Will Collins-Dean is Vice President, Senior Portfolio Manager, and Chairman of the Investment Stewardship Committee, and Kristin Drake is Vice President, Head of Investment Stewardship, and Member of the Investment Stewardship Committee at Dimensional Fund Advisors. This post is based on their Dimensional Fund Advisors memorandum.

A manager’s voting record on environmental and social (E&S) shareholder proposals is sometimes equated with a manager’s overall commitment to environmental, social, and governance (ESG) issues. But such an assessment does not consider a manager’s broader stewardship activities and the effectiveness of shareholder proposals at improving portfolio company governance. Dimensional’s [1] stewardship approach includes engagement, [2] proxy voting, and other advocacy efforts and is focused on maximizing shareholder value on behalf of our clients. Through these efforts, we consider how portfolio companies’ E&S policies and practices may impact company performance and valuations.

Landscape and Limitations of Shareholder Proposals for US Companies

Shareholder proposals are proposals submitted by a shareholder or group of shareholders requesting the company take a specific action, such as publishing a report or disclosing a policy on a given issue. Public companies in the US must submit a proposal that they receive from an eligible shareholder to a shareholder vote at a meeting of the company’s shareholders, subject to certain exceptions. While these proposals can be used for a variety of recommendations and requests, shareholder proposals are often put forward by shareholders with a specific issue-oriented agenda. E&S shareholder proposals, while increasing, continue to represent a very small percentage of overall votes, typically less than 1% of all voting matters at US public companies. [3] Institutional Shareholder Services (ISS) noted that the majority (507 or 60%) of the total shareholder proposals filed at US companies were E&S-related. However, after omissions and withdrawals, only 182 of these proposals went to a vote. [4]

E&S shareholder proposals represent an effort by certain shareholders to effect change at a company. However, shareholder proposals may not be the most effective approach to address specific issues at portfolio companies. For example, in the US, shareholder proposals of public companies are typically nonbinding and should not ask a company to take action that would interfere with normal operations or constitute micromanagement. E&S proposals are therefore generally limited to requesting actions such as setting targets, to be determined by the company, or increasing disclosure. Even as a method for achieving useful disclosure for investors, E&S shareholder proposals regularly fall short. Frequently, the resulting targets and disclosures made by portfolio companies are aspirational, non-standardized, and unaudited. Often, investors already have access to relevant information through the company’s current disclosures on the topic. Thus, we believe the additional reporting is of limited use to shareholders.

Our Approach

Because shareholder requests vary and each portfolio company is different, we evaluate E&S shareholder proposals on a case-by-case basis to assess whether the request is likely to enhance shareholder value. The framework we use to evaluate each proposal is outlined in our proxy voting guidelines. Our approach allows us to consider the inherent complexity of E&S issues and the limitations of shareholder proposals while viewing our voting decision within our broader engagement strategy with individual portfolio companies.

Generally, we will vote for proposals that may protect or enhance shareholder value and against proposals that seem unlikely to do so. To make this assessment, we typically consider whether the proposal addresses a material issue to the portfolio company—one that presents a business or financial risk. If a shareholder proposal requests action on an issue that is not material to the portfolio company, Dimensional will usually seek to vote against the proposal on the presumption that the proposal likely imposes unnecessary costs on the company and its shareholders.

For proposals addressing a financially material E&S issue to the portfolio company, we typically seek to engage with the portfolio company prior to voting. To evaluate how the proposal may impact shareholder value, we consider the company’s current handling of the issue, responsiveness to shareholder concerns, and current disclosures relative to industry practices and regulatory requirements, among other factors. We also weigh whether implementing the proposal could put the company at a competitive disadvantage. In some cases, expanding disclosure may be better addressed through broad regulatory action rather than at individual companies. If our evaluation indicates the disclosure may add value for shareholders, such as in cases where the portfolio company’s current disclosure is lacking and the proposal is unlikely to impose excessive costs to the company, we may support the proposal. If, upon review, we conclude the proposal is unlikely to protect or enhance shareholder value, we generally will vote against the proposal. However, even if we vote against a specific proposal, we may continue to engage with the company on the issue raised.

Dimensional’s Considerations for Environmental and Social Disclosure Proposals [5]

- What is the proposal requesting, and will the disclosure help shareholders assess the portfolio company’s handling of a financially material issue?

- What is the company currently doing about this issue on an absolute basis and relative to peers?

- Would the disclosure impose a high cost to the company and therefore to its shareholders?

Case Study: Comparing Climate Change Proposals

E&S shareholder proposals increasingly focus on climate change disclosure. While climate change itself is a material risk for many portfolio companies and one that Dimensional has examined closely, the effectiveness of many climate change shareholder proposals is less clear. In Exhibit 1, we present a comparison of two climate change-related shareholder proposals that Dimensional voted on in proxy year 2020: one at a US-based railroad company and the other at a US-based freight and logistics company. Both companies are in industries that the Sustainability Accounting Standards Board (SASB) has identified as having material risks posed by climate change. Dimensional engaged with each company to learn more about their current oversight, mitigation, and disclosure of climate change-related risks. In both cases, we carefully considered the portfolio company’s current disclosures on an individual as well as peer-relative basis. The disclosure at the railroad company already aligned with industry peers’ disclosures regarding climate change risk and provided specific information about climate change risks, emissions targets, and a strategic plan for reducing the impact of the risk. Additionally, it met Dimensional’s expectations for identifying specific risks and potential impacts from those risks and disclosing how management of such risks would be assessed. We determined additional disclosure would not be additive. Unlike that of the railroad company, the freight and logistics company’s current disclosure lacked specific details and lagged industry peers’ disclosures. By supporting improved climate change disclosure at the freight and logistics company, we believe shareholders may be better able to assess the portfolio company’s handling of material risks from climate change. Since the resulting disclosure could provide additional information for investors about how the board is managing the material risks presented by climate change, this additional clarity could lead to a lower discount rate or higher price for shareholders.

Exhibit 1: Comparing Climate Change Shareholder Proposals

Tools for Effective Stewardship

With a variety of stewardship tools at our disposal, we seek to employ the most effective approach for the issue at hand. We believe there are stewardship activities beyond E&S proposals that are more effective at improving shareholder value through enhancing a portfolio company’s oversight and disclosure of material E&S risks.

In the case of many E&S issues, meaningful change may be best accomplished through shifts in public policy. Dimensional participates in industry events and advocates for investors in public policy discussions. Further, we often manage sizable, long-term holdings on behalf of our clients, thus allowing us to engage directly with portfolio companies. We find that ongoing engagement with portfolio companies gives us a better opportunity to advocate for effective board oversight and disclosure of material E&S risks. From July 1, 2020, through June 30, 2021, we conducted over 350 discussions with portfolio companies related to E&S issues. In addition, we conducted multiple letter campaigns during the period, which allowed us to communicate with many companies about key topics.

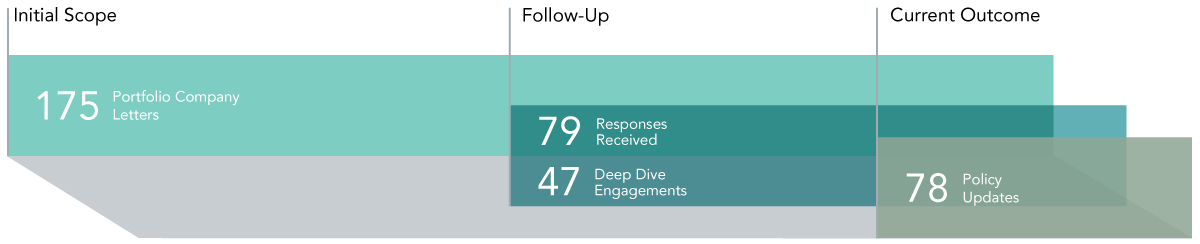

As shown in Exhibit 2, Dimensional identified 175 companies that, in our view, were lacking or not disclosing adequate oversight policies and procedures related to disclosure and oversight of material climate change risk. As of April 30, 2022, we observed that 78 of the companies had updated disclosures on the topic. Engaging directly with portfolio companies through letter campaigns and subsequent conversations allows us to emphasize our specific views on governance priorities, rather than those of a proposal’s proponent, and allows us to carefully consider each portfolio company’s response to our engagement.

Exhibit 2: Climate Change Risk Disclosure 2020-2021 Letter Campaign

In cases where progress through engagement is unsuccessful, voting against members of a portfolio company’s board of directors is often the most direct and consequential voting action we can take. For example, when a France-based retailer was unresponsive to the request for climate risk disclosure in our letter as well as our subsequent engagement attempts, we voted against the chair of the Board, which is responsible for material risk oversight and disclosure. By using a combination of stewardship tools, we were able to voice Dimensional’s specific concerns on the topic and hold directors accountable when they did not improve their disclosures.

Certain issues that affect portfolio companies may be better addressed through other means such as regulatory action. When Dimensional believes this to be the case, we may engage with industry actors or regulators to advocate. In 2021, Dimensional Fund Advisors, LP submitted a letter in response to the SEC’s call for opinions on climate risk disclosures.

Our Focus: Shareholder Value

Across all of Dimensional’s stewardship efforts, our focus is on seeking to maximize shareholder value. We evaluate E&S shareholder proposals based on whether they can reasonably be expected to enhance or protect shareholder value, and in many cases, we find that direct engagement and voting on director elections provide a more effective means for protecting shareholder interests.

Endnotes

1“Dimensional” and “we” refer to the Dimensional separate but affiliated entities generally, rather than one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., and Dimensional Japan Ltd.(go back)

2Dimensional from time to time discusses governance matters with portfolio companies to represent client interests; however, regardless of such conversations, Dimensional, on behalf of its clients, acquires securities solely for the purpose of investment and not with the purpose or intended effect of changing or influencing the control of any portfolio company.(go back)

3Dimensional calculation using voting data from proxy year 2021 (July 1, 2020–June 30, 2021).(go back)

4“2021 US Environmental and Social Shareholder Proposals Proxy Season Review,” ISS Insights, October 26, 2021.(go back)

5Provided for illustrative purposes only; not an exhaustive list of considerations.(go back)

Print

Print