Cynthia Dow leads Russell Reynolds Associates’ Legal, Risk & Compliance Officers capability; Harsonal Sachar leads Knowledge for Russell Reynolds Associates’ Legal, Risk & Compliance Officers and Human Resources Officers capabilities; and Leah Christianson is a member of Russell Reynolds Associates’ Center for Leadership Insight. This post is based on their Russell Reynolds memorandum.

High turnover & an acceleration of seasoned diverse appointments amid an intense business environment

In 2021, 59 Fortune 500 companies appointed new General Counsels. Russell Reynolds Associates wanted to study what differentiates those 59 new hires from past appointees. To do so, RRA captured the route to the top of General Counsels in the Fortune 500 (N=480), including those appointed last year (N=59), with a particular focus on diversity, career trajectory, and key experiences.

In comparison to previously hired Fortune 500 General Counsels, those appointed in 2021 are more likely to:

- Be female and ethnically diverse

- Be outsiders who are more seasoned in both their industry and the GC role

- Have a broader range of experiences

We hope GCs, CHROs, CEOs and boards will use these findings to:

- Gain a new appreciation for the pace of change and strides forward for diversity in the GC talent pool

- Think more proactively about internal executive development and de-risking succession planning

- Be more intentional about an equitable search process that includes top talent from in and outside the organization

1. General Counsels appointed in 2021 are more diverse

59 new General Counsels took the top legal job at Fortune 500 companies in 2021, an increase compared to 2020, which saw 52 General Counsels entering the ranks, and 2019, which saw 49 new appointees.

2020 saw an increase in pressure on companies to diversify their leadership, due to renewed energy behind the Black Lives Matter movement after George Floyd’s murder. Board appointments, which can take less time to come into effect than executive appointments (as executive roles require specific openings), showed immediate results. Of the newly elected directors within 2021’s S&P 500 rankings, 13.6% identified as Black. [1]

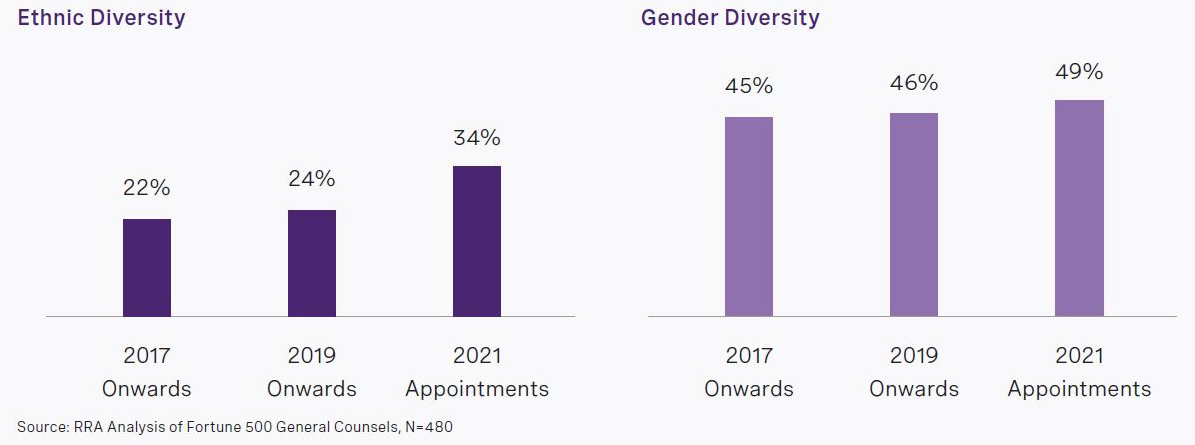

As circumstances led to new openings, General Counsel appointments followed suit, with ethnic diversity increasing from 24% 2019 onwards, to 34% in 2021 among the Fortune 500’s ranks. There is little doubt that this is the result of renewed energy and pressure for progress towards social justice, but also efforts by organizations to use every GC succession as an opportunity to search for a diverse slate of legal talent, and meaningfully diversify their leadership teams. Given that succession planning is an ongoing and multi-year endeavor, the General Counsel seat must come open, and then subsequent executive searches can take a number of months, diverse appointments will likely continue to increase over the next year.

In addition, General Counsel appointments almost reached gender parity last year with 49% of new appointments being female. By comparison, 42% of 2020 GC appointments were female.

Rise in Ethnic and Gender Diversity Appointments among Fortune 500 General Counsels

This is a significant increase when compared to prior years; in 2018, we reported that 28% of GC appointments in the Fortune 500 were female. [2] The GC appointments of the past year reflect both our current cultural moment as well as a strong pipeline of seasoned female in-house legal executives built over many years, and suggest a positive trend towards additional diversification and, by extension, a more inclusive and equitable Fortune 500.

Given the raised consciousness and urgency around racial and social justice, RRA’s DE&I conversations with clients have become more frequent and substantive over the past 18 months, with more clients proactively coming to us for advice regarding advancement opportunities and representation for Black executives on leadership teams and boards. We expect the urgency around these initiatives to continue.

Not only have there been noteworthy efforts to diversify the GC ranks, but the Covid-19 pandemic has also resulted in increased turnover within the GC ranks. The pandemic accelerated every company’s reliance on technology for communications, which inherently affected business models, leadership team interactions and the challenge of leading large enterprise teams. Between this business transformation, the ever-evolving regulatory environment, and executives taking stock of work and life priorities, many GCs left their positions. There are several root causes based on our conversations in the market.

General Counsel churn has risen due to evolving business models and new demands on leaders

Exhausted leaders

In 2020, GCs were thrust into an unprecedented situation with a constantly evolving regulatory environment. This took a major toll on all leaders, but especially those whose jobs suddenly involved attempting to interpret employee health and safety (EHS) data and using those interpretations to make potentially controversial decisions for their workforce. Now, the war in Ukraine can be expected to intensify and prolong this toll, especially where difficult decisions about the safety of people and business operations are a daily and critical focus. (Read RRA’s insights on executive responses to the war in Ukraine here.)

Reevaluating priorities

With the opportunity to be at home as well as to change physical locations due to remote work, many workers reevaluated where and how they wanted to spend their time, within and outside of an employment context. They also had new pressures and demands from the health and care considerations associated with young children, aging parents, and other vulnerable family members. GCs were not exempt from this reevaluation. In some cases, reduced travel demands have eased this tension but the prospect of a return to travel, commuting or a move back to a prior work location has prompted some to make lasting changes to their lives.

Early retirements initiated by GCs or organizations

With the shift to work from home and the subsequent new ways of working, some GCs who would have remained in the workforce for a few more years—sometimes to see the company through the crisis—decided to retire. Due to the aforementioned priority shifts, the effort required to return to working, commuting, and traveling under new and challenging conditions for the last year or two of their careers simply wasn’t worth it. In other cases, retirement decisions may have been accelerated by companies seeking new leadership, as they looked to adapt to the rapid business changes the last two years precipitated, potentially highlighting a mismatch between the sitting GC’s skillset and the anticipated demands of their role.

2. General Counsels appointed in 2021 are more likely to be outsiders who are more seasoned in both their sector and the GC role

In the current business environment, companies are gravitating towards seasoned legal professionals. In moments of crisis, which have been plentiful over the last two years, companies lean towards appointing a “been there, done that” General Counsel. By appointing executives with prior GC experience into the role, companies are mitigating the risk of having someone learn—and potentially fail—on the job in the face of a tumultuous business and risk landscape.

Given the need for experienced leaders, many companies are looking externally for their next GC. In addition to prior GC experience, organizations are increasingly placing a premium on relevant sector experience, given the significantly different business dynamics and regulatory frameworks between sectors. Again, there’s a sense that there is no time to learn on the job; organizations need a proven entity in this critical enterprise leadership role.

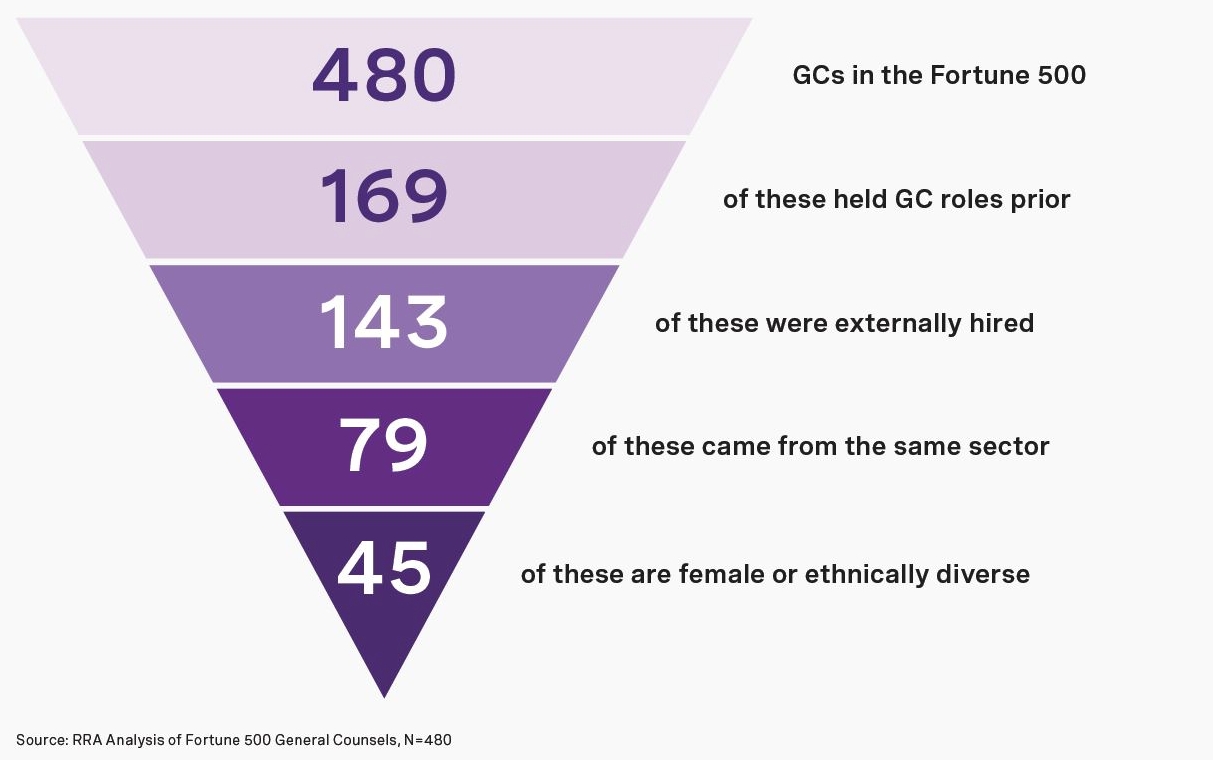

As a result of these priorities, the universe of available talent is limited and finite. Depending on the filters applied, a company can rapidly reduce their target candidate pool to <10% of the original talent pool. For example, by applying a few common requirements, a pool of 480 GCs in the Fortune 500 would be reduced to just 45 people, of whom an even smaller percentage will be available and well-matched to the company, culture and team.

The graphic illustrates how quickly the candidate pool shrinks when organizations lean towards experienced GCs from the same sector, are forced to hire externally due to a lack of internal bench/succession planning and leverage the opportunity to meaningfully diversify their C-Suite.

That said, this creates an interesting tension. To broaden the candidate pool and create more inclusive slates, hiring managers must also broaden their search into other sectors and to ready-now step-up candidates who have not yet held the role. The desire for a proven entity as well as for a diverse hire is difficult to balance. To combat this tension, leaders should take a page from the CEO succession playbook when planning for the next generation of GC talent. [3] Instead of looking for a new GC when the current one leaves, we suggest a three-to-five-year view that assesses internal talent, identifies multiple potential successors, and elevates next generation leaders via sponsorship and executive development. By looking to strong internal successors, the learning curve around the business, relationships and risk exposure is significantly flattened; on the flip side, the internal candidate may not have the requisite board, external stakeholder and executive team exposure unless consciously given opportunities to develop these.

Of course, even with appropriate succession planning, an organization’s next GC may still need to be recruited from outside of the organization. In particular, companies are more likely to appoint an external GC if a crisis or other urgent set of circumstances require significant change within their organization. This is aligned with common CEO succession practices, in which boards tend to look for candidates who are markedly different than the sitting CEO if the business is not performing well. [4]

3. General Counsels appointed in 2021 are more likely to have a broader range of experiences

Organizations increasingly expect GCs to have strong business acumen and an enterprise mindset, along with a strong foundational legal background. As the war for talent continues and the market becomes increasingly competitive, companies looking to attract and retain best in class GCs are expanding the role’s remit to include regulatory and government affairs, risk management, ESG and other areas of responsibility.

The evolving scope of the GC+ role

Over the past several years we have seen General Counsels acquire more responsibility. While the profile of a GC varies from company to company, the scope can broadly be divided into three buckets:

| Usually included | Often included | Sometimes included |

|---|---|---|

|

|

|

While 60% of Fortune 500 GCs explicitly have Corporate Secretary responsibilities included in their title or reporting line, the number is likely much higher, as it is quite common for these duties to be included in a GC’s remit without it being explicitly called out in a title or role description. While 36% of GCs have Compliance included in their remit, the number for most sectors is realistically much higher as well. Highly regulated sectors such as financial services and healthcare—where regulators frequently insist on the separation of legal and compliance with distinct reporting lines and a peer relationship—tend to have a smaller proportion of GCs with compliance in their organization, and skew the data.

This evolving scope also reflects CEOs and boards changing views regarding their General Counsel. CEOs tend to view their GC as “honest brokers” who want the best outcome for the enterprise and function as an objective executive across the C-Suite. As well, more GCs have had the chance to demonstrate their business acumen, leadership capability and enterprise perspective as a key member of the senior leadership team and close advisor to the board and CEO. In 2021, 24% of GCs appointed had prior experiences outside the legal function, up from 18% for GCs appointed during prior years. As such, CEOs are more willing to entrust GCs with additional functions, including those listed above.

What this means for leaders before, during and after a GC succession process [5]

1. Bolster internal executive development by starting early

As legal talent becomes more senior, significant commercial and governance assignments become essential developmental experiences on the path to a GC role. Board exposure and an appreciation of governance pressures and nuances that are built through substantive governance responsibilities are particularly important. Without intentional effort, many promising internal GC candidates lack the board exposure that is necessary to gain directors’ confidence.

By planning ahead, organizations can ensure internal candidates have the board and commercial exposure they need. Rotations into the corporate secretary role or function or assignments to support board committees are effective development opportunities. With respect to commercial exposure, providing internal candidates with the opportunity to lead special projects or transformation efforts, along with coaching and mentoring in tandem, is also highly impactful.

2. Manage an inclusive and equitable external search process

When companies look externally for talent, they often rely heavily on pedigree factors or recommendations from close sources that make a candidate feel like a safe choice but do not necessarily correlate to success in the role. To scope in as much relevant talent as possible, we recommend assessing candidates on accomplishments and track records, rather than asking everyone to check the same specific boxes. Leaders can create a more diverse and qualified pool of talent by:

- Reconsidering criteria where possible, including industry experience, scope and scale of prior roles, previous GC experience or a degree from a particular university, and instead focusing on success factors in the role

- Sourcing broadly in the market, and specifically sourcing diverse talent by tapping into affinity groups and networks of diverse leaders

- Assembling a diverse set of decision-makers for the search and providing representation to demonstrate the organization’s commitment to diversity and inclusion

- Using competency-based interviews to gain a deeper understanding of candidates’ track record, leadership capability, demonstrated success

3. Commit to building a more inclusive organizational culture that supports both development and hiring efforts

Creating a better succession process is an important step toward equity in the GC role. For sustainable progress, however, it is also essential to consider what happens outside of the succession process. A key question for leaders: What needs to happen for younger generations of diverse talent to stay long enough to be considered for GC role?

To build a powerful retention strategy, leaders will want to be intentional about sponsoring diverse talent in their organizations. This may include proactively inviting them into development processes, with clear communications about an individual’s potential to grow and progress in an organization as well as thoughtful and well-timed rotations to provide exposure and breadth of experience. These efforts are increasingly important as the workforce becomes more distributed, and standard opportunities to interact and build relationships across levels in an office are not available. While this can require substantial additional effort, commitment, and creativity, it is an essential element of being an inclusive leader, and the first step to making real change in the organization.

4. Be aware of, and accordingly de-risk, new General Counsels who may be insiders or outsiders

Organizations that are thoughtful about executive succession are also likely to see a payoff in the form of better business results: Nine out of 10 teams with successful leadership transitions meet their three-year performance goals, while up to half of those who struggle with such transitions underperform. [6] The best organizations are aware of the advantages and potential risks their new GCs bring.

Relative advantages of internally appointed versus externally hired GCs

Internally appointed GCs bring:

- Knowledge of the business and culture

- Existing working relationships

- Established trust & demonstrated judgment

- Meaningful career progress for the selected leader as well as a strong positive message to other colleagues on organizational commitment to developing talent

Externally hired GCs bring:

- Track record of success in the role, industry, or context

- Confidence & calm under pressure due to prior experience with the board and regulators, including during times of crisis

- Fresh perspective which is valuable to the team, organization, or business especially during crises or significant periods of transformation

De-risking internally appointed and externally hired GCs

Internally appointed GCs require:

- Exposure to stakeholders: Allow meaningful time with new internal and external stakeholders

- Immersion in new areas: Broaden experience via immersion into new/unfamiliar issues during the transition phase, including external resources & benchmarks

- Support in elevating impact: Coaching to help rise to the new challenge/role and have a voice at the table

Externally hired GCs require:

- Cultural integration: Expose the new GC to the executive and functional teams and broader organization via in person meetings, both 1:1 and in a group, both work-related and fun; especially important during transition/lift-off phase

- Clear-sighted assessment of strengths and development opportunities: Use robust leadership assessments to understand leadership tendencies and personality to ease onboarding and mitigate vulnerabilities

- Input from references: Speak to people who know the GC well to assess culture fit and potential blind spots and to support their success

Looking ahead

Gaining access to a more diverse network of GC candidates starts with a thoughtful and proactive GC succession process. By looking at strategies for developing internal talent, as well as the criteria used to assess external talent, CEOs, GCs and CHROs can maximize the opportunity to identify the candidates who bring the best combination of past experiences, leadership capability, and future potential, while also ensuring a diverse slate.

Methodology

- This analysis is based on Fortune 500 General Counsel route to the top data as of December 31, 2021, and includes 480 GCs

- The cohort covers all sectors, including Consumer (20%), Financial Services (20%), Healthcare (9%), Industrial and Natural Resources (38%) and Technology (12%)

- The cohort is 36% female and 18% ethnically diverse

- Note: Determination of whether a particular GC qualified as ethnically diverse was based on publicly available information, including, without limitation, trade journals, press releases and new reports that reference the ethnicity of the individual

Endnotes

1rra-corporate-board-practices-2021-edition(go back)

2Women Now Hold Just Over a Quarter of General Counsel Positions Among the F500 (russellreynolds.com)(go back)

3Is Your CEO Succession Plan Crisis-Era Ready?| Russell Reynolds Associates(go back)

4Beyond Presumptive Nominees: The Benefits of Strategic CEO Succession Planning | Russell Reynolds Associates(go back)

5Fortune 500 General Counsel Succession: Leveling the Playing Field to Create Equity(go back)

Print

Print