Rodolfo Araujo is Senior Managing Director, Marie Clara Buellingen is Senior Director, and Garrett Muzikowski is Director at FTI Consulting. This post is based on their FTI memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); Companies Should Maximize Shareholder Welfare Not Market Value by Oliver Hart and Luigi Zingales (discussed on the Forum here); and Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Max M. Schanzenbach and Robert H. Sitkoff (discussed on the Forum here).

In 2021, we saw investors scaling up to hold boards accountable for ESG oversight. Now, simple reporting isn’t enough — investors demand action.

From an investor’s perspective, a company’s directors are expected to proactively handle the governance of the corporation as well as govern risks and opportunities related to environmental and social (E&S) issues. In 2021, we saw the scales tip on holding boards accountable for oversight when it came to environmental, social and governance issues, known collectively as ESG. Such a perspective explains why directors are facing investor pressure on E&S, in particular.

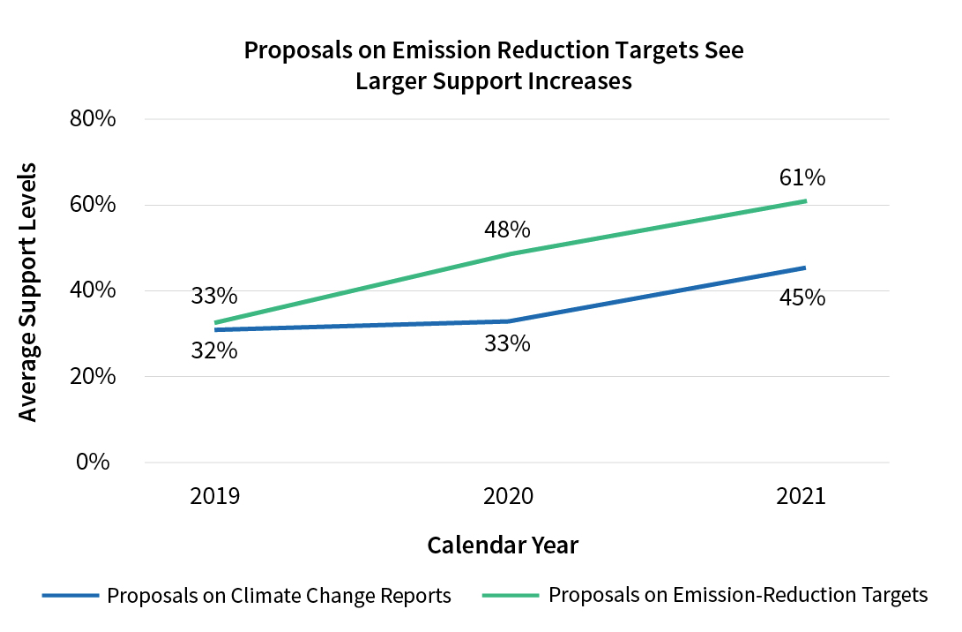

This year might bring another shift of similar scale. While climate change has been a major focus since the 2016 Paris Agreement, our analysis below of shareholder proposals filed to date for 2022 indicates that investors are moving beyond climate change reporting to demanding companies set challenging, realistic, and science-based targets to reduce their greenhouse gas (GHG) emissions.

For companies, the message from investors is clear: If you simply track your emissions but do not have a credible and detailed strategy on climate risk mitigation, you are at risk of shareholder activism.

Shifting Investor Expectations on Climate Disclosure

Since 2016, investors have pushed for companies to report on climate change and its impact on the business — whether it be through an annual report, in-depth scenario analyses, or a report on specific risks. In the absence of SEC regulations, companies could exercise considerable latitude in what they would disclose with regard to climate risk. In the case of the most widely adopted framework by the Task Force on Climate-related Financial Disclosures (TCFD), this would mean reporting on the key themes: climate change governance, strategy, risk management, as well as metrics and targets. Despite a range of net-zero commitments from companies, stringent targets were not commonly included in their disclosures. However, this is expected to change in 2022 under highly anticipated SEC requirements that will likely incorporate core TCFD tenants.

An early look at proposals filed so far for the upcoming 2022 annual meetings indicates a large shift in investor expectations. While they may have been satisfied with general emissions disclosures last year, the 2022 proposals suggest a greater push for quantitative metrics that can inform decision-making, as well as emission-reduction targets for Scope 1-3 emissions.

*2019 to 2021 data reflect proposals filed at annual meetings during that calendar year. 2022 data only reflect proposals filed as of February 15, 2022, for annual meetings occurring in 2022. As a result, 2022 numbers may increase as more proposals are filed. Source: ISS Analytics

It remains to be seen how many of these proposals will be omitted or withdrawn. However, the new SEC guidance may lead to fewer omissions. The deepening culture around shareholder engagement may also result in additional withdrawals after successful engagement between issuers and shareholders.

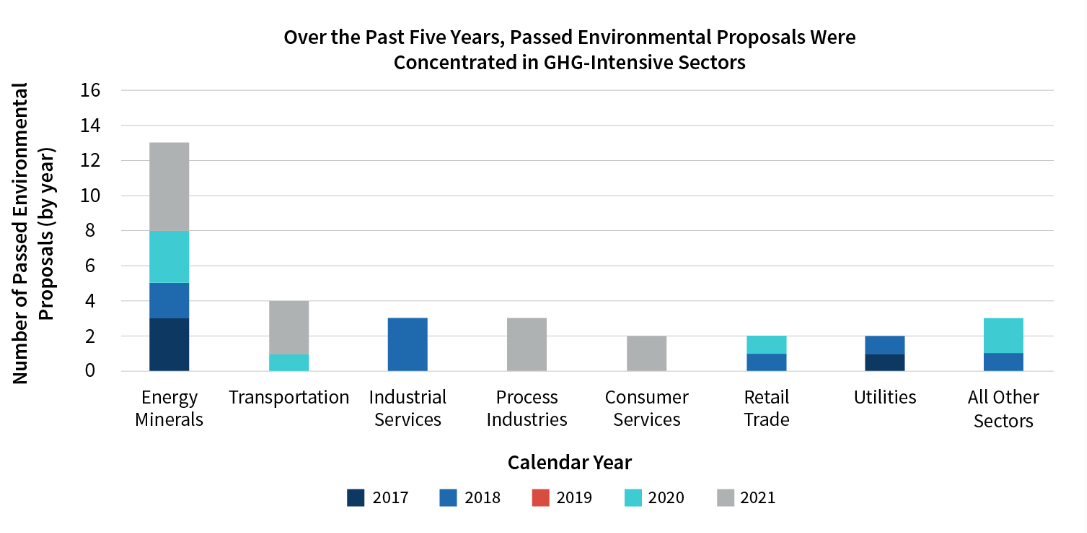

While climate risk is spread out across sectors, a company’s role in the transition to a low-carbon economy can vary. Case in point, environmental proposals in GHG-intensive sectors generally have the highest chances of passing.

*While many environmental shareholder proposals received significant support in 2019, none of the shareholder proposals that made it to the ballot passed. Source: ISS Analytics

Changing Regulatory Environment on Climate Disclosure

This shift is happening against the backdrop of anticipated regulatory changes that will require mandatory climate risk reporting. SEC Chair Gary Gensler emphasized in mid-February the importance of “requiring companies to assess climate risks & collect & publicly disclose relevant metrics for the first time & giving investors info they’ve needed for years.”

A significant sticking point will be whether companies will be required to not only report on GHG emissions within their direct control (Scope 1 and 2 emissions), but also on emissions resulting from their products and services (Scope 3 emissions). Depending on where a company operates, it may already be required to disclose Scope 1-3 emissions, as is the case under California’s Climate Corporate Accountability Act (CCAA) for companies with over $1 billion in revenue.

In addition, the SEC issued a Staff Guidance in November that makes it harder for companies to exclude certain shareholder proposals. This guidance change will likely result in more ESG-related shareholder proposals in general — and in more proposals related to climate change, specifically — making it to the ballot and going to a vote. Companies should take notice: Proposals that make it to a vote are increasingly likely to pass.

Source: ISS Analytics

Companies Need More Than an ESG Strategy

Investors increasingly expect companies to adhere to the gold standard of emission-reduction goals as set out by the Science Based Targets initiative (SBTi). These expectations will likely apply to organizations that have already made a net-zero commitment and morph into broader market expectations for all portfolio companies. Businesses that have recently elevated their climate change disclosures should nevertheless assess current disclosures to make sure they meet evolving market expectations this year and beyond.

Consider Costco’s January 2022 annual general meeting (AGM), which provided early insights into how investors have sharpened their focus on emission-reduction targets beyond programmatic reporting on climate action. A shareholder proposal submitted by Green Century Capital Management featured a resolved clause that states, “Shareholders request that Costco adopt short, medium, and long-term science-based greenhouse gas emissions reduction targets, inclusive of emissions from its full value chain, in order to achieve net-zero emissions by 2050 or sooner and to effectuate appropriate emissions reductions prior to 2030.” The proposal passed with an overwhelming 70% of shareholder support. Such a level of approval would not be possible without broad market support, particularly from large institutional investors. The lack of challenging reduction targets aligned to the SBTi likely drove Costco’s shareholders to approve Green Century’s proposal.

A whopping 70% support for emission-reduction targets at the 2022 Costco AGM suggests a detailed “Climate Action Plan” may not be enough.

In comparison, after facing a climate-related proposal from veteran ESG-player Trillium Asset Management in 2021, Costco was able to meet shareholder expectations by releasing a 10-part climate action plan. It includes metrics such as Scope 1 and 2 emissions, along with concrete steps on how the company plans to reduce emissions. Despite a lack of science-based targets, Costco’s action plan seemed to satisfy Trillium, which withdrew its climate proposal after the plan was released.

Investors Want to See Companies Walk the Talk

At the onset of the 2022 proxy season, climate action appeared to be the top ESG priority. To prevent shareholder dissent, companies should proactively set quantifiable emission-reduction targets or, at a minimum, communicate to shareholders when they will be able to set such targets. Climate risk should be a priority for all companies, but that should not minimize the importance of other ESG topics, as shareholders will continue to hold directors accountable for the broader governance of environmental and social issues.

A message for boards and management: Use quantifiable emission-reduction targets to demonstrate proactive management of climate risks and opportunities now.

Large institutional investors’ focus on improving ESG management has offered a platform for traditional activists to advocate for board refreshment. Engine No. 1’s successful 2021 campaign at ExxonMobil is a high-profile example related to climate risk. Carl Icahn’s proxy fight at McDonald’s — accusing the company of inhumane pork sourcing practices — is another recent example that will play out in the 2022 proxy season.

Such ESG-focused proxy fights may become more common in the future. As universal proxy is implemented for AGMs taking place after August 31 this year, it will become cheaper for dissident shareholders to nominate directors. If ESG activism campaigns continue to receive significant shareholder support, the nomination of directors may also become an attractive tool for smaller, responsibly focused investors to push their agendas.

Together, universal proxy and evolving investor expectations only further heighten the importance of strong governance of E&S issues. With climate change as a case in point, 2022 is shaping up to be the year where investors want to see corporate action behind ESG commitments.

Print

Print