Charles Mitchell is Executive Director of Knowledge Content & Quality at The Conference Board, Inc. This post is based on a Conference Board memorandum by Mr. Mitchell, Rebecca L. Ray, Ataman Ozyildirim, and Dana Peterson.

Energy, inflation, cyber risk, and recession are immediate CEO concerns. For long-term growth, the emphasis is on technology, automation, and upskilling existing workforces.

The War as Change Accelerator

The Russian invasion of Ukraine is proving to be the ultimate “grey swan” event—an event whose possible occurrence may be predicted but whose probability is considered small—creating extraordinary volatility and uncertainty with global ramifications for national economies, the business environment, consumers, and humanitarian relief. While the war has certainly forced many businesses to put part of their strategic plans on hold, our latest global survey of 750 CEOs and other C-suite executives shows it is also acting as an accelerator, speeding up strategy refinement and innovation, especially around cyber risk, supply chains, renewable energy, and crisis and contingency planning.

The war’s impact appears far-reaching. Just 9 percent of companies in our global survey say the war will have no material impact on their business operations in the coming year, though all companies will be dealing with energy and food inflation.

This special C-Suite Outlook midyear survey, conducted between May 10 and 24, is a follow-up to our annual survey released in January 2022, C-Suite Outlook 2022: Reset and Reimagine. The latest survey focuses on the impacts of the Russia-Ukraine conflict on the global business environment and firm-level operations. We asked about the actions executives are taking to mitigate the amplified risks caused by the conflict and their concerns about what may come next as the conflict continues. A separate section looks at longer-term growth strategies following back-to-back global shocks (i.e., the global pandemic and the war) and how CEOs and C-suite executives plan to attract and retain valuable talent in a time of acute labor shortages.

The war in Ukraine has created a new inflection point in geopolitics and the political economy. In the long term, the war and its impacts on inflation, economic growth, and a potential reshuffling of global alliances will demand innovative solutions. On the downside, its impacts will likely be felt most deeply by the world’s most vulnerable populations.

Insights for What’s Ahead

Our midyear global survey of CEOs and other C-suite executives about the impact of the war in Ukraine finds:

- The war is worsening the inflation outlook CEOs and other C-suite executives see the war fueling inflation through energy price volatility and higher costs for scarce This is leading to concerns over margin compression.

- Recession expectations are high More than 60 percent of CEOs globally say they expect a recession in their primary region of operations before the end of 2023 or earlier, a sentiment shared by other C-suite Fifteen percent of CEOs say their region is already in recession.

- Cyber risk grows There are high levels of concern about an escalation of the war, especially around cyberattacks. This means board members and senior management must recognize the present danger and ensure their organizations adopt a heightened security posture.

- Danger that competing economic blocs will emerge CEOs say rising US-China tensions are likely to have a major impact on business operations in the coming 12 months. They have serious concerns about the emergence of competing economic blocs—a division that would have significant negative impacts on global trade and economic growth for years to come.

- A yes to secondary sanctions but concerns about the consequences of sanctions already in place Even though a decision to introduce secondary sanctions would sharply escalate the economic battleground and set the stage for a fractured global economy and world order, the majority of CEOs globally favor them even though they do have concerns about the negative consequence of sanctions already in place.

- Renewable energy is part of longer-term growth strategy Energy price volatility related to the conflict is driving many firms to take a closer look at renewable energy as part of a longer-term growth strategy. Depending on how it is sourced, it can provide a hedge against the price volatility of fossil fuels, but initial investment costs can be

- Supply chain resilience is a priority Expect the emphasis on resilient and more environmentally and socially responsible supply chains—cited by CEOs as critical responses to the conflict—to gain momentum since investors will be focusing on those

- Stakeholder priorities shift in wartime The stakeholder views most important in determining organizational response to the war include those of customers, the board, and regulators. Employees have played a less important role in shaping the corporate business response to Ukraine than in dealing with domestic social and political issues not related to the war. Companies are not involving the employee populace in the economic impacts of the war since most are not in the areas of accountability most heavily

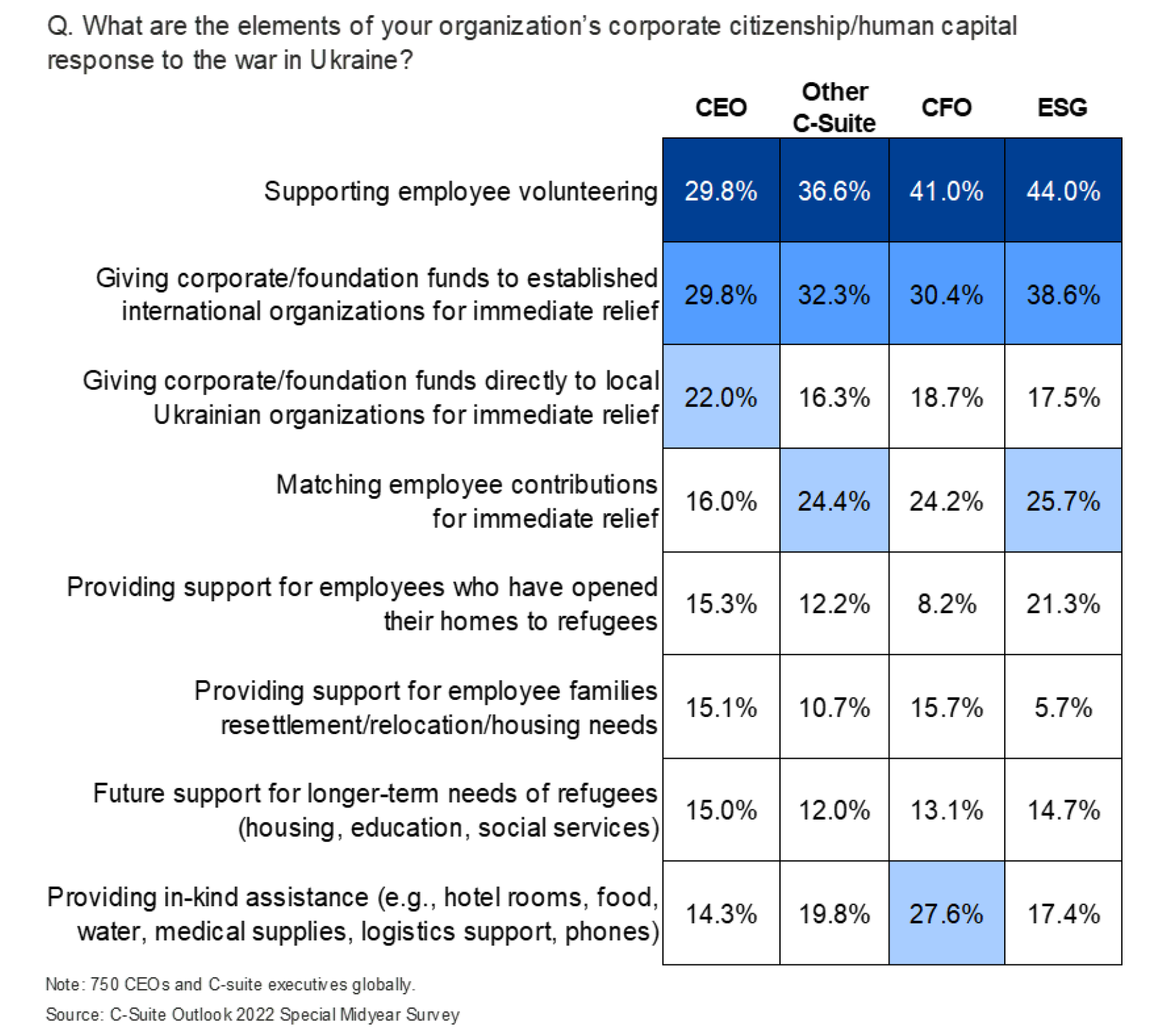

- Time to revisit corporate citizenship responses to the war CEOs say their corporate citizenship responses to the conflict are primarily focused on supporting employee volunteer efforts and providing cash to international relief organizations. As we’ve seen before with natural disasters, a relatively small percentage of companies are prepared to deal with the long-term, direct effects of the war. Given the conflict’s duration, it may be time to revise your overall Ukraine relief plan— support now needs to be viewed as a long-term proposition.

Long-term growth in a volatile global environment

- Technology and talent are the focus of longer-term growth strategies To ensure growth for their business over the next two to three years, CEOs say they are investing in digital transformation, developing new lines of business, upskilling and retraining existing employees, strengthening the corporate culture, and increasing productivity in their hybrid work models.

- Government policies that can drive growth More investment in infrastructure and R&D, an effective energy transition plan, along with lower taxes and less regulation, are favored government policies to spur growth. When asked which government policy actions would most help their business to thrive, CEOs say they can best benefit from lower taxes, public investment, fewer regulations, and an effective government energy transition plan.

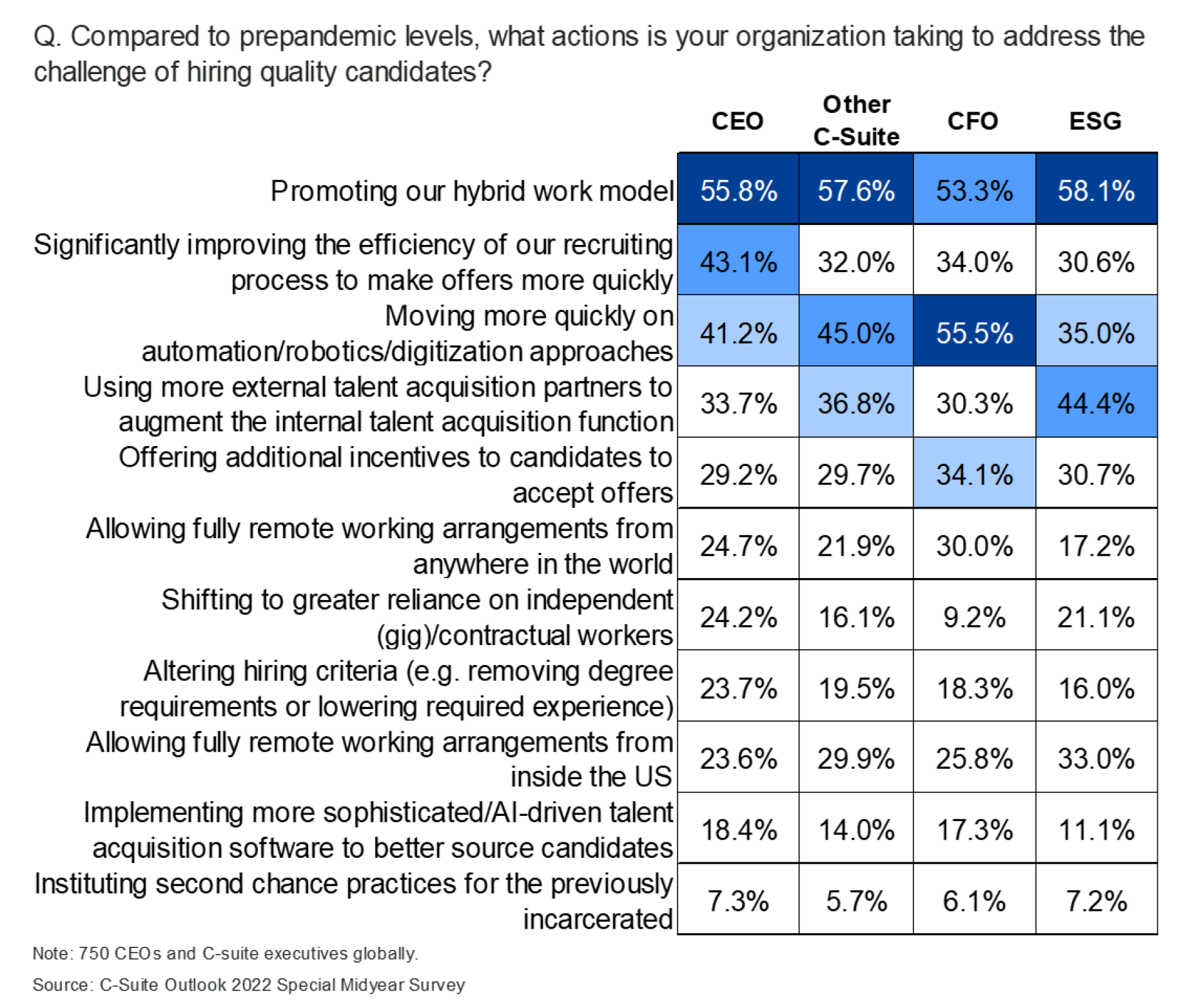

- Addressing the impact of labor shortages requires a three-pronged approach CEOs say they plan to attract more candidates by improving their recruitment process and workplace flexibility, accelerating automation, and shifting the workforce profile to more contractual workers versus full-time employees.

- To tackle labor force challenges, firms are doubling down on the hybrid work model and automation as well as improving their recruiting processes and communication around business strategy To improve retention in a time of tight labor markets, CEOs are focusing on more meaningful internal communication, greater workplace flexibility, employee wellness, providing opportunities for individual growth, and better incentives from higher pay to paid to time off for current employees.

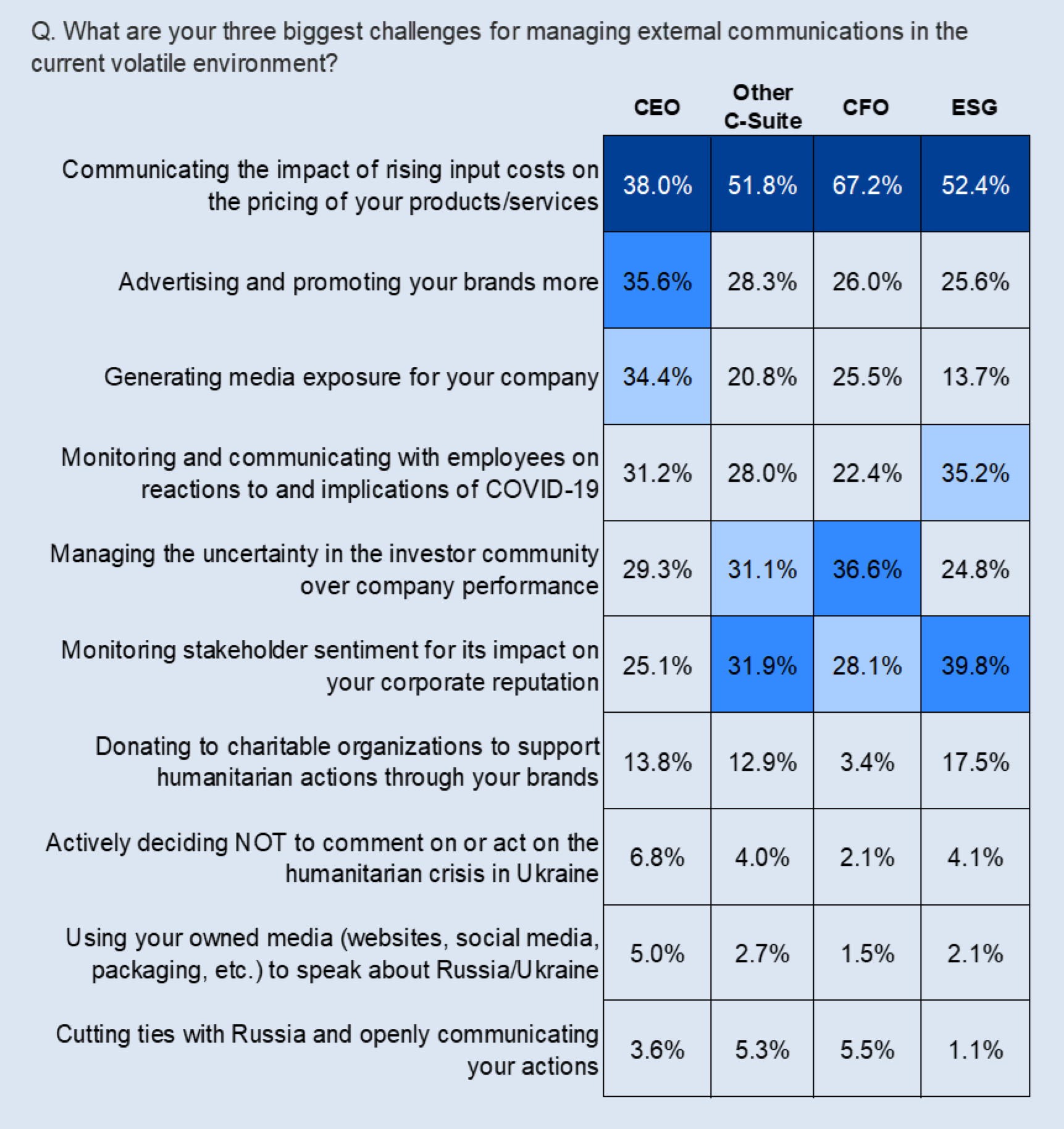

- The biggest challenge for external communications is the issue of rising prices Trust in corporations has been built up throughout the pandemic, but that trust can be eroded if there is any sense of Communicating the story to your customers should be handled carefully with honesty and transparency.

Volatility and uncertainty caused by the war in Ukraine means looking for innovative solutions

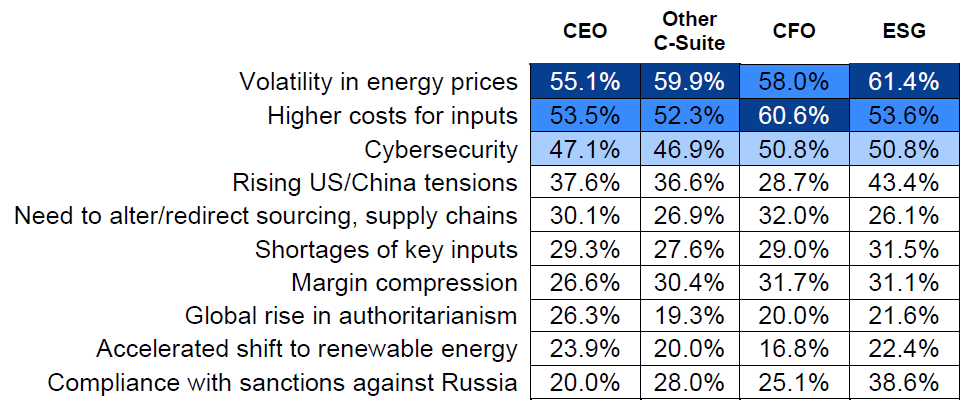

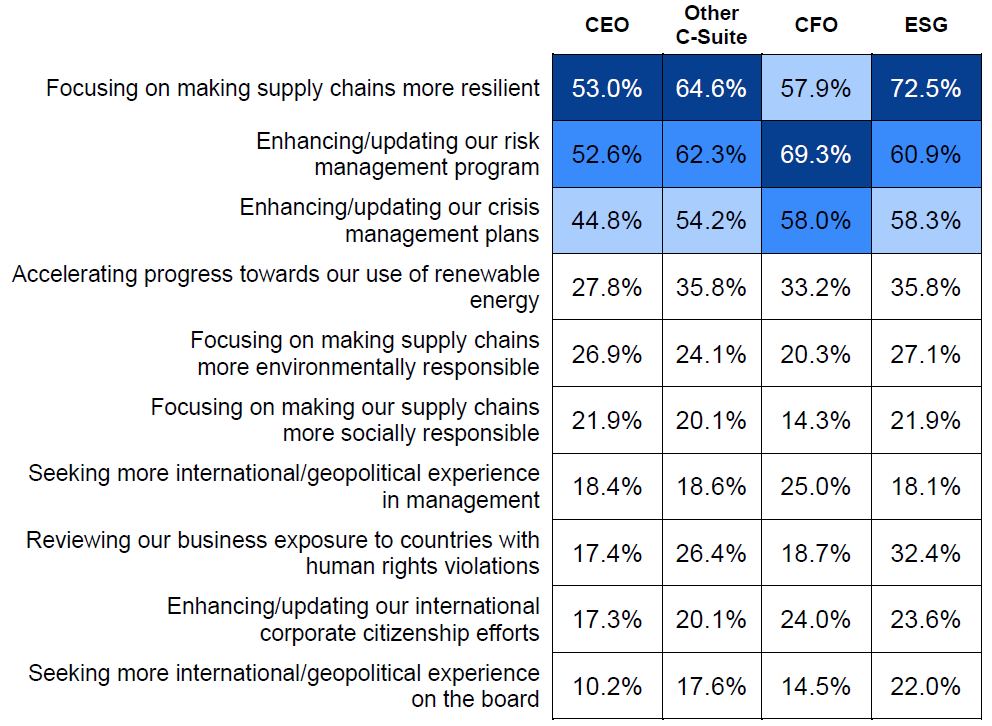

When asked specifically about the impact of the conflict in Ukraine, CEOs and other C-suite executives cite volatility in energy prices, higher input costs, and the growing risk of cyberattacks as the three most important issues that will affect their business operations in the next 12 months. Almost a third of CEOs surveyed see existing disruptions of supply chains being exacerbated by the war. Just 9 percent of companies in our survey say the war will have no material impact on their business operations in the coming year. In response to the war’s impacts, CEOs say their organizations are focusing on making their supply chains more resilient as well as environmentally and socially responsible, reevaluating and enhancing their corporate risk and crisis management programs, and to a slightly lesser extent, accelerating progress toward the use of renewable energy.

Figure 1.

For CEOs globally, the war in Ukraine is translating into concerns over energy price volatility, rising input costs, and heightened cybersecurity risks. For CEOs with operations In Russia, supporting humanitarian efforts and sanctions compliance are the war’s main impacts.

Q. Which of the following do you anticipate will have an impact on your business operations in the next 12 months specifically as a direct result of the war in Ukraine?

Note: 750 CEOs and C-suite executives globally.

Source: C-Suite Outlook 2022 Special Midyear Survey

CEOs of organizations with operations in Russia

Q. Which of the following do you anticipate will have an impact on your business operations in the next 12 months specifically as a direct result of the war in Ukraine?

Note: 750 CEOs and C-suite executives globally; n=59 for CEO with operations in Russia.

Source: C-Suite Outlook 2022 Special Midyear Survey

Firms are making supply chains more resilient, reevaluating corporate risk and crisis management programs, and accelerating progress toward the use of renewable energy.

Q. What steps are you taking in response to the war in Ukraine?

Note: 750 CEOs and C-suite executives globally.

Source: C-Suite Outlook 2022 Special Midyear Survey

There is concern about an escalation of the war, especially around cyberattacks. This means board members and senior management must recognize the present danger and ensure their organizations adopt a heightened security posture.

Most CEOs and other C-suite executives say they are somewhat concerned as opposed to highly concerned about the escalation of the war (i.e., US or NATO involvement, foreign military support of Russia, war spilling over into new regions, use of unconventional weapons). However, it is the threat of Russian retaliation through cyberattacks that has them most worried. Some 43 percent of CEOs and 42 percent of other C-suite executives say they are highly concerned about this specific threat. Almost half of CEOs globally cite cybersecurity as a war-related issue that will have a major impact on their business operations in the coming year (see Figure 1). In our annual C-Suite Outlook survey released in January 2022 prior to the Russian invasion, just 16 percent of CEOs cited cybersecurity as a high-impact, external issue facing their companies. That same survey found that less than 40 percent of CEOs believed their organizations were well prepared to meet future challenges related to a major cybersecurity crisis. [1]

Immediately after the invasion, The US Cybersecurity and Infrastructure Security Agency (CISA), warned that board members and senior management must recognize the present danger and ensure their organizations adopt a “heightened security posture.” [2] This warning may catch many corporate boards unprepared to provide the appropriate risk oversight. A recent survey by The Conference Board and the consulting firm PwC found 64 percent of executives believe that their board has a fair or poor understanding of cybersecurity. [3]

On a macroeconomic level, a broader conflict means worse outcomes for business investment and consumer spending but potentially more scope for additional rounds of government spending to fund military activities and accelerated investment in renewables. If the conflict is not prolonged for several years, the downside to global economic growth is likely to wane gradually throughout 2023. [4]

Figure 3.

The C-suite is concerned about a possible escalation of the conflict, especially Russian cyber retaliation.

Note: 750 CEOs and C-suite executives globally.

Source: C-Suite Outlook 2022 Special Midyear Survey

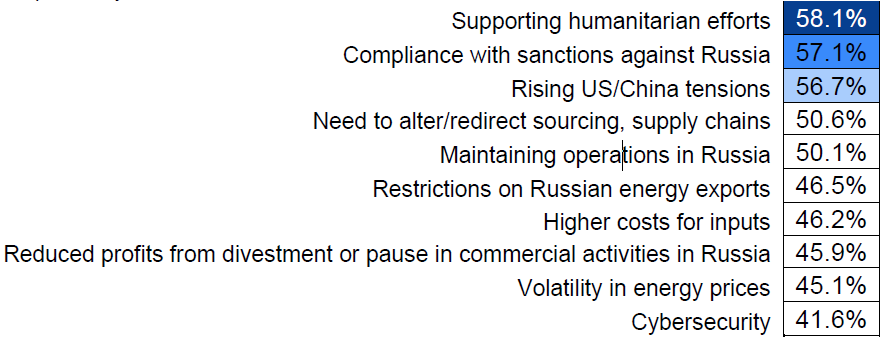

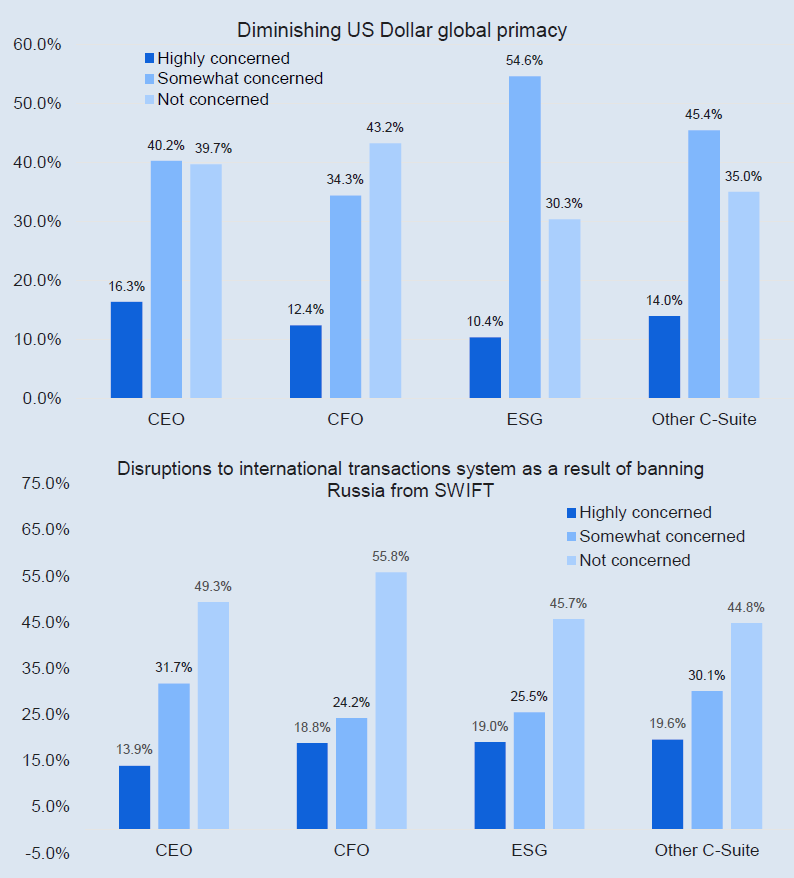

CEOs and other C-suite executives see the war further contributing to inflation through energy price volatility, higher costs for scarce inputs, and the ripple effect on global supply chains. This is leading to concerns over margin compression.

To mitigate inflation’s impact, more than half of responding CEOs favor passing higher input costs onto consumers, while 47 percent cite cutting costs. Absorbing price increases into profit margins is third at 36 percent, though there are few signs, at least for now, that CEOs are willing to take this action. In our initial survey released in January 2022, prior to the Russian invasion, 95 percent of CEOs globally said their organizations faced higher input prices, and rising inflation was seen as the second-highest external impact issue to affect their organizations in 2022, second only to COVID-19. Now, the war in Ukraine has exacerbated global inflation dynamics, and a protracted war will increase inflation woes. The ground war in Ukraine is presently cutting off key supplies for food, metals, and intermediate goods to the world. Financial sanctions are capping shipments of energy and other commodities from Russia. In response, Russia is cutting off natural gas shipments to several European economies that refuse to pay in rubles. Other forms of retaliation by Russia might also include cyber warfare that extends beyond the front in Ukraine. Together these developments are stoking and may continue to fuel inflation through global commodity prices and disruptions to supply chains. [5]

Figure 4.

Passing increases downstream, cutting costs, and absorbing price increases into profit margins are the chief ways to manage rising input costs. Few see changing vendors as a viable solution, likely a reflection of tight supplies and contractual obligations to vendors.

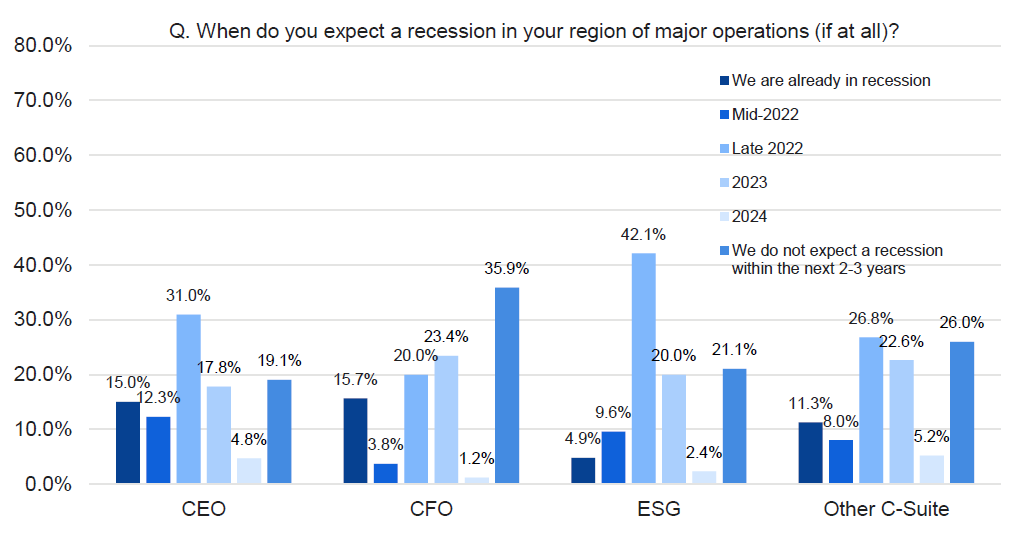

More than 60 percent of CEOs globally say they expect a recession in their primary region of operations before the end of 2023 or earlier, a sentiment shared by other C-suite executives. Fifteen percent of CEOs say their region is already in recession.

Figure 5.

C-suite executives, especially CFOs, are less convinced about the inevitability of recessions compared to CEOs.

Note: 750 CEOs and C-suite executives globally.

Source: C-Suite Outlook 2022 Special Midyear Survey

Historically high energy prices, renewed supply chain disruptions, heightened geopolitical risks, and eroding consumer confidence—on top of lockdowns in China and the ripple effect from the war in Ukraine—are all putting downward pressure on growth, leading to a significant drop in CEO confidence across the globe. These disruptions, along with restrictive monetary and fiscal policy, are fueling recession expectations. In our latest C-Suite Outlook survey, more than 60 percent of CEOs globally say they expect a recession in their primary region of operations within the next 12 to 18 months, a sentiment shared by other C-suite executives. Fifteen percent of CEOs say their region is already in recession.

A global recession is not our base case; we anticipate growth of 2.9 percent in 2022 and 2.3 percent in 2023, but there are other scenarios that could impact our base case and result in recession. The occurrence of one extreme event, or even a combination of several smaller unfavorable events, could thrust the world back into recession after a robust recovery from the pandemic. Stagflation—a period of very low growth (usually less than 2 percent) and high inflation (greater than 2 percent inflation)—if prolonged, could result in a longer or deeper recession.

However, in our view, a short period of stagflation, either globally or in select major economies, is of greater likelihood than recession over the next year and a half. [6]

The Conference Board Measure of CEO Confidence™ which declined sharply in both the US and Europe before the start of Q3 2022, underscores the concerns of the 60 percent of CEOs who expect a recession in the short to medium term. In the US, the Measure of CEO Confidence fell to 42, levels not seen since the start of COVID-19, while confidence levels in Europe dropped to 37. At 34, confidence levels were lowest among CEOs of western and non-Chinese multinational companies in China, where the measure was taken for the first time. A reading below 50 denotes more negative than positive responses. [7]

As Nobel Prize-winning economist Robert Shiller points out, fears of a recession and the ongoing negative narrative expressed by companies and the media can become a self-filling prophecy, [8] even with relatively positive economic fundamentals.

Expect the emphasis on resilient and more environmentally and socially responsible supply chains—critical responses to the conflict cited by CEOs—to gain momentum since investors will be focusing on those issues.

Almost a third of CEOs say the war is accelerating the need to alter/redirect sourcing and supply chains, already in distress during the COVID-19 pandemic. It ranks fourth in the list of war-related issues they expect to have a high impact on business operations in the next 12 months, after energy volatility, higher input costs, and the risk of cyberattacks. For organizations that have supply chains that run through either Russia or Ukraine, the need to redirect sourcing is particularly acute. It ranks as their number one war-related impact, with 68 percent of CEOs with supply chains in Russian and 64 percent with supply chains in Ukraine citing this as a major disruptor of business operations.

Fixing those stressed supply chains is the number one action organizations are taking in response to the war. Fifty-three percent of CEOs globally, 78 percent with operations in Russia, and 72 percent with operations in Ukraine say they are focusing on making supply chains more resilient. Globally, almost two-thirds of C-suite executives say their organizations are focused on this in response to the conflict.

Research by The Conference Board suggests that companies now recognize that shifting to regional and domestic suppliers, and diversifying supply sources away from high-risk areas and China should be strongly considered. North America, (and Central America by proximity) and certain other Asian economies may be optimal alternative locations. [9]

The commitment to enhance risk management and crises management plans is at least partially linked to recent supply chain shocks. One thing the crisis in Ukraine has shown is that “grey swans” do happen, and that contingency planning is now a mission-critical risk management and business planning requirement for multinational companies. CEOs and boards can use the conflict as a catalyst to address risk management and crisis management plans and processes and to have a candid discussion at both management and board levels about where people feel their organization is falling short in this area.

One thing that the crisis in Ukraine has shown us is that “grey swans” do happen. CEOs and boards can use the Ukraine conflict as a catalyst to address risk management and crisis management plans and processes and to have a candid discussion at both management and board levels about where people feel their organization is falling short in this area.

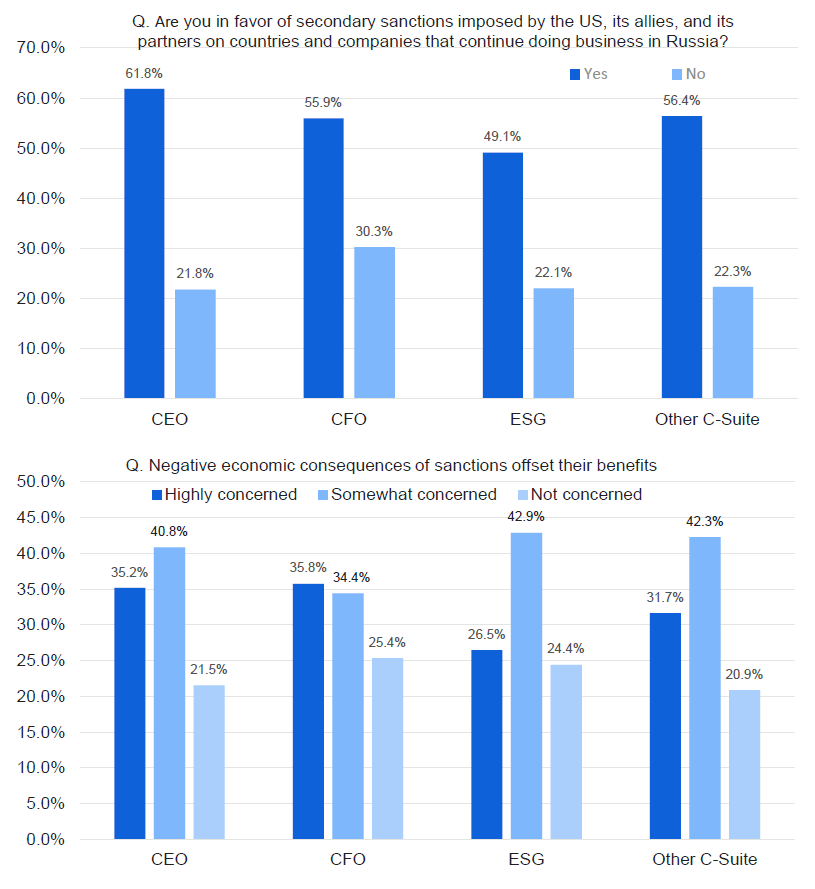

The majority of CEOs globally favor secondary sanctions, which put pressure on third parties to stop their activities with Russia by threatening to cut-off access to the US, its allies, and other partners, even though such actions would sharply escalate the economic battleground. Nevertheless, CEOs are concerned about the negative consequences of sanctions already in place.

A significant majority (62 percent) of CEOs globally say they are in favor of secondary sanctions that would be imposed by the US, its allies, and its partners on countries and companies that continue doing business in Russia. Such a decision would sharply escalate the economic battleground and set the stage for a fractured global economy and world order. [10] Secondary sanctions put pressure on third parties to stop their activities with Russia by threatening to cut-off the third party’s access to the US, its allies, and other partners that have imposed primary sanctions on Russia. The imposition of secondary sanctions is meant to force companies, banks, and individuals to make a tough choice: continue doing business with the sanctioned entity or with the US and its allies, but not both. [11] Despite a majority of CEOs saying they favor secondary sanctions, more than a third of CEOs globally say they are highly concerned about the negative economic consequences of sanctions offsetting their benefits.

Figure 6.

A majority of CEOs globally say they are in favor of secondary sanctions, but there are concerns that negative consequences of sanctions may outweigh the benefits.

Note: 750 CEOs and C-suite executives globally.

Source: C-Suite Outlook 2022 Special Midyear Survey

One possible explanation for their sentiments is that many CEOs may view secondary sanctions as an incremental increase since existing sanctions, such as constraints on dollar transaction and the US Foreign Direct Product Rule (for technology exchanges), already cover this ground. Another is that since firms are going through the pain of sanctions, governments need to close gaps, especially for big economies like China and India, for them to be effective against Russia.

Just 20 percent of CEOs say compliance with sanctions now in place will have an impact on their business operations in the next 12 months, though they will be impacted by rising food and energy inflation. However, the issue may require closer attention for many firms. On May 3, 2022, the US Securities and Exchange Commission’s (SEC) Division of Corporation Finance issued a reminder that public companies, either domestic or international, listed on US exchanges “may have disclosure obligations” arising from Russia’s invasion of Ukraine. These include but are not limited to reporting on exposure to Russia, Belarus, or Ukraine through operations, employees, investments, securities, sanctions, or legal or regulatory uncertainty; direct or indirect reliance on goods or services sourced in Russia or Ukraine or countries supporting Russia; actual or potential disruptions in the company’s supply chain; or business relationships, connections to, or assets in the affected countries. [12]

Not surprisingly, the view from Russia is different. For firms with operations in Russia, compliance with sanctions is cited by 57 percent of CEOs as a critical issue affecting their business operations in the next 12 months, and close to half say they are highly concerned about negative economic consequences of sanctions offsetting their benefits.

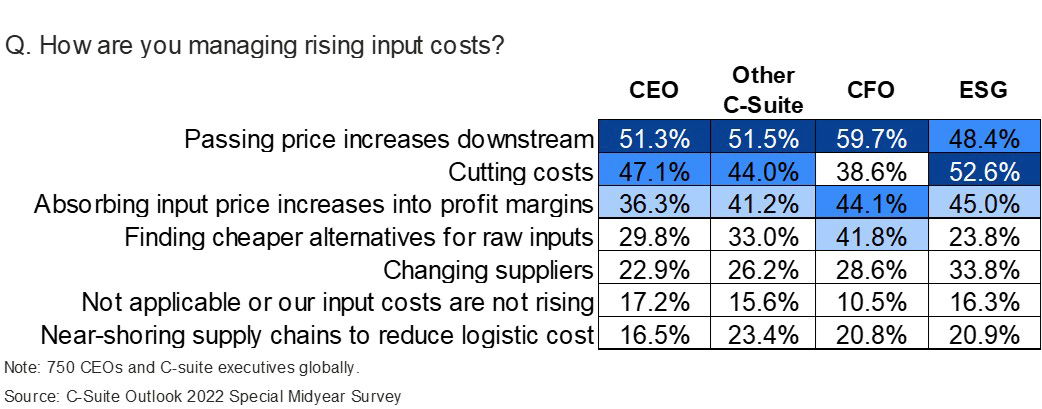

More than 60 percent of CEOs globally say they are in favor of secondary sanctions—a decision that would sharply escalate the economic battleground and set the stage for a fractured global economy and world order. However more than a third say they are highly concerned about negative economic consequences of sanctions offsetting their benefits. Almost half of CEOs say they are not concerned about disruptions to international transactions system as a result of banning Russia from SWIFT…Just 14 percent say they are highly concerned about this issue.

Diminishing the Dollar: Even before the Russia-Ukraine war, its primacy was under siege

As the US, NATO, and their allies and partners continue to respond to Russia’s brutality in Ukraine with escalating economic sanctions and close to one thousand businesses withdrawing from or ceasing operations in Russia, the Kremlin is pursuing an aggressive policy to find pathways to circumvent the economic sanctions. In the short term, the goal is to keep Russia afloat economically. Ultimately, in the longer term, the goal is to try and resurrect the former Soviet Union and its power and to create an alternative world order not dependent on the primacy of the US and the dollar.

Reducing the use of the US dollar has been an objective of both Russia and China for over a decade, to help shield their currencies from US sanctions and assert global economic leadership. Even before the imposition of the economic sanctions in response to the invasion of Ukraine, Russia has been reducing its share of trade conducted in dollars. At least for now, CEO respondents to our C-Suite Outlook survey show relatively little concern about this strategy. Just 16 percent note they are highly concerned about diminishing the global primacy of the US dollar. Some 40 percent say they are somewhat concerned; the same number say they are not concerned. Also, almost half of CEOs say they are not concerned about disruptions to the international transactions system as a result of banning Russia from SWIFT, a service that facilitates global transactions among thousands of financial institutions. Just 14 percent say they are highly concerned about this issue.

Source: CED Policy Brief: Russia’s Lifelines—India Stuck in the Middle or Russia’s Time-tested Friend? The Committee for Economic Development of The Conference Board, April 2022.

Note: 750 CEOs and C-suite executives globally.

Source: C-Suite Outlook 2022 Special Midyear Survey

Energy price volatility related to the conflict is driving many firms to take a closer look at renewable energy as part of a longer-term growth strategy. Depending on how it is sourced, it can provide a hedge against the price volatility of fossil fuels.

With a majority of CEOs and other C-suite executives citing war-related volatility in energy prices as having a major impact on their business operations, more than a quarter (28 percent) of CEOs globally (and 36 percent of C-suite executives) say their organizations are accelerating progress toward the use of renewable energy. The current geopolitical crisis is a reminder that fossil fuels are highly vulnerable to geopolitical risks, and prices for renewable energy are increasingly competitive. Depending on how it is sourced, it can provide a hedge against the price volatility of fossil fuels. [13] Many businesses are clearly struggling with sharply higher energy prices—40 percent of respondents to our European CEO Confidence survey said they did not expect energy prices to return to prepandemic levels before 2024, while 38 percent believe they will never go back—as a result of the West’s desire to shift away from Russian gas and oil. [14] Funding the hefty investment needed to meet that goal is a challenge, but more than 20 percent of CEOs globally (and 30 percent of C-suite executives) responding to our latest survey say they plan to invest in renewable energy as a growth lever over the next two to three years.

The Conference Board expects volatility will continue to characterize energy and oil markets, at least for the medium term. The evolution of the war in Ukraine and lower global oil demand as growth slows will be key factors in determining the path for prices ahead. For oil, production caps and disruptions in supply may keep prices around the $113/bbl range, well above the $70-$90/bbl price that prevailed before Russia-Ukraine conflict. These elevated prices will reflect the EU’s ban on Russian oil but also likely capacity constraints for oil production among Gulf states and the US. Still, risks of additional spikes or dives in oil prices loom as the potential for Russian retaliation or prospects of increased Gulf production may keep investors and consumers of oil guessing. [15]

More than a quarter of CEOs globally and more than a third of C-suite executives say their organizations are accelerating progress toward the use of renewable energy as a result of the Russian invasion of Ukraine.

We also expect a shift, but not a decrease, in focus on sustainability programs as some European firms may supplement their energy needs with a greater share of fossil-fuels in the short term. Current energy supply challenges offer business leaders an opportunity to accelerate efforts toward reducing or even eliminating dependence on Russian fossil fuels and invest in greener solutions. These actions may help achieve the EU’s objective of reducing greenhouse gas emissions (GHG) by 55 percent by 2030. In fact, two-thirds (66 percent) of respondents say that the current energy crisis will not significantly slow Europe’s long-term efforts to reduce greenhouse gas emissions.

Companies planning to invest in renewable energy can start by setting their level of ambition— how much renewable energy to source and by when. A next step is to determine an appropriate mix of renewable energy sourcing strategies, taking into consideration that at present there are practical limits to renewable capacity. Energy attribute certificates (EACs) are the easiest and most common sourcing method, but power purchase agreements (PPAs) are quickly gaining traction: they are a more impactful procurement option because they directly contribute to generating new renewable energy capacity. But PPAs may not be feasible for every context. Companies will need to consider a mix of sourcing strategies with the highest possible level of impact while considering their own specific circumstances and constraints. [16]

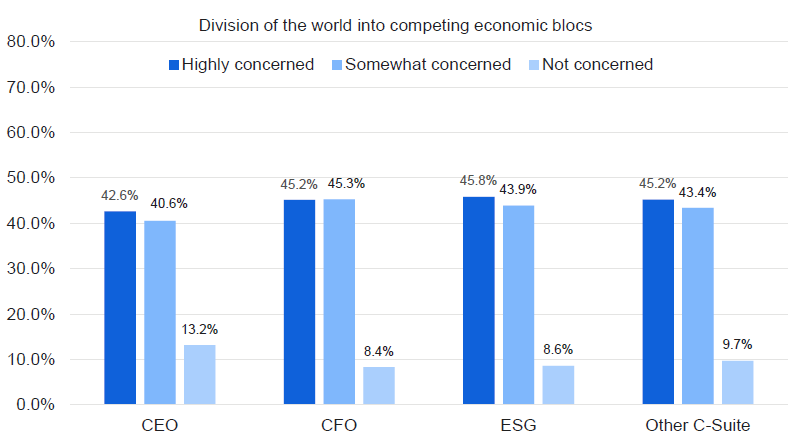

CEOs say rising US-China tensions are likely to have a major impact on business operations in the coming 12 months and rank it among the top five impacts. Many are highly concerned about the reemergence of competing economic blocs—a division that would have significant negative impacts on global trade and economic growth for years to come.

In our current C-Suite Outlook survey, CEOs and the C-suite express very high levels of concern over rising US/China tension. This concern is contributing to intense concern about a fundamental realignment of the global geopolitical landscape—the potential division of the world into competing economic blocs (i.e., the US and its allies vs. China and its allies). This division is likely to have significant negative impact on global trade and economic growth. Recent surveys by The Conference Board measuring CEO Confidence levels around the world confirm this concern. When asked, “Over the next 5-10 years, what do you think will be the most likely longterm effect of current great power tensions among Russia, US, and China?” four out of five CEOs in Europe responded they expect an acceleration in the division of the world into competing economic blocs. Along similar lines, 60 percent of CEOs in the US say geopolitical tensions will likely result in the globe dividing into Western/democratic and China/Russian spheres. With China, Europe, and the US all aiming to reduce their reliance on others for strategic imports, and trade sanctions increasingly used as a foreign policy tool, protectionism is becoming a fact.

Figure 7.

Concerns the war in Ukraine may create a new inflection point in geopolitics and the political economy—the emergence of Cold War-era type economic blocs.

Note: 750 CEOs and C-suite executives globally.

Source: C-Suite Outlook 2022 Special Midyear Survey

Stakeholder views most important in determining organizational response to the war include customers, the board, and regulators.

Employees have played a less important role in shaping the corporate response to Ukraine than in dealing with non-war related domestic social and political issues. Employees are interested stakeholders in social issues, and the war in Ukraine certainly has a social component as companies react by pulling out of Russia and providing support for those negatively affected by the war in the region. But companies are not involving the employee populace in the economic impacts of the war since most employees are not in the areas of accountability most heavily affected.

Figure 8.

Stakeholder views most important in determining organizational response to the war include those of customers, the board, and regulators.

With sanctions compliance cited as an issue likely to have an impact on business operations in the next 12 months, and the recent disclosure reminder from the US SEC, companies are treating regulators as a critical stakeholder in their war-related decision-making. When asked which stakeholders’ views are most important as they decide their organization’s business response to the war in Ukraine, CEOs globally ranked customers first, regulators second, and boards third. Employees were ranked sixth on the list of eight choices.

CEOs say their corporate citizenship program responses to the conflict are primarily focused on supporting employee volunteer efforts and providing cash to international relief organizations. As we’ve seen before with natural disasters, a relatively small percentage of companies are prepared to deal with the long-term direct effects of the war.

Figure 9.

As the war continues, citizenship programs may need more flexibility in addressing critical, longer-term needs as they emerge. The challenge will be focusing on immediate relief and longer-term recovery.

As with a natural disaster, when a geopolitical crisis such as the Russian invasion of Ukraine brings death and hardship, there is a powerful desire on behalf of companies and employees to help. While firms need to be mindful of the very real differences between natural disasters and wartime situations, they can still benefit from the lessons in disaster relief in terms of engaging senior management and employees, utilizing a wide range of financial resources, forging partnerships with other firms, and approaching communications with stakeholders in a consistent and thoughtful manner. [17]

Long-Term Growth in a Volatile Global Environment

In our survey, we also asked CEOs and other C-suite executives about longer-term growth strategies, including how they plan to deal with labor shortages and how their human capital management priorities are changing as the initial impacts of the COVID-19 pandemic translate into more permanent challenges.

To ensure growth for their business over the next two to three years, CEOs say they are investing in digital transformation, developing new lines of business, upskilling and retraining existing employees, strengthening the corporate culture, and increasing productivity in their hybrid work models.

When asked where they plan to invest to ensure growth for their business over the next two to three years, businesses are focusing investment on technology and people. CEOs say they are looking to digital transformation (the top-ranked growth lever with 58 percent citing this as part of their investment plans), along with developing new lines of business (52 percent), upskilling and retraining existing employees (44 percent), strengthening the corporate culture (39 percent), and increasing productivity in their hybrid work models (35 percent). Compared to prepandemic levels, CEOs say they are moving more quickly on automation, robots, and digital transformation because they can’t get enough people to work.

During severe labor shortages that hinder growth, organizations may be missing an opportunity to enlarge their available labor pool by failing to provide support for employees with caregiving responsibilities. Just 7 percent of respondents cite this as a priority.

Figure 10.

Businesses are investing in technology (digital transformation/automation), new revenue streams, and people (upskilling and looking for new skillsets) to spur future growth.

Figure 11.

When asked which government policy actions would most help their business to thrive, CEOs say they can best benefit from lower taxes, public investment, fewer regulations, and an effective government energy transition plan.

Human Capital Management

Addressing the impact of labor shortages requires a three-pronged approach: 1) attracting more candidates by improving recruitment processes and workplace flexibility; 2) accelerating automation; and 3) shifting the workforce profile to more contractual workers versus full-time employees.

More than half of global respondents (56.6 percent) say they are promoting their hybrid work model to attract workers, while 43 percent say they are looking to accelerate the movement to more automation and the use of robots. Orders for workplace robots in the US increased by a record 40 percent during the first quarter of 2022 compared with the same period in 2021; robot orders, worth $1.6 billion, climbed 22 percent in 2021, following years of stagnant or declining order volumes. [18]

To improve the ability to attract and hire quality candidates, CEOs say they are focusing on improving the efficiency of the recruiting process to condense time-to-offer, using more external talent acquisition partners to augment the internal talent acquisition function, and offering incentives to candidates, such as sign-on bonuses, equity awards, and additional benefit offerings. To widen the candidate pool, more than one-fifth of respondents say they are altering hiring criteria; for example, by removing degree requirements or certification for some roles or lowering the number of years of experience required to qualify for a position.

Figure 12.

To tackle labor force challenges, firms are doubling down on the hybrid work model, automation, robots, digital transformation, and improving their recruiting processes.

To improve retention in a time of tight labor markets, CEOs are focusing on more meaningful internal communication, greater workplace flexibility, employee wellness, providing opportunities for individual growth, and better incentives from higher pay to paid to time off for current employees.

To retain employees and foster organizational alignment, CEOs are clearly focused on reaching their workforces with improved communication around both the organization’s business strategy and its mission and purpose. Paramount for retention is flexibility. Globally almost half of CEOs are looking to promote their hybrid work model, and more than one-third are introducing policies that reduce stress and improve the employee experience, such as no meeting Fridays, limiting meeting time, and protecting employee time outside of core work time. Increasing opportunities for development is another critical element of retention. Globally, more than a third of CEOs say they plan to institute new employee development programs for advancement, reexamine job responsibilities to provide new opportunities for growth, and increase opportunities for workplace mobility.

Research by The Conference Board found that companies whose employees continued to thrive during the pandemic created trust and offered greater flexibility. Rather than heightening surveillance during the pandemic, successful firms trusted employees to make good decisions about where, when, and how they performed their work. They also communicated frequently and transparently through virtual town halls and other forums. Senior leaders went beyond the script by authentically sharing their own challenges, inviting employees to ask questions, and allowing themselves to be seen on camera as real people—rather than solely as polished executives. They also augmented their well-being programs in response to increased stress and anxiety, and they amplified corporate mission and purpose, recognizing the power of a common purpose as a unifying force for remote and geographically dispersed employees. [19]

Figure 13.

To boost retention, CEOs are focused on better communication around business strategy, company’s mission and purpose, greater workplace flexibility, employee wellness, and development opportunities.

Communications challenges

Figure 14.

The biggest communication challenge for CEOs and C-suite executives is telling their story about the impact of rising input prices on their products and services.

Note: 750 CEOs and C-suite executives globally; percent of respondents naming an issue among their top three choices.

Source: C-Suite Outlook 2022 Special Midyear Survey

Endnotes

1Charles Mitchell, Dana M. Petersen, Rebecca L. Ray et al., C-Suite Outlook 2022: Reset and Reimagine, The Conference Board, January 2022.(go back)

2Shields Up: 5 Urgent Cybersecurity Actions for Executives, CISA, February 25, 2022(go back)

3PwC and The Conference Board, 2021 Board Effectiveness: A Survey of the C-Suite, November 2021.(go back)

4Global Economic Outlook, The Conference Board, May 2022.(go back)

5Dana M. Peterson and Erik Lundh, StraightTalk® The Many Roads to Recession, The Conference Board, June 2022.(go back)

6Peterson and Lundh, StraightTalk® The Many Roads to Recession.(go back)

7Global CEO Confidence Plunged in May, The Conference Board, May 24, 2022.(go back)

8Robert Shiller, Narrative Economics: How Stories Go Viral and Drive Major Economic Events, Princeton University Press, 2019.(go back)

9Ataman Ozyildirim and Dana M. Patterson, Manufacturing: If Not China, Then Where? The Conference Board, June 2022(go back)

10CED Policy Brief: Russia’s Lifelines—India Stuck in the Middle or Russia’s Time-tested Friend? Committee for Economic Development of The Conference Board, April 2022.(go back)

11Daniel Flatley, What Secondary Sanctions Mean, for Russia and World, Bloomberg.com, April 2022.(go back)

12Robert Lamn, Cutting Ties with Russia (Part 3): A Reminder About Ukraine from the SEC, The Conference Board, May 2022(go back)

13Thomas Singer, Toward Renewable Energy, The Conference Board, February 2022.(go back)

14Ilaria Maselli and Konstantinos Panitsas, The Conference Board Measure of CEO Confidence™ for Europe by ERT: 2022 H1 Results, May 22, 2022.(go back)

15Hiba Itani, Supply-Demand Imbalances, Uncertainty to Keep Oil Prices in Flux, The Conference Board, June 13, 2022(go back)

16Singer, Toward Renewable Energy.(go back)

17Jeff Hoffman and Paul Washington, Corporate Citizenship During a Geopolitical Crisis (Part 4 of 5), The Conference Board, April 2022.(go back)

18Bob Tita, Robots Pick Up More Work at Busy Factories, The Wall Street Journal, May 2022.(go back)

19Robin Erickson, Barbara J. Lombardo, et al., Reshaping Employee Experience and Organizational Culture, The Conference Board, June 2021.(go back)

Print

Print