Natalie Cooper is Senior Manager and Robert Lamm is an independent senior advisor, both at the Center for Board Effectiveness, Deloitte LLP; and Randi Val Morrison is Vice President, Reporting & Member Support at the Society for Corporate Governance. This post is based on their Deloitte/Society for Corporate Governance memorandum.

Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; Does Enlightened Shareholder Value Add Value? (discussed on the Forum here) Stakeholder Capitalism in the Time of COVID (discussed on the Forum here), both by Lucian Bebchuk, Kobi Kastiel, and Roberto Tallarita; and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr.

Topics such as cybersecurity, human capital, climate, and political contributions that are associated with the seemingly limitless umbrella of “environmental, social, and governance” (ESG) are becoming standing items on many board agendas. This growing and ever-evolving list of issues that companies are expected to effectively manage is causing many boards to consider what it may mean for their oversight role and how to maintain and/or enhance oversight effectiveness. For many boards, this means taking a fresh look at their committee structure and practices to determine whether they are keeping pace with the board’s expanding and changing responsibilities and priorities or whether any changes may be warranted, such as adding new committees; revising committee charters; reallocating oversight delegation across the board and its committees; or modifying committee meeting formats (e.g., frequency or length).

This post presents findings from a May 2022 survey of Society for Corporate Governance members representing nearly 180 public companies. The intent of the survey was to understand current board committee structure, composition, and related practices, and how some of these practices have evolved over the past year.

Findings

Respondents, primarily corporate secretaries, in-house counsel, and other in-house governance

professionals, represent public companies of varying sizes and industries. [1] The findings pertain to these companies and where applicable, commentary has been included to highlight differences among respondent demographics. The actual number of responses for each question is provided.

Access results by company size and type.

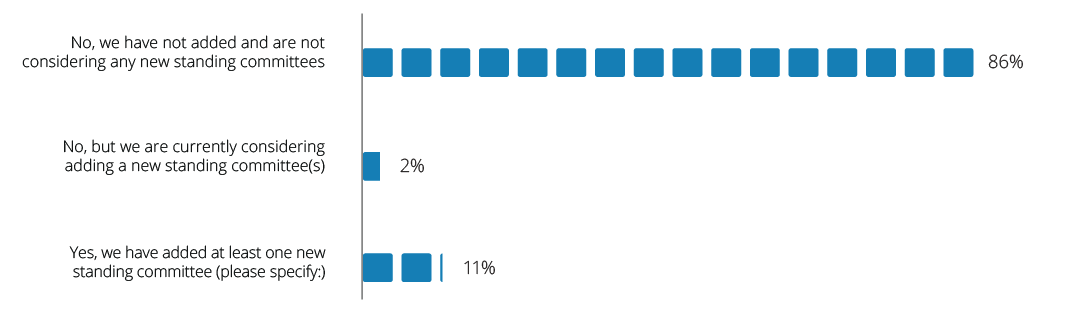

Has your board added any new standing committees in the past year? (170 responses)

Just 13% of respondents added or are considering adding at least one new standing committee. Among those that added a new committee, a technology committee was most common; others included cybersecurity, sustainability, and ESG-related committees.

Has your board formally expanded (i.e., by resolution and/or changes to committee charter) the remit/oversight responsibilities of any existing standing committees in the past year? (For example, expansion of the compensation committee to include human capital management oversight or expansion of the nominating and governance committee to include sustainability oversight) (164 responses)

55% of respondents reported their board expanded oversight responsibilities of one or more of its standing board committees. Many respondents indicated that their boards expanded committee oversight responsibilities to include ESG, either by delegating individual topics to specific committees or by delegating ESG as a whole to the nominating and governance committee.

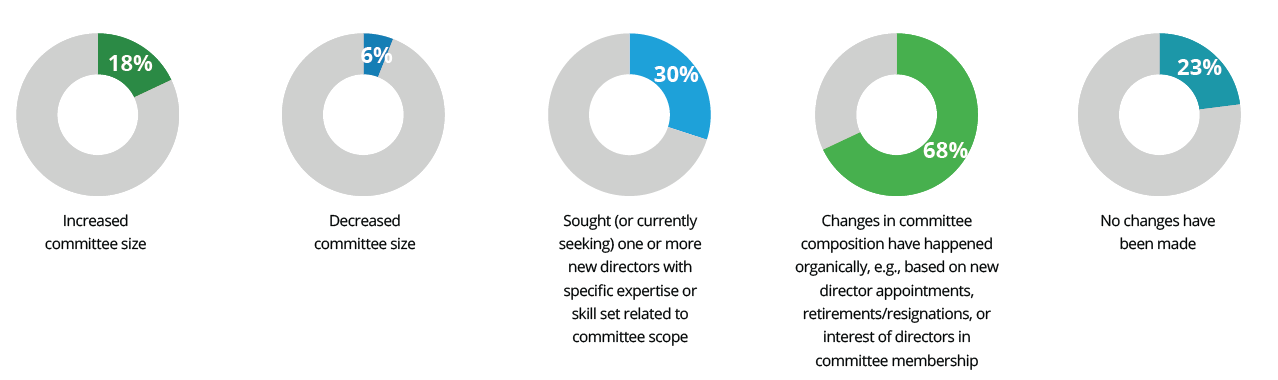

Describe which of these changes have been made to your board committee composition in the past year. [Select all that apply] (163 responses)

68% of respondents reported changes in their boards’ committee composition that came about organically (for mid-caps, this was 60%, and 78% for large-caps). Notably, aside from organic changes, 30% of respondents overall reported having sought or are currently seeking one or more new directors with specific expertise or skill sets related to a committee’s scope of responsibility. 23% of companies made no changes to their board committee composition (30% of mid-caps did not make any changes, compared to only 14% of large-caps).

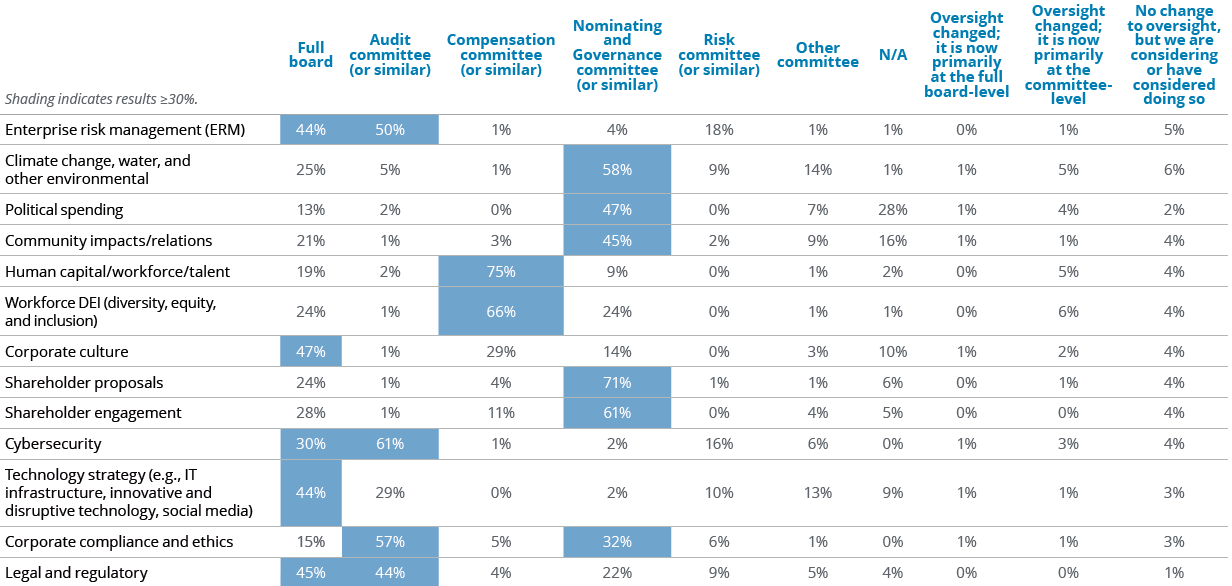

Indicate where primary oversight of the following areas resides among the board and its committees, and whether any modifications have been made to the delegation of primary oversight in the past year. [Select all that apply] (139 responses)

- Political spending: 59% of large-caps delegate oversight to the nominating and governance committee and 10% delegate to the full board; 19% said this is not applicable. In contrast, among mid-caps, 40% delegate oversight to the nominating and governance committee and

16% to the full board, while 33% said this is not applicable. - Shareholder proposals: 81% of large-caps delegate oversight to the nominating and governance committee and 14% to the full board, compared to 63% and 32%, respectively, for mid-caps.

- Shareholder engagement: 68% of large-caps delegate oversight to the nominating and governance committee and 27% to the full board, compared to 55% and 29%, respectively, for mid-caps.

- Few respondents said that the board changed delegation of oversight in the past year or were considering doing so.

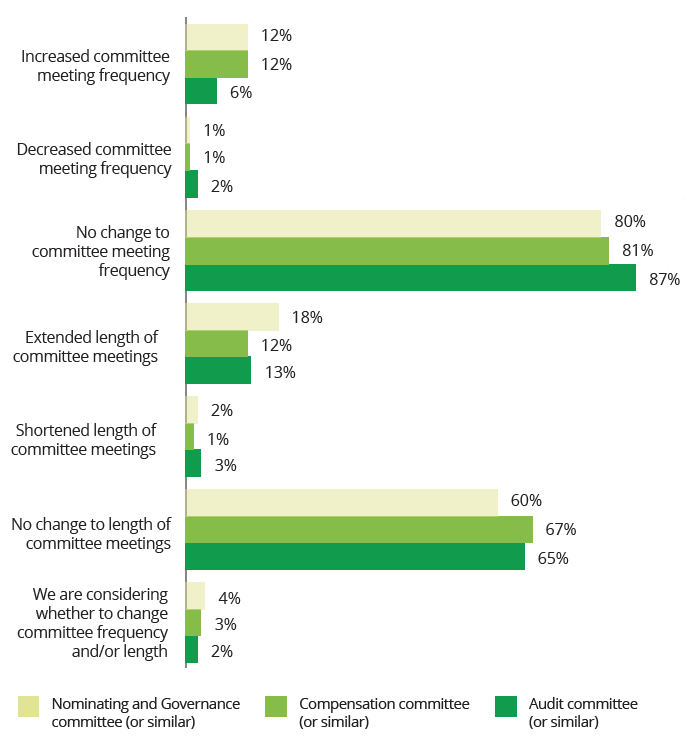

Indicate whether—in the past year—your board has changed the cadence in which its standing committees meet. [Select all that apply] (135 responses)

Across market caps:

- 16% of large-caps increased compensation committee meeting frequency, compared to 10% that did so for the audit committee and 11% for the nominating and governance committee.

- 19% of large-caps increased nominating and governance committee meeting length, compared to 16% that did so for the audit committee and 10% for the compensation committee.

- 3% of mid-caps increased audit committee meeting frequency, compared to 9% that did so for the compensation committee and 11% for the nominating and governance committee.

- 17% of mid-caps increased nominating and governance committee meeting length, compared

to 10% that did so for the audit committee and 14% for the compensation committee.

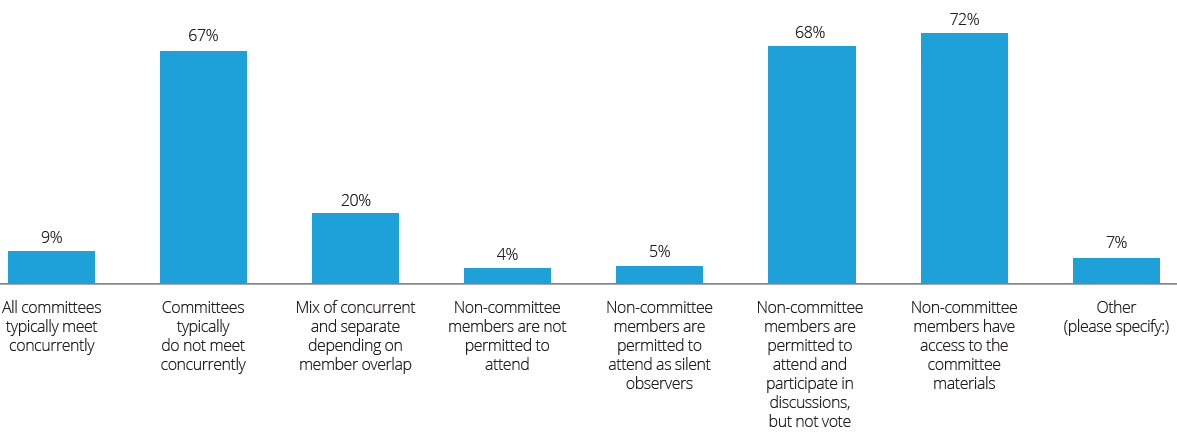

Describe the format of your board’s standing committee meetings and attendance policy. [Select all that apply] (139 responses)

55% of large-caps report that committees typically do not meet concurrently, compared to 78% of mid-caps. Additionally, 61% of large-caps report that non-committee members are permitted to attend and participate in discussions but not vote, compared to 75% of mid-caps.

A few respondents provided comments, including:

- This year we changed committee meetings from concurrent to consecutive so that the CEO can attend all committee meetings.

- All committees meet concurrently, but we are considering changing that since management often needs to present at multiple committees.

- The board chair attends all committee meetings; non-committee members attend only at the invitation, of the committee chair.

- In a virtual meeting format, non-committee members are not invited to attend. When we met in person, non-members were allowed to observe.

Our 2018 Board Practices Report posed similar questions. Then, 55% of respondents reported that some or all committees typically meet concurrently. Results were largely consistent from 2018 to 2022 for committee attendance policies. In the most significant difference, 79% reported in 2018 that non-committee members are permitted to attend and participate in discussions, but not vote compared to 68% in 2022.

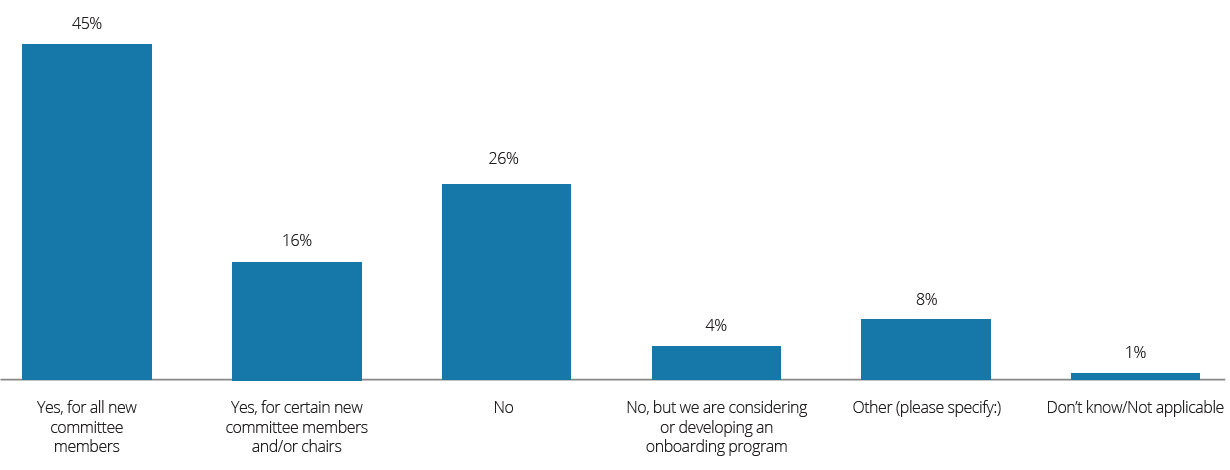

Does your board have an onboarding program for new committee members? (138 responses)

45% reported having an onboarding program for new committee members; however, the prevalence correlates positively with market cap size. Many respondent comments indicated that committee onboarding typically occurs as part of new director onboarding.

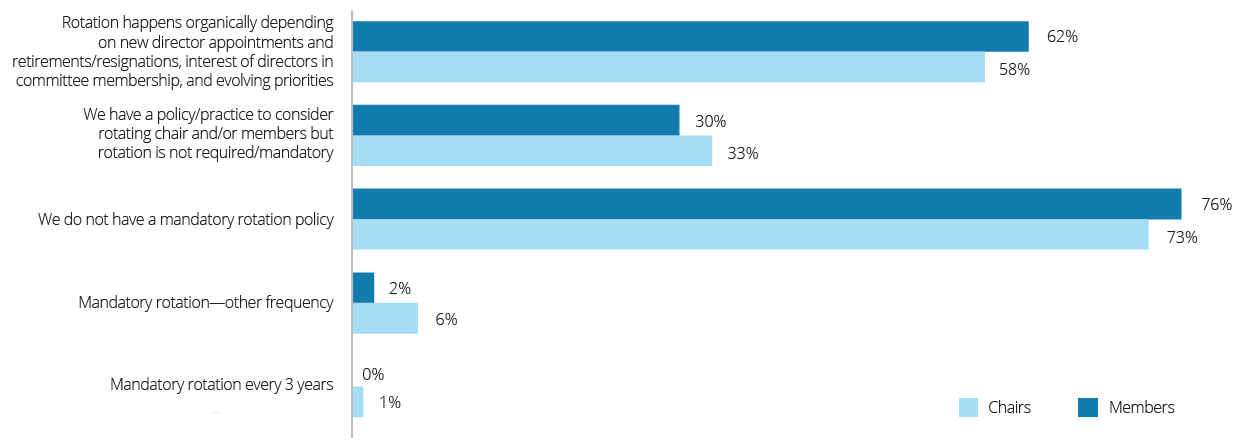

What is the frequency for which key committee chairs and members are rotated? [Select all that apply] (138 responses)

While mandatory rotation remains rare, 39% of large-caps and 27% of mid-caps indicated their boards have non-mandatory policies or practices to rotate committee chairs; for other committee members, such policy was reported by 36% of large-caps and 24% of mid-caps.

Our 2016 Board Practices Report posed similar questions, where 81% of respondents did not have a policy to rotate committee chairs, and 82% did not have a policy to rotate committee members. Note: In 2016, the answer choice did not specify whether the policy was mandatory.

Endnotes

1Public company respondent market capitalization as of December 2021: 46% large-cap (which includes mega- and large-cap) (> $10 billion); 52% mid-cap ($2 billion to $10 billion); and 2% small-cap (includes small-, micro-, and nano-cap) (< $2 billion). Respondent industry breakdown: 34% energy, resources, and industrials; 28% financial services; 17% consumer; 13% technology, media, and telecommunications; and 7% life sciences and health care.

Small-cap and private company findings have been omitted from this report and the accompanying demographics report due to the limited respondent population.

Throughout this post, in some cases, percentages may not total 100 due to rounding and/or a question that allowed respondents to select multiple choices.(go back)

Print

Print