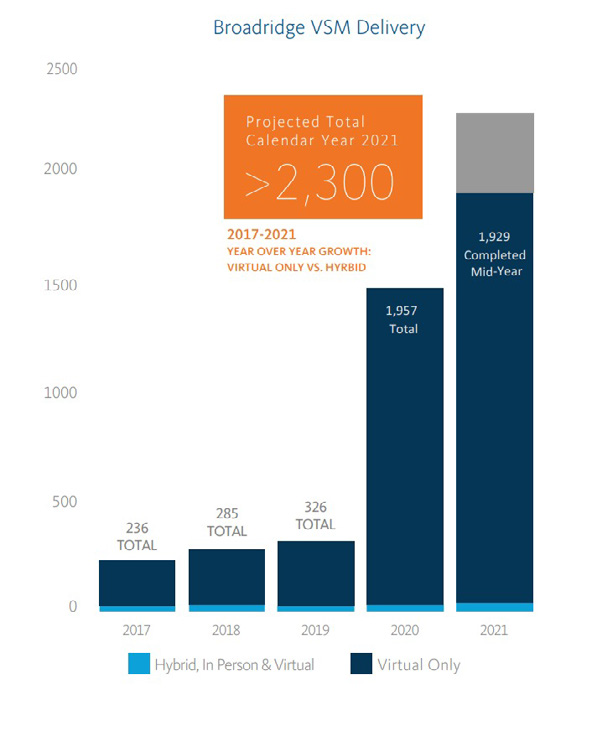

Broadridge VSM

Broadridge continues to see growth in the number of virtual shareholder meetings (VSM), even as many areas return to in-person work. Broadridge hosted 1,929 VSMs in the first half of 2021. Issuer and shareholder needs continue to evolve and Broadridge is committed to enhancing its VSM solutions now and in the future.

The prevailing COVID environment has been a key driver of the recent transition to virtual meetings, however, other factors are surfacing, indicating that virtual meetings will likely be standard practice. Some of those trends pushing VSM adoption include growing desire to reduce the carbon impact of annual meetings from meeting-related travel, the increased ability of shareholders to attend multiple meetings when companies use the virtual meeting format, improvements in virtual meeting governance, technology, increasing comfort with remote participation in governance meetings, and the simplicity of virtual meetings.

Print

Print