James Killerlane is the Corporate Secretary, Managing Director and Deputy General Counsel of BNY Mellon. This post is based on a BNY Mellon report.

Related research from the Program on Corporate Governance includes Companies Should Maximize Shareholder Welfare Not Market Value by Oliver Hart and Luigi Zingales (discussed on the Forum here); Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Max M. Schanzenbach, and Robebrt H. Sitkoff; and Exit vs. Voice by Eleonora Broccardo, Oliver Hart and Luigi Zingales (discussed on the Forum here)

The global focus on climate change, alongside pandemic challenges and social justice movements, which helped highlight social concerns, have helped drive sustainability activities to the top of the agenda across the corporate world. As BNY Mellon discovered in a recent survey, investor pressure on issuers echoes these societal changes. Consequently, issuers and investors are increasingly focused on the disclosure and engagement practices related to environmental, social, and governance (ESG) topics.

Our research finds that ESG considerations are rapidly becoming a core element of Investor Relations, enhancing IR teams’ practices for engaging with investors. As a result, IR teams that are just beginning to make ESG a standard part of their process can use our findings in two ways. First, we identify common disconnects to avoid. Second, we provide actionable insights on creating productive, informative ESG engagement (i.e., an approach for establishing and maintaining these focused relationships).

On the demand side, investors want increased ways to understand companies’ sustainability practices. They look for the disclosure of reliable data alongside engagement on key areas of focus, in order to integrate ESG considerations into their decisions. This confluence of investor demand and issuer communications in our research shines a light on additional potential disconnects. We also uncover valuable insights on what to disclose and when to disclose it (i.e., the specific data and information used to communicate ESG risks, activities and impacts).

Disconnects and Demands

Disconnect: Investors want more than what issuers are currently offering, but issuers think they are offering everything that’s being asked.

Disconnect: There is a shift in investor thinking from viewing ESG as a risk-mitigation exercise toward it being a driver of returns. Hence, issuers need to focus on and understand growing or changing investor demands.

Demand: Investors want more transparency on ESG topics, more quantitative (vs. qualitative) data and more consistency in reporting.

Demand: Investors want more focus on material issues and those with the greatest impact.

Demand: Up until now, there has been a strong focus on environmental issues but investors also want issuers to focus on social and governance issues in ESG reporting.

Strong Views on ESG Evolution and Utility

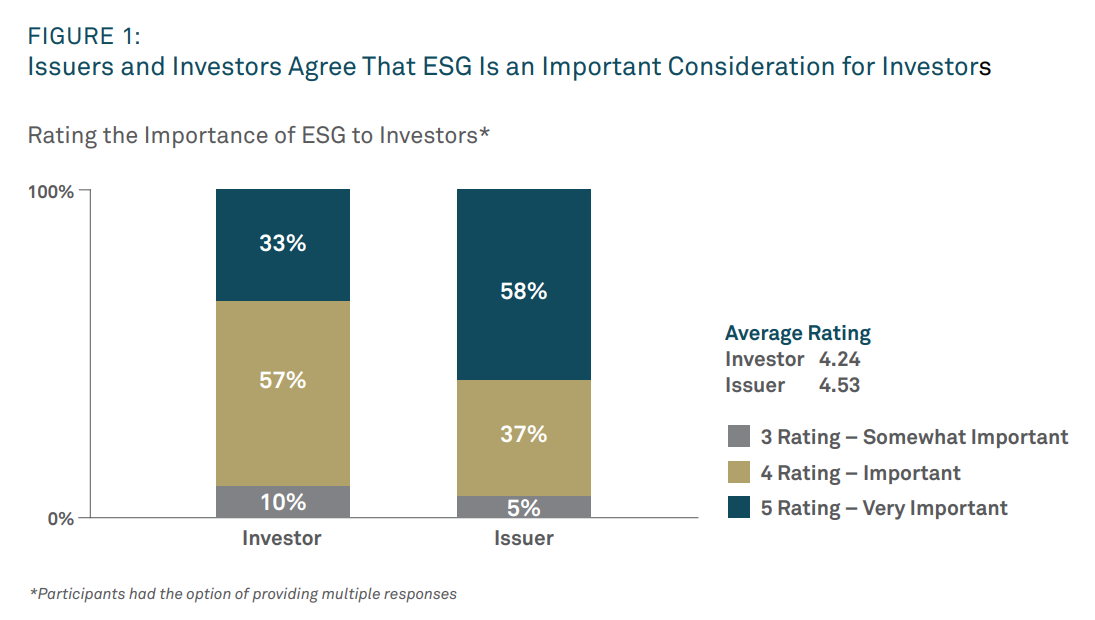

Investors and issuers in our research both described a shared belief in the general importance of ESG in their overall strategy. We found that 90% of investors and 95% of issuers rated ESG as a 3, 4, or 5 on a scale of importance from 1 to 5, with 81% of investors incorporating ESG information based on qualitative factors and 57% quantitatively (see Figure 1, “Issuers and Investors Agree That ESG Is an Important Consideration for Investors,” and Figure 2, “Methods Investors Use to Include ESG Criteria”).

One Tier 1 [1] North American investment manager for a mutual fund explained: “Ultimately, [ESG] seems to be the most underappreciated information by the market. It also has significant risk indications to any given investment for downside risk protection as well as future upside opportunity. I think that the lack of consensus around what ESG information is creates a lot of noise and volatility. That’s why it’s extremely important.”

Issuer and investor constituencies nevertheless did diverge in their specific perceptions of engagement and disclosure.

Engagement: Issuers generally expressed satisfaction with the status quo, although they welcomed greater engagement opportunities to improve investor relationships. For example, the Chief Investor Relations Officer at a large-cap financial firm noted, “I currently don’t think there is any disconnect with ESG engagement. We are trying to keep up with what investors are currently thinking. If there is some kind of a disconnect, we are very much willing to amend our disclosure.” A Vice President, Investor Relations at a U.S.-based mega-cap technology company also noted their firm was “continuing to look for creative ways to engage.”

Disclosure: Investors were more vocal about disclosure, seeking a greater amount of timely information, including access to historical numbers, subject matter experts (SMEs), quantitative and qualitative data required for risk-adjusted assessments, and, as a Tier 1 North American Investment Manager for a mutual fund described it, “a more complete picture” of the actual impact of sustainability programs. They also ask for historical data to add context, with a Tier 1 European Investment Manager – Mutual Fund saying, “We always like to have more quantitative data. It is important for historical KPIs to have some context.”

In short, we found that investors are integrating ESG information into their decision- making process while issuers are trying to respond to their need for this information. For example, a Tier 2 North American Mutual Fund Investment Manager described the impact of ESG, saying: “We don’t have any ESG-dedicated funds because our view is that would imply that other funds are not embracing ESG. The point is that we embrace ESG across the board.”

Our study found that ESG as a topic for Investor Relations is evolving on multiple fronts. As a result, respondents expected engagement tactics to adapt to ESG’s increasing role in future decision-making.

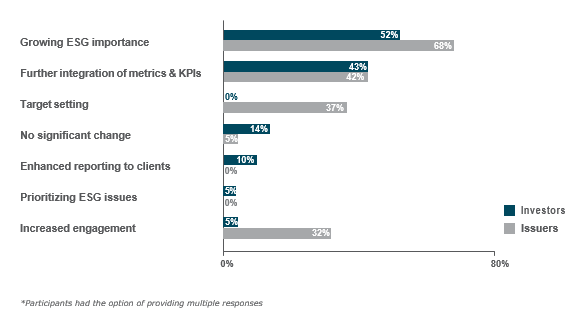

When we asked participants, “Looking at 2022 and beyond, how do you see ESG evolving as a part of the firm’s investment process or company strategy?” we saw 52% of investors and 68% of issuers attributing increased importance to ESG factors in their decision-making (see Figure 3, “View of ESG Evolution in 2022 and Beyond”).

Figure 3: View of ESG Evolution in 2022 and Beyond [2]

Investors expressed a view of ESG as a helpful focal point for making risk-adjusted company assessments. They also stated that companies with poor ESG profiles face direct financial risks or other hazards, indicating their use of ESG information to find alpha (outperformance) as well as to mitigate risk. Unsurprisingly, several investors also remarked that it has been common to include ESG principles and factors in investment decisions for some time as an additional layer of information to enhance financial analysis. This approach is particularly relevant for funds with long-term investment horizons.

A Tier 3 North American Mutual Fund Investment Manager expressed a risk-oriented perspective, saying, “We’ve long believed that incorporating ESG factors into our investment process just gives us a better feel for the quality of management and their risk-management priorities and practices, which allows us to better price risk.”

Meanwhile, a Tier 1 North American Mutual Fund Investment Manager took a long- term view, saying: “We focus on these areas… because we’ve determined that they are material to the financial stability of the company from a long-range perspective. All of our questions and inquiries are related to how these things impact value creation going forward.”

Creating the Conditions for Effective ESG Engagement

Strikingly, only 5% of investors expected increased engagement on ESG issues, compared to 32% of issuers (see Figure 3, “View of ESG Evolution in 2022 and Beyond,” page 5). Those perspectives could reflect a natural asymmetry, with issuers more motivated to engage and interact with the investor community.

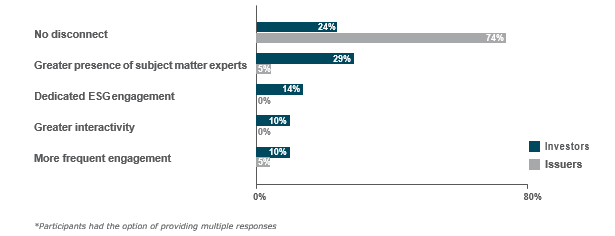

This asymmetry in expected future engagement paves the way for additional engagement disconnects that also emerged in our research (see Figure 4, “Disconnect in Current ESG Engagement”). These include:

- overall value of engagement

- quality of engagement

- use of engagement

In addition, participants suggested several potential root causes for such disconnects.

Figure 4: Disconnect in Current ESG Engagement [3]

Overall Value of Engagement

Investor demand only provides one piece of the puzzle. Engagement between investors and issuers is another key component. In investment speak, “Engagement” is a specific tool and part of an overall Stewardship strategy tool to drive further information on ESG data or impact corporate business strategy. However, investors can only utilize Engagement in that specific sense when they are already invested in an entity, not as an entry determinant. In this post and in our discussions with investors and issuers in this survey, we used the term “engagement” as a descriptor of more informal discussions with companies (i.e., small “e”) whereby corporates can also reach out and engage with investees both before and after an investment decision is made.

Using our “small e” definition, a minority, 19% of investors, said that company engagement impacts their decisions to include or exclude investments (see Figure 1, “Investors’ Incorporation of ESG in Investment Decisions”). Indeed, investors we spoke to appeared to be looking more generally at company information disclosure, in conjunction with ESG engagement activities, as factors influencing their views rather than directly determining them.

*It should be noted that our survey is somewhat self-selecting toward issuers and investors who wanted to talk about their ESG engagement practices, resulting in a positively biased sample. Nonetheless, no one rated the importance of ESG information as a 1 or a 2 in this population of 40 participants.

Also of note is the dominance of U.S.-based investors in our survey. With regulation such as Sustainable Finance Disclosure Regulation (SFDR) mandating an ESG lens in the evaluation of portfolios, EU-based investors may be more likely to fully integrate ESG discussion and engagement holistically into their investment process.

In our survey, engagement and disclosure dovetail in driving investors’ analysis of investments, according to a Tier 1 North American Mutual Fund Investment Manager, who described their role in stewardship as “to really directly engage with companies to get insights on how they are developing their ESG programs and what else they’re doing either from a capital allocation standpoint or oversight and reporting standpoint.”

Quality of Engagement

Yet, significant disconnects emerged around the quality of engagement. Nearly three-quarters of issuers (74%) said there was nothing significantly lacking, or no disconnect, in their current engagement practices with investors (see Figure 4, “Disconnect in Current ESG Engagement”). Still, that proportion may not have fully taken account of their attitudes toward the outcome or results of the engagement. Flipping the ratio, only a quarter of investors saw no disconnect.

With close to a third of investors asking for more subject-matter experts (SMEs) at such meetings, perhaps the addition of such experts would increase the impact of engagement in general. This change could potentially increase the low utilization of ESG for making investment decisions. Formalized Engagement for greater ESG disclosure can also greatly enhance investors’ decision-making capabilities.

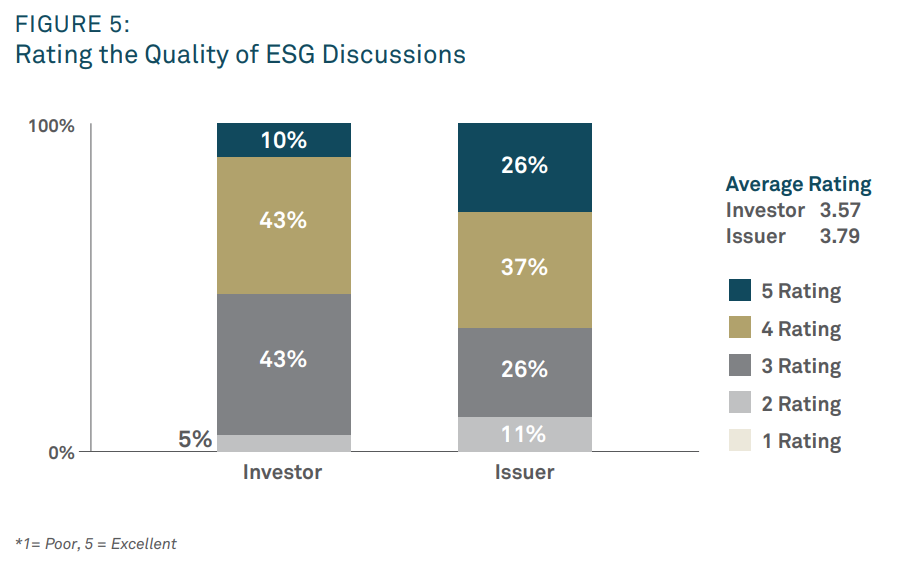

We would nevertheless highlight that both issuers and investors gave positive ratings to ESG discussion quality, despite the minority’s desire to include more SMEs (see Figure 5, “Rating the Quality of ESG Discussions”). No participant rated the quality of their engagement as a “1,” the lowest level, and more than half of each group rated engagement at a “4” or “5.”

Issuers are responding to investors’ requests for engagement, according to a Vice President of Investor Relations at a U.S.-based small-cap energy company, who noted: “In terms of engagement, if anyone is asking for a call, I definitely set that up. So, if investors are asking for it, we do provide it, but I don’t think there’s anything investors are asking for that we aren’t providing on the ESG side.”

A Senior Director of Investor Relations at a U.S.-based large-cap consumer services company revealed: “On the IR front, ESG has not been at the forefront… In terms of investor presentations at conferences or materials or decks, ESG has not been a part of our materials.”

At the same time, the Head of Investor Relations at an EU-based mega-cap financial firm perceived alignment between issuers and investors when seeking and supplying information. That observer said some large investors have always focused on ESG, while others will gain pace, and “as they understand and realize how important this is a little bit more, they will proactively ask for more.”

Engagement Forums

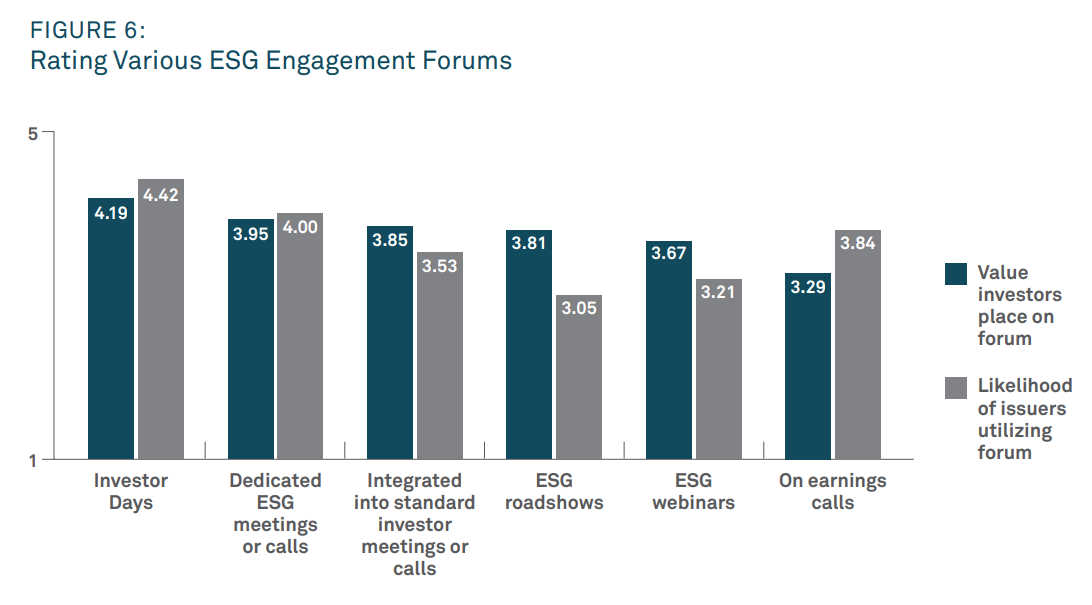

When looking at engagement forums, both investors and issuers held a favorable view of dedicated ESG meetings and roadshows, as well as ESG webinars (see Figure 6, “Rating Various ESG Engagement Forums”). We see this continuing in areas where there is need at least until ESG disclosure is more uniform and the financial implications of key ESG topics are more widely appreciated. They welcomed how these forums allow for an in-depth examination and analysis of specific topics. Concerning engagement, meanwhile, some also commented that these forums add the most value when they are interactive and focused on material information.

A Tier 1 North American Mutual Fund Manager observed that “I find ESG engagement to be more valuable when it is a more specialized forum rather than combining it with normal discussions. If I’m doing a regular roadshow of the company with a small group meeting of 6 investors and [I] am the only one who cares about ESG, you can’t talk about it. There’s not enough time, so if other people don’t care, so it will go off-topic immediately.”

A Tier 2 North American Investment Manager expressed some skepticism about paying lip service to ESG priorities: “I have found that on a lot of earnings calls, the ESG topic will be either part of the CEO’s opening statements so that the CEO can check the box or will be in the closing remarks before the call heads over to Q&A. When I hear that, I just view that as the CEO checking the ESG box. It’s not a substantive discussion. That’s why on earnings calls, it’s good to mention ESG, but I don’t know if I get a ton of value out of it like a dedicated ESG meeting or during an Analyst Day. It depends on the company.”

The broad topic of ESG on earnings calls can become diffused. A Tier 1 North American Investment Manager rated “the value of discussing ESG on earnings calls a ‘3’ not because ESG is not important, but because there are so many different things that would be discussed on that call, so it might be lost in the overall noise.”

On a related note, a Vice President, Investor Relations, at a U.S.-based large-cap consumer goods company said: “We did technically have an ESG specific kind of marketing event, but I’m not sure they are as impactful. We’re still trying to kind of figure out the best way to have these dialogues.”

In addition, a Vice President, Investor Relations at a U.S.-based mega-cap consumer goods firm described how Investor Days and other forums might evolve: “When we think about Investor Days that we’ve done in the past, we really don’t touch on ESG. Perhaps the CEO might make some overarching comments about it, but we have not incorporated that into earnings calls or Investor Days or presentations we do at conferences to date.”

Potential Causes of Engagement Disconnects

While our population was too small to derive statistical comparisons between issuers and investors, their anecdotal insights suggested that engagement experience differences might vary by issuers’ industry or market cap. In addition, we surfaced some potential gaps between the views of U.S. and non-U.S.-based issuers. For example, our specific sample found that U.S. issuers were less likely to have incorporated ESG topics into their Investor Days or to hold dedicated events.

What to Disclose & When to Discuss It

Investors saw a trend for companies moving from telling investors what they are doing to offering disclosure of the impact of their efforts.

Annual reports should be focused on key topics, brief and data-driven.

Investors sought substance and data behind the goals that management can articulate with intentionality.

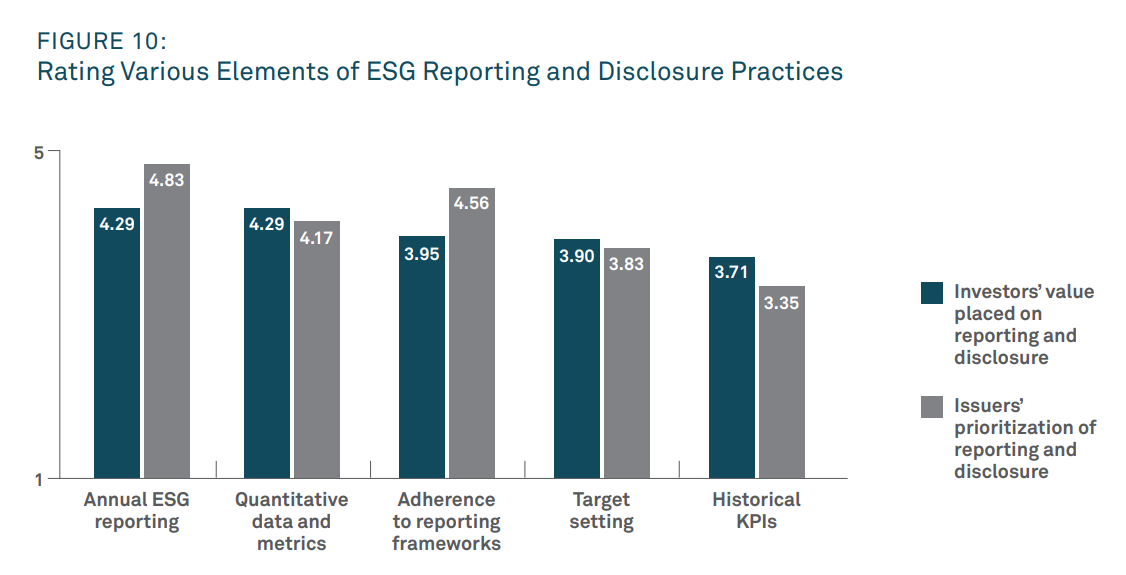

Investors noted that disclosures to date have been qualitative, while, in parallel, issuers are trying to identify more quantitative KPIs. However, gathering all the data remains challenging. In addition, historical reporting is difficult since many issuers have only been reporting this information for the past few years. It is only now that they are starting to track and establish a baseline for future reports.

ESG Disclosure—Desires and Disconnects

At present, quantitative reporting, including science-based targets and industry-standard metrics and KPIs, matter to both issuers and investors. Moreover, both groups said they perceive value in historical information rather than just a snapshot of a single point in time so that they can analyze any rate of change. For example, the Head of Sustainable Investing at a Tier 1 North American Investment Manager stated, “It’s important to have the annual and the historical information so that we can actually analyze the data as opposed to looking at a single point in time and trying to reach any kind of conclusion. We strongly believe that the analysis of change, rate of change and reasons for change are as important or possibly more important than the absolute numbers at any point in time for a pretty wide range of issues.”

A Portfolio Manager at a Tier 1 North America Investment Manager further explained, “The historical data going back is important because so few companies have more than a couple of years. We want to see that consistency and companies that have cared about this for more than the last two years.”

However, a Tier 3 Asia-Pacific Investment Manager expressed a contradictory view that “historical KPIs are not related to the future trajectory. Whilst it’s important to consider what progress has been made in the past, you’re also interested in the future for the company. We invest on the basis of the long term, not on the past.”

Issuers we surveyed integrate their ESG disclosures into their IR materials at a very high rate, with 84% including this information into either IR presentations or an ESG presentation that specifically tells their investment case and equity story (see Figure 7, “Inclusion of ESG in Investment Case”).

We see that this disclosure is both valued and further vetted by investors. As a Tier 1 North American Investment Manager explained: “Every single name that is vetted and initiated on must have its own ESG scores as defined by our internal analysts. That’s also been complemented with third-party data.”

In support of thorough verification, a Tier 1 North American Investment Manager asserted: “We look at company disclosures and directly cross-verify that the third-party data does not miss anything. We also look at ESG-specialist content.”

Surveyed investors said they ranked third-party data at about the same utility as company data. A full 81% of investors described third-party data providers and raters as a critical source of information. However, while 71% specifically cited company reports as valuable input, a large number of the participants also commented within the interviews conducted for this survey that they use information from any company source.

As issuers and investors continue to define how they will use this information, a Vice President of Investor Relations at a U.S.-based large-cap consumer goods company foresaw a shift from simply reporting activities to describing their impact: “I think it’s going to increasingly shift from ‘tell me what you’re doing’ to ‘tell us the impact those things are having’. That’s an area, too, where I think we’ve just got to up our game a little bit to be able to better measure some of the KPIs.”

Disclosure Disconnects

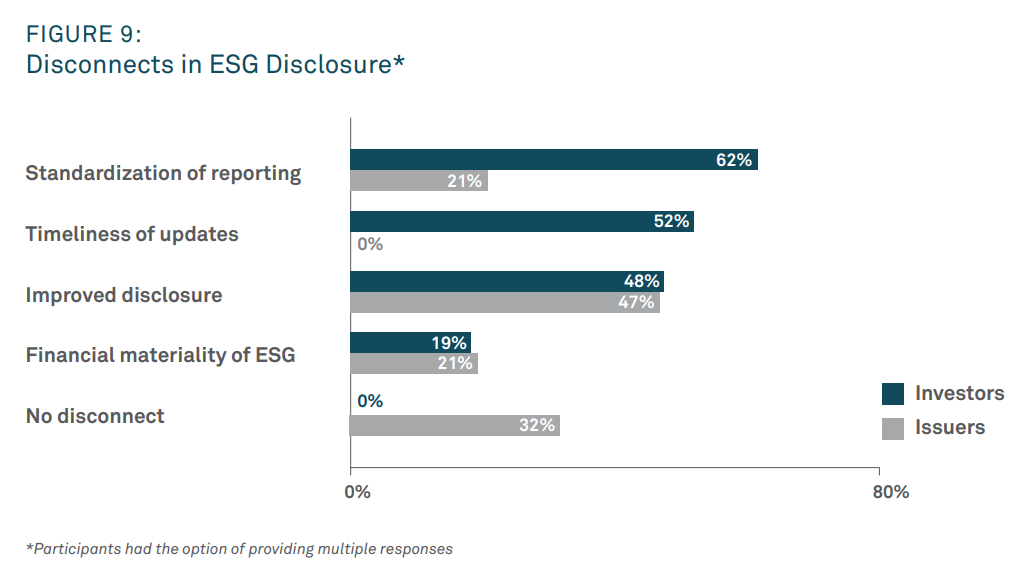

While issuers have strongly adopted the inclusion of ESG information in the equity story, two-thirds of issuers also identified some form of disconnect in their disclosure relative to what investors expect. Here, we asked two questions: of investors, we asked, “What is lacking from most issuers’ current ESG disclosures that is critical to your investment process?” and of issuers, we asked, “Is there a disconnect between what you currently disclose for ESG and what investors are asking of you?”

Juxtaposing their responses (see Figure 9, “Disconnect in ESG Disclosure”) helps to highlight where the disconnect lies. [4] Unlike issuers, investors perceived disconnects in standardization of reporting and timeliness of updates. However, both groups reported similar disconnects in improved disclosure and financial materiality.

The views expressed could suggest that issuers are not fully able to meet investor demand for more extensive standardization, particularly in jurisdictions without such external standards. This, in turn, highlights potential areas for improving the voluntary quality of their investor communications.

Annual reporting was seen as the most valuable source of information, with the longer timing cadence allowing for deeper information exchange. With some specific caveats noted in our discussions with investors, some shared an opinion that the value of including ESG information on quarterly calls is mixed, because these calls can be driven by short- term, results-oriented conversations and are time-constrained. In contrast, they said that ESG topics involve longer time horizons and are therefore more suited to annual disclosures.

Moreover, 62% of investors rated the inclusion of ESG information in earnings calls as a “2” or a “3”. They added that while they appreciate specialized forums to discuss this topic, that they want the earnings call to focus on financials, that they want to ask specific ESG questions or that they do not participate in earnings calls.

As a Tier 1 European Investment Manager noted, “The idea that we produce things on a quarterly basis is nonsense. There are things that are worth mentioning—like, for example, the impact you are having. That would require a more frequent update. But on the numbers side, as in I don’t want CO2s quarterly, I want it annually.”

Actionable Insights for Issuers

Despite differences in perception, our findings suggest that investors and issuers share the same end goal: productive, informative ESG engagement. Those objectives unite both engagement and disclosure as critical elements.

Six Starting Points for Issuers

- Provide increased quantitative data and standardized metrics for comparability.

- Set targets to promote accountability.

- Focus on recent KPIs in quarterly reporting.

- Use longer meetings for more in-depth presentations.

- Tie in and relate ESG to the investment case.

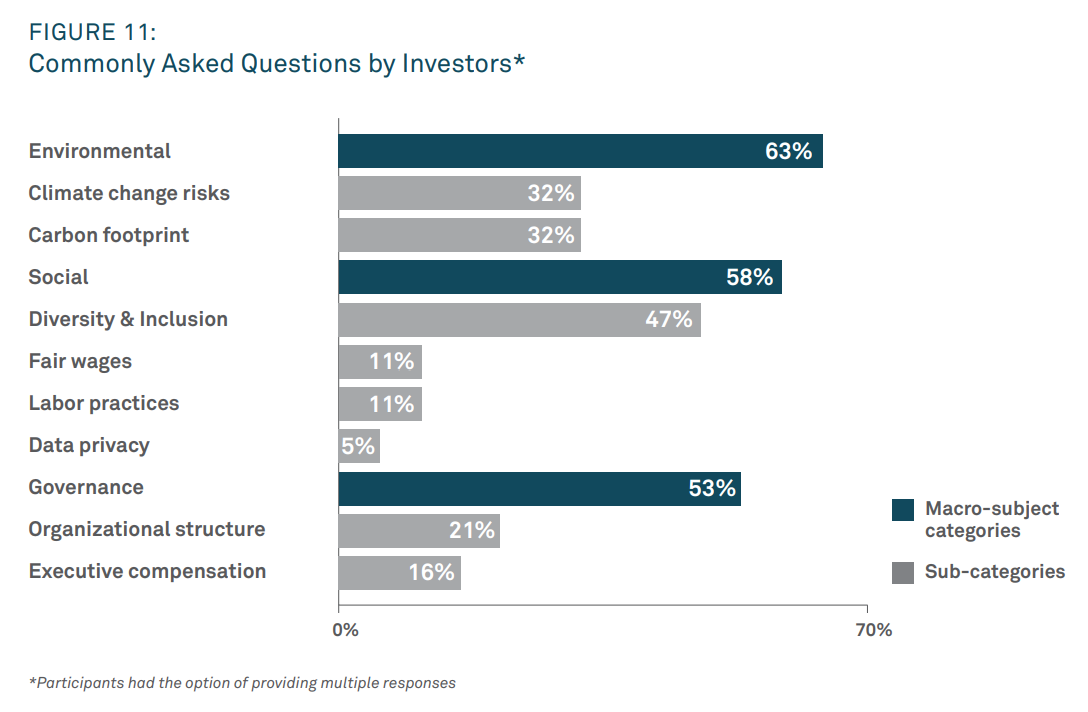

- Emphasize all ESG outcomes (not just environmental) in discussion of goals and progress.

Investors asked for science-based targets and specific KPIs to satisfy their disclosure needs, calling out a need for quantitative data and metrics in issuer disclosures. Standardization was a key challenge and related back to the call for improved metrics. Investors’ ability to track and integrate comparable information in their models was a common need.

A Tier 1 North American Mutual Fund Manager highlighted the standardization of disclosures, noting: “A standardization of disclosures is important. We rely a lot on the third-party vendors, MSCI and Sustainalytics. They may provide comparable information for different companies. If some companies started reporting SASB [indicators] more regularly, then there would be a set of metrics that they consistently report on, so it becomes easier for us to compare performance over time or compare performance between companies.”

Investors further observed that the foremost topics of interest in ESG categories tend to wax and wane with public consciousness. While we noted that trends in the subject of questions asked in engagement meetings follow the news cycle, investors did not see those meetings in and of themselves as critical determinants of valuation. For instance, a Vice President Investor Relations of a mega-cap technology company said: “They go with the trends. So last year, because of everything that was happening with Black Lives Matter, everything that was happening with COVID, a lot of the focus was on what are we doing for our people as we brought everyone home.” It may be that the discussions raised in the meetings are a reflection, rather than a driver, of current concerns. If so, the engagement itself might be the dominant factor.

One way to address this changing topical focus from investors is to continue to concentrate on what is material, and on outcomes that the company can impact.

As one Tier 1 North American Mutual Fund Manager noted: “There’s a lot of data in sustainability reports that we don’t really care about. Making that clear connection back to the business strategy is important. That is anything that you’re focusing on from an ESG perspective in terms of why you are focusing on it, what’s the business driver, and is it an opportunity or a risk mitigant. To the extent they can share financial implications, we would like to know how that translates to business strategy, impact earnings, affect margins, et cetera.”

“The separate stuff, which is equally important for other stakeholders, is more about sort of philanthropic efforts, community development and things like that should be pulled out into a separate report that isn’t necessarily for investors. This is where they can be showcasing what they want to showcase. Investors need it to be more targeted. It should be brief but focused on materiality.”

Finally, at least in the public view, there has been a greater emphasis on the environmental side of the widely encompassing ESG field, perhaps more so in Europe than the U.S., according to one commenter. Our findings serve as a reminder that social and governance issues should command equivalent weight where those issues are material to the company, and can comprise a panoply of subtopics. For example, investors identified questions about diversity and inclusion as their top-most area of focus. If issuers and investors wish to exchange comprehensive views across the vast territory of ESG, they must delve into all corners of the subtopics.

As noted by a Tier 1 North American Mutual Fund, “My issue with Europe is I feel like they place too much emphasis on the E (in ESG). They have sustainability targets. Some of them are starting to develop more social targets like for diversity/minority hires and those sorts of things, but those targets seem to be a little bit softer. The discussion on governance is not as robust as I would have expected it to be given that the G is really what governs E and S. Europe tends to over-index a little bit to E with less support on S and G. I think that there’s a really big focus, particularly out of Europe, on being green as opposed to being sustainable. I personally define those two terms differently. We would like to see more focus on just good corporate stewardship overall versus just the environment.”

Conclusion

Our survey led us to important considerations for issuers and insights to incorporate into ESG engagement meetings for the future:

- Investors and issuers both told us that ESG is and will remain important to them.

- Investors were clear that KPIs and statistics that are relevant and material to the business are important, as are historical figures.

- We learned that material disclosures are used more in valuation than in ESG-specific meetings.

- Investors furthermore focused on the idea that discussions of goals and the progress toward them should emphasize outcomes and not only inputs.

For issuers, including a discussion of ESG in both quarterly and annual meetings or special events was welcome, provided it fits the format and advances investor understanding with meaningful data. Investors continue to refine their ESG information needs, and issuers continue to publish more specific information. In tandem, a consensus with issuers must emerge to ease information exchange, make data more usable, enable longer-term comparisons and, ultimately, promote change.

The complete publication, including footnotes, is available here.

Endnotes

1Note: Tiers are defined by size segments of Assets Under Management. See Methodology (page 21 of the complete publication, available here) for full details.(go back)

2The questions asked of investors included open-ended text fields. Answers were then categorized and grouped for demonstration of results. This chart shows two questions: Of issuers we asked, “Looking at 2022 and beyond, how do you see ESG evolving as a part of your company strategy? How do you expect this to change your engagement and reporting?” Of investors we asked, “Looking at 2022 and beyond, how do you see ESG evolving as a part of your firm’s investment process? How do you expect issuers to respond to these trends?”(go back)

3The questions asked of investors included open-ended text fields. Answers were then categorized and grouped for demonstration of results. This chart shows two questions: Of issuers we asked, “Is there a disconnect between what you currently provide for ESG engagement and what investors are asking of you?” Of investors we asked, “What is lacking from most issuers’ current ESG engagement practices that is critical to your investment process?”(go back)

4The questions asked of investors included open-ended text fields. Answers were then categorized and grouped for demonstration of results.(go back)

Print

Print