Mary Ann Deignan is Managing Director; Rich Thomas is Managing Director and Head of European Shareholder Advisory; and Christopher Couvelier is Managing Director at Lazard. This post is based on a Lazard memorandum by Ms. Deignan, Mr. Thomas, Mr. Couvelier, Emel Kayihan, Antonin Deslandes, and Leah Friedman.

Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here) by Lucian Bebchuk, Alon Brav, and Wei Jiang; Dancing with Activists (discussed on the Forum here) by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch; and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System (discussed on the Forum here) by Leo E. Strine, Jr.

Observations on Global Activism Environment H1 2022

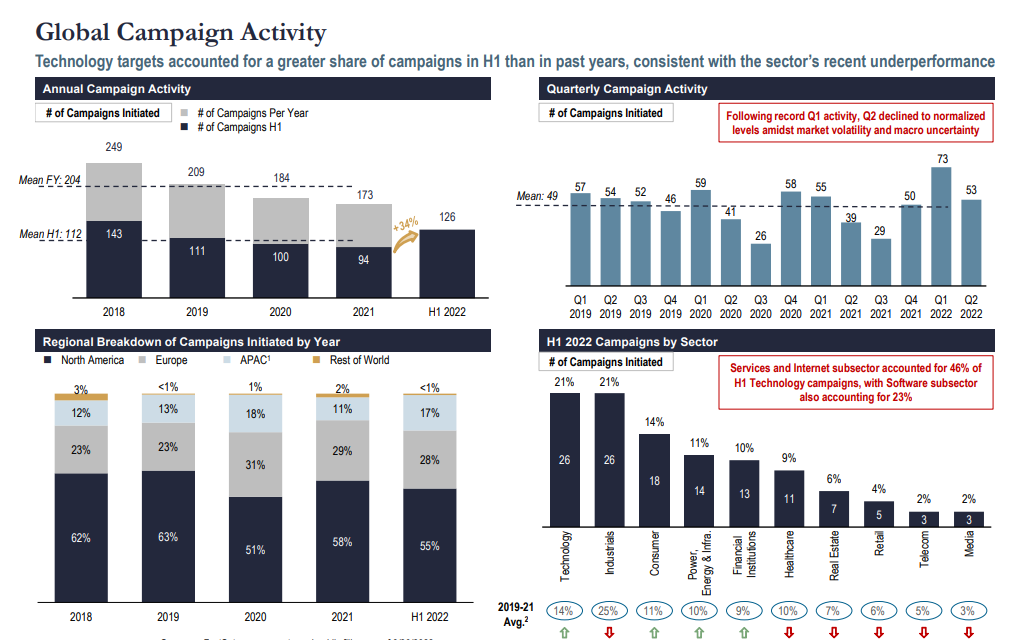

Activity Slows vs. Q1 but Remains Robust

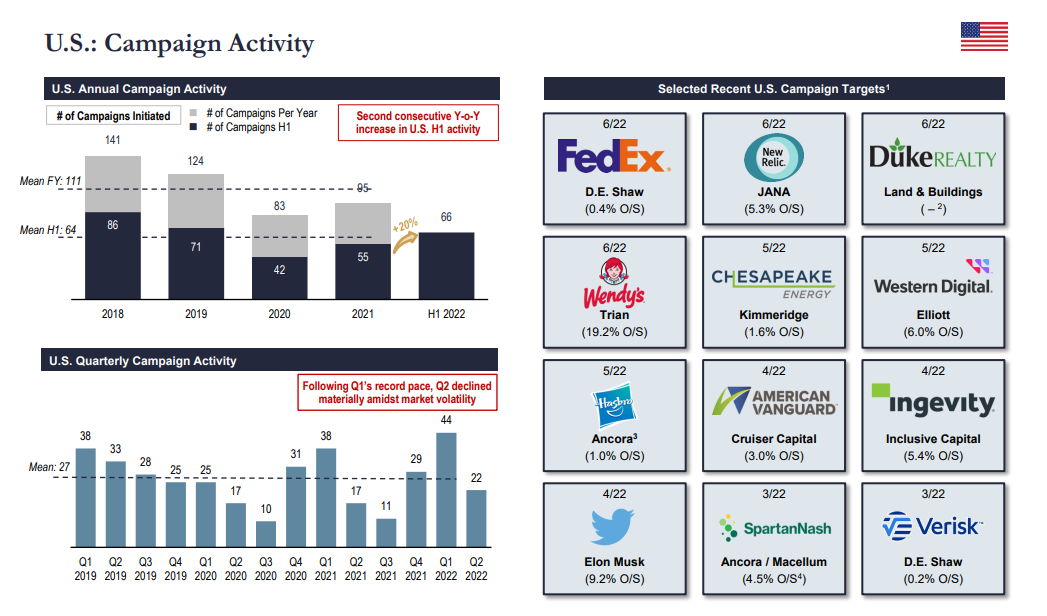

- Despite a challenging investing environment in 2022, activity remains elevated—Q2 was the second most active quarter in the past five quarters

- Global campaign activity for Q2 (53 campaigns) down 27% vs. Q1, in line with Q1/Q2 pattern of recent years

- Regionally, the decline was most acute in the U.S., where activity materially declined by 50%

- By contrast, Europe saw a strong Q2 with a 33% increase over Q1 levels

Technology Repositions as the Most Active Sector

- Technology companies accounted for 1 out of every 4 activist targets in Q2, resulting in Technology being the most targeted sector in H1

- Software, Services and Internet were the most active subsectors

- Primary activist objectives in Technology campaigns are in line with key themes across other sectors, with M&A, strategy and capital allocation dominating the narrative

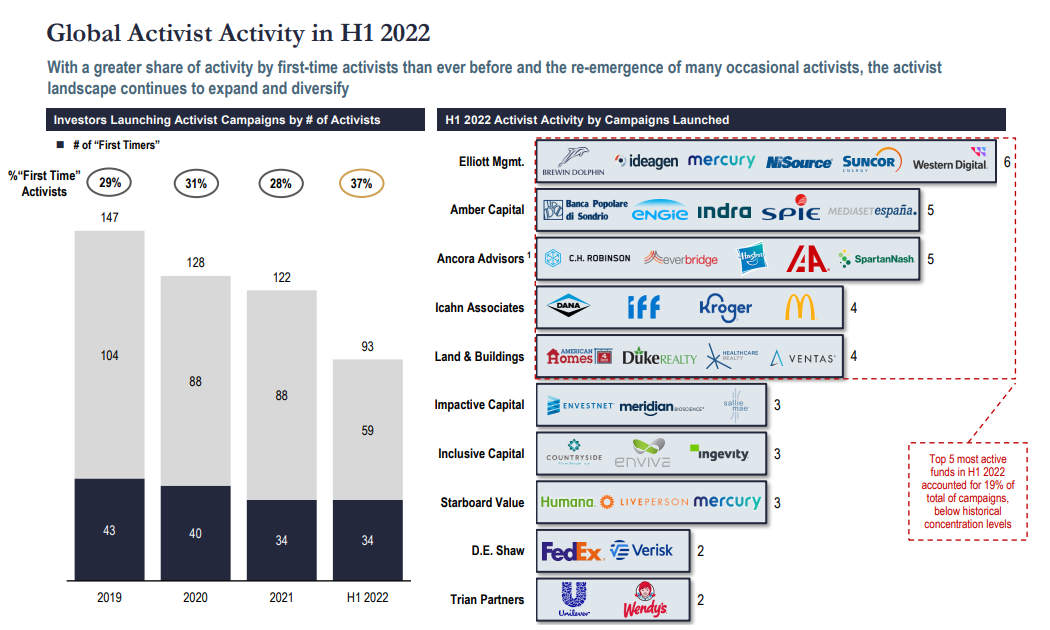

First Timers Break Records and Diversify the Field

- First time activists accounted for 37% of all activists launching campaigns in H1, the highest level in recent years

- In addition, campaigns were more dispersed across the universe of activists, with the top 5 most prolific activists accounting for 19% of all campaigns in H1, which is below the concentration levels observed over the past 5 years

- The H1 top activists feature a broad range of investor types including established global players, regional and sector focused funds, and increasingly active ESG specialists and occasional activists

European Activity at Record Levels

- Campaigns continued to climb in Europe, reaching a record 35 for H1 (up 67% vs. H1 2021)

- The impact of macroeconomic events was felt differently in Europe, translating into varied levels of activism across the continent

- French campaigns were significantly over-represented (~20% of European campaigns), as some of the largest companies found themselves in the crosshairs, while German campaigns (~6%) represented less than half of the country’s traditional contribution

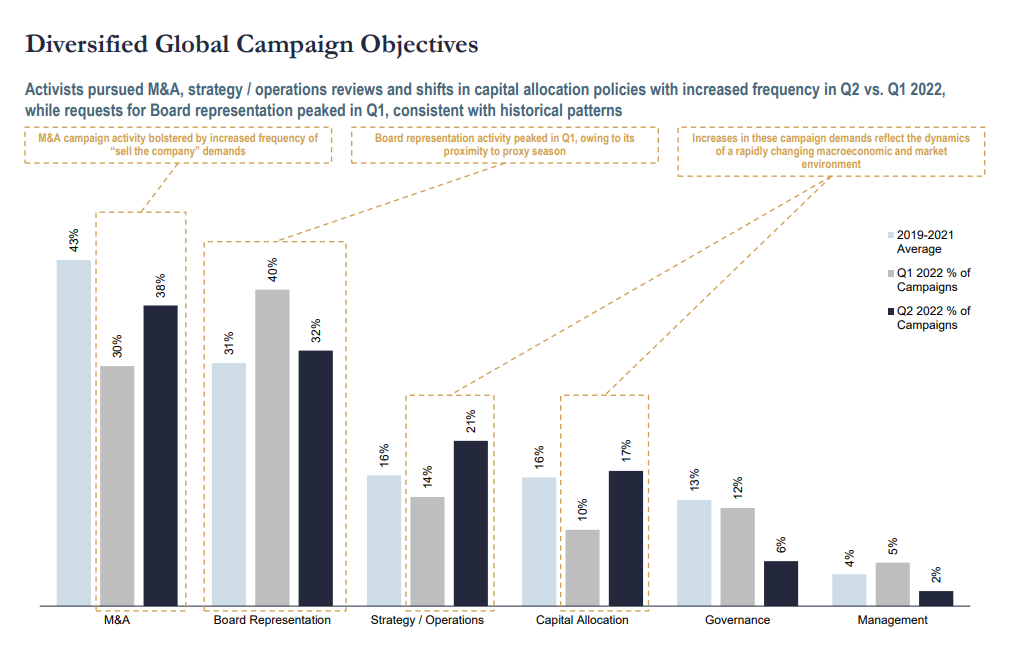

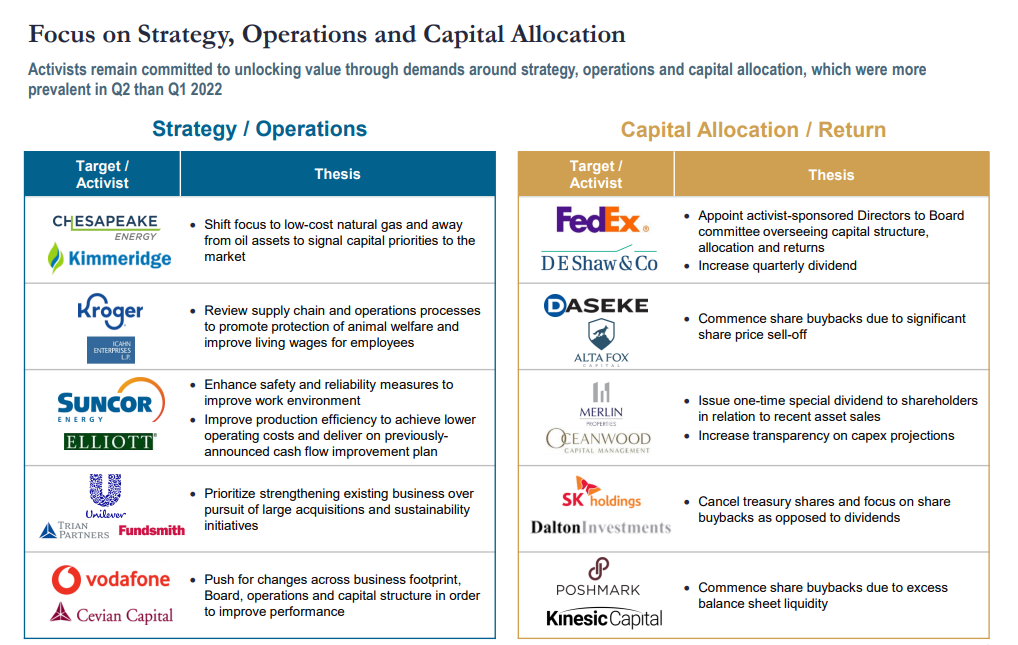

Campaign Demands Reflect Current Market and Economic Conditions

- The challenging macroeconomic and investing environment influenced activists’ demands in H1 2022

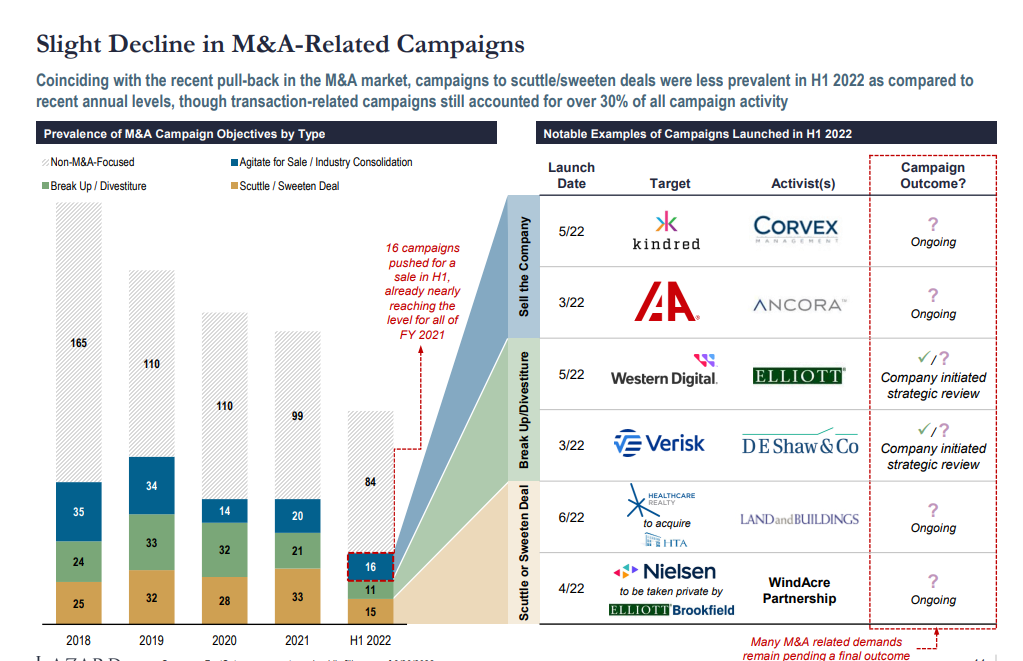

- The number of “sell the company” demands was 7 in Q2, bringing the H1 total to 16, as activists pushed the M&A option as an alternative to what they perceived as failed stand-alone strategies

- As the economic outlook deteriorated through Q2 there was increased focus on strategy and operations (21% of campaigns in Q2 vs. 14% in Q1) and capital allocation policies (17% of campaigns in Q2 vs. 10% in Q1)

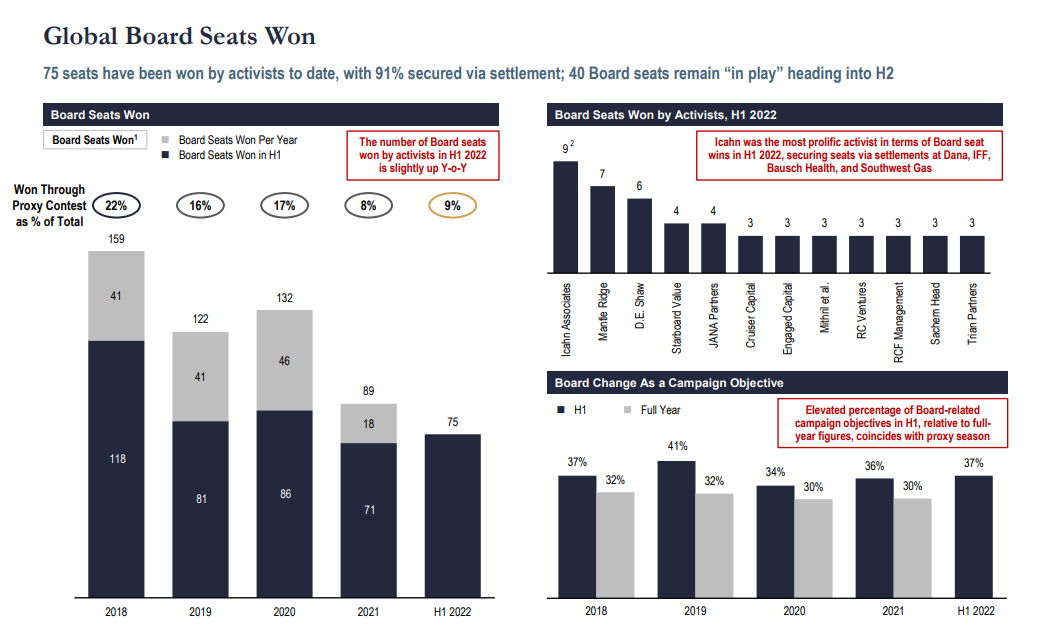

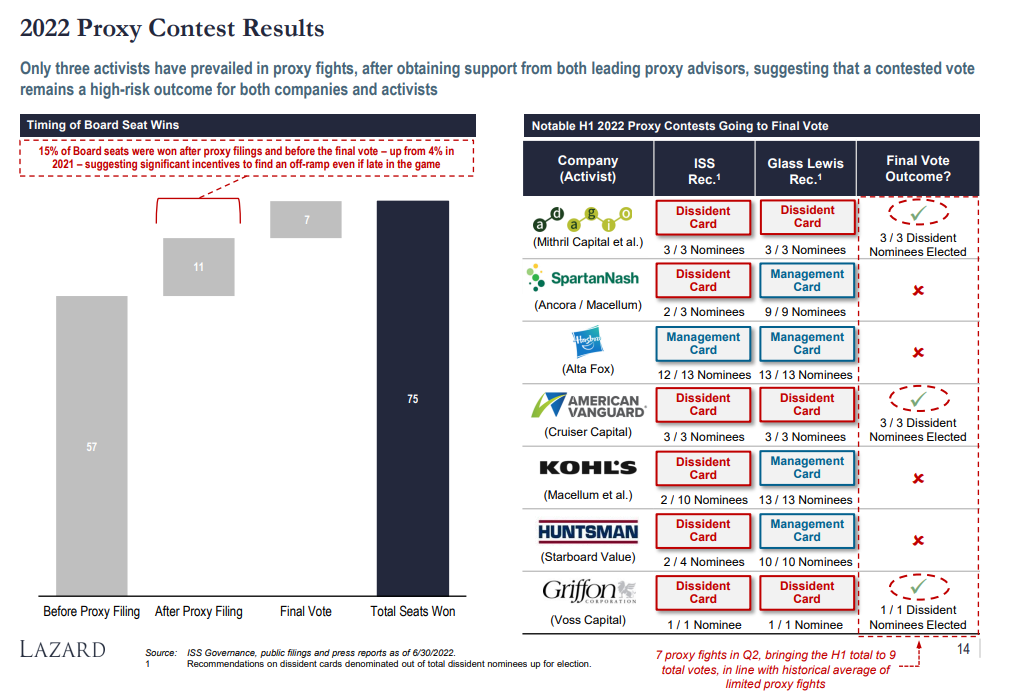

Settlements Continue to be Preferred Route to Board Representation

- Continuing 2021’s trend, a historically high proportion of Board seats (91% of the 75 total Board seats won) were secured via settlement agreements

- Only 7 proxy fights went to a final vote in Q2, bringing the H1 total to 9, in line with recent historical H1 levels and suggesting that a contested vote is a high-risk outcome for both companies and activists

- Icahn has been the most successful at obtaining Board representation in H1, with 9 Board seats, all via settlement

The complete publication, including footnotes, is available here.

Print

Print