Maria Castañón Moats is Leader, Paul DeNicola is Principal, and Catie Hall is Director of the Governance Insights Center, PricewaterhouseCoopers LLP. This post is based on their PwC memorandum.

Board and committee assessments are a critical part of driving continuous improvement in board performance. A well-executed assessment can help provide real insights into how a board operates and how directors work with one another. It will include both quantitative and qualitative aspects. And it leads to actionable takeaways that can make a real difference.

In our 2021 Annual Corporate Directors Survey, 47% of directors indicated that at least one of their peers should be replaced. Having a robust assessment framework shouldn’t be viewed as a way to get rid of underperformers. Rather, it should be viewed as a means to provide constructive feedback as part of the board’s continuous improvement process. Many directors tend to view assessments in a “check-the-box” manner and believe it’s difficult to be frank. [1]

So what are the leading practices? And, how are boards using assessments to become more efficient, evaluate gaps in board composition and improve their oversight of management?

What is the purpose of the assessment?

From the start, it’s essential for directors to agree on what they want to address in the assessment process. Some of the most common areas of focus include:

- Evaluating board composition. The makeup of the board is critical. Boards need a mix of skills, expertise and experience to effectively oversee the company. Understanding any gaps is the first step to ensuring optimal board composition. Looking at board composition also provides an opportunity to address director underperformance and gives the board a perspective on where they may want to make changes.

- Setting and monitoring board culture. Assessments are a great opportunity to look at board culture and dynamics. Does the culture encourage open discussion and disagreement? Does it promote continuous improvement, open feedback and coaching? Does it promote collaboration and information sharing? Or does it have directors who dominate discussions, closing off other points of view?

- Improving board practices. Boards may also use assessments to analyze the quality and quantity of materials they receive from management, evaluate their governance practices or consider process changes to make going forward. Assessments can be used to determine if boards are using their time during meetings on the right topics and whether their agendas are balanced to include strategic, compliance and tactical topics.

- Planning for board succession. Board assessments can be instrumental in board succession planning—helping to identify what skills and backgrounds will be required based on the company’s long-term strategy. And assessments can encourage boards to move to a more strategic and less reactive approach to board succession. In fact, nearly three-quarters (73%) of directors say conducting a full board or committee assessment is an effective way to promote board refreshment. [2]

Who should be assessed?

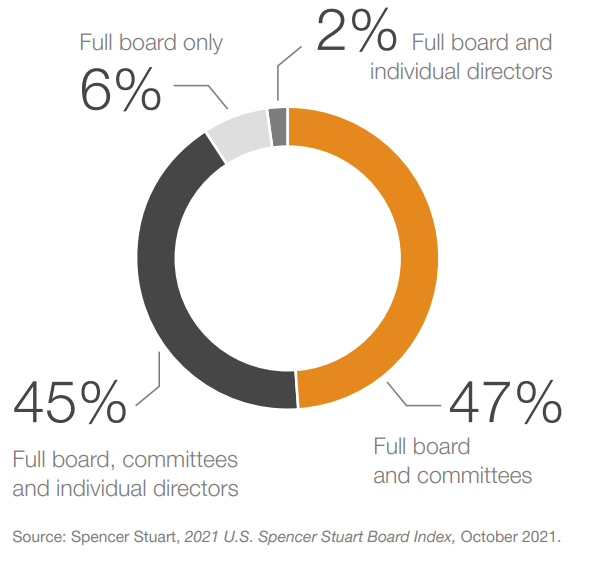

The NYSE requires boards of listed companies to conduct an annual performance assessment to “determine whether [the board] and its committees are functioning effectively.” [3] NASDAQ does not require the same, but many boards of NASDAQ-listed companies conduct self-assessments as a matter of good corporate governance. Nearly all (98%) S&P 500 boards disclose that they conduct some sort of annual performance assessment. [4]

Assessments can address:

- The full board. This allows the board to evaluate its overall performance, spot trends and acknowledge areas for improvement. And to determine if they are delivering value to the management team.

- Board committees. This provides visibility into how the board’s committees are structured and how they are performing against their charters. Committee assessments can also help the board monitor oversight allocation. Are Individual director assessments conducted by nearly half of S&P 500 boards responsibilities appropriately allocated between the full board and its committees?

- Individual directors. This provides information about what each director contributes and what value they bring to the boardroom. Individual assessments also help gauge the director’s participation in board and committee meetings and whether they stay up to date on the company’s business. Individual director assessments might also address what directors appreciate in their fellow directors and what behaviors they might like to see less of. A growing number of companies—47% of S&P 500 boards—report doing some sort of individual director assessment. [5]

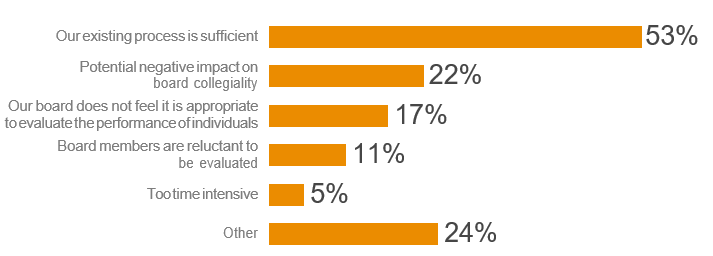

The debate over peer assessments

Some boards choose to have each director assess the other directors on the board. This is done anonymously, and sometimes facilitated by a third party. Peer assessments can provide a deeper look into how the board’s culture and performance are impacted by each of the directors. But some boards are hesitant to conduct peer assessments; directors may believe they can damage the board’s dynamics and collegiality.

If done in a constructive way, peer assessments can provide helpful feedback for each director. This input can help directors better understand where they might not be measuring up and how they can improve their individual performance. For boards that don’t currently do peer assessments but are considering doing so, a natural time to start is when you next add new directors.

Individual director assessments are conducted by nearly half of S&P 500 boards

Reasons why boards choose not to conduct individual assessments

Source: PwC, 2019 Annual Corporate Directors Survey, October 2019

What should boards assess?

Board, committee and individual assessments can help identify areas that need improvement. They can allow boards to gauge their readiness for the future. Assessments can also reveal which issues directors think should receive more attention. The process may also solicit feedback from people outside the boardroom who work closely with the board or committees. For example, someone should speak with members of the senior leadership team to understand what the board does well from their perspective and where they need more from the board.

| Board or committee performance | Individual director performance |

|---|---|

|

|

Source: PwC and The Institute of Internal Auditors Research Foundation, Board Effectiveness: What Works Best 2nd Edition.

Who should conduct the assessment?

Many assessments are conducted internally, by the board chair or lead director with the support of management. Sometimes the nominating and governance committee oversees assessments. In other cases, senior management or a third-party facilitator may handle the process. Ideally, however, the process is driven by board leadership. Committee assessments are typically conducted by the respective committee chairs.

Some boards use external advisors to help facilitate the assessment process. Twenty-one percent (21%) of S&P 500 companies used a third party to facilitate the assessment process [6] —a number of which indicated they use the outside party every two or three years. External advisors, as neutral intermediaries, can help create a more comfortable atmosphere that fosters openness and honesty from directors. However, it’s extremely important that any external facilitator the board selects be highly experienced.

What methods are typically used?

Assessments can be conducted in a number of ways. Written questionnaires or surveys, facilitated discussions and individual interviews (with the board chair or a third-party advisor) can all be in the mix.

- Questionnaires and surveys. Questionnaires can be structured in various formats, and usually include a number of open-ended questions. A key benefit is that they can offer anonymity to participants. The results are typically summarized and reported back to the full board (see Appendix for a sample board assessment questionnaire).

- Facilitated discussions. Some boards use facilitated discussions as a way to foster dialogue about board performance. The discussion is typically moderated by board leadership or an outside facilitator. Often, discussion topics are shared in advance and directors are asked to suggest additional topics.

- Individual interviews. Some boards use one-on-one interviews with each board or committee member to augment written questionnaires. The interviewer could be the lead director, chair of the nominating and governance committee, or a third party. He or she may also interview members of management.

Questions are usually open ended to allow for more engagement. The board typically discusses the results of the interview process, which are summarized without attribution. In some cases, board leadership will choose to meet with each individual board member afterwards to share feedback.

Advantages and disadvantages of assessment approaches

| Advantages | Disadvantages | |

|---|---|---|

| Written questionnaires or electronic surveys |

|

|

| One-on-one interviews with the board chair/lead director |

|

|

| One-on-one interviews with a third-party facilitator |

|

|

What happens after the assessment?

In order to truly benefit from the assessment, you need to have the right follow up. This is very important in setting board culture. Effective boards will use the information to identify an action plan.

And it is critical for board leadership to monitor how the action plan is implemented, keeping the full board updated on progress. Board leadership can do this by setting aside time to go through the results and having in-person “read-outs” to committees. The assessment results should also be considered when developing board and committee succession plans.

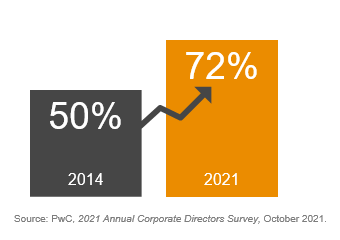

Board assessments are prompting action

Percentage of directors that say their board has taken some action in response to their last assessment process

Boards can start by identifying who will take charge of this follow-up process. That person should develop an action plan to implement any changes that come out of the assessment. The plan can identify changes to the agenda, new skills needed on the board and strategies for director education.

Should the company disclose information about the assessment to shareholders?

In the world of increasing transparency, disclosing the fact that the board performs a full board, committee or individual director assessment in the proxy statement should be the bare minimum. Some companies are even going beyond that statement and providing additional insights into the process. For more information read Getting real value from board assessments—Beyond “check the box”.

Concluding thoughts

An effective assessment process contributes to strong board oversight, good corporate governance and continuous improvement for directors and boards. And with the right process, boards can turn assessments into something valuable. However, this requires strong leadership to guide the process and directors who are prepared to be frank in their participation and appropriately follow up on the assessment’s findings.

The complete publication, including footnotes and appendix, is available here.

Endnotes

1PwC, 2021 Annual Corporate Directors Survey, October 2021.(go back)

2PwC, 2018 Annual Corporate Directors Survey, October 2018.(go back)

3NYSE Listed Company Manual, Rule 303A.09.(go back)

4Spencer Stuart, 2021 U.S. Spencer Stuart Board Index, October 2021.(go back)

5Ibid.(go back)

6Ibid.(go back)

Print

Print